Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Clean Energy ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Clean Energy Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Consumer Brand ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Consumer Brand Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Robotics and AI ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Robotics and Artificial Intelligence Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Hang Seng TECH ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Little Giant ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index.

- The Fund is exposed to concentration risk by tracking a single regions or countries.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Monthly Commentary

China Thematic ETFs – October 2025

Global X China Electric Vehicle and Battery ETF (2845)

Industry Update

Solid September EV Sales: According to CPCA, September NEV wholesale sales volume was 1.5mn, +22% YoY, +16% MoM. By individual brand, BYD reported September NEV PV sales of 396k units, -6% YoY and +6% MoM. Xpeng recorded YoY sales growth of +95% YoY to 42k. New P7 cumulative deliveries exceeded 10k units after its debut in late August. XPeng will launch X9/G01 EREV launch in 4Q. Li Auto sold 34k units in the month, -37% YoY. Volume could recover in 4Q driven by i8+i6 delivery ramp-up. China EV volume growth could accelerate in in the 4Q peak season. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF). (CPCA, Company data, October 2025)

Solid Battery demand: according to CABIA, EV battery installations rose 32% YoY and 12% MoM to 62.5GWh, while ESS battery sales held high at 35.6GWh, up 49% YoY. (China Automotive Battery Innovation Alliance, Mirae Asset, September 2025)

Battery material costs remained low: Battery grade lithium carbonate price was Rmb73.5k/ton, flat wow, -10%/-4%/-3%/+12% vs. the average in 3Q24/4Q24/1Q25/2Q25. Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers. (Goldman Sachs, October 2025)

Stock Comments

Battery companies such as CATL (+31%) and EVE Energy (+60%) recorded substantial return in the month as the market is now seeing improving supply-demand dynamics in the battery sector, which bodes well for the industry competitive landscape and profitability of leading companies. Key drivers for recent battery sector rally include: 1) Strong ESS demand and outlook. On 12 Sep, China’s NDRC set a cumulative ESS installation target of 180GW by 2027, implying annual power capacity of ~35GW in 2025-27, vs 44GW in 2024. Also, there have been provincial policies on capacity charge to ESS. Furthermore, YTD shipment data, media reports, and comments from several companies indicate strong overseas and domestic ESS battery demand. This leads to recovery in industry capability utilization, and price increase for ESS battery. 2) Positive newsflow around solid-state breakthrough. In September, EVE Energy rolled out its new solid-state battery. This could mark a significant step toward the commercialisation of solid-state batteries in China. 3) Abundant A-Share liquidity, driving the performance catch-up of A-Share vs Hong Kong market YTD.

Sanhua intelligence recorded 52% return in the month, a key contributor to the ETF. With increasing adoption and expectation for mass production, Humanoid robot is regaining traction, stimulating sentiments across the value chain. Tesla’s recent event and updates on Optimus robot drives the performance of Sanhua as a supplier for Tesla’s humanoid robots. (Mirae Asset, September)

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program (which has been extended in 2025), together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. Anti-involution campaign by the government could potentially improve the pricing environment. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. BYD’s launch of God’s Eye ADAS in mass market model should accelerate smart driving adoption in China. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X China Clean Energy ETF (2809)

Industry Update

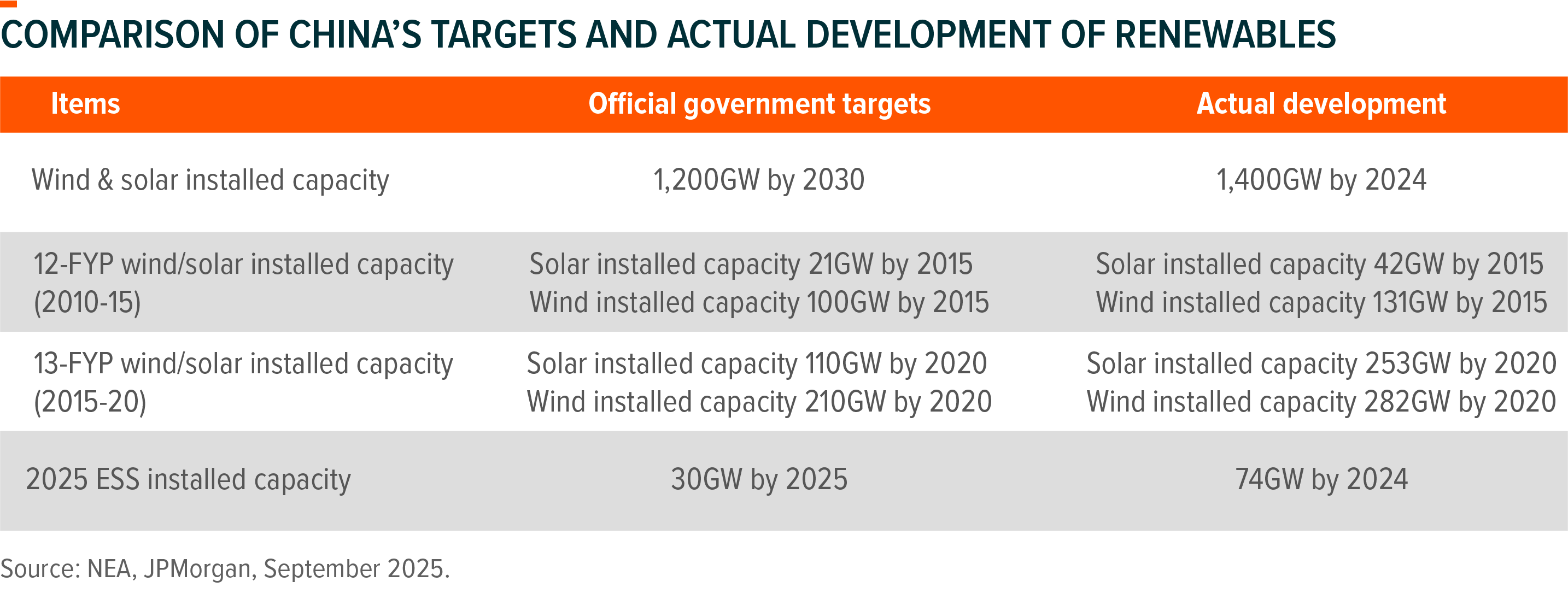

According to the China National Energy Administration (NEA), domestic solar installations reached 231GW in 8M25, up 65% YoY. August monthly installations were down 33% MoM and 55% YoY to 7.4GW, mainly impacted by new on-grid tariff policy. Wind installation was 58GW in 8M25, +11.6% YoY, in which August monthly installation 4.2GW. (NEA, August 2025) On 24 Sept, China President Xi Jinping unveiled China’s 2035 Nationally Determined Contributions (NDCs), pledging to expand installed capacity of wind and solar power to 3600GW, over sixfold of 2020 levels. By end-August, China solar and wind capacity had reached 1690GW, according to China NEA. We estimate the new target could imply at least 200GW annual installation for solar and wind in the coming 10 years. Investments in power generation capacity and power grid were Rmb499bn and Rmb380bn in 8M25, up 0.5% and 14.0% YoY, respectively. (NDCs, August 2025)

Stock Comments

Sungrow Power Supply Co., Ltd. Class A: Similar as Longi for anti-involution. Additionally, the company delivered a very strong 1H25 results with revenue up by 40%YoY and net profits up by 56%YoY, driven by fast growing ESS demand in and outside China. (Company data, September 2025)

NAURA Technology Group Co Ltd Class A: The company is one of the key beneficiaries from China’s semiconductor capex in the long term. The company’s 1H25 results were actually miss street estimations. Top line grew by 29.5%YoY, while bottom line was up by only 13%YoY due to GPM decrease.(Company data, September 2025)

China Yangtze Power Co., Ltd. Class A: The company delivered solid 1H25 results indeed. People turn more positive on growth sector while Yangtze Power is defensive play. (Company data, September 2025)

Preview

The top-down anti-involution reform is now playing a critical role to assist renewable industry self-discipline and sustainable growth. 2026 is the first year of the fifteenth five-year plan. We expect renewable installation may not decelerate on the back of China’s power consumption growth in the long term, driven by electrical vehicles, residential demand, data center and industrial/manufacturing demand. Wind may perform better than solar in the near term, driven by better profitability in export orders, offshore projects subsidies and better competition landscape.

Global X China Consumer Brand ETF (2806)

Sector Update

In August 2025, total retail sales grew by 3.4% YoY (vs 3.7%/4.8% in Jul/Jun), slightly below the Wind and Bloomberg consensus estimates of 3.8%. During Golden Week, overall demand remained lukewarm. According to the Ministry of Commerce (MOC), retail sales for the entire 8-day holiday increased by 2.7% YoY on a comparable basis, compared to 4.1% during the 2025 Chinese New Year (CNY) holiday and 6.3% in May. The Ministry of Culture and Tourism (MCT) reported that the average daily number of tourists during the holiday rose by 1.8% YoY, and daily tourism revenue increased by 1.0% YoY, suggesting a roughly 1% decline in per capita spending, while during the 2025 CNY and May holidays, tourist numbers grew by 5.9% and 6.4%, tourism revenue increased by 7% and 8%, and per capita spending grew by 1% in both periods. (Mirae Asset, September 2025)

Stock Comments

Seres Group (601127 CH): Seres recorded 25% return in September. Seres is a Chinese automotive manufacturer that produces electric and internal combustion engine vehicles. In 2Q25, the company’s revenue grew by 12% YoY to Rmb43bn, while the NP increased by 21% YoY to Rmb2bn. On September 23, the AITO brand officially launched its new-generation “M7” ultra-large size SUV, positioned at a price range of Rmb280k-380k, which is Rmb30k higher than the previous “M7” model. (Company data, September 2025)

Li Auto (2015 HK): Li Auto experienced 11% return in September. The company launched the i6 at a starting price of Rmb249.8k, matching the price of the L6 Pro and Rmb30k less than the L6 Max. The i6 offers two versions—rear-wheel drive and four-wheel drive—and comes equipped with standard features including Nvidia Thor-based AD Max, LiDAR, and 5C fast charging. (Company data, September 2025)

Pop Mart (9992 HK): Pop Mart recorded 17% loss in September. Buy flows have been noted from China hedge funds and regional long-only investors (UBS, September 2025). With improving IP numbers recently, risk/reward profile are becoming more reasonable. Key upcoming catalysts include the U.S. holiday season, particularly Halloween product launches, and the launch of Twinkle Twinkle’s first vinyl plush line.

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. During the Two Sessions, consumption was reaffirmed as a primary policy focus, and the introduction of the Special Action Plan to boost consumption underscores this commitment. Amid escalating trade tensions, China government may accelerate the pace and scale of these policies. We expect that macroeconomic recovery, supported by policies and the stabilization of the property market, presents the largest upside potential for China consumer sector in 2025. Among subsector, we favour those that are directly targeted by stimulus policies, such as home appliance and EV under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu, catering and beverage.

Global X China Robotics and AI ETF (2807)

Sector Update

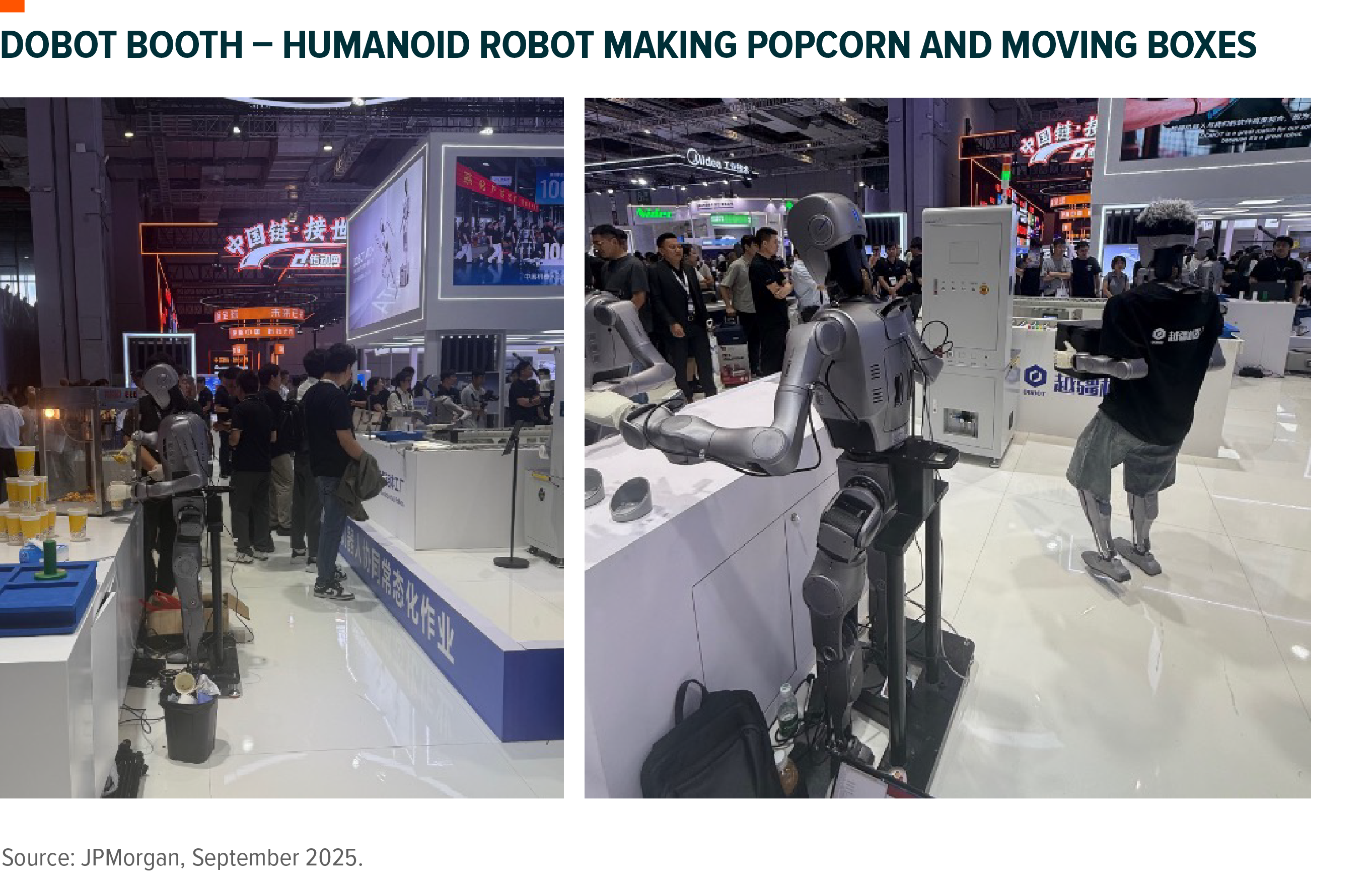

In the recent China International Industrials Fair(CIIF) in September, more companies were present than CIIF 2024 and WAIC in July. The overall message from the event is constructive: 1) clear improvement in order visibility driven by demand from EV, lithium battery and 3C electronics, 2) accelerating import substitutions led by leading companies, 3) a divergence in foreign companies’ China strategy, 4) more AI applications set to empower the rise of industrial automation, 5) rising R&D investments in the robotics supply chain, especially by China-US cooperation despite headlines about decoupling. Many companies across factory automation and robotics value chain reported that leading automakers are ramping up automation investments for capacity expansion, while lithium battery producers are accelerating capex for both traditional and solid-state battery lines. Electronics and general manufacturing are also showing signs of recovery. We note the sector is investing heavily in R&D in humanoid robot value chain with technology remaining more divergent than convergent. What is interesting is joint development projects by China and US/European are increasing, particularly in advanced control systems, software or the “brain” of the robot.

Stock Comments

Zhejiang Shuanghuan Driveline Co., Ltd. Class A: There is market chatter that the company will supply to Tesla’s humanoid robots, which was not confirmed by management indeed.

Huagong Tech Co., Ltd. Class A: The company is one of the key beneficiaries from 800G optical module domestic production and semiconductor imports substitution. The company also delivered solid 1H25 results with revenue up by 45%YoY and net profits up by 45%YoY driven by strong order growth in all segments.

Baidu, Inc. Sponsored ADR Class A: The company launched MuseSteamer AI video tool. They also partner with CAR Inc to start the driverless rental car services.

Hesai Group Sponsored ADR: The company turned profitable in 2Q25 driven by strong volume growth. People may take profits after its successful H share listing.

Preview

Robotics, AI and automation are one of the key beneficiaries from both China’s stimulus measures in the near term and the economy transition goal in the long run. We expect the monetization of humanoid robots in industrial, transportation and residential scenarios to accelerate going forward, driven by large amount of bottom-up R&D investment and continuously cost cutting. We may see some leading companies to deliver material fundamental changes in the coming twelve months.

Global X Hang Seng TECH ETF (2837)

Industry Update:

Global X Hang Seng TECH ETF (2837) recorded positive return in September. Internet cloud providers (Alibaba, Baidu) led the gain driven by the optimism around Cloud and other AI applications. Leading semiconductor companies also performed well as domestic substitution theme. With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiment that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

Baidu gained 49% in the month, a key contributor to the ETF. Its core advertising business remain under pressure, as Baidu undergoes AI search transformation. However, with the recent AI development in China, market tends to value the stock with SOTP valuation framework and attribute more value to its AI-related cloud and Robotaxi business. Baidu is one of the leading AI Cloud providers in China, offering full-stack AI architecture. Its AI Cloud revenue recorded substantial growth acceleration in past quarters thanks to strong AI demand. Baidu also has its proprietary Kunlun chips that are used for internal inferencing demand, and increasingly for external uses. It won deals with China Merchants Bank and China Mobile in Mar-25 and Aug-25, respectively. Furthermore, Baidu is also one of the largest Robotaxi providers in China and even globally. The number of fully driverless rides provided by Apollo Go increased by 148% YoY to over 2.2m in 2Q25. The cumulative rides provided to the public exceeded 14m as of Aug-25. Apollo Go covers 16 cities globally, and is in talk with multiple regions across Middle East, SE Asia, and Europe for potential overseas expansion. With its solid R&D capability, strong AI commitments, and ongoing AI integration with core business, Baidu is well positioned to benefit from the AI development in China.

Alibaba recorded 53% gain in the month, a key contributor to the ETF. Alibaba hosted 2025 Apsara Conference in the month. Management expects its global datacenter power usage to increase 10x by 2032, and will further increase AI investments. Alibaba also launched its flagship model Qwen3-Max in the event, the largest and most powerful foundation model in the Tongyi Qianwen family, with pre-training data reaching 36tn tokens and total parameters exceeding 1tn. Overall performance reportedly surpasses GPT-5 and Claude Opus 4, positioning it among the top three globally.

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its undemanding valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China.

Global X China Little Giant ETF (2815)

Industry Update

China Little Giant ETF gain positive return in the month. China A share market is supported by abundant liquidity, solid 2Q25 real GDP growth, and expanded policy support, both on the supply side (anti-involution) and the demand side. Small-mid caps are benefiting more from abundant liquidity. We still expect promoting emerging industries to climb up technology tree and supporting domestic substitution remain policies priorities in 2025. Therefore, these specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development. (Mirae Asset, August 2025)

Stock Comments

Keboda gained over 77% in September, a key contributor to the ETF. Keboda’s 2Q25 earnings rose 61% YoY and 19% QoQ, to Rmb245mn, above market expectations, and up from the 6% YoY earnings decline in 1Q. 2Q revenue grew 26% YoY, to Rmb1.7bn, within which revenue from auto light controllers rose 38% YoY, to Rmb0.9bn in 2Q. 2Q gross margin rose 1.1ppt YoY and 0.2ppt QoQ, to 27.2%, thanks to scale benefit. Together with FX gain, operating margin rose 3.1ppt YoY, to 14.6%. Keboda won Rmb7bn in new orders in 1H25, and in particular, a central domain controller project from a global OEM, which will integrate auto lighting functions with door locks, climate control, etc. Keboda’s acquisition of Czech-based IMI plant will give it better access to European OEM customers in the future. Auto central domain control system can be potentially expand into humanoid bot, which has also triggered rally in September. (Company data, September 2025)

Preview

As a high-quality, small-cap fund, Global X China Little Giant ETF is likely to benefit from government’s supportive policies on tech innovation and may outperform large-cap funds if the economy turns to recovery in 2025. SMid is likely to outperform given abundant liquidity in China A Share.