Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Biotech ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China MedTech ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China MedTech Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies in the medical technology industry. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant industry.

- Many of the companies with a high business exposure to a medical technology theme have a relatively short operating history. Rapid changes could render obsolete the products and services offered by these companies and cause severe or complete declines in the prices of the securities of those companies. Additionally, companies with medical technology themes may face dramatic and often unpredictable changes in growth rates and competition for the services of qualified personnel. They may potentially subject to (i) substantial government intervention in the technology industry (including restrictions on investment in internet and technology companies), (ii) complex laws and regulations including privacy, data protection, content regulation, intellectual property, competition, protection of minors, consumer protection and taxation, (iii) heavy and significant capital investment on research and development, (iv) risks of medical failure (including injury or death of patients), negligence or product liability claims, recall or withdrawal of products. These risks may result in adverse impact of the operating results of the companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Shares on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which

may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. - Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Crude oil prices are highly volatile and may fluctuate widely and may be affected by numerous events or factors such as crude oil production and sale, complex interaction of supply and demand of crude oil, weather, crude oil inventory level, war, speculator’s activities, economic activity and other financial market factors.

- Investment in futures contracts involves specific risks such as high volatility, leverage, rollover and margin risks. Crude oil price is highly volatile. Investors may suffer substantial /total loss by investing in the Fund.

- As the exposure of the Fund is concentrated in the crude oil market, it is more susceptible to the effects of crude oil price volatility than more diversified funds.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

Monthly Commentary on Key Themes – Dec 2023

[2837] Global X Hang Seng Tech ETF

The Hang Seng Tech Index recorded a 3.92% gain in November as investors became increasingly hopeful on the Fed’s interest rate cuts in 2024 and gained optimism on new policies to support financing for property developers.1 Over the month, better-than-expected Chinese economic data, easing US inflation, and the meeting between President Xi Jinping and Joe Biden also boosted market sentiment.

The key outperforming sectors were Communication Services and Information Technology.

Communication Services stocks bounced back from the previous month with improved revenue

Communication Services gained 9.05%, contributing 2.51% of the fund in November.2 Tencent Holdings Ltd (700.HK), accounting for 8.06% of the fund, gained 13.94% this month and contributed 1.06% to the return.3 The stock price gained after ByteDance announced that it will restructure its gaming unit.4

Kuaishou Technology (1024.HK), accounting for 7.07% of the fund, gained 12.37% this month and contributed 0.81% to the return.5 Its third-quarter financial report reported a net profit of RMB 2.18 billion, compared with a loss of RMB 2.71 billion in the previous year, as a result of increased traffic on its livestreaming platform that drives e-commerce revenue.6

Information Technology gained after strong performance release

The Information Technology sector contributed 1.47% to the fund in November.7 Lenovo Group (992.HK), accounting for 3.83% of the fund, gained 8.83%.8 Lenovo Group’s recent quarterly result showed the mobile phone business grew by 11% year-on-year (YoY) and high-end products accounted for 23%.9

Xiaomi Corp (1810.HK), accounting for 10.69% of the index, gained 9.85% in November and contributed 1.02%.10 The company announced its Q3 2023 results, breaking its two-year revenue slump with strong performance, reaching RMB 70.9 billion.11

[3110] Global X Hang Seng High Dividend Yield ETF

The Hang Seng High Dividend Yield Index gained 0.41% in November.12 Communication Services and Energy were the key contributors during the month.

Communication Services sector rallied

HKBN (1310.HK), accounting 2.48% of the fund, surged 24.54% in the month, contributing +0.50% to the return.13 The company announced its full-year results at the beginning of the month and stated that its revenue was HK$11.7 billion.14

Energy sector bounced back

The Energy sector contributed 0.43% to the fund in November. China Coal Energy (1898.HK), accounting 2.19% of the fund, rose 9.24% in the month and contributed 0.20% to the return.15 China Shenhua Energy (1088.HK), accounting for 3.13% of the fund, gained 6.24% contributing +0.19% to the fund.16 Recent coal mine accidents in Shanxi, China, may have a big impact on coal production as the coal industry chain is sensitive to any marginal change in supply and demand. Shanxi is China’s top coal producing region, accounting for more than 50% of the country’s coal production in 2022.17 As supply shrinks, demand will strengthen, resulting in higher coal prices and strengthening the coal industry.

[2845/9845] Global X China EV & Battery ETF

Flattish sequential auto sales growth, while EV penetration stays solid in November: Based on the announcements of individual auto brands, many of them registered flattish month-on-month (MoM) growth in November. BYD reported November new energy vehicle (NEV) sales of 301.9k units, +31% YoY/+0% MoM.18 Entering Q1 2024, net profit per car may fall back to below RMB 9k due to low season, inventory clearing, and price discount. Li Auto delivered 41,030 units of vehicles in November (+173% YoY/+2% MoM), suggesting its full-year delivery target (300k units) has been achieved ahead of time.19 Nio’s November deliveries logged 15,959 units, +13% YoY/-1% MoM.20 XPeng’s November deliveries logged 20,041 units, +245% YoY/+0% MoM.21

Battery production to grow in October: According to the China Automotive Battery Innovation Alliance (CABIA), China’s power battery installation reached 39.2GWh in October, up 7.6% MoM and 28.3% YoY.22 China’s power battery production reached 77.3GWh in October, down 0.1% MoM and up 23.1% YoY.23 Implied months of China power battery inventories were 2.1x in October 2023 (vs 1.9x historical average months of power battery inventory). LFP battery installation accounted for 68.4% of total power battery installations in October, up 2.0ppt MoM and up 4.0ppt YoY.24 CATL’s market share was 42.8% in October, +3.4ppt MoM but -5.5%ppt YoY, while BYD’s market share was -0.8% MoM but up 0.9ppt YoY to 26.2%.25

Battery material costs declined further in November: China’s spot lithium carbonate price was around RMB 110k/t at the end of November, down by around RMB 50k/t or 15% MoM.26 Lithium supply in China increased in November as some converters resumed production from maintenance last month; some brine player was reported to release inventory, which also affects sentiment. Demand stays lackluster as peak season is behind us. Both NCM and LFP cathode players have seen order reduction recently, suggesting weaker-than-expected consumption. Downstream keeps low inventory strategy and shows no interest in purchasing more than the minimum volume required, as the market is still cautious on lithium price outlook.

Strong momentum from Huawei AITO: The AITO brand deliveries reached 18,827units in November, with new AITO M7 deliveries at 15,242 units.27 Huawei announced that it will spin off its auto business unit (BU) by forming a joint venture (JV) with Chang’an. Huawei also calls on other partners to invest in the JV and aimed at turning the auto business into a profitable BU. Huawei’s move, in our view, will accelerate the development of China’s smart car ecosystem with its deepening partnerships with local original equipment manufacturers (OEMs) and suppliers.

Key stock movements:

BYD (002594.CH): BYD’s share price was down 16.5% in November, a negative contributor to the ETF.28 The stock has responded negatively to news of BYD cutting prices of select brands, raising concern on their recent inventory build. The strong AITO brand which features a strong smart driving capability also causes concern for BYD’s growth visibility into 2024, as they are generally considered a laggard in applying smart driving features to their vehicles.

CATL (300750.CH): CATL’s share price was down 10.0% in November, a negative contributor to the ETF.29 The share price underperformance in recent months was quite meaningful vs. peers. We believe the market remains concerned about the company’s ability to maintain their global market share as the US and Europe are raising their bar on battery imports.

Ganfeng (002460.CH): Ganfeng’s share price was down 10.9% in November, a negative contributor to the ETF.30 Lithium and lithium carbonate prices continued to correct further in November, for the fourth consecutive month. There are limited signs of inventory rebuild by the battery supply chain players. Many of the players stayed cautious about the lithium pricing outlook into 2024.

[2809/9809] Global X China Clean Energy ETF

Solar – Polysilicon still on the declining path: Solar polysilicon price fell to RMB 65/kg by the end of November, from RMB 82/kg a month ago.31 Module prices are now at RMB 1.01/1.0/W for M10/G12, lower than the RMB 1.13/1.14/W a month ago.32 According to SCI99, solar glass prices stayed at RMB 18.25/27.25/sqm for 2.0mm/3.2mm.33 Inventory levels increased to 22.26 days from 18.95 days.34 Soda ash prices increased to RMB 3,000/t from RMB 2,700/t.35

Inverter exports were down 14% MoM in October 2023.36 Total exports stood at USD 554 million in October (-14% MoM; -43% YoY).37 We believe the MoM fall was likely due to the ongoing inverter inventory pile-up in Europe. Some US inverter players, such as SolarEdge offered a bearish colour on European inverter demand in the second half of 2023.

Grid and power installation – Strong solar installation; grid capex back to decent growth: China’s October 2023 wind installations were 3.8GW (-16% MoM; +102% YoY), with 10M23 installations of 37.3GW (+77% YoY) vs. market expectation for 60-70GW for 2023.38 China’s October 2023 solar installations were 13.6 GW (-14% MoM; +142% YoY), with 10M23 installations of 142.6GW (+145% YoY) likely meeting the already high market expectations.39

In October, the electricity grid spending in China reached RMB 44 billion (+24% YoY), with 10M23 grid spending up +6.3% YoY.40 The grid spending is second-half loaded in China. December, in particular, is the strongest month and has constituted 15% of annual spending on average.41

[2807/9807] Global X China Robotics & AI ETF

China data showing signs of weakness in October: The latest monthly data points released by the National Bureau of Statistics on 15 November reported that China industrial robot production volumes were -18% YoY in October (-8% MoM and worse than past five years’ seasonality of +1% MoM); China machine tool production volumes were +23% YoY in October (+0% MoM and past five years’ seasonality of -16% MoM).42 Manufacturing FAI was +6% YoY in October (edged down vs. +8% last month).43 High-tech manufacturing fixed asset investment (FAI) stayed at +11% YoY in October (vs. +11% YoY in prior month).44 Railway FAI continued the recovery trend with +25% YoY in October (vs. +22% YoY in prior month).45

In October, the overall order trend was mixed. Inovance maintained its industrial automation order growth at +30% YoY in October.46 Some companies mentioned recovery in electronics capex. But this is offset by the decline in solar and battery investment. Looking forward, we see low visibility in manufacturing capex inflection with decelerating solar/ESS capex/demand while electronics is among the few end-markets that is trending up.

JMTBA data came in weaker than expected in October: Based on the final machine tool order data released by the Japan Machine Tool Builders’ Association (JMTBA) on 27 November, global machine tool orders totaled ¥112.1 billion (-21% YoY, -16% MoM) in October 2023.47 Domestic Japan orders fell sharply at ¥33.6 billion (-24% YoY, -25% MoM).48 The decline was the result of negative impacts beyond just seasonality, with the tapering off of term-end demand especially pronounced for automotive components, while slower adoption of manufacturing subsidies led to weaker demand for building construction and metal/die & mold-related investment, which had been robust primarily among SMEs. Overseas orders (ex-Japan) was ¥78.4 billion (-19% YoY, -12% MoM).49 Order interest in key regions was mostly disappointing or flattish, and there’s yet to be a clear signal of an order rebound.

[3191/3119] Global X China Semiconductor/ Asia Semiconductor ETF

China’s BOE to build USD 9 billion advanced OLED plant: BOE Technology Group said it will build a RMB 63 billion (USD 8.84 billion) production facility to make OLED screens using advanced technology. The factory, planned for Chengdu, will turn out organic light-emitting diode substrates using 8.6-generation technology. These panels, sized 2,620 by 2,290 millimeters, are more efficient than earlier generations because they can be made into more displays. The factory will be targeting to fulfil the demand in IT applications and the industry sees increasing adoption of OLED in mid-size IT products.50

Greater China foundry utilization expected to recover in 2024:

China foundries remain committed to CAPEX plans: SMIC raised its 2023 full-year capex to USD 7.5 billion (vs. USD 6.0 billion previously).51 Hua Hong projects its capex to be USD 1 billion in 2023 and USD 2.1 billion in 2024.52 China’s sustained high level of capex in its foundry industry boosts demand for domestic semiconductor equipment suppliers.

[2806/9806] Global X China Consumer Brand ETF

China consumption remains soft with weak consumer confidence but continues to stabilize, with total retail sales growing +7.6% YoY in October, improving from +5.5% YoY in September and +4.6% YoY in August.53 China’s retail sales is expected to grow +7.8% YoY in 2023 and +4.8% YoY in 2024, according to Morgan Stanley estimates.54

While the consumption polarization trend continued, we started to see some global luxury analysts revise down the industry growth rate for 2024 due to macro as well as the delay in Chinese recovery beyond high net-worth individuals. Bernstein revised down its global luxury industry growth forecasts from +11% YoY to +7% YoY while highlighting that Chinese consumers will be the essence for next year’s growth as they will be the major growth driver for the industry.55 Similarly, Morgan Stanley also downgraded LVMH (luxury proxy name) to neutral early this month.56

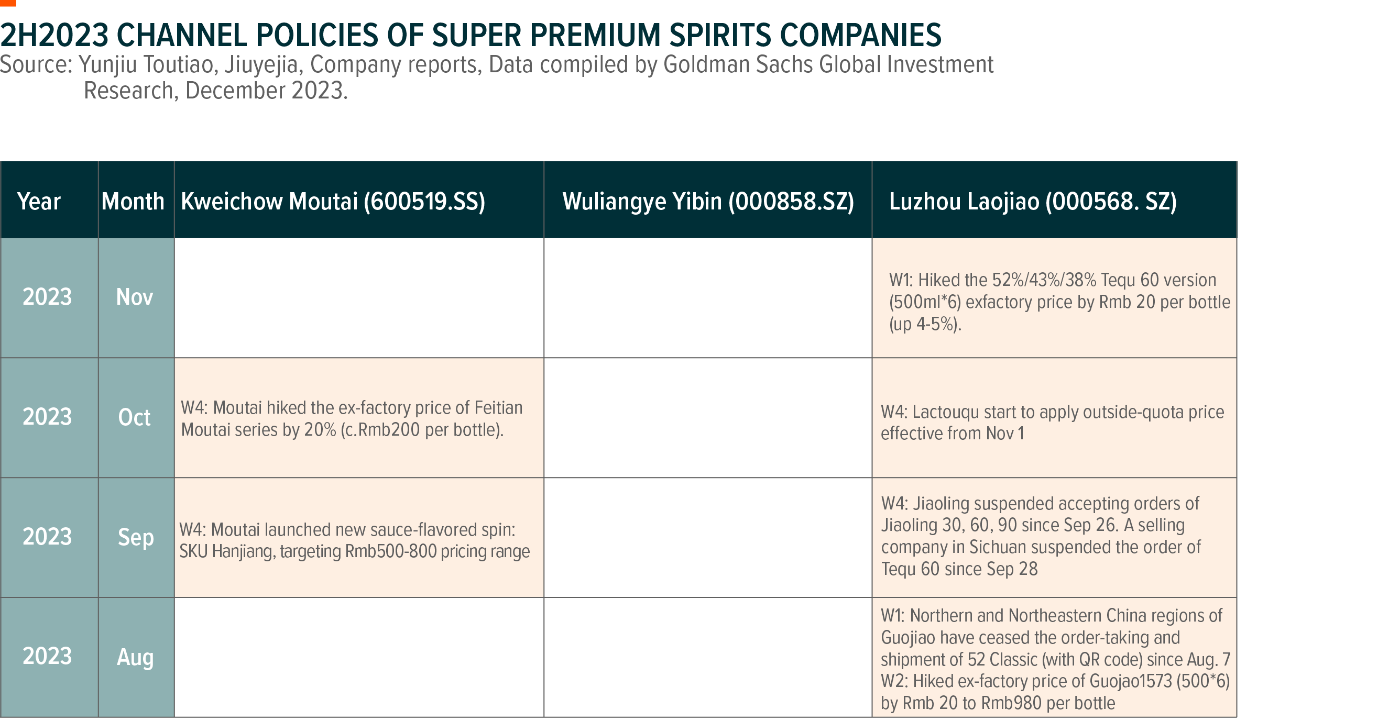

Premium baijiu demand is still more resilient than the overall baijiu industry, which enabled Kweichow Moutai to raise its ex-factory price by 20%. However, competition continues to intensify between premium brands, namely Wuliangye and Laojiao, amid softer consumer demand. According to Goldman Sachs, Guojiao recently communicated with some distributors that they would propose a front loading of 2024 sales rebate and increase the rebate by RMB 30-50 per bottle, while the full-year nominal ex-factory price will remain at RMB 980/bottle. While Wuliangye is still in the process of formulating its pricing strategy for 2024, it would keep its existing ex-factory price for Common Wuliangye at RMB 969/bottle for those meeting prepayment requirements before January 25th, 2024. We have seen intense competition across different consumer categories, from beer to cosmetics, but we are starting to see this in the premium baijiu segment amid weak consumption.

Brands that are positioned for consumption down trade seem to continue to be beneficiaries in this environment. We visited Eastroc’s (605499 CH) factory in Guangzhou in November, and sales momentum continues to remain strong. They just acquired land in Tianjin to further expand their capacity. Similarly, mass cosmetics have grown faster than premium cosmetics this year, which we haven’t seen in the past years, and this has benefited local cosmetics brands. Bernstein expects mass cosmetics to continue to outperform premium brands in 2024.57

We have seen some stabilization signs, although sustainability is still questionable. China’s consumer confidence is still hovering around historically low levels. The pace of consumption recovery will be based on the magnitude of the government’s stimulus policies from here. That said, we see limited downside risk from a valuation perspective. Valuation for many consumer companies has come down to more attractive levels, and thus, we are becoming more constructive on the China consumption theme.

[2826/9826] Global X China Cloud Computing ETF

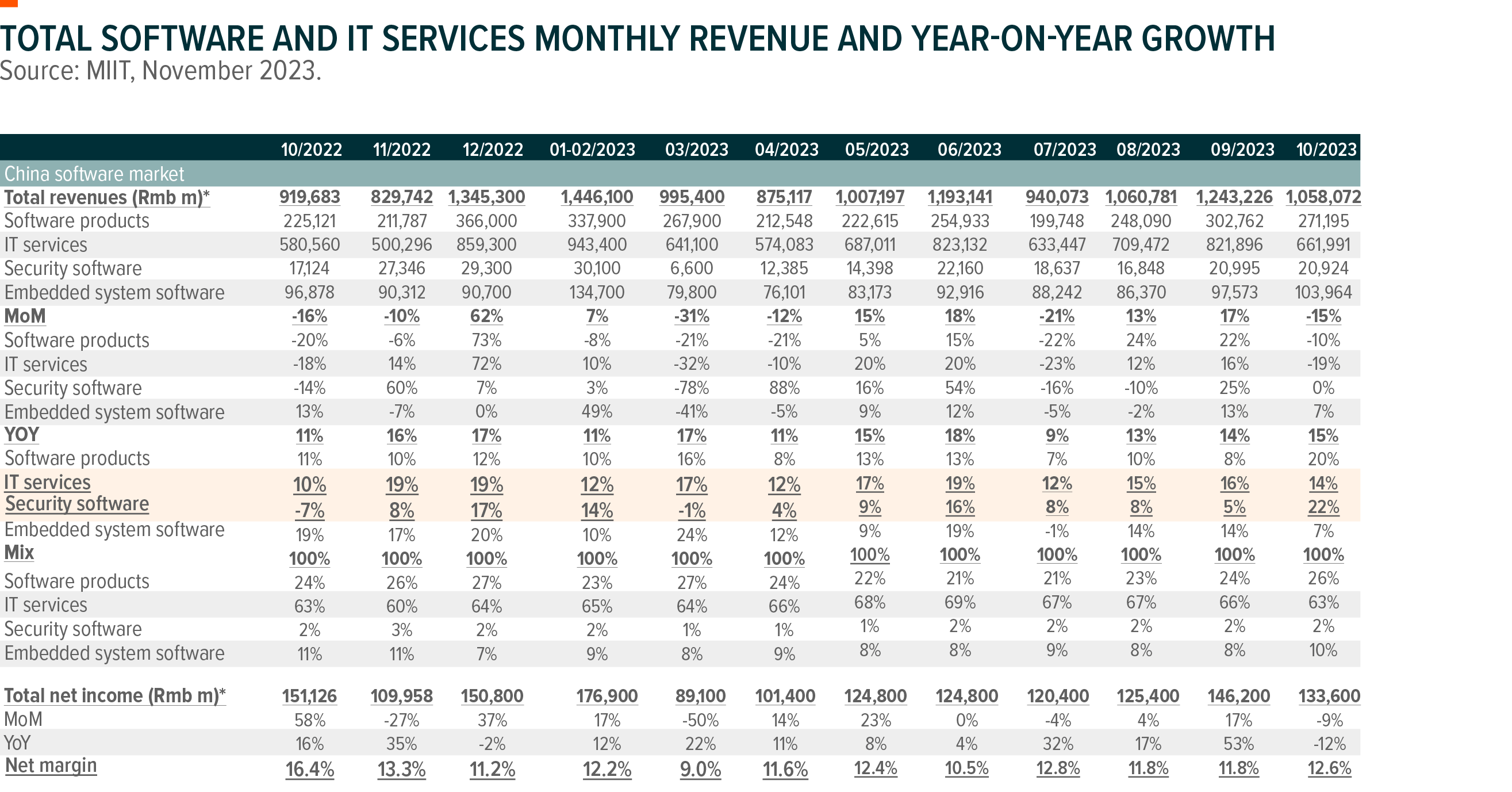

October revenue growth for China’s software industry: China’s software industry October revenues were +15% YoY, accelerating from August/September (+13%/+14% YoY), leading 10M23 revenues to increase by 13.7% YoY (vs. 9M23 at 13.5% YoY).58 IT services growth outpaced the industry at 15% YoY in 10M23, followed by embedded system software at +11% YoY, software products at +11% YoY, driven by industrial software at +12% YoY, and cybersecurity at +11% YoY.59 Net margin was at 12.6% in October (vs. 11.8% in September).60

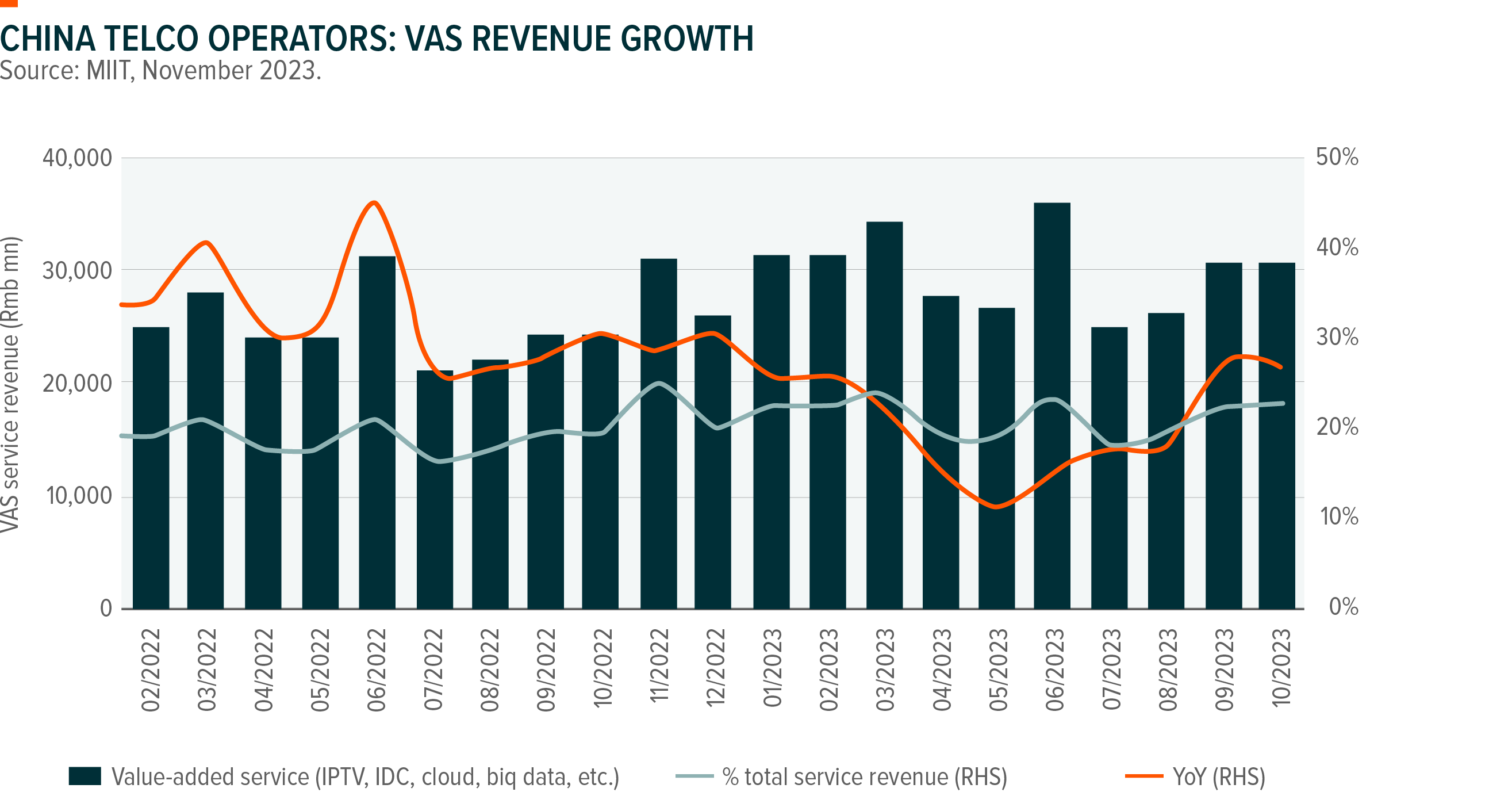

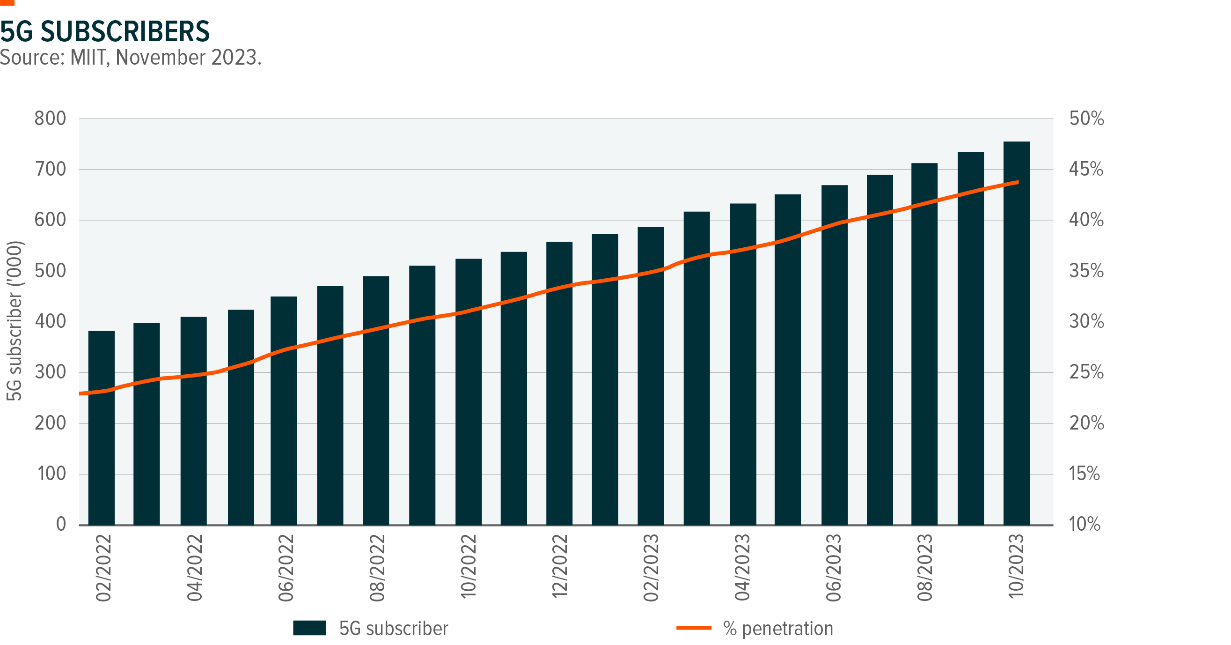

October revenue growth for China’s telecom industry: In October, based on MIIT data, telecom industry service revenue grew by 7.9% YoY, vs. 12.0% YoY in September.61 Traditional telecom service revenue growth remained stable at 3.2% YoY in October, vs. 3.8% in 9M23 and 3.2% in 2022.62 Value-added service revenue growth continued to recover from the slowdown in 1H23. Within value-added services, Cloud, big data, and internet of things (IoT) revenue grew by 41.5%, 41.4%, and 21.2%, respectively, in 10M23.63 Noticeably, cloud revenue recovered from 35% YoY growth in 9M23 to 41.5% in 10M23, the first month seeing cloud growth acceleration into 2023.64

[2820/2841] Global X China Biotech / China MedTech ETF

China’s first PD1 got US approval.

Junshi’s Toripalimab (PD-1) on 28 Oct 2023 obtained FDA approval treating NPC patients. This is the first China company developed PD-1 drug that obtained FDA approval.

Beigene could be next in line. The FDA completed the on-site inspection for BeiGene’s PD-1 in May 2023 and we expect BeiGene’s PD-1 to be the next one to get US approval after its EU approval

BD deals back in action!

In Nov 2023 we saw 5 biopharmaceutical deals. These were in the areas of CDK2, IL4Ra, ADC and GLP-1s.

The deals were –

1) BeiGene in-licensed an oral CDK2 inhibitor (to submit IND soon) global R&D and commercialisation exclusive rights from Ensem Therapeutics; BeiGene will pay upfront payment, milestones totalling US$1.33bn.

2) Simcere in-licensed the exclusive rights in Greater China to Rademikibart (IL-4Ra mAb) from Connect Biopharma with upfront payment of Rmb150m, milestone payments of up to Rmb875m and royalties up to low double-digit percentages of net sales.

3) Wuxi Bio and Myricx Bio (a UK biotech) announced that they have entered into a license agreement, for Myricx to have exclusive access to a proprietary antibody discovered by Wuxi Bio. Wuxi Bio will receive upfront, milestone payments and royalties.

4) Zhifei on Nov 23 announced to acquire 100% equity of Chongqing Chen’An Biopharma which has six clinical stage diabetes/obesity candidates.

[2815] Global X China Little Giant ETF

In November 2023, the Hong Kong/China market experienced consolidation, despite an earlier rally in anticipation of the Xi-Biden meeting in San Francisco. China Little Giant just listed in Nov. 20, 2023, and declined 2.3% during the month.

China’s 3Q23 GDP exceeded expectations, but October’s economic indicators were mixed. There was robust industrial production growth, and retail sales outperformed year-on-year estimates, but export momentum moderated, and fixed asset investment fell short due to ongoing weakness in the real estate sector. Discrepancies were observed between the National Bureau of Statistics and Caixin PMI, but both indicated some weakness in export orders.

Signs of policymakers taking more active measures to counter economic weakness are becoming more apparent. The most significant policy measures include: 1) the one trillion Yuan fiscal boost announced in late October to support investment and growth, 2) a sizable local government re-financing bond issuance as part of a debt-swap schedule to tackle local government debt stress, and 3) the reported one trillion Yuan program of People’s Bank of China’s Pledged Supplementary Lending (PBOC PSL) funding to support public housing and urban village development.65 Amid concerns about developers’ funding and liquidity stress, regulators are reportedly drafting a ‘white list’ of 50 developers to enhance their access to bank loans, bonds, and equity financing.66 Regardless of whether this is finalized, it confirms a shift in policy focus from solely supporting the overall market to also aiding privately owned enterprises (POEs). Additionally, eight ministries, including the central bank, issued “25 measures” last week to strengthen financing support for POEs.67

Despite various policy signals, property data continued to weigh on sentiment as October 23 home prices saw the largest decline since 2015, and overall sales values remained low.68 This coincided with a decline in the Hong Kong/China market, as investors expressed concerns about the effectiveness of newly introduced policies in restoring confidence. These policies included the Guangzhou urban village renovation plan and Shenzhen’s reduction of the down-payment ratio for second homes to 40%, down from as much as 80%.69

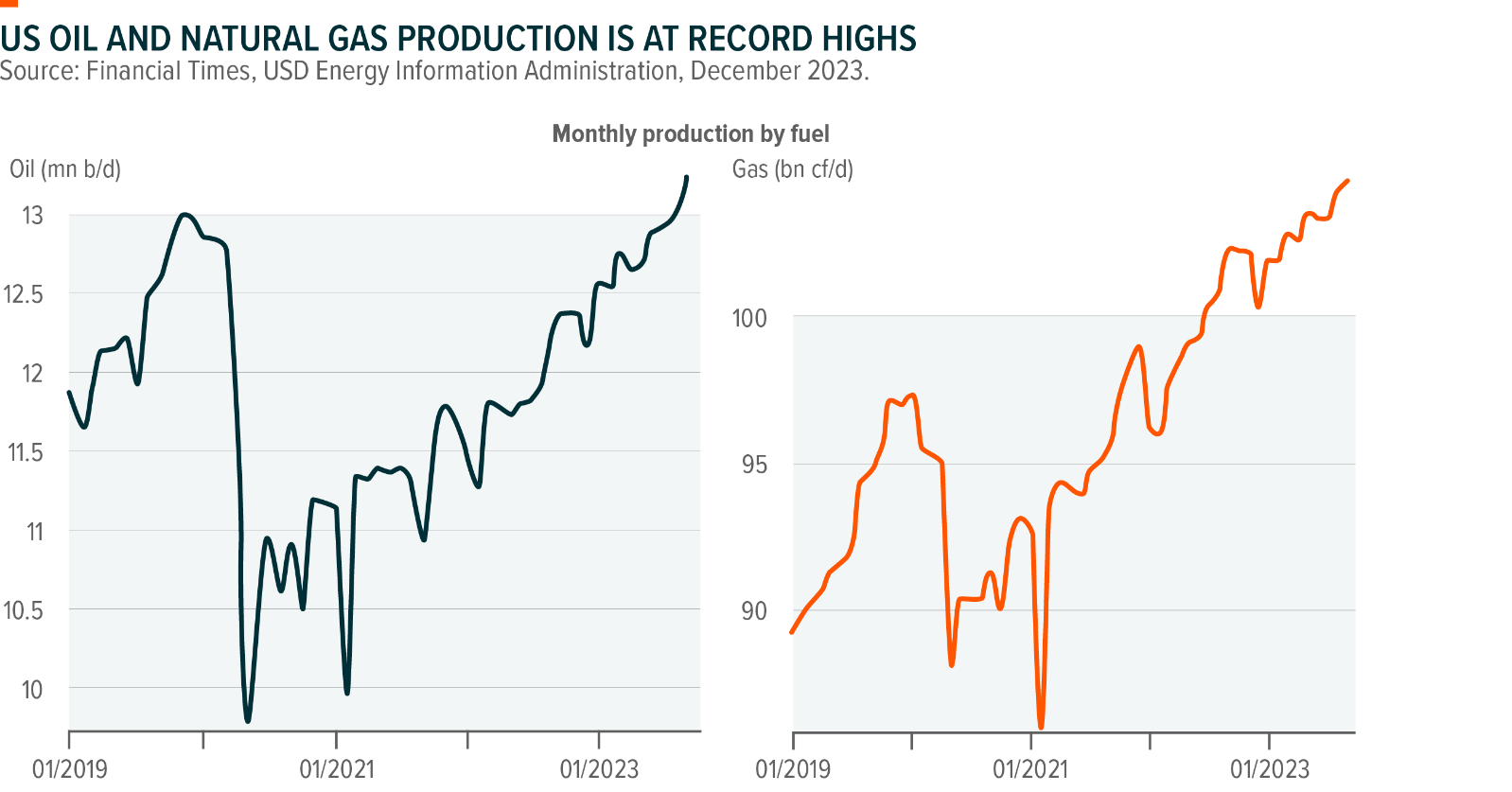

[3097] Global X S&P Crude Oil Futures Enhanced ER ETF

OPEC+ Meeting Update

OPEC+ members met on 30 Nov 2023.

Saudi Arabia, Russia and other members of the OPEC+ alliance have agreed to make additional voluntary cuts to oil production in 1Q24.

Incremental voluntary cuts add up to 900kbd, of which 200kbd from lower oil products exports from Russia and 700kbd spread between six OPEC+ members. The cuts will be in place through 1Q24, when global oil demand is seasonally weakest, and unwound gradually thereafter. Brazil will join OPEC+ in 2024 but will not participate in cuts – unsurprisingly as the country is set to be the second-largest source of volume growth to 2027 after the US.

OPEC+’s move again underlines the group’s determination to defend an oil price floor around USD80/b. In our view, OPEC+ may also be underestimating the strength in non-OPEC oil production growth, especially from the US.

A key uncertainty is compliance with the agreement: among the countries that have pledged new cuts, at least four (including the UAE, Iraq and Russia) are over-producing vs quotas. Another interpretation is that cuts are needed because demand is weak.

A bigger issue is that OPEC+ has used up its last bullets and created an even larger spare capacity overhang. OPEC spare capacity will rise from 5mbd now to c5.5mbd in 1Q24 (assuming c50% compliance with the new cuts). Including Russia and other non-OPEC countries, OPEC+ spare capacity should rise to more than 6mbd, the highest since June 2021.