Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X Hang Seng TECH Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng TECH Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Nasdaq 100 Covered Call Active ETF (the “Fund”) is to generate income by primarily (i) investing in constituent equity securities in the NASDAQ-100 Index (the “Reference Index”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “”premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations. If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the exchange may suspend the trading of options in volatile markets which may cause the Fund unable to write Reference Index Call Options at times.

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- The position of futures or options contracts held by the Manager may not in aggregate exceed the relevant maximum under relevant rules. If the position held or controlled by the Manager reaches the limit or the Fund grow significantly, the Manager will evaluate its position and consider closing out certain positions, which could restrict new share creation and cause the trading price to deviate from NAV.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the CME and/or the Fund’s broker, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking the performance of securities in a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

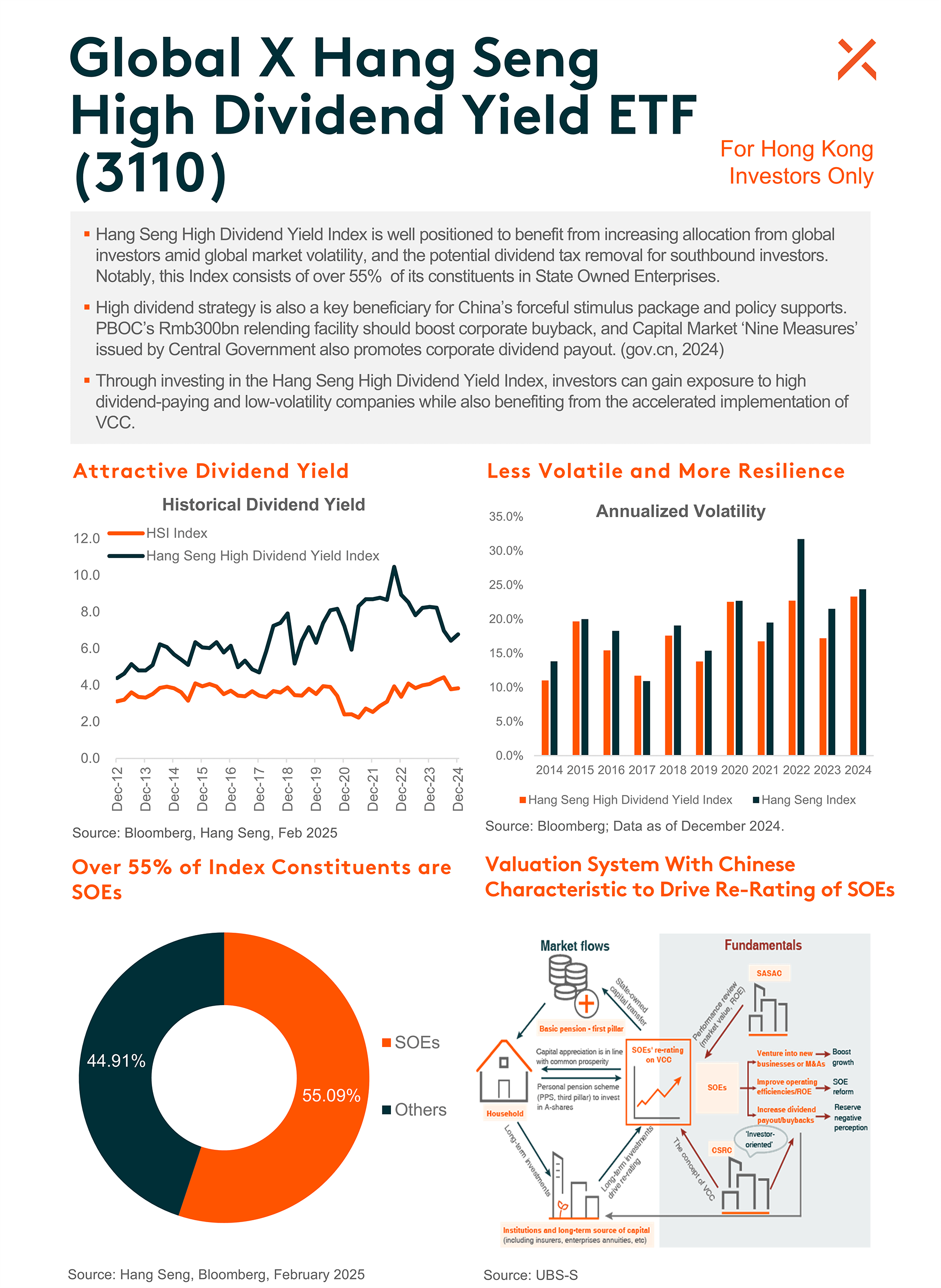

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

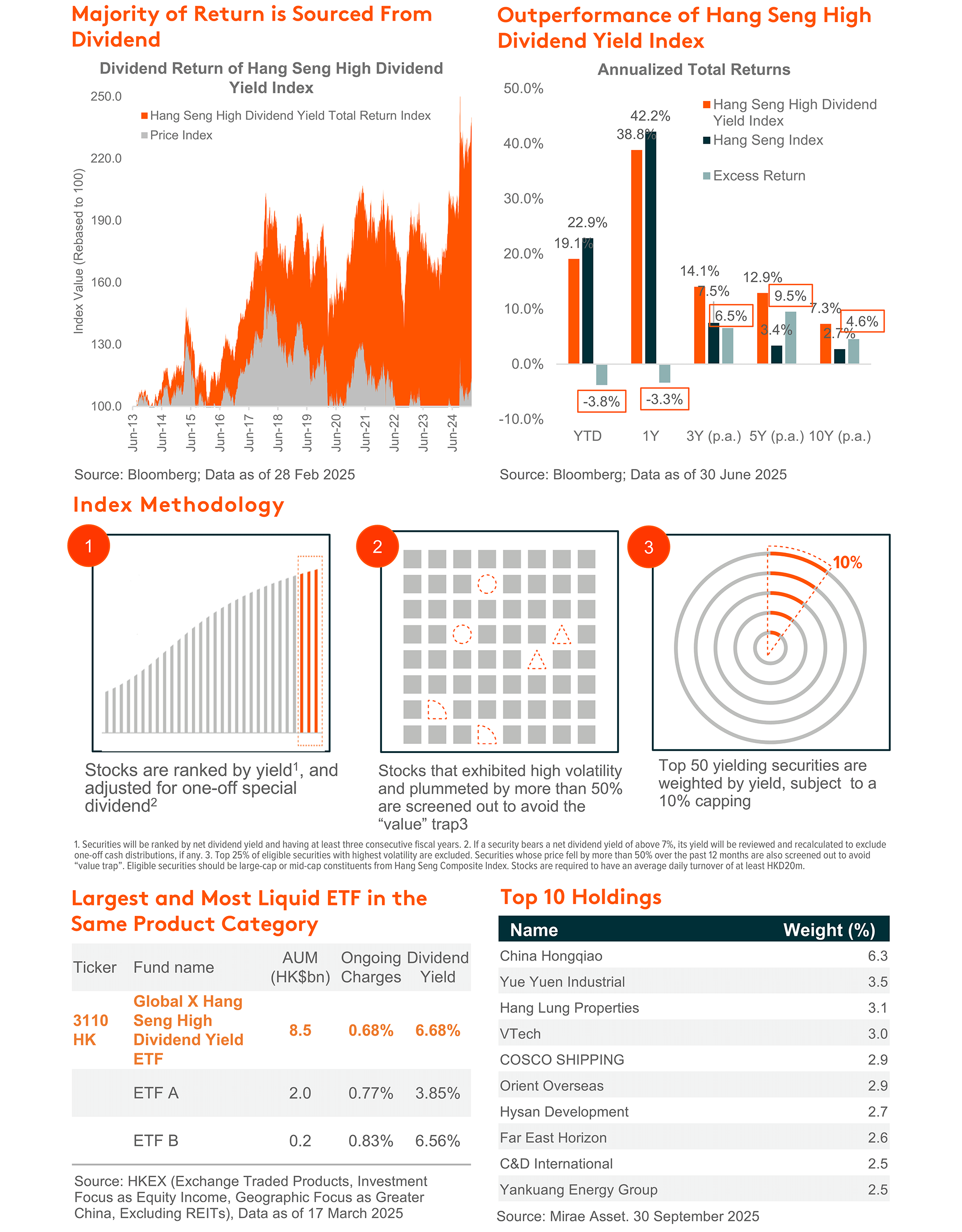

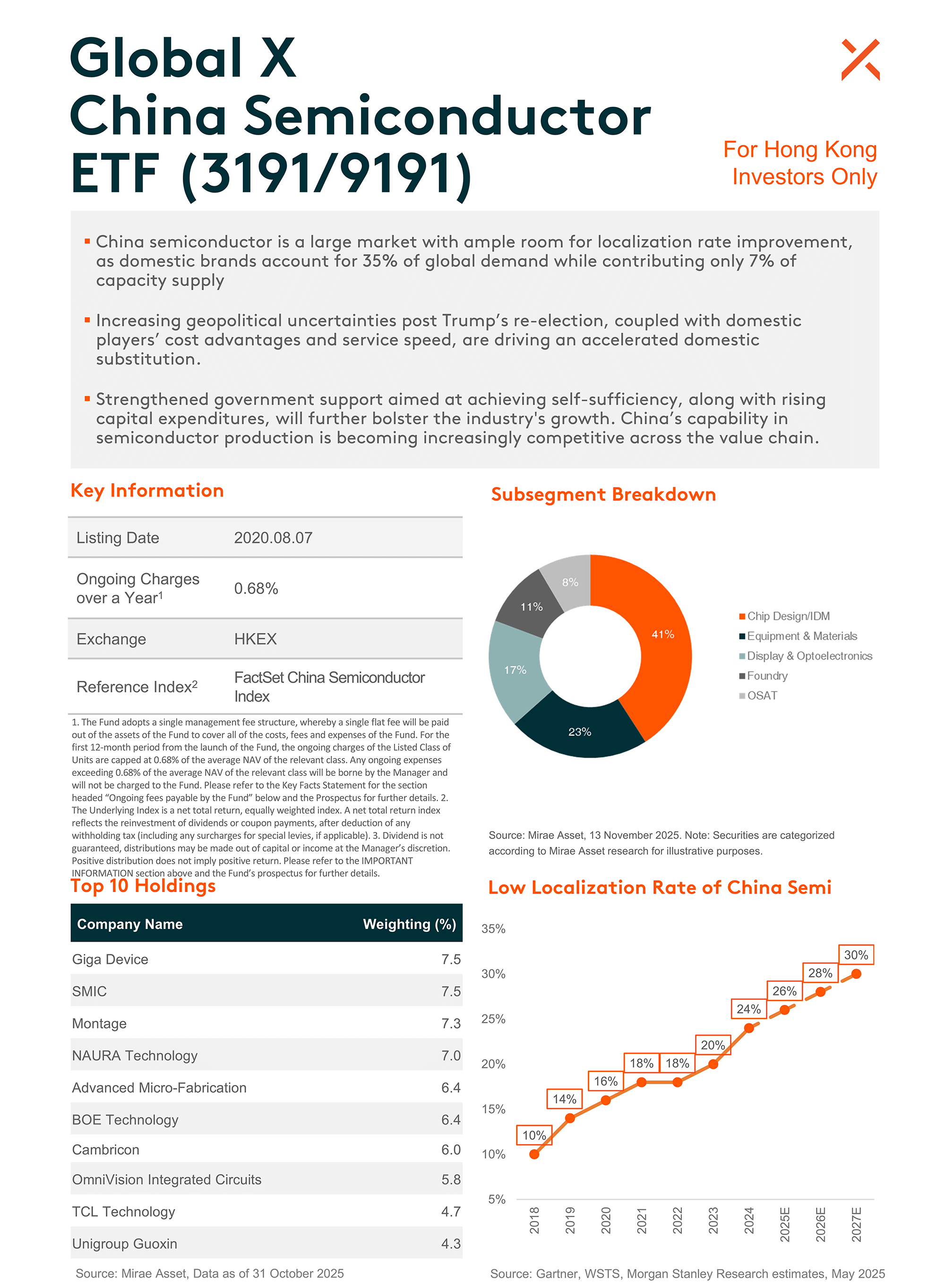

- The investment objective of Global X China Semiconductor ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Semiconductor Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The investment objective of Global X G2 Tech ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset G2 Tech Index.

- The Fund is exposed to concentration risk by tracking a specific region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

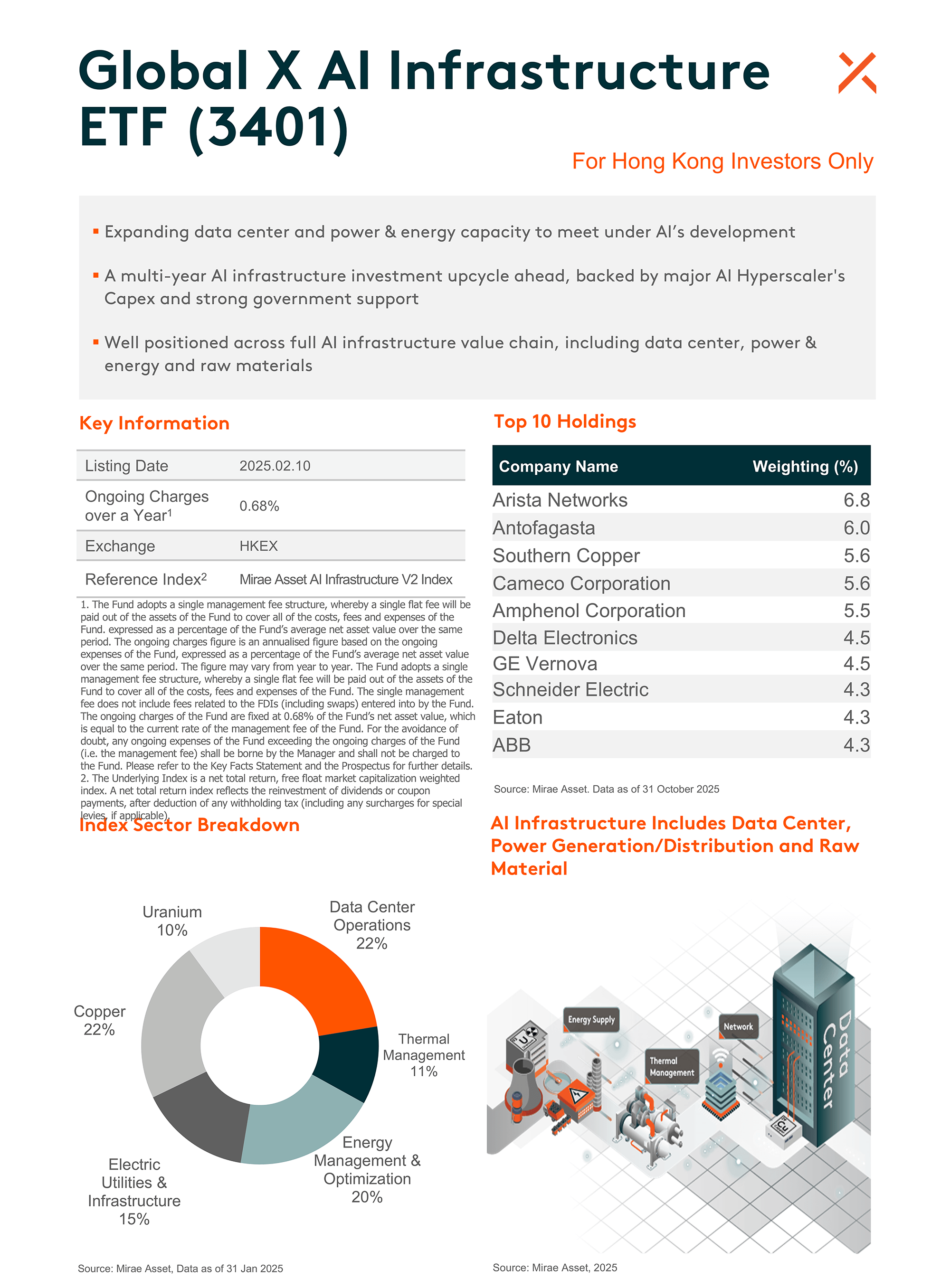

- The investment objective of Global X AI Infrastructure ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset AI Infrastructure V2 Index.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X Select ETFs

November 2025

| Product Name | Investment Points | Top 10 Holding (%) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

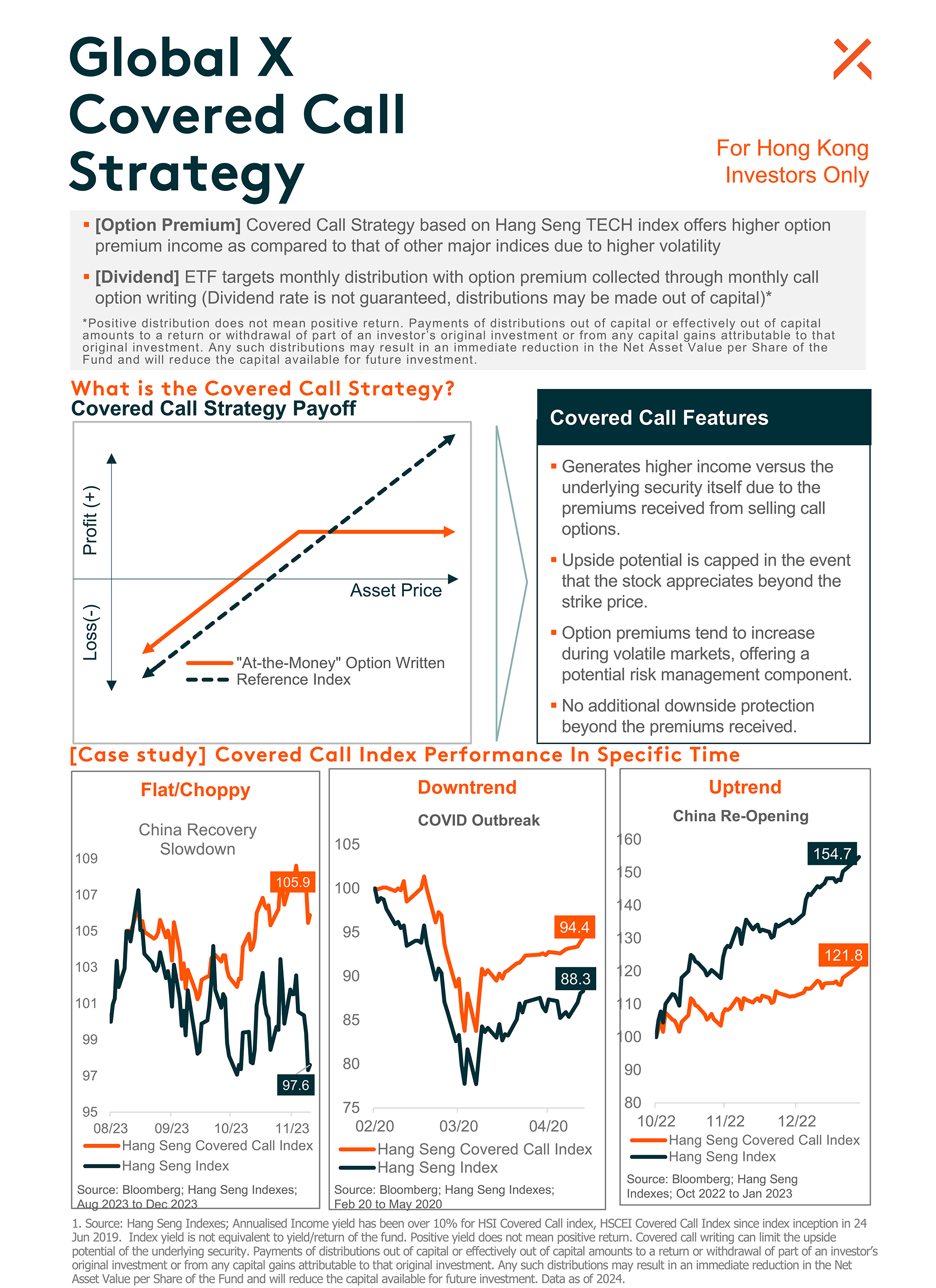

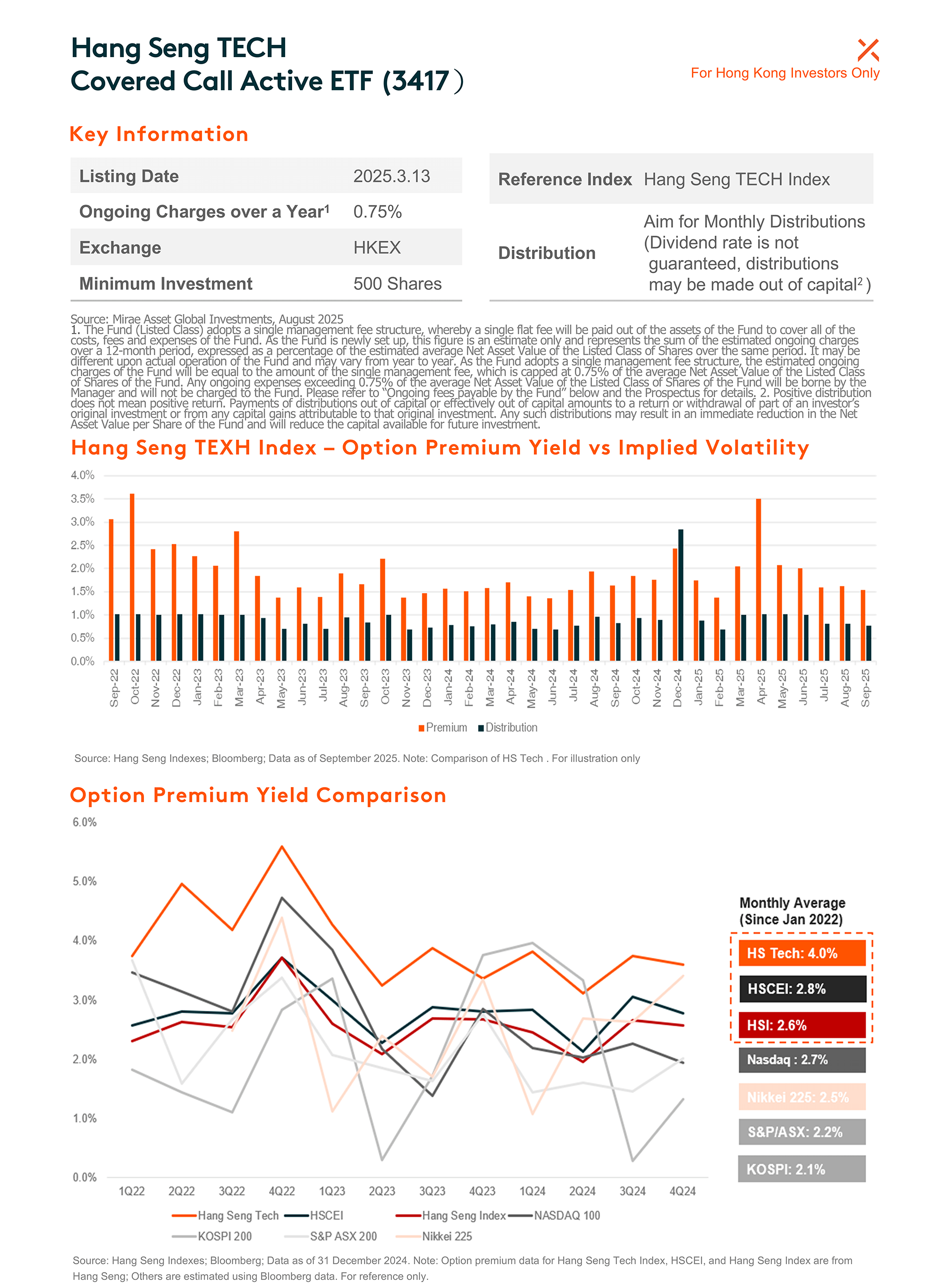

| Hang Seng TECH Covered Call ETF (3417) | Reason for Inclusion: Hang Seng TECH Index continued correction in October. Despite near-term volatility, longer term drivers for Hang Seng TECH remains intact with the rapid development of China’s core technology segments including AI, Semi, and EV. 3417 offers exposure to leading tech companies, and help investors to capitalize on volatility through option strategy. |

|

||||||||||||||||||||

| Covered call strategy based on Hang Seng TECH Index may has the higher option premium yield due to higher volatility of the index. The index is benefiting from the continued development and breakthrough by leading Chinese companies in technology sectors such as AI and Semiconductor, but is also impacted by intense competition in sectors such as food delivery service and EV. Covered call strategy is well-suited for positioning within this market. (Aims at Monthly Distribution. Dividend rate is not guaranteed, distributions may be made out of capital 1 ).

1.Positive distribution does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. |

||||||||||||||||||||||

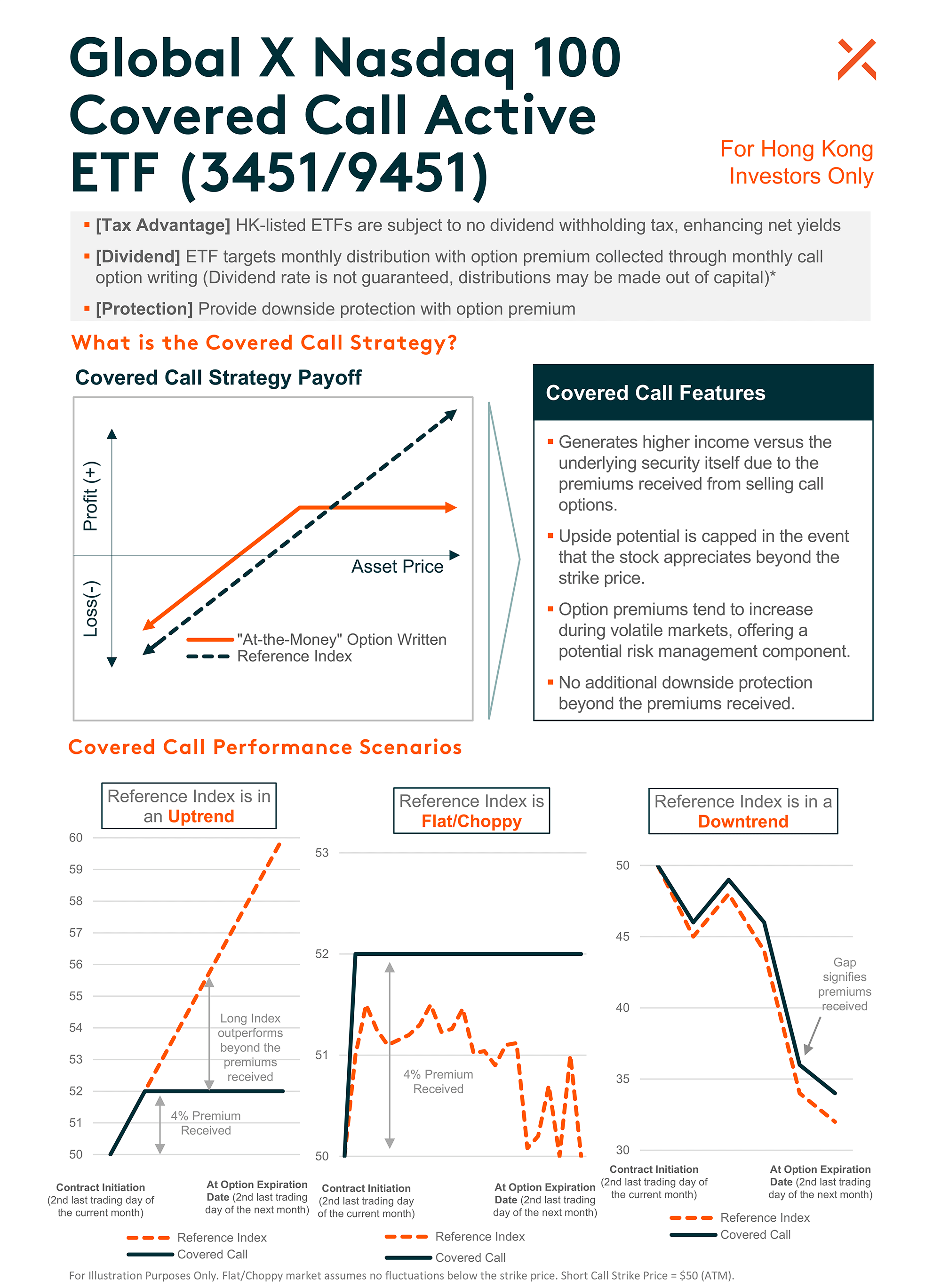

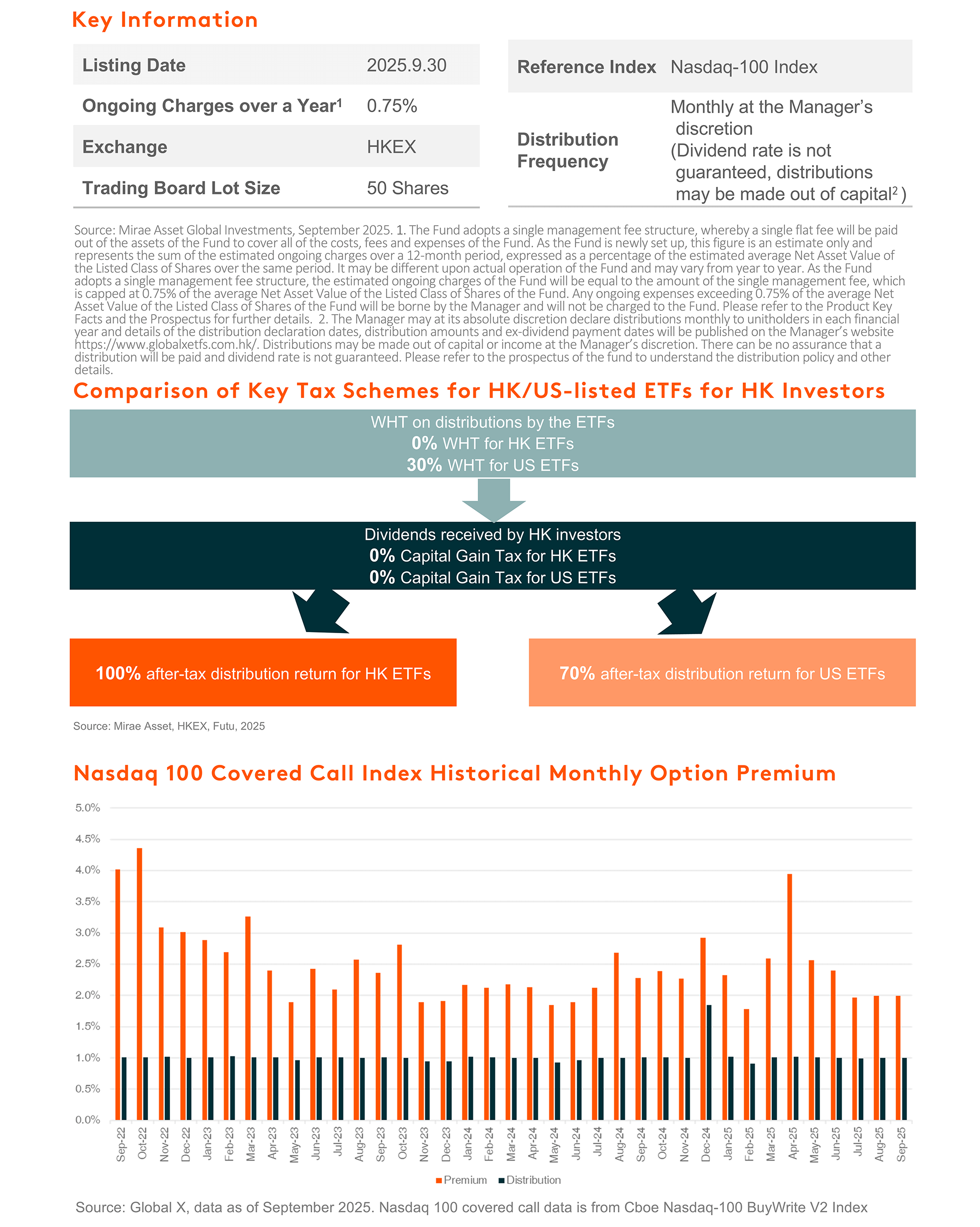

| Global X Nasdaq 100 Covered Call Active ETF (3451) | Reason for inclusion: 3451 implements covered call strategy on Nasdaq 100 index. The Nasdaq 100 index has high exposure to technology and growth-focused names. While we maintain a constructive long-term outlook on the growth of AI, we anticipate short term volatilities driven by macro data, geopolitics tension, and tariff policies. |

|

||||||||||||||||||||

| 3451 combines Nasdaq 100 exposure with an active covered call strategy, aiming to provide premium income potential, downside cushioning, and tax efficiency for Hong Kong investors. (Aims at Monthly Distribution. Dividend rate is not guaranteed, distributions may be made out of capital 1).

1.Positive distribution does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. |

||||||||||||||||||||||

| Global X Hang Seng High Dividend Yield ETF (3110) | Reason for Inclusion: High dividend strategy has better resilient amid market volatility. The fund was up in October, vs -4% for Hang Seng Index. China market has seen style shift recently from growth to value/dividend, as more investors take profit amid market turbulence and towards year-end. This could continue in short term and drive 3110 outperformance. |

|

||||||||||||||||||||

| Amid ongoing global trade uncertainty and the decreasing policy rates set by major central banks, the High Dividend Strategy continues to stand out for its combination of elevated dividend yields and reduced volatility. High dividend strategy is also a key beneficiary for China’s forceful stimulus package and policy supports. PBOC’s Relending facility should boost corporate buyback, and Capital Market ‘Nine Measures’ issued by Central Government also promotes corporate dividend payout. | ||||||||||||||||||||||

| Global X China Semiconductor ETF (3191) |

Reason for inclusion: With technological self-reliance reaffirmed as a key focus of the 15th FYP, China’s journey toward semiconductor localization represents a long-term structural growth opportunity. |

|

||||||||||||||||||||

| China’s semiconductor industry is positioned for structural growth, driven by two key catalysts. First, the low localization rate is set to rise, supported by persistent government backing and ongoing U.S.-China tech tensions. Second, the rapid development of cutting-edge AI models and applications within China is fueling a surge in domestic demand for AI compute, energizing the entire hardware supply chain. | ||||||||||||||||||||||

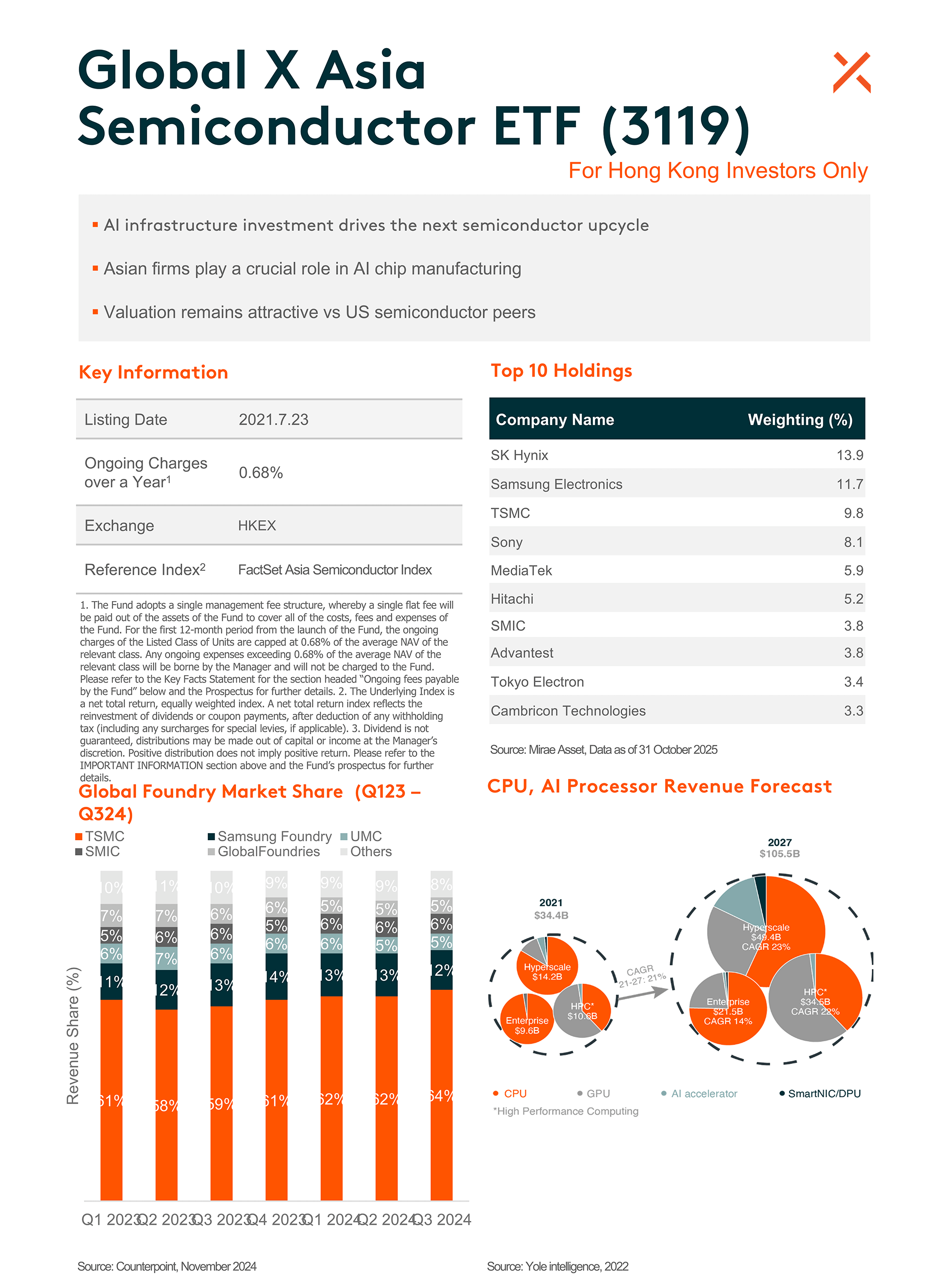

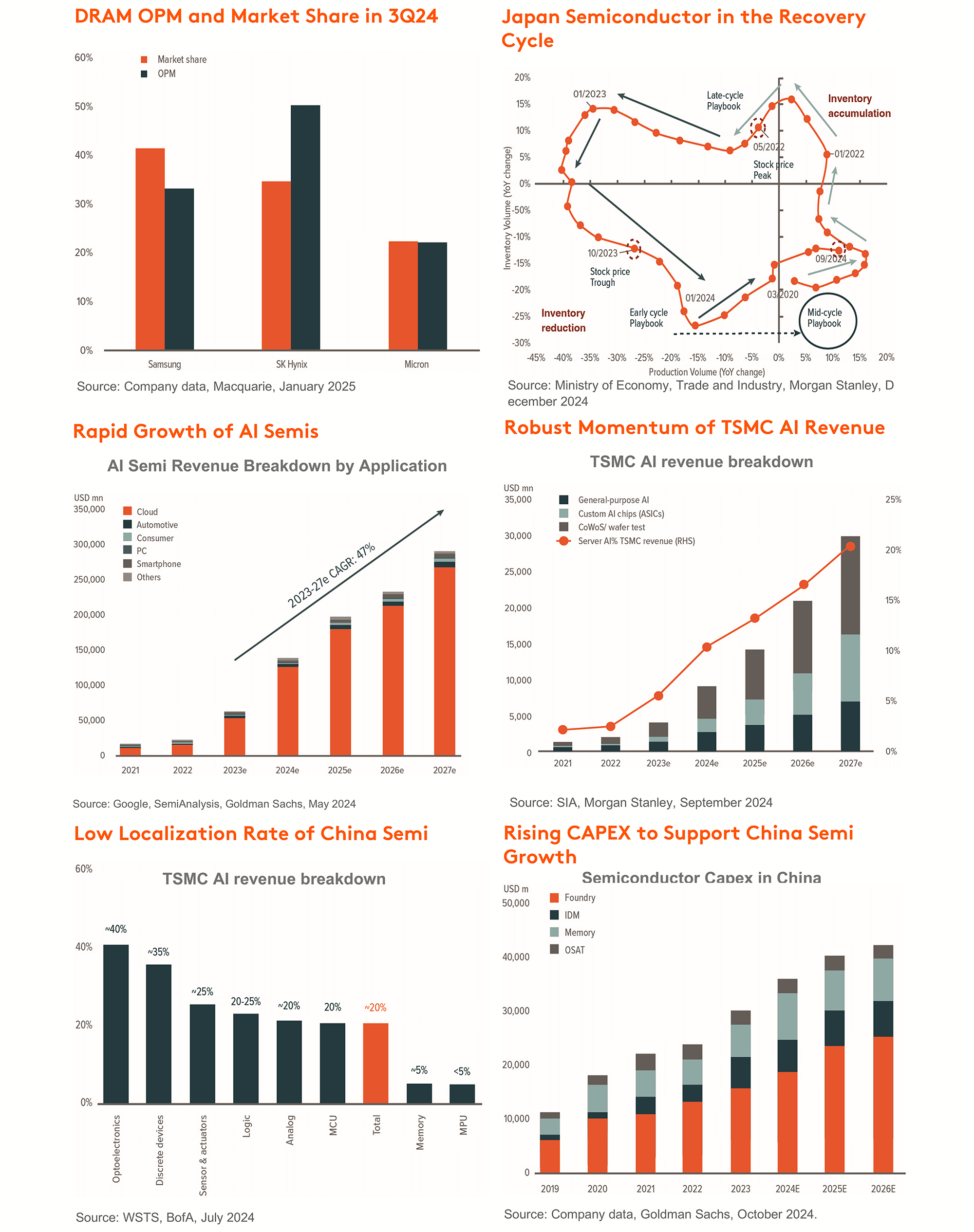

| Asia Semiconductor ETF (3119) | Reason for Inclusion: Asia has established itself as the undisputed center of the global semiconductor ecosystem, particularly for AI enabler. The AI boom is driving massive investments in hardware, where Asia demonstrates a marked edge. |

|

||||||||||||||||||||

| Asian nations like China have escalated its AI investments, betting on self-reliance to bolster its domestic semiconductor industry. Meanwhile, Korean semi stocks are rallying due to a memory super cycle, fuelled by capacity shortage as lots of memory supply is occupied by AI level memory upgrading. | ||||||||||||||||||||||

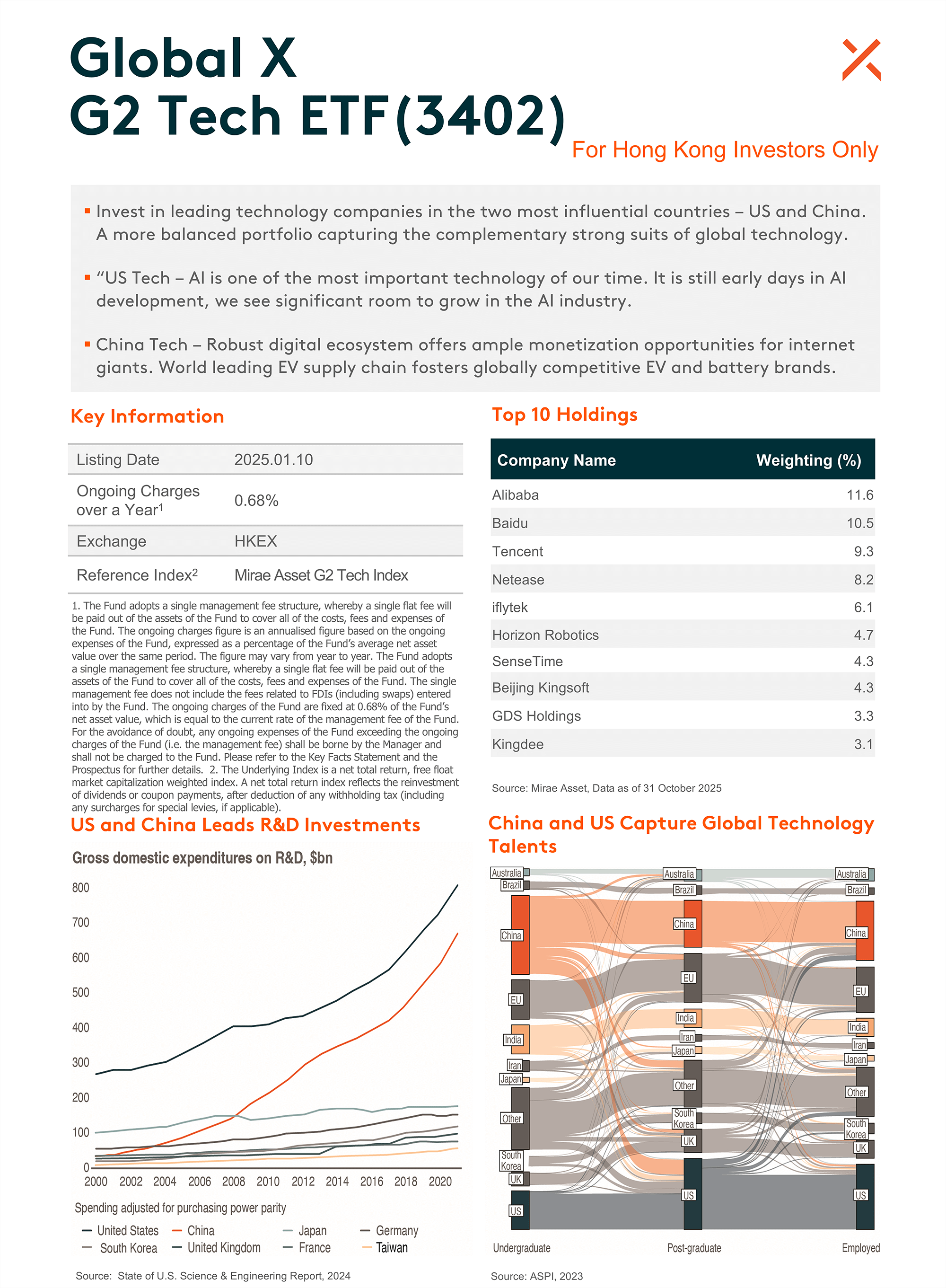

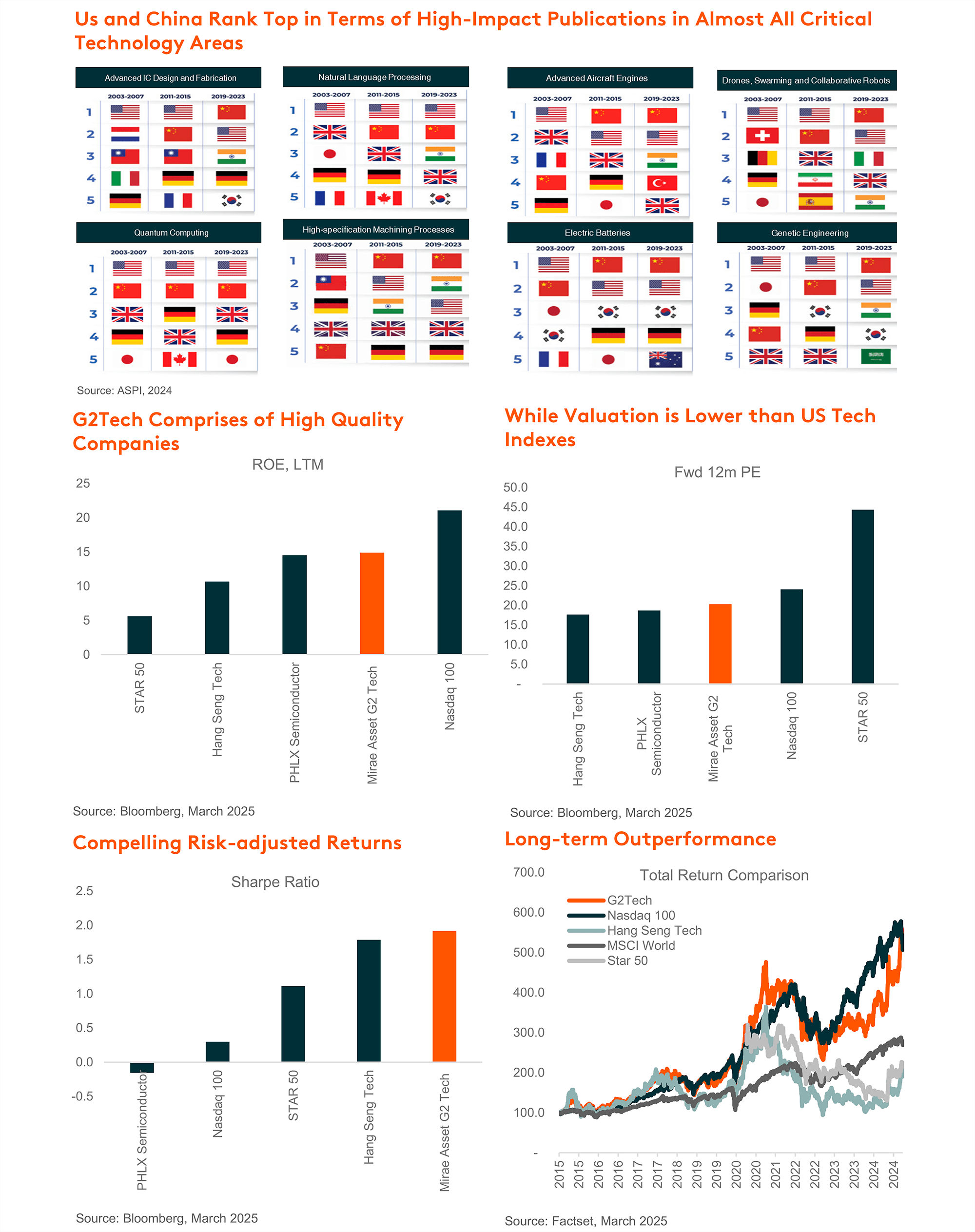

| G2 Tech ETF (3402) |

Reason for Inclusion: US China trade talk is viewed as positive, which lowers trade policy uncertainty and bodes well for stock market performance. Leading US AI companies’ performance is supported by continued AI CAPEX and solid EPS growth. China high tech companies are also gaining traction across sectors like AI, Semi, and Battery. |

|

||||||||||||||||||||

| The ETF invests in US and China technology leaders, offering a more balanced portfolio to capture the complementary strong suits of US and China technology. The recent development in China technology across AI, humanoid robot, and smart driving is regaining global investors’ attention on the innovation capability of Chinese companies, and could drive a more sustainable rerating on Chinese technology stocks. For US, the substantial investments into AI continues and tech giants are poised to benefit from AI development and adoptions. | ||||||||||||||||||||||

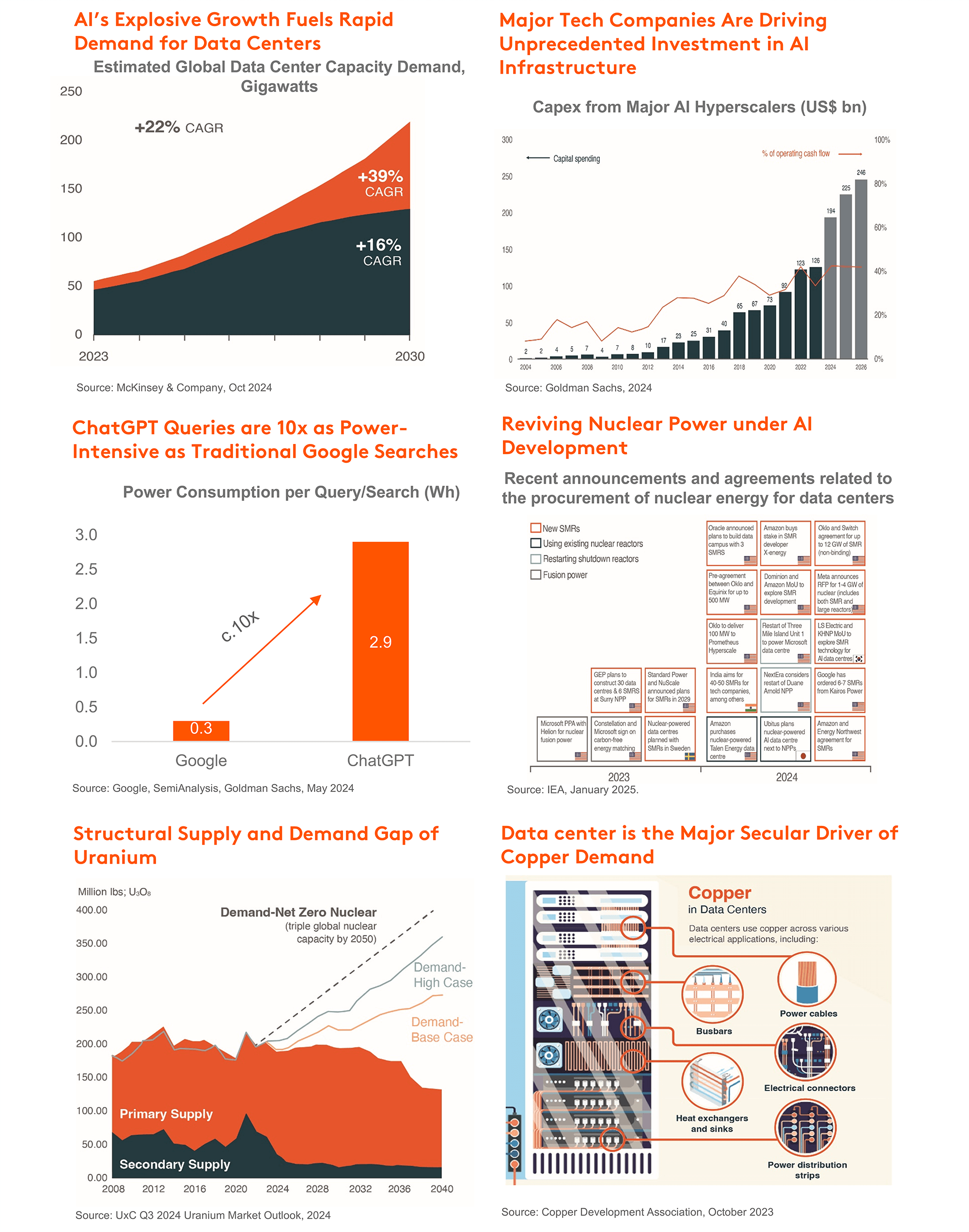

| AI Infrastructure ETF (3401) |

Reason for Inclusion: The AI boom is accelerating into a full-scale infrastructure supercycle, fueled by unprecedented hyperscaler investments. Despite this rapid buildout, a critical bottleneck persists on the supply side. |

|

||||||||||||||||||||

| The top 4 hyperscalers spent over $100 billion on AI capex in 3Q25, yet demand continues to outpace supply. Furthermore, the U.S. data center pipeline exceeds 125 GW—nearly five times the existing capacity. Morgan Stanley (October 2025) projects a 49 GW U.S. power generation shortfall by 2028, a constraint that is now igniting a nuclear energy renaissance. This structural imbalance suggests the AI infrastructure market will remain supply-constrained for the foreseeable future. |

Source: Mirae Asset, 31 October 2025.