Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF‘s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF(the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X Japan Global Leaders ETF(the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Index is reconstituted annually. Eligible securities are added into the Index as constituents during the next scheduled annual reconstitution. Similarly, securities that no longer meet the eligibility criteria of the Index may continue to remain in the Index until the next scheduled annual reconstitution, at which point they may be removed. There is no guarantee that the representativeness of the Index is optimised from time to time.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index Calculation Agent calculates and maintains the Index. If the Index Calculation Agent ceases to act as index calculation agent in respect of the Index, the Index Provider may not be able to immediately find a successor index calculation agent with the requisite expertise or resources and any new appointment may not be on equivalent terms or of similar quality. There is a risk that the operations of the Index may be disrupted which may adversely affect the operations and performance of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- Global X HSI Components Covered Call Active ETF(the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng Index (the “Reference Index” or the “HSI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSI ETF and long positions of HSI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSI ETF and long positions of HSI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSI Call Options over an exchange or in the OTC market. The HSI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSI Futures and writing HSI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSI Futures and the HSI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSI Futures and HSI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- To the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Global X HSCEI Components Covered Call Active ETF(the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index” or the “HSCEI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSCEI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSCEI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSCEI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSCEI ETF and long positions of HSCEI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSCEI ETF and long positions of HSCEI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSCEI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSCEI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSCEI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSCEI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSCEI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSCEI Call Options over an exchange or in the OTC market. The HSCEI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSCEI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSCEI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSCEI Futures and writing HSCEI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSCEI Futures and the HSCEI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSCEI Futures and HSCEI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (Mainland China). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in Mainland China. In addition, to the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed Mainland securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

Monthly Commentary on Key Themes – April 2024

Listen

Global X Asia Semiconductor ETF (3119)

Global X China Semiconductor ETF (3191)

Industry Update

- Asia supply chain plays a key role in Nvidia’s next-generation AI Processor: Nvidia introduced the Blackwell AI Processor at the GTC Conference, extending its leadership in AI computing. Nvidia said the new B200 GPU offers up to 20 petaflops of FP4 horsepower from its 208 billion transistors. GB200 which combines two of those GPUs with a single Grace CPU can offer 30 times the performance for LLM inference workloads, while also potentially being substantially more efficient. It reduces cost and energy consumption by up to 25 times over an H100, according to the company.1

Asia semiconductor supply chain will play a key role in the supply of the new Blackwell platform, in fact majority of the supply chain for this platform from chip level to server and rack level is located in Asia. TSMC will be the foundry partner to produce the Blackwell processors, while SK Hynix is the major supplier in HBM (high bandwidth memory) for the chip. - Samsung announced preliminary results: Samsung Electronics announced its 1Q24 preliminary earnings before the market opened on 5 April. It posted revenue of KRW71.1tn (+5% QoQ, +11% YoY) and operating profit of KRW6.6tn (+134% QoQ, 9x YoY) in 1Q24, which was much higher than market estimates, driven by the memory business.2

Stock Comments

- NAURA (+7.97%): Naura is a key local semiconductor equipment supplier in China. The company announced strong 4Q23 preliminary results, 4Q23 earnings of RMB 996mn at the midpoint up 49% YoY was well ahead of street expectations. Management also remains optimistic about WFE spending in China driven by both logic and memory capacity expansion.3

- Will Semi (+2.60%): Will Semi is one of the top 3 smartphone CIS suppliers globally. CIS inventory levels are now relatively healthy after destocking in 2023. The company is expected to gain market share in the flagship segment with the launch of competitive CIS models like the 50H. Overall recovery in smartphone shipment will also drive CIS industry demand.4

Preview

Increasing AI adoption in the data center and increasing penetration of AI at the edge and on-device will be the key enabler of the next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently, we are still in the process of cycle recovery as both stocks and earnings are below the previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.5

Global X China Robotics and AI ETF (2807/9807)

Industry Update

- China Machinery Industry Federation (CMIF): Machinery industry profit up 7.5% YoY to RMB 166.6bn in Jan-Feb. According to the latest data of CMIF, machinery industry revenue was RMB 3.9tn in Jan-Feb, up 3.3% YoY; machinery industry profit was RMB 166.6bn, up 7.5% YoY.6

- China Customs: 3D printing equipment export volume of 3.5mn units in 2023, up 88% YoY. According to the customs, 3D printing equipment export volume of 3.5mn units in 2023, up 88% YoY. Meanwhile, the 3D printing export value of RMB 6.2bn up 68.5% YoY.7

- Zhejiang Dingli Machinery: Announced capacity expansion in China. Dingli announced a capacity expansion for its electric AWP (aerial working platform) in Zhejiang with RMB 1.7bn capex, from its own cash. The company had RMB 3.2bn net cash at the end of 3Q23.8 Our take – neutral: We think the expansion will have little impact in the near term, but the new capacity coming from the company’s own cash indicates management confidence in AWP demand and Dingli’s competitiveness.

Stock Comments

- Baidu (+4.69%): According to the WSJ, Apple has been in preliminary discussions with Baidu about adopting Ernie LLM (large language model) in Apple devices in China – though such discussions are still exploratory, and it is unknown whether Apple has been engaging with other local generative AI companies at this stage.9

- Zuzhou TFT Optical (+11.63%): The company is a component supplier for Nvidia’s optical transceiver. Data center bandwidth upgrade drives demand for optical modules. AI-accelerated optical module upgrades drive rapid growth in high-speed optical module TAM.

Preview

The industry continues to innovate and bring AI to the edge, we expect increasing AI capabilities in PCs and smartphones. In China, domestic LLM suppliers see increasing demand to offer customized AI capabilities on upcoming domestic hardware. New energy demand slumped further in March but a recovery is emerging in traditional industries, led by consumer electronics. Whether this is because of seasonality in March post-CNY needs to be closely watched.

Global X China Electric Vehicle and Battery ETF (2845)

Industry Update

- Accelerating EV sales in March; EV penetration on the rise: According to CPCA estimates, March passenger NEV wholesale reached 820k, +33% YoY and +84% MoM.10 Based on the announcements of individual auto brands, BYD reported March NEV sales of 302k units, +46% YoY, driven by the solid sales momentum of “Honor” facelifts since late February with minor spec upgrades but meaningful price cuts of 10-20%. Overseas sales up 65% MoM to a record level of 38.4k units. Other major EV brands, including Li Auto (+39% YoY), NIO (+14% YoY), and Xpeng (+29% YoY), all recorded accelerating growth in March delivery. (for reference only, the abovementioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration was 43.7% in the last week of March, +1.2ppt MoM.11

- Battery inventory cycle bottoming out: According to the China Automotive Battery Innovation Alliance (CABIA), China’s EV battery installation was 17.9 GWh in February, down 45% MoM. EV battery inventory is in a continuous destocking cycle and there are signs of bottoming out, with global battery inventory months dropping significantly to 1.1 months in Jan 2024 from 3.5 months one year ago. CATL continues to expand market share, with domestic installation share rising 6ppts MoM in February, to 55%, while BYD’s share declined sequentially to 18%.

- Battery material costs rebounded in March: China’s spot lithium carbonate price was around RMB 112.3k/t at the end of March, +17% MoM 12, driven by a pickup in downstream scheduled production demand and short-term disruption in supply.13 Inventory-wise, the total inventory of lithium carbonate came in at 77,815 tons, -3% YoY.14

- Strong launch for Xiaomi SU7; Momentum continued for Huawei AITO: On 28 March, Xiaomi launched its first EV model SU7 with price ranges between RMB 215.9k and RMB 299.9k, and received record-high 89k deposits within 24 hours. Considering the potential refund by customers, SU7 could reach 100k units in 2024 total sales and become one of the best-selling premium EV sedans in China, comparable to the Tesla Model 3.15 The AITO brand deliveries reached 31,727 units in March (+50% MoM), with new AITO M7 deliveries at 24,598 units, +33% MoM.16

- Increasing promotions to drive accelerating 2Q EV sales: Following Xiaomi’s SU7 launch, major local EV brands kick-started peak sales season with new rounds of promotion campaigns, which, coupled with recovering store traffic and supportive policies, should drive accelerating sales in 2Q.17 However, the rich product pipeline in 2024 and the subsidies/price cuts introduced by major brands could lead to prolonged price competition, which will undermine the profitability of EV brands.

Stock Comments

- BYD (002594.CH): BYD’s share price was up 9% in March, a positive contributor to the index. BYD reported in-line 4Q23 results with net profit growing +19% YoY18. Net profit per car dropped by 16% YoY but is still decent despite industry price competition,19 thanks to economies of scale, supply chain integration, and increasing contribution of premium brands and exports. Notably, BYD has an unprecedented R&D team of ~100k engineers20, the largest among global carmakers, which should support its continued technology innovation. We are seeing more emphasis on BYD’s intelligent driving development that will elevate user experience and enhance competitive advantages. The dividend payout ratio increased to 30% of earnings, from 20% last year.

- CATL (300750.CH): CATL’s share price was up 16% in March, a positive contributor to the index. CATL posted better-than-expected 2023 results and raised the dividend payout ratio to 50% (2.8% yield) from 20% in 2022, delivering better shareholder returns. Several leading sell-side institutions upgraded CATL’s ratings on its strong cash-generating capability and better profitability outlook. Bloomberg reported that CATL is working with Tesla on a fast-charging battery in the US, which would present new progress in CATL’s tie-ups with North American local OEMs. Also, Xiaomi’s SU7 Pro launched in March 2024 adopted CATL’s 101kWh Qilin battery pack. SU7’s successful launch showcased CATL as an efficient enabler of EV startups and a definer of battery pack systems.21

Preview

We remain positive on the long-term growth potential for the EV and battery value chain, along with the upward global EV penetration trajectory. Domestic old car replacement demand and export sales should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive in 2024 with a strong new product line-up from EV brands and new entrants such as Xiaomi. Though intensifying competition among EV brands remains the key concern with major EV brands announcing fierce price cuts in the past 2 months, we are seeing a rapid consumer interest rebound for key EV models22 after price cut announcements, which should be a leading indicator for sales and further drive up EV penetration. In addition, recent signs of the battery inventory cycle bottoming out after destocking last year imply a normalized industry landscape that could lead to a better margin profile for battery industry leaders.

Global X China Clean Energy ETF (2809)

Industry Update

- Solar – Polysilicon and supply chain prices further stabilized: Solar polysilicon prices were RMB 68/kg by the end of March, staying flat compared to one month ago23. Increasing polysilicon supply and inventory pressure from wafers could weigh on polysilicon prices going forward. Module prices remain the same as last month. Solar cell and module export volume was up 49% YoY in Feb, which could further accelerate in 2Q with the destocking in EU nearing completion in 1Q.24 Solar glass prices were flat MoM and Inventory levels decreased to 21.59 days from 28.56 days in the previous month, implying demand recovery. Inverter exports value was US$ 0.45bn in February, down 48% YoY. Inverter demand could recover in 2Q24 with the ongoing destocking process25.

- Grid and power installation – Strong wind and solar installations; grid Capex delivered mild growth: China’s Jan-Feb 2024 wind installations reached 9.9GW, +69% YoY. Jan-Feb 2024 solar installations were 36.7GW, +80% YoY. In Jan-Feb 2024, the electricity grid spending in China reached RMB 32.7bn. +2.3% YoY.26 The National Development and Reform Commission and National Energy Administration jointly issued on 1 March the Guidance on high-quality development for the power grid distribution network. It sets multiple medium-term (by 2025) and long-term (by 2030) targets for improving the smartness and stability of the distribution power grid.

Stock Comments

- Sungrow (300274 CH): Sungrow’s share price grew by +18% in March, a positive contribution to the index. Sungrow displayed more resilient profitability compared to other peers in Solar industries, thanks to the more benign market conditions and less intense competition of solar inverter space compared to the main solar supply chain. Sungrow is poised to benefit from the global solar demand growth and further expand its market share for inverters globally.27 Its Energy Storage System shipments will continue to grow by 50% YoY in 2024 with a stable margin, driven by global ESS demand growth under lower lithium costs.28

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. However, it is worth noting that the solar supply chain entered a consolidation phase starting in 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. We are bullish on the electrical equipment players who benefit from increased grid and system investment in China and globally. They enjoyed a higher selling price and volume growth amid global equipment tightness.

Global X China Consumer Brand ETF (2806)

Industry Update

- Some of the economists on the street including Goldman Sachs and Morgan Stanley raised China’s 2024 real GDP forecast on stronger than expected exports and manufacturing capex. March PMI beat the street expectation ring 1.7pt to 50.8 thanks to policy support for infrastructure capex and manufacturing upgrades. Service PMI also edged up 1.4pt with stronger production-related services, but consumption-related service PMI slipped. Overall domestic demand remains weak and deflationary pressures remain. Meanwhile, the market now expects less chance for additional easing from the end-April Politburo meeting as real GDP growth is tracking at 5%yoy in 1Q24.29

- While consumer sentiment remains weak, the Qingming festival (4-6 April) came in as a positive surprise. The number of domestic trips came in 11.5% above the 2019 level and spending per trip also has improved to above 2019 levels for the first time since the pandemic. According to China Tourism Group Duty-Free, they are seeing improving international shopper conversion rates and average per shopper spending. We are carefully watching out whether these are early signs of some recovery in household consumption trends.

Stock Comments

- Techtronic Industries (+26.19%) was the major contributor in March thanks to strong 2H23 earnings results. Revenue grew +10%yoy which beat earlier guidance of +5% on stronger than expected Milwaukee Pro segment. Management continues to keep 2024 guidance for mid to high single-digit growth along with Gross Profit Margin expansion by 40-60bps. The market is positive on the company’s next phase of growth, led by heavy-duty and intelligent product innovation which helps its flagship Milwaukee brand to drive double-digit revenue growth over the coming five years.30

- Li Auto (-33.50%) was the major detractor in March as the company announced to revise down its 1Q24 delivery guidance to 76K-78K units from 100K-103K units previously, due to lower than expected order intake. This implies 25K-27K unit volume sales in March, much weaker than the previous guidance of 50K units primarily on Mega’s demand was below expectation and customers adopted wait-and-see mode towards new L7/L8/L9. Meanwhile, the company also lowered its full-year guidance to 564K-639K units (+50-70% YoY) from previously 650K-800K(+70-115% YoY). The expectation has now reset and the next catalyst to watch out for would be its L6 launch around Beijing Auto Show in April 2024.

Preview

China’s economy has had a strong start to the year thanks to robust exports and manufacturing capex. Yet, this means there may be less chance for fiscal easing beyond the equipment capex upgrading incentives. While we have seen some indications of household consumption trends during the festival period, overall consumer confidence remains weak. Property market recovery may support consumption recovery but this also remains subdued at this moment.

Global X China Cloud Computing ETF (2826)

Industry Update

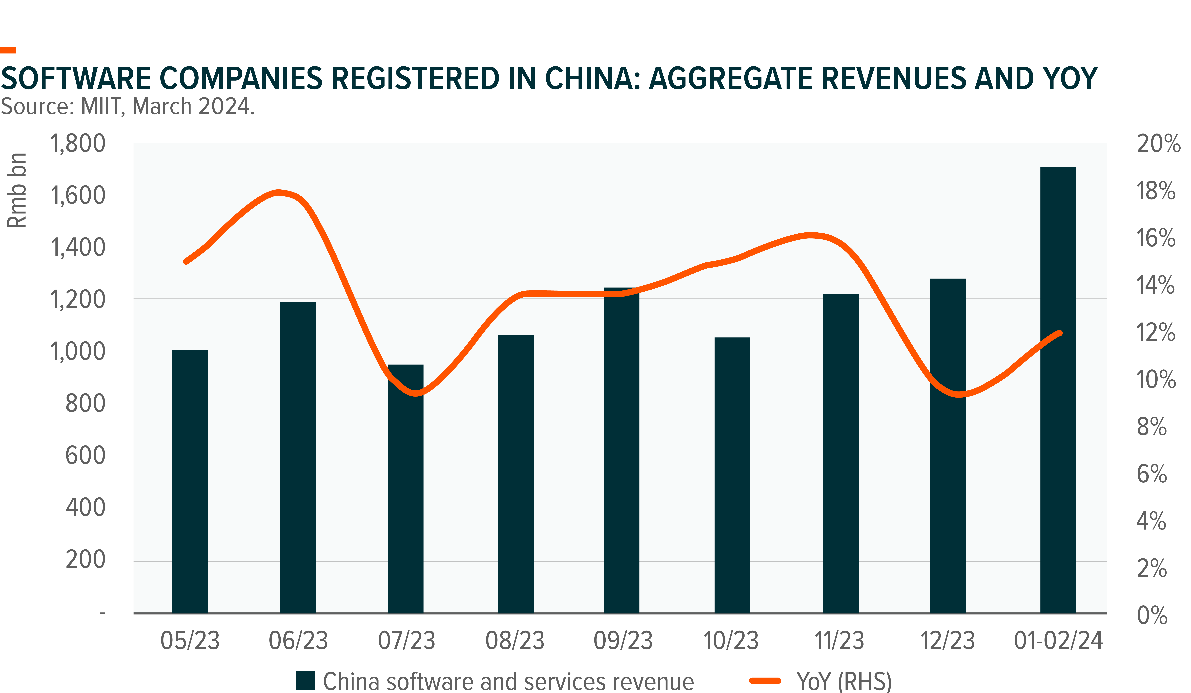

- China Software industry Jan and Feb 2024 revenues were +8.4% YoY, similar to the growth rate of December 2023. Revenue from software products +8.4% YoY to RMB 394.4bn during this period, while revenue from industrial software products +8.2% YoY to Rmb40.6bn. Cloud computing and big data services revenue +13.8% YoY, and e-commerce platform technical services revenue +3.8% YoY.31

Stock Comments

Key Contributors:

- Tencent (+10.47%): Tencent concluded 4Q23 with largely in-line 4Q revenue and a net profit beat (+44% YoY), alongside improving shareholder returns with upsized regular dividends and buyback. Mobile DnF is expected to be released in 2Q24, driving domestic mobile game revenue growth.32

- Beijing Kingsoft Office (+10.35%): KSO held the WPS AI Enterprise launch event on April 9th. During the event, the management introduced (1) a major upgrade of WPS Office, (2) new functionalities of WPS AI Enterprise, and (3) AI features of WPS collaboration. WPS AI Enterprise focuses on digital asset management (e.g., documents and chat history) and operating efficiency enhancement by replacing repetitive and routine work with AI. Grey testing of WPS AI for to-C started in late March 2024, with newly introduced WPS AI membership and WPS VIP, both of which support AI functions. The standard price for WPS AI member / WPS VIP is set at RMB 248 / RMB 348 per year (excluding discount), compared to RMB 148 / RMB 248 for WPS SVIP (basic) / WPS SVIP (pro).33

Key Detractors:

- Shanghai Baosight (-17.80%): The share price of Baosight was weak while CSI 300 was up 3% as 4Q23 revenue declined 25% YoY, missing market expectations, likely driven by software project delay with its parent and IDC weakness. 2023 connected transactions were down 2% YoY, much lower than the guidance.34

Preview

China software companies have concluded earnings reporting for 4Q23. 4Q23 industry revenue growth deteriorated from a low base. The forward-looking information is mixed with muted 2024 guidance and order book. IT spending of SOEs remains relatively more resilient than that of SMEs amid macroeconomic headwinds. On the other hand,

generative AI deployment has progressed faster than expected in various sectors, driving accelerated enterprise digitalization. We expect AI adoption to help increase productivity and optimize operational efficiency in the future, which means that there are potentially new growth drivers and improving margin for major software companies.

Global X Hang Seng TECH ETF (2837)

Stock Comments

Key Contributors:

- JD.com (+21.17%): JD stock price reacted positively to its solid 4Q23 results and improving shareholder returns announced. Management appears more committed to capital return now with a new buyback of up to USD 3bn for the next three years. The Company reiterated its previous revenue guidance for FY24, aiming to achieve faster revenue and GMV growth than China’s broad retail market.35

- Meituan (+21.30%): In 2023, Meituan share price underperformed the Hang Seng Tech index mainly because of elevated concerns about intensified competition in the local services industry with Douyin entering the business. Into FY2024, the competition dynamic has not deteriorated as Douyin seems to strike a balance between growth and profitability for its local services business. As a result, the market expects Meituan’s IHT margin to stabilize instead of inching lower. In addition, Meituan announced a plan to further reduce loss for new initiatives like community group purchases, which signals positively for a potential upward revision of group-level margin. As a result, the share price has rebounded from the trough.36

Key Distributor:

- Li Auto (-31.58%): Share price corrected more than 30% during the month because on Mar 21, Li Auto announced to lower 1Q24 delivery guidance from 100-103k units to 76k-78k units, implying 25k-27k units delivery in Mar, +18% to +28% YoY / +21% to +31% MoM; meanwhile, the company also lowered its full-year delivery guidance from the original 650k-800k units to 50%-70% YoY growth, implying 564k-639k units.37

Preview

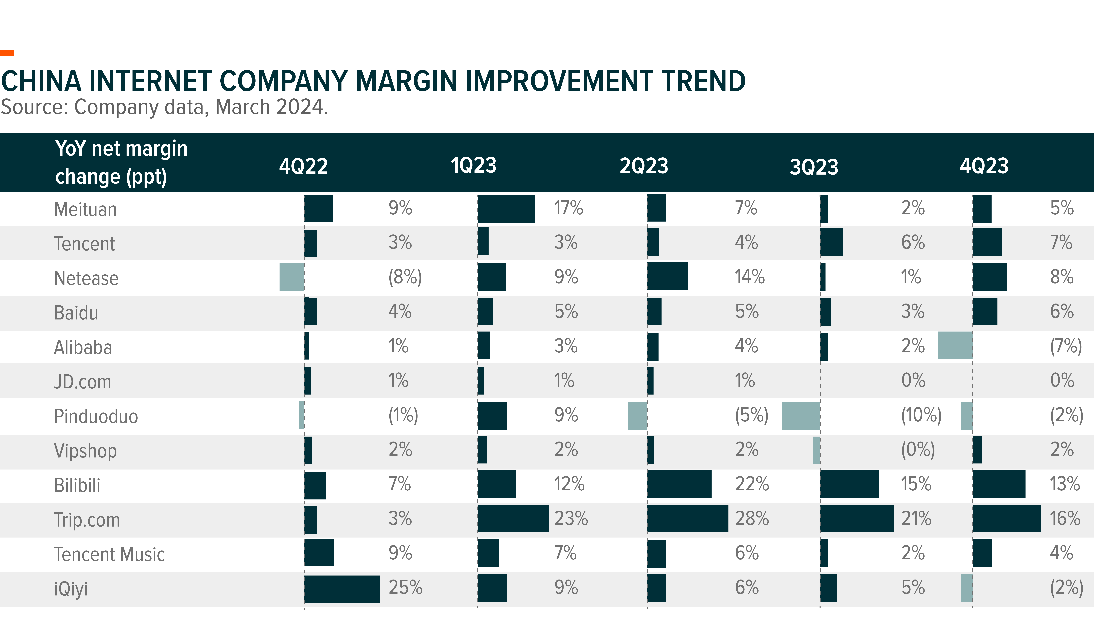

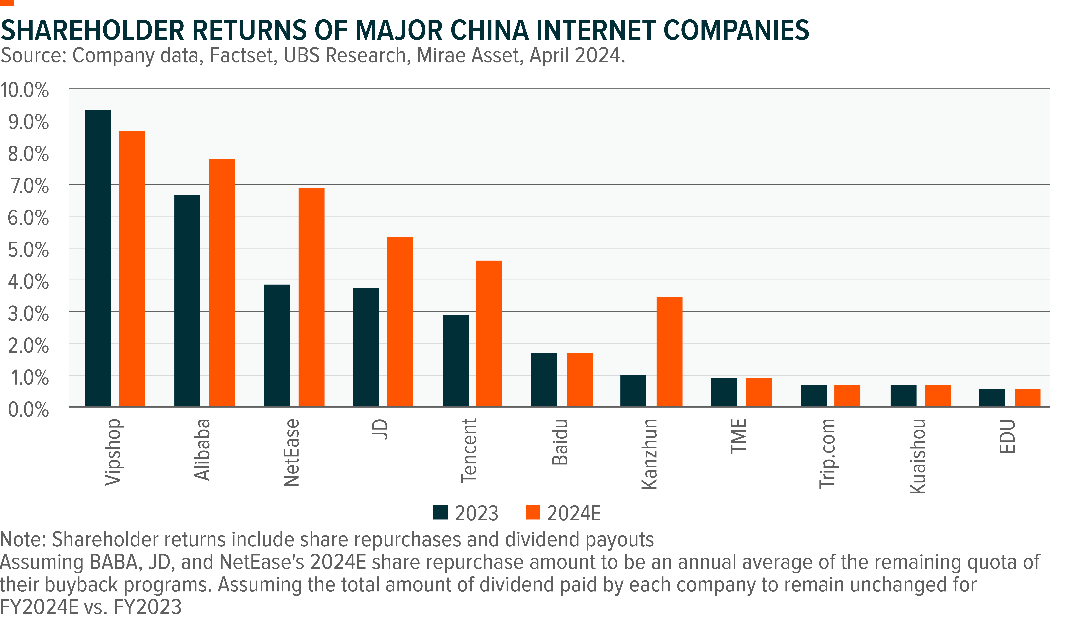

China internet companies continue to deliver a solid set of earnings results. We’ve been seeing solid earnings growth despite fluid macroeconomic conditions, mainly driven by increasing operational efficiency and fewer investments for non-core businesses. As a result, major internet platforms’ net profit margin increased meaningfully YoY throughout 2023. Meanwhile, internet companies are more committed to improving shareholder returns through upsized share repurchase programs together with dividend payouts.

Companies are commenting on a continuous focus on high-quality growth into FY2024 and as well as keeping an eye on overseas expansion opportunities.

Global X Hang Seng High Dividend Yield ETF (3110)

Industry Update:

- The Hang Seng High Dividend Yield Index recorded a mild decline of 0.1% in March 202438, mainly due to earnings pressure39, though partially offset by further supportive policies. The top-performing sectors were Consumer Discretionary and Material, whilst the bottom-performing sector was Utilities40. Financials, the largest sector in the index, recorded -3% in March, with a further decline in 4Q core earnings for major banks.41

- Further rollout of supportive policies remained the key to the share market rebound in China. On 13 March, the State Council announced plans to encourage the trade-in for consumption goods and upgrade machinery equipment, which should drive demand resurgence across consumption and industrial sectors. Media also reported that Chinese commercial banks were requested to support the financing of state-backed developer Vanke,42 which could alleviate concerns across the property value chain.

Stock Comments:

- China Hongqiao Group (1378 HK) emerged as the best-performing stock in the Hang Seng High Dividend Yield Index, delivering a remarkable return of over 40% in March.43 The company reported better-than-expected 2023 annual results with a strong beat in earnings, driven by the decrease in power tariff and higher-than-expected aluminum output.44 The dividend payout ratio was 47% in 2023, and management expects to maintain the payout ratio at 40-50% in the coming years.45 The lower level of aluminum inventory is likely to limit the price downside, and the elevated aluminum price and the expected higher alumina price will likely secure solid earnings for Hongqiao in FY24.46

Preview:

While short-term volatility persists, the Hang Seng High Dividend Yield Index demonstrated greater resilience relative to broad-based indexes. Notably, this Index consists of over 60%47 of its constituents in State Owned Enterprises. Supportive policies across consumption, property, and technology sectors as well as the capital market are key drivers for market rebound. The concept of the Valuation System with Chinese Characteristics (“VCC”) is back in the spotlight again in light of recent developments. The primary objective of VCC is to enhance the quality and investment value of listed companies, especially SOEs. By investing in the Hang Seng High Dividend Yield Index, investors can gain exposure to high dividend-paying and low-volatility companies while also benefiting from the accelerated implementation of VCC.

Global X China Little Giant ETF (2815)

Industry Update

- A-shares consolidated in Mar with CSI300/500/1000 recording +0.6%/-1.1%/+1.8% return.48 A-shares’ average daily turnover further recovered from cRMB 0.9tn in Feb to cRMB 1tn in Mar. As sentiment has recovered significantly, now the key debate is the sustainability of China’s macro data after posing a strong number in Jan-Feb, and the policies follow through after Two Sessions (ie. Trade-in old for new, etc.). Among the 11 Wind A-share Level-1 sector index, Materials (+5%), Discretionary (+4%), and Industrials (+4%) ranked top-three performers, while Real estate (-4%), Financials (-3%), and Healthcare (-2%) were the bottom three.49

- NPC headlines were in line to slightly better than expected including a 2024 ~5% GDP growth target, “new quality productivity”, “old-swapping-new” scheme for selected equipment & appliances, and a multi-year special sovereign bond issuance plan. The 2024 Government Work Report proposed “promoting the development of specialization, specialization, and innovation in small and medium-sized enterprises.” This is the third consecutive year that the term “specialization, sophisticated, distinctive, and innovative” (专精特新) has appeared in the government work report, reflecting the country’s continuous attention, commitment, and support for the development of the small and medium-sized enterprises program. It has been one of the backbones of the “new quality productivity” President Xi was focusing on. We believe policymakers will continue to fine-tune various supports for the program and encourage more emerging industries such as industrial software, cloud computing, AI, etc.

- Most Jan-Feb macro data were inline/better than the market expected. Specifically, we saw better-than-expected CPI, mainly driven by food (especially pork) prices, travel, and services, which alleviated the market’s deflationary concern. Yet how sustainable the recovery will be, remains a key to watch.50

Stock Comments

- Suzhou TFC (+11.95%): Though monthly performance was milder than in February, the largest index weight (8.57%) still contributed significantly in March. TFC benefited from Nvdia’s GTC event, as the key supplier for Fabrinet (optical module supplier for Nvdia’s subsidiary Mellanox). As spec upgrades increase further, one of the key concerns for optical module makers is the future technology of CPO. We think TFC is likely to have a much better position in the CPO era among current optical module peers.51

- Huafon Aluminum (+17.80%): Copper and Aluminum prices have rallied past Two Sessions. We think this is partly due to the re-emphasized carbon reduction cut (supply reduction) plan, as well as the demand recovery.

Preview

We will watch for sustainability of China macro data recovery and the policies follow through.

Global X Japan Global Leaders ETF (3150)

Industry Update:

- In March 2024, the FactSet Japan Global Leaders Index experienced a gain of 3.6% in JPY terms52, reflecting the continued strength and positive momentum of the Japanese equity market. This performance resulted in the market reaching historic highs. Among the sectors within the index, Materials emerged as the top-performing sector while the Healthcare sector was the bottom-performing one.53

- On 19 March 2024, BOJ ended 8 years of negative interest rates and raised its policy rate to 0% – 0.1%, from the previous -0.1% – 0%, its first-rate hike in 17 years. BOJ also announced the cessation of its Yield Curve Control (YCC) policy, though it will continue its purchase of Japanese Government Bond at ~JPY 6trn per month. We believe the significant policy shift reflects the positive reflation dynamics, which, coupled with accelerating wage growth from this year’s Shunto wage negotiations, will drive Japan’s domestic consumption demand and support Japan’s equity market. In addition, the current historically low valuation of the Japanese Yen bonds is beneficial for the continued growth of leading export companies.

Stock Comments:

- Mitsui & Co (8031 JP): was the top-performing stock in the FactSet Japan Global Leaders Index, delivering a return of over 7% in March (JPY term).54 Mitsui is one of the largest general trading companies in Japan with core business across metal resources, energy, and machinery infrastructure, and also a top 5 holding for the index. On 29 March, Mitsui announced investments in an upstream gas field and midstream pipeline business in Vietnam with total development costs of US$ 740mn,55 a project that steps up the energy transition strategy that Mitsui is emphasizing. Mitsui’s change in strategy is to focus its investments on projects with higher earnings visibility, which will strengthen shareholder returns.56

Preview:

We are optimistic about the overall Japanese equity market, supported by a combination of robust export growth, recovering domestic demand, and the weak currency. We see the BOJ rate hike as a positive signal for reflation and the start of normalization of the Japanese economy. Furthermore, Japan’s export sector has been performing exceptionally well, benefiting from a global economic recovery and increased demand for Japanese products. This export growth contributes to the overall strength of Japanese companies and their profitability. Additionally, the weakening of the JPY against major currencies enhances the competitiveness of Japanese exports, further bolstering the country’s export-driven economy. With these factors in play, the Japan export leaders stand to benefit from a favorable environment, attracting both domestic and international investors seeking opportunities for capital appreciation and growth.

Global X HSI Components Covered Call Active ETF (3419)

Global X HSCEI Components Covered Call Active ETF (3416)

Industry Update & Issue Analysis:

The Hong Kong stock market stabilized after rallying to a year-to-date high, with investment sentiment consolidating amid attractive valuations as investors sought a market bottom. The Hang Seng Index (HSI) and the Hang Seng China Enterprises Index (HSCEI) rose by 0.64% and 2.34% respectively in March, buoyed by gains in Chinese technology stocks. Analysis of the corresponding VHSI and VHSCEI Volatility Indexes, which gauge expected volatility for the HSI and HSCEI, showed decreases of 16.9% and 16.6% to 20.4 and 24.0 respectively, marking their lowest levels in recent time. Against this backdrop, the estimated premium generated by writing HSI and HSCEI out-of-the-money call options stood at 2.1% and 2.2% respectively in March.57