Important Information

Global X Hang Seng Tech ETF

Global X Hang Seng High Dividend Yield ETF

Global X China Consumer Brand ETF

Global X China Electric Vehicle and Battery ETF

Global X China Clean Energy ETF

Global X China Robotics and AI ETF

Global X China Semiconductor ETF

Global X Asia Semiconductor ETF

Global X China Cloud Computing ETF

Global X China Biotech ETF

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Biotech ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Key Themes – Oct 2023

Listen

[2837] Global X Hang Seng Tech ETF

Hang Seng Tech Index recorded a 6.2% loss in September, with oil prices surging and US Treasury yields reaching a historical high. The 10-year Treasury Yield increased almost 50bps over the month as investors expect a higher rate for longer. Aside from global economic risk, several issues in the Chinese economy also dragged Hong Kong and Chinese stocks, including real estate sector default risk, rising debt levels from local governments, and mounting deflationary pressure. The key underperforming sectors are consumer discretionary and IT.

Consumer Discretionary stocks declined before the long holiday: Consumer Discretionary detracted 3.8% from the index in September. Li Auto (2015.HK), accounting for around 8.2% of the index, fell 14.4% this month due to intensifying competition and a lack of near-term sales surprises before the long holiday in the mainland and Asian Games 2023. Meituan (3690.HK), down by 10.8%, and JD.com (9618.HK), down by 10.6%, recorded new 52-week lows.

Information Technology sector suffered as Apple increases pressure on suppliers: Kingdee International Software Group (268.HK) fell 20.5% over the month. Chinese software companies are not behind in developing generative AI technologies and developing business opportunities. However, monetization in the consumer market may be tough in the short term due to competition and consumers’ tight IT budgets. Chinese companies’ AI monetization is now more focused on the government and enterprise markets by providing model training and private model deployment services. Sunny Optical Tech (2382.HK) fell 14.7% after Apple’s launch event, which raised fears that Apple would increase pressure on its suppliers to maintain its profitability at suppliers’ expense. The sentiment may have worsened as China has reinforced the iPhone usage ban to civil servants.

[3110] Global X Hang Seng High Dividend Yield ETF

Hang Seng High Dividend Yield Index fell modestly by 1.0% yet outperformed the broad-based Hang Seng Index by 1.6%. The energy sector was the key contributor, while the real estate sector was the major detractor.

Energy sector rallied amid tight oil market and persistent inflation: Energy stocks returned strongly to 7.8% while the broad market fell. Energy prices are on the rise, which is a tailwind to the sector. Due to heatwaves and drought affecting the Yangtze River basin, supply from hydropower companies is expected to shrink. Demand for thermal power generation is likely to increase in the meantime. Against this backdrop, China Shenhua Energy (1088.HK) and China Coal Energy (1898.HK) both recorded double-digit returns in September 2023.

Real Estate sector continues to struggle as property sales slow: China’s real estate sector continues to decline, with the default risk of property developers remaining high. While a set of supportive policies was rolled out to support the fragile real estate sector, property sales growth remains muted in recent months. Yuexiu Property (123.HK) and New World Development (17.HK), accounting for 5.2% of the Hang Seng High Dividend Yield Index, fell along with their peers over the month, but they are unlikely exposed to default risk in the near term.

[2806/9806] China Consumer Brand ETF

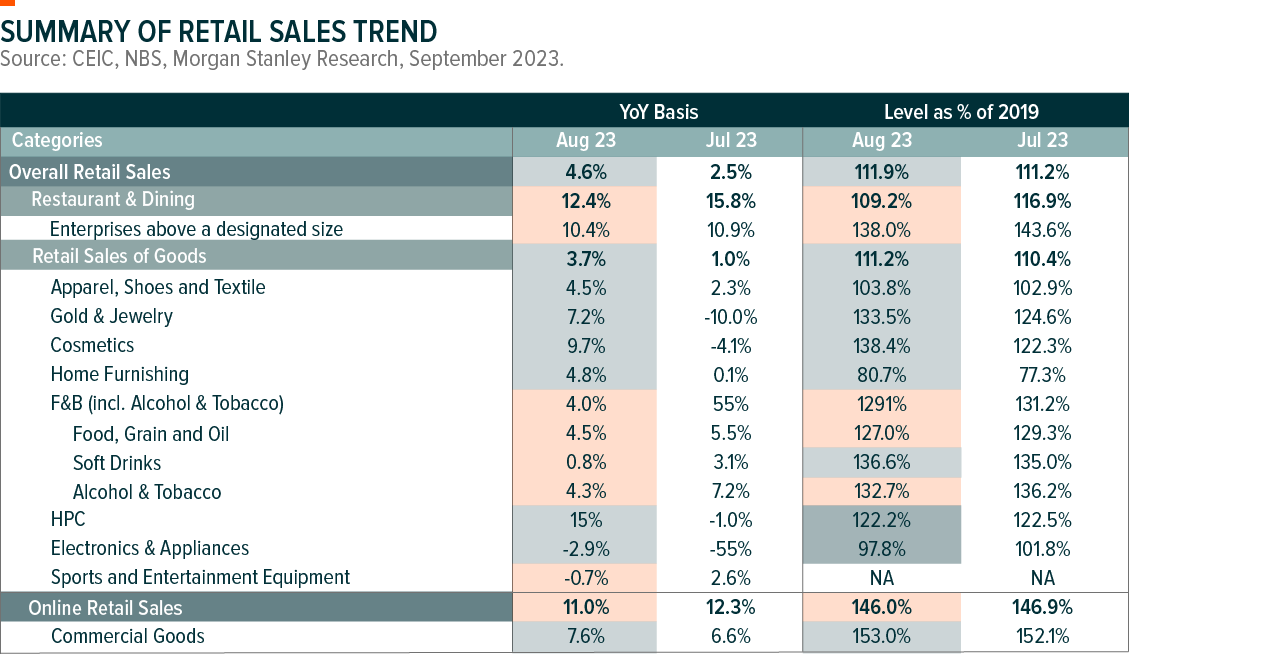

China’s consumption recovery pace remains soft, but there are some signs of stabilization since August. August retail sales growth was +4.6% year-on-year (YoY), beating the street expectation of +3.0% YoY growth and also improved from +2.5% YoY in July. By category, gold, jewelry, and cosmetics led the acceleration, while electronics and appliances and sports and entertainment equipment fell into negative territory in August. We expect the overall consumption trend to have been similar in September.

September is generally a low season for many consumer products as it is a month between the summer holidays and the October Golden Week holiday. The market is currently focusing on the China National Day Golden Week as this is the second major public holiday in China since reopening. Golden week data shows that overall consumption remained similar to the May holidays, although it was slightly weaker than the government’s expectation. According to the Ministry of Culture and Tourism (MoCT), total tourism traffic (826 million) and revenues (RMB 753 billion) were up +4% and +2%, respectively, compared to 2019, during the 8 days (26 September to 6 October). Implied spending per traveller was RMB 912, which came in slightly better than MoCT’s expectation.

Chinese consumers spent more on travel and experience than tangible goods, which supported the restaurant and retail service industry. Domestic travel traffic was strong, with long-distance travel (within China) being a key theme, with many travellers spending on cultural and experience travel. According to the China Association of Performing Arts, live performance/show box office and audience were up +83% and +61% compared to 2019 (source: Jefferies). International traffic, including both inbound and outbound, reached 1.48 million people, which was 85% of 2019 level, due to the international flight capacity bottleneck, which still has only returned to 57% of 2019 level, according to Macquarie.

Overall retail sales showed a gradual recovery, with lower ticket items performing better. Sportswear saw an acceleration in demand since September, and Baijiu sales have been in line with the continuous polarization trend. For Baijiu, Golden Week sales have been in line, with sell-out improving gradually from the dragon boat festival, leading to lower channel inventory and slightly better wholesale prices.

Meanwhile, the polarization trend has continued in China. For instance, while overall baijiu consumption has been somewhat sluggish, the premium segment continued solid momentum with resilient growth for Moutai. At the same time, the low- to mid-end is expected to have double-digit growth, while there is more pressure on the mid- to high-end segment. The original case of Feitian Moutai’s wholesale price per bottle remained above RMB 3,000, and common Wuliangye’s wholesale price per bottle also remained flattish at around RMB 960 levels. Such polarization trend has also been seen across different consumer categories, including beer and sportswear.

We expect the government may introduce more policies to support the economy as they have set the pro-growth tone at the Politburo meeting in July. On the other hand, the valuation of many consumer companies has come down to more attractive levels, and thus, we are becoming more constructive on the China consumption theme.

[2845/9845] Global X China EV & Battery ETF

Auto sales increase and EV penetration stays solid in September: Based on the announcements of nine individual auto brands, their September sales data in aggregate amounted to 224k units, or +9.0% month-on-month (MoM). BYD reported September new energy vehicle (NEV) sales of 287.5k units, +43% YoY/+5% MoM. 9M23 NEV sales improved +76% YoY to 2.08 million units, of which overseas NEV passenger vehicle (PV) sales volume logged at 28,039 units (+12% MoM). Li Auto delivered 36,060 units of vehicles in September, +213% YoY and +3% MoM. 9M23 sales increased +181% YoY to 244,225 units and 3Q23 sales reached 105,108 units, beating 3Q23 sales guidance of 100-103k units. Nio September deliveries logged 15,641 units, +44% YoY/-19% MoM, and 9M23 total deliveries came in at 109,993 units, +33% YoY. 3Q23 sales logged 55,432 units, in line with 3Q23 sales guidance of 55-57k units. Xpeng September deliveries logged 15,310 units, +81% YoY/+12% MoM. 9M23 sales were -18% YoY to 81,443 units.

Battery production to grow in August: According to the China Automotive Battery Innovation Alliance (CABIA), China’s power battery installation reached 34.9GWh in August, up 8.2% MoM and 25.7% YoY. China‘s power battery production reached 73.3GWh in August, up 20.2% MoM and 46.5% YoY. Implied months of China power battery inventories were 2.2x in August 2023 (vs 1.8x historical average months of power battery inventory). LFP battery installation accounted for 69.0% of total power battery installations in August, up 1.8ppt MoM and 6.9ppt YoY. CATL’s market share was 44.3% in August, up 2.5ppt MoM but down 2.5ppt YoY, while BYD’s market share was down 2.0ppt MoM but up 5.1ppt YoY to 27.0%.

Battery material costs have declined further in September: China spot lithium carbonate price was around RMB 170k/t at the end of September, down by around RMB 40k/t or 20% MoM; GFEX futures were trading at RMB 130-150k/t; spodumene CIF dropped to USD 2,370/t and monthly average declined by over 20% as well; spread remained at a relatively low level. High-cost converters, especially those lepidolite based, are scaling back production as they struggle to make profit. Demand below expectation has been the key issue this year. The market stays calm without meaningful restocking for the National Day holiday, as cathode and downstream are cautious on price momentum. Spodumene price is still far above the cost curve and is expected to drop further with LC, thus reducing cost support for LC. Unless demand surprises on the upside, the vicious cycle is hard to stop until it hits spodumene cost and/or leads to a spodumene production cut.

Refreshed model from Tesla and newly launched model from Huawei: Tesla released its new Model 3 Highland version in September, with prices starting at RMB 259.9k. The manufacturer’s suggested retail price (MSRP), RMB 28k higher than the previous version, was higher than our expectation, which could help ease the intensifying price competition in China’s EV market. According to TroyTeslike, Tesla’s order backlogs in China doubled MoM to around 36k units as of mid-September. The Huawei-backed AITO brand launched the new M7 SUV featuring Huawei’s ADS 2.0 system, with map-free city navigation cruise assistance (NCA) functions said to cover the entire country in December. Huawei and Chery’s first co-developed model, Zhijie S7, which will benchmark Tesla Model S, will come to market in November. AITO’s next flagship, M9, is scheduled for launch in December, with a presale price range of RMB 500-600k.

Key stock movements:

BYD (002594.CH): BYD’s share price was down 5.1% in September, a positive contributor to the ETF. BYD outperformed most EV makers in September as select EV makers announced a new financing plan. BYD has a solid balance sheet and cash flow profile which implies a lower financing need. The company is negatively impacted by Europe’s new investigation into China’s auto exports, but the overall magnitude is small.

CATL (300750.CH): CATL’s share price was down 14.2% in September, a negative contributor to the ETF. The stock responded negatively to the news of Ford’s suspension of its new US battery plant construction, which was more driven by the US UAW labor union negotiation. Other operating performance has been quite resilient. The stock has showed resilient share price performance throughout the whole 3Q vs. the 2nd tier battery makers.

Ganfeng (002460.CH): Ganfeng’s share price was down 14.3% in September, a negative contributor to the ETF. Lithium stocks were the major negative contributor in September, given the recent sharp correction to lithium and lithium carbonate prices. The demand-supply condition stays unfavorable. There are also additional supply disruptions to Ganfeng’s asset portfolio.

[2809/9809] Global X China Clean Energy ETF

Solar – Polysilicon still searching for price floor; deflation across the whole supply chain: Solar polysilicon price grew to RMB 87/kg by end-September, from RMB 80/kg a month ago. Module prices are now at RMB 1.21/1.22/W for M10/G12, lower than the RMB 1.24/1.25/W a month ago. According to SCI99, solar glass prices remained stable week-on-week (WoW) at RMB 19.75/27.75/sqm for 2.0mm/3.2mm. Inventory levels decreased by 2.9% WoW to 17.27 days. Soda ash prices decreased by 2.9% WoW to RMB 3,300/t.

Inverter exports were down 10% MoM in August 2023. Total exports stood at USD 690 million in August (-10% MoM; -28% YoY). We believe the MoM fall was likely due to the ongoing inverter inventory pile-up in Europe that we were made aware of at Intersolar Europe. We see the MoM cut as a miss, given China cell/module exports posted a MoM recovery in August 2023.

Grid and power installation – Strong solar installation; grid capex taking a pause: In August, China added 26.4GW (+1.2x YoY) generation capacity, including 16.0GW solar (+1.4x YoY), 2.0GW thermal (+37.4% YoY), 2.6GW wind (+1.2x YoY), 1.7GW hydro (-30.1% YoY), and nil in nuclear. In 8M23, PRC’s new power generating capacity was 198.6GW (+1.1x YoY), comprising 113.2GW solar (+1.5x YoY), 34.3GW thermal (+72.9% YoY), 28.9GW wind (+79.2% YoY), 7.2GW hydro (-44.8% YoY), and 1.2GW nuclear (-47.8% YoY).

In August, capex for PRC power plants was +13.3% YoYto RMB 69.0 billion, comprising RMB 26.1 billion (+3.3% YoY) for solar, RMB 18.9 billion (+31.1% YoY) for wind, RMB 8.3 billion (+1.0x YoY) for nuclear, RMB 7.2 billion (-3.1% YoY) for thermal, and RMB 6.4 billion (+11.1% YoY) for hydro. Meanwhile, PRC’s power grid capex was +1.4% YoY to RMB 270.5 billion in 8M23, including -45.7% YoY to RMB 23.2 billion in August.

[2807/9807] Global X China Robotics & AI ETF

China data are showing some recovery in August: The latest monthly data points released by the National Bureau of Statistics reported on 15 September that China industrial robot production volumes were -19% YoY in August (-3% MoM vs. July and slightly better than past five years’ seasonality of -10% MoM); China machine tool production volumes were +0% YoY in August (+0% MoM vs. July and past five years’ seasonality of +1% MoM). Manufacturing FAI was +7% YoY in August (moderated vs. +4% in July). High-tech manufacturing fixed asset investment (FAI) dropped to +11% YoY in August (vs. +12% YoY in July). Railway FAI continued the recovery trend with +25% YoY in August (vs. +25% YoY in July).

August activity data (CPI/PPI) came in stronger than expected, pointing to a gradual improvement in sequential growth momentum amid the ongoing policy easing. Meanwhile, August orders announced by Inovance maintained 30+% YoY in August vs. 30-40% YoY in July; Haitian domestic orders improved to +15% MoM (+20% YoY), though it was due to an average selling price (ASP) adjustment. Yiheda mentioned a marginal pick up to 20% order YoY growth from 10% in May-July. EV component companies generally agree that their production plans for EV are solid, with a quarter-over-quarter (QoQ) sequential improvement in Q3. For solar exposure, the inverter export decline narrowed in August, and upstream component companies expect to see a further recovery of residential solar demand in Q4. For battery equipment companies, order trends have diversified as companies with more overseas orders have seen relatively better competitiveness.

JMTBA data suggest the bottom likely reached, but clear recovery driver lacking: Based on the final machine tool order data released by the Japan Machine Tool Builders’ Association (JMTBA) on 27 September. Global machine tool orders totalled ¥114.8 billion (-18% YoY, +0% MoM) in August 2023. Domestic Japan orders were ¥35.7 billion (-31% YoY/-9% MoM), a decrease from the previous month. On the other hand, overseas orders (ex-Japan) increased to ¥79 billion (-10% YoY/+5% MoM), up from the previous month, and as a result, overall orders were unchanged from the prior month. By region, orders declined versus the previous month in Japan and Europe, were mostly flat in North America, and were up a strong 17% MoM in China. While the outlook remains uncertain, we think overall orders have likely bottomed out, given that the absolute level in China turned up for the first time in four months after the sharp deceleration seen to date. However, we still do not see any industries or regions where we can expect a clear recovery in the near term, so we look for overall orders to trend near the bottom point for the time being, apart from a temporary upturn due to seasonal factors in September.

[3191/3119]China Semiconductor/ Asia Semiconductor ETF

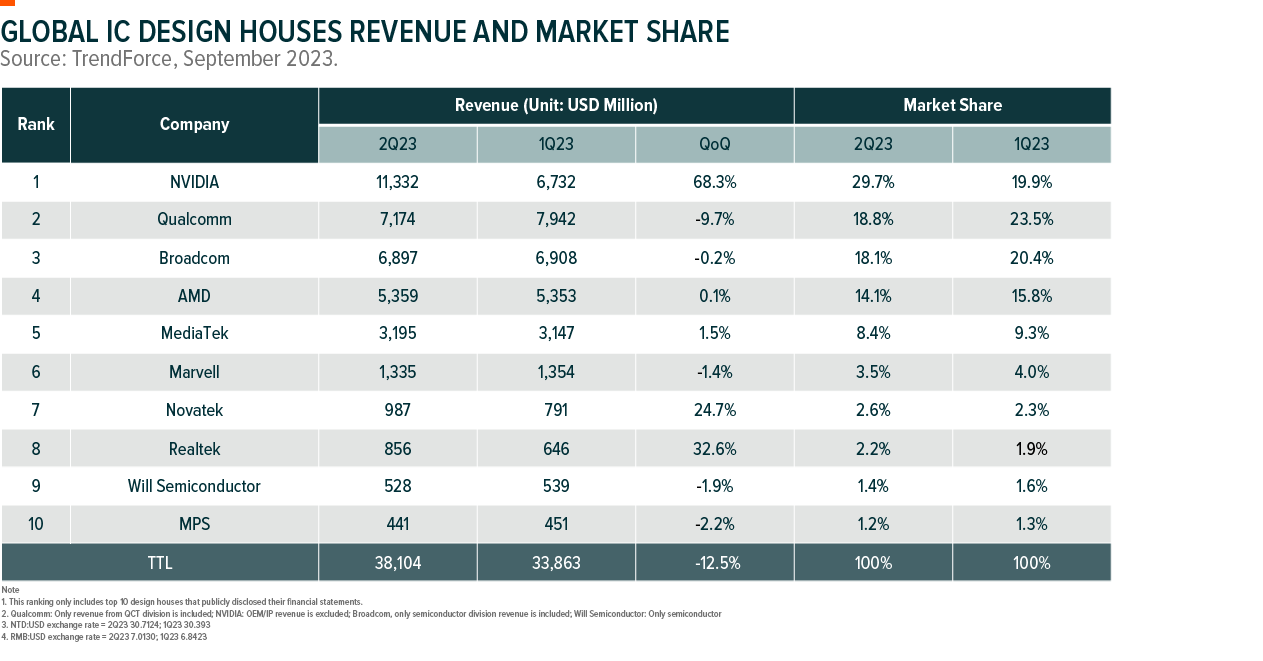

Q2 revenue for top 10 global IC houses surges by 12.5% as Q3 on pace to set new record: Fuelled by an AI-driven inventory stocking frenzy across the supply chain, TrendForce reveals that Q2 revenue for the top 10 global integrated circuit (IC) design powerhouses soared to USD 38.1 billion, marking a 12.5% quarterly increase.

DRAM and NAND contract price stopped declining: September contract price of general-purpose PC DRAM has remained the same at USD 1.3 compared to that of last month, while the price is down 54.4% YoY. The contract price of general-purpose NAND for memory cards and USBs is USD 3.82 as of end-September, which is the same as that of last month. The current NAND contract price is down 11.2% YoY. It is reported that NAND companies are trying to increase the price, which could lead to a slight increase in ASP.

Huawei unveils new products at star-studded product launch: Chinese telecommunications giant Huawei once again drew public attention with its fall product launch on 25 September. The company introduced new tablets, watches, TVs, and high-end branded smartphones, specifically the “Ultimate Design” models.

[2826/9826] Global X China Cloud Computing ETF

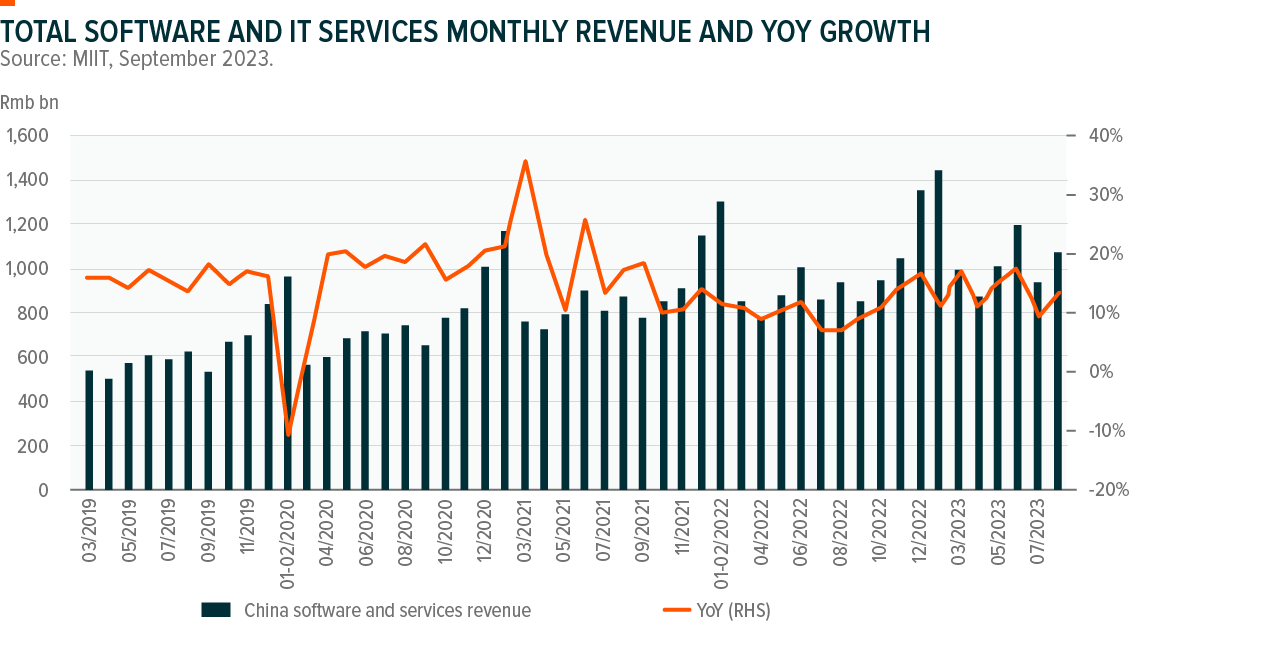

August revenue growth for China software industry: China Software industry August revenues were +13% YoY, accelerating from July (+9% YoY), while still slower compared to June (18% YoY), leading 8M23 revenues to increase by 13.5% YoY. IT services growth outpaced the industry at 15% YoY in 8M23, driven by cloud computing and big data analysis services, embedded system software at +12% YoY; software products grew by +11% YoY, driven by industrial software at +13% YoY; and cybersecurity grew by +10% YoY. Net margin was down to 11.8% in August (vs. 12.8% in July).

July revenue growth for China telecom industry: August telco revenue grew 6.2% YoY, same as June, reversing the decelerating trend in 2Q23 (5% YoY). Mobile revenue grew 1.1% YoY, while fixed line revenue growth of 10.4% YoY was a new high since July 2021. 5G industrial internet revenue growth has seen 3 straight months of recovery to ~18% YoY in August, from ~12% in May, although cloud growth at ~35% remains at a historic low, similar to July.

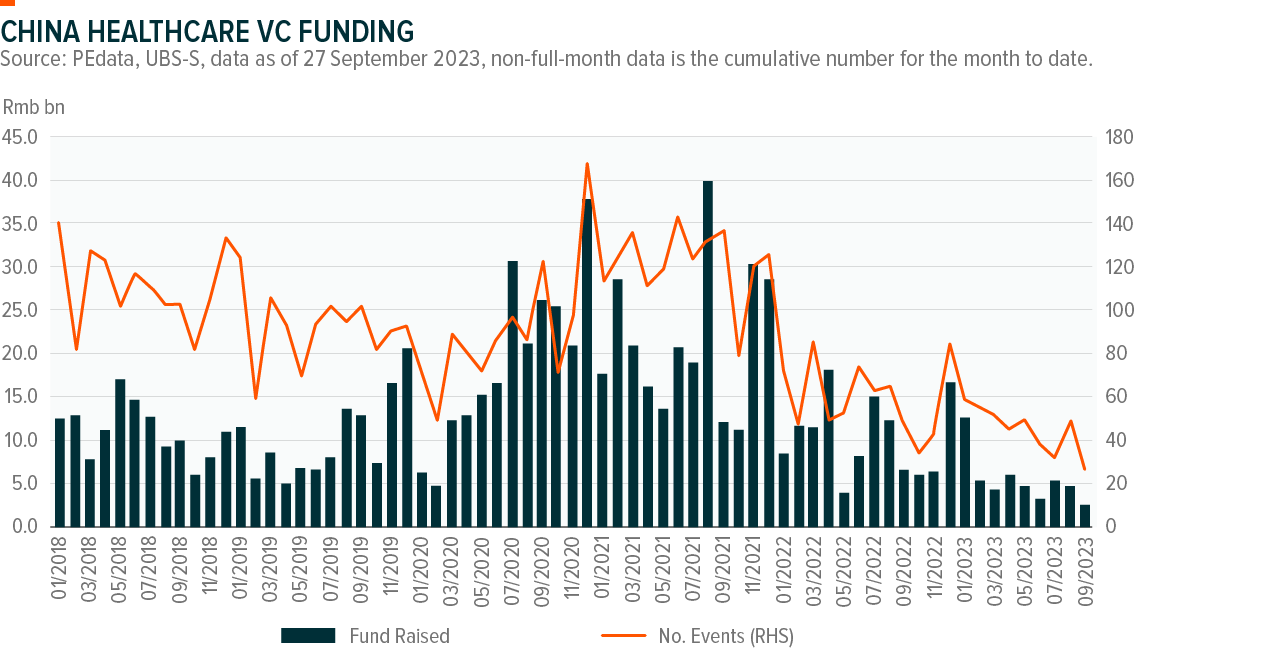

[2820/9820] Global X China Biotech ETF

National Reimbursement Drug List (NRDL): The National Healthcare Security Administration (NHSA) held a H223 press conference in which it said the new list may be unveiled in early December 2023 and effective from 1 January 2024.

Generic drug evaluation application guide: The Center for Drug Evaluation (CDE) published on 25 September a draft soliciting comments on “Guidelines for Acceptance and Review of Quality and Efficacy Consistency Evaluation of Generic Drugs”. The key update in this draft was the proposal of a three-year window for companies to submit generic drugs for evaluation that begins once the first generic drug of the same type has passed consistency evaluation; any applications submitted after this three-year window would not be accepted. However, drugs considered essential for clinical uses or in short supply may apply to provincial or municipal Medical Products Administration (MPA) for an extension.