Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Biotech ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Biotech Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Little Giant ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index.

- The Fund is exposed to concentration risk by tracking a single regions or countries.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Core TECH ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset China Tech Top 30 Index.

- The Fund is exposed to concentration risk by tracking a single region or country. It is potentially more volatile than a broad-based fund due to adverse conditions in the region.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit (the “Unit”) on the SEHK is driven by secondary market trading factors. The Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Clean Energy ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Clean Energy Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X China ETFs 2025 Performance Review

A Year of Remarkable Returns

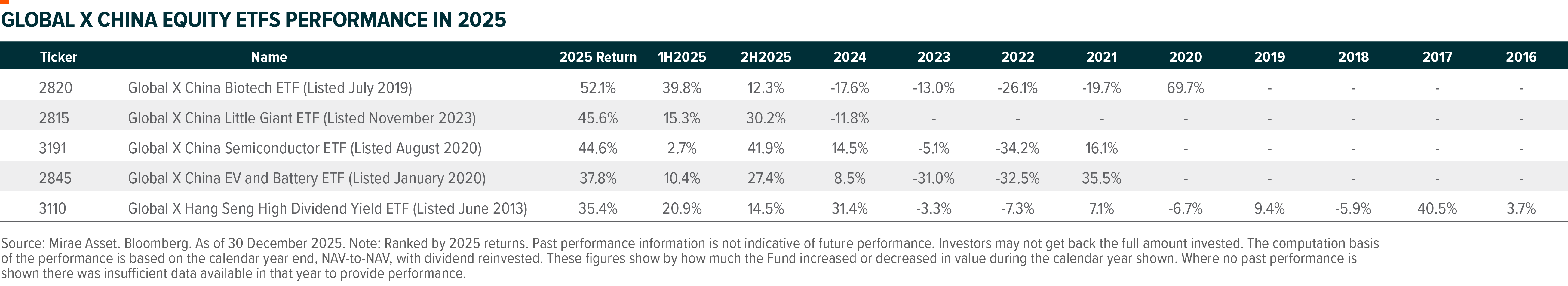

Hang Seng Index surged 32% in 2025, marking its best performance in five years, with Hong Kong standing out as one of the top-performing markets worldwide. We cited various drivers for the performance, including the strong tractions around China’s high tech sectors, the low starting valuation and investor positioning, continued policy supports, increase in China’s bargaining power against the US, and abundant liquidity in both onshore and offshore China market. These factors also support our positive HK/China market views into 2026, as outlined in our Outlook Report. Riding on the China market rally, Global X China thematic ETFs also deliver remarkable returns, particularly notable among technology and high-end manufacturing-focused ETFs that have outpaced the broader Hong Kong/China market indices. On the other hand, Hang Seng TECH Index underperformed Hang Seng Index after its substantial correction in 4Q, with key drags coming from major local services & ecommerce platforms that are suffering from intensified competition in the quick commerce sector. Around 55% of weightings for Hang Seng TECH Index are internet related companies, and it has limited exposure to other technology themes such as biotech and battery. (Hang Seng Index, Mirae Asset, 2025)

With this note, we discuss the key trends that we observe from analysing Global X China ETFs performance in 2025. In the second part, we also review and dissect the key drivers for the top performing ETFs.

Key Trends and Observations

- ‘Core Tech’ Sectors Gaining Traction

As we highlighted throughout the year, China’s ‘core tech’ sectors – such as Semiconductor, Biotech, and Battery that are at fast growing stages – are gaining strong momentum and outperform the broad-based China market. The strong performance is bolstered by: 1) China’s manufacturing strength, that is supported by China’s vast talent pool and sophisticated supply chain; 2) Supportive policy. China’s 15th FYP again highlights self-reliance in high-tech sectors as a key national strategy; 3) Overseas expansion. Chinese companies are not only capturing domestic market but also gaining overseas market share, we are seeing this in EV, Battery, Solar, and increasingly in Biotech. We see these as structural drivers that will support multi-year performance. See more in our previous report.

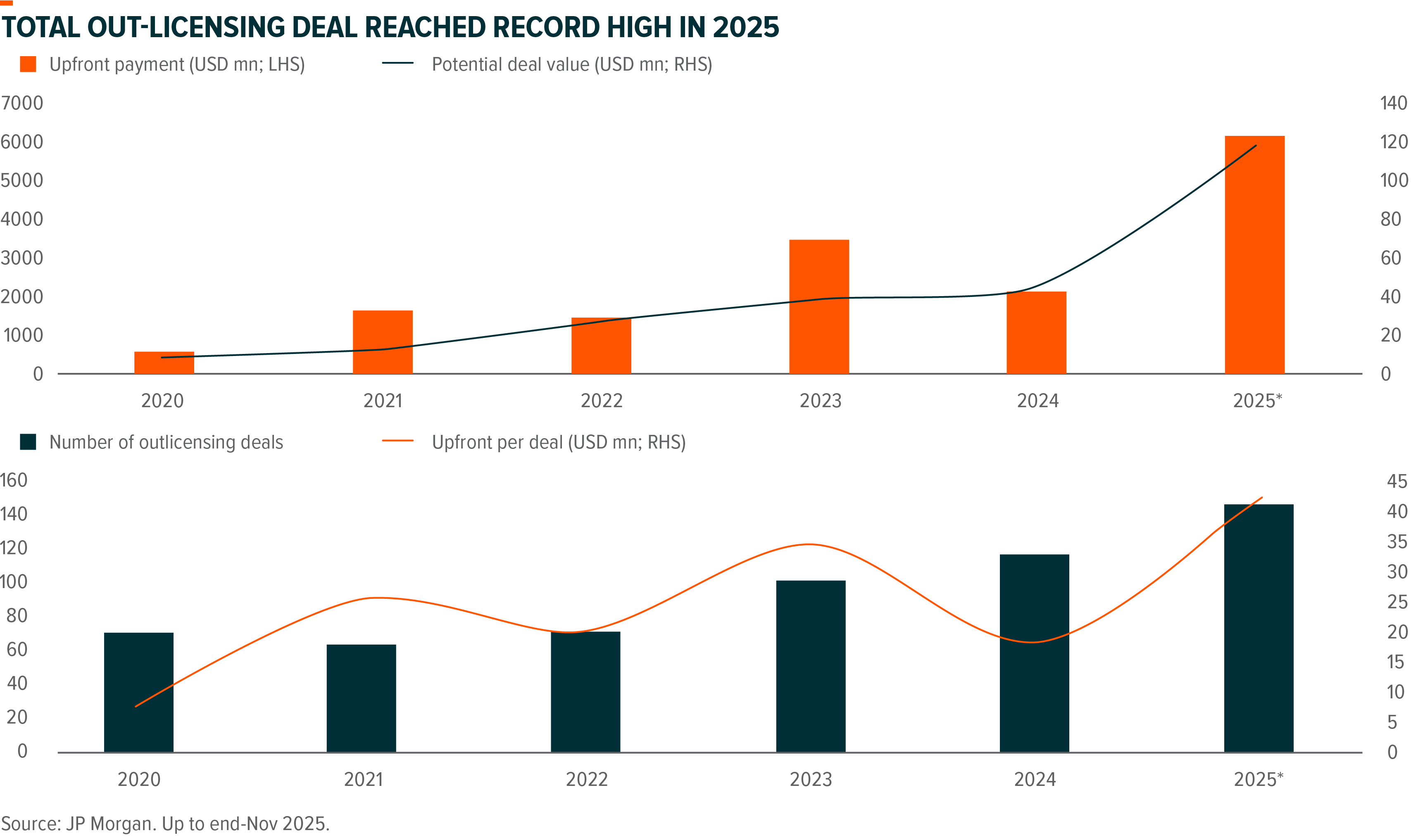

Among Global X top-performing ETFs, we see Global X China Biotech ETF (2820), Global X China Little Giant ETF (2815), Global X China Semiconductor ETF (3191) and Global X China Electric Vehicle and Battery ETF (2845) fit into this theme: 1) China’s Biotech sector is the best performer in 2025, driven by the booming out-licensing deal on the back of the growing innovative capability of Chinese biotech companies. 2) China semiconductor sector is riding on two structural growth drivers: AI developments and localisation. 3) China EV players are suffering from heightened competition in domestic market, but their rapid expansion into overseas market opens up their revenue and profitability potential. Leading Chinese battery players also command major market share in global market, and they are benefiting from the strong ESS demand globally. 4) ‘Little Giant’ companies refer to niche high tech market leaders that are endorsed by Chinese government. Thousands of ‘Little Giant’ companies make up China’s sophisticated manufacturing supply chain and are benefiting from China’s economy transition.

In addition, Global X China Core TECH ETF (3448) (listed in July 2025) also recorded strong return since launch. The ETF covers diversified core tech sectors and offers easy access for investors to capitalize on China’s technology growth.

We will discuss more for each of these ETFs in the second part of this note.

- High Dividend Strategy: Sustained Long-term Outperformer

Even in a bull market in 2025, Global X Hang Seng High Dividend Yield ETF (3110) gained a solid 35%. This brings annualised total return for Hang Seng High Dividend Yield Index to 10% for the past 10 years, outperforming Hang Seng Index by 5% (annualised) throughout different market cycles. We note that the investment case of High Dividend strategy in Hong Kong market is characterised by its low valuation – even after the rally, Hang Seng Index trades at 11.3x 12m Fwd PE, HSHDYI trades at 8.7x. Annualised dividend yield for HSHDYI is 6.4%, appearing more attractive in a global rate cutting environment. (Mirae Asset, 2025)

- ‘Anti-Involution’ Beneficiaries

Following years of excessive capital expenditures and irrational expansion, sectors such as solar, battery, and lithium find themselves entangled in overcapacity, resulting in compressed profitability levels, even among the industry leaders. Regulators are putting more effort to address the hyper-competition issue, with notable policy momentum acceleration in the second half of 2025. Starting from the CFEAC meeting on July 1, significant industrial regulatory bodies such as MIIT, NDRC, and SAMR have begun issuing top-level proposals. The July Politburo meeting reaffirmed the campaign’s priority. Albeit still at an early stage, anti-involution campaign would prompt regulation of low-price competition and promote outdated capacity exit. Global X China Clean Energy ETF (2809) is a clear beneficiary of China’s ‘Anti-involution’ push, returning 35% in 2H25 following a 4% loss in 1H25.(Mirae Asset, 2025) Battery and lithium companies are also benefiting from the improving industrial landscape, driving the gain for Global X China Electric Vehicle and Battery ETF (2845).

Top Performing Global X China Equity ETFs

Global X China Biotech ETF (2820)

After years of soft performance, China biotech becomes one of the best performing sectors in 2025, with Global X China Biotech ETF (2820) recording 52% return in 2025. The strong performance is driven by 1) the strong momentum in out-licensing innovative drug, supported by the growing innovation capability of Chinese biotech companies; 2) recovering global investor interests in Chinese market and technology sector; 3) stable domestic healthcare policy with ongoing support for innovation; and 4) low starting investor positioning and sector valuation. (Mirae Asset, 2025)

There has been correction in the sector since its peak in early Oct, which is potentially driven by investor profit taking, concerns over price cut levels in the recent NRDL price negotiations, and relatively muted out-licensing deal flow and company catalysts. Despite near term volatility, outlook for China biotech sector should remain positive into 2026. Chinese companies have demonstrated improving innovative capabilities supported by China’s vast talent pool and regulatory supports, and the ramp-up of commercialization should also bring better profitability for Chinese biotech companies. Geopolitics concerns for China healthcare may be easing, lifting overhang over Chinese CXOs.

Global X China Little Giant ETF (2815)

Global X China Little Giant ETF (2815) recorded 46% return in 2025, driven by positive tailwinds including favourable sector beta (technology focused) and sufficient onshore liquidity (esp. beneficiary for small-mid cap). Overall China A-Share sentiment and performance is also supported by favourable policy (anti-involution), more stable geopolitical environment (with China successfully leveraging rare earth as bargaining chip against the US), and the gradual reallocation of household assets into equity market. (Mirae Asset, 2025)

“Little Giant” are picked by governments, featuring high-quality small-mid cap companies in China’s strategic important technology industries. They are industry leaders in niche markets and play a crucial role in the supply chain for China’s high-end manufacturing sector. Specialized and sophisticated SMEs「專精特新小巨人」is a key tool for China to achieve China‘s economic transition towards high-quality growth. Based on “Little Giant” lists provided by the government, Global X China Little Giant ETF (2815) invests in 50 listed “Little Giant” companies ranked by average ROE and weighted by total market cap. (Mirae Asset, 2025)

Global X China Little Giant ETF has large exposure to technology sectors such as semiconductor , Tech Hardware and Biotech that have high potential with structural growth driver: Domestic substitution for semiconductor and high-end manufacturing sector; Improving innovative capability and ongoing out-licensing for biotech sector. The ETF is well positioned to capitalize on the structural growth opportunity for these niche technology sector leaders.

With ROE being a key selection criteria, Solactive China Little Giant Index has higher ROE and operating margin as compared to other broad-based and small cap China indices. The small cap and technology-oriented features also support higher realized and expected growth rates for Solactive China Little Giant Index . Valuation is undemanding considering the higher growth expectation. (Mirae Asset, 2025)

Global X China Semiconductor ETF (3191)

Global X China Semiconductor ETF (3191) gained 45% in 2025 (Mirae Asset, 2025), mainly driven by intensifying domestic substitution narrative and robust AI demand. We believe China’s journey toward semiconductor localization is a long-term structural trend.

Global AI demand remains strong into 2026, driven by the scaling up of token growth for complex inference. This should drive the structural AI spending up cycle, a part of which will flow into semiconductor value chain. It is also the same case for China, where we already see continued hypergrowth in AI inference demand/tokens, driven by both To-C & To-B demand. For example, daily token usage of Doubao Large Model exceeding 50trn in Dec 2025 (vs. 30trn in Oct), and China data centers are expecting 2026 to kick off a demand upcycle. (Company data, 2025)

Localisation is another structural driver. While China brands accounts for 29% of global semis demand, local firms only account for 5-7% of global semis capacity supply (Goldman Sachs, 2025). This disparity highlights a relatively low localization rate in China, particularly for specific semiconductor devices. With the ongoing tension between the US and China with respect to semiconductors, the trend to create a self-sufficient, localized, semi ecosystem will be ongoing, which should be beneficial for domestic players. Companies across the supply chain, from foundries, equipment to fabless, continue to build domestic solutions to service the large local semiconductor demand. China’s local GPU self-sufficiency ratio could rise from 39% now to 50% in 2027. (MS estimates, 2025)

There has been evolving dynamics of domestic & foreign chip supply, on potential NVIDIA H200 supply and further ramp-up of domestic chip supply for Chinese hyperscalers in 2026. The US government will allow NVIDIA to sell H200 chips to China and the government will collect a 25% fee the sales. As per Reuters, Alibaba and ByteDance have expressed interest in purchasing H200 chips from NVIDIA , and Chinese regulators are also gathering feedback from domestic hyperscalers to assess demand for the H200. On the other hands, local chips can still address inference computing for Chinese hyperscalers, thus will continue to ride on this domestic AI demand boom. (Reuters, 2025)

Two local GPU companies – Moore and MetaX – are recently listed in China’s STAR broad, gaining 400%+ and 600%+ return on their first day of listing. Another major GPU company Biren will be listed in January in Hong Kong market, further bolstering sector sentiments. (Company data, 2025) Policy support remains strong. China government is deeply committed to technological self-sufficiency. Self-sufficiency of high-tech sectors including AI and Semiconductor remains a top strategic goal for China as mentioned in its 15th FYP. (Mirae Asseet, 2025)

Global X China Electric Vehicle and Battery ETF (2845)

Global X China Electric Vehicle and Battery ETF (2845) gained 38% in 2025. Notably, the ETF’s constituents in Battery sector, namely CATL, EVE Energy, and Gotion High-tech recorded solid returns as the market is now seeing improving supply-demand dynamics in the battery sector, which bodes well for the industry competitive landscape and profitability of leading companies. As outlined in our 2026 Outlook Report, we are optimistic on battery sector over improving supply-demand dynamics, on the back of a strong global ESS demand and more rationalised capability expansion. (Mirae Asset, 2025)

EV updates: EV stocks recorded relative underperformance in past months due to the weaker domestic auto sales volume data. Positive news is that on 30 December, NDRC announced that China will extend the cash-for clunker stimulus in 2026 at Rmb20k for NEVs and Rmb15k for ICEV. And local governments will offer trade-in subsidies up to Rmb15k for NEVs and Rmb13k for ICEVs. What’s new compared to 2025 subsidy is that latest subsidies include price coefficients that would cap national subsidy per car at 12% for NEV and 10% for ICEV of the car’s price and local subsidies at 8% for NEV and 6% for ICEV. The new subsidy plan is largely in line with previous market expectation, and could reduce concern over subsidy program uncertainty. However, domestic sales volume growth could still be under pressure in 2026 due to the 5% purchase tax hike and high base in 2025. Nevertheless, we see robust overseas sales volume growth for domestic leaders like BYD, which could be an increasingly important revenue and profit drivers. Furthermore, Non-auto initiatives, such as humanoids, could continue to gain traction for EV OEMs and autopart companies.

Global X Hang Seng High Dividend Yield ETF (3110)

Global X Hang Seng High Dividend Yield ETF (3110) gained 35% in 2025, marking another year of out-performance against the Hang Seng Index, with majority of outperformance coming from 4Q. Following a tech-driven rally in the first three quarter this year, the Hong Kong/China market entered into a consolidation phase in 4Q amidst a confluence of factors, such as the re-escalation of US-China trade tensions, investor profit-taking, central government meeting, and the onset of the 3Q25 reporting season. More investors are rotating from growth/tech to value/dividend amid market volatility. Although US-China trade talk at end-October yielded positive results that lowered trade policy uncertainty, the prolonged shutdown of US government is draining market liquidity and leads to sell down of global risk assets at the start of November. Defensive strategies such as high-dividend stocks offer a more robust position for investors to navigate the market volatility. Furthermore, in a global rate-cutting cycle, the current 6.4% dividend yield for HSHDYI appears more attractive given the widening yield spread vs bond yield. (Mirae Asset, 2025)

Alongside the shifting investor preferences recently, we identify compelling investment cases for the high-dividend strategy within the Hong Kong/China market over the long term. Fundamentally, Chinese listed companies have the ability to enhance shareholder returns, bolstered by high cash positions, robust free cash flow, and a presently low payout ratio.

High dividend theme is further bolstered by policy support delineated in the Nine Measures of April 2024 and the PBOC’s initiative in September 2024 to encourage corporate buybacks. In terms of fund flow dynamics, the high yield and low volatility characteristics of the high dividend strategy align well with insurers’ investment requirements. This strategy is poised to draw increased interest from insurers over the long term, particularly given the persistently low deposit rates and bond yields in China. Likewise, this dynamic applies to China’s household savings pools, which may increasingly channel into the equity market as individuals pursue higher returns amid a low-interest-rate environment.