Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X AI & Innovative Technology Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence and innovative technologies as detailed below.

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Sub-Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X EV and Humanoid Robot Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses (the “EV/Battery Business”), humanoid robots and robot-related automation businesses (the “Humanoid Robotic Business”).

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Fund’s ability to invest in A-Shares or access the PRC markets through the programme will be adversely affected.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Monthly Commentary

Active ETFs – October 2025

Global X AI & Innovative Technology Active ETF (3006)

Industry Update

OpenAI is launching the Sora app, its own TikTok competitor, alongside the Sora 2 model

OpenAI announced the release of Sora 2, an audio and video generator to succeed last year’s Sora. Along with the model, the company also launched a linked social app called Sora, where users can generate videos of themselves and their friends to share on a TikTok-style algorithmic feed. (TechCrunch, September 2025)

Apple launches iPhone 17

New products include the iPhone 17 Pro, iPhone 17 Pro Max, and iPhone Air, as well as new Apple Watch and AirPods models. It comes as Apple remains under pressure to prove itself, grappling with questions over its artificial intelligence plans, as well as increasing competition. The iPhone 17 base model has so far outperformed expectations, thanks to the pricing remaining unchanged despite upgrades in memory storage (CNBC, September 2025)

Meta to build gigawatt cluster for AI

Meta is building several multi-GW clusters. Meta is calling the first one Prometheus and it’s coming online in 2026. Meta is also building Hyperion, which will be able to scale up to 5GW over several years. At an estimated US$30bn per gigawatt for this type of infrastructure, according to semiconductor research firm SemiAnalysis, Meta is making one of the largest single investments in AI computing power. (Meta, Semianalysis, July 2025)

Stock Comments

Alphabet+14.28% – The stock continue to rally after a U.S. judge ruled against breaking up the Google parent, clearing a major regulatory overhang and adding about $210 billion to the company’s market value. The ruling by Judge Amit Mehta allows Google to retain control of its Chrome browser and Android mobile operating system, while barring certain exclusive contracts with device makers and browser developers. (Reuters, September 2025)

Apple +9.7% – New products include the iPhone 17 Pro, iPhone 17 Pro Max, and iPhone Air, as well as new Apple Watch and AirPods models. It comes as Apple remains under pressure to prove itself, grappling with questions over its artificial intelligence plans, as well as increasing competition. The iPhone 17 base model has so far outperformed expectations, thanks to the pricing remaining unchanged despite upgrades in memory storage (CNBC, September 2025)

Preview

The Global X AI and Innovative Technology Active ETF (3006) is committed to being at the forefront of AI investment, leveraging our expertise to identify and capitalize on opportunities across the AI value chain. By focusing on both established leaders and emerging innovators, we aim to provide our investors exposure to one of the most dynamic and impactful sectors of the global economy. As the AI landscape continues to evolve, we remain dedicated to adapting our strategy to ensure that our investors benefit from the full spectrum of AI-driven growth and innovation.

Global X EV and Humanoid Robot Active ETF (3139)

Industry Update

Global xEV sales reached 10.2mn units as of August 2025, +23.5%YoY, in which China accounted for 7.5mn units, +25.7%YoY, Europe 1.5mn units, +26.2%YoY and the US 1.1mn units, +7.8%YoY, despite the policy/tariff headwinds in the first half of the year. The global penetration remains in the early stage compared to the 80~90mn units sales auto market every year. As one of the key beneficiaries, global battery also witnessed much stronger sales year-to-date than people’s initial expectation. According to SNE and CABIA research, global battery shipment recorded a new high level of 907GWh as of July 2025, +47%YoY, in which EV battery accounted for 697GWh, +37%YoY and ESS battery 210GWh, +93%YoY. LFP batteries are widely accepted by automakers with an installation rate of nearly two-thirds of the total xEV sales. (Mirae Asset, September 2025)

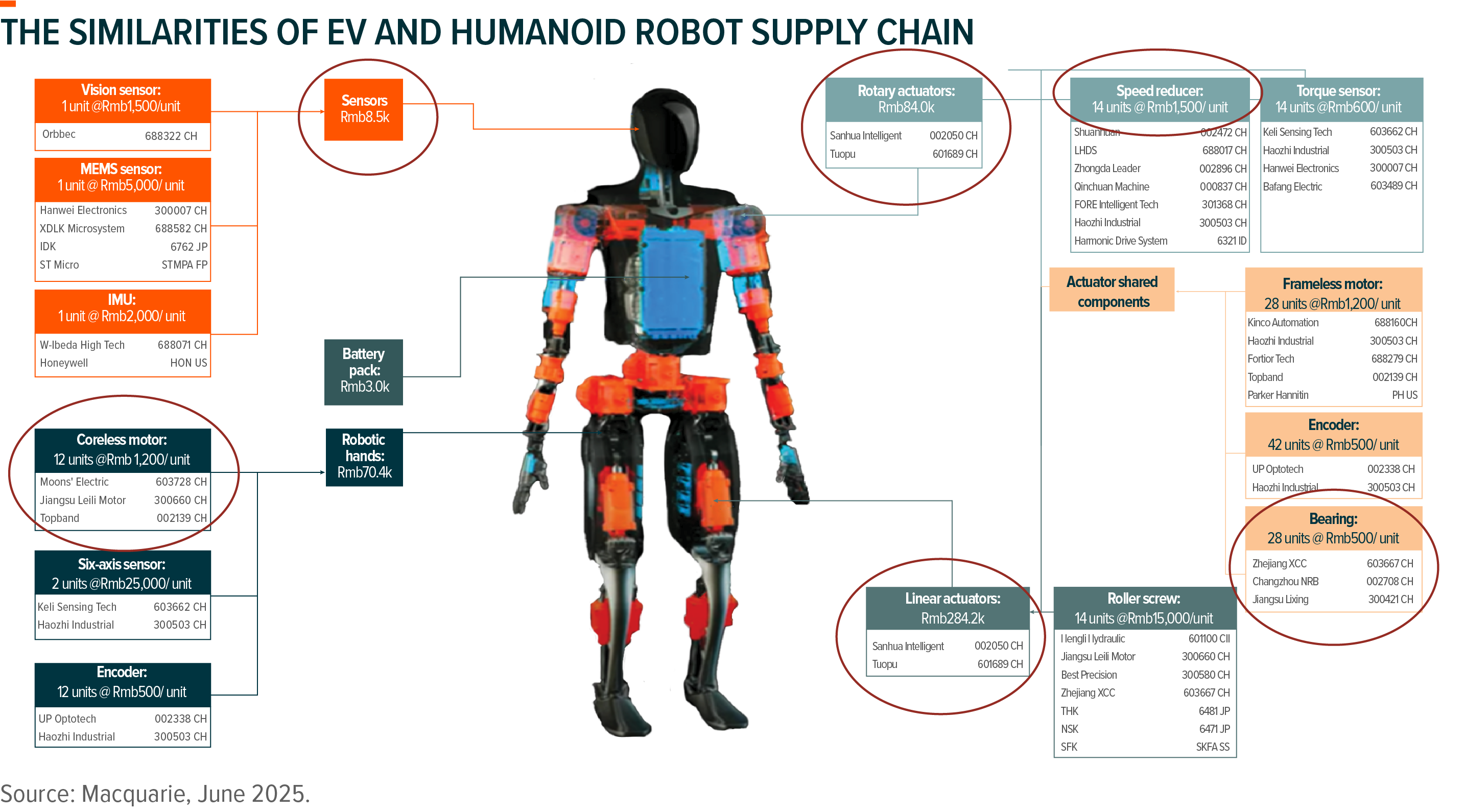

2025 is seen as humanoid robotics’ breakout year with a major breakthrough in practical and affordable robot products and visible mass production. Elon Musk’s bullish guidance of humanoid robot shipment in early 2025 brought Chinese robots components supply chain in the spotlight, coupled with Unitree robots dance show in Spring Festival Gala. Based on the talks with companies in the humanoid supply chain, the industry is moving towards developing lightweight, flexible and easily deployable robots that can enhance operational efficiency and reduce costs. Competition in some key components including reducer, motor, screw, sensor sounded intensified, which implies cost cutting could be faster than expected and monetization more visible, especially in industrial and residential scenarios. (Mirae Asset, September 2025)

Stock Comments

EVE Energy: The company’s revenue was up by 30%YoY and the recurring net profits up by 18%YoY, slightly beat street expectation. Management indicates their ESS battery exports to the US are not impacted by the US bill. (Company data, September 2025)

Fuyao Glass Industry: The company delivered strong 1H25 results with revenue up by 17%YoY and net profits up by 37%YoY, driven by auto sales growth and product mix upgrading. (Company data, September 2025)

CATL: The company delivered solid 1H25 results with revenue up by 7%YoY and net profits up by 33%YoY, in which EV battery accounts for 80% of the total sales and ESS 20%. Utilization is quite full now and production is sequentially improving. (Company data, August 2025)

BYD: The company delivered 23%YoY revenue growth and 14%YoY net profits growth in 1H25, which was miss the street estimates. The company’s sales were slowing down in July thanks to seasonality, competition and unclear subsidy policies pan-China in the middle of the year, despite strong exporting numbers. BYD also guided down their whole-year shipment from 5.5mn units to 5.2mn units. (Company data, August 2025)

Preview

There is no doubt that electric vehicle and humanoid robot are the two fastest-growing manufacturing businesses in the world, and the most promising sectors with huge room to grow in the coming decade, catering to global energy transition and aging population issues. We are constructive on both themes as well as the leading companies in each sector that are continuously working on technology innovation, making strategic self-help efforts and gaining market share globally in spite of protectionism.