Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, annual reconstitution risk, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risk, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, risk of reliance on the Index Calculation Agent, trading difference risk, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X India Select Top 10 ETF’s (the “Fund”) underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Global X K-pop and Culture ETF’s (the “Fund”)The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, equal weighted index risk, risks related to companies with technology themes, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risks, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, trading difference risk, risks associated with ADRs, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks, reliance of the same group risk and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

Monthly Commentary

Global Thematic ETFs – Oct 2024

Global X India Select Top 10 ETF (3184 HK)

Industry Update

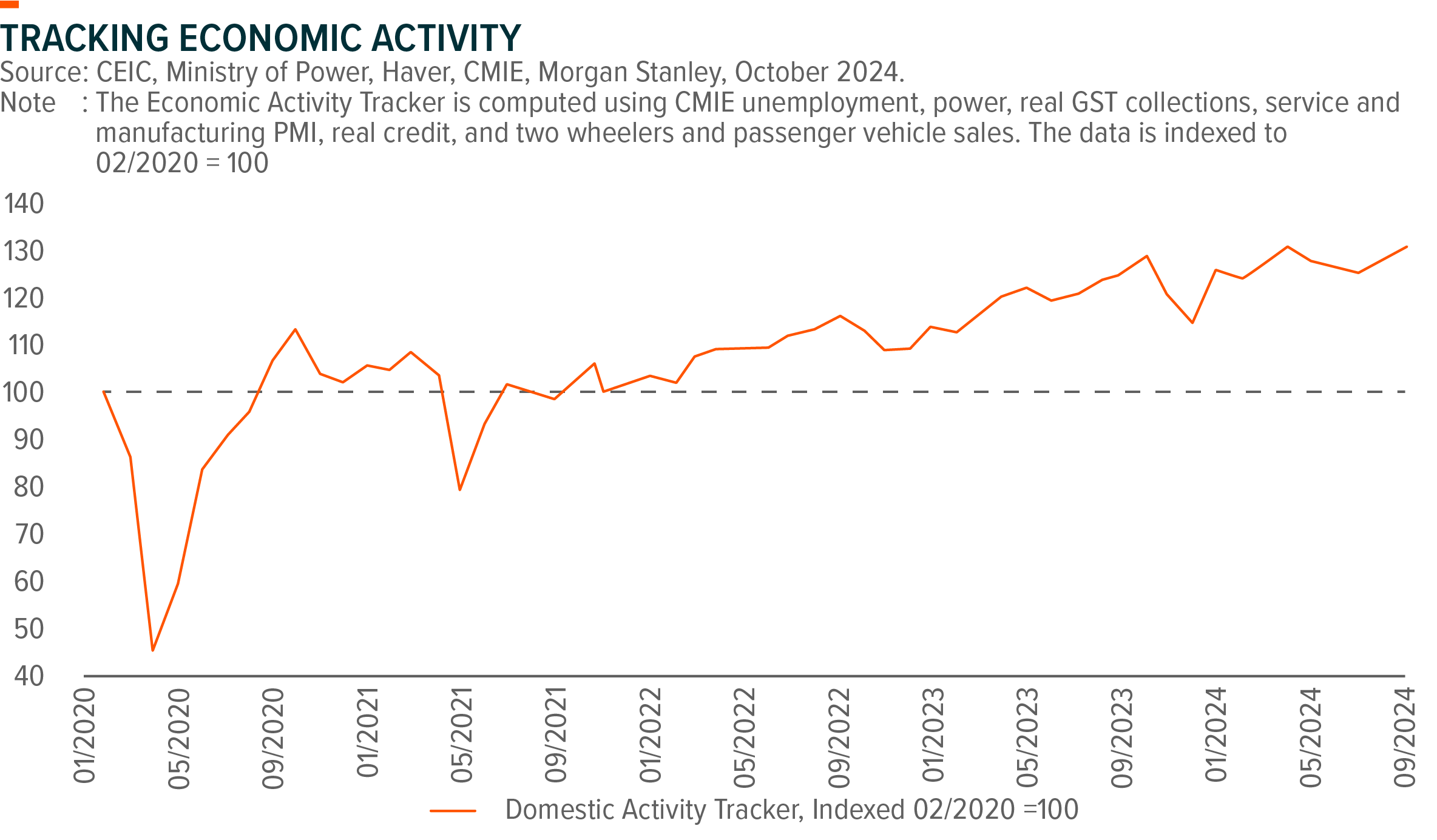

The MSCI India Index was up 2.15% (in USD terms) over the September reporting period. While some of high frequency data showed a moderating growth trend, we believe overall growth trajectory largely remains on track. GST collections for September steadily grew at 6.5%yoy to Rs 1.73tn. Manufacturing PMI softened to 56.5 (vs. 57.5 in Aug) and Services PMI moderated to 57.7 (vs. 60.9 in Aug) but both remained in expansionary zone in September. Passenger vehicle sales turned positive on a yoy basis and two wheelers grew at a faster pace along with rural consumption recovery. Consumer sentiment continued to improve sequentially. Headline CPI inched up to 3.65%yoy in August while core CPI (ex food, fuel) remained steady at 3.4%yoy in August. High frequency food prices for September showed sequential decline across all categories and the favourable trend in monsoon is likely to help prevent unprecedented increase in food prices and support mass consumption recovery. Overall, we still believe a broad-based recovery is on track with rural consumption gaining traction as well as private capex picking up.

Stock Comments

- Bharti Airtel (BHARTI IN) was the major contributor in September thanks to its strong growth outlook post tariff hike. The company reported steady 1QFY25 results with revenues up 3%yoy and EBITDA up 1%yoy. India revenues grew 10%yoy while international revenues were down 15%yoy. Strong net adds of subscribers (2.3mn) and ARPU of Rs 211 (+5%yoy) as well as strong additions in postpaid (+0.8mn) and data subs (6.3mn) supported strong growth in India. The street also started to build in multiple tariff hikes considering competitive landscape and raised ARPU estimates for FY26/27. Moderating CAPEX with rising EBITDA will lead to strong FCF generation, and enable the company to deleverage its balance sheet and support shareholder returns in the next few years.

- Tata Consultancy Services (TCS IN) was the major detractor in September due to concerns demand recovery trend with deal momentum slowing into US elections. TCS commented that demand in the UK was getting incrementally weak and led to weak employee utilization. Also, demand in BFSI also turned incrementally weak in 2QFY25 compared to 1QFY25. That said, manufacturing, healthcare, and regional markets is expected to show sequential growth. In addition, Accenture FY24 results showed an improving revenue trend thus we will have to watch out for Indian IT companies upcoming earnings results and more importantly the managements’ commentary on demand outlook.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Global X K-pop and Culture ETF (3158 HK)

Industry Update

KOSPI declined 3.0% MoM to 2,593 in September, marking its third consecutive month of decline. The daily average turnover dropped 4%. The MSCI KR edged down 2.6%, underperforming peers MSCI APxJ and MSCI EM. Early in September, the KOSPI slipped to the 2,500 level amid a risk-off sentiment as concerns about a potential US recession resurfaced. Additionally, hawkish comments from the BOJ governor intensified foreign exchange volatility, while stocks in the memory sector faced renewed pressure due to worries about peak cycle performance. Heavy selling from foreign investors negatively impacted the KOSPI, as they shifted their investments away from AI and technology stocks in favor of defensive names and laggards in the context of increasing macroeconomic uncertainties. On the other hand, battery materials and consumer staples were big outperformers in September. Later in the month, market levels overall recovered to a high of 2,672 post the Fed’s 50bp rate cut and recovery in China sentiment late-month on the back of new stimulus. Among sectors, Materials, Consumer Staples, Industrials, Energy, Consumer Disc., Internet, Financials, and Healthcare outperformed, while Utilities and Technology underperformed.

Korea’s customs exports increased by 7.5% YoY to US$58.5bn in September, broadly in line with expectations (consensus US$58.1bn). The popularity of ‘K-beauty’ continues to gain traction on the global stage, with exports up 13/11% YoY/MoM to US$782mn in September 24. Total cosmetics exports in 3Q were up 19% YoY, and 3% QoQ to US$2,173mn.

Stock Comments

- Amorepacific (090430 KS): The cosmetics sector has been volatile with multiple factors at play, but recent hope of a China recovery has dominated, bringing a 19% return of Amorepacific in September. Amore’s China restructuring process seems on track and domestic earnings could have a sharp YoY margin recovery with cost tightening and solid online performance (higher margins). Meanwhile, COSRX US sales still look volatile, largely depending on its marketing activities in AMZ. Management has been strategic regarding pricing and profitability, especially as competition has intensified and overall demand has cooled. Nevertheless, COSRX continues to be a crucial growth driver, and rising visibility of China restructuring could support a strong earnings recovery.

- SM Entertainment (041510 KS): SM recorded 7% return in September. The company is currently under transition to multiple production system, led to expanded portfolio of artists. New management team aims to increase the cadence of new artists, and penetrate new market segments. Additionally, the positive momentum with NCT, Aespa, and RIIZE along with new artists pipeline positions the company for continued growth, despite the high comps in 2023. Furthermore, we see potential earnings upside from likely restructuring of subsidiaries, many of which are currently unprofitable. As part of selling non-core assets, SM C&C (ads, travel, management) and KeyEast (actor management) are up for sale in August 2024.

- HYBE (352820 KS): HYBE experienced 8% loss in September, mainly on lingering dispute with ADOR. On September 11, NewJeans members called for Min Heejin to be reinstated as ADOR CEO during a YouTube Live. On September 25, ADOR, the agency representing NewJeans, held a board meeting and decided to extend Min Hee-Jin’s term as a board member, while rejecting her return as CEO. ADOR offered a compromise, proposing that Min continues as a producer of NewJeans, but Min declined. The conflict between HYBE and Min is likely to persist and raises concerns that HYBE could ultimately lose NewJeans from its artist roster.

Preview

Although facing short term fluctuations, we maintain positive on the rise of K-Pop and cultural phenomenon in global market and expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. Beyond that, price competitiveness and compelling value propositions stand out as key factors driving the strong export of Korean consumer goods in the global market, especially under current economic uncertainties and consumer downtrading trend. Recently, optimism surrounding China recovery has raised. However, both the magnitude and timing of China stimulus translating to Korean companies’ earnings remains uncertain. We remain cautious on the impact from China market especially for some companies with meaningful China exposure.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

Stock Comments

Nvidia see strong in demand outlook for 2025 despite delay in Blackwell

CEO Jensen Huang said demand for Blackwell chips has been “insane” and confirmed the chips are in “full production”. Blackwell delays have caused concern for investors, with many looking to the rollout as the next big catalyst for the chipmaker after a recent stock slump fueled by a mid-July sell-off from the unwinding of the yen carry trade. On top of its latest Blackwell update, Nvidia’s move to the upside also comes as the company backed ChatGPT developer OpenAI in its latest funding round. (CNBC)

Google considers sourcing from nuclear power plants

Google is considering how to bring electricity from nuclear power plants to its data centers, CEO Sundar Pichai said in an interview with Nikkei in Tokyo as the tech giant searches for ways to meet the huge energy demands of its artificial intelligence projects. Google’s initiative will likely reignite the development of carbon-free power sources. Toward that end, Pichai also said his company will increase its investment in solar and thermal power. (Nikkei)

Global X Japan Global Leaders 10 ETF (3150 HK)

Industry Update

In September 2024, the FactSet Japan Global Leaders Index recorded loss of 1% in JPY terms 1. Japan stock market started September with a decline on the concerns over US economy, Yen appreciation, and uncertainty over US Tech stocks performance. Subsequently market recovered as Fed delivered a higher-than-expected 50bps cut, and the Yen appreciation concern recede. The new Ishiba administration has turned to a more dovish fiscal stance, and the administration might adopt a market-friendly policy stance that could support market performance.2USDJPY ended September at 144, from 146 as of end August.3

Stock Comments

Hitachi recorded total return of 6% in September, a positive contributor to the ETF. Power grid and domestic System Integration maintains solid performance. Power grid business is benefiting from selling price hike on the back of strong demand, and domestic System Integration business sees growth in digital transformation projects for its energy customers. Hitachi will use proceed from dissolving its air conditioning JV for additional shareholder returns in the future, which should support its share price.

Seven & I recorded total return of 2% in September, a positive contributor to the ETF. Seven & I is reported to be selling its superstore business and its stake in Seven Bank. The proceed could be used for additional shareholder returns or investment for growth, 4 which could benefit the company.

Preview

Japan stock market went through massive volatility over past few months under concern for JPY appreciation and US economy recession. While short term outlook remains uncertain given slowing global economy and potential for Japan-China fund flow on the back of strong China market rally, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging).5

Global X AI & Innovative Technology Active ETF (3006 HK)

Industry Update

Microsoft gives Copilot a voice and vision in its biggest redesign yet

Microsoft is unveiling a big overhaul of its Copilot experience, adding voice and vision capabilities to transform it into a more personalized AI assistant. Copilot is being redesigned across mobile, web, and the dedicated Windows app into a user experience that’s more card-based and looks very similar to the work Inflection AI has done with its Pi personalized AI assistant. (The Verge)

OpenAI raised $6.6 billion from investors, which could value the company at $157 billion

The funding has attracted returning venture capital investors including Thrive Capital and Khosla Ventures, as well as OpenAI’s biggest corporate backer Microsoft, opens new tab, and new participation from Nvidia. The company is on pace to generate $3.6 billion in revenue this year on mounting losses of over $5 billion. It projects major revenue jump next year to $11.6 billion, according to sources familiar with the figures. (Reuters)

Stock Comments

Tencent recorded + 15.42% return. Tencent continue to dominate China’s online consumer market in terms of revenue size and traffic volume. Most of its services rank in the top three by user base. Tencent delivered much strong than peers ads growth of +20% YoY in 2Q, driven by Wechat verticals – VA, OA and mini programs.

China tech sector rallied on stimulus package from the government. Including a combination of monetary policy, sector specific policy and likely followed by fiscal policy. The market turns more positive on the China tech sector, where valuation was significantly below historical average due to demand slow down concerns.

Global X Electric Vehicle and Battery Active ETF (3139 HK)

Industry Update

China’s policymakers announced a series of stimulus policies in the last three weeks to boost domestic housing, consumption and equity markets. Feedback from channels showed strong auto consumption acceleration before and during Golden Week Holidays in both auto sales volume and single ticket size, maybe driven by the wealth effect and people having more confidence on economy going forward after stock market rally. Some brands shared in the preliminary holiday sales results that auto sales jumped up on the single day of 1 October 2024 that was equal to almost the whole-week sales early before.

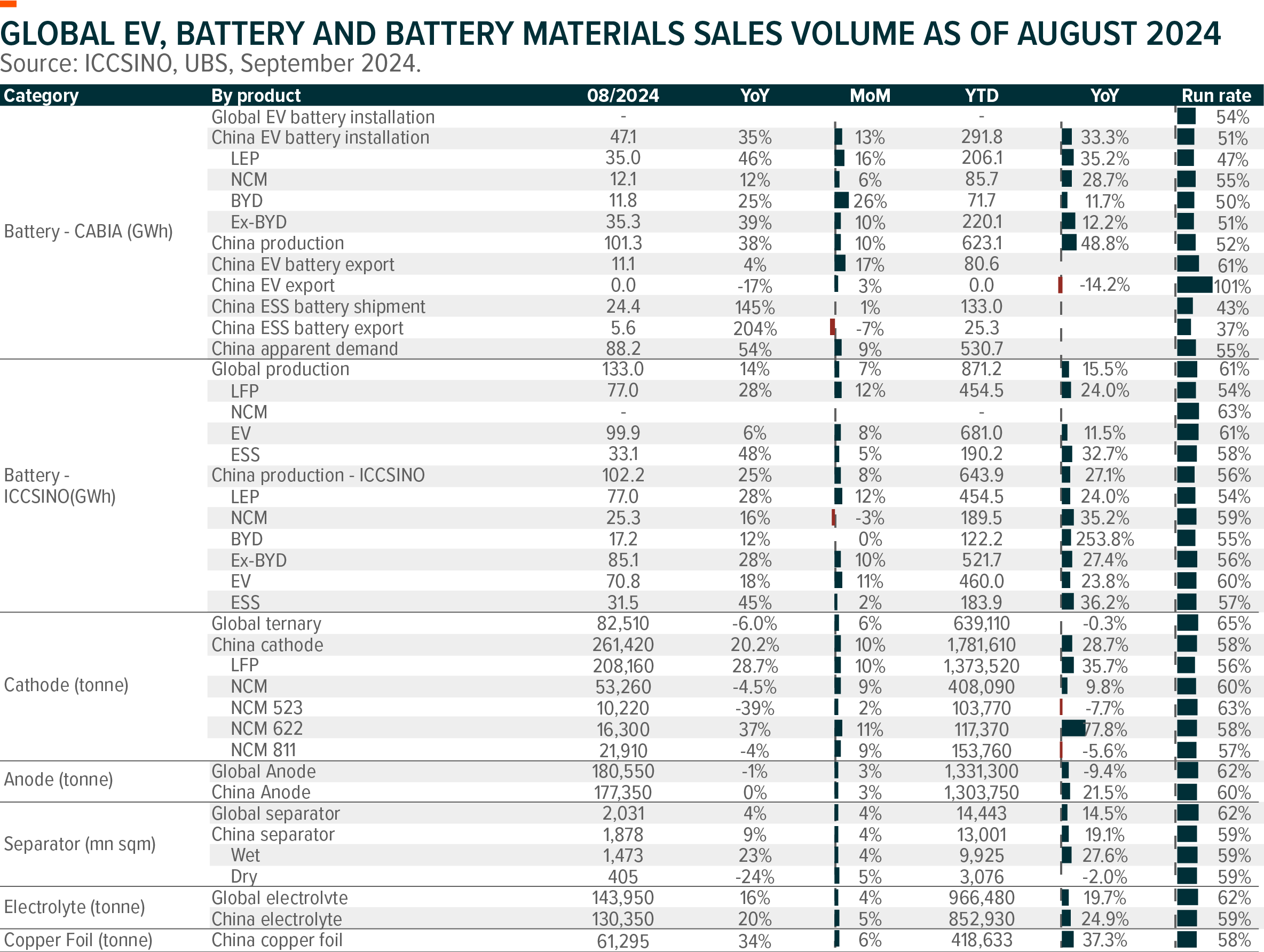

CPCA announced China’s August EV wholesales of 1.05mn units, +32%yoy and +11%mom, sending 8M24 wholesales to 6.6mn units, +30%yoy. August BEV sales is 591k units and PHEV 460k units. During 8M24, BEV sales reached 3.83mn units, +7%yoy, while PHEV 2.78mn units, +85%yoy. August xEV penetration rate reached 48.7%. China’s August battery production recorded at 101.3GWh, +37%yoy and +10.4%mom, and xEV battery installation 47.2GWh, +35%yoy and +13.5%mom, respectively. Industry has been accelerating production and installation in September driven by restocking for traditional peak season, coupled with ongoing xEV trade-in and stimulus policies.

Lithium carbonate prices have come down to below Rmb80,000 per ton, which is much close to most lithium producers’ production cost. We have seen some high-cost production suspended recently in China and spodumene mine tendering slowdown/prices decline in Australia. EV/battery production cost cutting from lithium-related raw materials would be limited from here.

Stock Comments

Ganfeng Lithium: CATL suspended their high-cost lithium production in China, implying positive signals on lithium supply. Additionally, we saw lithium carbonates prices rebound after China’s stimulus polices.

BYD: The company delivered strong Q2 results with double-digits growth in top line and bottom line. BYD is gaining market share in and outside China, with price-competitive xEV models. They also guided up their auto sales to 5 million units in 2025.

Preview

We didn’t change our long-term view that global EV transition is a visible decade growth story in most of the major economies such as Europe, China, ASEAN, South America and the Middle East regions. Some of Chinese leading EV makers have shown the early signs of competitiveness in global competition and continuously gained market share from legacy automakers in China and outside China. As one of the key beneficiaries, the worst time is behind for battery sector, though it takes time for bottom-out. We expect more M&As and capacities exit in battery and battery materials industries. Auto semiconductor industry would be another key beneficiary in spite of slowdown in the near term. Leading companies’ technology competitiveness remain solid in the foreseeable future. Yet, we have also seen some early signals of new entrants’ catch-up. China’s recent stimulus policies are definitely positive to the whole value chain globally. However, we will be more cautious on individual stocks going forward after stocks rallied too much in a short period of time. It takes time for fundamentals to match the valuation expansion.