Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, annual reconstitution risk, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risk, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, risk of reliance on the Index Calculation Agent, trading difference risk, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X India Select Top 10 ETF’s (the “Fund”) underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Global X K-pop and Culture ETF’s (the “Fund”)The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, equal weighted index risk, risks related to companies with technology themes, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risks, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, trading difference risk, risks associated with ADRs, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks, reliance of the same group risk and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

Monthly Commentary

Global Thematic ETFs – Nov 2024

Global X India Select Top 10 ETF (3184 HK)

Industry Update

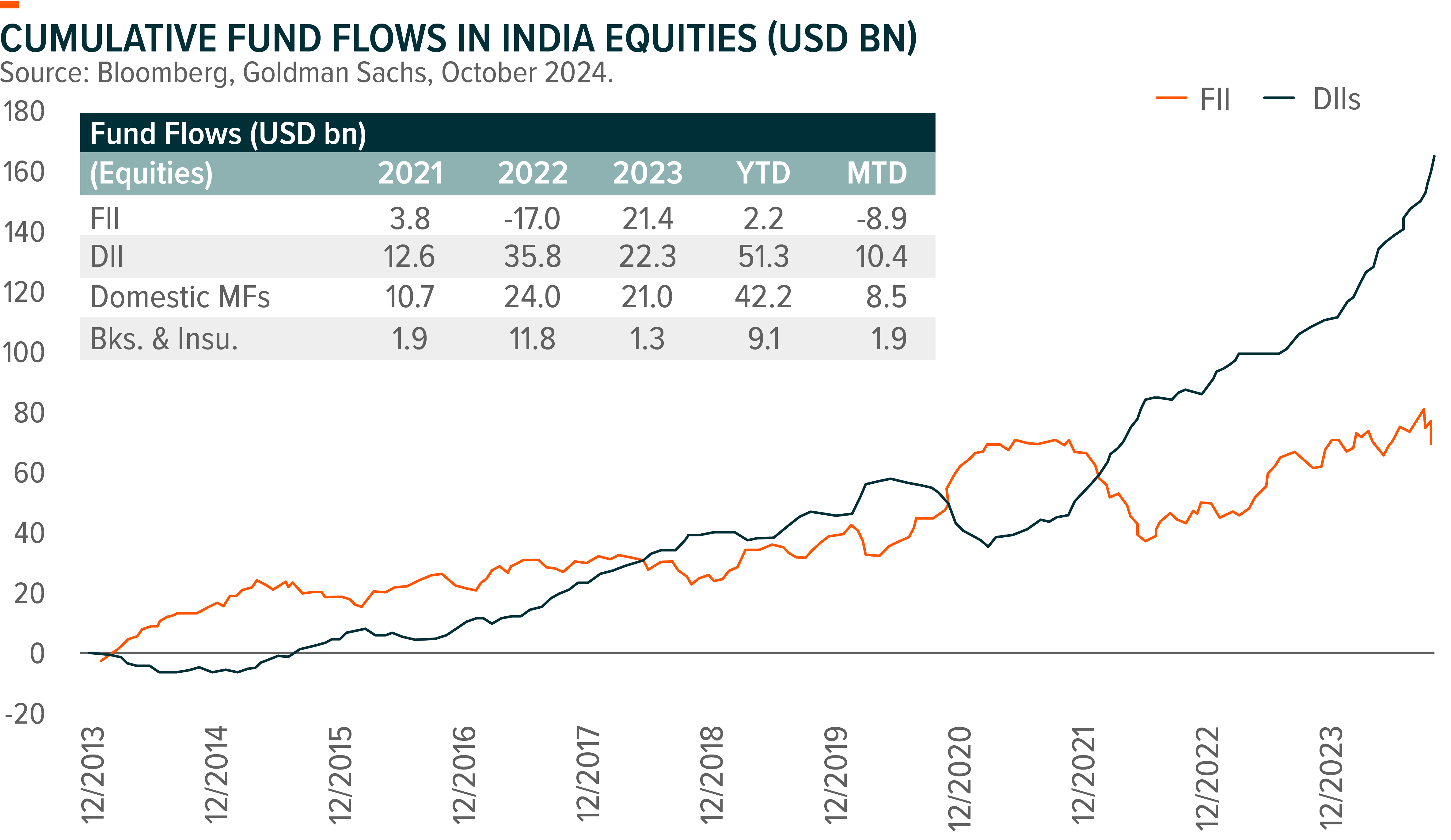

The MSCI India Index fell 7.7% (in USD terms) over the October reporting period amid global equities correction with MSCI World declining 2.3% during the same period. India small-caps, mid-caps, and large-caps declined by 3.8%, 8.0% and 7.3% respectively during the month. Growth indicators weakened on a sequential basis largely due to seasonal factors and festival related calendar changes. Thus far 60% of MSCI India companies have reported of which 30% has been a beat while 41% has been a miss. In terms of sectors, IT and Financials particularly Private Sector Banks delivered decent earnings growth, while Commodities like Oil and Gas, Cement and other Materials sectors have been a drag on earnings. Headline CPI rose to 5.5%yoy in September while core inflation remained range bound at low levels of 3.6%. Food inflation picked up and October CPI is expected to come higher than that of September as usual, but the strong monsoon is likely to help prevent unprecedented increase in food prices after peaking in October. Indian equity flows from foreign investors ended with a net selling of USD 10.4 billion (vs. USD +5.9 billion in September) marking the highest monthly outflow, while domestic institutional investors maintained their buying trend by net buying USD 12.8 billion (vs. USD +3.8 billion in September).

Stock Comments

- ICICI Bank (ICICIBC IN) was the major contributor in October thanks to its strong 2QFY25 earnings results. The company reported a beat led by strong loan growth, modest opex growth and benign credit cost. The company managed delinquency in unsecured loans better than its peers. The bank’s loan book grew healthily at 4.4%qoq or 15%yoy driven by strong momentum across retail business and SME. Deposit book grew 5%qoq and 15.7%yoy with CASA growing at 4.3% as the company focused on acquiring quality customers and try to become their primary bank. The management des not expect cost of funding to increase much from here. PAT grew 15%yoy in 2QFY25 and the street revised up its earnings forecast post the result.

- Hindustan Unilever (HUVR IN) was the major detractor in October due to below expectation 2QFY25 results. Volume grew +3% which came in below the street expectations. Revenue, EBITDA, and Adjusted PAT grew 3%, 3%, and 2% respectively during the quarter. While rural consumption is keep improving gradually, it was not enough to offset slowdown in urban mass consumption. This has seen across staples sectors and led to overall underperformance of staples sector during the month. In addition, a robust growth of quick commerce channel increased competition for traditional FMCG companies as this reduced big FMCG companies’ distribution moat in traditional channel.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Global X K-pop and Culture ETF (3158 HK)

Industry Update

KOSPI declined 1.4% MoM to 2,556 in October, marking its fourth consecutive month of declines. Daily average turnover was US$12bn, flat MoM, with retail participation rising to 62%. The MSCI KR (in USD terms) declined by 6.8%, underperforming its peers: MSCI APAC fell 4.6%, and MSCI EM dropped 4.4%.

Throughout October, market attention was primarily drawn to the significant rise in global interest rates, 3Q earnings, external developments such as the China rally and the upcoming US elections, and the activities of activist funds and corporations. Sentiment surrounding the US elections shifted over the past month, with sectors like Banks (benefiting from potentially higher rates if there is a Republican sweep), Defense (poised to gain from increased global defense spending under Trump), and EV batteries/materials (expected to benefit from broader subsidies and stimulus under a Democratic administration) receiving varying levels of investor interest. China’s rally in September peaked early in October before experiencing a pullback, which alleviated some outflow pressure in Korea; however, foreign investors still recorded net sales for the month. Sector performance varied, with Utilities, Financials, and Communication Services outperforming, while Discretionary, Materials, and Staples underperformed. Tech stocks rebounded, performing in line with expectations after two months of significant underperformance.

Stock Comments

- HYBE (352820 KS): HYBE recorded 10% return in October thanks to improving market sentiment, suggesting that the worst may be behind the K-pop sector. Increased expectations for Weverse monetization and the resumption of concerts in China further contributed to this positive outlook. Looking ahead to 2025, the likely reunion of BTS in the second half of the year will be a key focus.

- NCsoft Corporation (036570 KS): NCsoft recorded 14% return in October, driven by the global success of TL and improving momentum with LM in Korea. This positions the company to potentially generate an annual OP of W100bn. With over W3tn in cash and marketable securities following the sale of its commercial building, we believe there is limited downside to the current market capitalization of W4.6tn. Additionally, with four confirmed new titles set for release through 2025, we see the risk-reward balance tilting favorably toward the upside.

- CJ ENM (035760 KS): CJ experienced 10% loss in October. Over the past three years, CJ ENM has invested approximately W500bn into its streaming platform, TVing, with a significant portion allocated to content production. However, this initiative now faces a substantial risk, as TVing may lose essential user traffic support from Naver. Starting in November 2024, Naver will include Netflix in its Plus Membership offerings, allowing subscribers to select only one content provider. As a result, about 2 million of TVing’s total 7 million MAUs within Naver’s ecosystem may migrate to Netflix. Additionally, CJ ENM’s TV advertising revenue has declined by DD% YoY for eight consecutive quarters, implying a structural downtrend.

Preview

Although facing short term fluctucations, we maintain positive on the rise of K-Pop and cultural phenomenon in global market. Recent hit track APT by Rose and Bruno Mars, along with Han Kang’s Nobel Prize win in Literature, have significantly raised global awareness of K-pop culture. We expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. that, price competitiveness and compelling value propositions stand out as key factors driving the strong export of Korean consumer goods in the global market, especially under current economic uncertainties and consumer downtrading trend. Recently, optimism surrounding China recovery has raised. However, both the magnitude and timing of China stimulus translating to Korean companies’ earnings remains uncertain. We remain cautious on the impact from China market especially for some companies with meaningful China exposure.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

Industry Update

TSMC posted strong 3Q result and 4Q guidance

3Q strong beat on GPM: 3Q24 GM exceeded its high-end guidance of 55.5%, to 57.8% (vs cons. Of 54.8%), with 4Q24 GM guidance coming in at 58% (at the midpoint; vs cons. of 54.7%) We believe this is driven by higher UTR (Utilisation Rate) in N5/N3, and slower than expected depreciation growth potentially due to slower ramp of oversea fabs. We think the N5 UTR likely exceed 100% in 3Q and will continue to stay at this level in 4Q.

4Q guidance beat: For 4Q24E, management guided revenue to be in the range of US$26.1-26.9bn. GM in the range of 57.0-59.0%, and OpM in the range of 46.5-48.5%. The margin guidance was well above street expectations due to higher utilisation rate.

(Mirae, company data)

Google remains positive on Cloud growth outlook

Strong Q3 results within Google Cloud segment, including revenues +35% YoY driven by AI-related workloads & Gen-AI products continuing to scale. Management provided positive commentary on both AI overviews (incremental to engagement/query growth & positive early monetization trends) and YouTube subscriptions.

Global X Japan Global Leaders 10 ETF (3150 HK)

Industry Update

In October 2024, the FactSet Japan Global Leaders Index recorded return of 2% in JPY terms1. Japan market was volatile in October due to US and Japan political events, yet the global economic cycle and JPY depreciation supported the market. Japan market rebounded in the first half of October on the back of easing concern over the policy continuity under the new Ishiba administration. However, the market weakened in the second half of the month due to growing speculation that Japan’s ruling coalition would lose its majority in the snap Lower House election called by Prime Minister Ishiba right after taking office. The market rebounded at month end driven by yen depreciation and solid US economic indicators. USDJPY ended October at 152, from 144 as of end September.2

Stock Comments

Fast Retailing recorded total return of 4% in October, a positive contributor to the ETF. Fast Retailing reported solid FY8/24 results after the close on October 10. Consolidated business profits grew by 27% YoY and higher than previous guidance. 4Q business remains solid in Europe, North America, and Southeast Asia. FY8/25 guidance calls for consolidated business profits of ¥530 bn, +9% yoy, also higher than market expectations.

Canon recorded total return of 6% in October, a positive contributor to the ETF. Canon reported lower-than-expected 3Q operating profit of ¥98.2 billion, and lowered FY2024 guidance. 3Q miss was mainly due to the medical and imaging segments. The expense cut was more than expectation. Restructuring was going well at sales companies, and restructuring benefits will come later from FY12/26. Canon targets to complete expense improvements and ensure mid-term plan is achieved in FY12/25.

Preview

Japan stock market went through massive volatility over past few months under concern for JPY VOLATILITY and US economy recession. While short term outlook remains uncertain given slowing global economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging).3

Global X AI & Innovative Technology Active ETF (3006 HK)

Industry Update

OpenAI launched search function in ChatGPT

OpenAI released its highly anticipated search product, ChatGPT Search, to take on Google. The company is enabling real-time information in conversations for paid subscribers (along with SearchGPT waitlist users). Rather than launching as a separate product, web search will be integrated into ChatGPT’s existing interface. The feature determines when to tap into web results based on queries, though users can also manually trigger web searches. ChatGPT’s web search integration finally closes a key competitive gap with rivals like Microsoft Copilot and Google Gemini, which have long offered real-time internet access in their AI conversations. (OpenAI, Verge)

Anthropic Unveils New AI Model with Computer Use Capability

Anthropic recently announced a significant upgrade to its Claude 3.5 Sonnet model and introduced a new Claude 3.5 Haiku model. One key update is a new “computer use” capability, currently in public beta, which allows Claude to interact with computer interfaces as a human would—moving cursors, clicking buttons, and typing text. This feature can automate multi-step processes, such as form-filling and spreadsheet management, marking a significant step toward more advanced workflow automation. (Telecom Talk)

Stock Comments

NVIDIA + 9.32%

Supply chain indicate on track ramp for Nvidia’s Blackwell platform in 2025. Initial production issues are behind the company and there is high conviction in prior guidance that they will have several billion in Blackwell revenue in the January quarter. Any new Blackwell orders now that aren’t already in queue will be shipped late next year, as they are booked out 12 months or so, which continues to drive strong short term demand for Hopper which will still be a major factor though the year.

TSMC +9.71%

3Q strong beat on GPM: 3Q24 GM exceeded its high-end guidance of 55.5%, to 57.8% (vs cons. Of 54.8%), with 4Q24 GM guidance coming in at 58% (at the midpoint; vs cons. of 54.7%) We believe this is driven by higher UTR (Utilisation Rate) in N5/N3, and slower than expected depreciation growth potentially due to slower ramp of oversea fabs. We think the N5 UTR likely exceed 100% in 3Q and will continue to stay at this level in 4Q.

4Q guidance beat: For 4Q24E, management guided revenue to be in the range of US$26.1-26.9bn. GM in the range of 57.0-59.0%, and OpM in the range of 46.5-48.5%. The margin guidance was well above street expectations due to higher utilisation rate. 4

Global X Electric Vehicle and Battery Active ETF (3139 HK)

Industry Update

China’s policymakers announced a series of stimulus policies since late September which boosted equity market as well as people’s confidence on big ticket-size consumption. Thus, we witnessed strong auto sales in October in China. CPCA announced China’s September xEV wholesales of 1.23mn units, +48%yoy and +17%mom, sending 9M24 wholesales to 7.91mn units, +33.7%yoy. The preliminary October xEV sales number would be further accelerating to 1.4mn units, +58%yoy and +14%mom, driven by China’s recent economy stimulus policies. September BEV sales is 723k units and PHEV 508k units. During 9M24, BEV sales reached 4.6mn units, +11.3%yoy, while PHEV 3.3mn units, +86.5%yoy. xEV penetration rate stayed above 50%.

In the US side, as we get closer to Presidential election, there are arising concerns on removal of IRA consumer tax credit (up to US$7,500/vehicle) and more tariff on all imported EV and battery goods from Asian manufacturers. US September and October auto sales were mild recovery, while BEV penetration stayed around 8~9% thanks to affordability, limited product offerings and consumers’ reticence to change their behavior. HEV penetration should continue to outgrow BEV going forward.

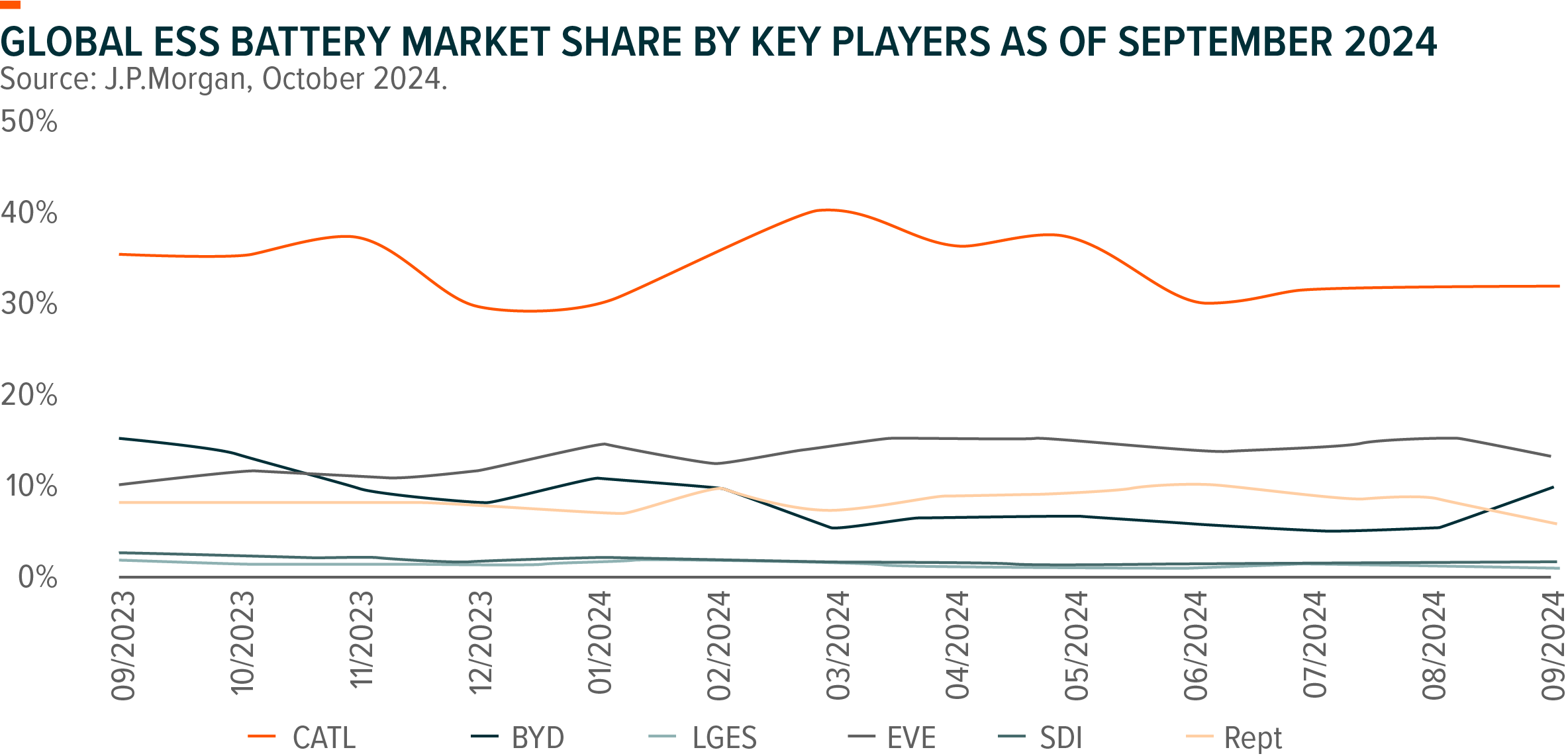

Global battery market continues to see robust growth YTD, in which energy storage battery installation and shipment maintain 50%+yoy growth, much faster than EV battery, driven by strong renewables demand in the major economies like the US and Europe. Chinese battery makers have been dominant in ESS battery market, on account of the cost competitiveness of LFP batteries. CATL is ranked top 1, followed by EVE energy and BYD.

Stock Comments

CATL: Company delivered solid Q3 results with gross margin improved. CATL has been continuously gaining market share globally despite global EV demand headwinds.

BYD: The company delivered strong Q3 results with 2024 and 2025 sales volume revised up. BYD is gaining market share in and outside China, with price-competitive xEV models.

Preview

We didn’t change our long-term view that global EV transition is a visible decade growth story in most of the major economies such as Europe, China, ASEAN, South America and the Middle East regions. Some of Chinese leading EV makers have shown the early signs of competitiveness in global competition and continuously gained market share from legacy automakers in China and outside China. As one of the key beneficiaries, the worst time is behind for battery sector. We expect more M&As and capacities exit in battery and battery materials industries. China’s recent stimulus policies are definitely positive to the whole value chain globally. We will be selective on the most innovative players in each segment along the value chain who have partnership with the most successful EV models.