Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Global X China Cloud Computing ETF (2826/9826)

Listen

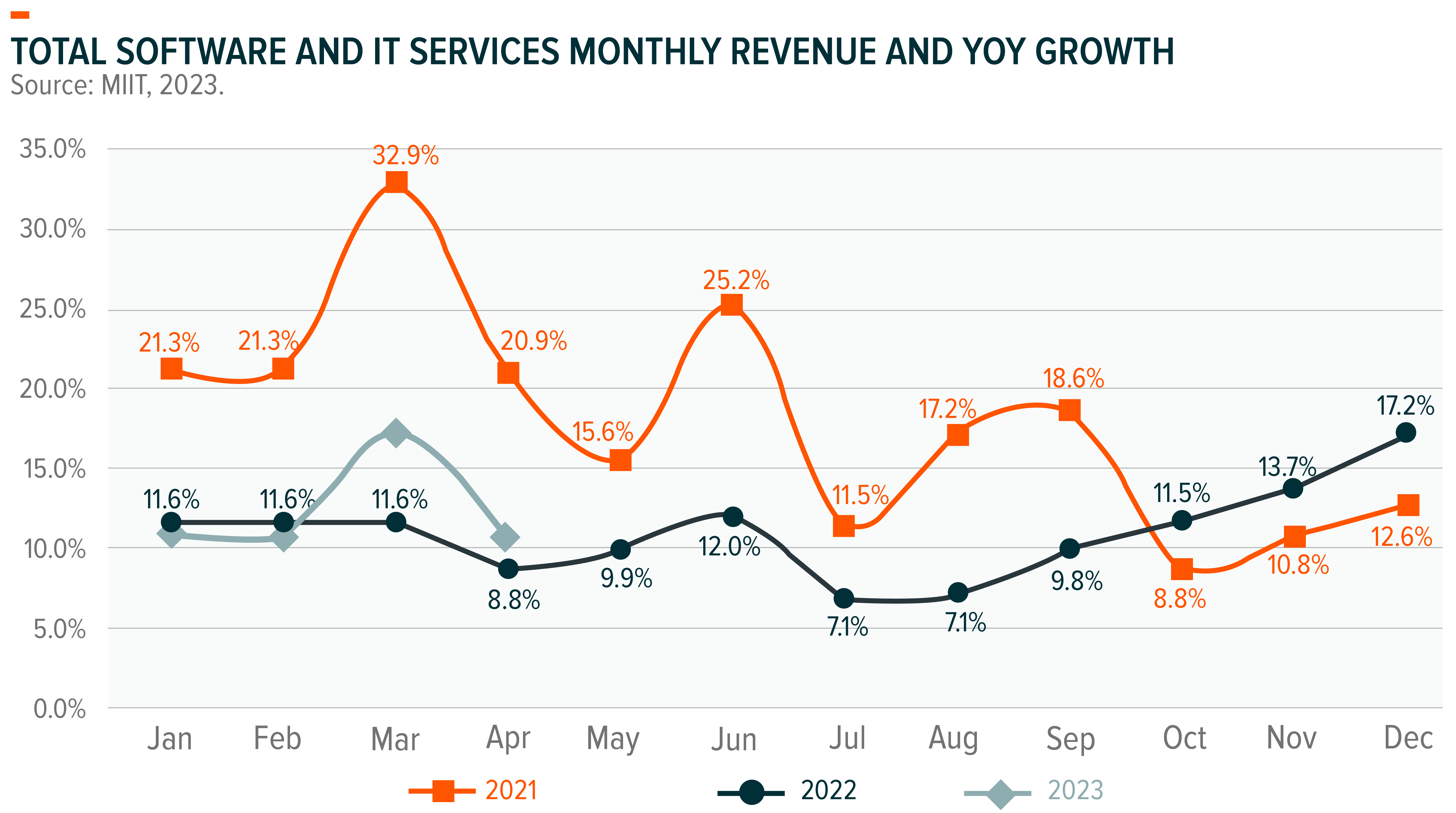

According to the Ministry of Industry and Information Technology, China’s software and IT service revenues were up 10.9% year-on-year (YoY) in April 2023, decelerating from 17% YoY growth in March. This drop-off likely reflects the slower macro recovery and lower-than-expected government spending on software localization initiatives due to budget constraints.

On the other hand, Chinese telco companies’ cloud revenue continued to grow strongly. It is an industry consensus that government policies are currently a tailwind for telcos’ cloud businesses since state-owned enterprises (SOEs) would favor telcos as a “safe” choice, especially when considering data security risk and the need to support localization initiatives. As SOEs and industrial digitization will be the main driver of cloud growth in China, telco companies will likely continue to see a sustainable advantage and, thus, more market share gain. As such, we expect private cloud demand growth will continue to outgrow that of public cloud in the near term.

However, with the fast development of artificial intelligence-generated content (AIGC), there should be a meaningful uplift in terms of public cloud resource demands driven by AI model training. We expect public cloud providers such as AliCloud, Tencent Cloud, and Baidu Cloud to be well-positioned to capture such demands in the medium to longer term.