Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Biotech ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Global X China Biotech ETF

Riding on Positive Momentum

China biotech sector recorded sector wise rally yesterday driven by supportive policy announcements and solid corporate earnings. Year-to-date, Global X China Biotech ETF (2820 HK) recorded solid return, showing signs of stabilization after consecutive years of soft performance. On the back of still-low valuation and investor positioning, we see favourable risk-return profile for China biotech sector as bolstered by domestic policy support, improving corporate earnings, more favourable macro factors, and ongoing globalization themes.

Supportive Policy Announcements

A draft regulation regarding VBP (volume-based procurement) optimization is being circulating over past few days. The document includes optimizing access standards, bidding rules, and implementations, and could largely mitigate the current unreasonable low bidding prices and improve the cash flow for biotech companies, if the draft is sustained. This also echo to 2025 Government Work Report (GWR) released in early March which mentioned the optimization and quality enhancement of VBP. Additionally, we are seeing a series of supportive policies including encouraging M&A by SOEs in biotech sectors and the supports for innovative drug developments that can propel long-term growth within the sector.

Improving Corporate Earnings and More Out-licensing Deals

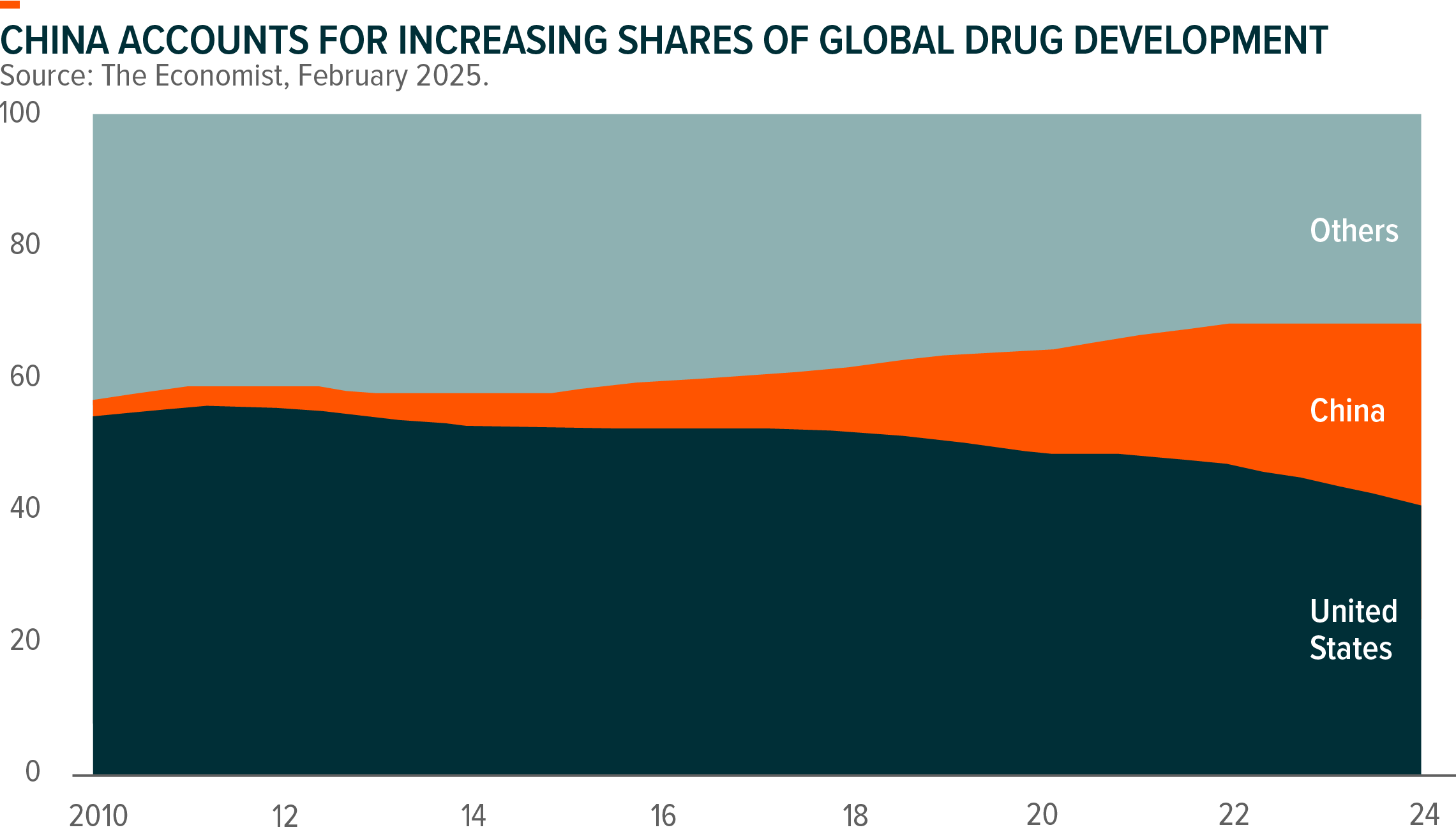

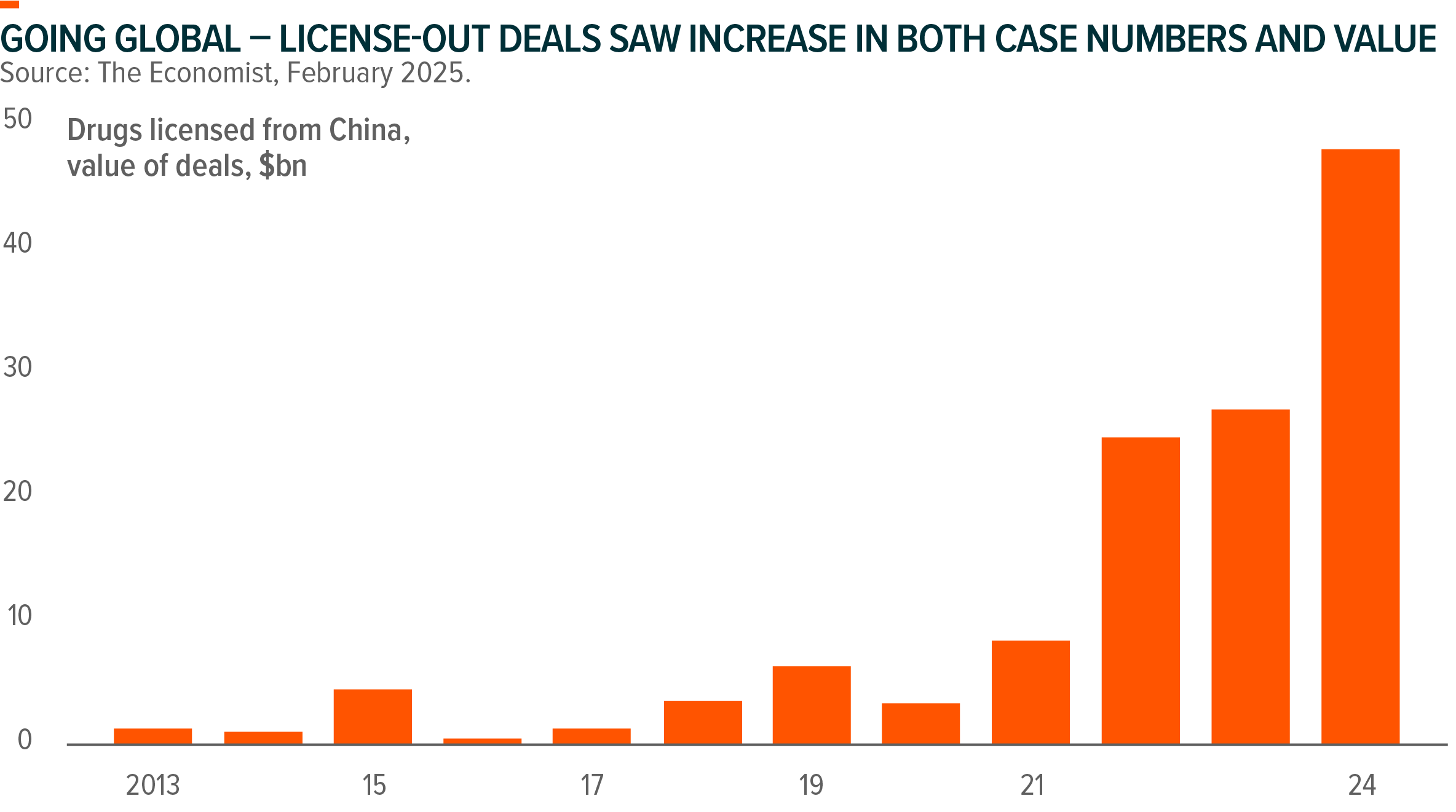

On track commercialization progress leads to better earnings visibility, with several biotech companies including Hutchmed and Innovent better-than-expected profitability in the latest quarter. Several leading biotech companies could be reaching breakeven in 2025 as bolstered by strong sales growth, further supporting the positive sentiments around the segment. Additionally, Chinese companies are expanding globally as we see rising number and value of licence-out deals in past 2 years, further increasing revenue potential for the sector.

| Global X China Biotech ETF (2820/9820) |

|

|---|---|

| Listing Date | 25 Jul 2019 |

| Reference Index | Solactive China Biotech Index NTR2 |

| Primary Exchange | Hong Kong Stock Exchange |

| Total Expense Ratio | 0.68% p.a.1 |

| Product Page | Link |

Source: Mirae Asset; Data as of April 2025.