Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF’s (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Japan Global Leaders ETF(the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Index is reconstituted annually. Eligible securities are added into the Index as constituents during the next scheduled annual reconstitution. Similarly, securities that no longer meet the eligibility criteria of the Index may continue to remain in the Index until the next scheduled annual reconstitution, at which point they may be removed. There is no guarantee that the representativeness of the Index is optimised from time to time.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index Calculation Agent calculates and maintains the Index. If the Index Calculation Agent ceases to act as index calculation agent in respect of the Index, the Index Provider may not be able to immediately find a successor index calculation agent with the requisite expertise or resources and any new appointment may not be on equivalent terms or of similar quality. There is a risk that the operations of the Index may be disrupted which may adversely affect the operations and performance of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- Global X India Select Top 10 ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index (the “Underlying Index”).

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- The number of constituents of the Underlying Index is fixed at 10. The Fund by tracking the Underlying Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- High market volatility and potential settlement difficulties in the equity market in India may result in significant fluctuations in the prices of the securities traded on such market and thereby may adversely affect the value of the Fund. The BSE has the right to suspend trading in any security traded thereon. The Indian government or the regulators in India may also implement policies that may affect the Indian financial markets. There may also be difficulty in obtaining information on Indian companies as disclosure and regulatory standards in India are less stringent than those of developed countries.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- Global X HSI Components Covered Call Active ETF(the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng Index (the “Reference Index” or the “HSI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSI ETF and long positions of HSI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSI ETF and long positions of HSI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSI Call Options over an exchange or in the OTC market. The HSI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSI Futures and writing HSI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSI Futures and the HSI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSI Futures and HSI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- To the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Global X HSCEI Components Covered Call Active ETF(the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index” or the “HSCEI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSCEI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSCEI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSCEI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSCEI ETF and long positions of HSCEI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSCEI ETF and long positions of HSCEI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSCEI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSCEI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSCEI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSCEI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSCEI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSCEI Call Options over an exchange or in the OTC market. The HSCEI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSCEI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSCEI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSCEI Futures and writing HSCEI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSCEI Futures and the HSCEI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSCEI Futures and HSCEI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (Mainland China). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in Mainland China. In addition, to the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed Mainland securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

Monthly Commentary on Key Themes – June 2024

Listen

Global X Asia Semiconductor ETF (3119)

Global X China Semiconductor ETF (3191)

Industry Update

- SMIC 1Q results better than expected, China domestic foundry gradually recover: 1Q24 Rev of US$1.75bn (+4% QoQ) and GM of 13.7% were higher than guidance. 2Q24 revenues to grow 5%~7% QoQ, ahead of street. 2Q24 GM is guided at 9%~11% (vs. 13.7% in 1Q24), trending down on increasing depreciation. Management expects full year revenue rate to exceed industry growth (project 8% YoY growth for mature foundry), street at 10% YoY growth for FY24.1

Capacity increased to 814.5k wpm (8” equivalent) by 1Q24, vs. 805.5k wpm in 4Q23; UT rates at 80.8%, vs. 76.8% in 4Q23. Management expects CAPEX to peak in 2024/25, and think significant capacity expansion is unlikely at the mature node even amid supply chain decoupling when UTR is too low. SMIC is adding 60k wpm this year, with 7.5bn USD CAPEX.2 - Hua Hong announced 1Q results, and investors look for analog demand to bottom out: Hua Hong guided for 2Q24 revenue of US$470-500mn (up 2-9% Q/Q), GPM 6-10%. Utilization is better sequentially thanks to sustained demand from CIS (capacity full throughout the year) and PMIC. Investors turn more positive on the stock given the relatively lower channel inventory for domestic analog suppliers.3

Stock Comments

- SMIC (+7.02%): Solid 1Q results and 2Q guidance drive the stock higher. 2Q24 revenues to grow 5%~7% QoQ, ahead of street. Investors look to buy the cycle recovery as demand gradually picks up across various downstream applications.

- TongFu Microelectronics (+9.49%): Packaging demand started to recover as the company reported solid 1Q24 results, and revenue grew 14% YoY. The company is acquiring KYEC’s China capacity which covers logic, memory and analog applications. The acquisition will help Tongfu increase its market share in the China market.4

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.5

Global X China Electric Vehicle and Battery ETF (2845)

Industry Update

- Solid May EV Sales; EV penetration continues to increase: According to CPCA, May passenger NEV wholesale volume reached 910k, +35% YoY and +16% MoM.6 Based on the announcements of individual auto brands, BYD reported May NEV sales of 332k units, +38% YoY, nearing its historical high monthly sales of 340k units in Dec 2023, driven mainly by solid sales momentum of Honor facelift models offering minor spec upgrades but meaningful price discounts of 10-20% vs. their 2023 Champion versions.7 Other major EV brands recorded divergent performance, with NIO (+234% YoY) showing accelerating sales growth driven by discounts, while Li Auto (24 % YoY) and XPeng (+35% YoY) delivered a relatively steady growth in May.8 (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration reached a high level of 49.3% in the last week of May.9

- Xiaomi and Huawei maintain strong momentum: Xiaomi delivered 8,646 units of SU7 in May 2024, +22% MoM. Xiaomi will continue to ramp up capacity and start double-shift production in June to ensure monthly delivery of over 10k units.10 On 31 May, Huawei AITO launched Ultra range version for AITO M7, with price range from Rmb290k to Rmb330k. Company expected M7 Ultra delivery to reach 20k units in June, bringing AITO Brand to 40k units delivery in single month.11

- Battery inventory stabilizes: According to the China Automotive Battery Innovation Alliance (CABIA), China’s EV battery installation was 35 GWh in April, +41% YoY. EV battery inventory is in a continuous destocking cycle and there are signs of bottoming out, with global battery inventory months dropping significantly to a normalized level of 1.4 months in April 2024 from 3.1 months one year ago. CATL domestic market share stabilizes MoM at 44% in April, and BYD’s share also stabilizes MoM at 28%.

- China ramps up investments in high-tech EV batteries: China is planning to invest Rmb 6bn in the all-solid-state batteries, according to China Daily. Six leading companies including CATL and BYD are expected to lead the R&D of all-solid-state batteries, as supported by the fundings by respective government departments.

- Battery material costs slightly declined in May: China’s spot lithium carbonate price declined by 4% MoM to around RMB 107 k/t at the end of May.12 Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- BYD (002594.CH): BYD’s share price was up 5% in May, a positive contributor to the ETF. On 28 May, BYD unveiled its 5th generation DM-i platform, bringing greater fuel efficiency (2.9L/100km), longer range (up to 2100km), and higher thermal efficiency (46%). Based on the new DM-i, BYD also launched Qin L and Seal 06, both priced below Rmb100k, which should further accelerate share gain from JV this year. BYD’s PHEV sales continues to outgrow BEV sales, reaching record high 184k units, +54% YoY.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand and export sales should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive in 2024 with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Recent signs of battery inventory cycle bottoming out after destocking last year implies a normalized industry landscape that could lead to a better margin profile for battery industry leaders.

Global X China Clean Energy ETF (2809)

Industry Update

- Solar – Polysilicon prices declined: Solar polysilicon prices were Rmb41/kg by the end of May, further decreased by over 16% compared to one month ago, implying that most providers are cash-cost loss making. Polysilicon production is expected to decline as more capacity is going into overhaul, potentially leading to price stabilization.13 Module prices saw a mild decline, with module maker’s low utilization rate potentially extending into June, according to PV InfoLink. Solar module and inverter export volume recorded MoM improvement in April, suggesting recovering demand in Europe.In May, the State Council released Action Plan for Energy Conservation and Carbon Reduction during 2024-25, calling for more efforts to stimulate renewable energy development in China. In addition, in a meeting with enterprises and economists, central government also express concerns over current excess investment in new energy sector, which could be counterproductive.14 This could imply a potential supply-side control by regulators, which can benefit the overall development and profitability for the industry.Grid and power installation – Solid wind and solar installations growth; Grid investments accelerating: China’s Jan-Apr 2024 wind installations grew+19% YoY while solar installations expanded +24% YoY over the same period. In Jan-Apr 2024, the electricity grid spending in China reached Rmb122.9bn. +25% YoY.15 Action Plan for Energy Conservation and Carbon Reduction during 2024-25 issued in May also promotes the acceleration in construction of ultra-high-voltage (UHV) transmission lines and grid system upgrades to lower renewable curtailment,16 which bodes well for industry development.

Stock Comments

- China Longyuan Power (916 HK): recorded 30% total returns in May, a positive contributor to the Index. The company reported in-line 1Q24 results in end-April. Longyuan is expected to yield better returns from upgrades of current wind turbine, as its existing wind project portfolio largely consists of projects in regions with best wind resources in China. In addition, its green power trading can partially support renewable tariffs17, and its current valuation is still below historical average, with its derating since 1H22.

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. Robust power demand growth as driven by AI and EV development is driving up global power demand. However, it is worth noting that the solar supply chain entered a consolidation phase starting 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. We are bullish on the electrical equipment players who benefit from increased grid and system investment in China and globally. They enjoyed a higher selling price and volume growth amid global equipment tightness.

Global X China Cloud Computing ETF (2826)

Industry Update

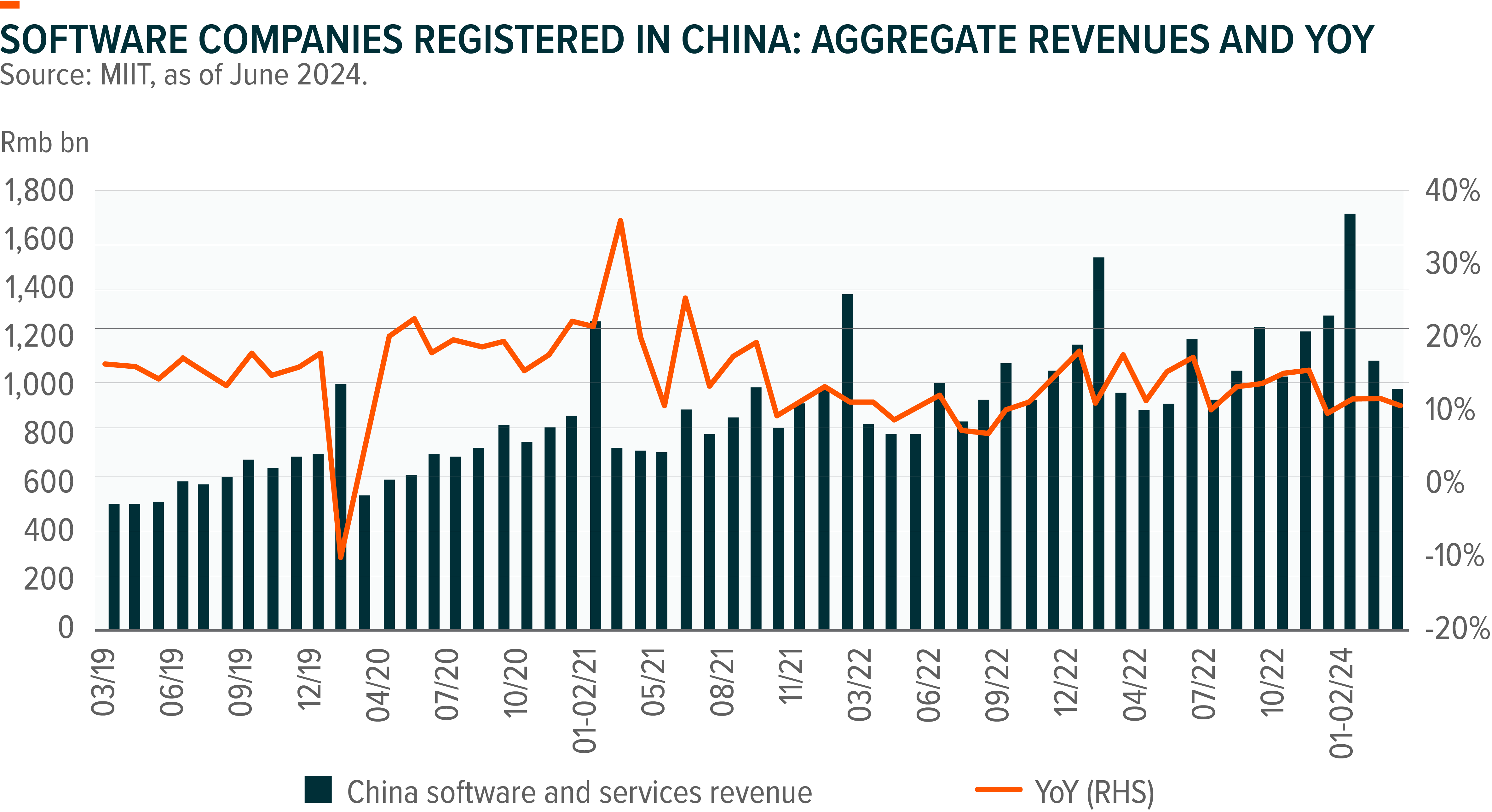

- In April 2024, China Software industry revenues were +10.9% YoY, leading 4M24 total industry revenue growth at 11.6% to Rmb2,802bn.18 4M24 revenue from cloud computing and big data +14% YoY, while revenue from software products and Cybersecurity were slower at 9%, potentially reflecting the IT spending driven by generative AI is now still more at infrastructure side, and not yet toward platform or application software.

Stock Comments

- Thunder Software Technology: Thundersoft share price reacted positively to the recent AI PC trend, as Microsoft and Dell released AI PCs on Qualcomm chipsets. Thundersoft indicated that it is a supplier to Qualcomm’s AI PC platform. Overall there has not been any quantitative data with regards to AI PC related revenue contribution to Thundersoft announced by the Company yet.

- Tencent Holdings Ltd: Tencent’s overseas games continued to surprise positively since start of the year. Tencent has been expanding its games overseas via building in-house studios and acquisitions of overseas studios. These investments are starting to bear fruit, e.g. strong grossing of PUBG Mobile and Brawl Stars.19

- Beijing Kingsoft Office Software: Chinese software companies’ stock price were generally weak for the month as market remained concerned on the subdued enterprise and local government IT spending budget. Kingsoft Office remain one of the best quality companies within China software space. Since the release of its WPS AI product in April 2024, management noted positive user feedback and the company plans to keep three types of membership from late-Jun 2024, including (1) Super membership (Rmb148/year), (2) WPS AI membership (Rmb248/year), and (3) Premium membership (Rmb348/year) covering both AI and other value-added features.

- iflytek Co: Share price has been weak for the month as market remains concerned on 2Q24 results. Since the launch of iFlytek LLM Spark in May 2023, the Company has received positive feedback from consumers, especially on products such as learning pad with 99% YoY rev. growth in 1Q. In addition, SOEs show strong interest in AI application and monetization is on the way. However, tight government budget and continuing investment are short-term headwinds, and AI revenue contribution is relatively small and cannot offset the negative impacts.

Preview

China software industry revenue growth remained muted into 2Q24, as the industry has not yet seen any inflection in terms of the weak enterprise IT spending. Overall industry growth slightly slowed down as compared to 1Q24. In addition, revenue growth outlook of vertical software continues to be under pressure especially for infrastructure, real estate, and financial services related categories. Most local software companies have slowed down their headcount expansion (avg. employees down to 11.7k in 2023 from 11.8k units in 2022)20 to pursue margin improvement. Despite slower hiring and spending, we see software companies still investing in LLM/ AI and view it as a priority for R&D spending in 2024, particularly for training in-house vertical LLMs or integrating third-party general LLMs with its applications. As result, in 2Q24 till date, the software product launches have accelerated driven by AI related software product updates.

Global X China Consumer Brand ETF (2806)

Industry Update

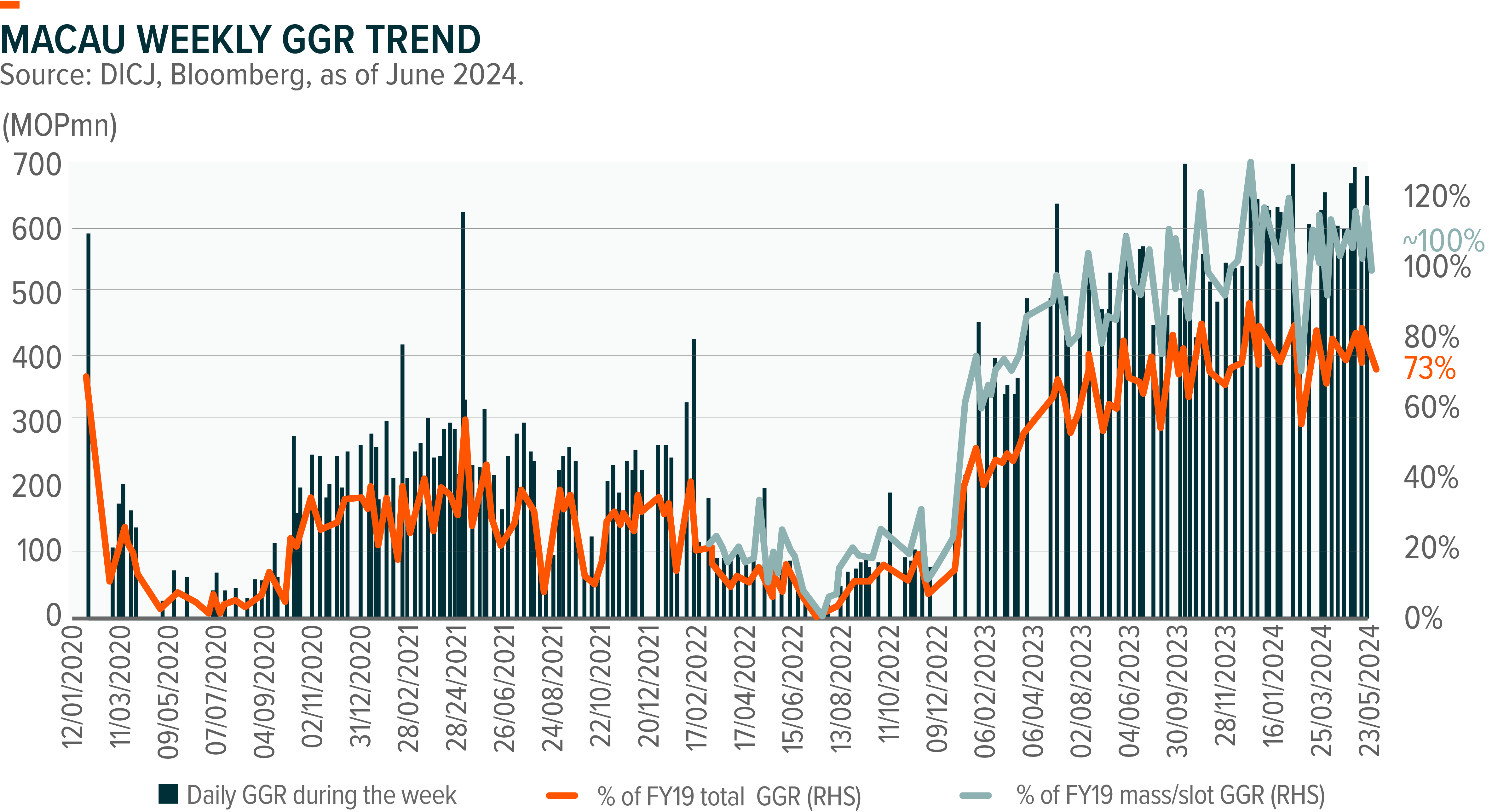

- Consumption demands in China were weak across restaurants, beer and Baijiu sectors for the month of May, mainly impacted by the extreme weather conditions. Macau’s gross gaming revenue (GGR) came in at MOP20.2bn in May, tracking steadily at 78% of the pre-COVID19 level vs. 79% in April. In absolute terms, the daily GGR run-rate of MOP651mn marked a new high since reopening helped by better-than-expected performance of MOP910mn during the Labor Day holidays.

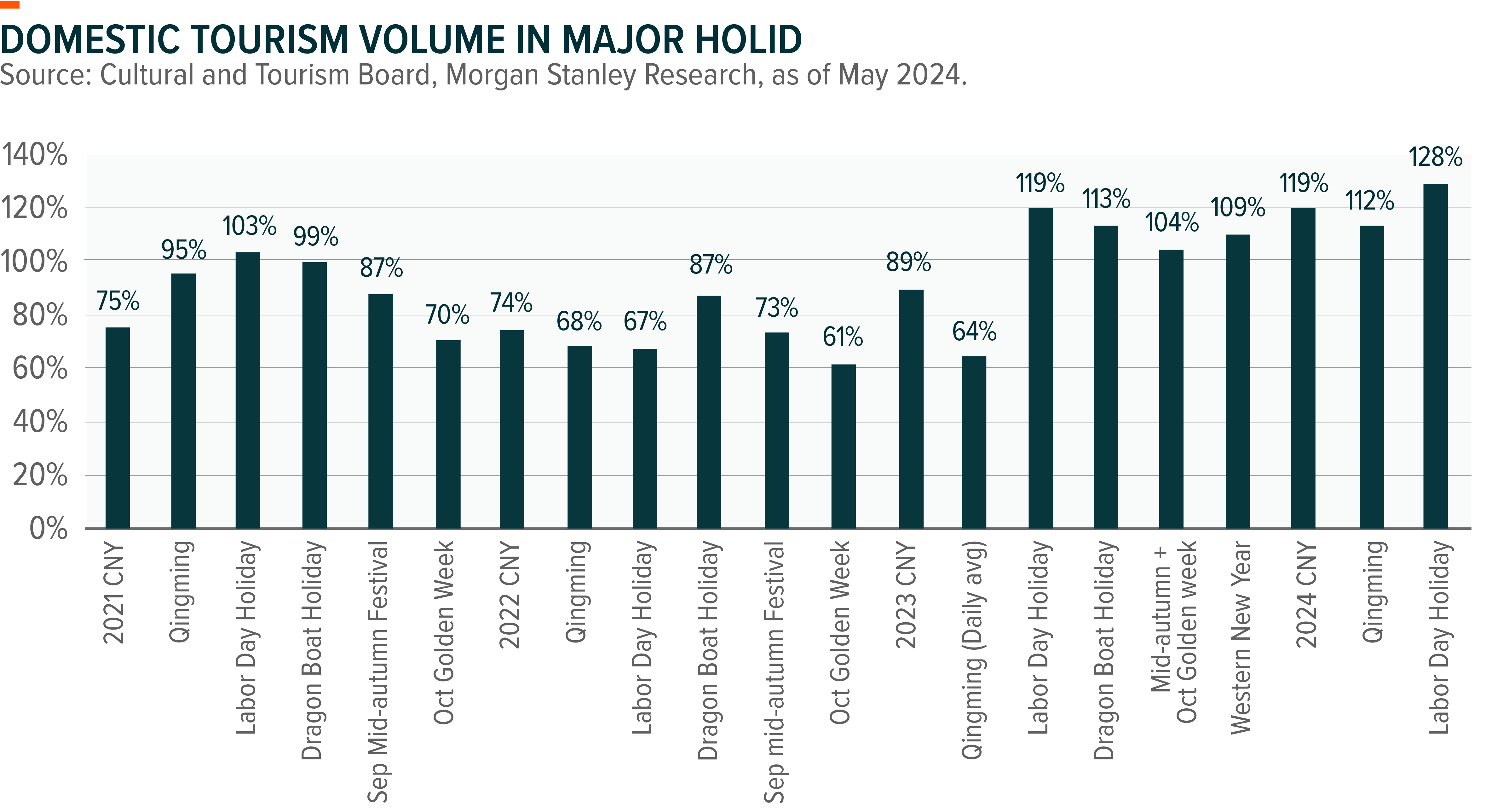

- For the Labor Day holidays in particular, airfare and hotel were negatively impacted by extreme weather conditions in Southern part of China. According to the Ministry of Culture and Tourism, a total of 295mn traveled domestically on May 1-5th, +8% YoY against the high-base last year boosted by pent-up demand as the first major holiday break after mainland China removed all travel restrictions in Feb-23.21 Tourism revenue grew +13% yoy to Rmb167bn or 14% above pre-pandemic levels, implying each traveler still spent less than what they used to in FY19. Into the Dragon Boat Festival, domestic tourist rose 8.1% YoY to Rmb40bn, and tourists grew 6.3% YoY to 113mn (June 8-10th) driven mainly by short-haul travel.

Stock Comments

- Tingyi Holding Corp.: Share price reacted positively to the recent robust demand for beverage. On the other hand, demands for noodles were weak. Beverage segment grew lower than HSD% in Jan-May while Noodle segment slightly declined but turned positive in May with product upgrade. Both segments saw margin improvement YTD in both GPM and NPM.

- Li Auto: On April 22, Li Auto cut prices of its entire model lineup except for the newly-launched L6. The cuts of Rmb18-30k – the first time the company officially cut MSRP, amid continuously intensifying competition within the China EV industry. Stock price reacted negatively to the price cut.

- Techtronic Industries.: Market expects likely slower restocking since April due to: 1) softening sales at Home Depot on a sequential decline of US home sales; and 2) Milwaukee share loss in the short-term.

Preview

Into the month of May, most of the consumer sectors in China didn’t see a meaningful uptick in retail sales growth. Expectation for travel related demands were elevated prior to the Labor Day holiday, leaving limited room to beat.

Despite near-term weakness in China consumption, emerging opportunities we have identified include: 1) rising presence in the overseas market, as Chinese consumer brands now become increasingly competitive globally, 2) strong technology development in areas like electric vehicle, and 3) emergence of local consumer brands that have been gaining market share from MNCs (multinational corporations) leveraging social media and offline channels.

Global X Hang Seng TECH ETF (2837)

Industry Update

- Hang Seng TECH Index continued to delivered a flat return in May, following a 7% gain last month, as driven by accumulating policy supports, and previous low base in terms of valuation and investor positioning. Major internet companies reported 1Q24 results in May, with most of companies delivered better-than-expected net profit growth22, driven by operational efficiency gains and high quality revenue growth, supporting further share prices rebound. Key internet companies continue to execute share repurchase program to elevate shareholder returns.

Stock Comments

- Tencent (700 HK): recorded solid growth of 5% in May, a positive contributor to the index. Tencent successfully launched highly expected DnF Mobile on 21 May, and has been topping China mobile game IOS grossing chart thereafter23, which will be supporting its domestic game revenue growth from 2Q24 onwards. Tencent reported better-than-expected 1Q24 results on 14 May with adj. Net Profit growth of +54% YoY, driven by Video Account monetization ramp up, international game revenue growth, and gross margin expansion. Tencent has been conducting aggressive share repurchase of ~HK$1bn per day to ramp up shareholder returns.

- NetEase (9999 HK/NTES US): recorded share price decline of 9% in May, a negative contributor to the index. NetEase’s high ARPPU games could be affected by potential regulatory tightening24 that caps gamer spending upsides. Performance of Condor Heroes launched in March is weaker than expected, and grossing for legacy games could further decline. Key catalysts are further announcements and solid performances of its upcoming key games.

Preview

Although China internet sector is entering a mature stage with the already high online penetration and peaking timespent, there are still emerging themes driving re-accelerating growth across different subsectors, on the back of a normalizing domestic regulatory environment on internet platforms. A robust game pipeline and solid new game performance is driving more positive online gaming outlook. Ad tech upgrades and the emergence of more effective ad formats should support the continued market share gain by key online advertising platforms, and the applications of AI across cloud, games, ads, and other key sectors is driving new demand and enhancing operational efficiency. Continued execution of upsized share repurchase program increases shareholder returns and should provide supports for future share price performance.

Global X Hang Seng High Dividend Yield ETF (3110)

Industry Update

- The Hang Seng High Dividend Yield Index recorded a solid growth of 8% in May 2024, as the high dividend and low valuation characteristics of Hong Kong listed stocks are attracting more inflows from foreign investors under current volatile global markets. The top-performing sector was Material, whilst the bottom-performing sector was Automobile25.

- Further rollout of supportive policies remained a key driver to share market rebound in China. In April, the State Council introduced the once-in-a-decade “9 Measures” to guide capital market development, focusing on strengthening capital market regulations, enhancing shareholder returns and raising the quality of listed companies. In addition, the southbound inclusion of REITs and potential removal of dividend tax for southbound investors could also drive positive earnings revisions and multiple re-rating for Hong Kong Market,26 attracting more inflow for high dividend stocks.

Stock Comments

- China Shenhua Energy (1088 HK) recorded total returns of 16% in May, a positive contributor to the Index. China thermal coal prices recorded solid increase throughout the month due to the strong pre-stocking demand heading into summer peak season.27 Shenhua reported resilient 1Q24 results in end-April despite weak coal prices, recording better-than-peer net profit contraction thanks to higher contributions from power and logistics segments.

Preview

Hang Seng High Dividend Yield Index is well positioned to benefit from increasing allocation from global investors amid global market volatility, and the potential dividend tax removal for southbound investors. Notably, this Index consists of over 60%28 of its constituents in State Owned Enterprises. Supportive policies across consumption, property, and technology sectors, as well as the ongoing capital market reforms are key drivers for market rebound. The concept of the Valuation System with Chinese Characteristics (“VCC”) is back in the spotlight again in light of recent developments. The primary objective of VCC is to enhance the quality and investment value of listed companies, especially SOEs. By investing in the Hang Seng High Dividend Yield Index, investors can gain exposure to high dividend-paying and low-volatility companies while also benefiting from the accelerated implementation of VCC.

Global X Japan Global Leaders ETF (3150)

Industry Update:

- In May 2024, the FactSet Japan Global Leaders Index experienced a gain of 2% in JPY terms29, reflecting resilient performance for leading Japan corporates. Major Japanese companies reported 20% YoY Net Profit growth in FY3/24, as buoyed by weak yen and solid export demand.30 Total value of buyback programs in FY23 came to an all-time high. Among the sectors within the index, Semiconductor and Media Sectors emerged as the top-performing sector while Automobiles sector was the bottom-performing one.

- On prolonged US inflationary pressure, JPY depreciated by 10% YTD with USD/JPY reaching 15731 by the end of May, despite the fact that BOJ ended 8 years of negative interest rates in March and raised its policy rate to 0% – 0.1%. Current historical low valuation of Japanese Yen should continue to support the growth for leading export companies. In addition, solid real wage growth after two rounds of strong Shunto wage negotiations and ongoing corporate reforms should drive Japan’s domestic consumption demand and support Japan equity market.

Stock Comments:

- Hitachi (6501 JP) recorded 10% total returns in May, a positive contributor to the index. Hitachi reported Mar-24 quarter results in end-April with better than expected revenue and operating profit. The company also guided higher than expected FY3/25 profit, as driven by strong global power grids and power equipment demand, and strong domestic system integration orders.32 Hitachi completed its acquisition of Thales’ signaling equipment unit on 31 May, which could expand Hitachi’s regional footprint and widen its business opportunities in the high-margin services field.33

Preview:

We are optimistic about the overall Japan equity market, supported by a combination of robust export growth, recovering domestic demand, ongoing corporate reform, and the weak currency. We see BOJ rate hike as a positive signal for reflation and the start of normalization of Japanese economy. Further rate hike from BOJ and potential rate cut by US Fed in 2H24 should help to stabilize JPY. Furthermore, Japan’s export sector has been performing exceptionally well, benefiting from a global economic recovery and increased demand for Japanese products. Additionally, the weakening of the JPY against major currencies enhances the competitiveness of Japanese exports, further bolstering the country’s export-driven economy. With these factors in play, the Japan export leaders stand to benefit from a favorable environment, attracting both domestic and international investors seeking opportunities for capital appreciation and growth.

Global X India Select Top 10 ETF (3184)

Market Update:

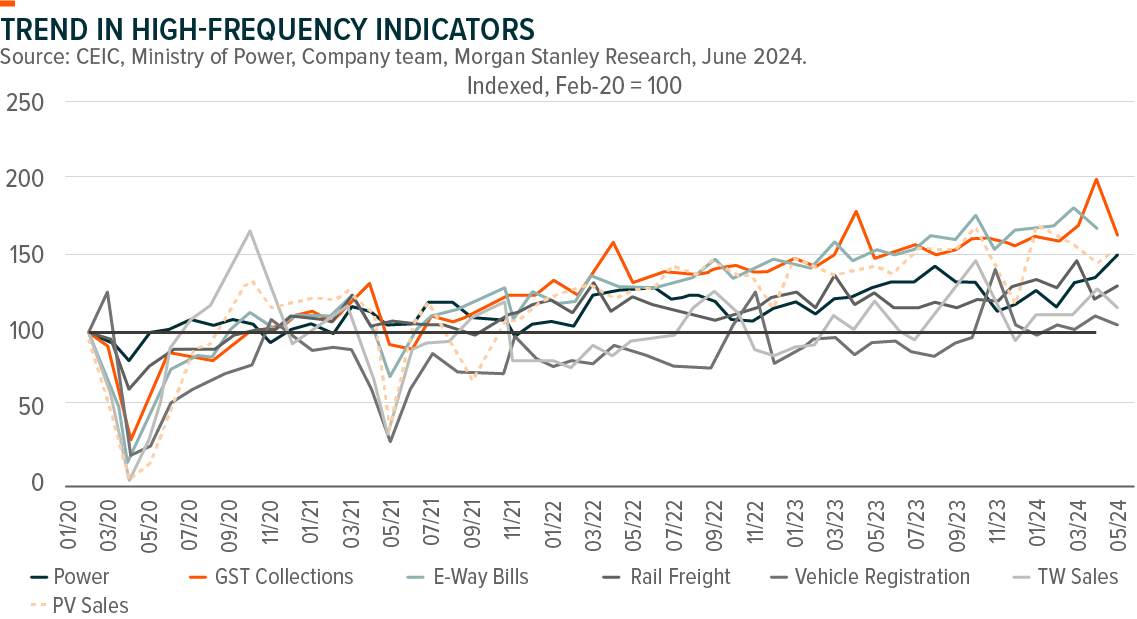

- We remain constructive on India’s growth outlook as the BJP-led New Democratic Alliance (NDA) retained its majority which will lead to macro stability, policy continuity and a number of structural reforms to be made in the third term of Modi government. The market experienced volatility when the general election results came in as a surprise compared to exit polls with the Bharatiya Janta Party (BJP) losing its single-party-majority status in the lower house of Parliament. Nevertheless, the market recovered on the following days as Prime Minister Narendra Modi secured third term with the support of allies under the NDA. We expect the government to continue to invest on infrastructure, boost manufacturing sectors, and also focus on private consumption including rural areas to drive more balanced growth in coming years. Domestic economy continued to remain strong in May. GST collections grew +10%yoy, manufacturing PMI came in 57.5, service PMI came in 60.2, credit growth remains buoyant growing +15.8%yoy, and passenger vehicles sales grew both on YoY and MoM basis in May. Consumer sentiment also improved further. We believe India’s economy is in the upcycle and this has more years of steady expansion ahead driven by investment, consumption as well as exports.

Stock Comments:

- Bharti Airtel (BHARTI IN) was the major contributor in May thanks to improving competitive landscape of telecom sector in the country. The market has been very competitive since Reliance Jio’s entrance into the market which led consolidation of the industry. It seems industry participants are now aligned with the current market structure and expect the awaited tariff hike post-election to lead to ARPU hike in coming quarters while CAPEX has peaked out and will moderate going forward, which would lead to better returns on capital and FCF of the company.

- Titan (TTAN IN) was the major detractor in May post 4QFY24 results due to weaker than expected EBIT margin of 12.1%. While jewellery sales continued to be strong with +19%yoy growth (ex-bullion) but margin came in lower due to sharp rise in gold prices and rise in competitive intensity. Margin pressure may persist near term as gold price remains high but this is positive for mid to long term gold demand. The company continue to focus more on top-line growth than profitability, which we believe is the right strategy considering the company’s growth opportunity ahead.

Preview:

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. In the near term, formation of the cabinet, trend in monsoon rainfall, budget for FY2025 in July will be the major event to watch out for the market.

Global X HSI Components Covered Call Active ETF (3419)

Global X HSCEI Components Covered Call Active ETF (3416)

Industry Update & Issue Analysis:

In May, the Hong Kong stock market experienced modest returns after reaching a year-to-date high, followed by a subsequent retreat, resulting in a new range-bound trading pattern. The Hang Seng Index (HSI) and the Hang Seng China Enterprises Index (HSCEI) rose by 2.54% and 2.15%, respectively, primarily driven by financial stocks. The corresponding VHSI and VHSCEI Volatility Indexes, which measure expected volatility for the HSI and HSCEI, dropped slightly to 22.15 and 25.27, respectively. In this context, the estimated premium generated by writing out-of-the-money call options for the HSI and HSCEI stood at 2.0% and 1.9%, respectively, in May.34