China EV Market: Improving sales & long-term outlook

Listen

CHINA EV SALES CONTINUES RISING TREND

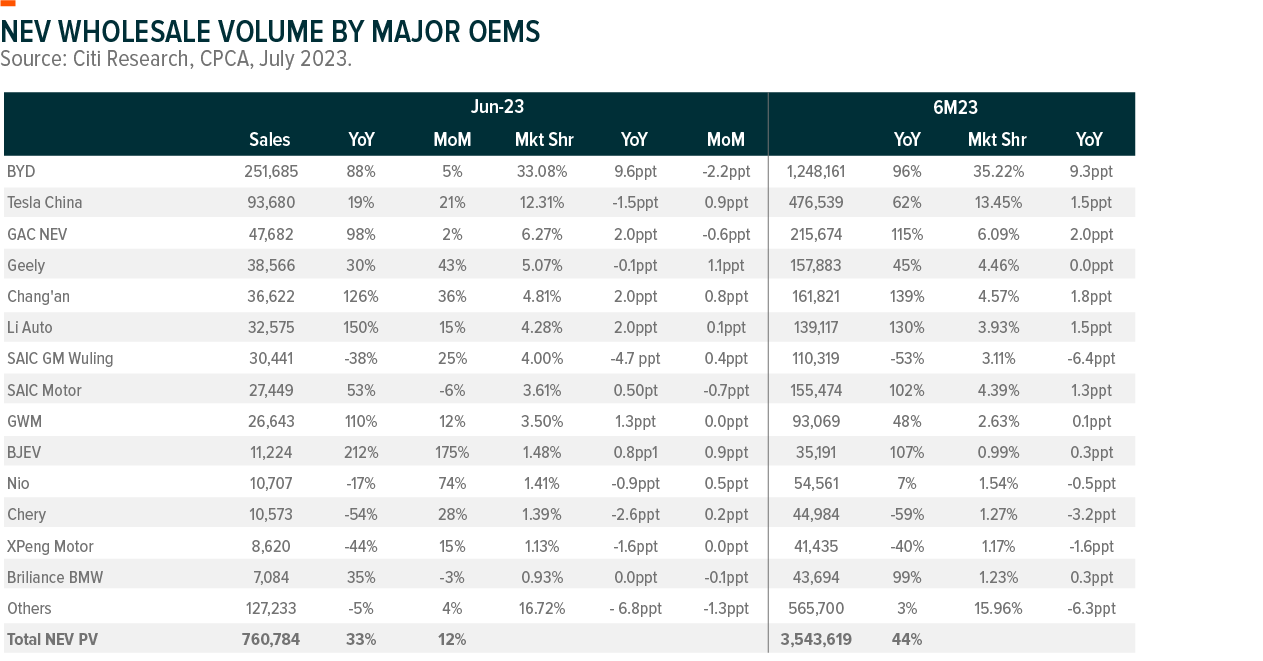

China passenger vehicle wholesales ended at 11.1 million units as of 1H23, +8.7% year-on-year (yoy), in which electric vehicles (EVs) accounted for 3.54 million units, +44 % yoy. EV penetration is 32%. Battery electric vehicle (BEV) wholesales increased by 30%yoy to 2.52 million units, while plug-in hybrid electric vehicles (PHEVs) almost doubled to 1.02mn units. Chinese local brands’ market share has been continuously increasing from 35.8% in 2020 to 49.5% as of June 30, 2023, mainly driven by competitive new EV models and supportive EV policies. 1BYD is the leader outperforming the sector, recording wholesale volume of 251.7k units of sales, +88%yoy, and continuously gaining market share to 35% as of 1H23, despite weak auto sales at the beginning of 2023. Other leading brands, such as GAC, Geely, Chang’an, Li Auto and Great Wall, also witnessed significant EV sales and growth at the same time. Additionally, JV brands, for example, Brilliance BWM and SAIC Motor-VW, are also accelerating their electrified transition in China with price-competitive new models.

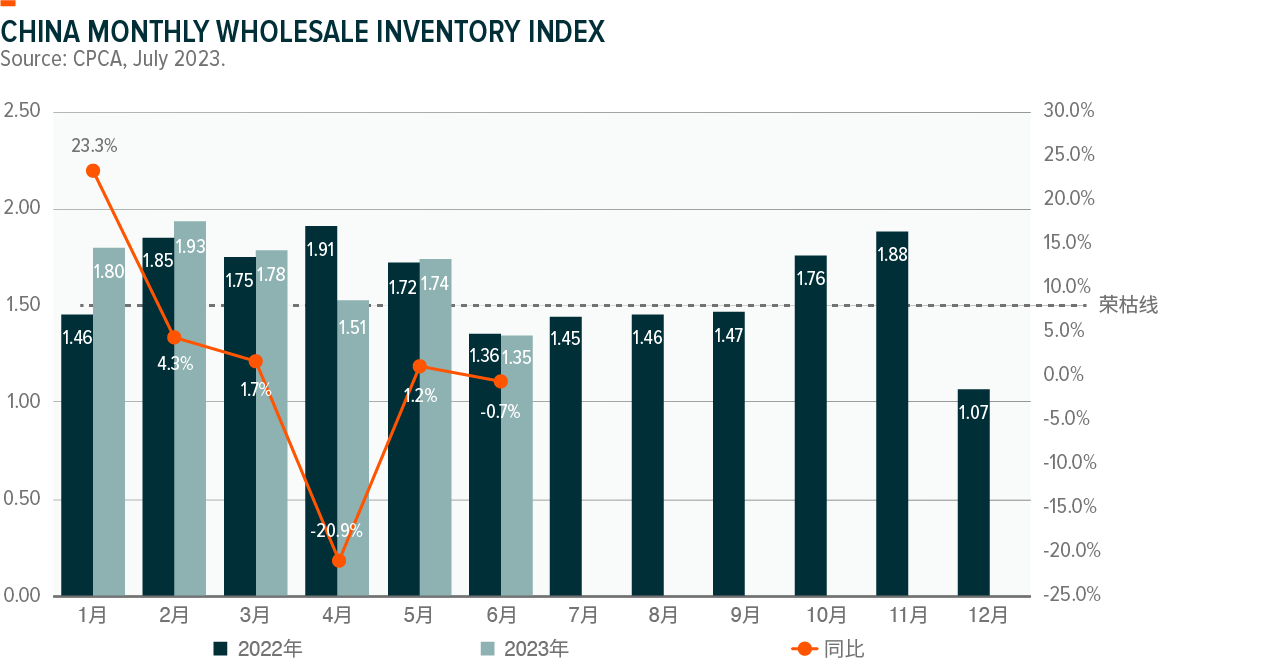

Inventory has been the key issue at the beginning of this year, which resulted in disordered incentive spending and weak sentiment on sales in March. Successive stimulus policies, such as local subsidies on auto sales, or subsidies on EV replacement in rural areas help boost auto demand, coupled with auto shows and promotions from automakers and wholesalers. Destocking has turned out to be very successful as inventory decreased to a relatively healthy level in June, both on a year-over-year and month-to-month basis. July is normally a low season thanks to hot weather and deteriorating promotions after mid-year. On the bright side, sales deceleration carrying forward might be cushioned by a new wave of automakers’ official price cuts in July. These price cuts indicate to us that some automakers are strategically prioritizing EV sales volume over profits in the short run.

- On 6 July, SAIC-VW announced it will reduce the tagged price range of ID.3 pure electric sedan by RMB 37,000 for the low-end version (from RMB 163,000 to RMB 126,000) and by RMB 43,000 for the high-end version (from Rmb193k to Rmb150k).

- On July 10th, SAIC-GM Cadillac Lyriq SUV announced it would reduce its tagged price by Rmb60k with price range down from Rmb440-480k to Rmb380-420k.

- On 13 July, Geely Auto reduced the ‘Emgrand L HiP’ price range by Rmb20k to Rmb106-119k.

- On 20 July, Dongfeng Nissan officially reduced Ariya’s electric SUV price range by Rmb60k to Rmb200k-283k.

- On 20 July 20, NETA Auto announced it will reduce the tagged price range of its large-size sedan ‘NETA S’ by Rmb30-53k (from Rmb190-Rmb342k to 160-Rmb270k).

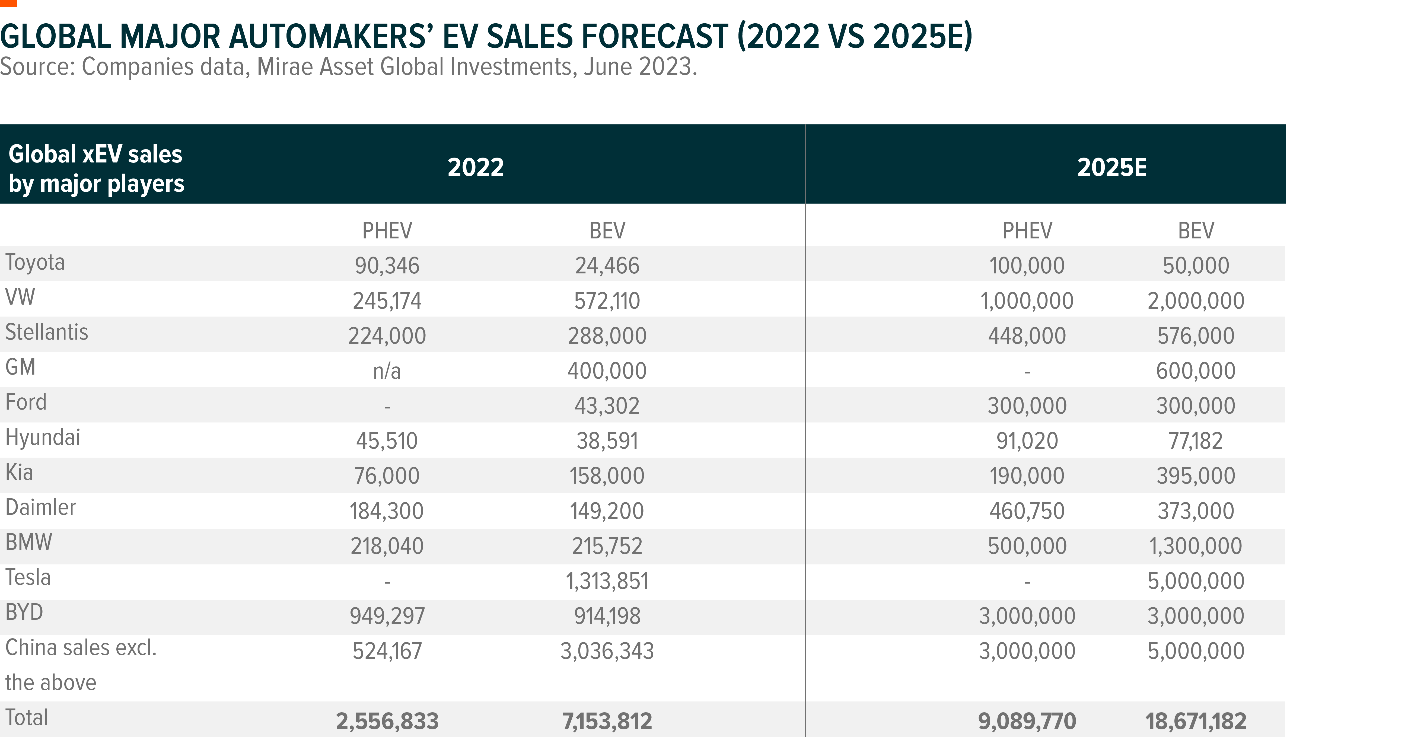

OUTLOOK REMAINS POSITIVE DRIVEN BY EV TRANSITION Looking ahead, particularly from a long-term perspective, we remain very positive on global electrified transition and EV penetration in major markets like China, Europe, the US, and some ASEAN countries as electric vehicles become more and more cost competitive. There is no doubt on China’s ambition to make the EV and EV supply chain one of the key drivers of next-stage economic growth. Widely spotting on other countries, we have also observed the trend of EV sales speeding up, citing the sales number by non-Chinese leading automakers (Exhibit 3). For BMW, Daimler, and Kia, BEV and PHEV sales have accounted for double digits of their total auto sales in 2022, while this number is close to 10% for VW and Stellantis. BMW is moving ahead of other traditional OEMs. Company-guided BEV sales would contribute to 50% of their total sales by 2025. American brands, GM and Ford, are also fast catching up in new models design and battery procurement as shown in public news. 2Even the lagging part, Japanese brands like Toyota and Honda, have announced their plans for battery production or new models timeline, for example, Honda set up a JV with LGES and will collaborate with CATL on battery production in China. 3The electric vehicle market would still be one of the most promising sectors in the foreseeable future.