Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which

may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. - Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X Hang Seng TECH ETF’s (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X India Select Top 10 ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index (the “Underlying Index”).

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- The number of constituents of the Underlying Index is fixed at 10. The Fund by tracking the Underlying Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- High market volatility and potential settlement difficulties in the equity market in India may result in significant fluctuations in the prices of the securities traded on such market and thereby may adversely affect the value of the Fund. The BSE has the right to suspend trading in any security traded thereon. The Indian government or the regulators in India may also implement policies that may affect the Indian financial markets. There may also be difficulty in obtaining information on Indian companies as disclosure and regulatory standards in India are less stringent than those of developed countries.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X HSI Components Covered Call Active ETF(the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng Index (the “Reference Index” or the “HSI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSI ETF and long positions of HSI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSI ETF and long positions of HSI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSI Call Options over an exchange or in the OTC market. The HSI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSI Futures and writing HSI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSI Futures and the HSI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSI Futures and HSI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- To the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Global X HSCEI Components Covered Call Active ETF(the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index” or the “HSCEI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSCEI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSCEI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSCEI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSCEI ETF and long positions of HSCEI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSCEI ETF and long positions of HSCEI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSCEI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSCEI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSCEI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSCEI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSCEI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSCEI Call Options over an exchange or in the OTC market. The HSCEI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSCEI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSCEI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSCEI Futures and writing HSCEI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSCEI Futures and the HSCEI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSCEI Futures and HSCEI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (Mainland China). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in Mainland China. In addition, to the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed Mainland securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

Monthly Commentary on Key Themes – July 2024

Listen

Global X Asia Semiconductor ETF (3119)

Global X China Semiconductor ETF (3191)

Industry Update

- Samsung to Raise Memory Price by 15-20% in Q3, boosting Second Half Performance

According to a report from South Korean media Maeil Business Newspaper, Samsung Electronics plans to raise prices for server DRAM and enterprise NAND flash by 15% to 20% in the third quarter due to surging demand for artificial intelligence (AI). This move is expected to improve the company’s performance in the second half of the year.1 - TSMC Secures Another AI Opportunity, Winning Order from SK Hynix

According to a report by the Economic Daily News, TSMC has secured another AI business opportunity. Following its exclusive contract manufacturing of AI chips for tech giants such as NVIDIA and AMD, TSMC, in collaboration with its subsidiary, the ASIC design service provider Global Unichip Corporation (GUC), has reportedly made progress in producing essential peripheral components for AI servers, specifically high-bandwidth memory (HBM). Together, they have secured a major order for the foundational base die chips of next-generation HBM4.2

Stock Comments

- JCET (600584 CH, +22.5%) : China Resources group acquired majority stake in JCET. Recovery in smartphone and PC shipment drive OSAT utilization rebound. JCET continue to invest in advanced packaging.

- Giga Device Semiconductor (603986 CH, +15.1%): DRAM pricing continues to move up QoQ in 2024. Gigadevice is expected to place 850m RMB of DRAM orders in 2024 and benefit from the DRAM upcycle. Pricing of other products like MCU, NOR also stabilized in 1H24.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.3

Global X China Robotics and AI ETF (2807/9807)

Industry Update

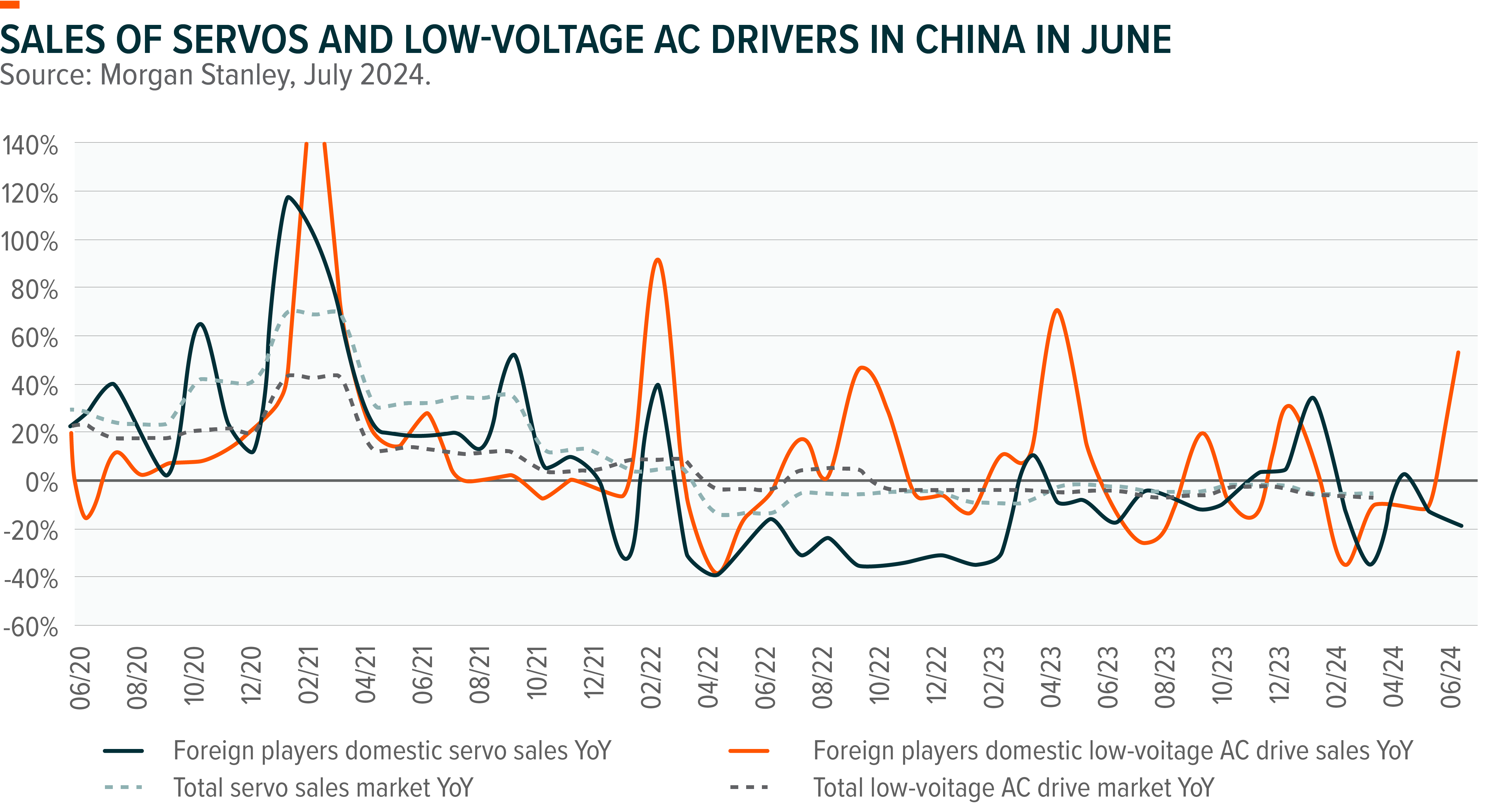

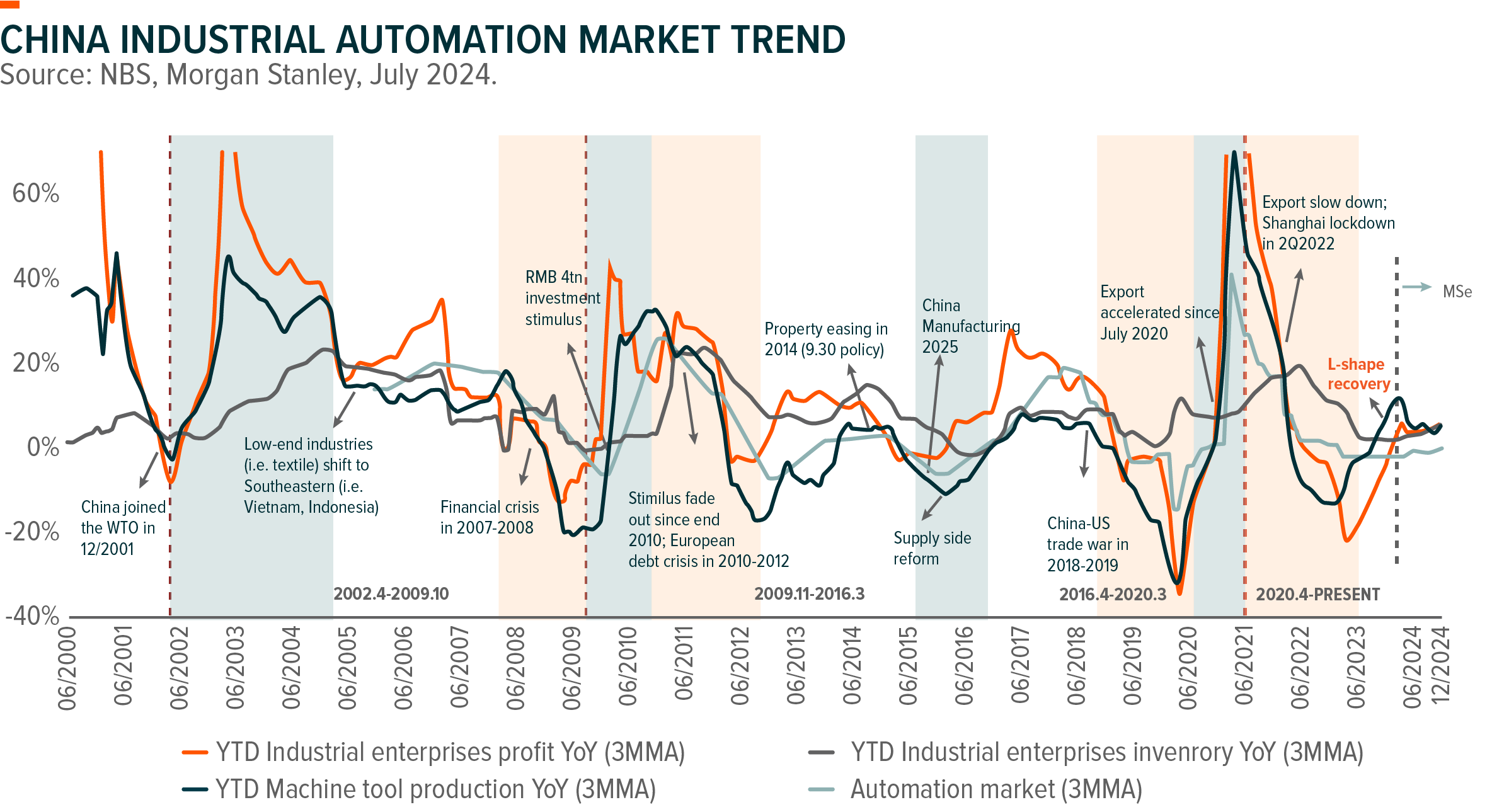

- Domestic industrial automation demand recovery remains sluggish in June. The order recovery in some traditional industries was sustained. Consumption-related downstream export demand was relatively solid but softened on a mom basis. Leading domestic companies IA orders grew slightly YoY in June, dragged by new energy industries, but were continuously gaining market share from foreign brands.

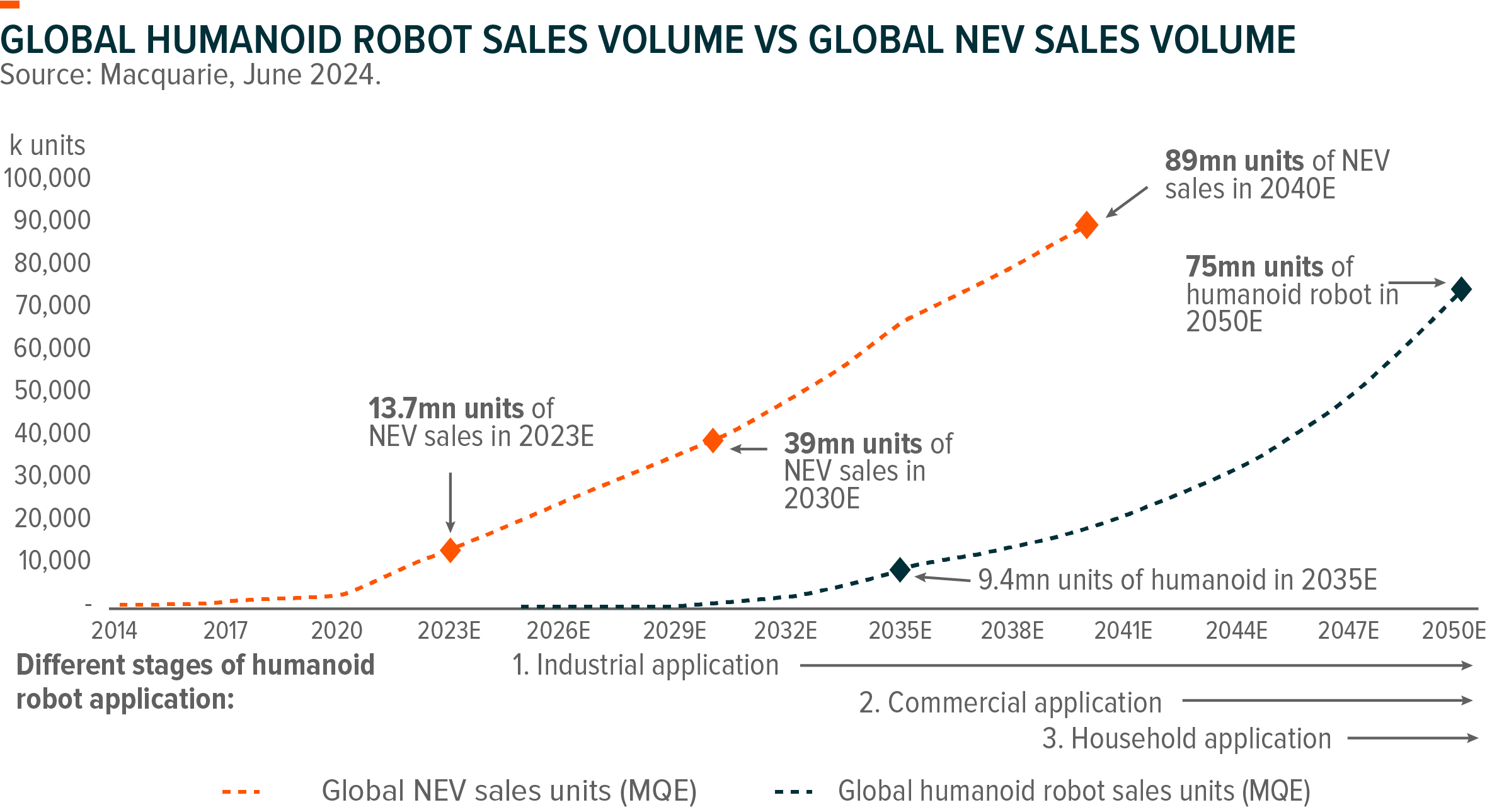

- Tesla’s new generation of humanoid robot will be launched at the end of this year,4 which may speed up the growth of the global humanoid robotics market in the coming years. Tesla’s robot is leading in software and hardware integration, cost control and commercialization. Company mentioned recently that the new robot is working at the production line and being internal tested. We may expect more followers coming out after Tesla proves the mature production and manufacturing system.

Stock Comments

- Zhongji Innolight (300308 CH) : 1Q24 net income surged 304% YoY to Rmb1.0bn, 29% above street, thanks to strong 164% YoY revenue growth to Rmb4.8bn(26% ahead of street consensus), and 3.2ppts YoY(-2.6ppts QoQ) gross margin expansion in 1Q24 to 32.8%. During earnings call, management expected 800G ramp to accelerate sequentially and QoQ margin expansion ahead on better product mix, higher yield and cost-down. We didn’t see any fundamentals worsening in the last month. Company remains on the growth trajectory.

- Nari Technology (600406 CH): China posted the announcement to accelerate UHV lines construction in June, for which Nari is one of the key beneficiaries. Company’s new orders YTD beat expectations at 12%, vs revenue guidance of 8.6% this year. Distribution grid and digitalization capex are likely to ramp up with NEA’ latest policies.

Preview

China industrial automation market has bottomed, though we are still not seeing any signals of out. The drag from new energy sectors are much more severe than expected and will likely last longer. On the bright side, first, demand recovery from traditional industries are better than expected. Second, exporting is accelerating despite at the very early stage and on a low base. Last but not the least, local companies are proactively optimizing their product mix and penetrating to new customers or existing customers’ new product lines, gaining market share from foreign brands, which partially offset the negative impact on sales and profits due to demand slowdown. We anticipate the L-shape recovery may continue in 3Q24.

Humanoid robot has been a key AI application trend. According to Macquarie’s recent estimates, global sales volume for humanoid robots to reach 9.4 million units by 2035E with a CAGR of 69% over 2025-2035E and market size to reach US$209bn with a CAGR of 50% over the same time.5 Market has been doubtful on the on-the-ground presence of AI in real industrial applications. Should Tesla prove their products effectiveness in the manufacturing lines, we’ll see a reliable way for commercialization and monetization in China in the foreseeable future.

Global X China Electric Vehicle and Battery ETF (2845)

Industry Update

- Solid June EV Sales; EV penetration continues to increase: According to CPCA, June passenger NEV wholesale volume reached 970k, +28% YoY and +8% MoM.6 Based on the announcements of individual auto brands, BYD reported June NEV sales of 342k units, +35% YoY, back to the historical peak monthly sales level in Dec 2023, driven mainly by solid demand for the DM-i 5.0, (Qin L/Seal 06) and promotions on the DM-i 4.0/Denza.7 Other major EV brands recorded robust growth, with NIO (+98% YoY) registering record delivers of 21,209 units in June, and Li Auto seeing re-acceleration in growth (+47% YoY). (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration was 44% in the last week of June.8

- Xiaomi and Huawei maintain strong momentum: Xiaomi delivered 11.6k units of SU7 in June 2024, 9+34% MoM. Xiaomi will continue to ramp up capacity and will accelerate delivery in July. 10 Huawei AITO M9 total order exceeded 100k units 6 months after launches, and AITO M7 Ultra delivery reached 20k units 1 month after launches.11

- EV Battery sales grew by 2% MoM to 56 GWh in May, and ESS battery sales grew by 18% MoM to 22 GWh. Exports for EV batteries increased to 10 GWh and ESS batteries exports rose to 4.0 GWh in May.12 May EV battery installations reached 40GWh in May, +41% YoY. CATL reported 43% market share in domestic installations in May, +2ppts YoY, and BYD share was 29%.

- EU tariff: On 12 June, European Commission disclosed the level of provisional countervailing duties on China BEV imports. Additional duties are applied to China EV brands on top of existing 10% tariff, and individual additional duties for three sampled Chinese EV producers BYD, Geely and SAIC will be 17.4%, 20% and 38.1%, respectively. The new tariff is effective on 4 July.

- Battery material costs further declined in June: China’s spot lithium carbonate price declined by 12% MoM to around RMB 93 k/t at the end of June.13 Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- BYD (002594.CH): BYD’s share price was up 10% in June, a key contributor to the ETF.

BYD launched Qin L and Seal 06, powered by DM-i 5, at the end of May, and recorded strong demand in June. EU’s announcement on 17.4% additional tariff on BYD export has been expected by the market, and we note that the incremental tariff is targeting BEV (Battery Electric Vehicle), but does not include PHEV (Plug-in Hybrid Electric Vehicle). This could create opportunity for BYD’s DM-i technology powered PHEVs to capture market, as its SEAL U DM-i is set to launch in Europe in 3Q24.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand and export sales should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive in 2024 with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands. Recent signs of battery inventory cycle bottoming out after destocking last year implies a normalized industry landscape that could lead to a better margin profile for battery industry leaders.

Global X China Clean Energy ETF (2809)

Industry Update

- Solar – Polysilicon prices further declined:Solar polysilicon prices were Rmb39/kg by the end of June14, further decreased by over 5% compared to one month ago, implying that most providers are cash-cost loss making. Polysilicon production is expected to fall by 18% MoM in June as more capacity is going into overhaul, potentially leading to price stabilization.15 Module prices remain weak, with module maker’s utilization rates increased in June. Solar module and inverter export volume recorded mild MoM improvement in May, suggesting recovering demand in Europe.

- Positive policy for Solar supply-side control: In June, China National Energy Administration’s Renewable Energy Department reiterated its support for the healthy development of the solar industry. Regulator aims to guide the healthy capacity expansion for solar industry and improve technology innovation ability with enhanced industry standard. The exit of excessive capacity and more disciplined capacity expansion should support profitability improvement for major players.

- Grid and power installation – Solid wind and solar installations growth; Grid investments accelerating: China’s Jan-May 2024 wind installations grew+21% YoY while solar installations expanded +29% YoY over the same period. In Jan-May 2024, the electricity grid spending in China reached Rmb170.3bn. +22% YoY.16 Action Plan for Energy Conservation and Carbon Reduction during 2024-25 issued in May also promotes the acceleration in construction of ultra-high-voltage (UHV) transmission lines and grid system upgrades to lower renewable curtailment,17 which bodes well for industry development.

Stock Comments

- China Yangtze Power (600900 CH) recorded 9% total returns in June, a positive contributor to the Index. Benefiting from the strong hydropower resources, Yangtze Power reported 2Q24 power generation growth of +43% YoY to 67.9bn KWh. In addition, July water inflow in Three Gorges remained strong, implying solid momentum of hydropower resources could continue in 3Q24. Yangtze Power is currently trading at 3.4% 2024E dividend yield for 2024E, its dividend payout could be well supported due to its strong cash flow and less capex ahead.18

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. Robust power demand growth as driven by AI and EV development is driving up global power demand. However, it is worth noting that the solar supply chain entered a consolidation phase starting 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. In addition, hydro power can be a key beneficiary for potential power reform thanks to its lower cost, and more stable and manageable power output compared with wind and solar.

Global X China Cloud Computing ETF (2826/9826)

Industry Update

- In May 2024, China Software industry revenues were +11.8% YoY, leading 5M24 total industry revenue growth at 11.6% to Rmb4,932bn. 5M24 revenue from IT services +13% YoY, while revenue from software products and cybersecurity were +9%, similar trend as compared to 4M24.

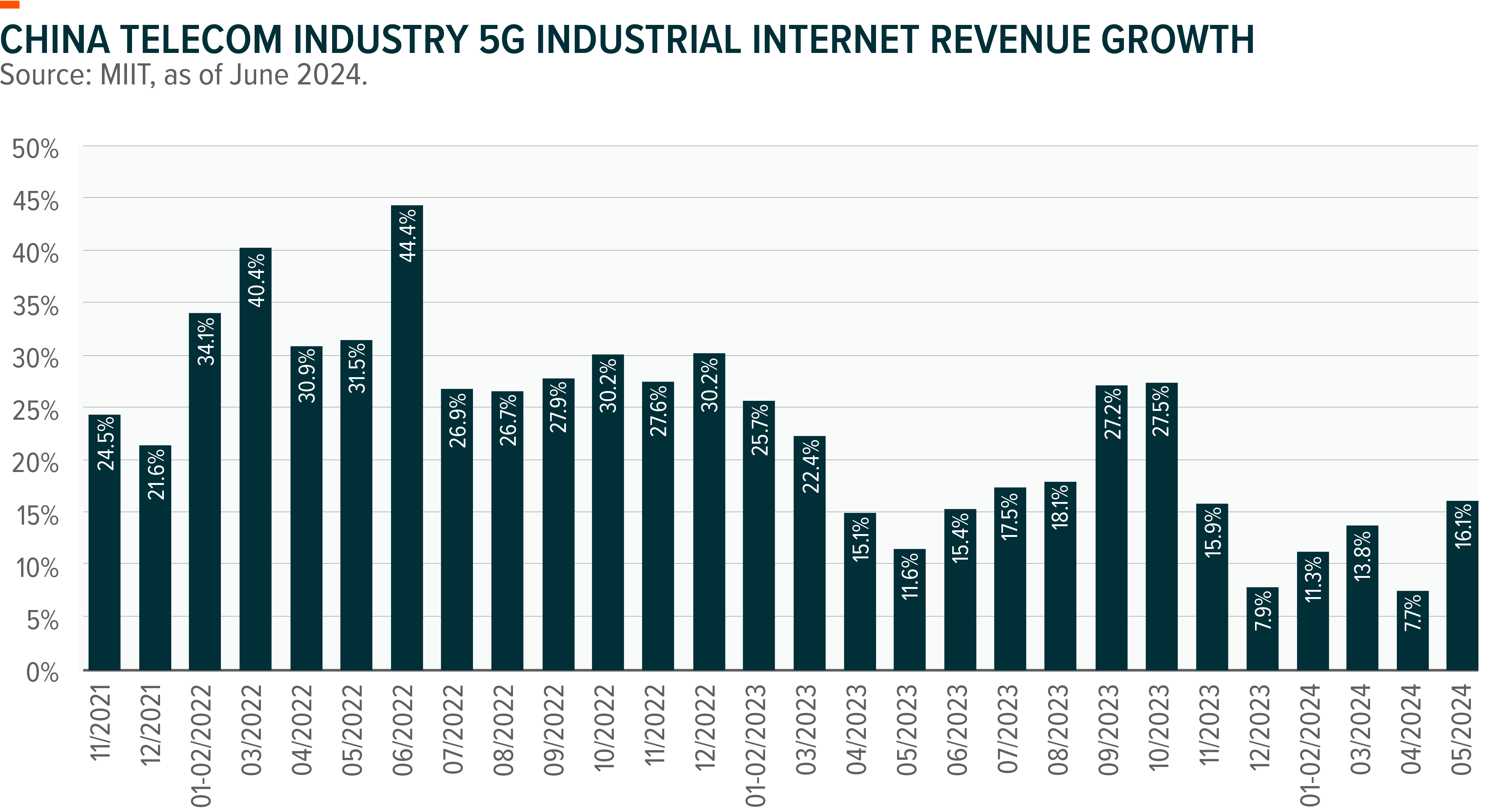

- May China telecom industry revenue grew 2.5% YoY, still weak. Mobile revenue fell 5.1% YoY (-2.1% YTD) indicating ARPU pressure. May fixed line rev growth accelerated to 6.3% YoY with YTD growth of 5.2%. 5G industrial internet revenue recovered to ~16% YoY in May, a six-month high.

Stock Comments

- Netease Inc Sponsored ADR: Stock price reacted positively to the recent announcement of new game release timeline. Blizzard China announced the return of World of Warcraft in China on Aug 1, and the expansion pack “The War Within” will be released globally on Aug 27. In addition, Naraka: Bladepoint Mobile will be released on 25 Jul. It has a large pre-registration gamer base which focuses on game balance and innovations. A number of features are highlighted, such as Copilot (AI teammate), which enables gamers to interact through voice communications. In addition, new users should pick up the game play easily.

- Tencent Holdings Ltd.: Tencent’s overseas games continued to surprise positively since start of the year. Tencent has been expanding its games overseas via building in-house studios and acquisitions of overseas studios. These investments are starting to bear fruit, e.g. strong grossing of PUBG Mobile and Brawl Stars, according to SensorTower, July 2024.

- Beijing Kingsoft Office Software. Inc. Class A: The company provided preview for its upcoming quarterly results. Overall tune remained bearish with a potential downward revision of revenue and earnings, due to weak customer spending amid a continuous macro headwind.

- Thunder Software Technology Co., Ltd. Class A: Momentum tapered off post the announcement of collaboration with Qualcomm on AI PC platform as there’s no immediate revenue contribution yet.

Global X China Consumer Brand ETF (2806/9806)

Industry Update

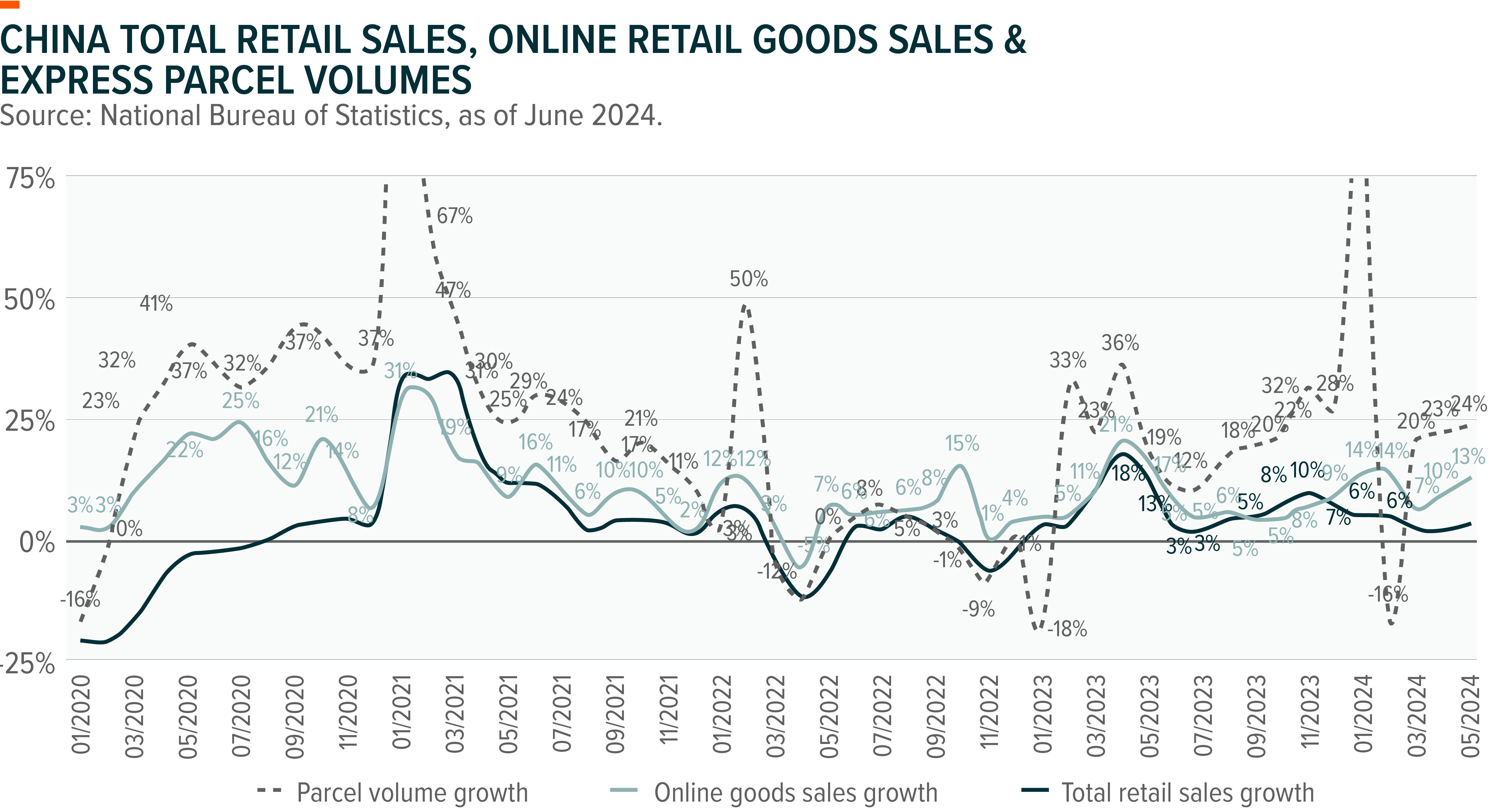

- China national online retail GMV grew 13% in May, largely driven by front-loaded sales due to an earlier start of the 618 Shopping Festival and cancellation of the pre-sales period this year. For the 618 Shopping Festival that concluded on June 20th, Leading platforms no longer report headline GMV growth but market expect mid-to-high single digit industry GMV growth, and a flattish to teens sales growth for individual traditional and livestreaming e-commerce platforms. Return rated edged up for categories including apparel as consumers become more price sensitive and cautious in terms of their purchasing behaviors. Competition remained intense with leading platforms offering traffic support and promotions to attract merchants (especially small to medium-sized merchants) and consumers.

- Domestic demands for sportswear, baijiu, beer and restaurant were weaker than expected into the month of June. Macau’s gross gaming revenue (GGR) came in at MOP17.7bn in June at 74% of the pre-COVID19 level vs. 79%/78% in Apr/May, likely due to weaker seasonality

Stock Comments

- Fuyao Glass Industry Group Co., Ltd. Class A: The company expects a stabilized profitability level with upward potentials driven by a potential decline in soda ash cost and improving utilization rate. Moreover, a 6-7% price hike will drive revenue growth.

- Tingyi (Cayman Islands) Holding Corp.: Share price reacted positively to the recent robust demand for beverage. On the other hand, demands for noodles were weak. Beverage segment grew lower than HSD% in Jan-May while Noodle segment slightly declined but turned positive in May with product upgrade. Both segments saw margin improvement YTD in both GPM and NPM.

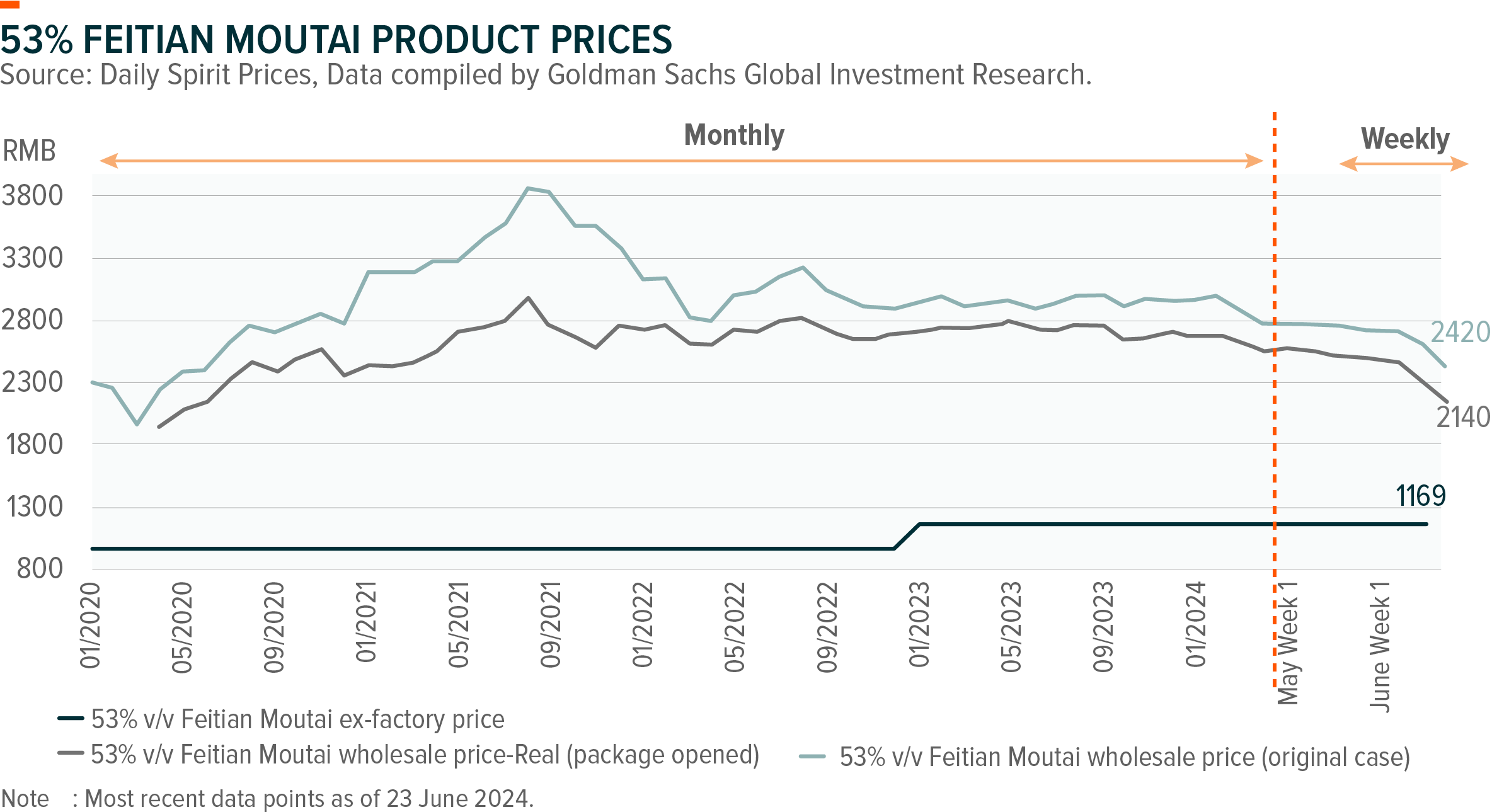

- Kweichow Moutai Co., Ltd. Class A.: First-tier wholesale ASP of Feitian Moutai declined from ~Rmb2,500 to ~Rmb2,150 mainly due to weaker than expected demands. This have resulted in some market concerns and short-term stock price pressure. In recent weeks, wholesale price rebounded to Rmb2,200+ as the company released price stabilization measures.

Global X China Little Giant ETF (2815)

Industry Update

- A-shares retreated in June with CSI300/500/1000 recording -3.3%/-6.9%/-8.6%. A-share turnover eased to an average of cRmb0.72trn in June from cRmb0.85trn in May. Lower expectations for strong policy stimulus by the Third Plenum, mixed economic activity data, M1 contraction and no MLF/LPR cut, as well as a depreciating CNY vs USD, sent China equities lower. Small caps notably underperformed large caps (CSI1000 -8.6% vs. CSI 300 -3.3%) possibly due to mounting delisting risks especially for small-cap names or loss-making companies. Among the 11 Wind A-share Level-1 sector indices, Telecom (+5%), Utilities (+2%) and IT (-2%) ranked as the top-three performers, while Real Estate (-14%), Staples (-11%) and Materials (-8%) as the bottom three.

- The May activity data sent mixed signals. Industrial production came in moderately below expectations, growing 5.6% YoY. Fixed investment came in modestly below expectations, rising only 4.0% YoY in Jan-May. Retail sales grew 3.7% YoY, improving modestly.

- Geopolitical tension was also back in focus (as US presidential election approaching), which dragged export names. Moutai price falling also reflected weakened consumption confidence, especially at luxury segment. No progress on property inventory purchase policies, no policy rate cut, and disappointing policy comments from Premier Li and other senior policy makers as well as low Third Plenum policy expectation dragged sentiment.

- We started to see more policy support towards tech space especially those related to AI/Semiconductor. Pharmacy names witnessed deep loss on “price comparison system” policy while anti-corruption campaign might continue to dragged other health care sectors.

Preview

We will watch closely on Third Plenum and potential policies to support new productive forces.

Global X Hang Seng TECH ETF (2837)

Industry Update

- Hang Seng TECH Index recorded a 3.5% loss in June 2024, after rallying over 30% from the troughs in January to the highs in mid May. Throughout the month we are seeing a divergent performance among sectors, with online gaming companies gaining tractions thanks to successful launches of high quality new games, while ecommerce platforms (esp. live streaming ecommerce) recording losses due to slowing GMV growth. Weak domestic consumption sentiments also weigh on performance of consumption brand in June.

Stock Comments

- Bilibili (BILI US/9626 HK) recorded gain of +14% in June, a positive contributor to the index. Bilibili successfully launched its San Guo SLG Mobile Game in June, and the game recorded better than expected grossing performance, ranking top 5 among all China Mobile Games (IOS Channel) within 2 weeks after launches.19 In addition, its advertising revenue growth could accelerate in 3Q24, benefiting from the large amount of new game launches throughout the summer.

- Kuaishou (1024 HK) recorded loss of 17% in June, a detractor to the index. Live streaming ecommerce growth during 618 shopping festivals slowed significantly to +12% YoY in 2024, from +124%/+28% YoY in 2022/2023.20 After years of rapid expansion in users, profitability, and ecommerce share gains, Kuaishou’s growth could be facing pressure due to intensified industry competition and peaking user penetration and engagement.

Preview

Although China internet sector is entering a mature stage with the already high online penetration and peaking timespent, there are still emerging themes driving re-accelerating growth across different subsectors, on the back of a normalizing domestic regulatory environment on internet platforms. A robust game pipeline and solid new game performance is driving more positive online gaming outlook. Ad tech upgrades and the emergence of more effective ad formats should support the continued market share gain by key online advertising platforms, and the applications of AI across cloud, games, ads, and other key sectors is driving new demand and enhancing operational efficiency. Continued execution of upsized share repurchase program increases shareholder returns and should provide supports for future share price performance.

Global X Hang Seng High Dividend Yield ETF (3110)

Industry Update

- Hang Seng High Dividend Yield Index recorded -0.6% return in June. Market sentiment was tepid with mixed macro signals including subdued domestic PMI and solid exports. While general regulatory stance has been supportive across capital markets and property markets, property sales data has yet to show significant recovery. Further policy announcements in the upcoming July 3rd Plenum meeting should be the key to sustain market sentiment and performance.

- Hang Seng High Dividend Index conducted annual rebalancing on 7 June 2024. 11 new stocks were included as index constituents while the same amount were eliminated, and stocks are weighted by yield after rebalancing. One-way turnover was 32%.21 By sector, Financials and Industrials sectors have the largest weight gains, while Energy and Materials sectors recorded reduced weights. SOE continue to account for over 55% of total holdings, brining potential re-rating opportunities under ‘VCC’ theme.

Stock Comments

- China Unicom (762 HK) recorded total returns of 14% in June, a positive contributor to the index. China Unicom targets a double-digit net profit growth on steady revenue in 2024. Company expected dividend payout ratio in 2024 to be no lower than 2023 level (~55%), and expected 2024 Capex to decline by 50% YoY. Cloud business remain the key growth driver for China Unicom, and its cooperation in network sharing could lead to lower investment burden and potentially higher cash return.

Preview

Hang Seng High Dividend Yield Index is well positioned to benefit from increasing allocation from global investors amid global market volatility, and the potential dividend tax removal for southbound investors. Notably, this Index consists of over 55%22 of its constituents in State Owned Enterprises. Supportive policies across consumption, property, and technology sectors, as well as the ongoing capital market reforms are key drivers for market rebound. The concept of the Valuation System with Chinese Characteristics (“VCC”) is back in the spotlight again in light of recent developments. The primary objective of VCC is to enhance the quality and investment value of listed companies, especially SOEs. By investing in the Hang Seng High Dividend Yield Index, investors can gain exposure to high dividend-paying and low-volatility companies while also benefiting from the accelerated implementation of VCC.

Global X India Select Top 10 ETF (3184)

Market Update:

- India’s strong economic growth continued driven by robust domestic demand, supported by both consumption and investments. Private consumption is likely to become more broad-based as rural consumption improves thanks to expectations of a favorable monsoon this year. In addition, the improving outlook for global trade is leading to an uptick in exports and is likely to support the overall growth outlook. Furthermore, the softening trend in core CPI seems encouraging and price stability is expected to stay, which is also supportive to a sustained growth.

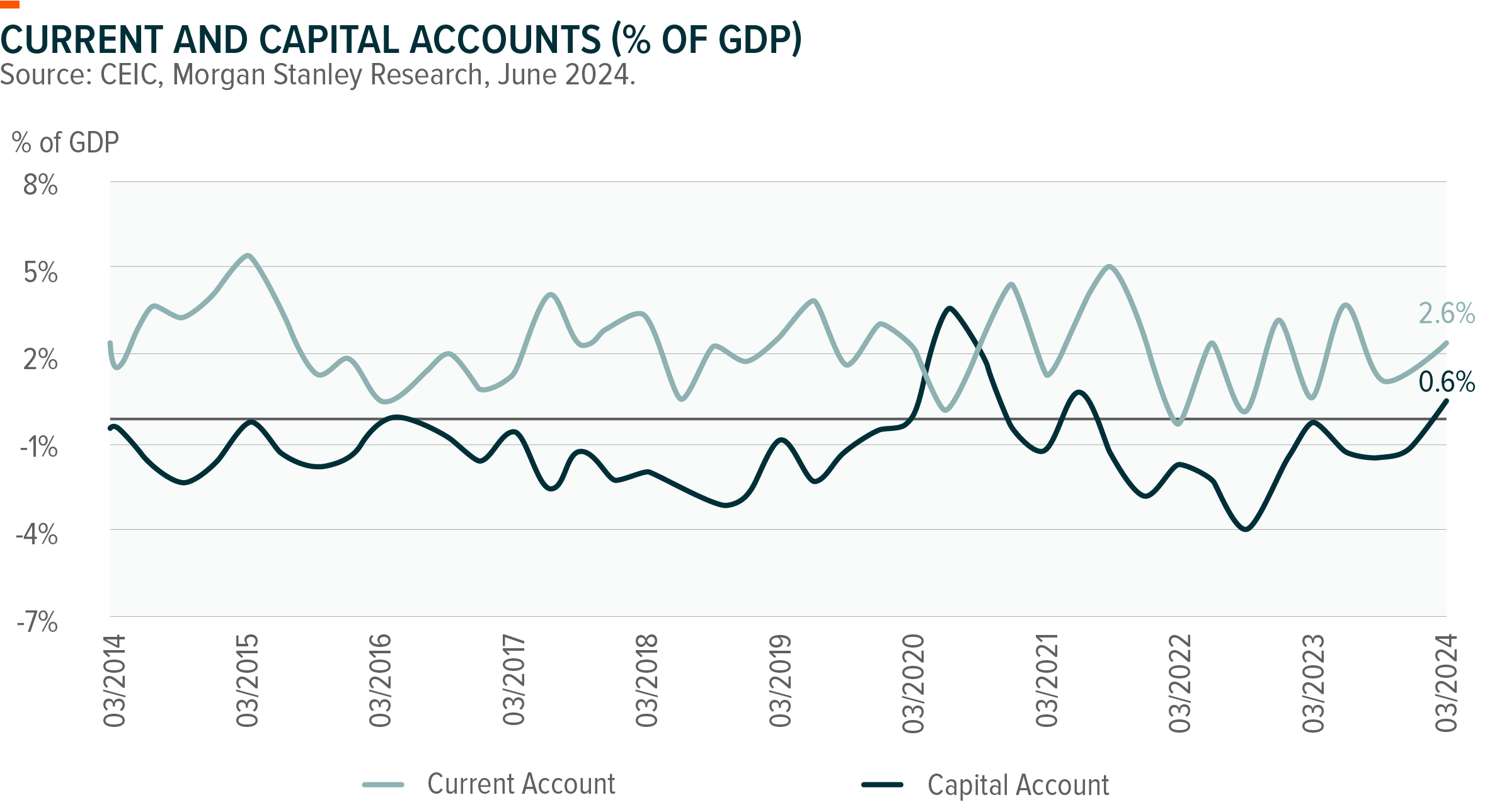

- The current account recorded a surplus of 0.6% pf GDP (US$5.7bn) in 4QFY24 improved from a deficit of 1% of GDP(US$8.7bn) in 3QFY24. Merchandise trade deficit narrowed as exports improved sequentially while imports moderated slightly. Gross service exports increased 4.1% while net services exports grew 9.2%yoy in 4QFY24. The current account surplus improved to a three quarter high and overall balance of payments (BoP) surplus accelerated to US$30.8bn or 3.3% of GDP from US$6bn (0.7% of GDP) in the previous quarter. The overall BoP surplus recorded US$63.7bn or 1.8% of GDP for the full year FY24.

Stock Comments:

- Infosys (INFO IN) was the major contributor in June as the industry heads towards stability in spend for 2HCY24. The companies had baked in easy assumptions on discretionary spends for the year and Infosys is likely to record sequential revenue growth based on ramps in mega deal wins of FY24. Accenture reported its results during the month and the company indicated acceleration in growth for next year also contributed to positive sentiment towards Indian IT sector.

- Larsen & Toubro (LT IN) was the major detractor in June as the market increasingly concerned on whether the government would reduce investments and increase allocation more towards on private consumption after the election. In addition, there is limited near term catalysts given relatively moderate orders. Near term, the market will be watching out for the upcoming central government budget in July.

Preview:

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. In the near term, trend in monsoon rainfall, budget for FY2025 in July will be the major event to watch out for the market.

Global X K-pop and Culture ETF (3158)

Market Update:

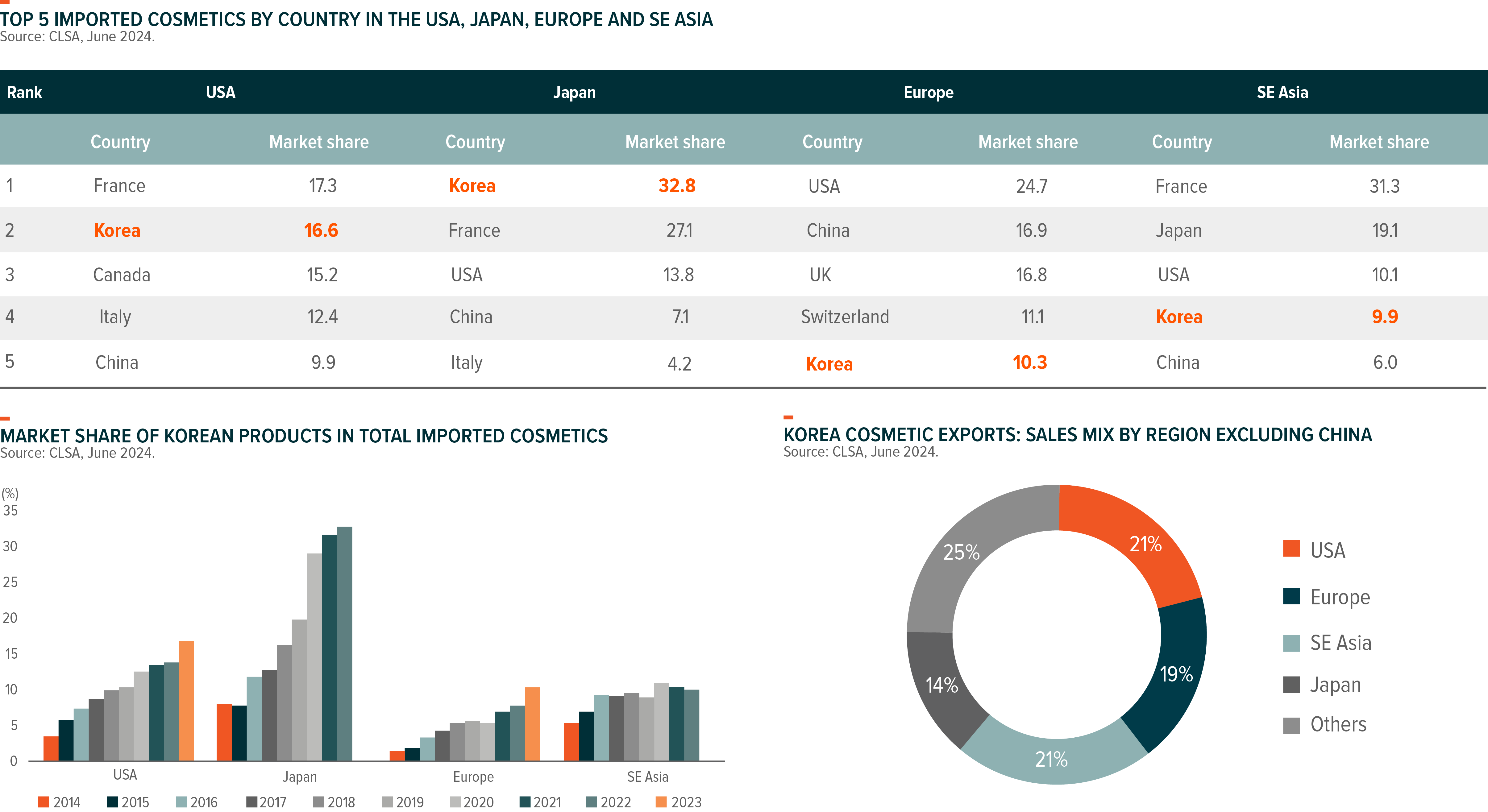

- Korean goods such as cosmetics and food and beverages (F&B) performed well this year thanks to companies’ strong growth in overseas markets particularly in the US. Korea’s cosmetics export to the US for the first time surpassed that of China. K-pop and culture continues to gain global consumers’ attraction and further extend their interests towards Korean products. The rising indie brands trend amid increasing online penetration also bodes well for Korean brands gaining market share across different countries.

- While non-China overseas sales contribution has been increasing fast for many companies, China still contributes meaningful revenue shares for many large brands. Thus, we have seen some stock performance correction in June amid weak China consumption as the market concerned there may be another earnings downward revisions after 2Q24 results for those companies with large China business exposure.23

Stock Comments:

- Samyang Food was the major contributor in June thanks to strong Bul-dak product, a spicy chicken-flavored fried noodle, in overseas markets. The company is expected to expand its production capacity by 30% by 2025E compared to that of 2023 on the back of robust demand increase in the US and China. The company has sustained an average operating margin of 12% and the street expects that there might be upside to this as operating leverage kicks in with strong sales. 24

- LG Household and Healthcare and Amorepacific were one of the major detractors in June due to concerns on weaker than expected 2Q24 results considering weak China consumption. These leading Korean cosmetics brands have high exposure to China and thus not immune to slowdown in China consumption. Amorepacific has successfully diversified its geographic mix especially after its acquisition of Cosrx, which has been one of top selling brands on Amazon US, but still the company is expected to have another earnings cut after 2Q24 results due to its China business.

Preview:

K-pop and culture theme is a structural growth story and it continues to provide a halo effect towards Korean goods such as cosmetics and packaged food. We believe Korean contents and products will continue to gain shares in global markets. Yet, we will watch out for 2Q24 earnings results as some of these companies still have meaningful China exposure and there might be negative earnings impact near term from weaker than expected China demand.

Global X HSI Components Covered Call Active ETF (3419)

Global X HSCEI Components Covered Call Active ETF (3416)

Industry Update & Issue Analysis:

In June, the Hong Kong stock market softened and remained mostly flat. Sentiment cooled down, continuing a range-bound trading pattern, which is favorable for a covered call strategy. Specifically, the Hang Seng Index (HSI) dropped by 1.1%, while the Hang Seng China Enterprises Index (HSCEI) rose slightly by 0.15%. The corresponding Volatility Indexes, VHSI and VHSCEI, which measure expected volatility for the HSI and HSCEI, dropped to 19.2 and 21.7, respectively, reaching nearly three-year lows.25 This low volatility suggests that investors perceive limited downside risk in the near term.

Against this backdrop, the estimated premiums generated by writing out-of-the-money call options for the HSI and HSCEI were 1.7% and 1.5%, respectively, in June. The stable market conditions and reduced volatility create an optimal environment for employing a covered call strategy, allowing investors to generate income from option premiums while mitigating the risk of significant price movements.