Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Index is reconstituted annually. Eligible securities are added into the Index as constituents during the next scheduled annual reconstitution. Similarly, securities that no longer meet the eligibility criteria of the Index may continue to remain in the Index until the next scheduled annual reconstitution, at which point they may be removed. There is no guarantee that the representativeness of the Index is optimised from time to time.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index Calculation Agent calculates and maintains the Index. If the Index Calculation Agent ceases to act as index calculation agent in respect of the Index, the Index Provider may not be able to immediately find a successor index calculation agent with the requisite expertise or resources and any new appointment may not be on equivalent terms or of similar quality. There is a risk that the operations of the Index may be disrupted which may adversely affect the operations and performance of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- Global X HSI Components Covered Call Active ETF (the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng Index (the “Reference Index” or the “HSI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSI ETF and long positions of HSI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSI ETF and long positions of HSI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSI Call Options over an exchange or in the OTC market. The HSI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSI Futures and writing HSI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSI Futures and the HSI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSI Futures and HSI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- To the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Global X HSCEI Components Covered Call Active ETF (the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index” or the “HSCEI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSCEI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSCEI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSCEI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSCEI ETF and long positions of HSCEI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSCEI ETF and long positions of HSCEI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSCEI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSCEI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSCEI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSCEI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSCEI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSCEI Call Options over an exchange or in the OTC market. The HSCEI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSCEI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSCEI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSCEI Futures and writing HSCEI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSCEI Futures and the HSCEI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSCEI Futures and HSCEI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (Mainland China). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in Mainland China. In addition, to the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed Mainland securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

Monthly Commentary on Key Themes – March 2024

Global X Asia Semiconductor ETF (3119 HKD)

Global X China Semiconductor ETF (3191 HKD)

Industry Update

– China domestic equipment supplier ACM Research guided optimistic outlook for 2024: Management expects the China Wafer Fab Equipment (WFE) market to grow in 2024, and the company to grow ahead of the industry driven by market share gain. ACM Research has provided guidance of 23% YoY growth for 20241 driven by solid spending in China’s semiconductor capacity expansion.

– Report on potential collaboration between SK Hynix and TSMC on HBM4: TSMC and SK Hynix are reported to collaborate on HBM4 in the future, with TSMC handling some of the process. Both companies are expanding their presence in their respective markets, with TSMC being a dominant manufacturer of Nvidia’s Graphics Processing Units (GPUs), and SK Hynix gaining market share in the HBM market.2

Stock Comments

– NAURA (+24.7%): Naura is a key local semiconductor equipment supplier in China. The company has announced strong 4Q23 preliminary results with 4Q23 earnings of RMB 996 million at the midpoint, showing a 49% YoY increase. This performance has exceeded street expectations. The management also remains optimistic about WFE spending in China driven by both logic and memory capacity expansion.3

– ASMPT (+27.3%): ASMPT is a key equipment supplier in hardware assembly, OSAT, and advanced packaging. The company is well-positioned to benefit from the OSAT CAPEX recovery trend. ASMPT has also invested resources to expand its market share in the growing advanced packaging space.4

Preview

Increasing AI adoption in the data centers and increasing penetration of AI at the edge and on-device will be the key enablers of the next upcycle semiconductor as AI-enabled devices have much higher semiconductor contents. Currently, we are still in the process of cycle recovery as both stocks and earnings are below the previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.5

Global X China Electric Vehicle and Battery ETF (2845 HKD)

Industry Update

– First two months of EV sales stronger than expected, pending March sales figures to assess growth: 2M24 EV retail sales tracking had 59% YoY growth, better than the market expectation. Based on the announcements of individual auto brands, BYD reported February New Energy Vehicle (NEV) sales of 122.3k units (-37% YoY/-39% MoM6) and 2M24 sales of 323.8k units (-6% YoY). Li Auto delivered 20,251 units of vehicles in February (+22% YoY/-35% MoM)7 and 2M24 sales of 51,416 units (+62% YoY). The company will start the delivery of MEGA in March. Nio February deliveries logged 8,132 units, (-33% YoY/-19% MoM.8) Xpeng February deliveries logged 4,545 units (-24% YoY/-45% MoM.9) (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF)

– Battery production is expected to recover in March: There are yet industry data points on battery production due to the holiday season. According to ZE consulting, March procurement was above the low expectations industry players had before the holidays and is also a recovery from a low base in Jan-Feb 24 (and 1Q23) as battery makers pull forward demand restocking to March.10

– Battery material costs declined to a lesser degree in February: China’s spot lithium carbonate price was around RMB 96.3k/t at the end of February, down by around RMB 0.2k/t or 0.1% MoM.11 Inventory-wise, the total inventory of lithium carbonate came in at 79,919 tons (vs. 73,735 tons last month).12

– Strong momentum from Huawei AITO: The AITO brand deliveries reached 32,973 units in February (-36% MoM), with new AITO M7 deliveries at 18,479 units (last month was 31,353).13 Accumulated orders of the new M7 and M9 have exceeded 150k and 50k units since the product launch.14

– Growing market concern on price competition: It appears that many local OEMs are following market leaders with price cuts and promotions. Many players launched aggressive promotion campaigns as they destocked inventory ahead of facelifts or new model launches. Tesla is also rolling out promotions, which they also did last year when the auto sales were not strong.

Stock Comments

– BYD (002594.CH): BYD’s share price was up 12.0% in February, which was a neutral contributor to the ETF.15 BYD delivered a market performance this month. The company has a strong product pipeline in the next couple of months but near term may suffer from margin erosion due to aggressive price cuts for destocking ahead of the facelift.

– CATL (300750.CH): CATL’s share price was up 7.9% in February, which was a negative contributor to the ETF.16 The stock didn’t rebound as much in February and the index as the correction in January was not as sharp. The stock still suffered margin erosion concerns due to increased competition and aggressive price competition at the customer end.

– Ganfeng Lithium(002460.CH): Ganfeng Lithium’s share price was up 24.4% in February, which was a positive contributor to the ETF.17 The lithium prices started to stabilize and establish a floor. We also entered a traditional seasonal recovery time ahead of new product launches in March and April.

Preview

The first two months of China EV sales are better than what the market originally anticipated as they extrapolate the weak January sales condition. The aggressive price competition is a negative driver of near-term earnings, but these corrections and promotions are not new and unusual. Tesla also did a similar price cut early last year and investors are not new to these promotion strategies. We believe the China auto market to stay competitive in 2024. This should put a higher pressure on the overseas JV ICE brands. With lithium prices finding a short-term floor and battery supply chains starting to restock ahead of new product launches, we believe the sector to do well in the upcoming months.

Global X China Clean Energy ETF (2809 HKD)

Industry Update

– Solar – Polysilicon prices stabilized, same as the supply chain prices: Solar polysilicon prices reached RMB 68/kg by the end of February, slightly higher than the RMB 66/kg a month ago.18 Module prices are now at RMB 0.90/0.93/W for M10/G12, the same as last month.19 According to SCI99, solar glass prices stayed at RMB 16.25/25.50/sqm for 2.0mm/3.2mm. Inventory levels increased to 28.56 days from 25.35 days. Soda ash prices dropped to RMB 2,350/t.20 The latest 2024 inverter export data is not yet available. Based on preliminary data (which may be subject to future adjustment), Germany registered residential ESS installations of 201MWh21 in February 2024, down 41% YoY and 37% MoM. 22 It is too early to be optimistic that the industry is bottoming out.

– Grid and power installation: The latest monthly installation is not yet available. The National Development and Reform Commission and National Energy Administration jointly issued on 1 March the Guidance on high-quality development for the power grid distribution network. It sets multiple medium-term (by 2025) and long-term (by 2030) targets for improving the smartness and stability of the distribution power grid.

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. However, it is worth noting that the solar supply chain entered a consolidation phase starting in 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. The optimism around the European market’s sequential recovery turns out to be only temporary. We have yet confidence in the market turnaround in Europe. Meanwhile, we are bullish on the electrical equipment players who benefit from increased grid and system investment in China and globally. They enjoyed a higher selling price and volume growth amid of global equipment tightness.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

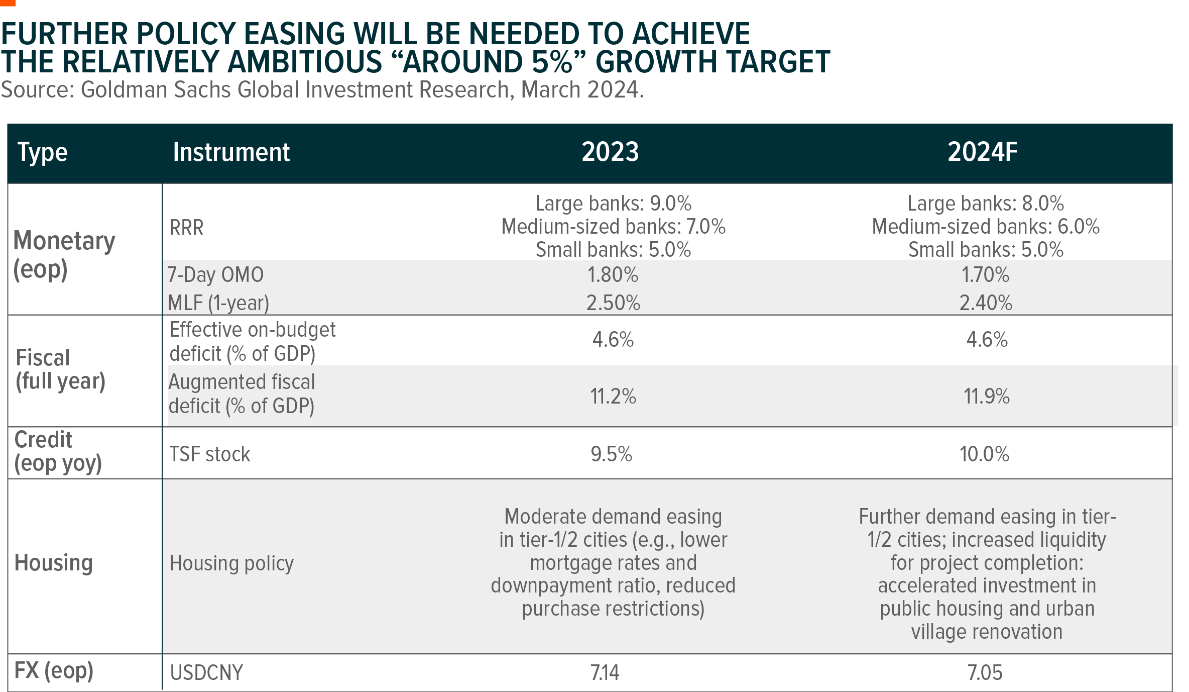

– Two Sessions turned out to be largely in line with the expectation. The GDP growth target was set around 5% which came in slightly higher than anticipated, 3% inflation target, and 3% official on-budget deficit ratio. Top policymakers reiterated a supportive stance and the PBOC governor highlighted that there is still room to cut RRR, and the PBOC will expand structural policy tools. That said, the market seemed disappointed as no detailed measures were being announced to support the consumption and property market which would be needed to reach a 5% growth target.23

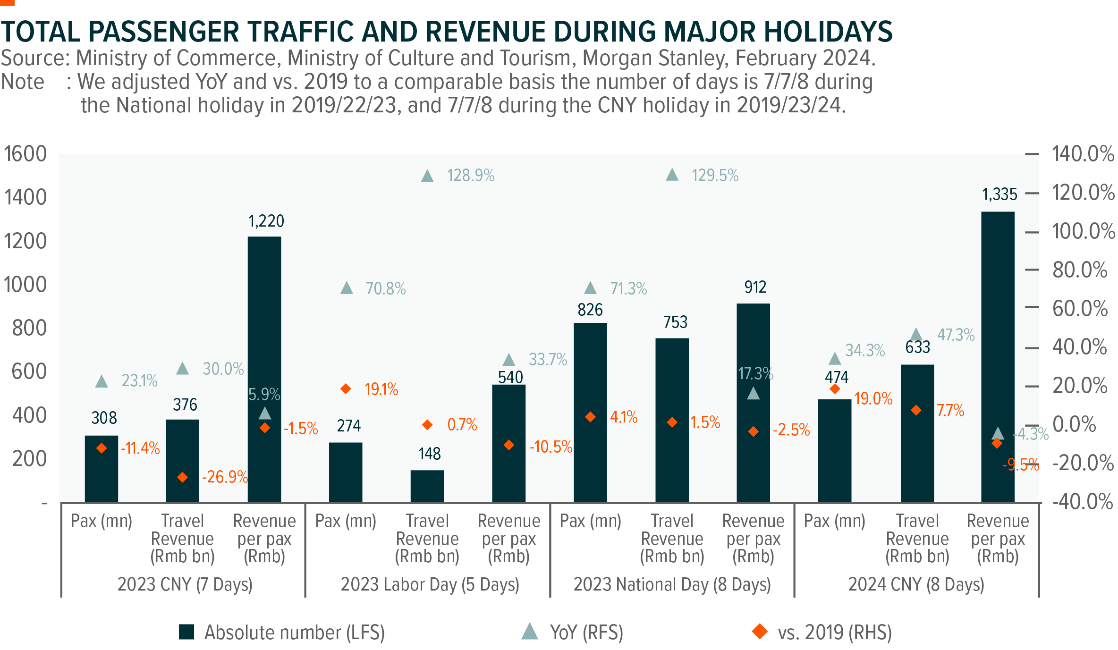

– While consumer sentiment remains weak, CNY holiday data came in better than feared. Domestic and outbound traffic were both strong on the back of strong traffic. Total tourism revenue increased +47% YoY to RMB 633 billion (+8% vs. 2019) but spending per traveler remained weak at around RMB 1,335, which was 4.3% YoY lower than last year.24 Outbound travelers reached 1.69 million during CNY recovering nearly 90% of the 2019 CNY level.25 Chinese traveling to Hong Kong and Macau was also strong during the holiday.

Stock Comments

– Li Auto (000568 CH) was the major contributor in February thanks to strong 4Q23 earnings results. Revenue grew +136% YoY and +20% QoQ beating the consensus estimates by 4.5%. Gross margin reached 23.5%, vehicle margin held up better than expected thanks to the scale and battery savings and recorded 22.7% in 4Q23. Operating margin came in at 7.3% which led to a non-GAAP net income of RMB 3.8 billion which was 7% higher than the street consensus. The company guided 1Q24 revenue of RMB 31.3-32.2 billion and sales volume of 100-103K units which was largely in line with the expectation.26

– Shenzhou Int’l (2313 HK) was the major detractor in February due to concerns about the intensifying China trade war and Bro Eastern’s issued profit warning. Trump’s preparation for an escalating trade war against China per the Washington Post on 27th January 2024 led to a sharp correction of the stock.27 However, Shenzhou would not have much impact even if the tariff went up because the company has almost no products for the US market that are made in China plants today. Bros is the largest yarn supplier to Shenzhou and Bros issued a profit warning which also increased concerns about Shenzhou’s growth amid a weak consumption environment.28

Preview

Top policymakers reiterated their supportive stance. For example, the Head of NDRC emphasized that the authority will roll out a large-scale consumer goods and equipment upgrade program. Policymakers’ promise on continued monetary policy easing with PBOC governor highlighting that there is still room to cut RRR. We are watching out for more detailed supportive measures to be announced in the coming months.

Global X China Cloud Computing ETF (2826 HKD)

Industry Update

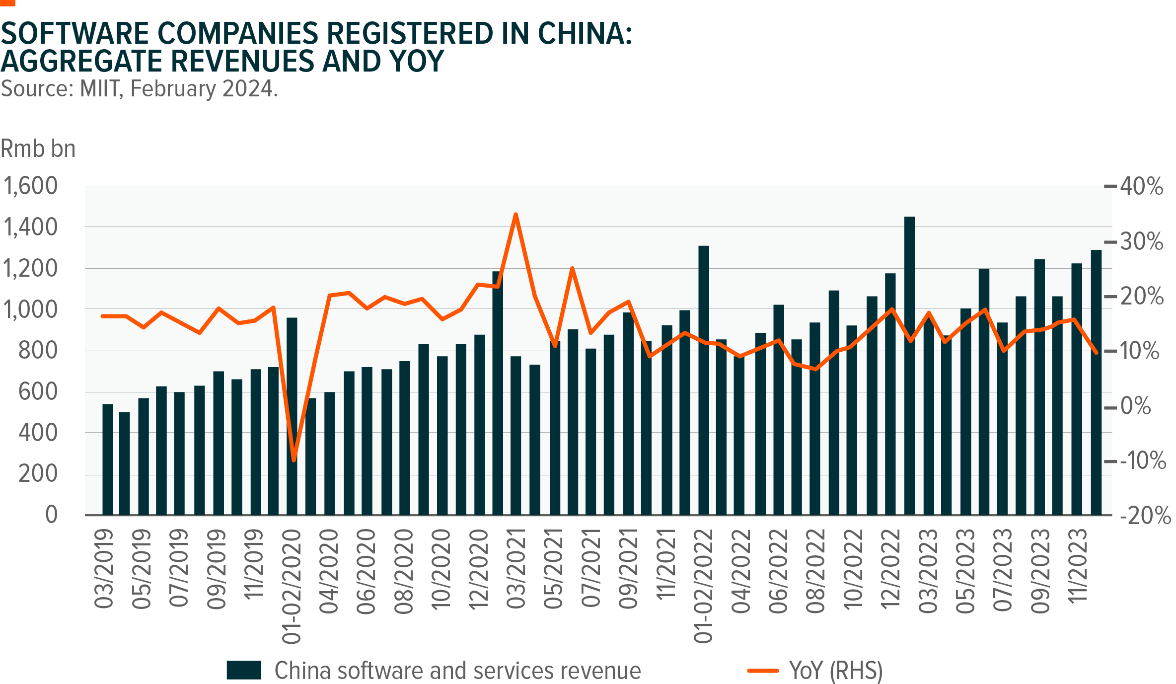

– China Software Industry December revenues were +9% YoY, slowing down from Oct/Nov (+15%/+16% YoY), leading 2023 revenues to increase by 13.4% YoY.29 IT services growth outpaced the industry at 15% YoY in 2023, driven by cloud computing and big data analysis services growth at 15% YoY, while EDA software growth slowed at 6% YoY, and e-commerce IT services growth was at 10% YoY, followed by software products at +11% YoY, driven by industrial software at +12% YoY, cybersecurity at +12% YoY, and embedded system software at +11% YoY. Net margin was 12.2% in December (vs. 13.1% in November).30

Stock Comments

Key Contributors:

– Beijing Kingsoft Office Software. Inc. Class A: AI-related companies have seen share price outperformance during the month. 2023 results were better than feared. Revenue was RMB 4.6 billion, +17% YoY. Normalized net profit came in at RMB 1.26 billion, +34.6% YoY, and in the upper half of the previous preliminary result range.31

– iFlytek Co., Ltd. Class A: The Company released its Spark Large Language Model (LLM) v3.5 in January. 30th. The key upgrades of Spark LLM v3.5 focused on: (1) improvement of 7 core LLM capabilities; (2) adaption to local computing platform: enhanced computing efficiency and bandwidth utilization by 40~50% based on “Flying Star One” platform; (3) enhanced voice recognition capability on multilingual and personification; and (4) Office software application: generating document and presentation empowered by Spark LLM. iFlytek plans to launch Spark LLM v4.0 in 2Q24 which reaches similar capability of GPT-4.0.32

Preview

1Q is traditionally a weak season for the software industry with more volatility as most China software companies recognize project-based revenues in 4Q, and most companies are loss-making in 1Q due to higher OPEX costs amid a smaller revenue scale. Most of the China software companies’ stock prices already corrected meaningfully in January 2024, with forward multiple at 2 standard deviations below historical avg., even after factoring earnings downward revisions. Into February, China’s software sector has recovered from January low, and we expect further stock price upside to be primarily driven by improvement in fundamentals.

Global X Hang Seng Tech ETF (2837 HKD)

Stock Comments

Key Contributors:

– Li Auto, Inc. Class A: Li Auto’s share price moved up after its 4Q23 results, which surprised the market positively thanks to better per vehicle GPM and one-off adjustment. Total revenue grew 20% QoQ to RMB 41.7 billion, exceeding the high end of guidance of RMB 38.5-39.4 billion. Vehicle GPM rose 1.4pt QoQ to 22.7%, higher than the market expectation of 20-22%.33

– Meituan Class B: Meituan share price was negatively impacted by the intensifying competition dynamic of the local services industry, with Douyin entering the space. The operating profit margin of Meituan’s IHT (In-Store, Hotel & Travel) business is guided to reduce to 35%. With still intense competition for its IHT business, the recent stock price rally may have been driven by reports of more aggressive loss reductions in the New Initiatives business, which will lead to a meaningful improvement of net profit margin for the Group. 34

Key Detractor:

– Baidu, Inc. Class A: Baidu reported 4Q23 earnings results in line with market expectations. However, the market remains concerned about its core advertising business revenue growth in the near term due to a fluid macroeconomy condition. On AI monetization, looking ahead to 2024, the firm expects AI technologies to contribute billions of RMB in additional revenue to the advertising business.35

Preview

China’s internet sector is entering a normalized base after reopening in 2023 post-Covid across major verticals with the focus shifting toward take rates (eCommerce with Ad Tech upgrades) and ARPU uplift (in music/entertainment). Companies also increasingly focus on improving operation efficiency through cost optimization and increasing shareholder returns through dividend payouts and/or share repurchases. Into FY2024, more companies announced upsized dividend/repurchase policies, which signals a positive sign for the sector’s shareholder return trend.

Global X Hang Seng High Dividend Yield ETF (3110 HKD)

Industry Update & Issue Analysis:

– The Hang Seng High Dividend Yield Index gained 5.0% in February 2024 on hopes that more supportive policies to be rolled out by Chinese policymakers. The top-performing sector was Consumer Discretionary whilst the bottom-performing sector was communication services36.

– The Lunar New Year festivities provided a substantial boost to the Consumer discretionary sector. China’s travel activity and spending jumped above pre-pandemic levels during the New Year holiday, in a sign that consumption was improving in the world’s second-largest economy.

Single Stock Comments:

– Xinyi Glass (0868 HK) emerged as the best-performing stock in the Hang Seng High Dividend Yield Index, delivering a remarkable return of over 20% in February37. The company’s exceptional performance was further underscored by its impressive financial results for the year 2023. With a 4.6% growth in net profits38, Xinyi Glass demonstrated its ability to capitalize on market opportunities and drive sustainable growth. In recognition of the company’s success and commitment to creating value for its shareholders, Xinyi Glass raised its final dividend by an impressive 68%39. This dividend increase serves as a testament to the company’s dedication to rewarding its shareholders and reflects its strong financial position.

Outlook:

While short-term volatility persists, the Hang Seng High Dividend Yield Index demonstrated greater resilience relative to broad-based indexes. Notably, this Index consists of over 60%40 of its constituents in State Owned Enterprises. The concept of the Valuation System with Chinese Characteristics (“VCC”) is back in the spotlight again in light of recent developments. During the Chinese Securities Regulatory Commission (“CSRC”) Work Conference in late January 2024, the Chairman reiterated the significance of VCC and called for actions to expedite implementation. The primary objective of VCC is to enhance the quality and investment value of listed companies, especially SOEs. By investing in the Hang Seng High Dividend Yield Index, investors can gain exposure to high dividend-paying and low-volatility companies while also benefiting from the accelerated implementation of VCC.

Global X China Little Giant ETF (2815 HKD)

Industry Update

– A-shares rebounded in February with CSI300/500/1000 up by 9.4%/13.8%/11.7%. The rally was fueled by a confluence of factors, including robust high-frequency data, policy easing, strategic buying by the national team, and leadership changes at the China Securities Regulatory Commission (CSRC). Among the 11 Wind A-share Level-1 sector index, IT (17%), healthcare (11%) and consumer discretionary (10%) ranked top-three performers, while real estate (3%), utilities (3%) and telecom (3%) were the bottom three.

– The national team’s purchasing of key A-share index-linked ETFs, including CSI300, CSI500, CSI1000, ChiNext, and A50, also played a pivotal role in the market’s positive momentum. Further buoyancy was added with the appointment of Wu Qing as the new CSRC chairman, an individual known for his tough stance on securities violations, which has been welcomed by the market.

– Travel spending reached new highs, superseding 2019 levels, but per capita spending was still down 10% from 2019. The 8-day main period of the Spring Festival saw 474 million domestic tourism trips taken, a new record and rising by 19% from 2019 levels, while the total spending reached RMB633bn, also up 7.7% from 2019. However, despite the rosy headlines, the per capita spending per trip was still down about 10% from 2019 levels and down 5% from last year’s levels. Consumer confidence was hovering around historically low levels as of December 2023, underscoring headwinds from the property front and the labor market.

– New home sales for 44 cities remain weak at -40% YoY during Feb 2-15th (vs. same period in 2023 on lunar calendar basis), whilst secondary transactions for 50 cities during the 8-day CNY holiday are strong at +70% compared to the CNY holiday in 2023. Though the divergence is likely due to project completion concerns and price correction in the secondary market, yet second-hand home sales recovery could be one of the leading indicators in the past.

Stock Comments

– Suzhou TFC (+58.77%): TFC is a leading provider of integrated solutions for optical components, with clients including Mellanox (a subsidiary of Nvdia). 5G network construction and upgrades of data centers to 400G and 800G will drive demand for high-speed light engines. We expect the light engine business to become an important driver for the company in the long term, with the company’s high-speed light engine products being certified by more customers.41

Preview

We will watch any policy from Two Sessions (and potential 3rd planum), with anticipation for further details on the “new productive force” and relevant industrial policies.

Global X Japan Global Leaders ETF (3150 HKD)

Industry Update & Issue Analysis:

– In February 2024, the FactSet Japan Global Leaders Index experienced a notable gain of 5.6%42 in JPY terms, reflecting the continued strength and positive momentum of the Japan equity market. This performance resulted in the market reaching historic highs. Among the sectors within the index, Consumer Staples emerged as the top-performing sector while healthcare was the bottom-performing one43.

– Investors are growing more optimistic about the potential normalization of Japan’s monetary policy, indicating that policymakers have confidence in the sustainability of wage increases. A persistent and upward trajectory in wages, coupled with ongoing labor shortages, is anticipated to have a direct and positive effect on stimulating consumer spending.

Single Stock Comments:

–Mitsubishi Corp (8058 JP) was the best-performing stock in the FactSet Japan Global Leaders Index, delivering a remarkable return of over 20%, in the JPY term, in February44. Mitsubishi Corp’s share price soared to an all-time following its announcement of a significant share buyback plan. The company has committed to spending 500 billion JPY45 on re-purchasing its own shares. The news of Mitsubishi’s share buyback plan has resonated well with investors, resulting in a surge in the company’s stock price.

Outlook:

We are optimistic about the overall Japan equity market, supported by a combination of easing monetary policies, robust export growth, and the weak currency. The continuation of accommodative monetary policies provides a supportive environment for businesses, effectively stimulating economic growth. Furthermore, Japan’s export sector has been performing exceptionally well, benefiting from a global economic recovery and increased demand for Japanese products. This export growth contributes to the overall strength of Japanese companies and their profitability. Additionally, the weakening of the JPY against major currencies enhances the competitiveness of Japanese exports, further bolstering the country’s export-driven economy. With these factors in play, the Japan export leaders stand to benefit from a favorable environment, attracting both domestic and international investors seeking opportunities for capital appreciation and growth.

Global X HSI Components Covered Call Active ETF (3419 HKD)

Global X HSCEI Components Covered Call Active ETF (3416 HKD)

Industry Update & Issue Analysis:

-In February, the Hong Kong stock market had a strong start in the year of Dragon, as sentiment was recovered by a barrage of supportive measures. Among different sectors, we see the Technology sector as the top contributor. The Hang Seng Index (‘HSI’) and the Hang Seng China Enterprises Index (‘HSCEI’) rose by 6.6% and 9.3% respectively in February. Looking at the corresponding VHSI and VHSCEI Volatility Indexes, which measure the expected volatility for the HSI and HSCEI, dropped by 5% and 2%, respectively, to 24.5 and 28.7. In this context, the estimated premium generated by writing February HSI and HSCEI at-the-money call options is 2.5% and 3.0% respectively.46