Immunotherapy II: Market Growth and Trends

Who is leading in immunotherapy in China ?

In the previous report we discussed basics about immunotherapy, including immune-checkpoint inhibitors – PD1 (programmed cell death protein 1) and PDL1. (programmed death-ligand 1)

In this report we will discuss current development stage of PD1/ PDL1 in China, market sizing as well as leading companies pursuing it.

Market Potential

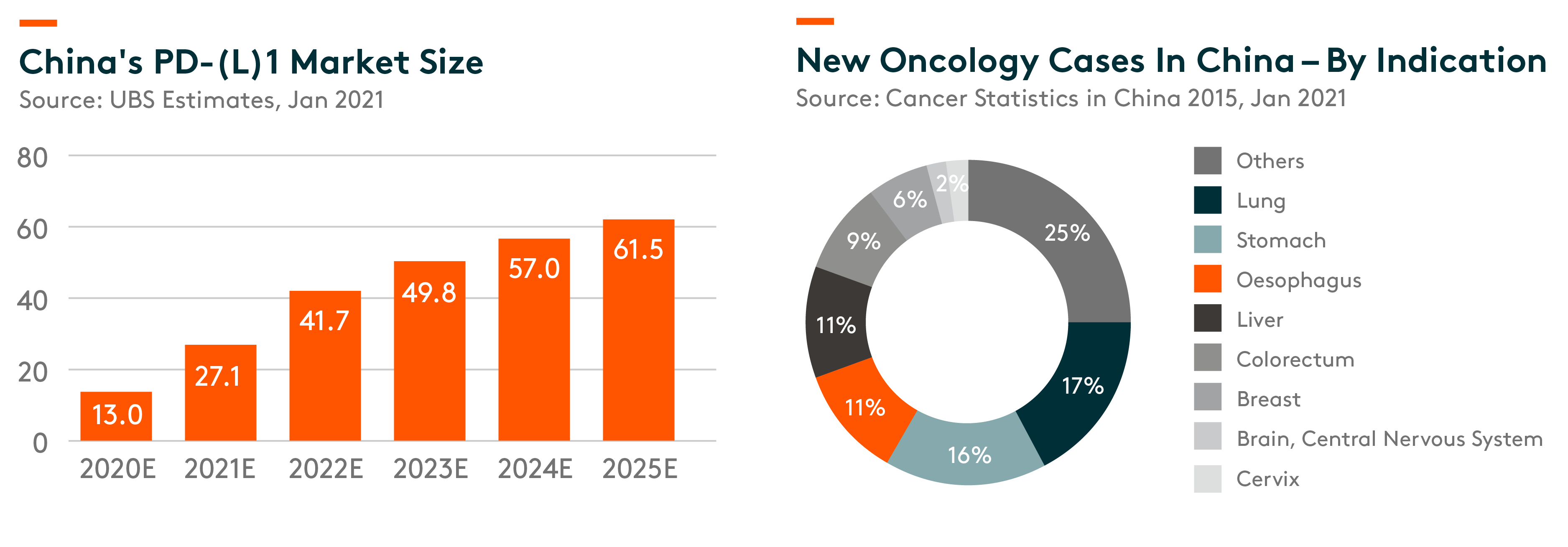

China’s PD(-L)1 sales is expected to grow at 36% compound annual growth rate (CAGR) 2020-25e to RMB 62 bln (vs 2020e is expected to be RMB13 bln). This rapid growth will be mainly be driven by (i) significant medical demand to address a large patient population; (ii) favorable regulatory reforms to drive faster launches, with bigger/wider indication coverages; and (iii) reimbursement expansion, bridging the gap between demand and supply. Lung cancer, stomach cancer, Oesophagus cancer and liver cancer, in total, represent about 55% of new cancer cases in China.

In China, there are 142 PD-(L)1/ PDL1 inhibitor related later-stage clinical trials ongoing, targeting cancer sites with higher incidence and frontline/(neo) adjuvant treatment, compared to only a handful that have been approved so far, that too for only a small number of indications. These clinical trials are aiming for a wider patient coverage. We are positive on PD-(L)1’s efficacy in the frontline treatment of major cancer types as well as in adjuvant settings. We think the leading domestic players are well placed relative to the competition.

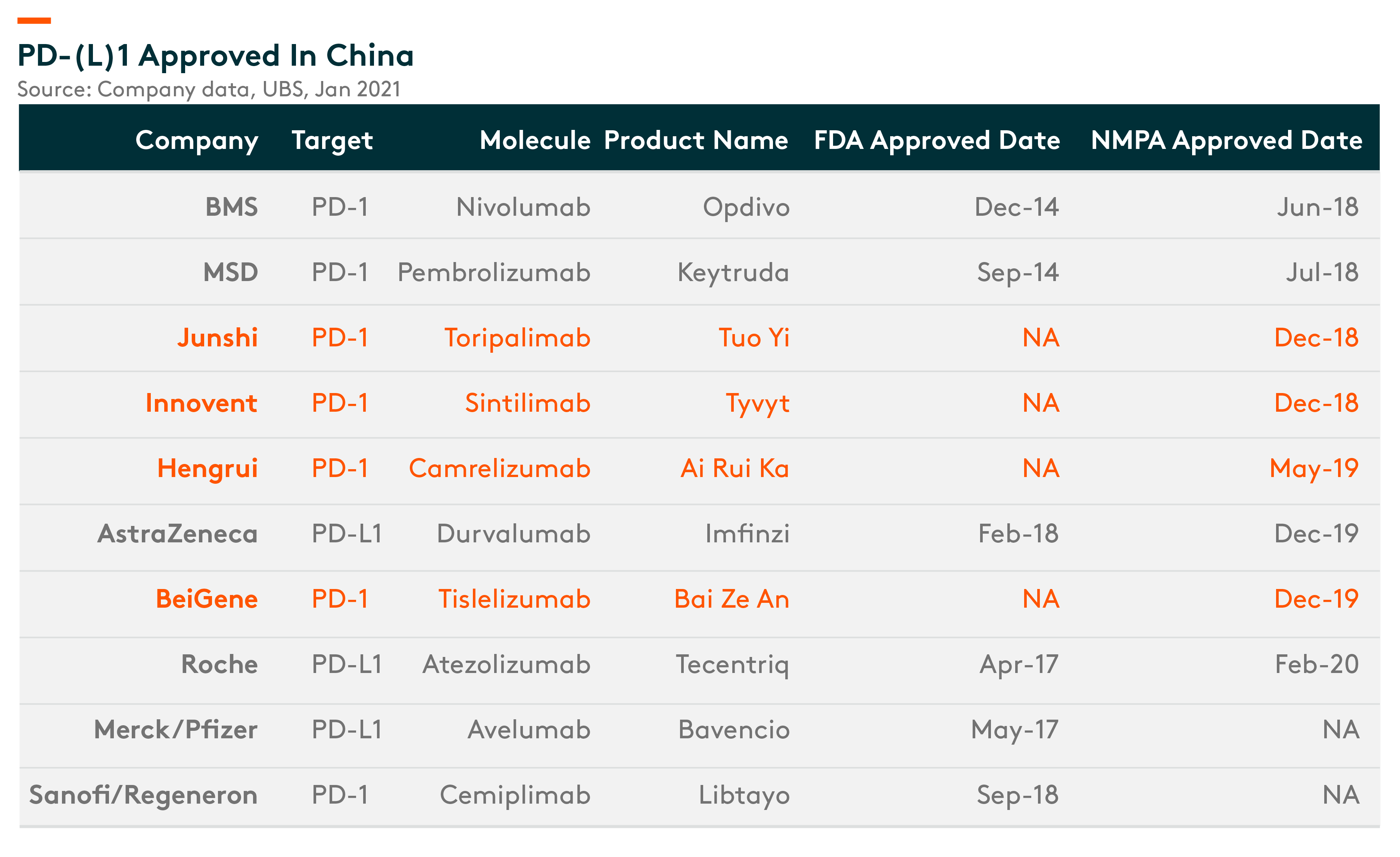

Four leading domestic companies are leading the way in approvals as well as in key large indications.

PD-(L)1 Approved in China – Very Few approvals so far. Only 4 domestic companies have received approval so far, that too for small indications

We detail below two key large indications (lung and stomach) and discuss progress among MNCs (multi-national companies) as well as Chinese companies.

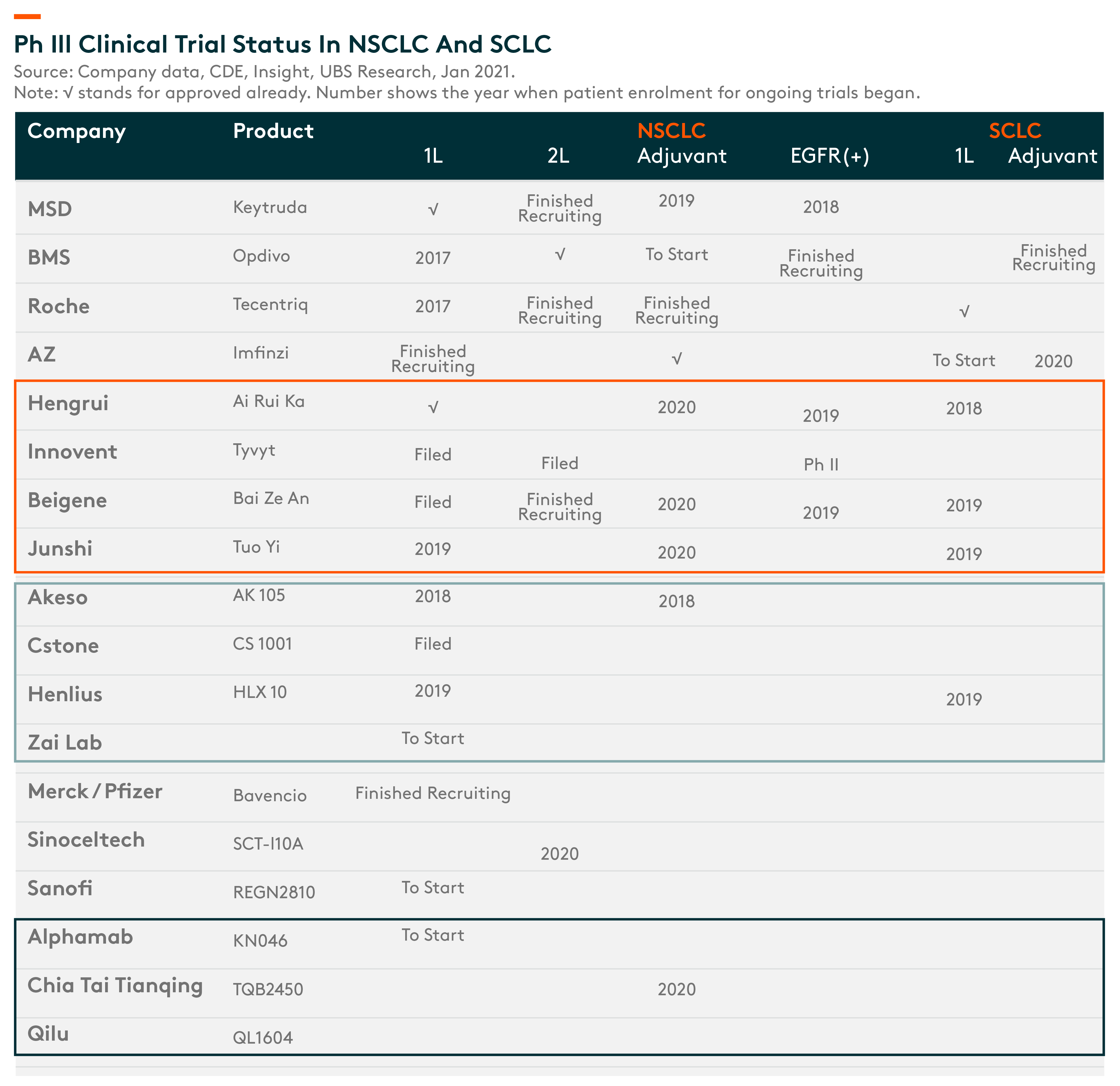

Lung cancer has the highest incidence worldwide and is well-studied by MNCsIt is getting competitive in China, but MNCs have taken the lead so far.

Hengrui, Innovent and BeiGene are the Tier 1 domestic players, with indications approved or filed already. We believe, once these domestic companies get approved and included in reimbursement, they will be able to penetrate into tier 2/3 cities before the second wave of approvals come in, thereby creating a strong entry barrier.

Ph III clinical trial status in NSCLC and SCLC – Leading domestic companies ahead of others in development for NSCLC indication

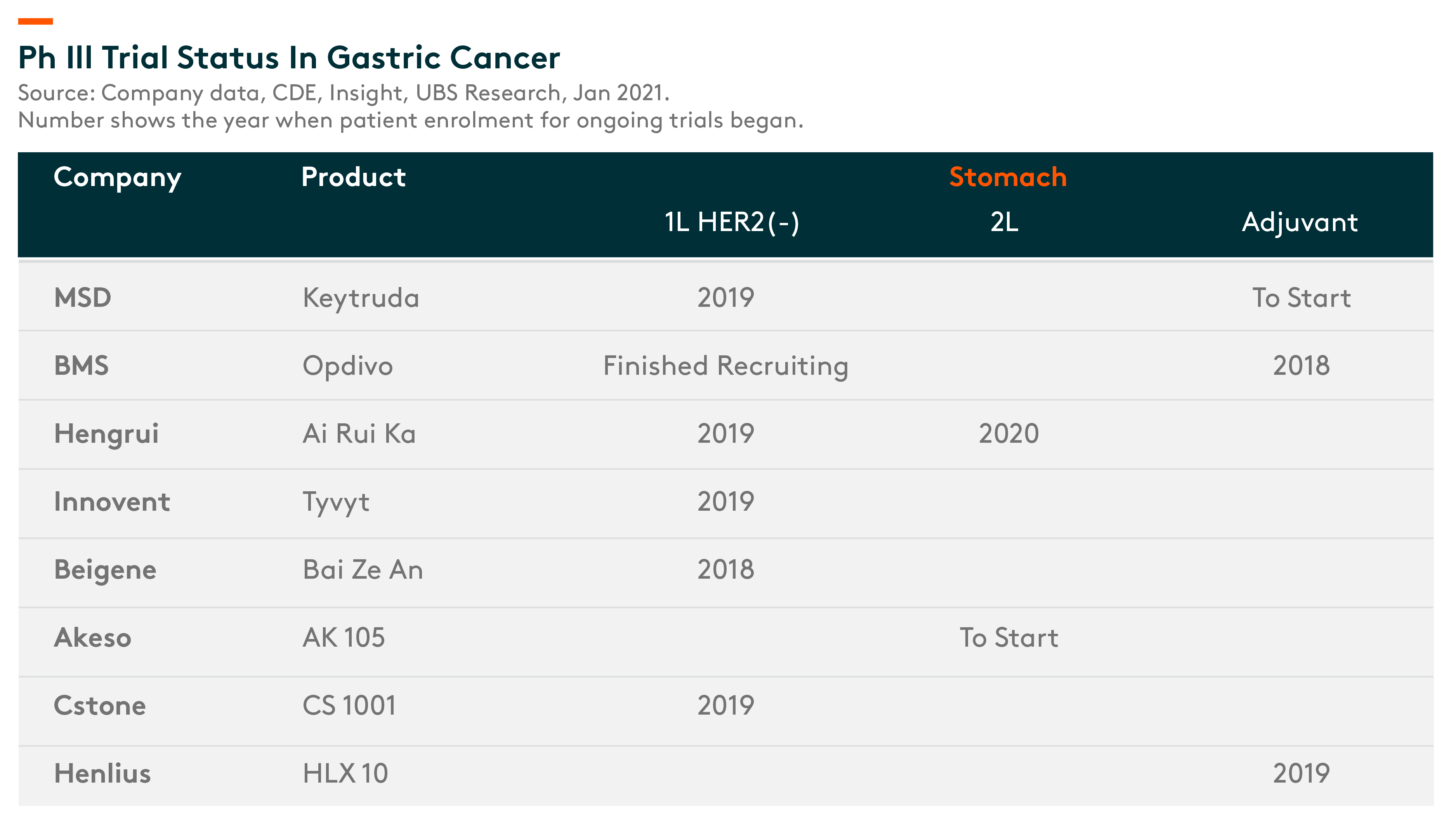

Stomach cancer is the second most prevalent cancer type in China, and new cases comprise 50% of the total incidence worldwide. (UBS Research, 13 Jan 2021)

Considering the various combo therapies in different cancer indications, we believe that the PD-(L)1 inhibitor as an immune modulator would likely play a basic role in carrying various other innovative drugs for oncology treatment.

Companies that can consistently develop newer treatment modalities, provide low-cost, high-quality drugs, and have strong academic-based sales team should be able to capture market share.

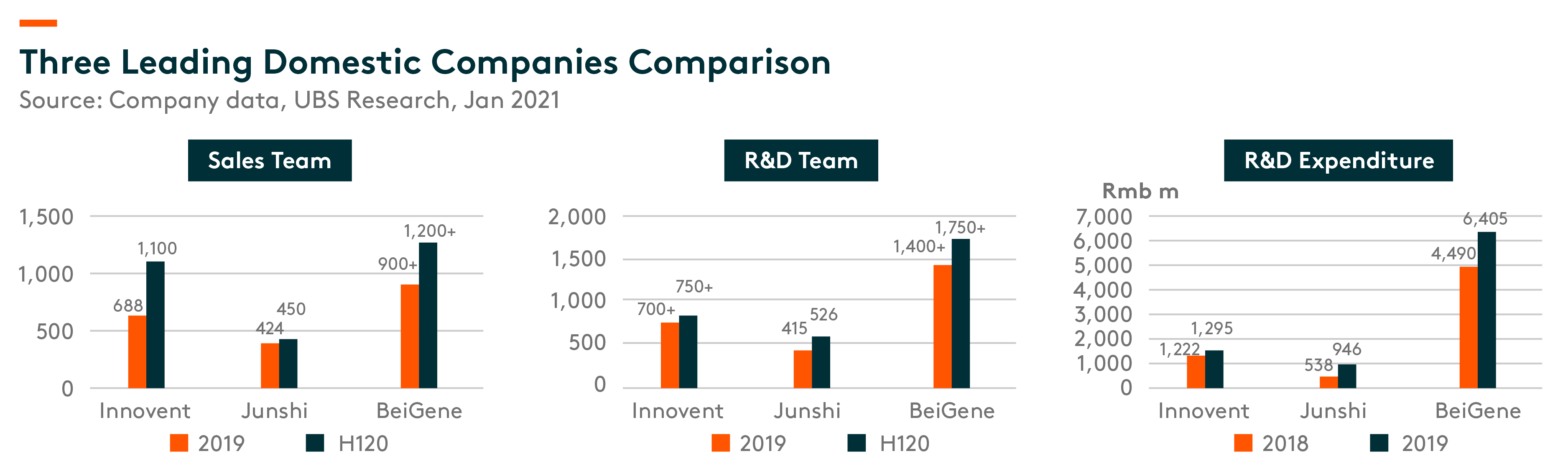

R&D capability is the key driver for the development and successful launch of innovative medicines. By H120, BeiGene had the largest R&D team (400+ in research and 1,350+ in clinical development), while the R&D teams at Innovent and Junshi are also growing. In terms of R&D expenditure, BeiGene, Innovent, and Junshi spent Rmb6.4bn, Rmb1.3bn, and Rmb0.9bn, respectively, in 2019.

We compare below R&D team, R&D expenditure as well as sales team of three leading domestic companies.

Related ETF

Global X China Biotech ETF seeks to provide investment results that closely correspond to the performance of the Solactive China Biotech Index NTR, offering an access high growth potential through companies critical to the development of biotechnology in China.

Other Features

- Targeted Exposure: The fund delivers targeted exposure to an emerging theme and industry.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the biotech theme in China.

Click here to learn more about our Global X China Biotech ETF.