FAQ on the latest rally of China EV battery ETF

Q: The Solactive China Electric Vehicle and Battery Index recently rallied about 25% from its February lows. What are the reasons behind the rebound?

1) Evidence is growing that China’s battery inventory cycle is bottoming out

One of the key reasons the China EV Battery ETF has corrected over the past years is the concern about battery oversupply and falling margins.

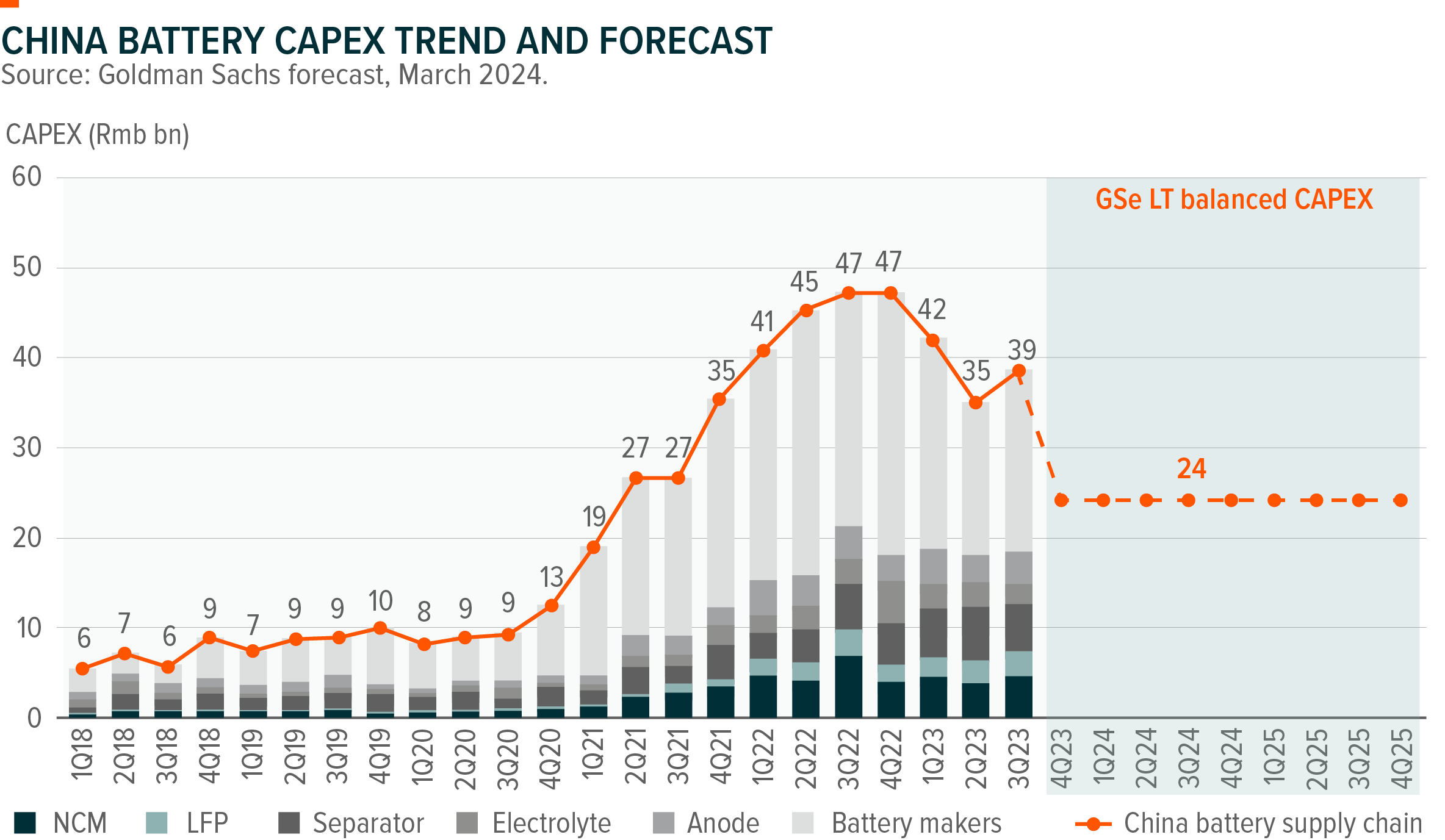

Let’s recap what happened in the past few years. The EV demand surged in 2021-2022, but the EV battery supply could not keep up. In response, Chinese battery supply companies invested heavily in building battery manufacturing capacities. However, by 2023, there was a significant oversupply built, resulting in a vicious inventory cycle (shrinking inventory → falling intermediate prices → loss of inventory assets) in 2023.

In 2024, however, there are signs of a normalization of the battery supply and inventory cycle. Based on research firms’ analysis of battery inventories and our communication with battery companies, there is a growing consensus that the inventory cycle has now bottomed out as Chinese battery companies have significantly reduced capex and shrunk inventories over the past year.

Here are a few important evidences:

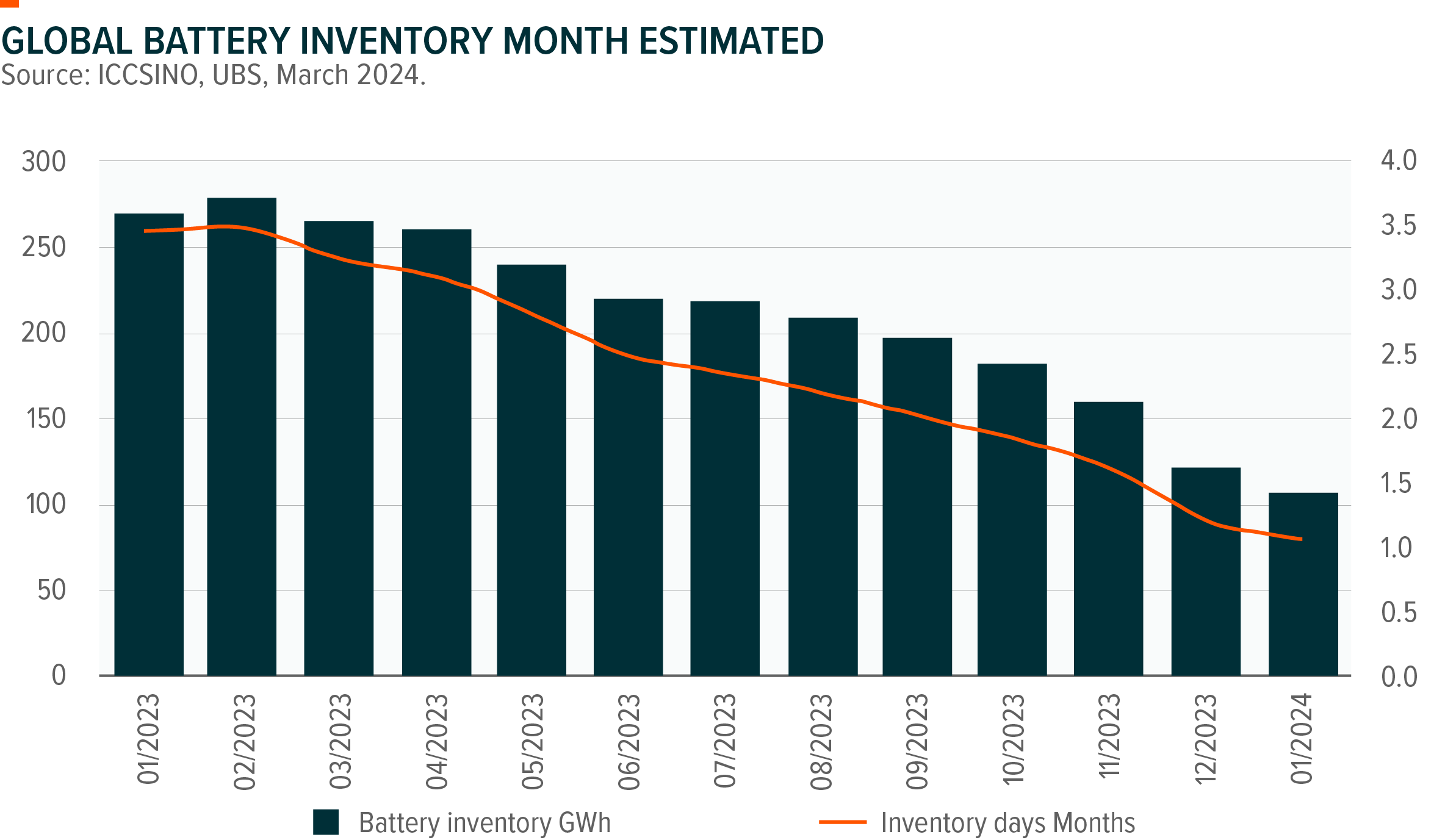

First, according to the battery research institute ICCSINO, global battery inventory months have dropped significantly from 3.5 months in January 2023 to about one month in January 2024.

Second, on March 15, CATL released its 2023 earnings, which showed that capex for 2023 was down a whopping 30% YoY from 2022. Thanks to reduced capex, CATL’s free cash flow increased by 300% YoY in 2023, which led to a significant dividend payout (from 25% of 2022’s profit to 50% of 2023’s).

2) Valuation attractiveness

Over the past two years, valuations of China’s EV battery ETFs have declined significantly due to oversupply concerns and the US IRA issue.

Comparing between Korean and Chinese supply chains, Korean battery stocks trade at an average of about 38x 2023 earnings, and Chinese stocks trade at 16x 2023 earnings (Source: Bloomberg, March 2024).

If we assume that the China battery inventory cycle gets normalized (i.e., margins normalized), the current valuation level is quite attractive.

Q: Will inventory normalization not be sufficient to support the normalization of industry behavior?

When we talk about the normalization of supply and demand, it doesn’t necessarily mean that companies should go bankrupt or exit the industry. The key observation point should be whether the major players rationalize their business activities based on margin profile or ROE. In our view, as of 2024, the business strategies of Chinese battery companies have shifted to a more rational stance.

Recap: Chinese companies invested aggressively in 2021-2022, driven by over-optimism and government support, but as products went through a downward cycle in 2023, many companies changed their strategy. As we mentioned earlier, CATL’s revenue grew 22% YoY in 2023, but capex decreased by 30% YoY (Source: CATL, March 2024).

Also, from a policy perspective, there was an inflection point during 2023. In March 2023, President Xi Jinping was reported to say that he was concerned about overinvestment in battery capacity. Over the past year, battery companies have hardly raised new money from the capital market. Don’t be confused about the government’s direction: The Chinese government is very supportive of new innovative technology development but wary of capacity overcapacity at the same time.

Q: What are recent trends in the Chinese battery industry?

First, as mentioned earlier, the consensus is building that the industry cycle is bottoming out. We are seeing a slight rebound in intermediate prices from the February bottom. Recently, major sell-side research firms such as MS, JPM, and Global Sachs have upgraded their ratings on Chinese battery stocks.

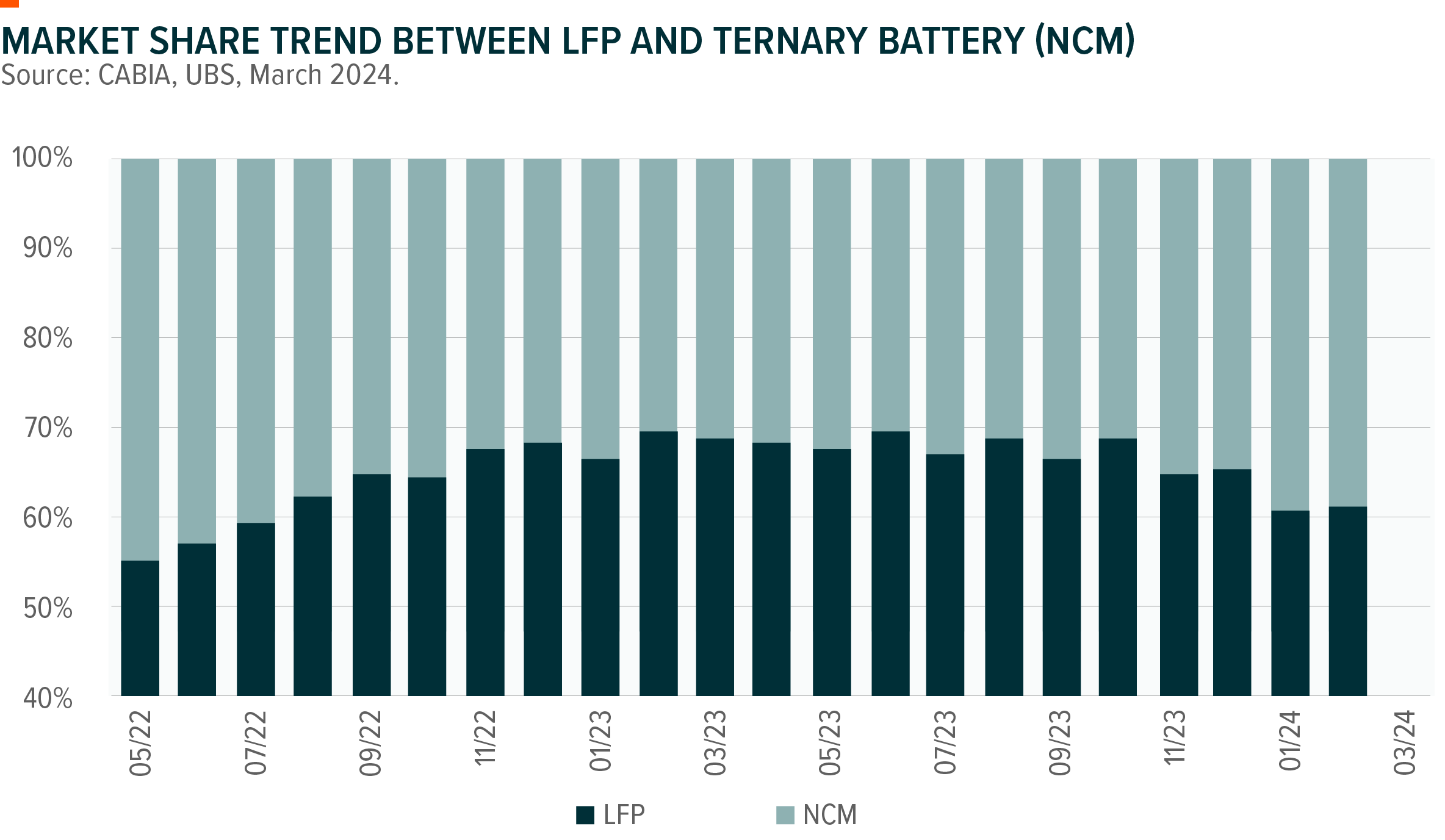

Second, one of the lingering concerns has been the higher share of LFP (lithium iron phosphate) batteries. The LFP battery is not a high-value-added product from battery makers’ perspectives, and thus, its growing market share has meant a lower margin for the whole supply chain. However, with the recent popularity of new models from Huawei, Li Auto, etc., which use a ternary battery (so-called NCM battery, which has a higher margin), there is room for the battery supply chain to improve its margin profile.

Third, Chinese EV brands are quickly expanding overseas, thanks to their strong cost competitiveness (for instance, the selling prices of BYD’s Atto 3 in Europe nearly double those in China). In particular, there are high expectations for Chinese makers to penetrate middle-income countries such as Southeast Asia, the Middle East, and South America. On the European side, there is a rising chance of imposing heavy tariffs on China-imported EVs, but BYD and major Chinese companies are expected to overcome the issue by building local assembly facilities in Europe.