China Consumer Industry: Annual Review and Outlook

Listen

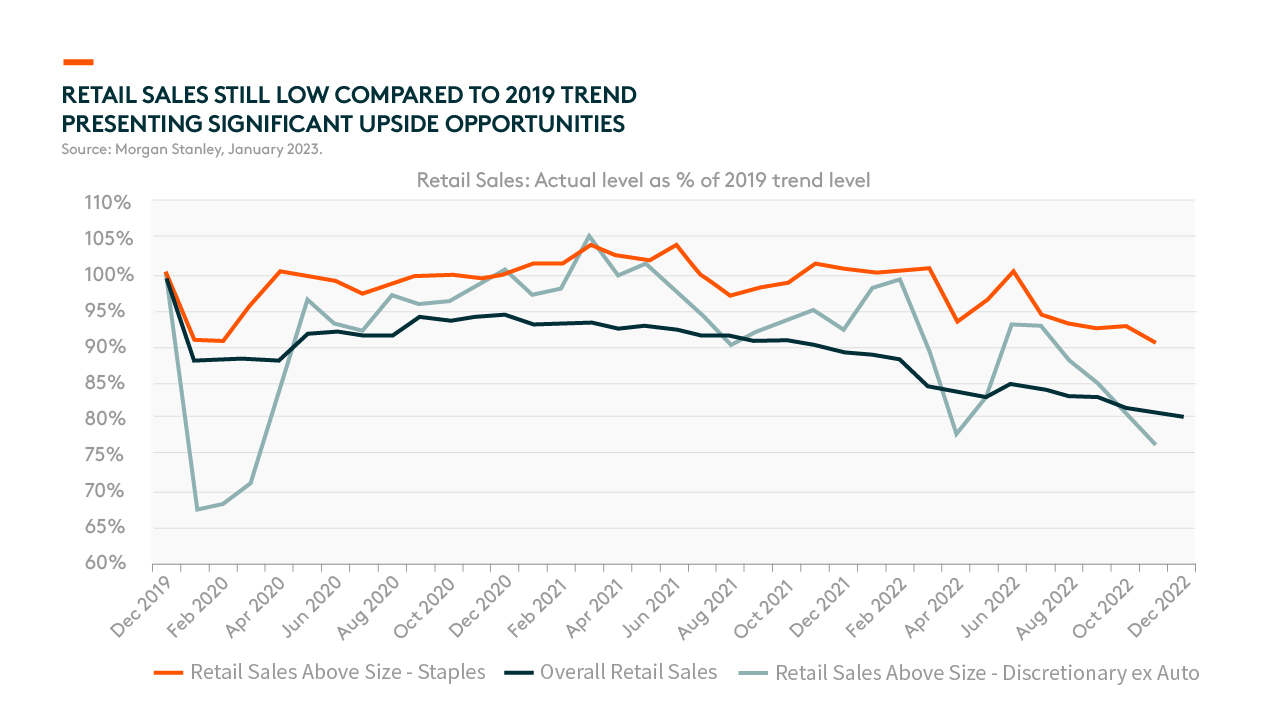

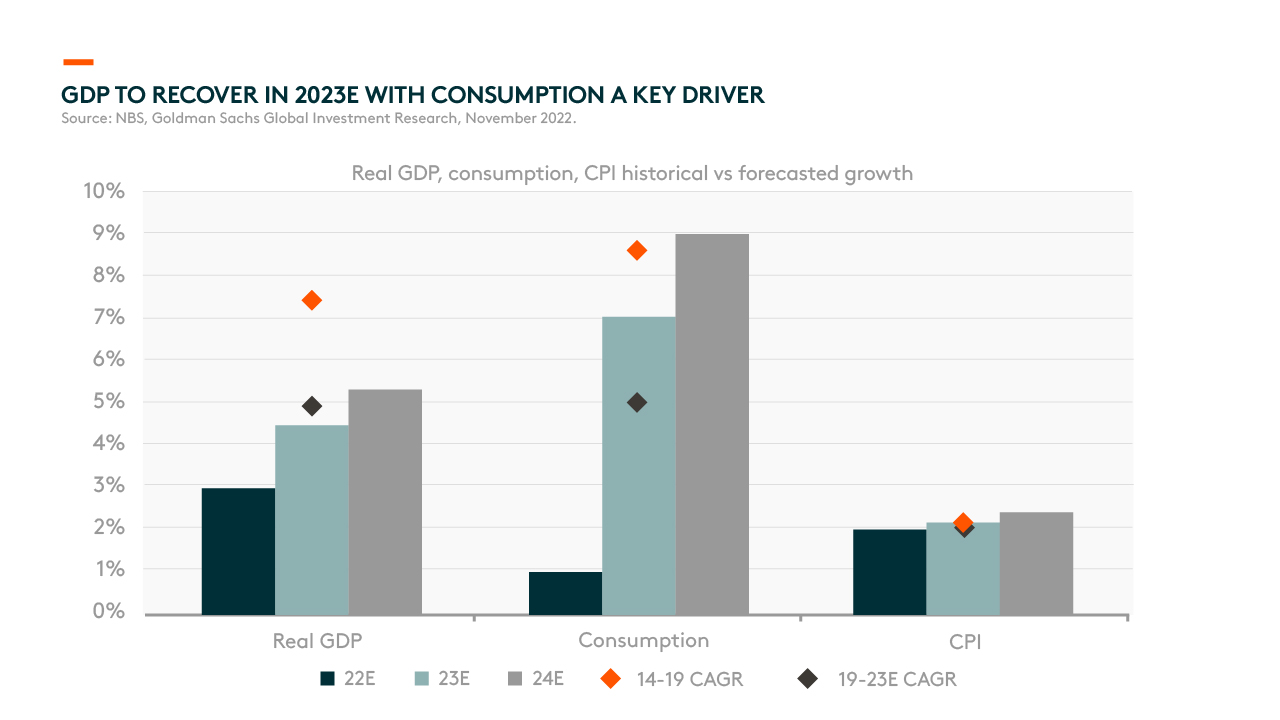

China’s consumption activity was heavily hit by the zero-COVID policy in 2022. Consumer sentiment declined to a record low level amid tight restrictions. Overall retail sales in December 2022 remained 20% below that of 2019 trend 1, with offline activities or discretionary spending generally seeing a bigger impact. That said, the country started to reopen after the National Party Congress in October, and reopening progress has been faster than the market’s anticipation. The government has announced meaningful relaxation measures as well as policies to stabilize the property market since November 2022. We believe China will focus on growth next year, and we expect private consumption to be the major growth driver of China’s economic growth, benefiting consumer companies in 2023.

Reopening to Drive Strong Consumption Growth

We believe reopening can lead to a strong rebound in consumption in China next year as the zero-COVID policy massively suppressed consumption activities in 2022. Among the consumer sectors, we expect consumer discretionary and services to show a stronger recovery than staples. We expect most discretionary and service industries, including restaurants, travel, sportswear, and apparel sales, to show strong growth as the country reopens. Whereas staples categories generally have been much more defensive as people consumed more packaged food and beverages while staying at home and even stocked up more products in preparation for lockdowns or quarantines under zero-COVID. Among staples, those with higher on-trade consumption or high reliance on restaurant channels, such as beer and condiments companies, would benefit from reopening. For example, pre-COVID, roughly half of the overall beer consumption occurred on-trade. In the near term, we may see some hick-ups with rising confirmed cases, as we experienced elsewhere outside of China, but soon we expect to see a fuller reopening which will drive strong consumption growth in coming quarters.

Market Consolidation, Enhanced Cost Structure, and Easing Raw Material Costs

Leading companies will rebound strongly after the tough times. Smaller businesses usually go out of business, while bigger companies tend to gain market share during the downturn. Thus, we expect many industries to have gone through market consolidation in the last few years. For instance, according to Goldman Sachs, an estimated 100,000 independent restaurants in the US closed by the end of 2020 due to COVID, compared to ~8,000 during the Great Recession in 2008/2009. We expect China to be in a similar situation at this time.

Meanwhile, companies have enhanced their cost structures over the last two years, and thus, we expect to see higher operating leverage kick in once the top line recovers. In addition, raw material costs have generally softened since 2H22. Thus, we expect margin pressure from the raw material cost side to also reduce in coming quarters. Overall, we expect leading companies to emerge strongly with consumption recovery as the country reopens in 2023.

Outlook for 2023

Consumer companies suffered in the last two years amid the pandemic, but we believe the worst is behind us. We expect reopening to be the major growth driver in 2023, along with the government’s supportive measures to stabilize the property market as they focus on economic growth. We expect consumer companies, particularly in discretionary and service industries, to rebound strongly as outdoor activities resume. Many local brands have become much more competitive during the downturn, and we also expect to see them rebound strongly when consumption recovers in the coming quarters. Overall, we have a constructive view on China’s consumption growth into 2023.