Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of principal. Investor should note:

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X HSCEI Components Covered Call Active ETF (the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index” or the “HSCEI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSCEI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSCEI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSCEI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSCEI ETF and long positions of HSCEI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSCEI ETF and long positions of HSCEI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSCEI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSCEI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSCEI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSCEI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSCEI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSCEI Call Options over an exchange or in the OTC market. The HSCEI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSCEI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSCEI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSCEI Futures and writing HSCEI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSCEI Futures and the HSCEI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSCEI Futures and HSCEI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (Mainland China). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in Mainland China. In addition, to the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed Mainland securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

US Presidential Election

Implications on China Market

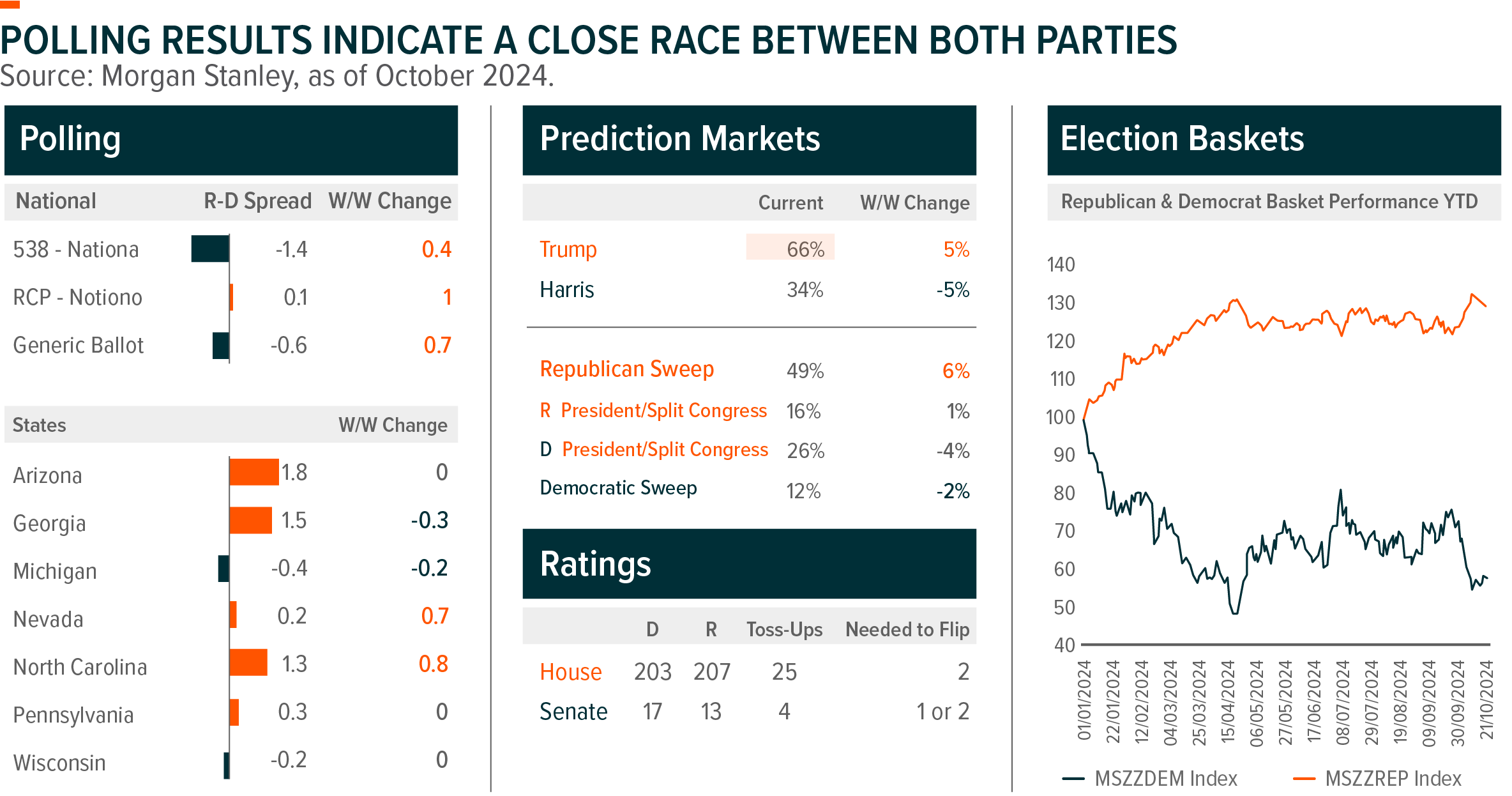

US Presidential Election is less than one week away. Current prediction markets show higher probability for a Trump Victory (66%) and Republican Sweep (49%), yet we note that both directions could be possible in the close race. The election outcome and policy directions could be consequential to China equity market performance. In a Trump-win scenario, higher tariff (proposed 60% for China), deregulation and US corporate tax cuts could hurt China’s exports and equity market performance, but will also impose inflationary pressure for the US Economy. Harris-win scenario could be potentially more favourable to China market in the short term given the assumption of no trade war and better near-term policy visibility. However, we believe the subsequent policy reactions by China governments will be the more determinant factor for China market performance. The NPC Standing Committee Meeting will be held between November 4-8, overlapping with the November 5 US Presidential Election and the November 6-7 FOMC Meeting. This timing allows for potential contingency plans in response to the US election results.

Trade War 2.0 – Implications on China Market

Trade policy under a Trump victory scenario is the major market focus. Trump’s proposed tariffs of 60% on Chinese imports with a 10% or 20% duty on goods from the rest of the world would raise the US tariff level to the highest since the mid-1940s. However, we note that the proposed 60% China tariff is less likely as higher tariff, coupled with Trump’s other agenda of deregulation and corporate tax cut, will bring inflationary pressure to the US economy. A 60% tariff on China + 20% on RoW would increase the average US household spending by US$2,600 per annum, reduce 1% of US GDP by 2026, and raise inflation 2ppts higher in 2025 (Peterson Institute for International Economics). In addition, potential tariff retaliation from China and other US trade partners will also affect US tariff decisions.

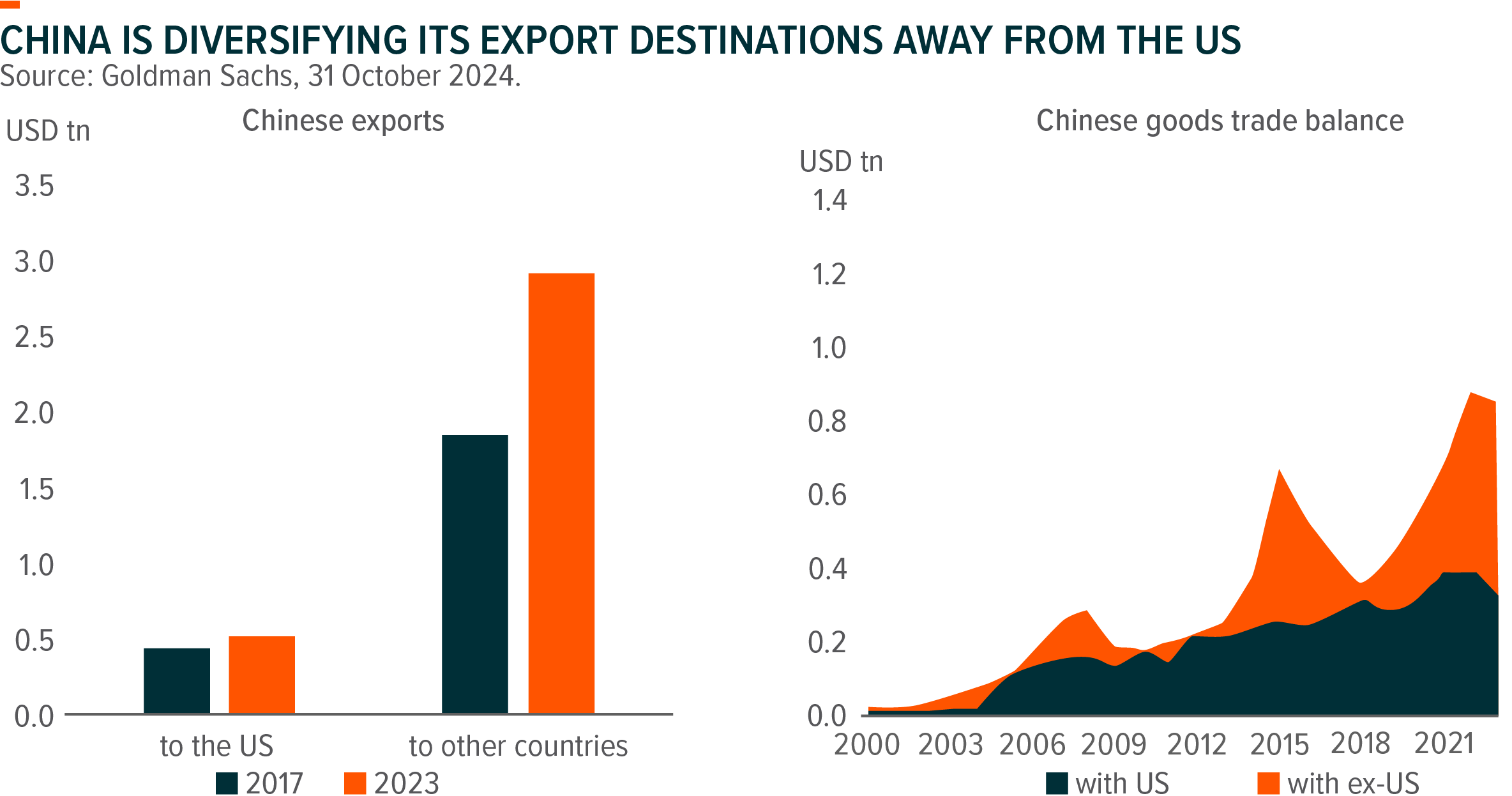

The 2018-19 trade war materially weighted on China’s economic growth due to lower exports, increased uncertainty, and tighter financial conditions. RMB also depreciated during the trade war as a policy response by China government. Tariff implications on China should be different this time as we are witnessing ongoing structural changes in China over the past few years. Chinese manufacturers are diversifying away their export destinations from US to the rest of the world, and China exports are shifting to high value-added products with unique global competitiveness. On the flip side, China is facing more economic challenges including prolonged housing downturn, weak domestic demand, and overcapacity. We believe such hurdles would offer more incentives for China government to adopt more forceful policy stimulus, which should be the key determinant factor to support economic and market recovery.

Global X ETFs in Focus

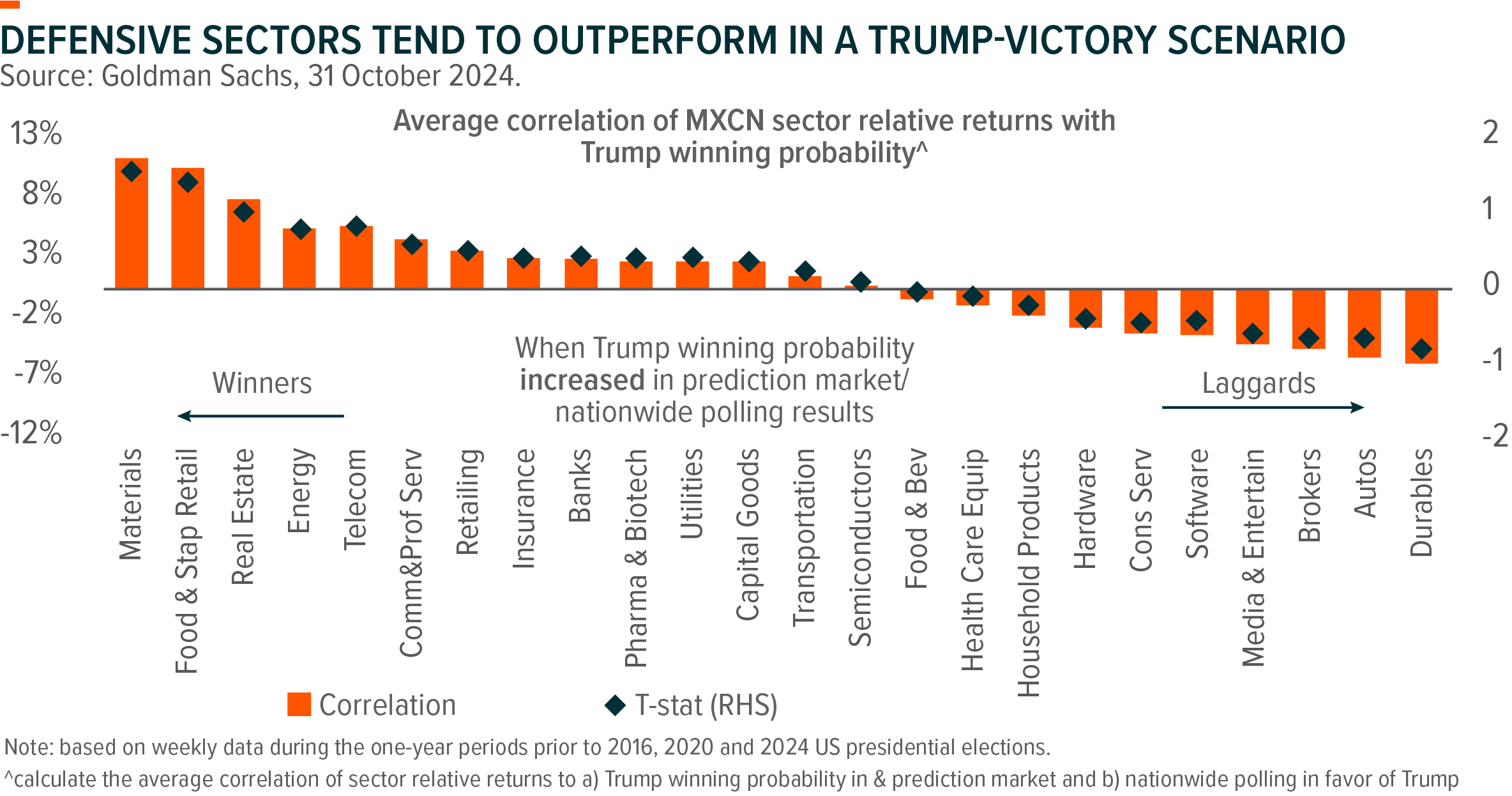

Trump Presidency – Defensive and Domestic-oriented Sectors Will Outperform

In a Trump-victory scenario, Chinese government could be adopting more forceful fiscal stimulus to combat tariff headwinds. Sectorally, defensive themes including old economy, cyclicals and SOE are less affected by tariff, while exporters such as Autos, Technology Hardware, Home Appliances, and Solar supply chain will be affected. Meanwhile, sectors like Internet and domestic-oriented consumptions that are more closely related to domestic economy are likely to be key beneficiary of fiscal stimulus adopted by central government.

In a high tariff environment, defensive and domestic market focused ETFs can deliver more stable returns amid uncertainty. Global X Hang Seng High Dividend Yield ETF (3110 HK) invests in Hong Kong listed high dividend names across financials, utilities, and property sectors with lower overseas exposure, offering over 7% annualized dividend yield for investors. Global X HSCEI Components Covered Call Active ETF (3416 HK) is well positioned to outperform in a volatile market as option premium will rise in tandem with market volatility. 3416 HK provides monthly dividend distribution to investors.

Across China thematic products, tariff may have negative impact on home appliance sector, particularly affecting our key holdings of Global X China Consumer Brand ETF (2806 HK), Midea and Haier, which together account for c.15% of our portfolio. Midea and Haier have 59% and 48% sales from overseas market as of 2023, respectively. Other holdings primarily focus on domestic consumptions and are less likely to be impacted by US tariff. Therefore, we view the tariff impact to be relatively limited for 2806 HK. Moreover, we see potential upside from stronger-than-expected domestic consumption stimulus policies in response to Trump’s tariff.

Harris Presidency – Exporter Growth Will Continue

Albeit with lower probability, a Harris Presidency and Blue sweep scenario is a more favourable outcome for China equity market given the assumption of status-quo trade policy and better near-term policy visibility. In addition, as Harris advocates a partial reversal of corporate tax cuts which will weigh on the EPS growth for US Corporates, the EM-DM EPS growth differential could narrow. EM (including China) equities could benefit from fund flow perspective. As supported by China’s stimulus policy, macro-sensitive sectors such as internet and consumer, as well as exports like Autos, Technology Hardware, Home Appliances, and Solar supply chain will likely outperform.

Assuming no major policy changes after US election, Global X China thematic ETFs are well positioned for outperformance. We prefer industries with solid fundamentals and strong growth momentum. Global X China EV and Battery ETF (2845 HK) is benefiting from the strong EV sales and improving battery industry landscape in China. Global X China Clean Energy ETF (2809 HK) is benefiting from improving supply and demand dynamics of solar industry as well as robust growth from wind, hydro and power grid sector. Global X China Semiconductor ETF (3191 HK) is riding on the development of edge AI and higher localization rate.

All Eyes on the November NPC Standing Committee Meeting

Though US Presidential Election brings uncertainty, we reckon that Government’s stimulus policy remains the most determinant factor for China equity market performance. The much-anticipated NPC Standing Committee Meeting will take place during November 4-8. The size and mix of previously announced fiscal stimulus measure such as local government debt swap and bank recapitalization program could be announced at the meeting, and market is expecting NPC to approve additional trillions of ultra-long-term central government special bond issuance quota. As the meeting overlaps with US Presidential Election, NPC might approve more fiscal resources in the case of a Republican Victory to counter imminent tariff risks.

Related Global X ETF

| Global X Hang Seng High Dividend Yield ETF (3110 HK) |

Global X HSCEI Components Covered Call Active ETF (3416 HK) |

Global X China Clean Energy ETF (2809 / 9809 HK) |

|

|---|---|---|---|

| SEHK Listing Date | 17 Jun 2013 | 29 Feb 2024 | 17 Jan 2020 |

| Reference Index | Hang Seng High Dividend Yield Index | N/A | Solactive China Clean Energy Index NTR |

| Primary Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.68%p.a.1 | 0.75%.p.a.2 | 0.68%p.a.3 |

| Product page | Link | Link | Link |

| Global X China Semiconductor ETF (3191 / 9191 HK) |

Global X China Electric Vehicle and Battery ETF (2845 / 9845 HK) |

Global X China Consumer Brand ETF (2806 / 9806 HK) |

|

|---|---|---|---|

| SEHK Listing Date | 07 Aug 2020 | 17 Jan 2020 | 17 Jan 2020 |

| Reference Index | FactSet China Semiconductor Index | Solactive China Electric Vehicle and Battery Index NTR | Solactive China Clean Energy Index NTR |

| Primary Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.68%p.a.4 | 0.68%.p.a.5 | 0.68%p.a.6 |

| Product page | Link | Link | Link |

Source: Mirae Asset, 31 Oct 2024.