Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

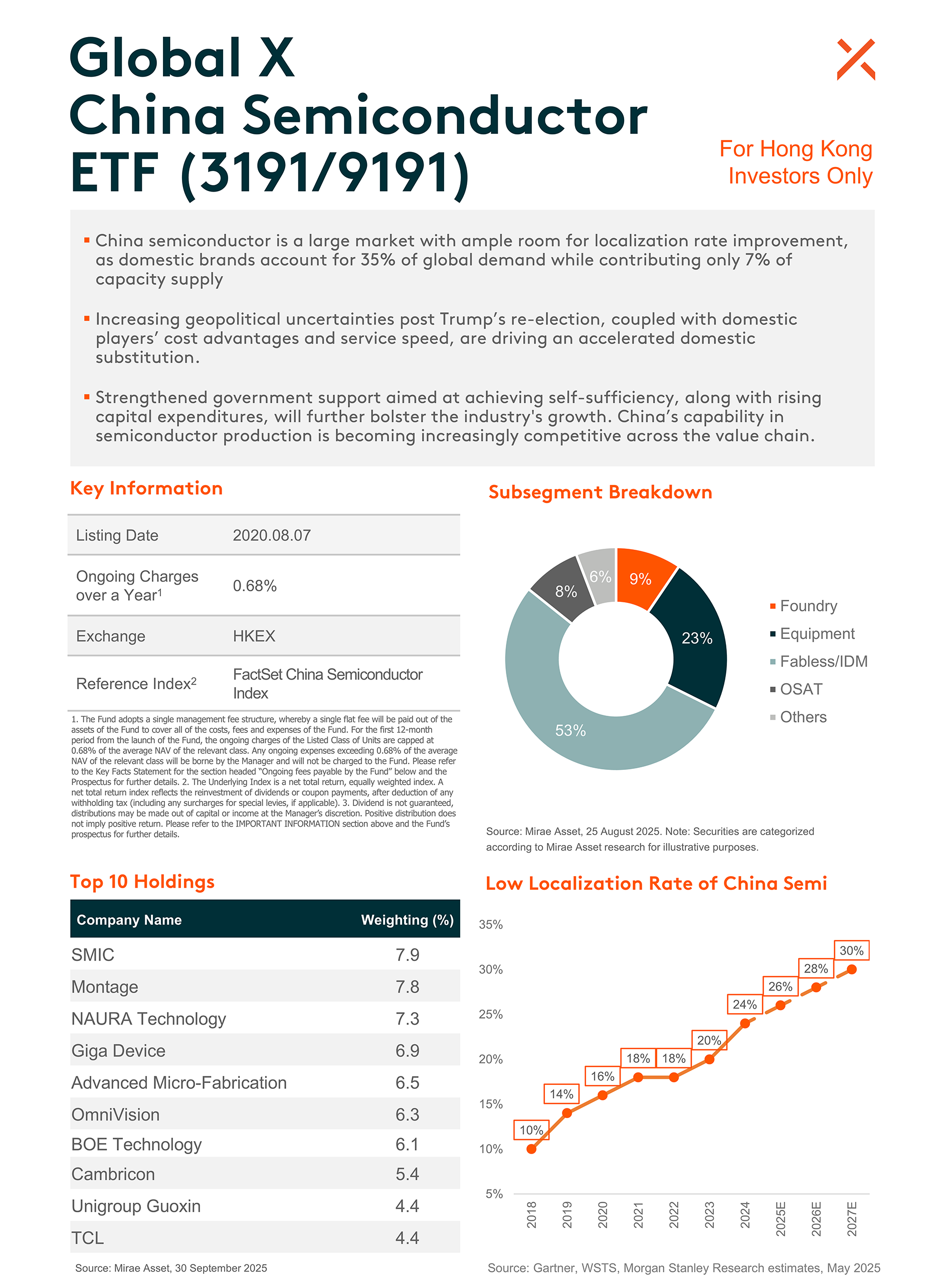

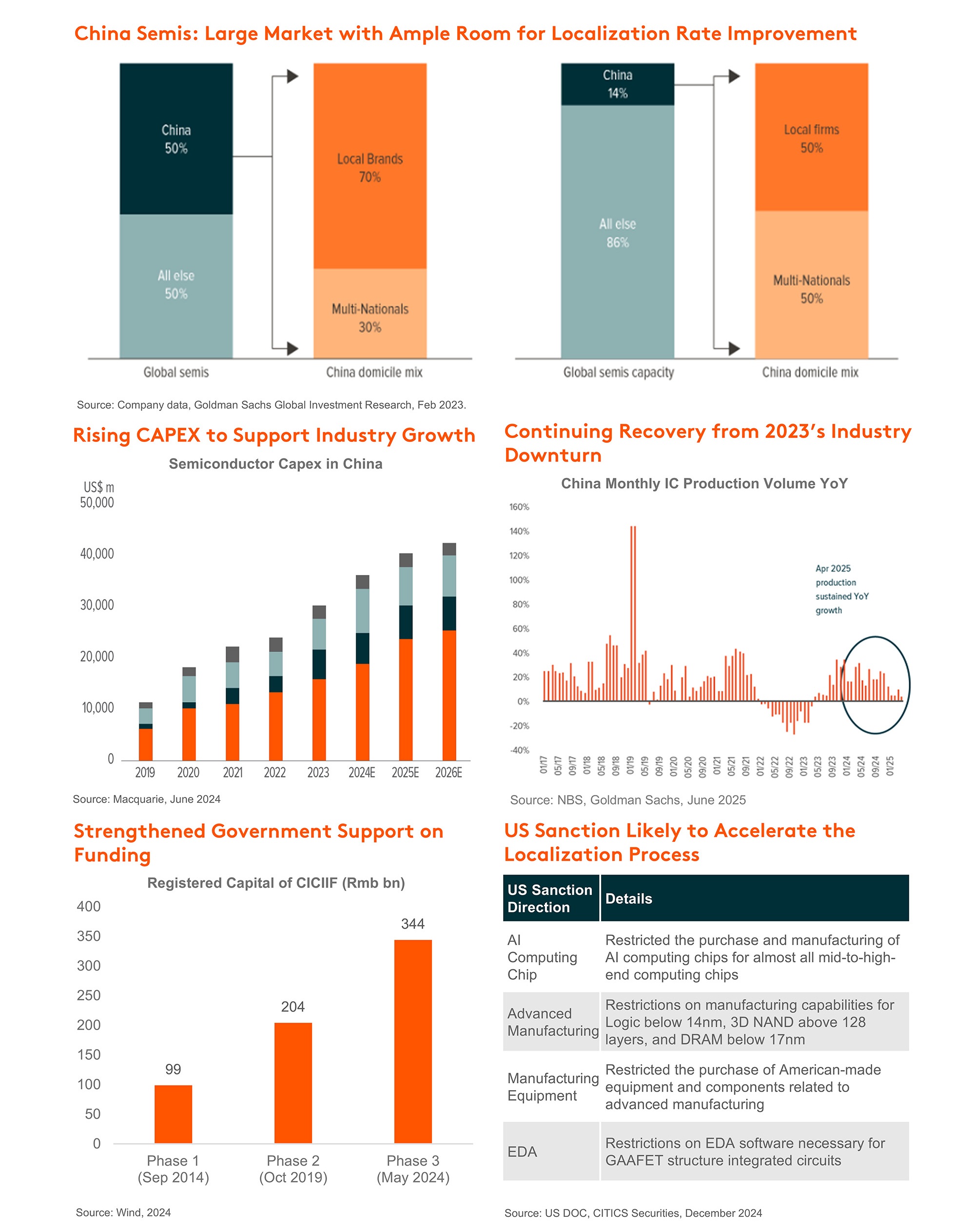

- The investment objective of Global X China Semiconductor ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Semiconductor Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Robotics and AI ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Robotics and Artificial Intelligence Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

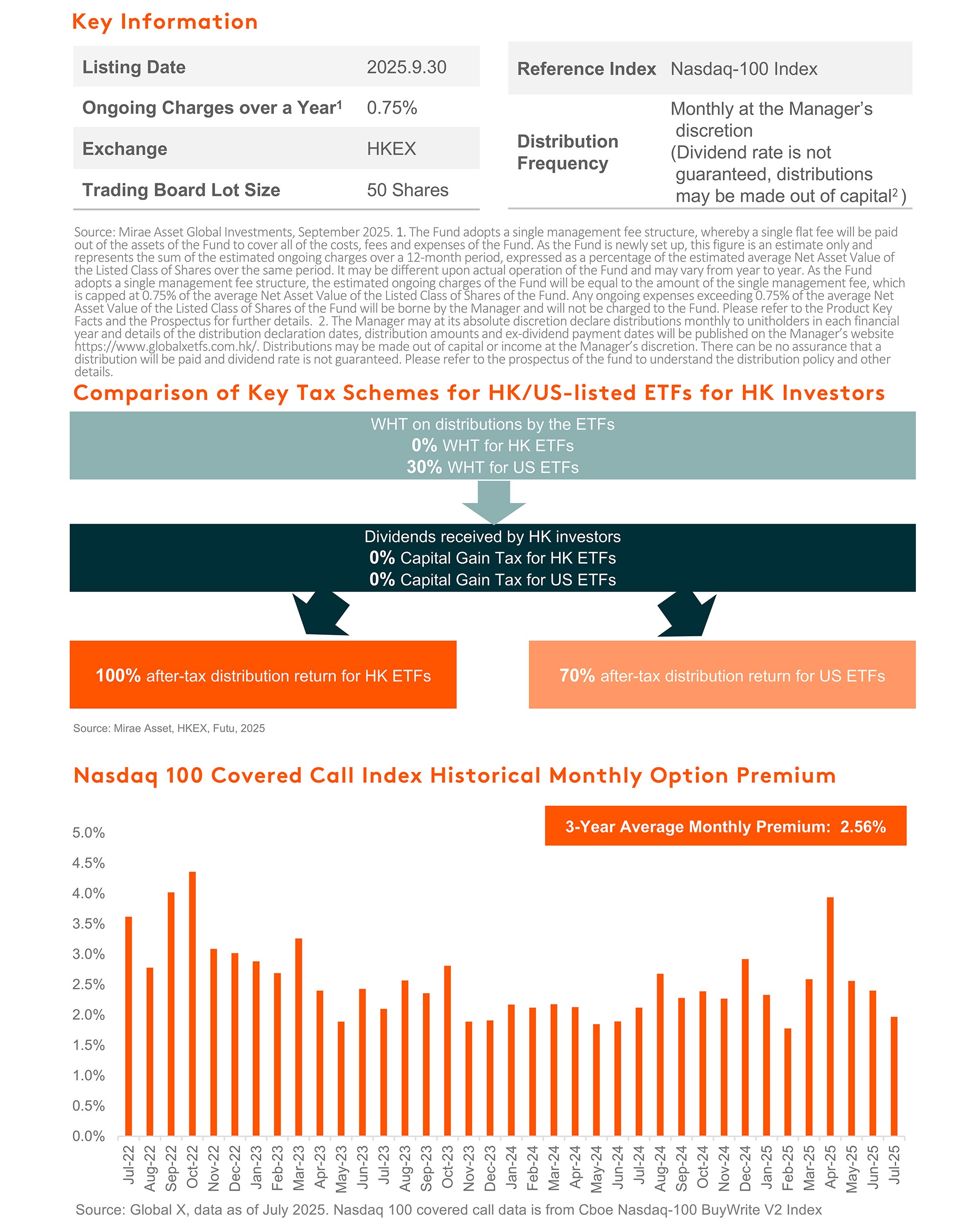

- The investment objective of Global X China Cloud Computing ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Cloud Computing Index NTR.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Companies in the internet sector may face changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

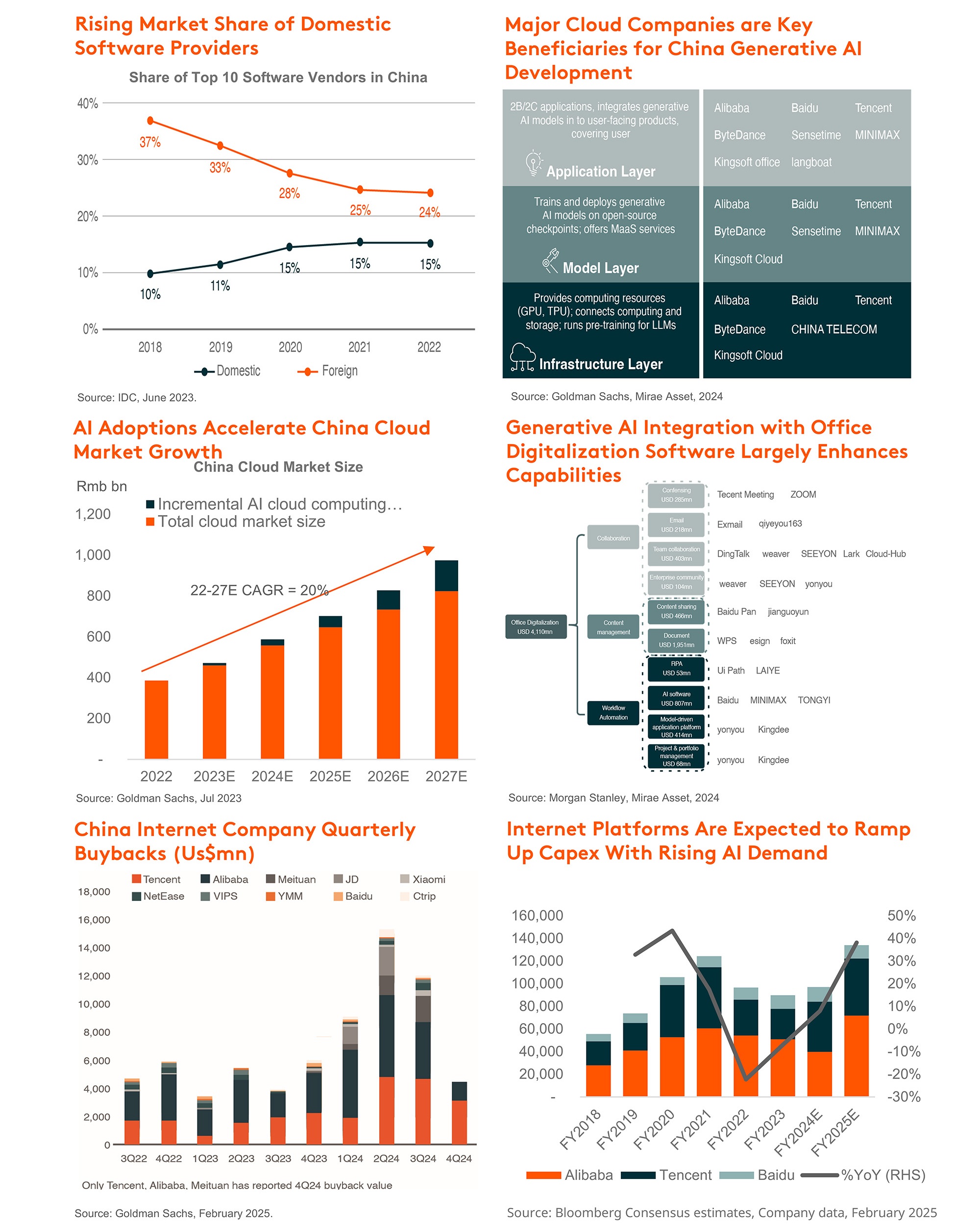

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

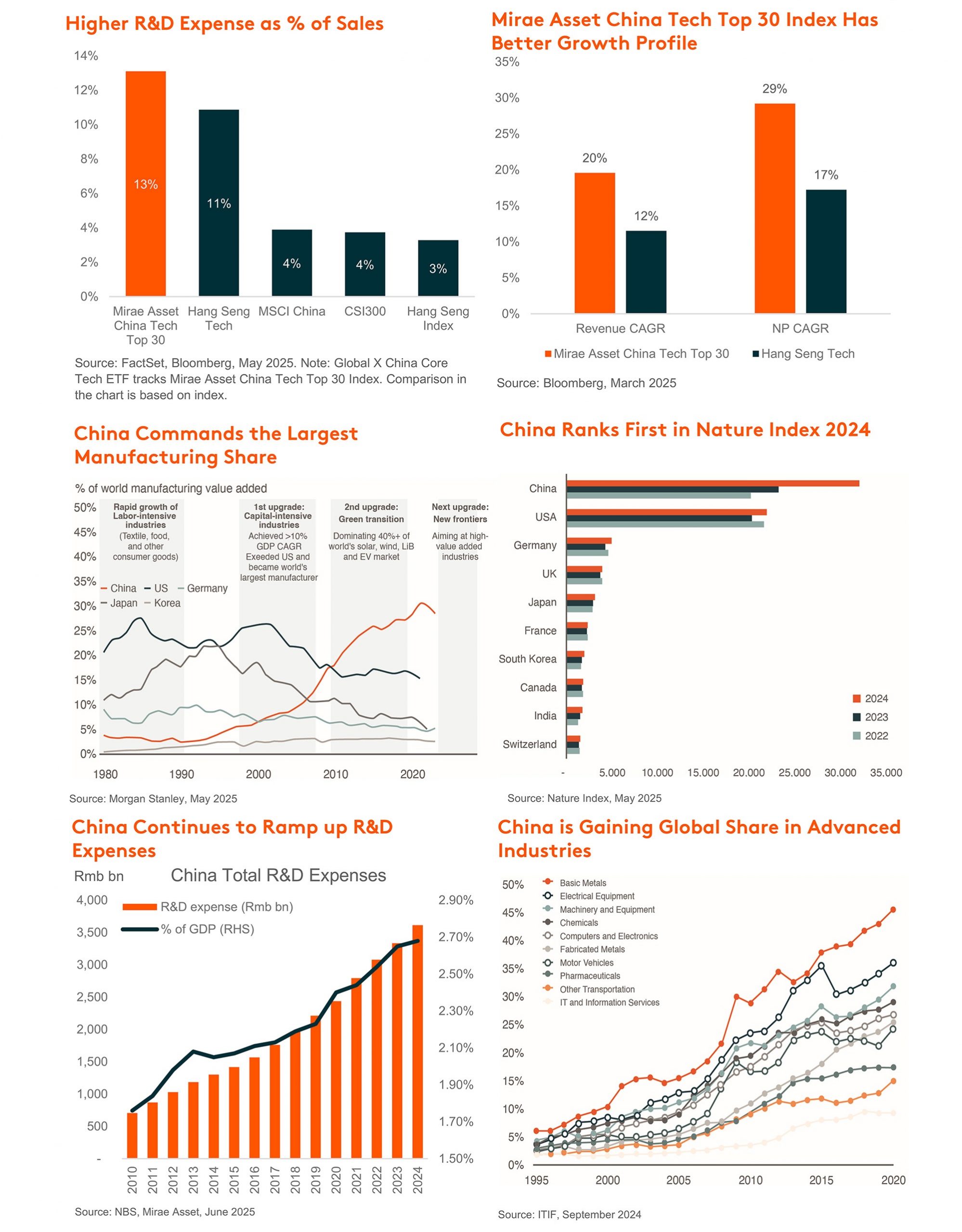

- The investment objective of Global X China Core TECH ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset China Tech Top 30 Index.

- The Fund is exposed to concentration risk by tracking a single region or country. It is potentially more volatile than a broad-based fund due to adverse conditions in the region.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit (the “Unit”) on the SEHK is driven by secondary market trading factors. The Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

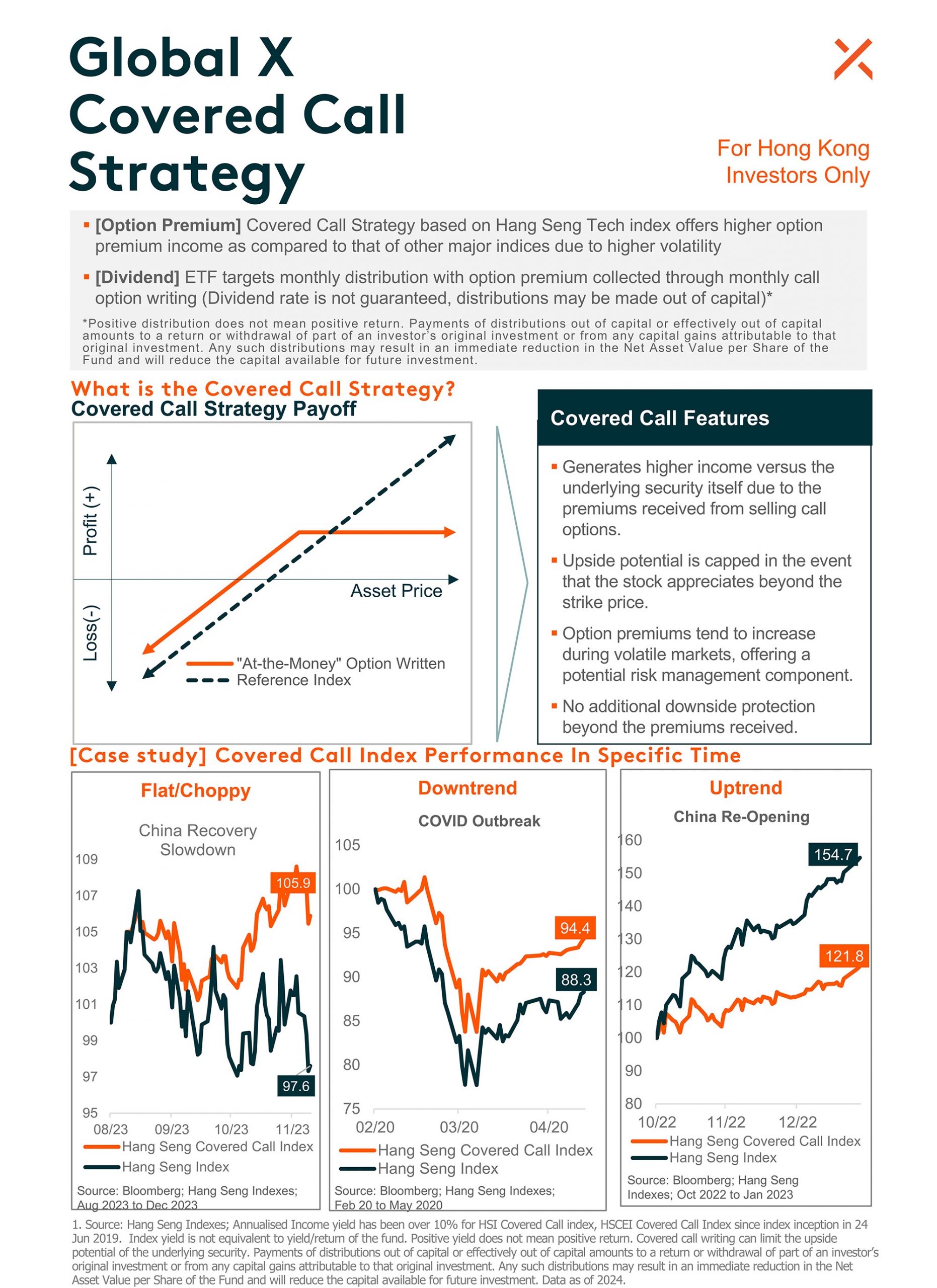

- The investment objective of Global X Hang Seng TECH Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng TECH Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

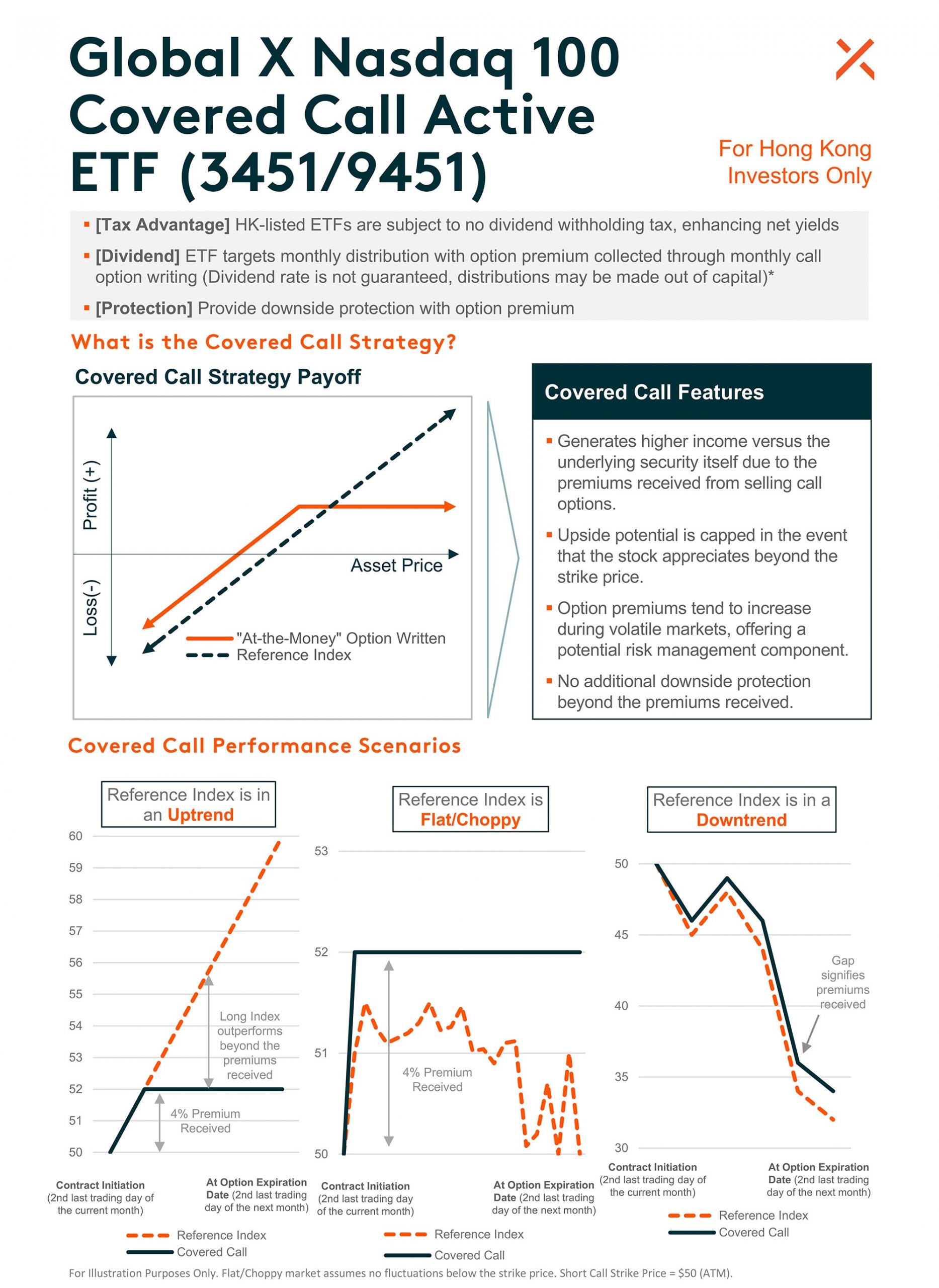

- The investment objective of Global X Nasdaq 100 Covered Call Active ETF (the “Fund”) is to generate income by primarily (i) investing in constituent equity securities in the NASDAQ-100 Index (the “Reference Index”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “”premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations. If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the exchange may suspend the trading of options in volatile markets which may cause the Fund unable to write Reference Index Call Options at times.

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- The position of futures or options contracts held by the Manager may not in aggregate exceed the relevant maximum under relevant rules. If the position held or controlled by the Manager reaches the limit or the Fund grow significantly, the Manager will evaluate its position and consider closing out certain positions, which could restrict new share creation and cause the trading price to deviate from NAV.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the CME and/or the Fund’s broker, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking the performance of securities in a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

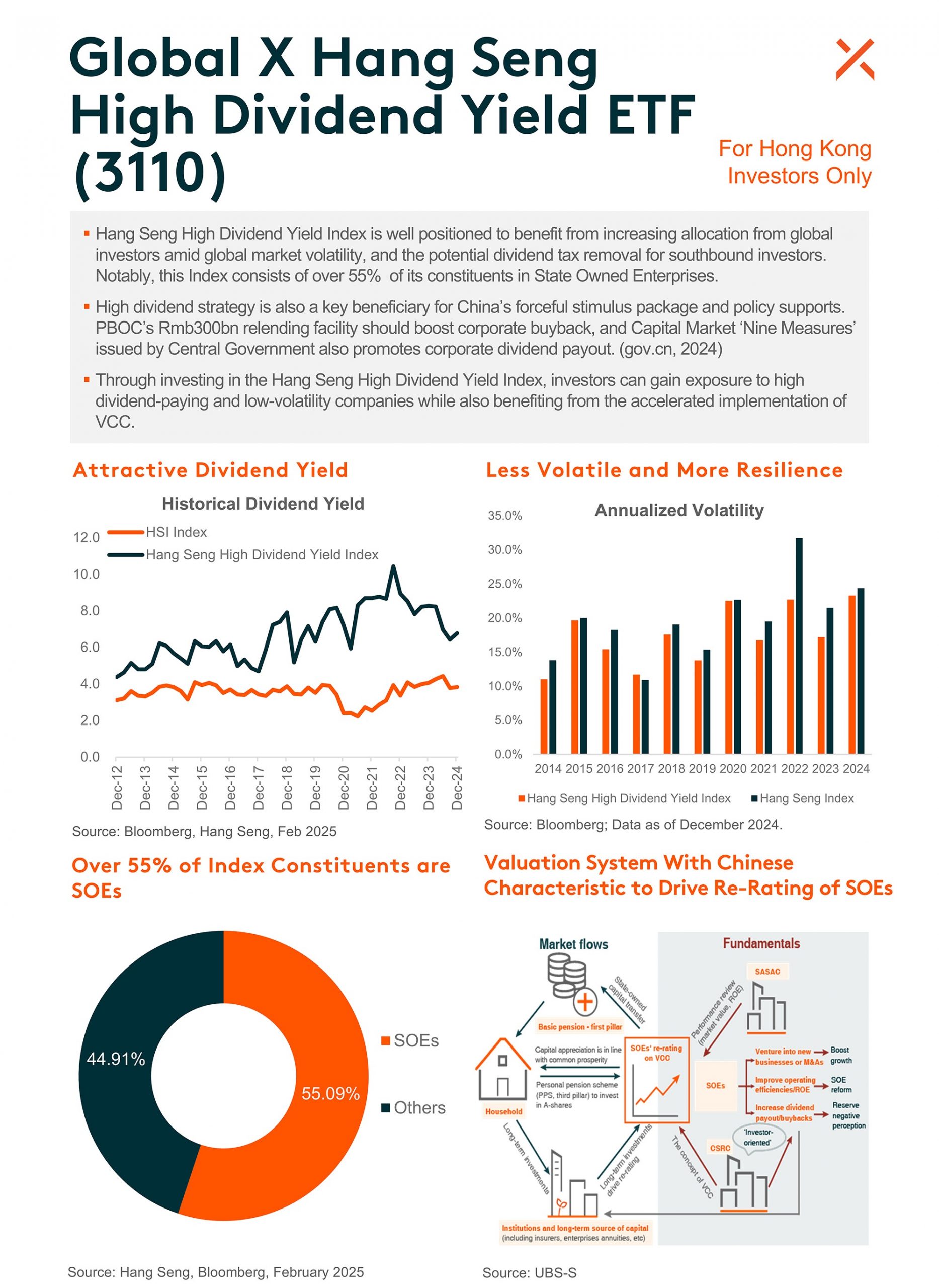

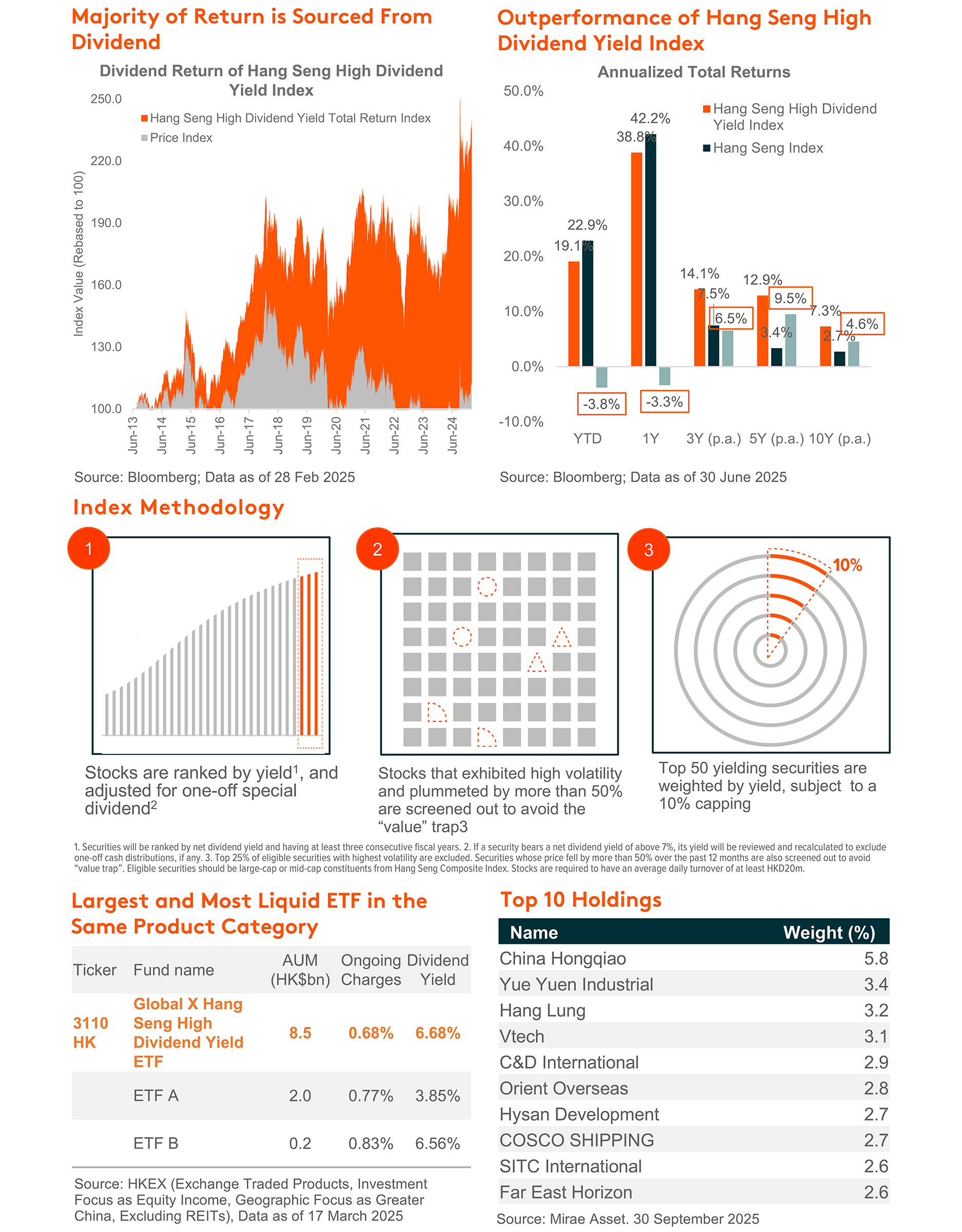

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X Select ETFs

October 2025

| Product Name | Investment Points | Top 10 Holding (%) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hang Seng TECH Covered Call Active ETF (3417) | Covered call strategy based on Hang Seng TECH Index may has the higher option premium yield due to higher volatility of the index. Hang Seng TECH Index is likely to remain volatile. The index is benefiting from the continued development and breakthrough by leading Chinese companies in technology sectors such as AI and Semiconductor, but is also impacted by intense competition in sectors such as food delivery service and EV. Covered call strategy is well-suited for positioning within this market. (Aims at Monthly Distribution. Dividend rate is not guaranteed, distributions may be made out of capital 1).

1. Positive distribution does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. |

|

||||||||||||||||||||

| China Core TECH ETF (3448) | As the global competitiveness of China’s tech companies continues to rise, they are expected to deliver good stock returns in the mid-long term. This ETF provides a hedging tool to investors with high exposure to US tech stocks. In addition, this ETF has limited exposure to internet stocks, this differentiates from other technology indices. Large cap internet companies are already well-owned by many investors. Through exclusion of these companies, the ETF serves a diversification tool for investors’ technology portfolio. The portfolio also has better revenue/EPS growth prospects with reasonable valuation. |

|

||||||||||||||||||||

| Global X China Semiconductor ETF (3191) |

China semiconductor self-sufficiency trend is accelerating and gaining traction. Recent developments have intensified market sentiment on this trend. It started with reports that Nvidia had asked its suppliers to halt H20-related production (Link), followed by DeepSeek’s new V3.1 model optimized for next-gen domestic AI chips, China’s ban on tech firms buying Nvidia’s AI chips, Huawei’s unveiling of an ambitious three-year AI chip roadmap, and SMIC’s testing of a Chinese-developed DUV lithography tool, underscoring the urgency and concerted effort to achieve technological self-reliance. We believe China’s journey toward semiconductor localization is a long-term structural trend. |

|

||||||||||||||||||||

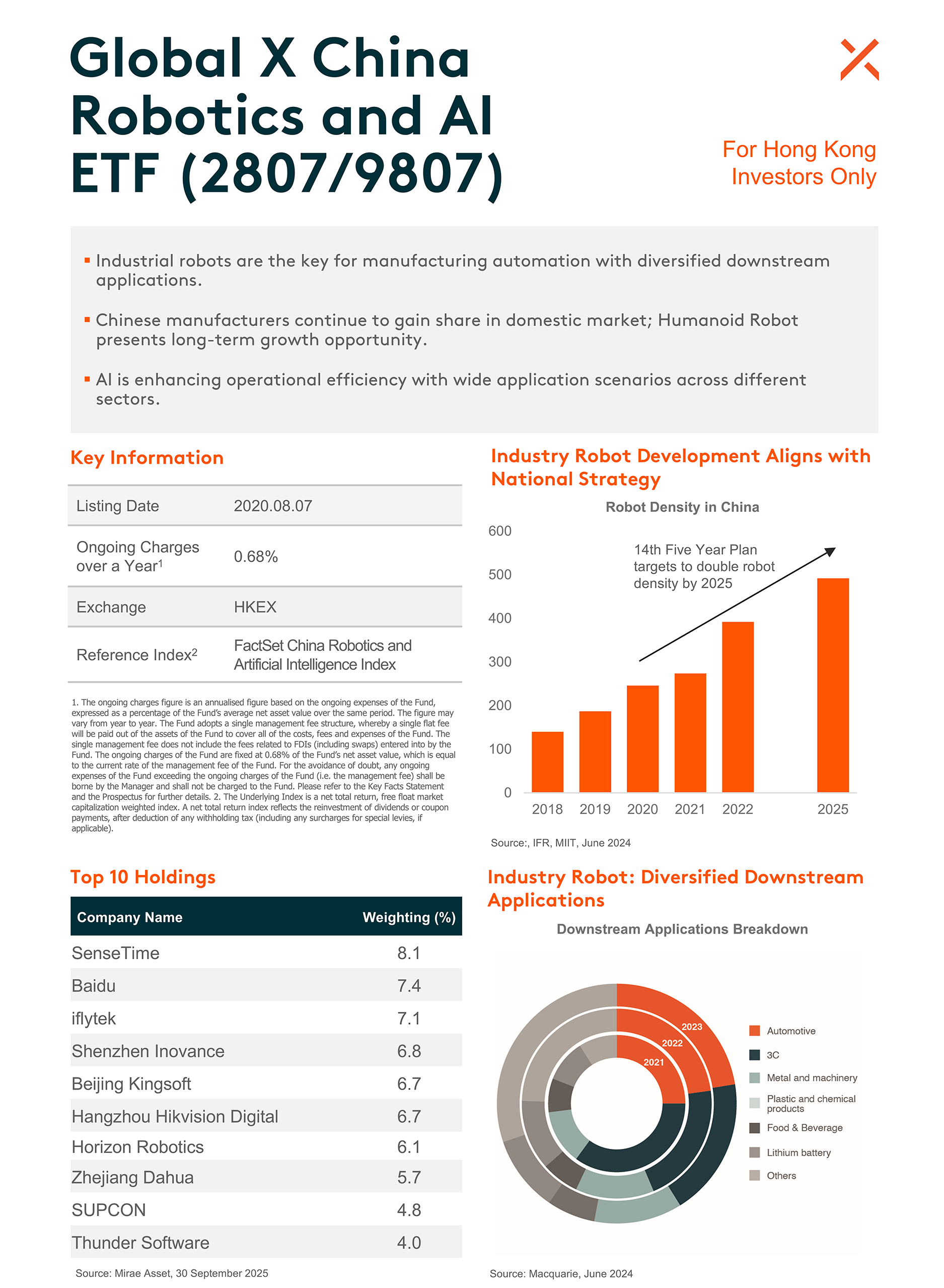

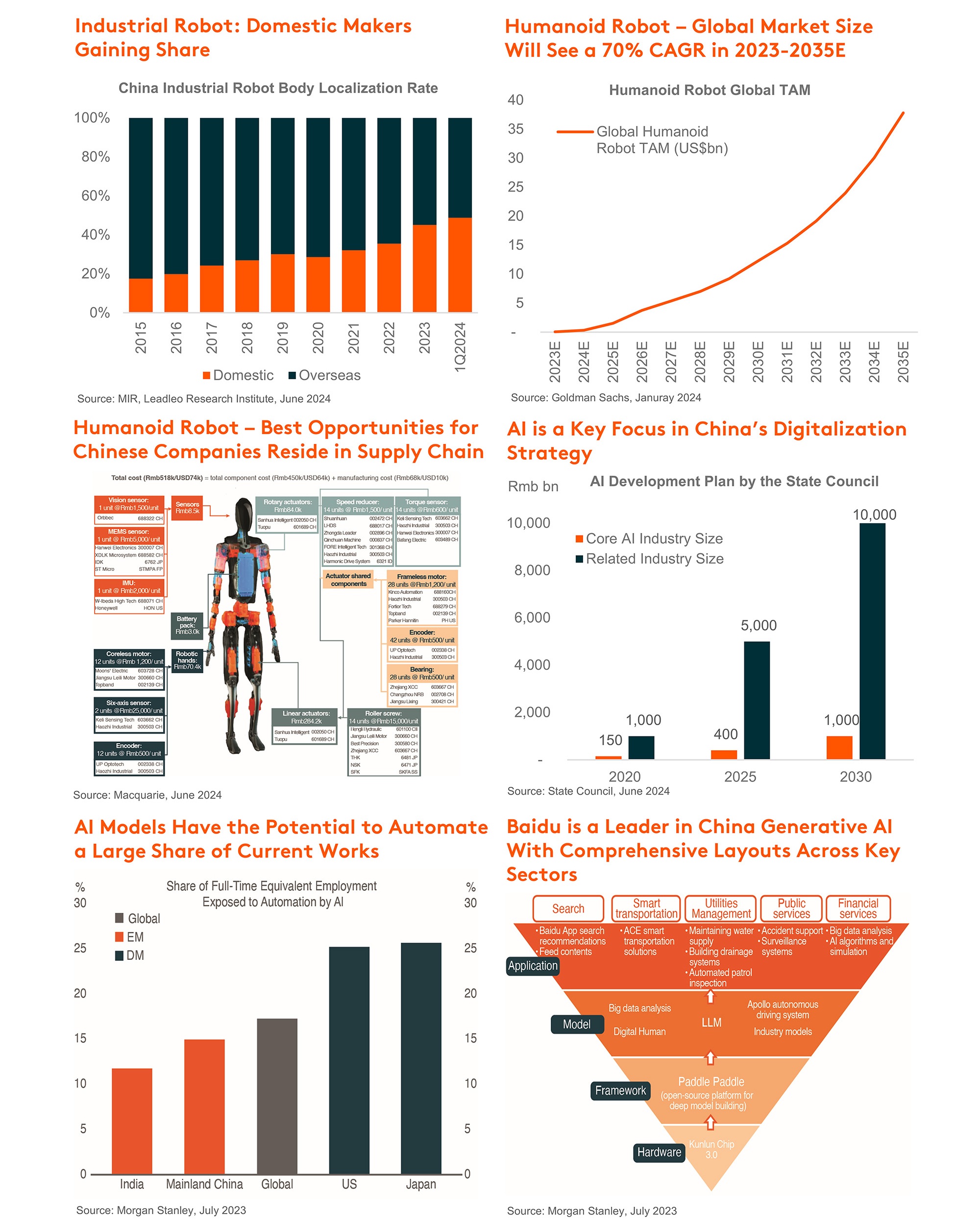

| China Robotic and AI ETF (2807) |

The ETF invests in leading Chinese Robotic and AI companies. In addition to the traditional Robotic & Automation sector, the ETF also provides exposure to Humanoid Robot and Autonomous Driving sectors – two of the most prominent Physical AI applications. Humanoid Robot is seeing accelerating adoption in China, with several leading humanoid makers securing US$millions worth of order in past few months. Leading Chinese Robotaxi operators are also expanding services across major cities in China as well as overseas markets. For traditional robotic sector, factory automation demand is bottoming out for some OEM segments including lithium battery, electronics, auto and industrial robotics. |

|

||||||||||||||||||||

| Global X Hang Seng High Dividend Yield ETF (3110) | Amid ongoing global trade uncertainty and the decreasing policy rates set by major central banks, the High Dividend Strategy continues to stand out for its combination of elevated dividend yields and reduced volatility. High dividend strategy is also a key beneficiary for China’s forceful stimulus package and policy supports. PBOC’s Relending facility should boost corporate buyback, and Capital Market ‘Nine Measures’ issued by Central Government also promotes corporate dividend payout. |

|

||||||||||||||||||||

| Global X Nasdaq 100 Covered Call Active ETF (3451) | 3451 implements covered call strategy on Nasdaq 100 index. The Nasdaq 100 index has high exposure to technology and growth-focused names. While we maintain a constructive long-term outlook on the growth of AI, we anticipate short term volatilities driven by macro data, geopolitics tension, and tariff policies. 3451 combines Nasdaq 100 exposure with an active covered call strategy, aiming to provide premium income potential, downside cushioning, and tax efficiency for Hong Kong investors. (Aims at Monthly Distribution. Dividend rate is not guaranteed, distributions may be made out of capital 1 ).

1. Positive distribution does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. |

|

||||||||||||||||||||

| China Cloud Computing ETF (2826) | The ETF invests in major Chinese internet cloud service providers, data center, and software companies, which are key beneficiaries of AI development in China. Top 3 holdings are Alibaba, Tencent, and Baidu, whose cloud revenue growth accelerated substantially over past quarters thanks to strong AI demand. There are also strong synergies for AI integration with their core business – namely online gaming, ecommerce, and advertising. Major data centers, such as GDS, are also benefiting from the increased AI Capex from tech giants. In addition, many of the software and gaming companies are already integrating AI in their products and R&D process, leading to enhanced user engagements, incremental monetization opportunities, and cost savings. |

|

||||||||||||||||||||

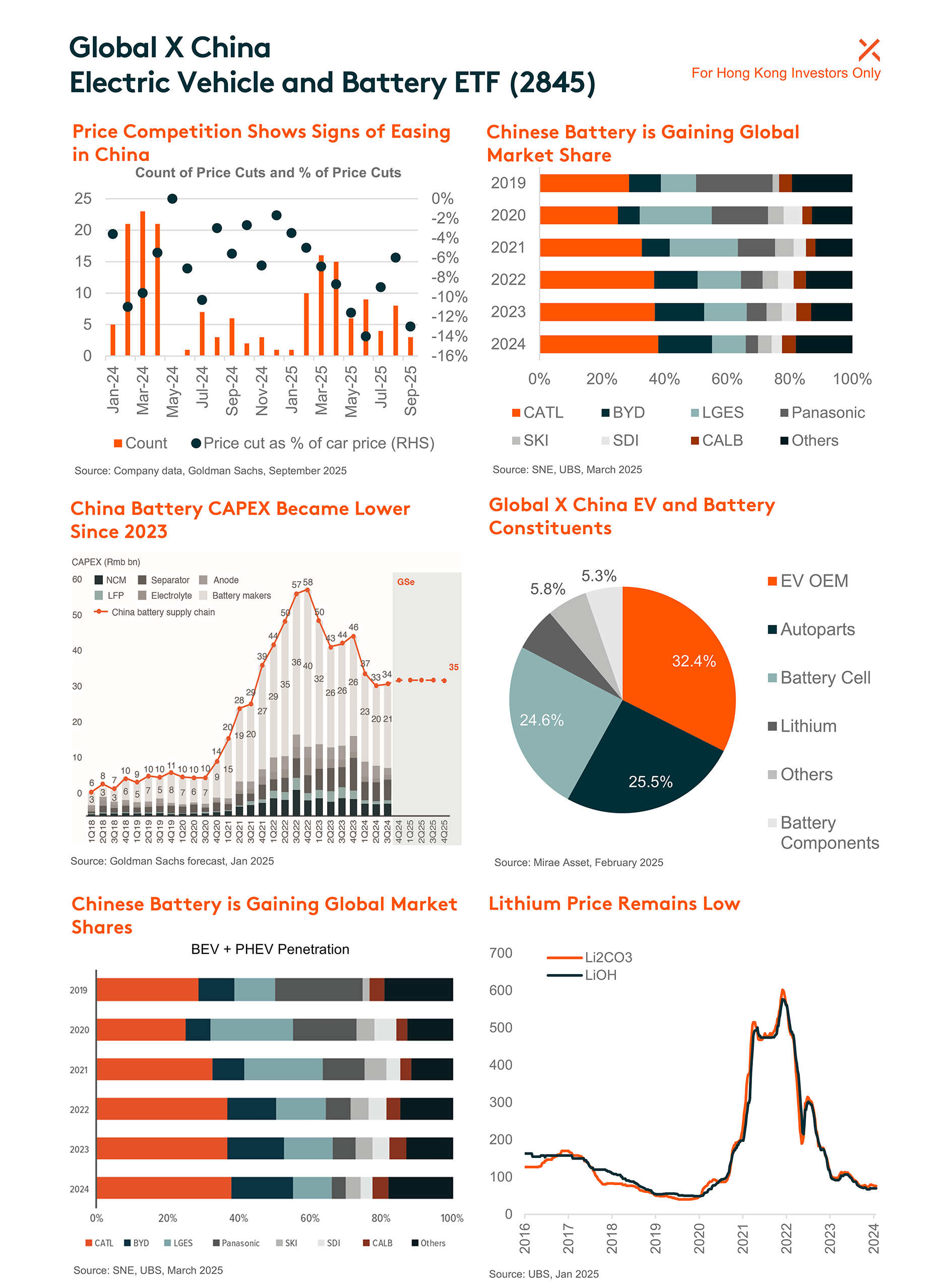

| China Electric Vehicle and Battery ETF (2845) | The ETF rallied substantially since August. Notably, the ETF’s constituents in Battery sector, namely CATL, EVE Energy, and Gotion High-tech recorded solid returns as the market is now seeing improving supply-demand dynamics in the battery sector, which bodes well for the industry competitive landscape and profitability of leading companies. Key drivers include strong ESS demand and outlook, supportive policies, and abundant A-Share liquidity. After the rally, CATL is one of the cheapest battery stocks globally, while its domestic and overseas business growth remains solid. To meet growing demand, CATL is ramping up its capacity in coming years, while smaller players should slow down capacity building due to lower utilization and profitability. CATL is well positioned to further solidify its leading industry position. |

|

Source: Mirae Asset, 30 September 2025.