Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X HSCEI Components Covered Call Active ETF (the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index” or the “HSCEI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSCEI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSCEI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSCEI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSCEI ETF and long positions of HSCEI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSCEI ETF and long positions of HSCEI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSCEI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSCEI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSCEI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSCEI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSCEI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSCEI Call Options over an exchange or in the OTC market. The HSCEI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSCEI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSCEI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSCEI Futures and writing HSCEI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSCEI Futures and the HSCEI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSCEI Futures and HSCEI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (Mainland China). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in Mainland China. In addition, to the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed Mainland securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Global X HSI Components Covered Call Active ETF (the “Fund”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng Index (the “Reference Index” or the “HSI”) and selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HSI Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HSI Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HSI Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the HSI ETF and long positions of HSI Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HSI ETF and long positions of HSI Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HSI Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HSI Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HSI Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HSI Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HSI Call Options may not be sufficient to offset the loss realised.

- The Fund may write HSI Call Options over an exchange or in the OTC market. The HSI Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HSI Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HSI Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HSI Futures and writing HSI Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HSI Futures and the HSI Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- HSI Futures and HSI Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- To the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Global X Hang Seng TECH Components Covered Call Active ETF (the “Fund”) aims to generate income by primarily (i) investing in constituent equity securities in the Hang Seng TECH Index (the “Reference Index” or the “HS TECH”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a HS TECH Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the HS TECH Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the HS TECH Call Options written, plus the premium received.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and HS TECH ETF and long positions of HS TECH Futures, the Fund also writes call options on the Reference Index. For the avoidance of doubt, the Fund does not seek to track the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of a HS TECH Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the HS TECH Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise HS TECH Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If a HS TECH Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the HS TECH Call Options may not be sufficient to offset the loss realised.

- The Fund may write HS TECH Call Options over an exchange or in the OTC market. The HS TECH Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into HS TECH Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write HS TECH Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in HS TECH Futures and writing HS TECH Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the HS TECH Futures and the HS TECH Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the SEHK and/or the Fund’s brokers, the Fund may experience significant losses.

- HS TECH Futures and HS TECH Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- The Fund is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with the majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in a single region.In addition, to the extent that the constituent securities of the Reference Index are concentrated in Hong Kong listed securities of a particular sector or market (i.e., technology), the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, the Fund must receive cash collateral of at least 100% of the valuation of the securities lent valued on a daily basis. However, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The investment objective of Global X US Treasury 3-5 Year ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset US Treasury 3-5 Year Index (the “Underlying Index”).

- The Fund is exposed to the Credit/Default risk of issuers of the debt securities that the Fund may invest in; the Credit Rating risk that the credit ratings assigned by rating agencies are subject to limitations and do not guarantee the creditworthiness of the security and/or issuer at all times; the Downgrading risk that the Manager may or may not be able to dispose of the debt securities that are being downgraded; the Interest rate risk that the prices of debt securities rise when interest rates fall, whilst their prices fall when interest rates rise; the Policy risk that the changes in macro-economic policies in the US may have an influence over the US’ capital markets and affect the pricing of the bonds in the Fund’s portfolio, which may in turn adversely affect the return of the Fund; the Sovereign debt risk that the Fund’s investment in US Treasury securities may be exposed to political, social and economic risks that the Fund may suffer significant losses when there is a default of the US Treasury; the valuation risk that the valuation of the Fund’s instruments may involve uncertainties and judgmental determinations. If such valuation turns out to be incorrect, this may affect the Net Asset Value calculation of the Fund.

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Underlying Index is subject to concentration risk as a result of tracking the performance of a single geographical region, namely the US, and is concentrated in debt securities of a single issuer, namely the US Treasury. The Fund’s value may be more volatile than that of a fund having a more diverse portfolio and may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the US market.

- The base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the collateral, adverse market movements in the collateral value or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of distributions out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The investment objective of Global X US Treasury 0-3 Moth ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the ICE 0-3 Month US Treasury Bill Index (the “Index”).

- The Fund is exposed to the Credit/Default risk of issuers of the fixed income securities that the Fund may invest in; the Credit Rating risk that Credit ratings assigned by rating agencies are subject to limitations and do not guarantee the creditworthiness of the security and/or issuer at all times; the Interest Rate risk that the prices of fixed income securities rise when interest rates fall, whilst their prices fall when interest rates rise; the Downgrading risk that the Manager may or may not be able to dispose of the fixed incomes securities that are being downgraded; the Sovereign Debt risk that the Fund’s investment in US Treasury securities may be exposed to political, social and economic risks; the Valuation risk that the Fund’s investments may involve uncertainties and judgemental determinations. If such valuation turns out to be incorrect, this may affect the Net Asset Value calculation of the Fund.

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

-The Index is subject to concentration risk as a result of tracking the performance of a single geographical region, namely the United States, and is concentrated in debt securities of a single issuer, namely the US Treasury. The Fund’s value may be more volatile than that of a fund having a more diverse portfolio and may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the United States market. - The base currency of the Fund is USD but one of the trading currencies of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, the Fund must receive cash collateral of at least 100% of the valuation of the securities lent valued on a daily basis. However, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Monthly Commentary

Income ETFs – May 2025

Distribution is not guaranteed. Distribution may be made out of capital. Positive yield does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

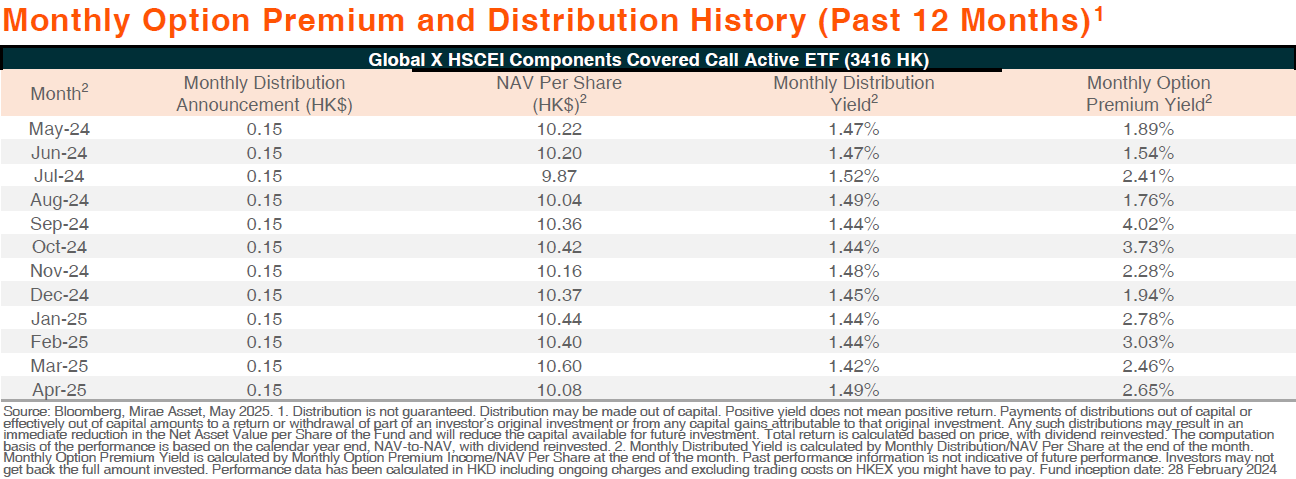

Global X HSCEI Components Covered Call Active ETF (3416)

- Monthly Distribution Paid in April 2025: The ETF distributed HK$0.15 per share on 7 April 2025.

- Monthly Distribution Announcement in April 2025: The ETF announced monthly distribution of HK$0.15 per share on 11 April 2025, to be distributed on 8 May 2025.

- Premium Earned in Apr 2025: Premium earned by selling index call options for the HSCEI edged up to 2.65% in Apr 2025 due to increase in market volatility.

- Total Return: The Year-to-date total return as of 30 April 2025 is 2.26% (including 5.69% distribution return and 3.43% price decline).

For further performance information please visit the 3416 product page

Source: Bloomberg, Mirae Asset, May 2025. The fund inception date: 28 February 2024. Past performance information is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of the performance is based on price, with dividend reinvested. Performance data has been calculated in local currency. Where no past performance is shown there was insufficient data available in that year to provide performance. Where no past performance is shown there was insufficient data available in that year to provide performance. The downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Call Options written, plus the premium received. If a Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Call Options may not be sufficient to offset the loss realized.

Calendar Year Performance

Source: Mirae Asset; April 2025.

| Year | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Fund | — | — | — | — | — |

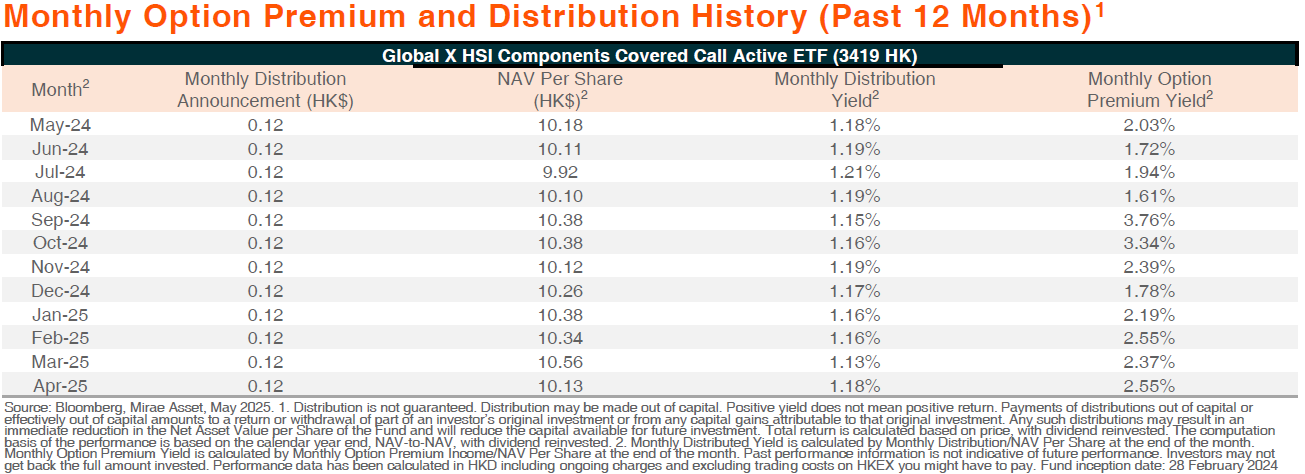

Global X HSI Components Covered Call Active ETF (3419)

Update

- Monthly Distribution Paid in Apr 2025: The ETF distributed HK$0.12 per share on 7 April 2025.

- Monthly Distribution Announcement in April 2025: The ETF announced monthly distribution of HK$0.12 per share on 11 April 2025, to be distributed on 8 May 2025.

- Premium Earned in Apr 2025: Premium earned by selling index call options for the HSI further edged up to 2.55% in Apr 2025 due to increase in market volatility.

- Total Return: The Year-to-date total return as of 30 April 2025 is 2.20% (including 4.60% distribution return and 2.40% price decline).

For further performance information please visit the 3419 product page

Source: Bloomberg, Mirae Asset, May 2025. The fund inception date: 28 February 2024. Past performance information is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of the performance is based on price, with dividend reinvested. Performance data has been calculated in local currency. Where no past performance is shown there was insufficient data available in that year to provide performance. Where no past performance is shown there was insufficient data available in that year to provide performance. The downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Call Options written, plus the premium received. If a Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Call Options may not be sufficient to offset the loss realized.

Calendar Year Performance

Source: Mirae Asset; April 2025.

| Year | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Fund | — | — | — | — | — |

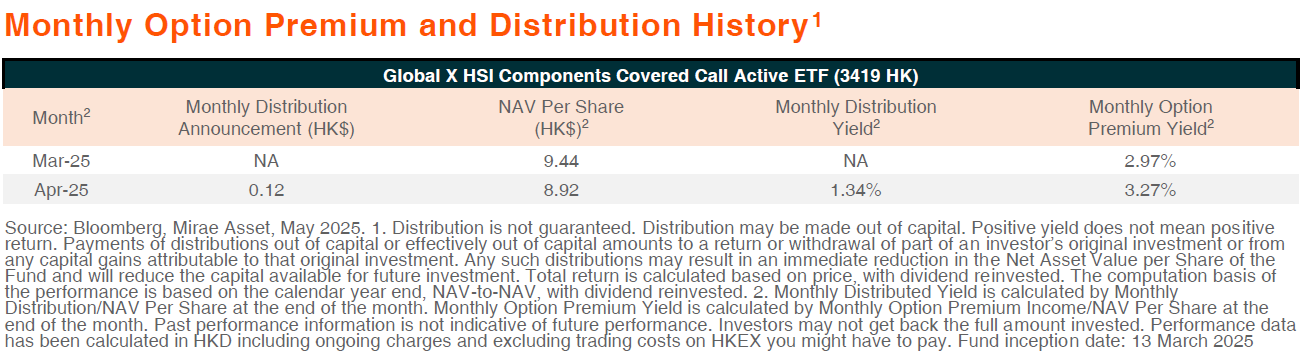

Hang Seng TECH Components Covered Call Active ETF (3417)

Update

- Monthly Distribution Announcement in Apr 2025: The ETF announced monthly distribution of HK$0.12 per share on 11 April 2025, to be distributed on 8 May 2025.

- Apr 2025 Option Premium Yield: Premium earned by selling index call options for the Hang Seng TECH was 3.27% in Apr 2025.

For further performance information please visit the 3417 product page

Source: Bloomberg, Mirae Asset, May 2025. The fund inception date: 13 Mar 2025. Past performance information is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of the performance is based on price, with dividend reinvested. Performance data has been calculated in local currency. Where no past performance is shown there was insufficient data available in that year to provide performance. Where no past performance is shown there was insufficient data available in that year to provide performance. The downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Call Options written, plus the premium received. If a Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Call Options may not be sufficient to offset the loss realized.

Global X Hang Seng High Dividend Yield ETF(3110)

Market Update

Hang Seng High Dividend Yield Index recorded flat return in April 2025, outperforming Hang Seng Index. High dividend stocks demonstrated better resilience during market turbulence in early April caused by escalated US-China trade tension. 3110 HK should be less affected by US tariff due to lower US revenue exposure as compared to other broad-based China market indices, and higher weightings of domestic demand-focused defensive sectors such as banks and utilities. We believe high dividend strategy should remain attractive thanks to solid dividend yields and lower volatility. PBOC’s recently announced and implemented Rmb300bn relending program should drive an increase in corporate share repurchase and enhance overall shareholder returns. In addition, there are potential incremental fund flows from household savings currently deposited in the bank to seek higher yield, as savings rates are falling.

Stock Comments

- CK Infrastructure recorded +12% return in the month, a key contributor to the ETF. The stock declined substantially in March as its proposed sale of Panama ports to US investors caused heated discussion and regulator attention amid intensified US-China geopolitical tensions. The stock recovered majority of its share price loss as global trade uncertainty prompts investors to refocused on dividend strategy.

Preview

Hang Seng High Dividend Yield Index is well positioned to benefit from increasing allocation from global investors amid global market volatility, and the potential dividend tax removal for southbound investors. Notably, this Index consists of over 55% (Bloomberg, September 2024) of its constituents in State Owned Enterprises. Supportive policies across consumption, property, and technology sectors, as well as the ongoing capital market reforms are key drivers for market rebound. The concept of the Valuation System with Chinese Characteristics (“VCC”) is back in the spotlight again in light of recent developments. The primary objective of VCC is to enhance the quality and investment value of listed companies, especially SOEs. By investing in the Hang Seng High Dividend Yield Index, investors can gain exposure to high dividend-paying and low-volatility companies while also benefiting from the accelerated implementation of VCC

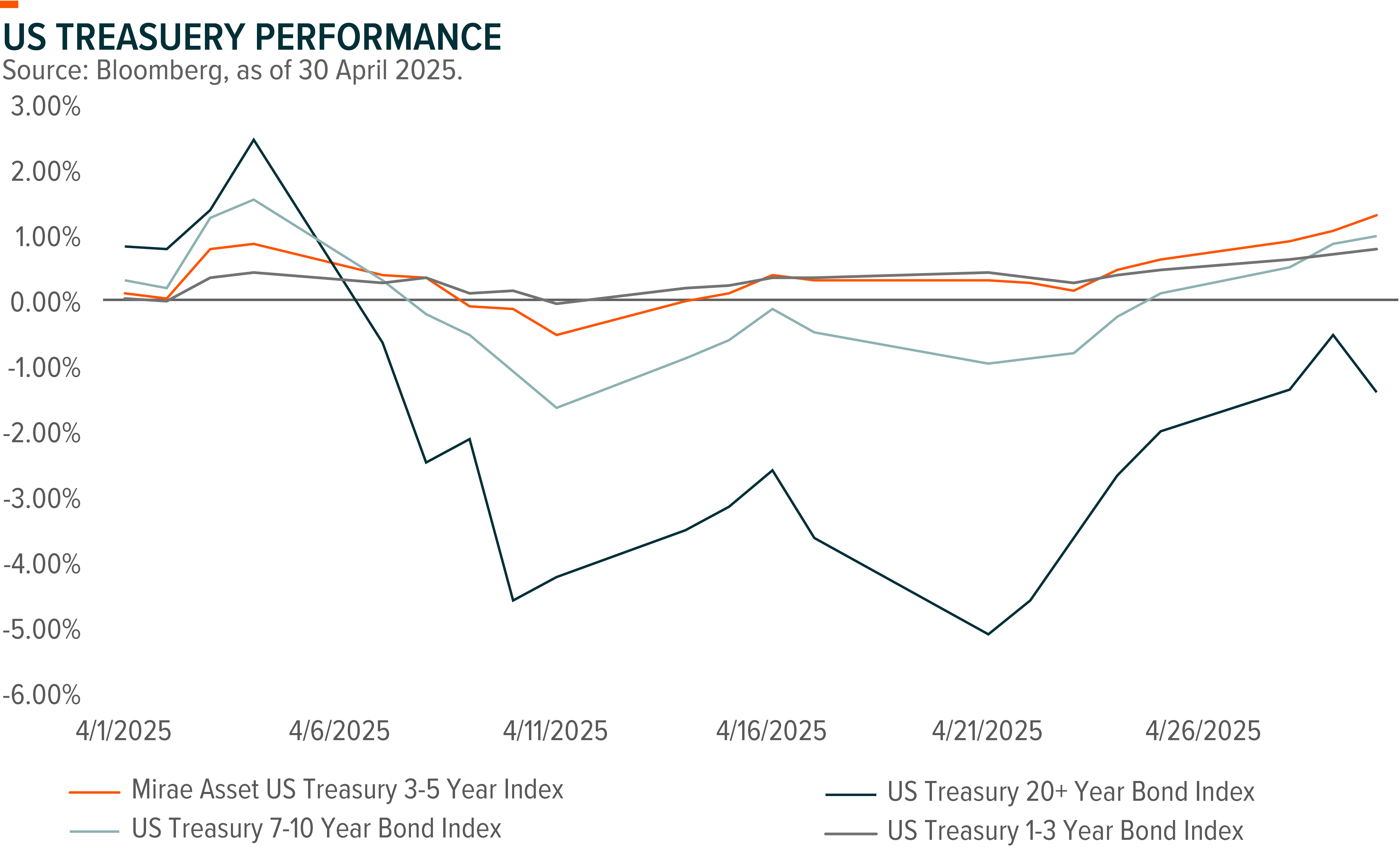

Global X US Treasury 3-5 Year ETF (3450/9450)

April proved to be a volatile month marked by significant market fluctuations. Treasury yields experienced a sharp decline following President Trump’s “Liberation Day” announcement, which accompanied an 8-9% drop in broad equity indices. Even the solid non-farm payroll print failed to alleviate growing recession concerns. Against this backdrop, 3-5y US Treasury yields fell by 25 bps within a single week – the steepest weekly decline since last August. While yields partially recovered in the subsequent week amid a risk-off sell-off of USD-denominated assets, they resumed their downward trajectory after April 11th as policy uncertainty eased, with the Trump administration showing greater flexibility in its trade war stance.

The 3-5 year U.S. Treasury segment performed well in April, posting a 1.29% return. This intermediate sector demonstrated notable resilience, outperforming other tenors while maintaining relatively lower volatility.

Preview

Looking ahead, against the backdrop of slowing economic growth and persistent political uncertainty, we maintain our view that US Treasuries remain an effective hedge against recessionary risks, though their effectiveness varies across the yield curve. As growth expectations continue to moderate, we anticipate the front to intermediate segments of the curve will outperform during this ongoing normalization period. The Global X US Treasury 3-5 Year ETF is particularly well-positioned to capitalize on this capital appreciation opportunity.

Global X US Treasury 0-3 Month ETF (3440)

Market Update

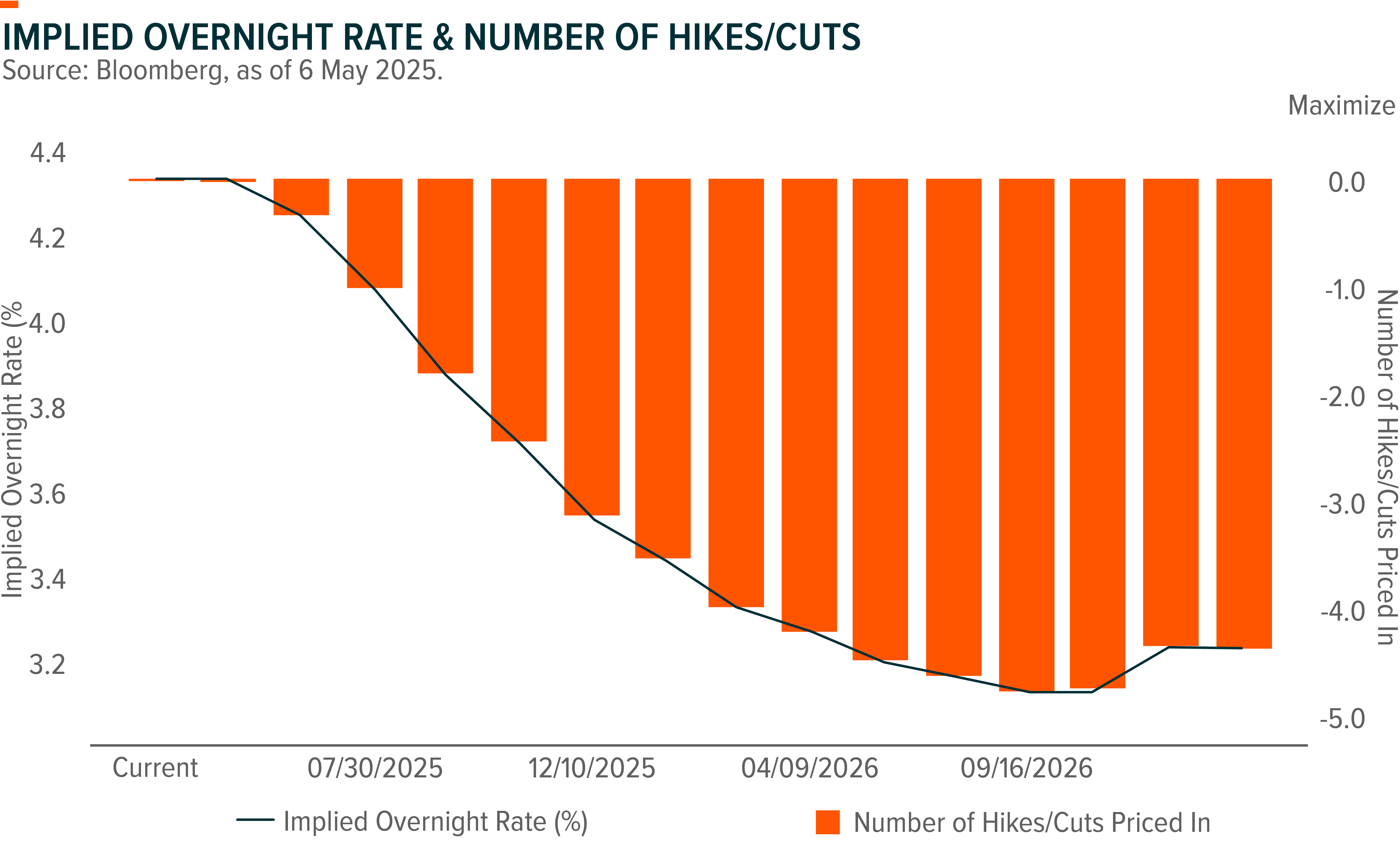

The month of April was a ‘rollercoaster’ of a month, with volatility day in and day out. Markets were driven by daily (or even shorter) headlines regarding tariffs and geopolitical news. While weak sentiment data initially led markets to price in recession risks, subsequent economic releases did not indicate a sharp downturn. The April PMI and ISM services surveys pointed to modest growth, with most ISM components showing slight improvement in recent months. Employment data also remained resilient, with nonfarm payrolls adding 177k jobs in April. Against this backdrop, market expectations for Fed easing moderated, with pricing now reflecting 25 bps of rate cuts by the July FOMC meeting—down from 36 bps a week earlier.

Preview

Given market expectations for a shallower path of Fed easing, the short-end of curve continues to look attractive, particularly in an environment of persistent curve inversion and lingering uncertainty around potential policy shifts under the new administration. In this context, we emphasize maintaining low-rate sensitivity, especially after the significant rate volatility observed year-to-date.

Globally, ultrashort bond ETFs have seen growing assets under management, fuelled by investor demand for yield-generating strategies with relatively low volatility. However, many ultrashort bond funds incorporate securities with embedded credit risk, rather than focusing solely on short-term Treasuries. This makes the Global X U.S. Treasury 0-3 Month ETF a compelling choice for investors seeking pure exposure to short-term US Treasuries, offering liquidity and stability amid ongoing market uncertainty.