Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X AI & Innovative Technology Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence and innovative technologies as detailed below.

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Sub-Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Electric Vehicle and Battery Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Sub-Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Monthly Commentary

Active ETFs – August 2025

Global X AI & Innovative Technology Active ETF (3006)

xAI launches Grok 4 alongside a $300 monthly subscription

Grok is xAI’s answer to models like OpenAI’s ChatGPT and Google’s Gemini, and can analyze images and respond to questions. xAI launched two models: Grok 4 and Grok 4 Heavy — the latter being the company’s “multi-agent version” that offers increased performance. According to xAI, Grok 4 scored 25.4% on Humanity’s Last Exam without “tools,” outperforming Google’s Gemini 2.5 Pro, which scored 21.6%, and OpenAI’s o3 (high), which scored 21%. (TechCrunch, July 2025)

OpenAI Just Its First Open-Weight Models Since GPT-2

OpenAI just dropped its first open-weight models in over five years. The two language models, gpt-oss-120b and gpt-oss-20b, can run locally on consumer devices and be fine-tuned for specific purposes. For OpenAI, they represent a shift away from its recent strategy of focusing on proprietary releases, as the company moves toward a wider and more open group of AI models that are available for users. (Wired, July 2025)

H20 ban lifted for China

US technology giant Nvidia says it will soon resume sales of its high-end artificial intelligence (AI) chips to China.The US government has assured the firm that it will grant the licences needed to restart exports to the world’s second largest economy, the company said in a blog post. The move reverses a ban on sales of Nvidia’s H20 chips to Beijing, which was imposed by US President Donald Trump’s administration in April over concerns that they could be used by the Chinese military. (BBC, July 2025)

Stock Comments

Nvidia +12.58%: H20 ban lifted for China. US hyperscalers such as Meta and Microsoft reported strong results and CAPEX guidance which eased investors’ concerns on the AI CAPEX cycle.

TSMC +7.81%: The company delivered a strong set of 2Q result and 3Q guidance. Management revised up full-year revenue guidance from mid 20% to 30% YoY growth in USD.

Preview

The Global X AI and Innovative Technology Active ETF Fund is committed to being at the forefront of AI investment, leveraging our expertise to identify and capitalize on opportunities across the AI value chain. By focusing on both established leaders and emerging innovators, we aim to provide our investors exposure to one of the most dynamic and impactful sectors of the global economy. As the AI landscape continues to evolve, we remain dedicated to adapting our strategy to ensure that our investors benefit from the full spectrum of AI-driven growth and innovation.

Global X Electric Vehicle and Battery Active ETF (3139)

Industry Update

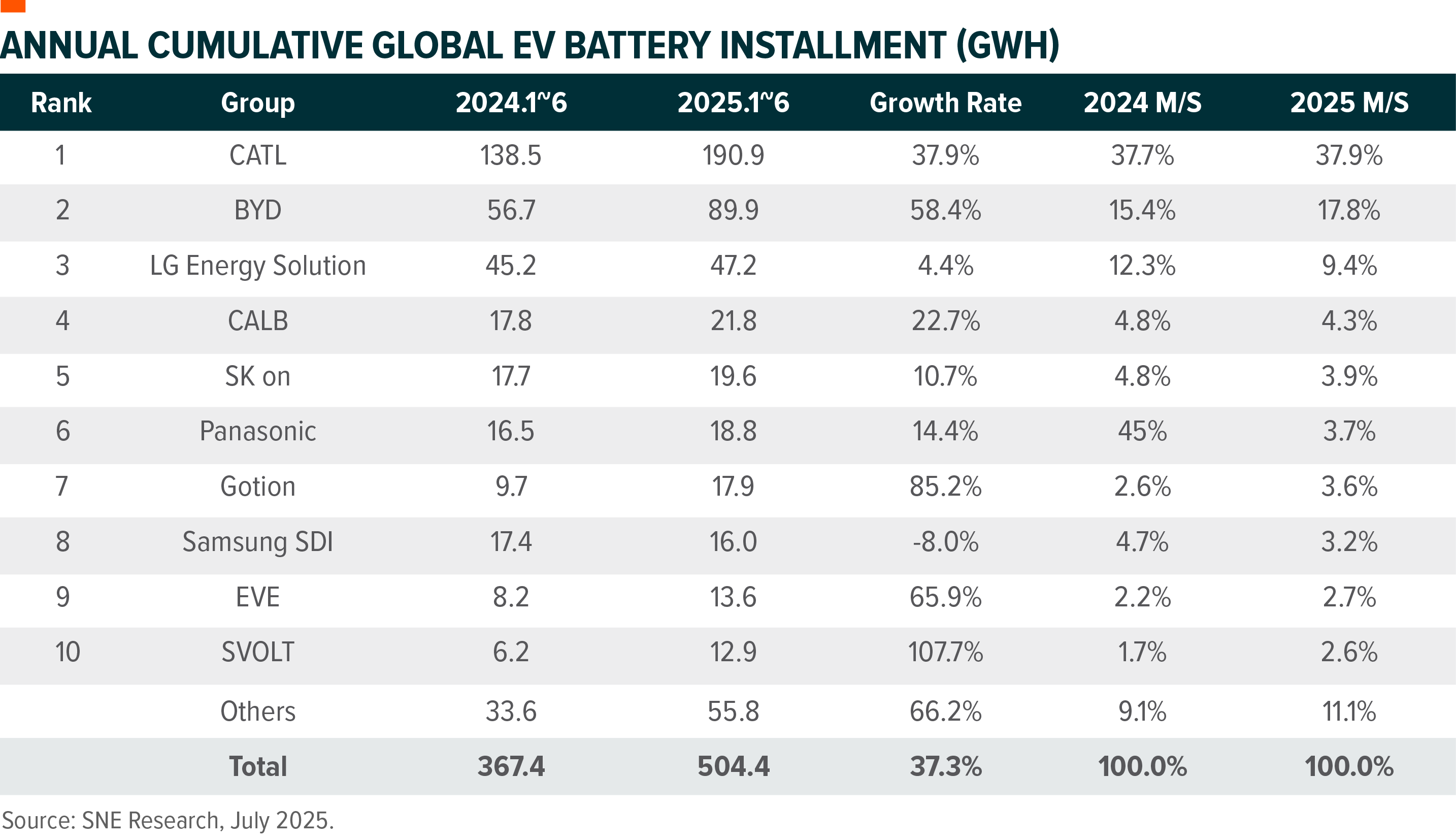

China auto sales were slowing down in July thanks to seasonality, less promotions from car makers and unclear subsidy policies in the middle of the year. Electric vehicles were also decelerating despite further penetration growth. Battery production was stronger than the downstream. According to SNE research, global EV battery installment ended at approximately 504GWh in 1H25, +37%YoY, in which CATL, BYD, Gotion, EVE energy and Svolt are gaining market share. CATL remained top1 in the global battery usage ranking, posting a 37.9%YoY(190.9GWh) growth. Key Chinese OEMs such as ZEEKR, AITO, Li Auto, and Xiaomi adopted CATL’s batteries, and many global major OEMs, including Tesla, BMW, Mercedes-Benz, and Volkswagen, are also using CATL’s batteries.

We also witnessed lithium stocks rallied a lot in the last one months mainly due to the mine rights investigation in Jiangxi, China, coupled with the expectation of anti-involution impact on supply cut. Lithium carbonate prices have rebounded from less than Rmb60,000/t to Rmb80,000+/t.

Stock Comments

NVIDIA Corporation: The company’s quarterly results beat street expectation. Management indicates the pace of rack shipment is improving. The Trump administration approved H20 sales to China which also helps with earnings going forward.

BYD Company Limited Class H: The company’s sales were slowing down in July thanks to seasonality, competition and unclear subsidy policies pan-China in the middle of the year, despite strong exporting numbers. BYD also guided down their whole-year shipment from 5.5mn units to 5.2mn units.

Preview

We remain constructive on China EV and battery sales in 2025 despite sales a little bit slowdown in the last three months, as it is an important vehicle for China government to boost economy in the near term and reduce the dependency on oil imports from the long-term perspectives. We are positive on the leading companies who are continuously working on technology innovation, making strategic self-help efforts and gaining market share globally in spite of protectionism.