Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X China Biotech ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Key Themes – Feb 2024

Global X Hang Seng Tech ETF (2837 HKD)

Industry Update

- Hang Seng TECH Index experienced a decline of 20.2% in January, primarily driven by weakness in the Consumer Discretionary and Information Technology sectors amid extended concerns about China’s sluggish economy, a lack of more forceful stimulus, and the Federal Reserve’s reluctance to cut rates soon.1 After initially responding positively to the reserve requirement cut, China’s stock market quickly lost its momentum.

- China electric vehicle (EV) manufacturers are off to a bumpy start, with a fall in sales in January. The underperformance of key holdings within this theme, including Li Auto and XPeng, contributed to the sector’s negative performance. Oversupply, intensifying competition and mounting concerns about a slowing economy all have contributed to the negative performance.

Stock Comments

- XPeng (9868 HK): The company encountered challenges despite the positive impact of government stimulus on consumer spending in the EV market. The company reported a net loss of over US$500 million in its third quarter, indicating its ongoing struggle to achieve profitability.2 The persistent lack of profitability has adversely affected investor sentiment towards XPeng. In the long term, sustainable profitability will be a crucial factor in determining the success of investments in companies like XPeng within the EV industry.

Preview

While short-term volatility and downside risks persist, it is important to note that the long-term growth potential of the Consumer Discretionary and Information Technology sectors remains significant. Technological advancements, evolving consumer preferences, and innovation-driven strategies are expected to drive future growth.

Global X Hang Seng High Dividend Yield ETF (3110 HKD)

Industry Update

- Hang Seng High Dividend Yield Index fell 4.7% in January 2024.3 Considering the Hang Seng Index declined by 9.2% over the same period, the defensiveness and resiliency of high dividend stocks were exceptionally strong in the first month of 2024.4 The Real Estate sector, representing 6.9% of the index, was the largest detractor for the index in January amid the news of China Evergrande Group’s liquidation.5

- The downturn in China’s property market persisted, with tier-one and tier-two cities continuing to experience a decline in home sales compared to the previous month. Despite recent easing policies, the optimistic sentiment was short-lived. The Hong Kong High Court issued a winding up order against China Evergrande Group, served as a reminder of the fragile state of the sector.6

Stock Comments

- YueXiu Property Co. (123 HK): YueXiu Property Co. experienced a significant decline of 23.4% over the month, primarily due to the downward trend in home sales across various tiers of cities in China.7 It was one of the largest detractors in the Hang Seng High Dividend Yield Index. The negative sentiment surrounding the company was further compounded by the spill-over effect from China Evergrande Group, which impacted investor confidence.

Preview

While short-term volatility and downside risks persist, Hang Seng High Dividend Yield Index demonstrated greater resilience relative to broad based indexes. Notably, this Index consists of over 60% of its constituents in State Owned Enterprises. The concept of the Valuation System with Chinese Characteristics (“VCC”) is back in the spotlight again in light of recent developments. During the Chinese Securities Regulatory Commission (“CSRC”) Work Conference in late January 2024, the Chairman reiterated the significance of VCC and called for actions to expedite implementation. The primary objective of VCC is to enhance the quality and investment value of listed companies, especially SOEs. By investing in the Hang Seng High Dividend Yield Index, investors can gain exposure to high dividend-paying and low-volatility companies while also benefiting from the accelerated implementation of VCC.

Global X China Electric Vehicle and Battery ETF (2845 HKD)

- Weaker than normal pre-holiday auto sales; pending March sales figures to assess growth: Based on the announcements of individual auto brands, many of them have registered sharp double-digit month-over-month (MoM) decline in January. BYD reported January new energy vehicle (NEV) sales of 201.5k units, +33% year-over-year (YoY)/-41% MoM.8 Higher margin products (export and high-end products) account for a higher share of the sales volume at 26%.9 Li Auto delivered 31,165 units of vehicles in January (+106% YoY/-38% MoM).10 Nio January deliveries logged 10,055 units, +18% YoY/-44% MoM.11 Xpeng December deliveries logged 8,250 units, +58% YoY/-59% MoM.12

- Battery production dropped in December: According to the China Automotive Battery Innovation Alliance (CABIA), China’s power battery installation reached 48GWh in December, up 7% MoM.13 Energy storage battery sales in November was 18GWh, up 13% MoM. Battery production reached 78GWh, -11% MoM. LFP batteries accounted for 65% of total battery installation.14 CATL’s market share in domestic installation rose 1ppt MoM in December, to 45%, while BYD’s share was stable at 23%.15

- Battery material costs declined further in January: China’s spot lithium carbonate price was around RMB 96.5k/t at the end of January, down by around RMB 4k/t or 0.4% MoM.16 Inventory-wise, the total inventory of lithium carbonate came in at 73,735 tons (vs. 66,584 tons last month).17

- Strong momentum from Huawei AITO: The AITO brand deliveries reached 32,973 units in January (+35% MoM), with new AITO M7 deliveries at 31,253 units (last month was 20,611).18 Accumulated orders of the new M7 have exceeded 140k units since the product launch.19

- Growing market concern on competition and customer affordability: The Huawei AITO achieved great success in auto sales after its product launch late last year. This, together with a solid pipeline of new EV and PHEV models in 2024, led to renewed concern about increased market competition in China. This is not entirely new, as we entered 2023 with a sharp Tesla price cut and also competitive model launches. But this time around in early 2024, the weak pre-holiday auto sales could reflect an underlying customer affordability issue amid economic slowdown.20

Stock Comments

- BYD (002594.CH): BYD’s share price was down 13.8% in January, a positive contributor to the ETF.21 There are growing market concerns on increased price competition in the China auto space. BYD has outperformed the Chinese EV OEM in the month because many believed BYD could be the winner under intense price competition.

- CATL (300750.CH): CATL’s share price was down 7.1% in January, a positive contributor to the ETF.22 The stock has outperformed the entire battery supply chain universe. Many believed CATL could be the winner under intense price competition due to their battery technology leadership and solid balance sheet.

- Ganfeng (002460.CH): Ganfeng’s share price was down 20.5% in January, a negative contributor to the ETF.23 The price correction is more than cover the temporary rebound in December last year. There are limited signs of inventory rebuild by the battery supply chain players. Many of the players stayed cautious about the lithium pricing outlook into 2024.

Preview

We are confident about China’s NEV penetration into 2024 as auto suppliers have solid and competitive car model pipelines. We believe it is still too early to be concerned about the customer affordability issue by extrapolating the January sales condition, which is heavily distorted by the holiday. The market share competition in 2024 will remain very intense, with traditional auto suppliers and overseas brands taking a major hit. New entrants such as Huawei AITO and Xiaomi are raising consumer attention in smart driving. While we think lithium prices have some further downside, the marginal impact on the supply chain and battery cost is much lower than before. The supply chain is in a much better position to restock into 2024, which is positive for the battery makers.

Global X China Clean Energy ETF (2809 HKD)

Industry Update

- Solar – Polysilicon prices stabilized but supply chain prices are still on the declining path: Solar polysilicon prices reached RMB 66/kg by the end of January, slightly higher than the RMB 65/kg a month ago.24 Module prices are now at RMB 0.90/0.93/W for M10/G12, lower than the RMB 0.95/0.98/W a month ago.25 According to SCI99, solar glass prices stayed at RMB 16.50/25.50/sqm for 2.0mm/3.2mm. Inventory levels increased to 25.35 days from 24.25 days. Soda ash prices dropped to RMB 2,450/t.26Inverter exports were up 6% MoM in December 2023.27 Total exports stood at US$595 million in December (+6% MoM; -40% YoY).28 The positive MoM growth drove some market optimism around the potential for the industry to bottom out.

- Grid and power installation – Strong solar installation; grid capex back to decent growth: China’s December 2023 wind installations were 34.51GW. The 2023 installations reached 69.90GW (+86% YoY), meeting the market expectation of 60-70GW.29 China’s December 2023 solar installations were 51.87 GW, with 2023 installations of 215.7GW (+147% YoY), beating the already high market expectations of 180-200GW.30 In December, the electricity grid spending in China reached RMB 82 billion (+2% YoY), with FY2023 grid spending up +5.2% YoY.31 The grid spending in China is second-half loaded. December, in particular, is the strongest month, constituting 15% of annual spending on average.32

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. However, it is worth noting that the solar supply chain entered a consolidation phase starting in 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. The optimism around the European market’s sequential recovery turns out to be only temporary. We have yet confidence on the market turnaround in Europe. Meanwhile, we are bullish on the electrical equipment players who benefit from increased grid and system investment in China and globally.

Global X Asia Semiconductor ETF (3119 HKD)

Global X China Semiconductor ETF (3191 HKD)

Industry Update

- TSMC expects foundry industry to grow by 20% in 2024: Management expects the foundry industry to grow by 20% YoY in 2024, driven by shipment recovery in key terminals like smartphones, PCs, as well as continuous investment in data centers.33 Management lifted the long-term outlook of AI contribution to high teens % or higher of its total revenue in 2027 (from low teens %). Reiterated long-term revenue growth of 15-20% CAGR and gross margin of 53% and above to be achievable.

- SK Hynix expects recovery in memory demand: Management is anticipating a recovery in demand this year, and expects a gradual adjustment to production cuts in line with normalizing inventory level. Full-year DRAM bit growth to be mid-high teens % YoY. Favorable pricing environment for DRAM is expected to be sustained into 2025.

- CXMT and YMTC to step up development pace: ChangXin Memory Technologies (CXMT) and Yangtze Memory Technologies (YMTC), the former specializing in DRAM memory and the latter in NAND flash chips, have accelerated their development this year. Both companies are expected to add more capacities this year, providing a boost to domestic semiconductor equipment demand.34

Stock Comments

- ASMPT (+2.12%): ASMPT is a key equipment supplier in hardware assembly, OSAT and advanced packaging. The company is well-positioned to benefit from the OSAT CAPEX recovery trend. ASMPT have also invested resources to expand their market share in the growing advanced packaging space.35

Preview

Increasing AI adoption in the data center and increasing penetration of AI at the edge and on-device will be the key enabler of the next upcycle semiconductor, as AI-enabled devices have much higher semi content. Currently, we are still in the process of cycle recovery as both stocks and earnings are below the previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

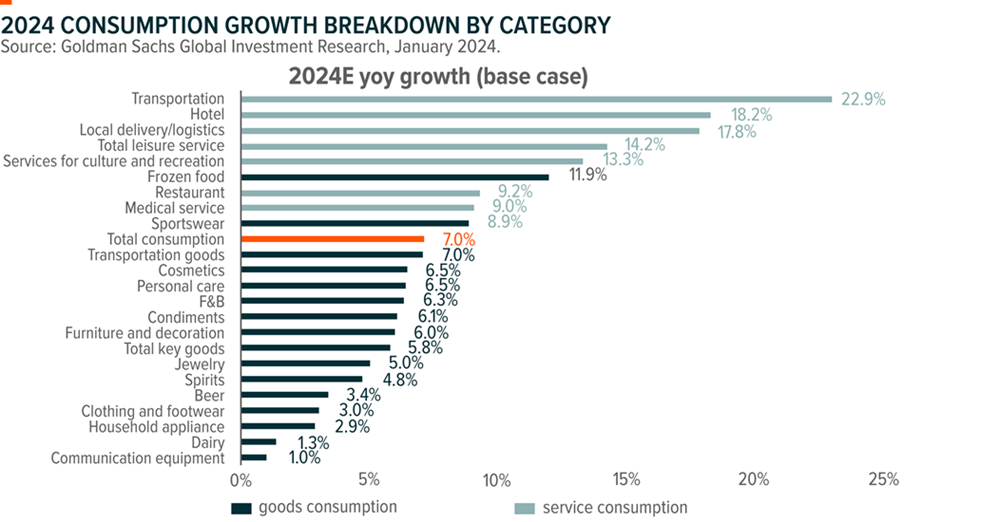

- China consumption remains soft amid weak consumer confidence, with total retail sales growing by +7.4% YoY in December.36 That said, Morgan Stanley’s Consumer Survey indicated that Chinese New Year (CNY) sentiment seemed better than feared. More consumers plan to increase spending budget during CNY Golden Week this year.37 A net of 34% of consumers plan to increasing spending compared to that of a net 16% in 2023 survey.38 Consumers are will to spend more on consumer services than physical goods such as travel, live entertainment, visit pubs/clubs and shopping malls. However, we will have to watch out whether such trend phase out after the holiday or can continue the momentum even after CNY.

- Headline consumer price index (CPI) deflation intensified in January, falling 0.8% YoY.39 China has been in deflation for three straight quarters. Primary housing sales remained subdued and wage/income growth has been weak.

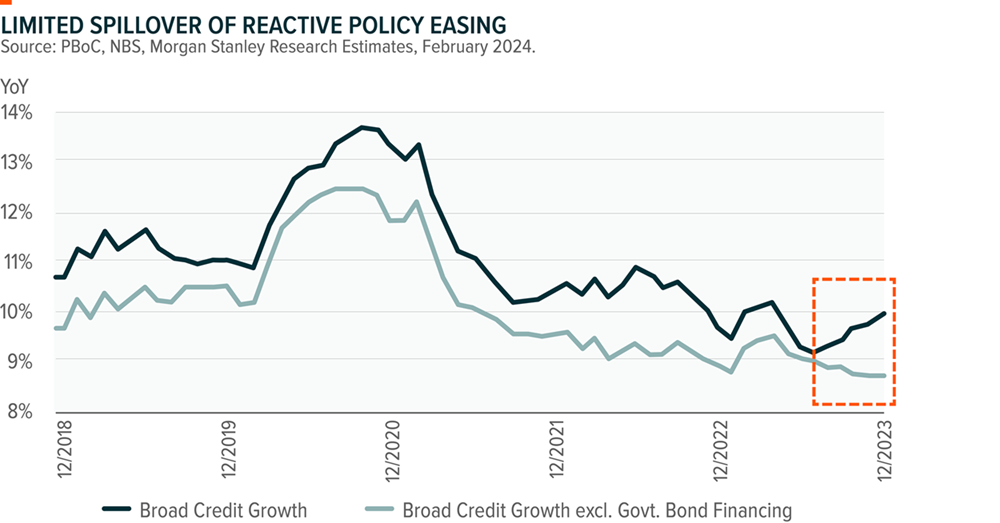

- Policy easing measures so far have been reactive and insufficient to drive growth and boost consumption and business sentiment. There are upcoming events in 1H24, including NPC, Politburo Meeting, and Third Plenum, and we will be watching out for more stimulus that can trigger the growth. This will be key for China’s consumption growth as well for 2024.

Stock Comments

- Home appliance companies namely Midea (000333 CH) and Haier Smart Home (600690 CH) were the biggest contributor of the month thanks to steady state growth outlook amid soft consumption in China on the back of their global exposure, less dependent on property cycle/new home sales. Both companies expect to deliver double digit earnings growth with undemanding valuation of 11x 24P/E for Midea and 12x 24P/E for Haier.40

- Li Auto (000568 CH) was the major detractor in January due to concerns on intensifying competition amid overall soft auto demand. A few OEMs including Tesla launched new time-limited promotions during January which may potentially continue in February as well. Overall market momentum is likely to remain sluggish.41

Preview

We have started to see sell-side revising down earnings estimates for 2024 and 2025 amid soft consumption environment. This may continue throughout 1Q24 along with companies’ FY23 full year results announcement. Also, consumption growth is likely to be the lowest in 1Q24 considering high base from first two months of last year and recover gradually throughout the year. Above all, the government’s stimulus/policy to support growth will be the critical thing to watch out for in the coming months.

Global X China Cloud Computing ETF (2826 HKD)

Industry Update

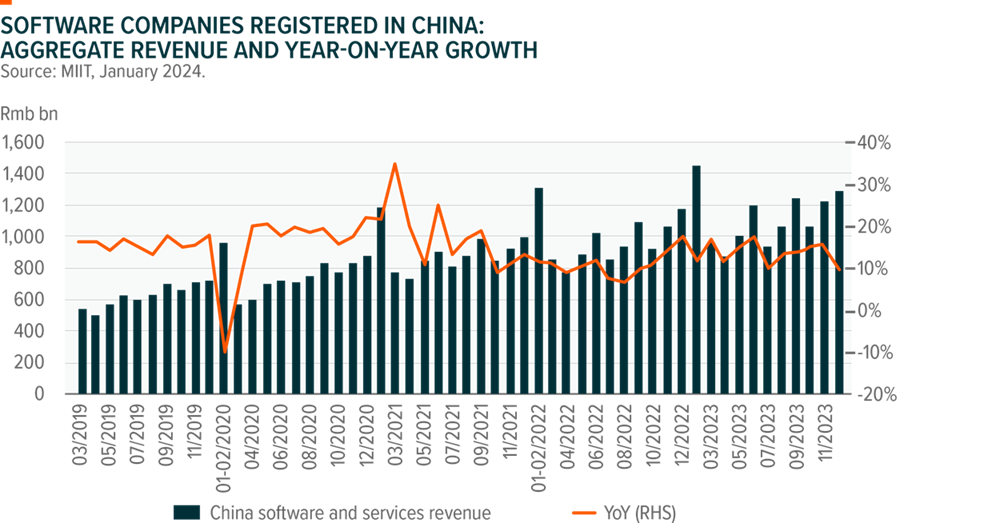

- China Software industry December revenues were +9% YoY, slowing down from October/November (+15%/+16% YoY), leading 2023 revenues to increase by 13.4% YoY.42 IT services growth outpaced the industry at 15% YoY in 2023, driven by cloud computing and big data analysis services growth at 15% YoY, while EDA software growth slowed at 6% YoY, and e-commerce IT services growth was at 10% YoY, followed by software products at +11% YoY, driven by industrial software at +12% YoY, cybersecurity at +12% YoY, and embedded system software at +11% YoY.43 Net margin was 12.2% in December (vs. 13.1% in November).44

Stock Comments

Key Contributors:

- NetEase Inc Sponsored ADR: Stock price rebounded post a sharp decline due to potential new regulation on the online gaming industry. Overall, market prefers companies with reasonable valuation and high dividend payout. Therefore, NetEase stock price remained resilient amid market sell down in January 2024.45

- Hygon Information Technology Co., Ltd. Class A: Due to rising US export restrictions, Chinese chip designers including Tencent (0700) are aggressively pitching their AI chips as alternatives to Nvidia’s. Into 2024, the local substitution has been accelerating, which led to increasing orders from internet platforms.46

Key Detractors:

- Beijing Kingsoft Office Software. Inc. Class A: Fundamental earnings and AI development are both progressing well. However, the Chinese market experienced a broader selloff in January 2024, and many AI-related names were negatively impacted.47

Preview

China’s stock market has been very volatile this month, and software/IT services stocks have shown their high-beta nature. Overall, software companies’ valuation has retreated to a historical low. Into 2024, the market has been expecting continuous monetization of AI technology and a gradual recovery of Chinese software companies’ revenue growth if macroeconomy conditions improve.

Global X China Little Giant ETF (2815 HKD)

Industry Update

- A-shares corrected in January with CSI300/500/1000 down -6.3%/-13.5%/-18.7%, the worst monthly decline since October 22.48 It was first shaken by rumored that some mutual funds were allowed to sell and corrections caused more pain and spillover to more derivative products and quant fund selling/derisking. Energy, financials and telecom performed better while IT, healthcare and materials were the main drags.

- China’s 4Q GDP was in line at 5.2% YoY.49 Meanwhile, December activity data came in somewhat mixed. Industrial production and retail sales fell MoM, while fixed investment rose 4.0% YoY in December, with an uptick in both manufacturing and infrastructure FAI, despite real estate FAI weakening further (-12.4%).50 Export also improved (partly due to base effect). However, market took it negatively assuming we would see less stimulus from policy makers.

- Though the 50bp RRR cut and support on onshore large cap ETFs provided some cushion, yet it was not enough to offset the deflationary/nominal growth outlook amidst no clear signs of China’s property bottoming out, 1) anti-corruption moving further in the financial sector with secondary market spillovers, 2) news flows on more US restrictions on China biotech and tech, and 3) Fed turning more hawkish.51

Preview

We see ongoing style rotation to value/risk off as national team buying was likely mainly in the large cap etf which also triggered rotation to value and defensive large cap/SOE names. As the China Little Giant ETF’s holdings are all mainly A-share small-mid cap names, hence they were affected the most from this correction.

Global X China Biotech ETF (2820 HKD)

Industry Update

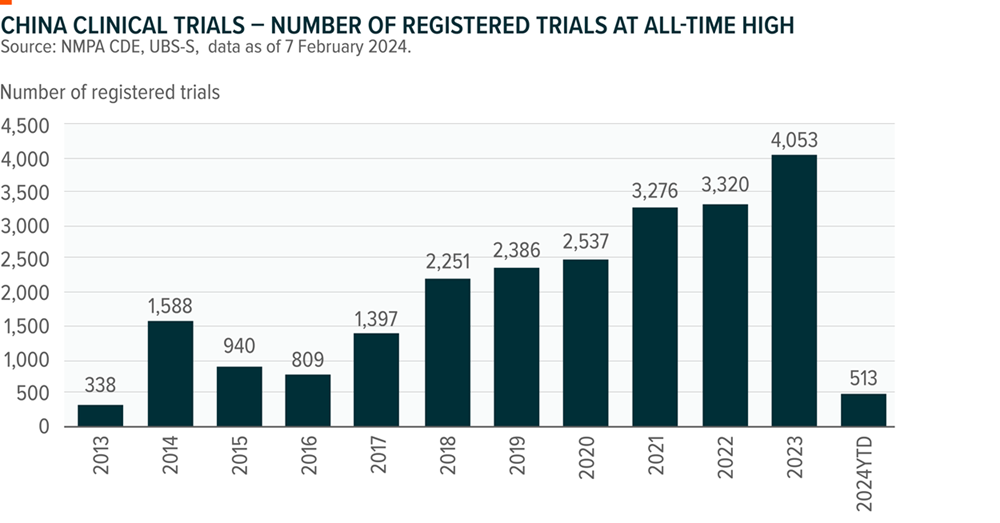

- Draft bill called Biosecurity Act in the US: Wuxi Apptec, Wuxi Biologics, as well as the entire CRO/CDMO sector stocks were down in January 2024, as Wuxi Apptec was named in a draft bill called the Biosecure Act introduced in the US House of Representatives to restrict federally-funded medical providers from using foreign adversary biotech companies of concern. Wuxi Apptec’s management clarified that the draft bill has not been enacted into law, and the legislative process requires separate review and approval of the House and the US Senate. The company does not believe the four allegations are true. In addition, the company also announced a share repurchase program.52

Stock Comments

Key Detractors:

- Wuxi Biologics: Wuxi Biotech’s CEO was named in in draft bill called Biosecurity Act in the US. The company has come out with a clarification highlighting its position.

- Wuxi Apptec: Wuxi Apptec was named in a draft bill called the Biosecurity Act in the US. Wuxi Apptec management clarified that the draft bill has not been enacted into law, and the legislative process requires a separate review and approval of the House and the US Senate. The company does not believe the four allegations are true. In addition, the company also announced a share repurchase program.