Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, annual reconstitution risk, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risk, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, risk of reliance on the Index Calculation Agent, trading difference risk, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X India Select Top 10 ETF’s (the “Fund”) underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Global X K-pop and Culture ETF’s (the “Fund”)The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, equal weighted index risk, risks related to companies with technology themes, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risks, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, trading difference risk, risks associated with ADRs, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks, reliance of the same group risk and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

Monthly Commentary

Global Thematic ETFs – Dec 2024

Global X India Select Top 10 ETF (3184 HK)

Industry Update

The MSCI India Index was down 0.39% (in USD terms) over the November reporting period outperforming the MSCI APxJ/EM Indices. India market remained weak in the 1H November due to concerns over global growth, mixed festive season, and soft 2QFY25 earnings results but the market sentiment recovered in 2H of the month in anticipation of policy continuity post Maharashtra elections.

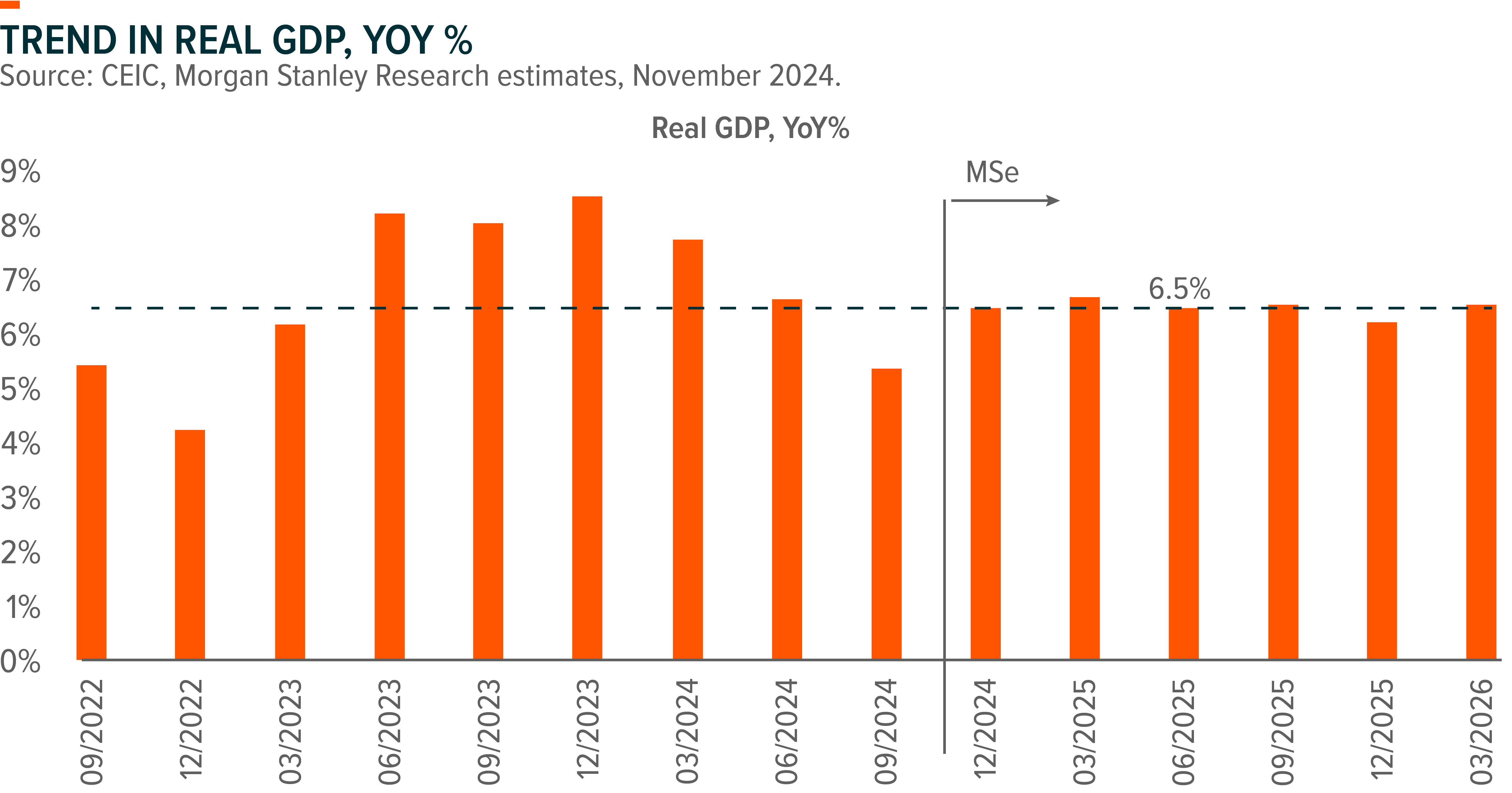

India GDP growth moderated to 5.4%yoy in 3QCY24 which came in below the street expectation of 6.5%yoy, leading to 1HFY25 GDP growth of 6%yoy. Slowdown was mainly driven by CAPEX as well as private consumption. Consumption grew 6%yoy while CAPEX merely grew 5.4% while net exports contributed positively. CAPEX growth slowdown was well anticipated due to the general election and we have already witnessed the uptick in government spending from September onwards, thus we expect growth to have bottomed out and rebound in 2HFY25. October CPI rose to 6.2% largely driven by higher food prices and the RBI maintained policy rate at 6.5% and kept neutral stance. November inflation is likely to remain around the 5.5-5.7% level and expected to gradually moderate thereafter considering higher output for summer crop production and likely gains in winter crop. This may give a room for the RBI to start an easing cycle from 1QCY25 onwards. Indian equity flows from foreign investors ended with a net selling of USD 2.6 billion (vs. net selling of USD 10.4 billion in October), while domestic institutional investors maintained their buying trend by net buying USD 5.3 billion (vs. USD +12.8 billion in October).

Stock Comments

- Tata Consultancy Services (TCS IN) and Infosys (INFO IN) were the major contributor in November on the back of positive demand environment and outlook for Indian IT services. The market sees a Trump win as the start of strong up cycle for the sector considering tax cut and strong US GDP will lead to strong order book and benefit Indian IT services companies.

- Sun Pharmaceutical (SUNP IN) was the major detractor in November due to Sun Pharma’s Leqselvi launch getting delayed. The US district court of New Jersey has blocked the launch of Sun Pharma’s Alopecia Areata drug Leqselvi by granting a preliminary injunction to Incyte Corp. The delay led to earnings cut of 3-6% for the company but also increased concerns on competitive dynamics as the competing molecules will have relatively long term clinical data by the time Sun Pharma’s drug comes into the market.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Global X K-pop and Culture ETF (3158 HK)

Market Update

In November, KOSPI declined 3.9% MoM to 2,456, marking five consecutive months of decline. The Korean market underperformed peer markets with MSCI KR (in USD terms) declining by 6.0%, while MSCI APAC and MSCI EM fell by 1.4% and 3.7% respectively. Despite the overall volatility of Korean market, the entertainment sector has experienced a strong rally this month, with four leading players – HYBE, YG, SM and JYP – recording 5%, 25%, 20% and 56% growth in November, respectively. HYBE’s performance was relatively subdued due to NewJeans’s announcement on Nov 28 to leave ADOR (Link). We see this situation raises the possibility of NewJeans leaving HYBE, which could negatively affect HYBE’s earnings in the short term; however, we remain constructive on HYBE’s 2025 outlook, driven by BTS’s return, younger artists ramping up and improved monetization of Weverse. The overall strong performance of the entertainment sector can be attributed to a few key factors: 1) the industry’s resilience to potential tariff hike post Trump’s re-election: if the Trump administration implements universal tariffs, it could pose challenges to the export-oriented Korean economy, but the realm of fandom remains largely unaffected by such tariffs; 2) improving fundamental in 2025, fuelled by top artists’ comeback (namely Blackpink and BTS), China rebound, low base and improved monetization. We also see K-pop is regaining traction recently, as Blackpink’s Rosé and Bruno Mars are topping the charts with their collaboration song “APT”, generating fresh buzz for Korean culture.

Stock Comments

- JYP (035900 KS): JYP recorded 56% return in November thanks to sector-wise rebound and strong 3Q results. JYP’s 3Q24 revenue came in at W170bn (+22.1% YoY), 8.0% above consensus, thanks to robust merchandise sales of W50bn. Operating profit came in at W48bn, 24.1% above consensus, led by the strong top-line growth and increased profit contribution from JYP360 (a subsidiary handling goods sales online). Major artists, such as Stray Kids and Twice, are improving their revenue contributions to JYP recently. Stray Kids have been conducting their third world tour in Asia/Australia in Aug-Dec 2024 and plans to announce concerts in the Americas/Europe in 2025 to further expand a global fan base. They will also release a regular album in Japan and special album in 4Q24. Twice’s Misamo unit plans to host dome tours in Japan and collaborate with a global artist.

- YG Entertainment (122870 KS): YG recorded 25% return in November, driven by sector-wise rebound and constructive 2025 outlook. YG’s growth next year will be driven by Blackpink’s comeback, with the next tour expected to match or exceed the prior tour’s attendance. Additionally, legacy groups 2NE1, Treasure, and Winner are set to add revenue contributions, with 2NE1’s 15th-anniversary Asia tour kicking off in Oct 2024 and Winner’s new album expected following its members being discharged from military service in Dec. 2024 was a tough year for YG due to the lack of artists’ activities, but its artist line-ups are poised to come back in 2025.

- Kolmar (161890 KS): Kolmar experienced 26% loss in November. Kolmar reported W627bn revenue (+21% YoY) and W55bn OP (+76% YoY) in 3Q24. OP was 7% below consensus, mainly due to 1) -1% YoY OP growth at HK Inno N (due to intensified competition in hangover cure products); 2) weaker margin at Kolmar Wuxi (due to flattish revenue growth) & 3) larger-than-expected operating loss at Kolmar US (mainly due to W4bn inventory write-off). Korea cosmetics business delivered strong OP growth of +185% YoY driven by +47% YoY revenue growth and margin expansion. Kolmar provided constructive comments on Korea cosmetic biz outlook but muted comments on overseas cosmetic biz for 2025

Preview

Although facing short term fluctucations, we maintain positive on the rise of K-Pop and cultural phenomenon in global market. Recent hit track APT by Rose and Bruno Mars, along with Han Kang’s Nobel Prize win in Literature, have significantly raised global awareness of K-pop culture. We expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. that, price competitiveness and compelling value propositions stand out as key factors driving the strong export of Korean consumer goods in the global market, especially under current economic uncertainties and consumer downtrading trend. Recently, optimism surrounding China recovery has raised. However, both the magnitude and timing of China stimulus translating to Korean companies’ earnings remains uncertain. We remain cautious on the impact from China market especially for some companies with meaningful China exposure.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

Microsoft: Microsoft delivered solid 1Q25 results. 1Q25 beat: Revenue growth of 16% YoY, ~200bps ahead of consensus of ~14% YoY growth. Azure and other cloud services revenue grew 33% and 34% in constant currency with healthy consumption trends that were in line with expectations.

Overall commercial bookings growth of 30% YoY reported or 23% in constant currency (cc), as well as 17% YoY growth in current remaining performance obligations (cRPO) well illustrate Microsoft share gains in a tepid software spending environment.

Management guided Q2 Azure revenue growth to be 31% to 32% in constant currency driven by strong demand for its portfolio of services. Management expects total GenAI revenue to exceed a $10 billion annualised run-rate in 2Q25. (Mirae, Company data)

NVIDIA: Supply chain indicate on track ramp for Nvidia’s Blackwell platform in 2025. Initial production issues are behind the company and there is high conviction in prior guidance that they will have several billion in Blackwell revenue in the January quarter. Any new Blackwell orders now that aren’t already in queue will be shipped late next year, as they are booked out 12 months or so, which continues to drive strong short term demand for Hopper which will still be a major factor though the year.

Amazon: Amazon reported better-than-expected earnings and revenue for the third quarter, driven by growth in its cloud computing and advertising businesses. In cloud, Amazon Web Services revenue was a hair below consensus estimates, but it’s growing faster than the same period last year. Sales grew 19% during the quarter compared to a year ago when sales accelerated by 12%. Profitability shined, as AWS margins were 400bp better than expected. This led to a $1bn (11%) better than expected AWS EBIT result.

BYD: The company actually delivered very strong EV sales in the recent few months. Market may be worried about sales slowdown in early 2025 when subsidies exit for a short period of time, taking profits as a result.

Global X Japan Global Leaders 10 ETF (3150 HK)

Industry Update

In November 2024, the FactSet Japan Global Leaders Index recorded flat returns in JPY terms1. November opened with Trump trade rally, but later declined on relatively weak corporate earnings, concerns about tariffs and export restrictions on China under Trump 2.0, the worsening Russia-Ukraine situation, and yen appreciation. By sector, domestic demand stocks were favoured by investors due to a strong yen and caution about the short-term negative impact of Trump 2.0.2 USDJPY ended November at 150, from 152 as of end October.3

Stock Comments

Sony recorded +10% gain in November 2024, a positive contributor to the ETF. Sony reported solid Sep-Q results in November, with +57% YoY growth in Operating Profit, driven by solid margin for Game & Network Services thanks to improved hardware earnings as well as sales growth for 3rd party software. The launch of new games (both 1P and 3P) in 2025 should drive game revenue growth. Sony is reported to be in talk to acquire KADOKAWA, a publishing company with core business across publication & intellectual property (IP) creation; animation & film; gaming; and education & EdTech. The potential acquisition could bring synergies for Sony’s content business.

Seven & I recorded +18% gain in November 2024, a positive contributor to the ETF. On 13 November 2024, Bloomberg reported that Seven & i is considering to go through management buyout (MBO) and at potential valuation of ¥9 tn, a c.50% premium as compared to the ¥6 tn valuation at previous close. Earlier, Seven & I also received acquisition offer from Alimentation Couche-Tard at ¥2,800/share (vs ¥3,500/share for the potential ¥9 tn MBO). Either case presents opportunities for minority shareholder to take profit.

Preview

Japan stock market went through massive volatility over past few months under concern for JPY volatility and US economy recession. While short term outlook remains uncertain given slowing global economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging).4

Global X AI & Innovative Technology Active ETF (3006 HK)

Industry Update

Microsoft delivered solid 1Q25 results

1Q25 beat: Revenue growth of 16% YoY, ~200bps ahead of consensus of ~14% YoY growth. Azure and other cloud services revenue grew 33% and 34% in constant currency with healthy consumption trends that were in line with expectations.

Overall commercial bookings growth of 30% YoY reported or 23% in constant currency (cc), as well as 17% YoY growth in current remaining performance obligations (cRPO) well illustrate Microsoft share gains in a tepid software spending environment.

Management guided Q2 Azure revenue growth to be 31% to 32% in constant currency driven by strong demand for its portfolio of services. Management expects total GenAI revenue to exceed a $10 billion annualised run-rate in 2Q25. (Mirae, Company data)

OpenAI is charging $200 a month for an exclusive version of its o1 ‘reasoning’ model

The company is releasing the full version of its o1 model (replacing o1-preview), which was initially released as a limited preview in September (code-named ‘Strawberry’). The company is also introducing ChatGPT Pro, a new $200 monthly subscription tier that includes unlimited access to OpenAI o1, GPT-4o, and Advanced Voice mode. It also includes a version of o1, exclusive to Pro users, that uses more compute to provide the best possible answer to the hardest problems (called o1 pro mode). (The verge)

Stock Comments

NVIDIA + 4.14%

Supply chain indicate on track ramp for Nvidia’s Blackwell platform in 2025. Initial production issues are behind the company and there is high conviction in prior guidance that they will have several billion in Blackwell revenue in the January quarter. Any new Blackwell orders now that aren’t already in queue will be shipped late next year, as they are booked out 12 months or so, which continues to drive strong short term demand for Hopper which will still be a major factor though the year.

AMAZON +11.53%

Amazon reported better-than-expected earnings and revenue for the third quarter, driven by growth in its cloud computing and advertising businesses. In cloud, Amazon Web Services revenue was a hair below consensus estimates, but it’s growing faster than the same period last year. Sales grew 19% during the quarter compared to a year ago when sales accelerated by 12%. Profitability shined, as AWS margins were 400bp better than expected. This led to a $1bn (11%) better than expected AWS EBIT result.

Global X Electric Vehicle and Battery Active ETF (3139 HK)

Industry Update

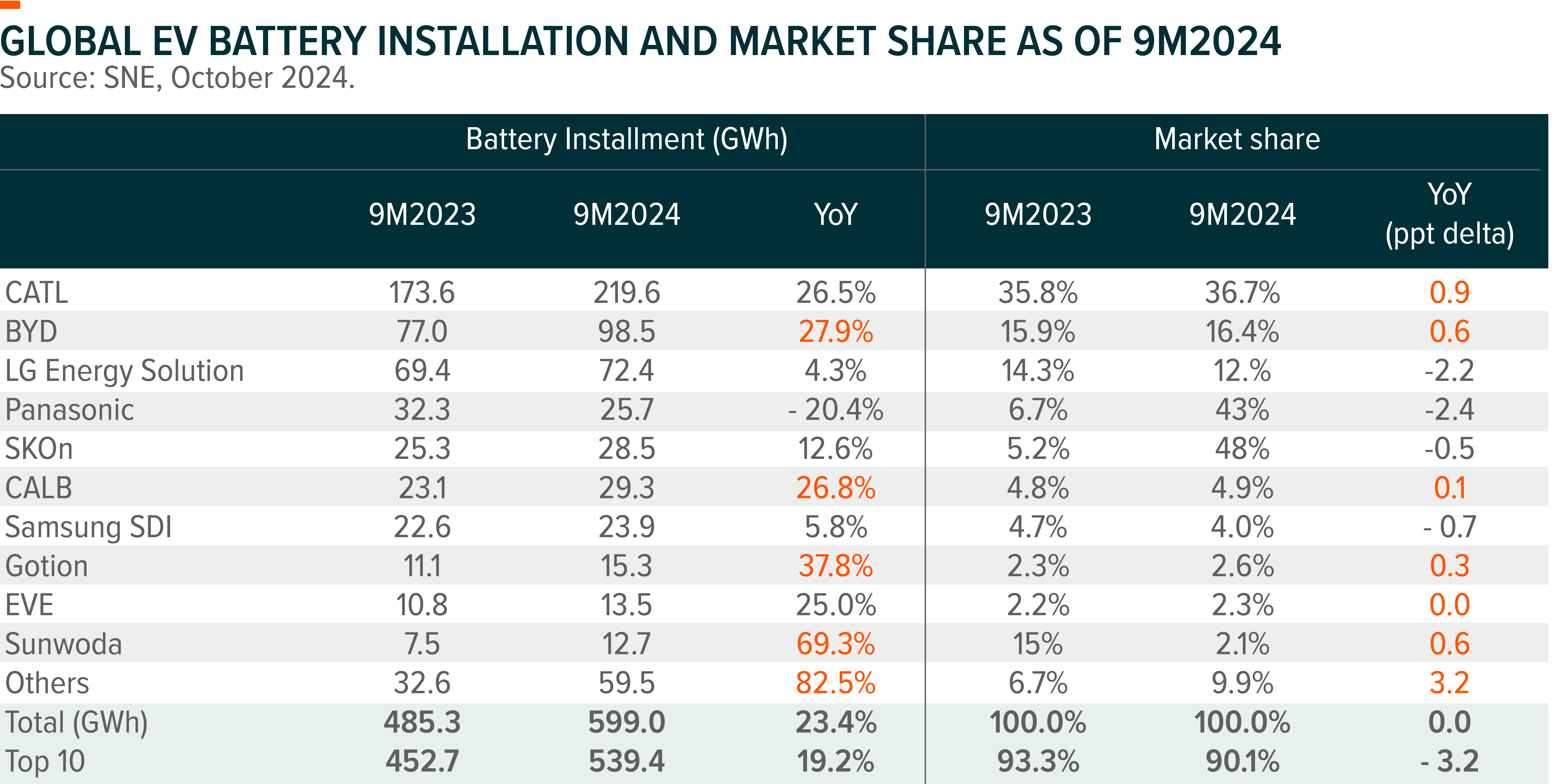

10M24 xEV sales in key regions (Europe, China, US) ended at 13 million units, +22%yoy (vs PV market +2%yoy), in which non-China markets accounts for 4.66 million units, 36% of total sales. BEV sales ended at 8.1 million units, +11%yoy, while PHEV sales 4.9 million units, +51%yoy, respectively. 10M24 global xEV penetration arrived at 27.7%, +4.7ppt YoY. In October 2024, global xEV penetration hit a new high at 33.7%, up by 8.0ppt YoY, largely driven by China EV sales surge to 54.4%, up by 16.7ppt YoY. 9M24 global EV battery installations reached 599GWh, further accelerating to +23.4%yoy. CATL led with 220GWh, +26.5%yoy, with m/s of 36.7%. BYD and LG Energy Solution are No.2 and No.3 battery producers, with 98.5GWh and 72.4GWh sales, m/s qoq stable at 16.4% and 12%, respectively.

Global energy storage battery production ended at 267GWh in 10M24, +50%yoy, in which Chinese manufacturers took 97% of the global share. China domestic demand accounts for ~50% of the total ESS battery shipment, followed by the US(17%), Europe(14%) and other regions (~18%). Interestingly, we have seen fast growing demand of hybrid power projects, for example, solar and ESS, in India and ME regions, driven by power outages and improving economics with great sunlight irradiation, declining solar panel costs and less requirement on constructions.

Stock Comments

Tesla INC: Company delivered solid quarterly results and unveiled their self-driving robotaxi. The stock also benefits from positive sentiment after Trump comes into power.

BYD: The company actually delivered very strong EV sales in the recent few months. Market may be worried about sales slowdown in early 2025 when subsidies exit for a short period of time, taking profits as a result.

Preview

Looking ahead to 2025, we expect China xEV sales around 15mn units, +40%yoy, Europe +5%yoy to 4.56mn units, US flat yoy at 1.57mn units and other markets of 0.74mn units. We expect ESS battery may still see 30%+ fast growing next year, driven by more energy storage used per Wh in renewables projects and mild renewables installation growth globally. We believe, battery business success relies on EV partnership in the long run. CATL, BYD and LGES are relatively better positioning at the moment. Competition amongst the second-tier Chinese battery makers (EVE, CALB, Gotion, Sunwoda) and SDI could be intensified to win orders from leading EV makers from a long-term strategic perspective, but the worst time on ASP and margins are behind.