Introduction of Electric Vehicle Battery

Electric vehicle (EV) has become one of the most promising industries in the past decade, together with EV battery and related materials. A deep dive into the value chain will help us better understand EV industry dynamics. In this article, we would like to look into cathode and anode materials.

Cathode and anode materials

Battery is a chemical compounded product with multiple basic components: cathode, anode, electrolyte, hole-transferrable separator and other sub-components. Cathode and anode work together to provide power by converting chemical energy into electrical energy. Different electrodes produce different chemical reactions that affect how much energy it can store and how fast discharging/charging process takes place.

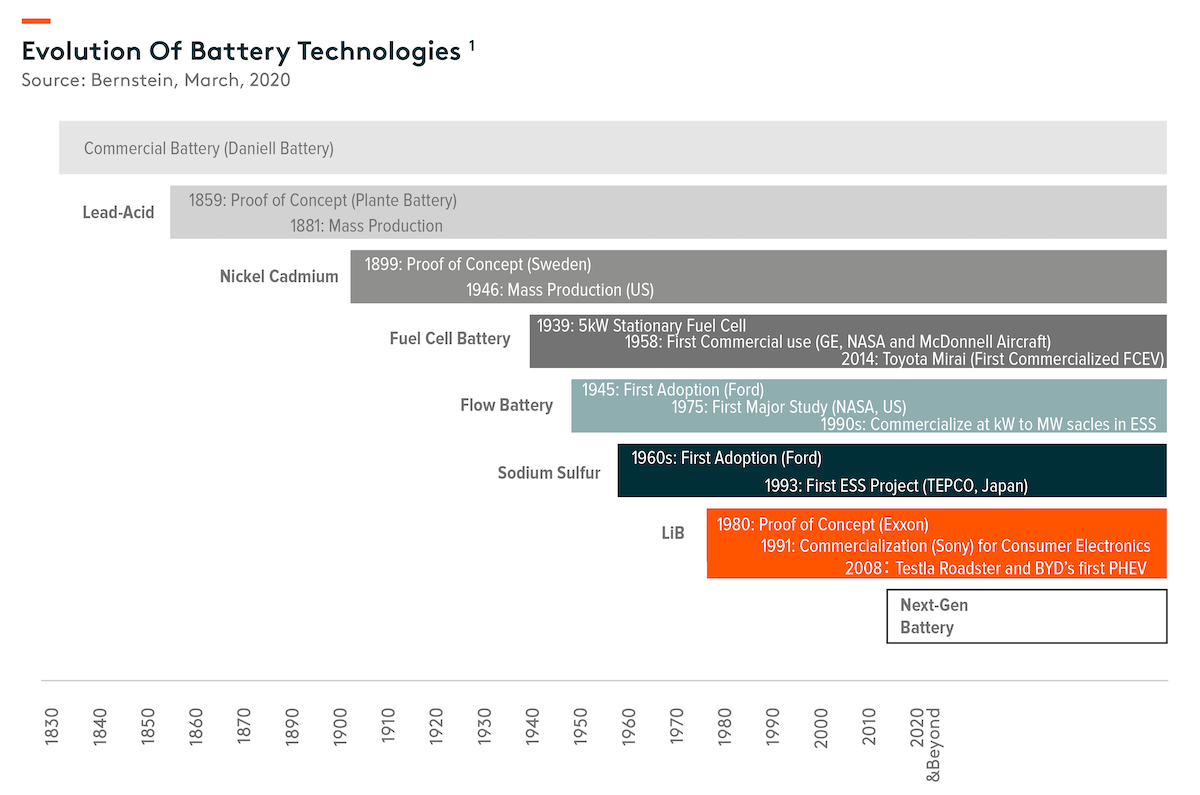

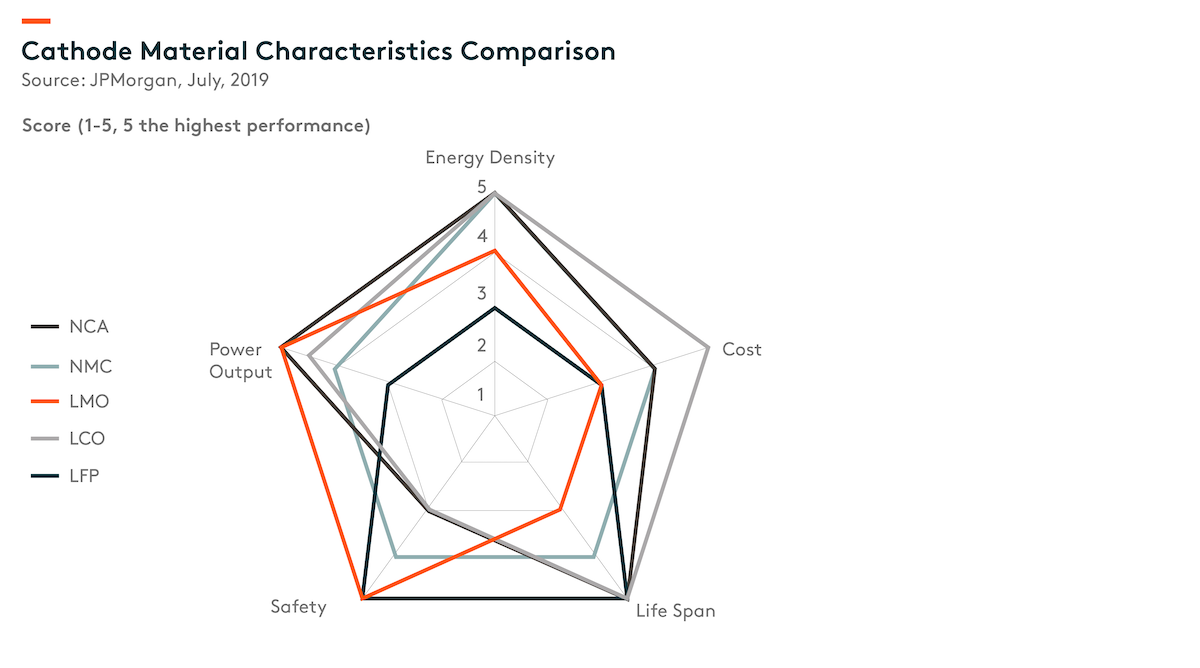

Cathode materials have kept innovating in the past decade. Lithium-ion (Li-ion) turns out to be the mainstream nowadays thanks to higher energy density and voltage, longer runtime and easier manufacture. Cathode materials face tradeoffs amongst five key factors, namely energy density, power output, life span, safety and cost. Specifically, for EV battery, lithium nickel manganese cobalt oxide/ lithium nickel cobalt aluminum oxide (NMC/NCA, LiNiMnCoO2/LiNiCoAlO2) and lithium iron phosphate (LFP, LiFePO4) are the two typical types of cathodes as a result of the balance of these five factors (Exhibit 2).

Anode is a relatively mature business as graphite has been used since 1990s due to its high energy density and fast-charging speed. Natural graphite was used at first while synthetic graphite was adopted after 2000 for uniformity.

Development of cathode and anode industries

Sony made the first lithium-ion battery with Li2CoO3 as cathode and graphite anode in the early 1990s. Japan initiated Li-ion battery’s massive production and led the industry for a decade, thanks to the emerging electronics industry. Korea and China caught up successively after 2000, and have been gaining market share in light of lower production cost and the rise of EV industry.

Cathode is the biggest cost item and the most important part of a battery as it decides energy density and power output. Consequently, this part has witnessed fast upgrade and technology changes, especially after the EV industry took off globally. It means a short operating lifespan of old -generation production lines and continuous R&D expenditure. Investment in technology matters more than short-term capacity expansion to cathode makers if they want to keep competitive in the long term. As a result, the cathode industry remains fragmented with a long tail of players, though China has been leading with a share of over 60%.2

Anode is made from oil or coal. That is why it was Japanese petrochemical companies which produced anode first. However, anode used to be a very small business to those companies, such as Hitachi chem, which they didn’t pay much attention to. It is also one of the key reasons why China is able to surpass them decades later.

Chinese companies, Shanshan and BTR, found out knowhow on anode massive production around 2000, and have focused on anode innovation and cost reduction since then. Different from cathode, the anode market is highly consolidated thanks to mature and stable technologies. China took up over 83% of global market share in anode (natural and artificial), with the top five players’ market share of 79% in 2019.3

In the past few years, silicon has been introduced to anode chemistry for higher energy density. Panasonic is supplying NCA 21700 batteries based on 5%4 of silicon mix for anode active materials. However, cycling lifetime remains a challenge due to poor chemistry properties of silicon. Thus, good cost control in graphite production will still be the key of Chinese manufacturers’ competitiveness in the coming years.

Nature of the business

Taking a leading cathode company, Beijing Easpring, as an example, raw materials take up 85% in the total production cost, followed by manufacturing cost (equipment depreciation and amortization, and utilities) at 10% and labor cost at 1%.5 Apparently, the cathode industry is like a manufacturing business using chemical making technologies, or an assembling business that mixes lithium compounds and nickel-cobalt-manganese compounds. The upstream includes mining and nonferrous metallurgical companies, while the downstream includes battery makers and EV original equipment manufacturers (OEMs). Metal prices are the determinant of cathode price and cathode makers’ profitability. As metal prices are determined by downstream EV battery demand and upstream mining supply, cathode players do not have much bargain power. That is also why it is hard to consolidate the leading position by lower cost from larger scale at the moment when technology is fast changing. Hence, we do not expect a high margin in cathode part.

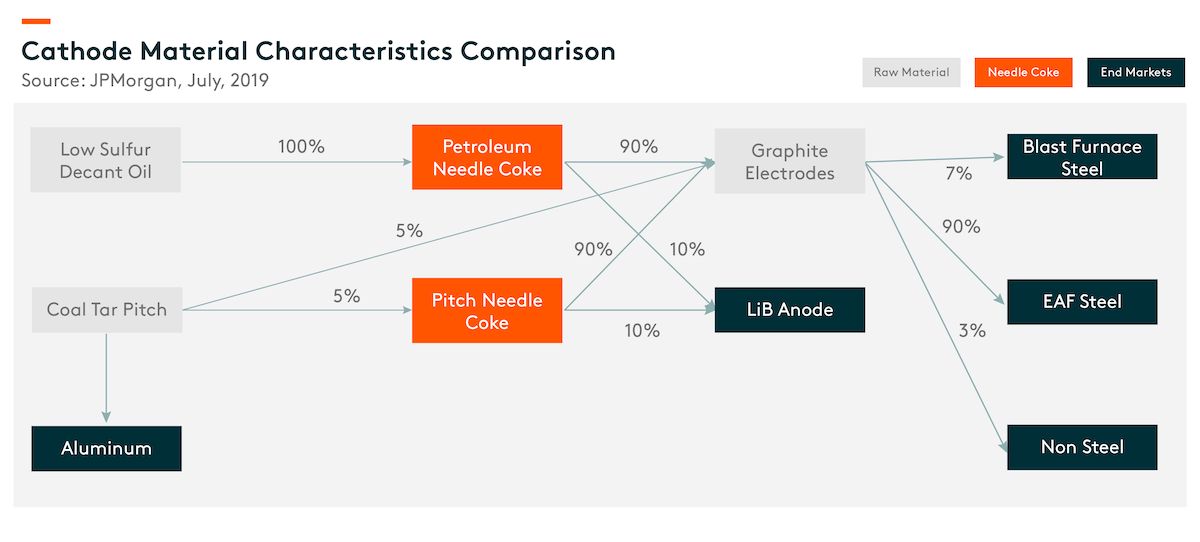

Different from cathode, anode is made from natural graphite or coal chemicals/petrochemicals. It is a typical chemical manufacturing process to generate products with special physical or electrochemical properties. Upstream suppliers are needle coke makers based on either petrochemical or coal chemical roadmap. Taking Ningbo Shanshan, a leading Chinese anode maker, as the example, raw materials account for 35% in the total production cost, followed by manufacturing cost (equipment D&A, electricity and graphitization outsourcing) at 55% and labor cost at 6-7%.6 As Exhibit 3 shows, EAF steel is the major application of graphite, which means EAF steel demand and upstream supply largely determine raw material cost of anode (needle coke price). Thus, efficient equipment, low electricity price and in-house graphitization process become the key solutions to be cost competitive. Some regions with cheap electricity, such as coal-rich Inner Mongolia, have limited new graphite capacities as it is energy intensive. Those which have already had capacities in these regions enjoy the first-mover advantages.

Outlook for battery materials

Cathode materials are heading for higher energy density, higher power output with acceptable cost and safety range. Other than significant technology innovation, integration along the cathode value chain is another vital trend for commercial success. It will help better control cost and gain more market power, not only for cathode players but also EV battery makers. In fact, CATL, a leading EV battery maker in China, has been actively investing in every part along the cathode supply chain to optimize its production cost. For pure cathode makers, resembling business implies they need great sales channels and close ties with leading EV battery producers. In addition, good access to funding is also necessary for expansion and ultimate success.

For anode, energy density, charging speed and cost are the main determinants of future innovation. To achieve the first two, new materials have to be brought in given energy density limit of element carbon. Economy of scale is one way for cost reduction in addition to equipment improvement, relocation to cheap electricity region and in-house graphitization. Japan is leading the inclusion of silicon into the current carbon structure and it may change the competition landscape today. Chinese players still have chance to catch up as they have been working on anode innovation and have had great technology accumulations for years.