Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X AI & Innovative Technology Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence and innovative technologies as detailed below.

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Sub-Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Electric Vehicle and Battery Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Sub-Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Monthly Commentary

Active ETFs – September 2025

Global X AI & Innovative Technology Active ETF (3006)

Industry Update

TSMC’s 2nm Node Reportedly Set for 60K Monthly Output in 2026, with Prices 50% Above 3nm

According to Liberty Times, TSMC is expected to have four 2nm fabs running at full capacity next year, with a combined monthly output of 60,000 wafers. However, as Wccftech points out, while TSMC is preparing for full-scale 2nm production, the company reportedly has no plans to offer discounts to customers. Liberty Times, citing industry sources, notes that each 2nm wafer could be priced as high as USD 30,000, representing a 50 percent increase over 3nm wafer pricing. (Liberty Times, August 2025)

Nano Banana: Image editing in Google Gemini gets a major upgrade

The Gemini app now has a new image editing model from Google DeepMind. Gemini 2.5 Flash Image enables targeted transformation and precise local edits with natural language. For example, the model can blur the background of an image, remove a stain in a t-shirt, remove an entire person from a photo, alter a subject’s pose, add color to a black and white photo, or whatever else you can conjure up with a simple prompt.This update focuses on maintaining a consistent likeness when editing photos of people and pets as users saw significant improvement vs previous model. (Google, August 2025)

Alphabet shares surge after dodging antitrust breakup bullet

The stock rallied after a U.S. judge ruled against breaking up the Google parent, clearing a major regulatory overhang and adding about $210 billion to the company’s market value. The ruling by Judge Amit Mehta allows Google to retain control of its Chrome browser and Android mobile operating system, while barring certain exclusive contracts with device makers and browser developers. (Reuters, September 2025)

Stock Comments

Alphabet+11% – The stock rallied after a U.S. judge ruled against breaking up the Google parent, clearing a major regulatory overhang and adding about $210 billion to the company’s market value. The ruling by Judge Amit Mehta allows Google to retain control of its Chrome browser and Android mobile operating system, while barring certain exclusive contracts with device makers and browser developers. (Reuters, September 2025)

Apple +12% – Cook appeared with Trump to announce Apple’s plans to spend $100 billion on American companies and American parts over the next four years. The company’s plans to buy more American chips pleased Trump, who said Apple would be exempt from future tariffs that could double the price of imported chips. Market turn its focus on iPhone 17 launch in September. (CNBC, August 2025)

Quarterly Earnings Review

TSMC – 2Q beat: revenue exceeded high end of guidance +17.8% QoQ to 30.07bn USD. GPM at 58.6% was close to high end of the guided 57-59% range. 100bps impact from ramp up of oversea fab mainly from margin dilution of Arizona fab, 220 bps from fx. EPS of NTD 15.36 was up 10.2% QoQ ~6% ahead of street. (Company data, Mirae Asset, September 2025)

Alphabet – 2Q slight beat: Top line of $96.4 billion (+13% Y/Y ex-FX) was slightly ahead of street. Search revenue growth of +12% Y/Y and Cloud revenue growth of +32% Y/Y. 2Q Capex beat grew +$5.2 billion Q/Q to $22.4 billion, the company raised FY25 capex spend guide to $85 billion (vs. $75 billion). (Company data, Mirae Asset, September 2025)

Microsoft – Azure growth of 39% came in well ahead of expectations of 36%, and represented a 4% point acceleration QoQ. In the quarter, gross margins beat consensus by ~40 bps. Operating income margin of 44.9% came in above consensus at 43.6%, by 130 bps. As a result, the company was able to deliver $3.65 in earnings per share, which compared to consensus at $3.40. (Company data, Mirae Asset, September 2025)

Nvidia – Nvidia reported revenue of $46.7 bn, slightly above the Street at $46.5 bn. Gross margin of 72.4% was in line. Operating margin of 64.5% was above the Street at 63.5%. EPS of $1.04 was in-line. Data Center revenue of $41.1 bn was below the Street at $41.3 bn. Gaming revenue of $4.3 bn was above he Street at $3.9 bn. Professional Visualization revenue of $601 mn was above the Street at $534 mn. Automotive revenue of $586 mn was in line with the Street at $586 mn. (Company data, Mirae Asset, September 2025)

Preview

The Global X AI and Innovative Technology Active ETF is committed to being at the forefront of AI investment, leveraging our expertise to identify and capitalize on opportunities across the AI value chain. By focusing on both established leaders and emerging innovators, we aim to provide our investors exposure to one of the most dynamic and impactful sectors of the global economy. As the AI landscape continues to evolve, we remain dedicated to adapting our strategy to ensure that our investors benefit from the full spectrum of AI-driven growth and innovation.

Global X Electric Vehicle and Battery Active ETF (3139)

Industry Update

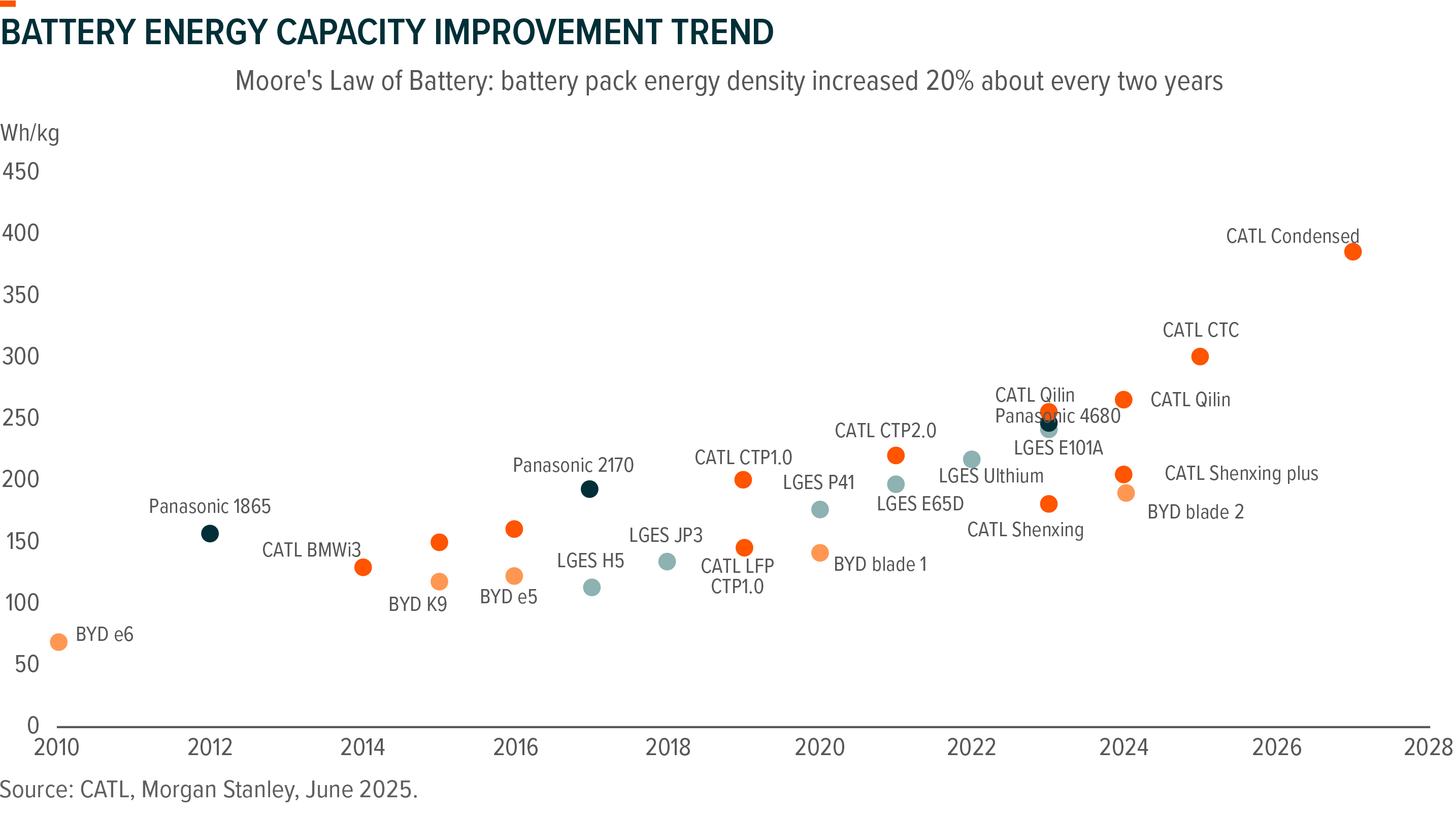

The latest industry feedback shows that Chinese major battery companies’ total scheduled production for September 2025 is 129.2GWh, +46%YoY and +7%MoM, respectively, much faster than overseas peers (Source: Jefferies, August 2025). Additionally, CATL’s September output is reportedly 69.5GWh, +43%YoY and +8%MoM, followed by two anonymous domestic battery producers of 23.3GWh and 10.7GWh, +20%YoY and +2%MoM, and +60%YoY and +15%MoM, respectively. People’s expectation on Q4 outlook remains positive, driven by front-loading EV demand due to EV purchase tax subsidies cut starting from 2026 (Mirae Asset, September 2025).

In the semi-annual earnings calls, the battery equipment companies also updated the solid-state battery development in China is accelerating. China government announced to subsidize by more than $830million to domestic companies who are eligible in technology competitiveness to develop solid-state batteries in 2024 (Reuters, May 2024). Wuxi Lead’s management shared they have got Rmb400-500mn solid-state battery new orders in 1H25 and expect more from the top Chinese players in 2H25, since it is the time point for the regulator to review the progress. They shared some of their clients aim to double their total capacity in the next three years and the new round of upcycle may last longer given the strong demand seen from clients. (Company Data, August 2025)

Stock Comments

EVE Energy: The company’s revenue was up by 30%YoY and the recurring net profits up by 18%YoY, slightly beat street expectation. Management indicates their ESS battery exports to the US are not impacted by the US bill. (Company data, September 2025)

Fuyao Glass Industry: The company delivered strong 1H25 results with revenue up by 17%YoY and net profits up by 37%YoY, driven by auto sales growth and product mix upgrading. (Company data, September 2025)

CATL: The company delivered solid 1H25 results with revenue up by 7%YoY and net profits up by 33%YoY, in which EV battery accounts for 80% of the total sales and ESS 20%. Utilization is quite full now and production is sequentially improving. (Company data, August 2025)

BYD: The company delivered 23%YoY revenue growth and 14%YoY net profits growth in 1H25, which was miss the street estimates. The company’s sales were slowing down in July thanks to seasonality, competition and unclear subsidy policies pan-China in the middle of the year, despite strong exporting numbers. BYD also guided down their whole-year shipment from 5.5mn units to 5.2mn units. (Company data, August 2025)

Preview

We remain constructive on China EV and battery sales in 2025 despite sales a little bit slowdown in the last three months, as it is an important vehicle for China government to boost economy in the near term and reduce the dependency on oil imports from the long-term perspectives. We are positive on the leading companies who are continuously working on technology innovation, making strategic self-help efforts and gaining market share globally in spite of protectionism.