Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

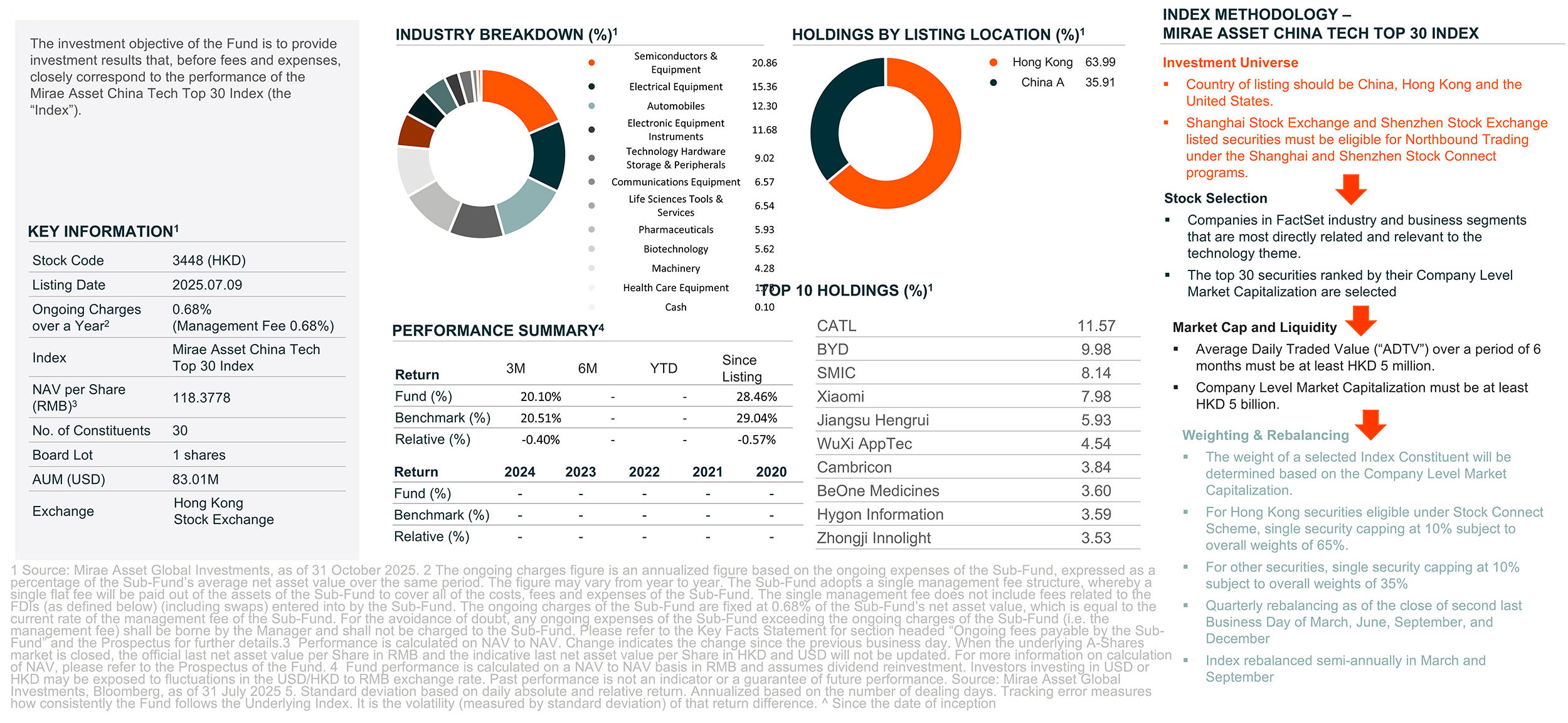

- The investment objective of Global X China Core TECH ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset China Tech Top 30 Index.

- The Fund is exposed to concentration risk by tracking a single region or country. It is potentially more volatile than a broad-based fund due to adverse conditions in the region.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit (the “Unit”) on the SEHK is driven by secondary market trading factors. The Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

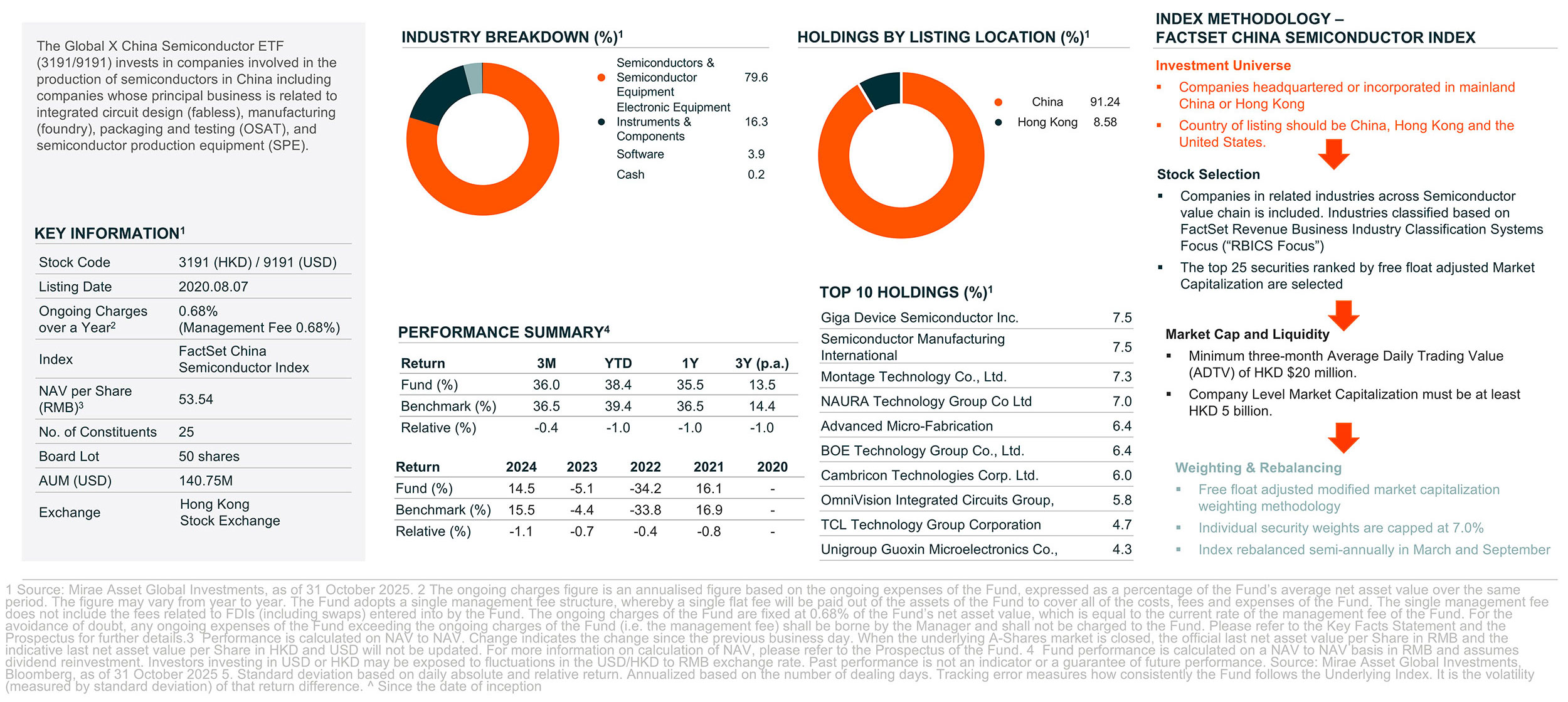

- The investment objective of Global X China Semiconductor ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Semiconductor Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

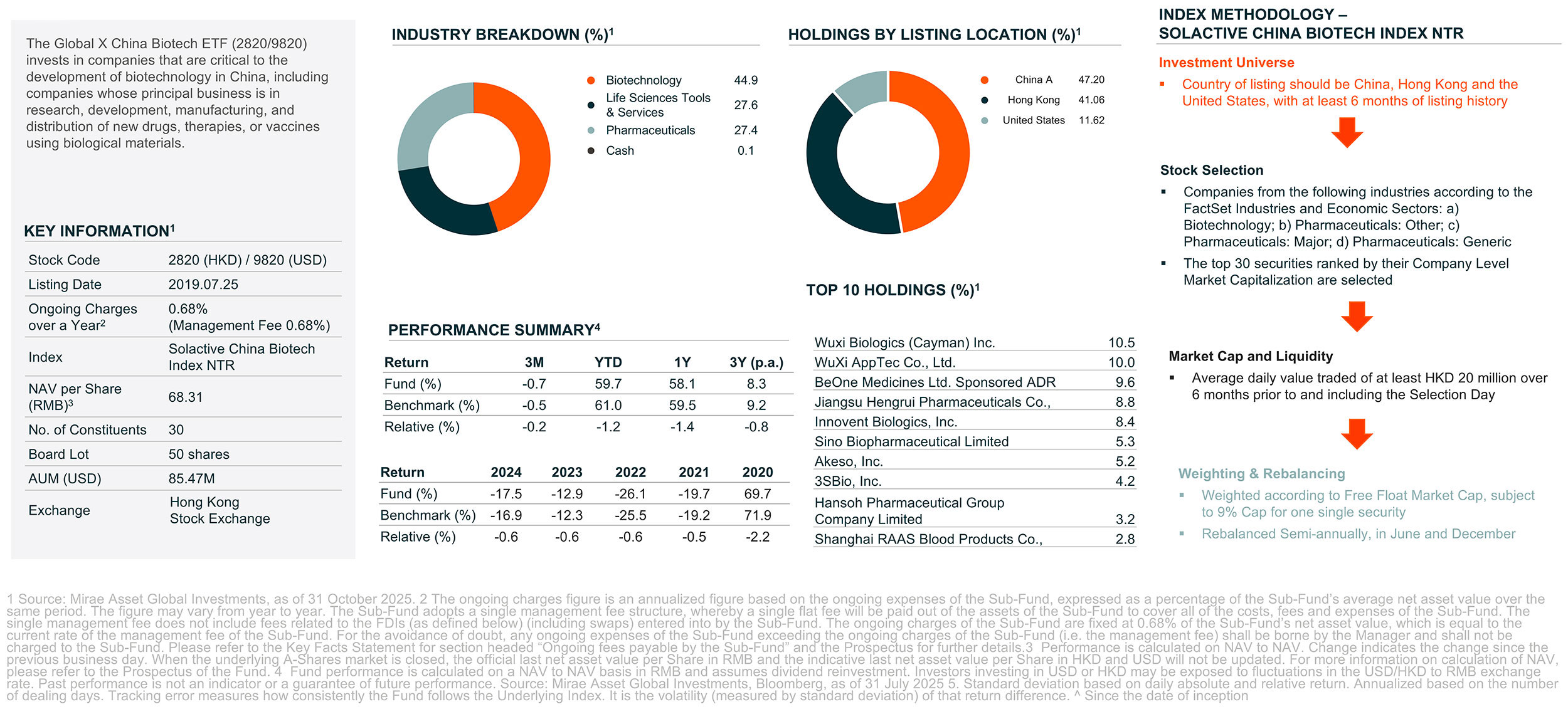

- The investment objective of Global X China Biotech ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Biotech Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

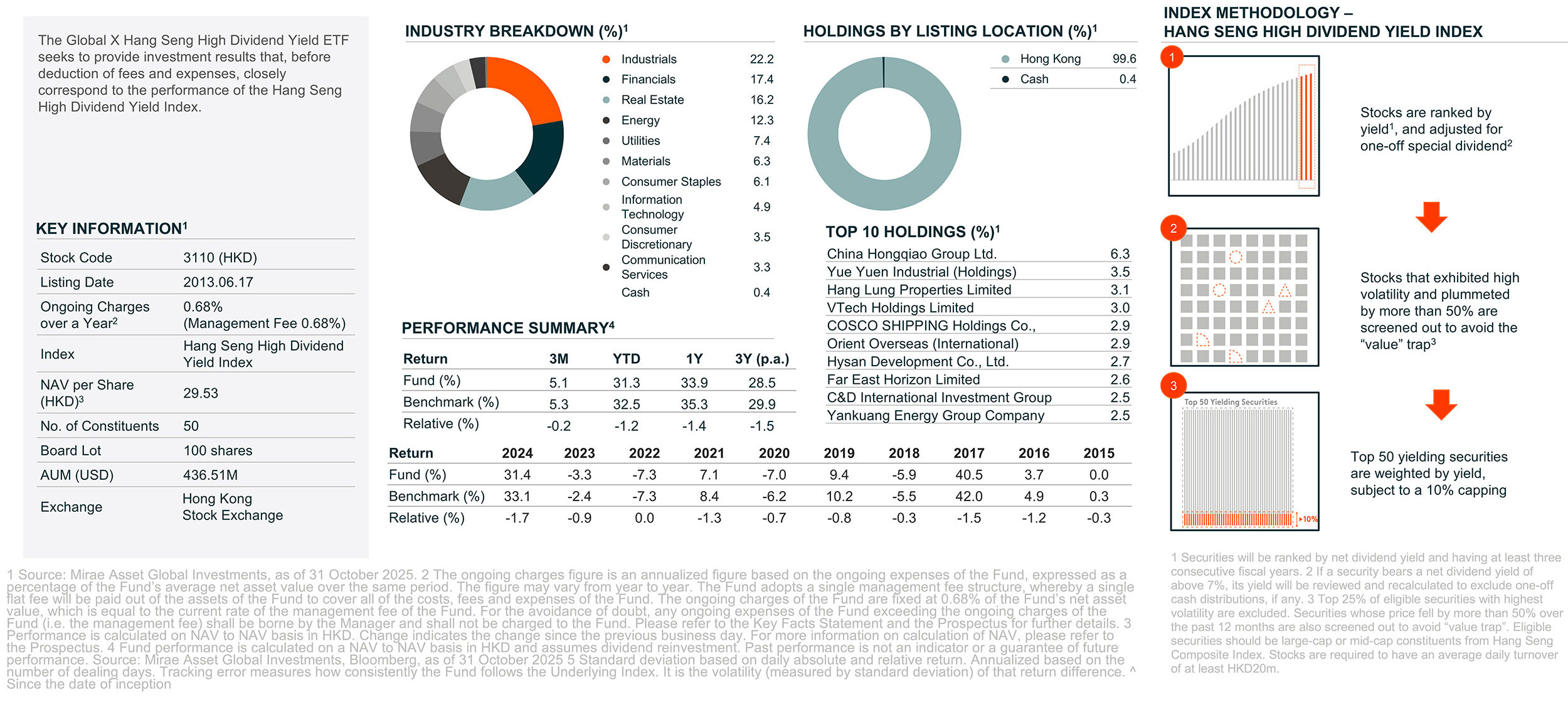

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

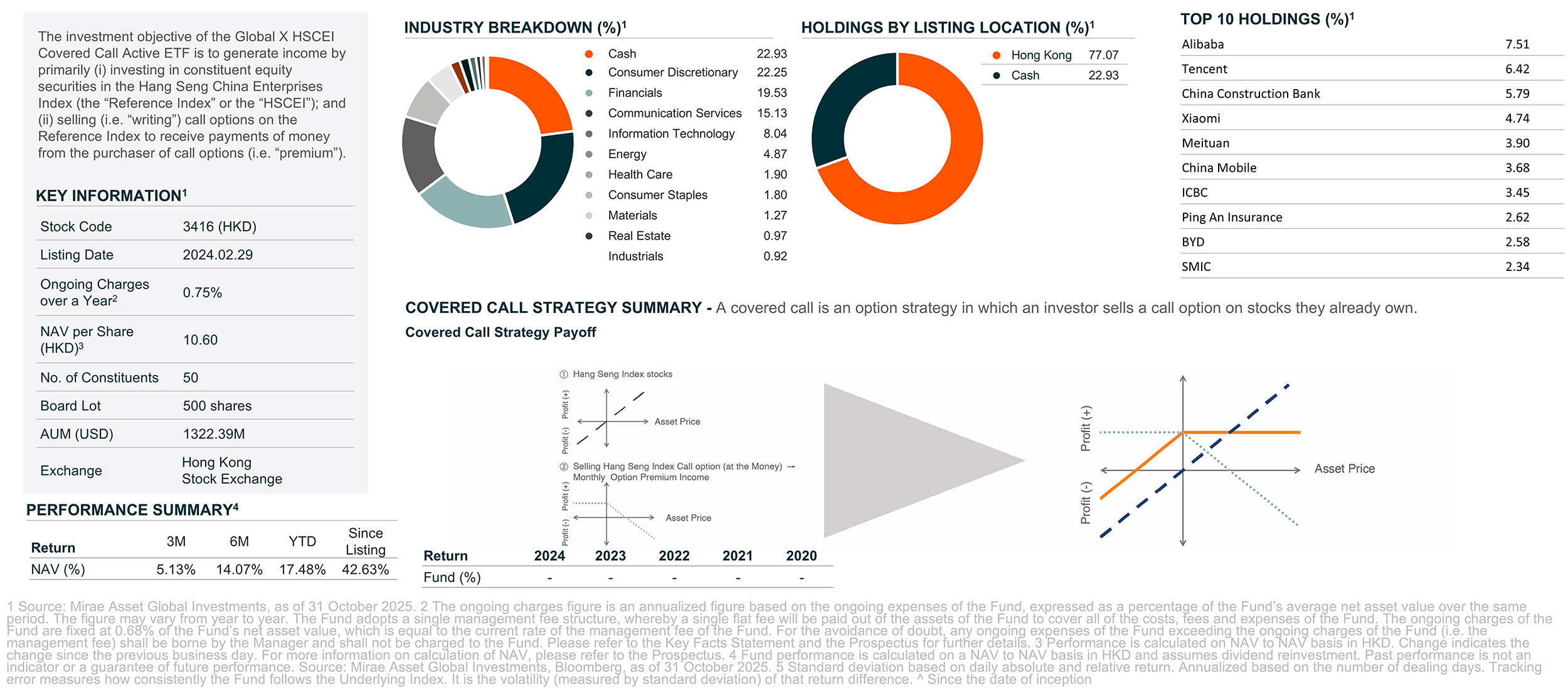

- The investment objective of Global X HSCEI Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

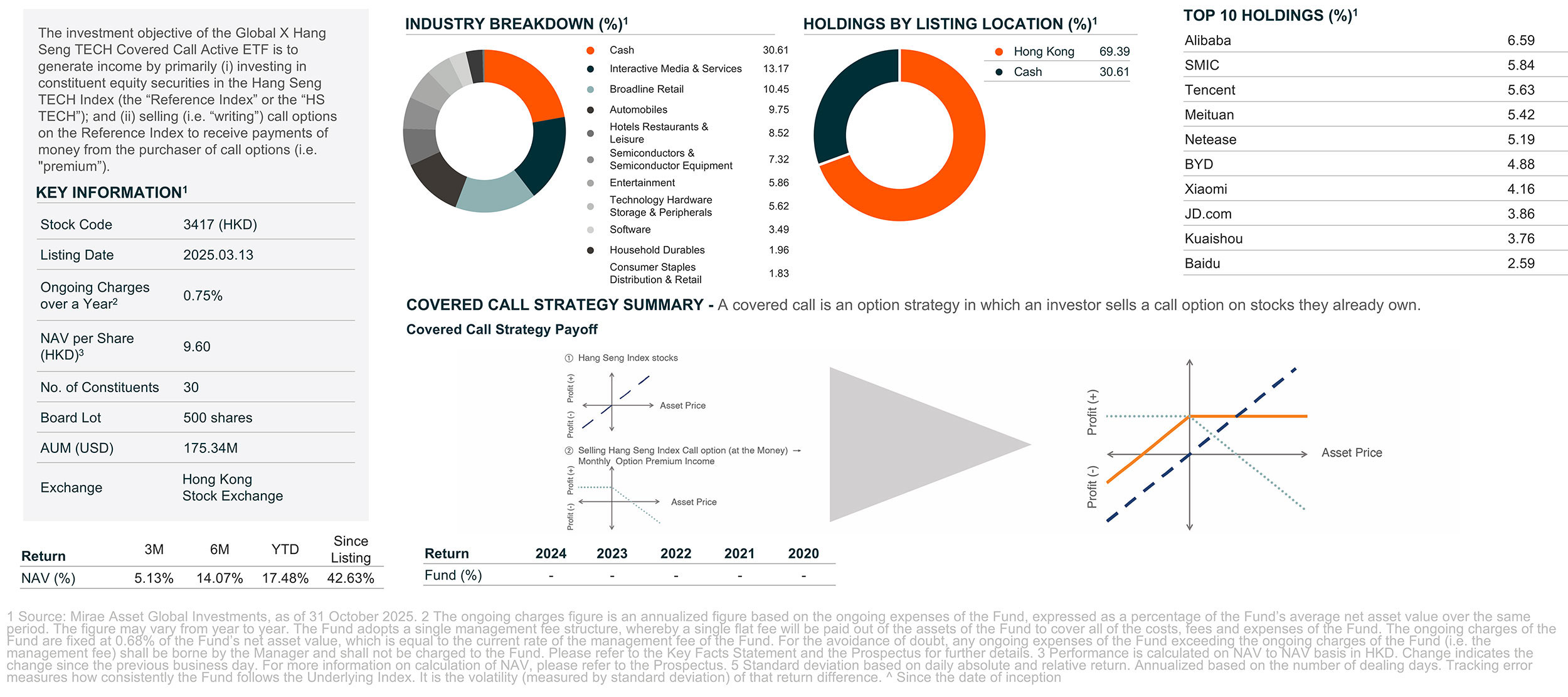

- The investment objective of Global X Hang Seng TECH Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng TECH Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

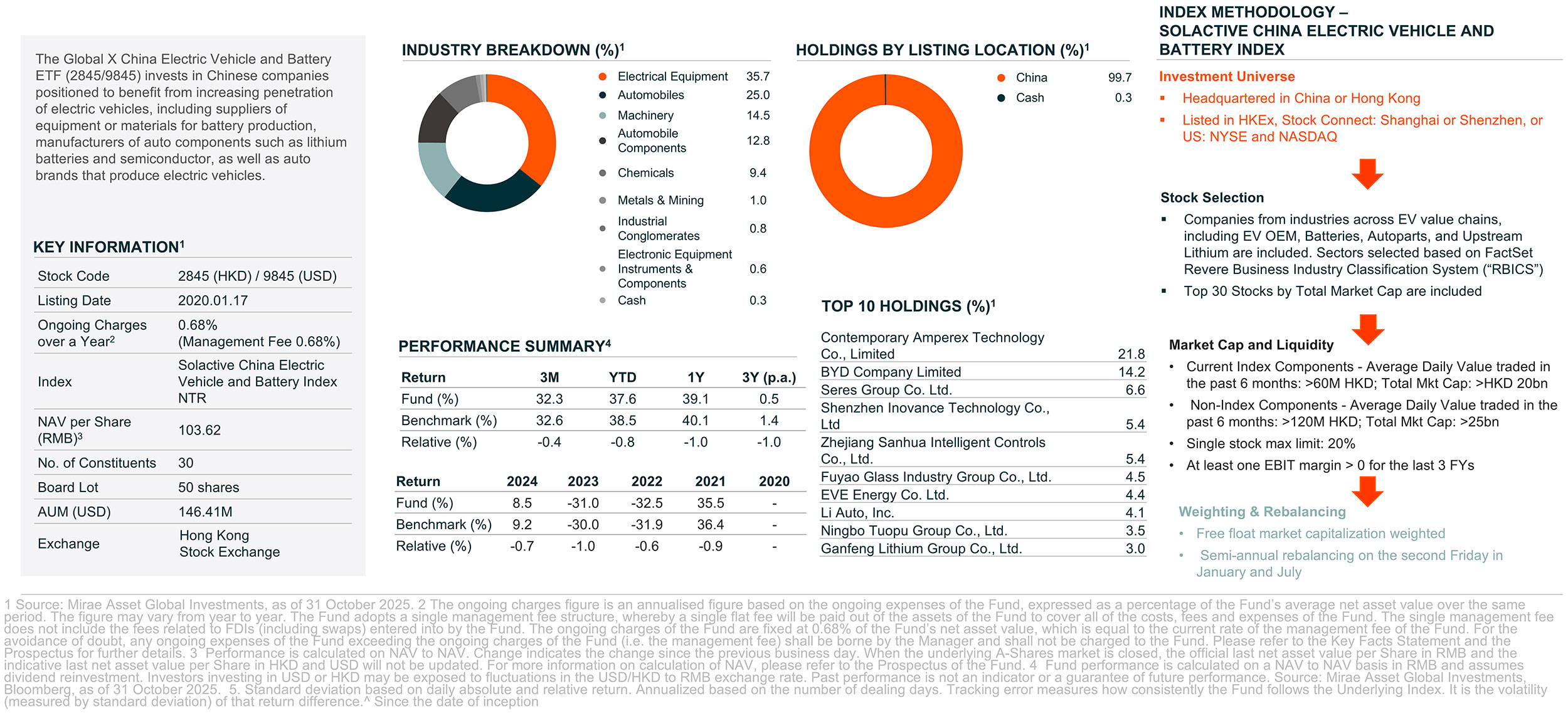

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

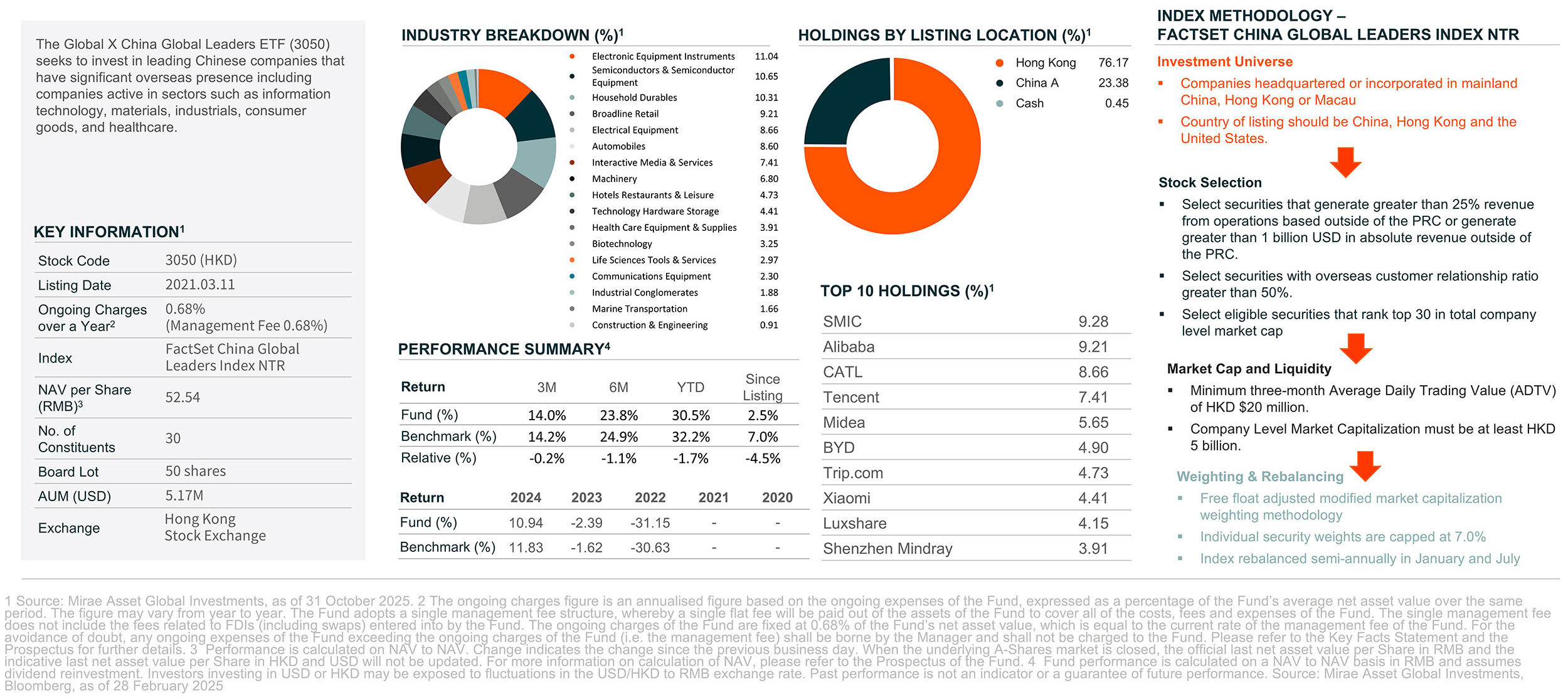

- The investment objective of Global X China Global Leaders ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Global Leaders Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

China Strategy 2026

PART 1: Market view – Executive Summary

Upside Potential in 2026

- The Chinese stock market saw significant growth in 2025, and we expect decent upside potential in 2026.

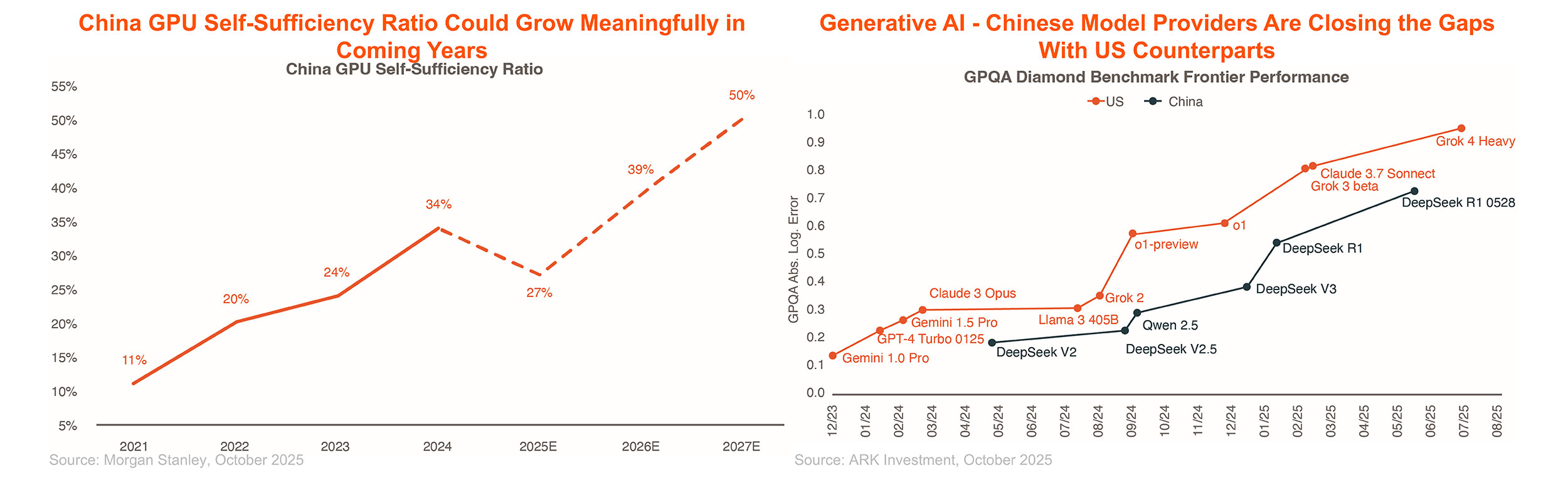

- First, for years, investor sentiment toward Chinese equities has been weighed down by fears that the US pressure on China would limit industrial growth. China’s efforts to become more self-reliant are paying off.

- The use of rare earths as a key negotiating tool to prevent further sanctions,

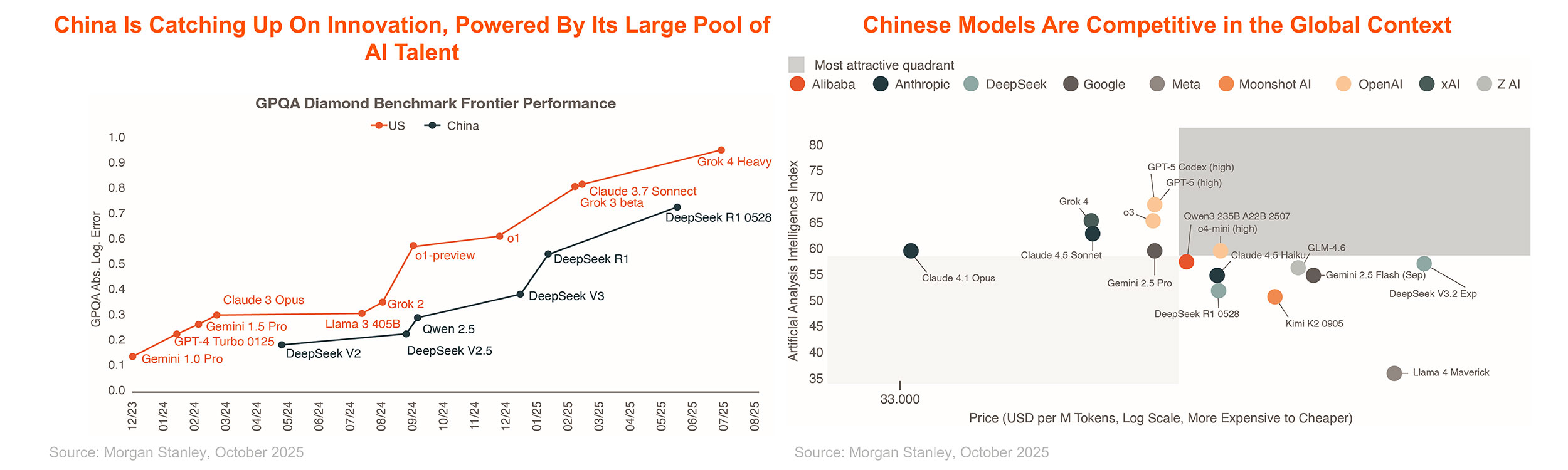

- the DeepSeek moment implies less demand for high-end chips and domestic mass production of AI chips began,

- Concerns about blocking energy imports have been alleviated thanks to the expansion of solar/wind power generation and the widespread adoption of electric vehicles, and

- Fears of exclusion from the dollar settlement system may also be eased by the growing use of USD stablecoins.

- Second, for a stock market to be attractive, it must be home to a large number of world-class companies, similar to the US market. China has successfully fostered a number of world-class companies with strong global competitiveness.

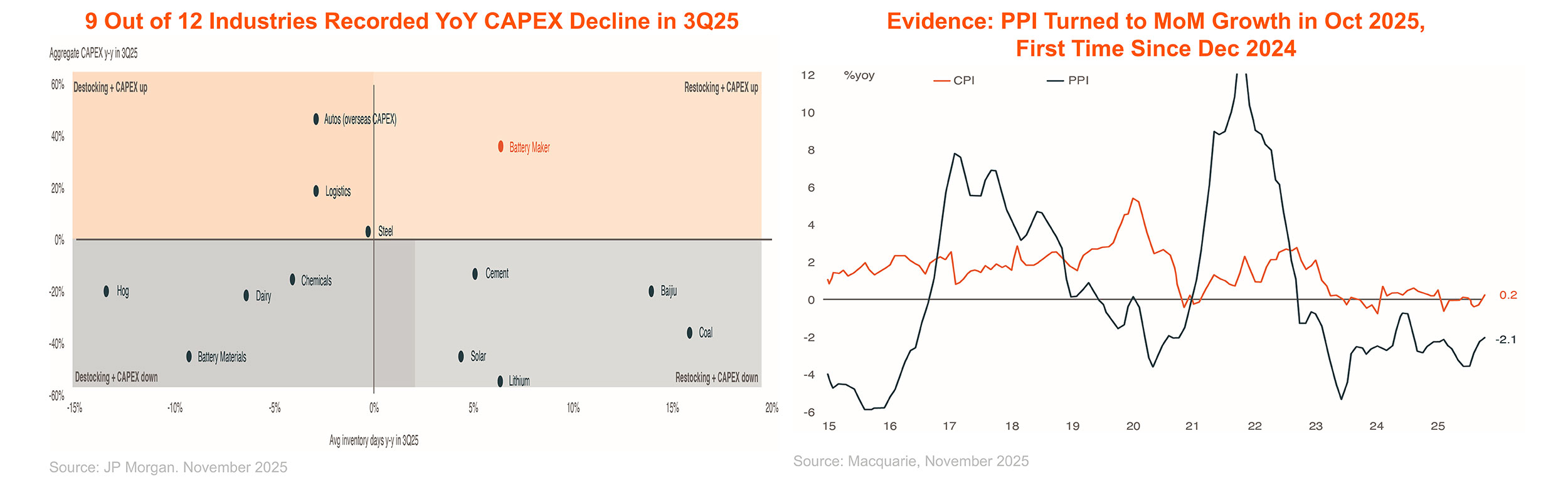

- Third, while China is home to many world-class companies, margins tend to be very low due to oversupply. However, policies limiting IPO, promoting anti-involution and natural cycle adjustments are addressing the oversupply problem.

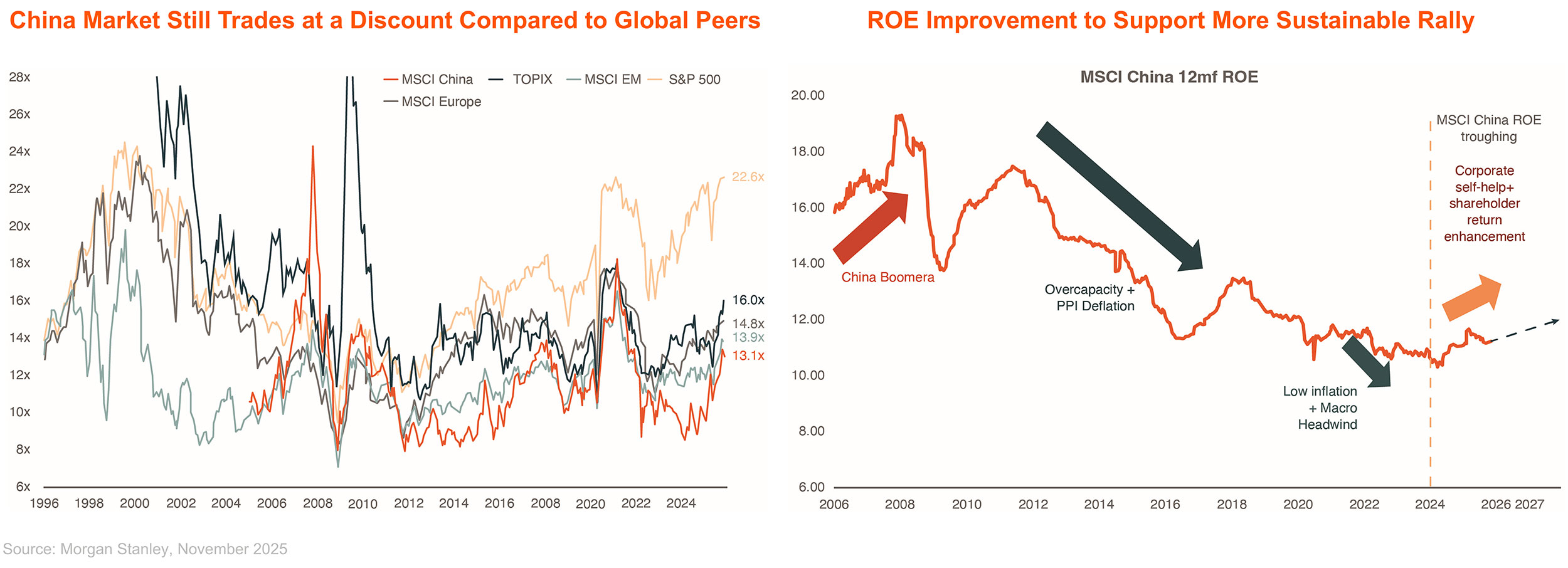

- Fourth, as sentiment recovers, the cheap valuations will become more visible. The MSCI China Index’s 12-month forward PER is 12.5x, compared to 22.5x for the S&P 500 Index. (Bloomberg, Mirae Asset, November 2025)

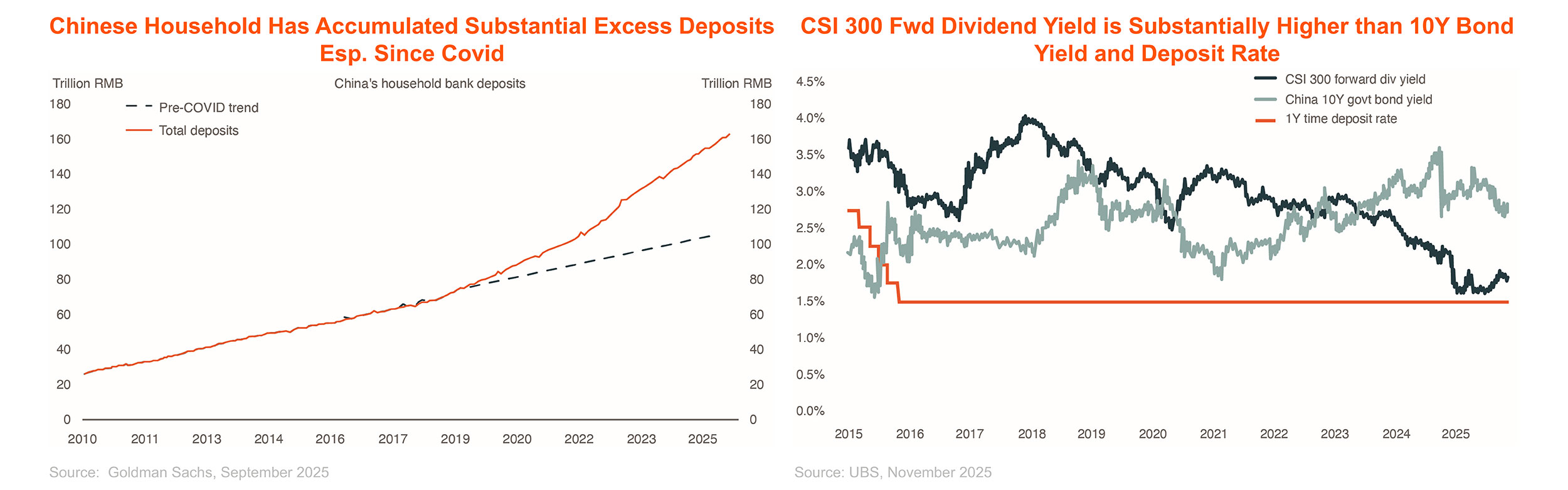

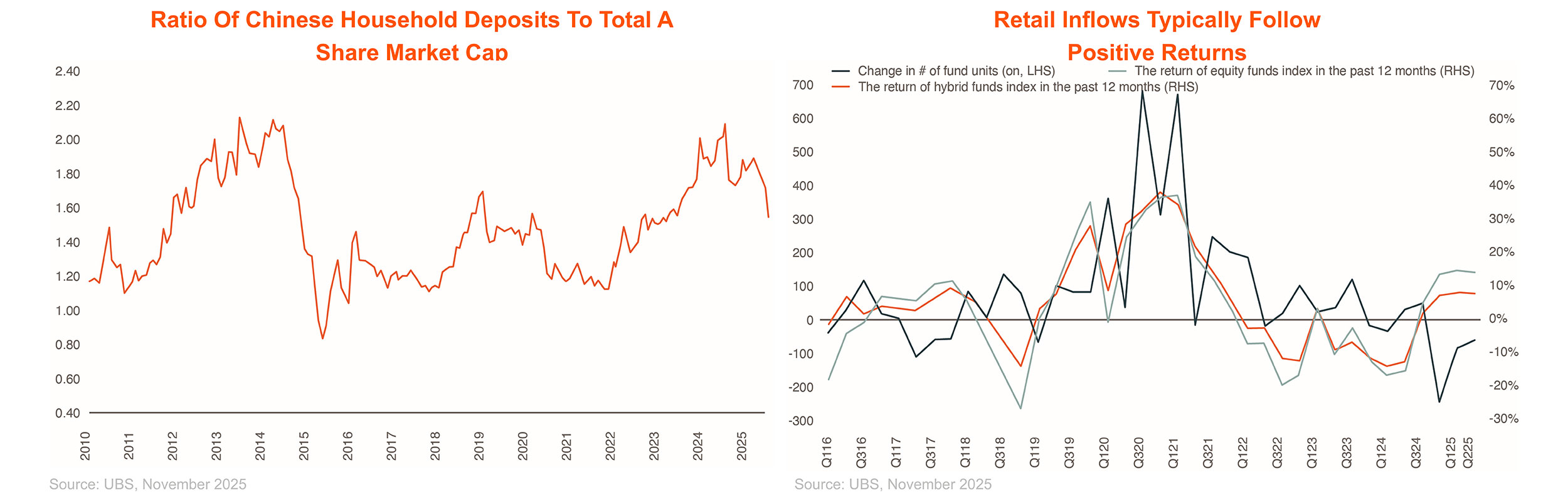

- Fifth, market liquidity is abundant. As the export competitiveness strengthens, the trade surplus is expected to exceed US$1 trillion this year. This surplus will provide a solid foundation for liquidity in the Chinese stock market. In the first quarter of this year, total Chinese household deposits exceeded 160 trillion yuan (GS, 2025) (GDP ~130 trillion and A-share market cap is about 100 trillion, NBS & STCN)

- The sluggish economic recovery following the property slump remains a significant risk factor. Producer prices have been in negative territory for three consecutive years, and job creation is still weak. However, the Chinese government has ample policy tools at its disposal—such as government bond issuance and monetary easing —which should limit the risk of a severe economic downturn.

- At this juncture, the most effective way to revive consumption is through the wealth effect. Supporting the stock market will likely be at the core of economic policy measures, which is also positive for equity investors.

PART 1.1: Market View – in detail

Oversupply Is a Major Cause Of Chinese Market Underperformance

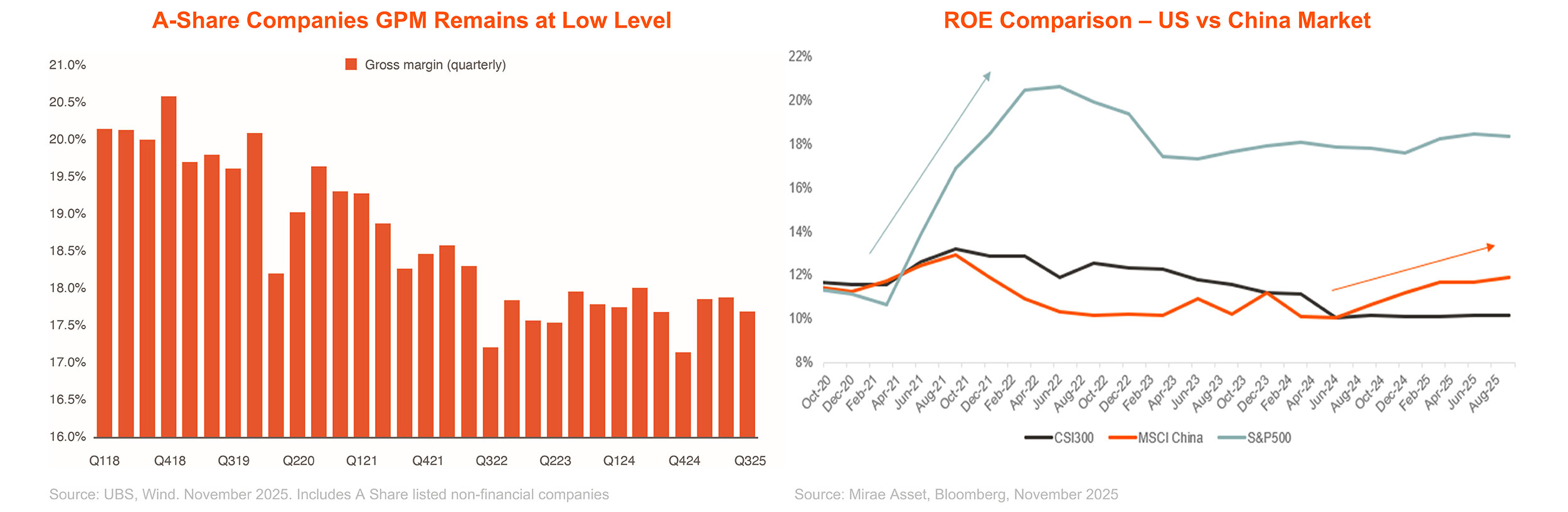

- Overcapacity and oversupply have led to a depressed pricing environment, which has led to low profitability for Chinese companies

- The gross profit margin of A-share stocks has declined over the past five years, reaching a record low of 17.5%

- This contrasts sharply with S&P 500 stocks, which still enjoy strong margins and profitability

However, A Balance Between Supply And Demand Is Approaching

New Capital Market Policies Will Limit Growth In Corporates’ Capex

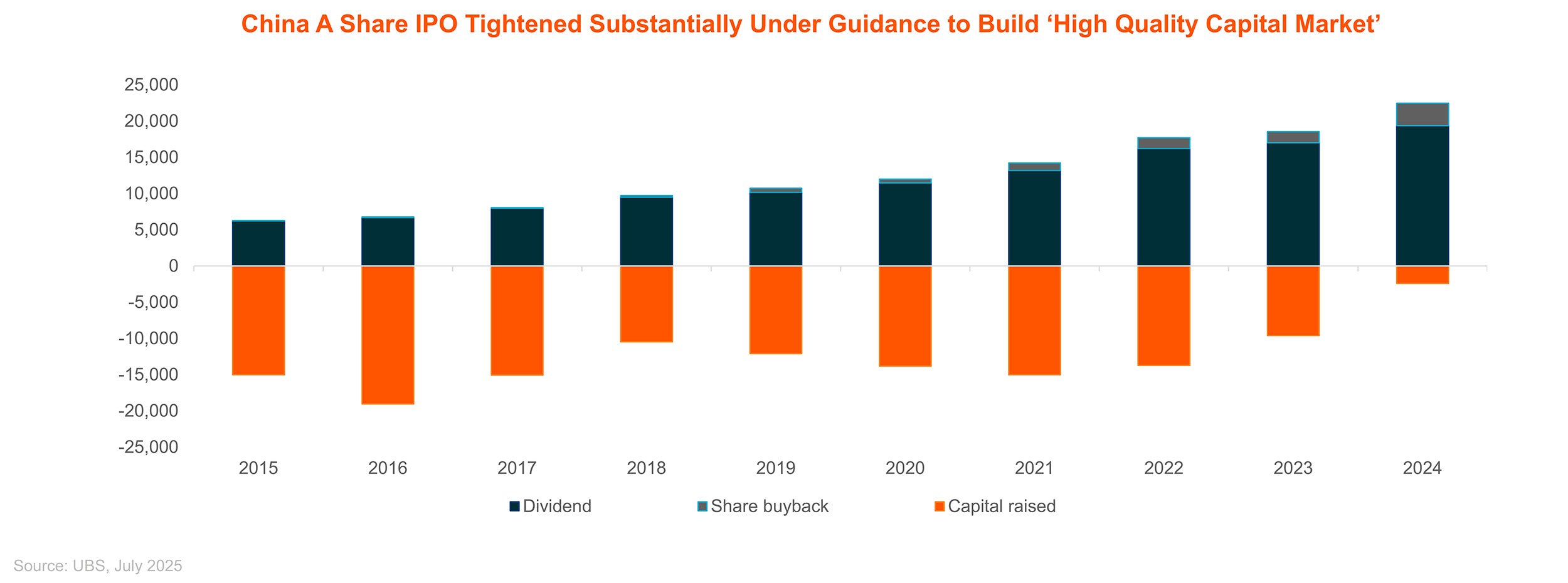

- 新国九条 in 2024:The government implemented policies focused on minority shareholders’ interests by encouraging dividend payout and restricting IPOs

- This policy discouraged companies from financing excessive capital expenditure plans

China’s Efforts To Become More Self-reliant Are Paying Off

- In addition to leveraging rare earths to counter US tech barriers, China’s efforts to achieve self-reliance in strategic important areas also bears fruits

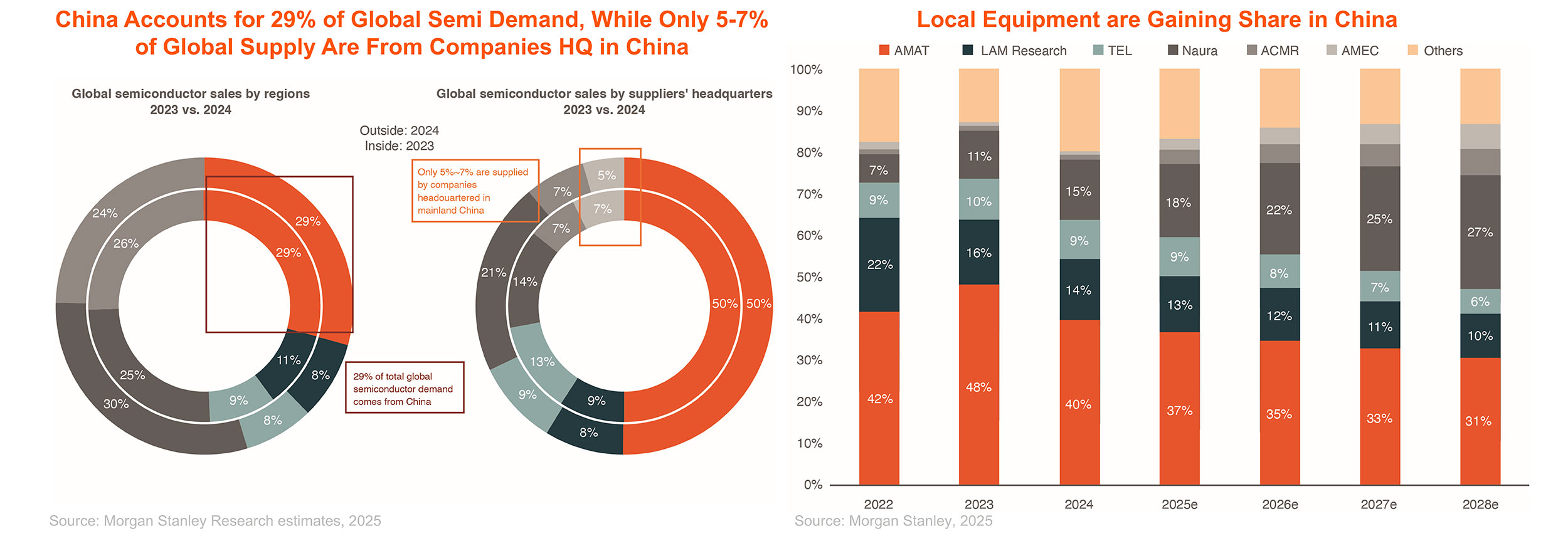

- Continued US Chip ban and robust China AI demand is leading to rise in self-sufficiency ratio

- Despite US Chip ban, Chinese companies are making globally competitive AI models, featuring high performance and cost-effectiveness, which could bode well for adoption

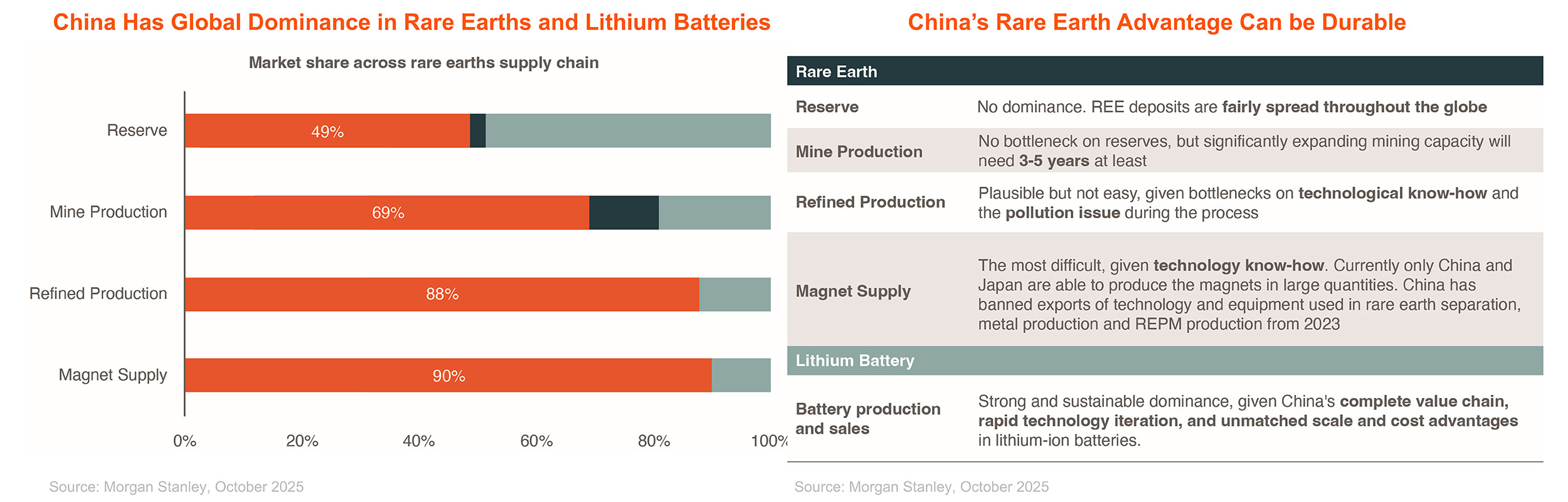

China Discovered Powerful Bargaining Chip To Offset American Aggression: Rare Earth

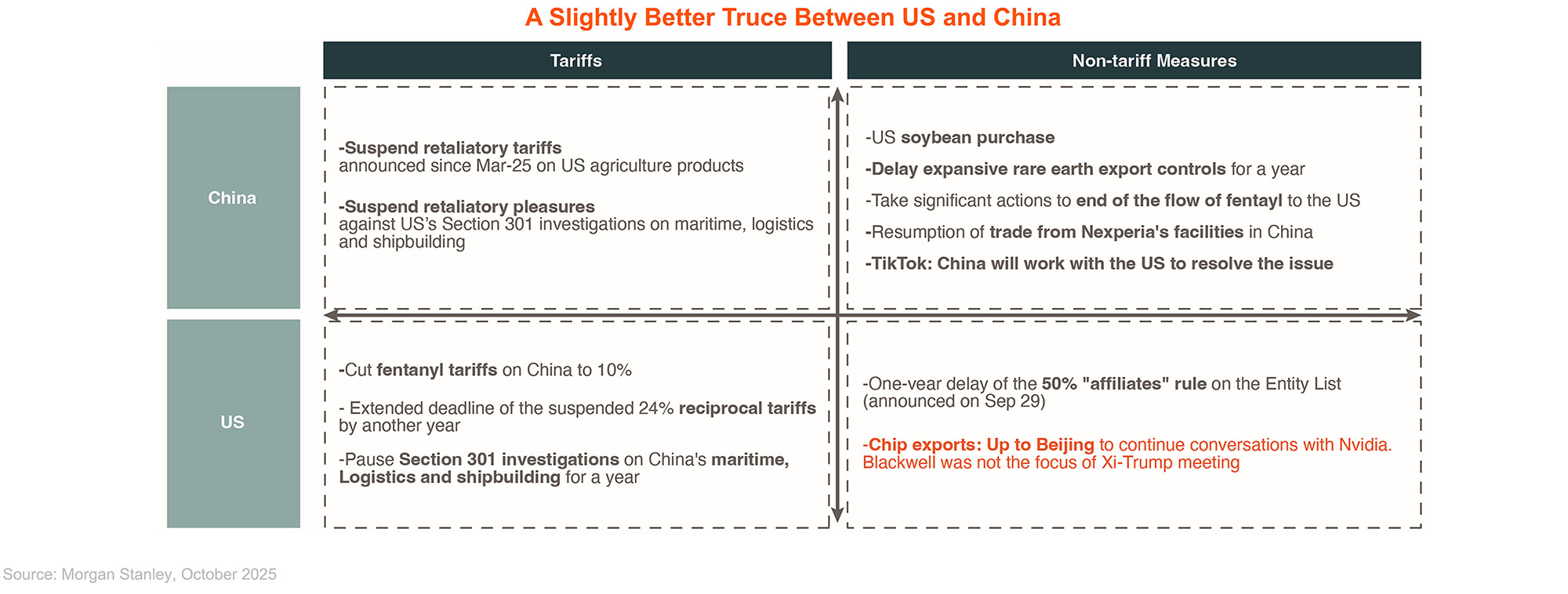

- After the re-escalation of trade war in October, US and China reached agreements on trade post President Xi-Trump meeting. Though the agreement could be fragile and subject to temporary escalation in the future, China has leveraged rare earth to enhance its bargaining power to counter US Tech barrier

- China has established a dominant position in several critical materials essential for high-tech industries, with its strongest advantage in refining and magnet production

- China’s leverage can be durable: Technology know-how and pollution issue could be the bottlenecks for the US and its alliances. Meaningful capacity expansion would take at least 3–5 years (MS)

As Sentiment Recovers, The Cheap Valuations Will Become More Visible

- Confidence is key to boost valuation: The success stories of China’s DeepSeek, Humanoid Robot, and Biotech out-licensing this year are driving China market’s rerating

- Even after the rally, China market still trades at a discount to peers

Where Will The New Money Come From? Take a look Into Households’ Deep Pocket

- China’s total household savings exceeded Rmb160trn, with the highest household savings rate among major economies. A gradual reallocation of household asset will provide abundant liquidity into equity market

- Equity market appears more appealing, compared to deposit rate (1-1.5%) and government bonds yield (10yr at c.2%)

- There’s substantial room for reallocation into equity market. Current ratio of household deposit to A share market cap remains above historical average

- Retail inflows typically accelerates following positive market returns. Current retail sentiments are not overheating despite solid YTD return in China market

PART 2: Which ETFs to Buy in 2026 – Executive Summary

From High Growth to Moderate Growth – Where Are the Opportunities?

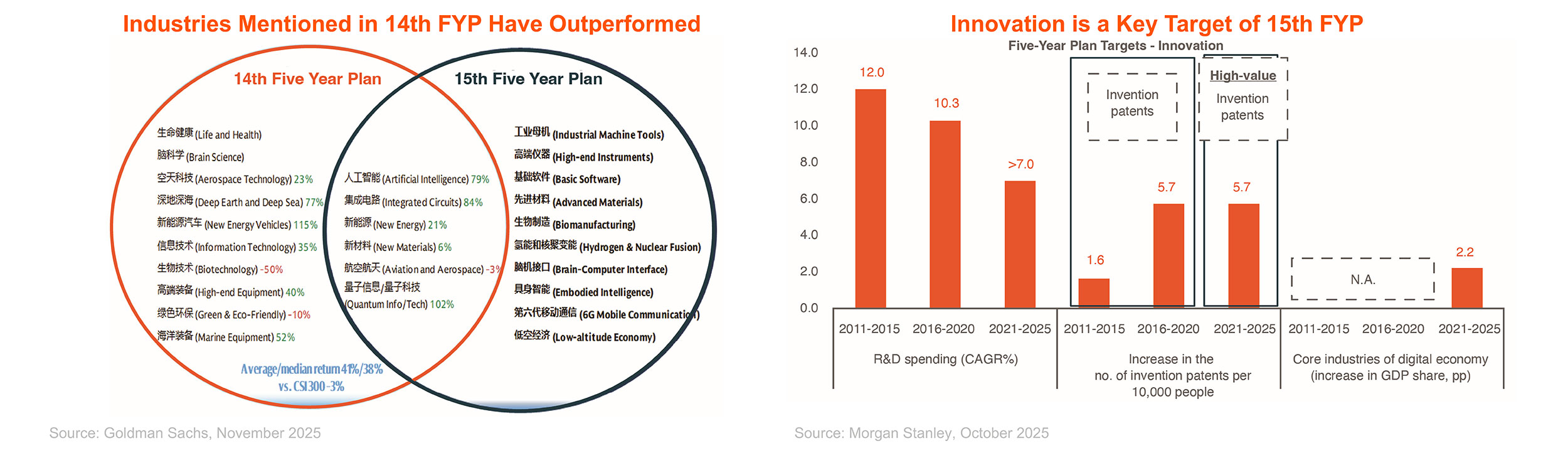

China’s economy has shifted from a high-growth phase to a moderate-growth trajectory. In the next decade, GDP growth is expected to hover around 4%, which means domestic consumption will find it difficult to deliver strong growth. However, we believe certain technology industries still have double-digit revenue growth potential over the medium to long term.The draft of the new Five-Year Plan has been released, and as expected, it emphasizes self-reliance in core technologies such as AI, semiconductors, clean tech and biotechnology. We have high confidence in the feasibility of these policy goals.Interestingly, most of the industries highlighted are well represented in Global X China Core TECH ETF (3448) (aka. 十五五 ETF)

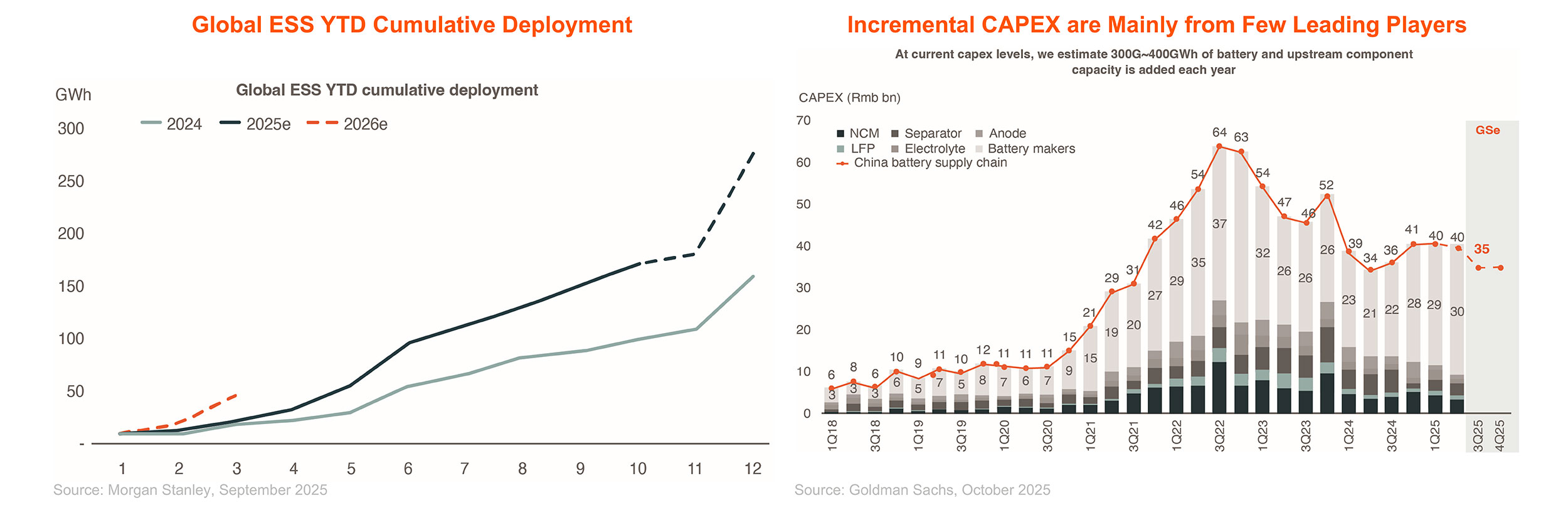

Industrial Cycle Matters

One recurring challenge in the China investment is a paradox: China leads globally in many advanced industries, yet profitability remains low. Why? Because there are too many competitive players within China, leading to intense domestic oversupply. Even world class companies cannot enjoy high margins. Therefore, it’s important which industry has favorable supply and demand cycle.Currently, the battery sector stands out. Demand for ESS (Energy Storage System) batteries has exceeded expectations, transforming what was once an oversupplied industry into one where supply is now tight.If you’re interested in investing in industry upcycle, we recommend Global X China Electric Vehicle and Battery ETF (2845).

Managing Volatility and Finding Value

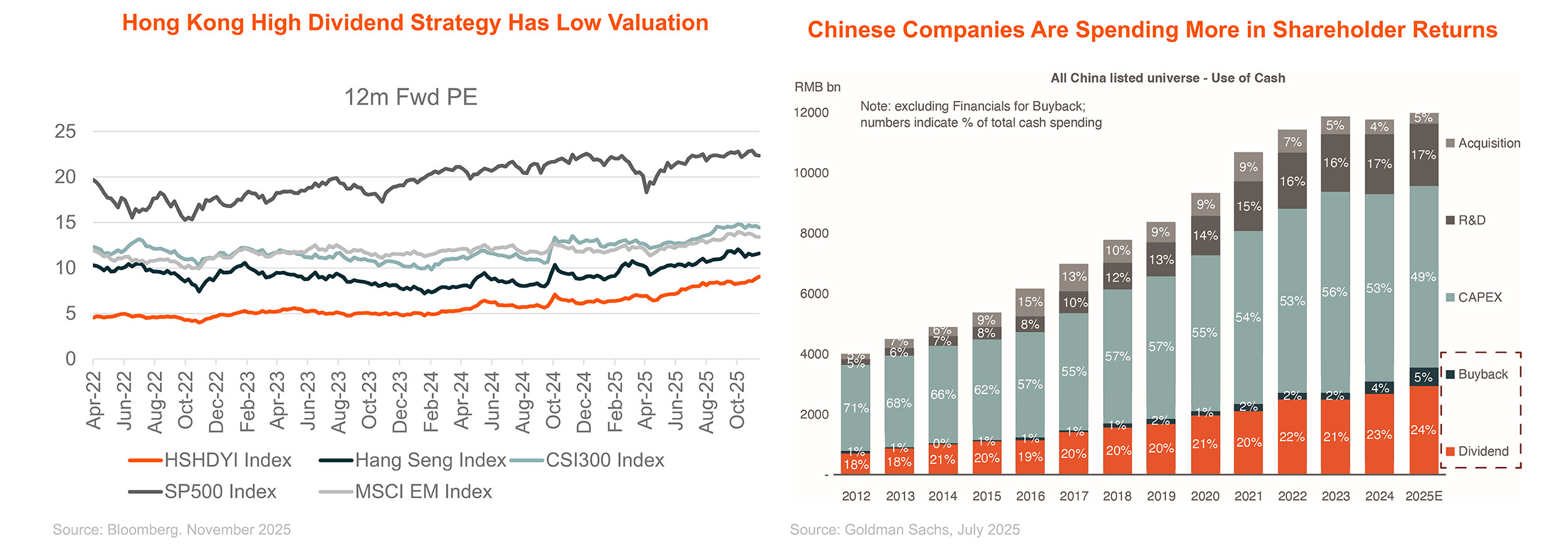

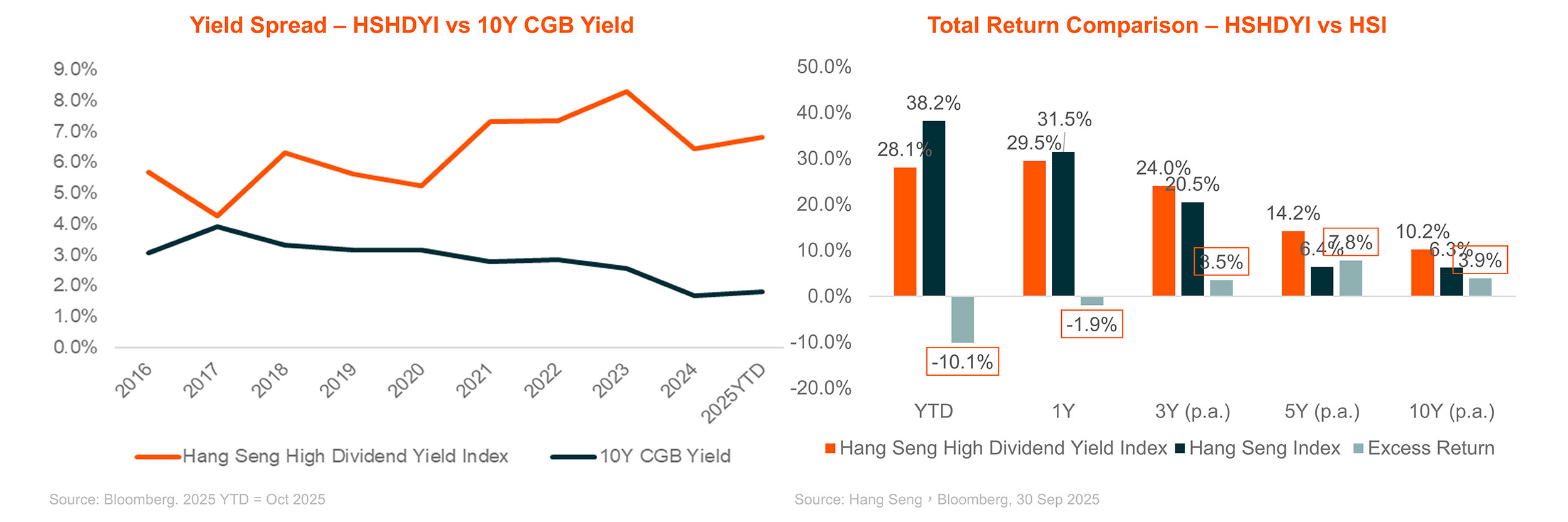

We recognize that the high volatility of the Hong Kong stock market is structurally driven by geopolitical tensions, policy changes, and liquidity fluctuations. To generate profits from this high volatility, we recommend covered call strategies such as Hang Seng TECH Covered Call Active ETF (3417) and HSCEI Covered Call Active ETF (3416). These strategies also provide partial downside protection.Another key characteristic of the Chinese market from a global perspective is that it remains one of the cheapest markets in the world. In this context, Hang Seng High Dividend Yield ETF (3110) is attractive. China is virtually the only major stock market offering a dividend yield of over 6% (Bloomberg, Mirae Asset, 2025). In contrast, markets like the US and Europe are too expensive to offer attractive dividend yields. The combination of low valuations and high dividends suggests that Chinese dividend ETFs could be an attractive long-term investment strategy.

The Potential of Chinese Exporters

We hold a positive view on the potential of Chinese exporters. At the current level of Chinese product quality and cost structure, there is no reason why Chinese products should not stand out in global markets. Moreover, when expanding overseas, these companies can avoid the intense domestic competition that often erodes margins. Establishing a presence in global markets is, in itself, proof of global competitiveness.Of course, Chinese companies face the limitation of not being able to enter the US market. However, China’s diplomatic efforts over the years have created an environment where Chinese firms can secure positions in most markets outside the US.

Global X China Global Leaders ETF (3050) (aka. China exporters ETF) should never be underestimated.

Theme 1: China’s 15th FYP and Core Tech Self-reliance

- Global X China Core TECH ETF (3448 HK)

- Global X China Semiconductor ETF (3191 HK)

- Global X China Biotech ETF (2820 HK)

Theme 2: Income Support

- Global X Hang Seng High Dividend Yield ETF (3110 HK)

- Global X Hang Seng TECH Covered Call Active ETF (3417 HK)

- Global X HSCEI Covered Call Active ETF (3416 HK)

Theme 3: Industry with favourable Supply-Demand Cycle: Battery

Theme 4: China Export Machine Never Sleeps

PART 2.2: Which ETFs to Buy in 2026 – in detail

China Always Achieves Five-year Plan Goals, And The New Plan is Aimed at Core Tech

- China’s 15th FYP continues its focus on technology self-reliance and economic security, with the overarching goal to promote tech-led growth amid domestic and global challenges

- AI, Semiconductors, Green Energy, and Biotech remain top priorities, with dedicated task forces tackling supply chain bottlenecks

- China already commands the largest global manufacturing share of around 30%. Next focus will be capability over capacity. Industrial policy further moves from subsidies to targeting R&D and healthy competition.

- Semiconductor industry remains a focus area for US-China high tech competition. Mentioned in 15th FYP as the strategic important area to achieve high tech self-reliance, China’s semiconductor industry is benefiting from two structural trends: 1) Localization; 2) Robust AI demand

- AI + (人工智能+) mentioned in the 15th FYP is the key to China’s digitalization initiatives. AI will be integrated with economy as an infrastructure and tool to enhance the overall productivity

- China has built up robust AI ecosystem spanning infrastructure, AI model, and applications

- Chinese AI models feature cost-effectiveness, which bode well for increased adoption. China has abundant use cases across virtual (internet, software) and real world. (humanoid robot, autonomous driving)

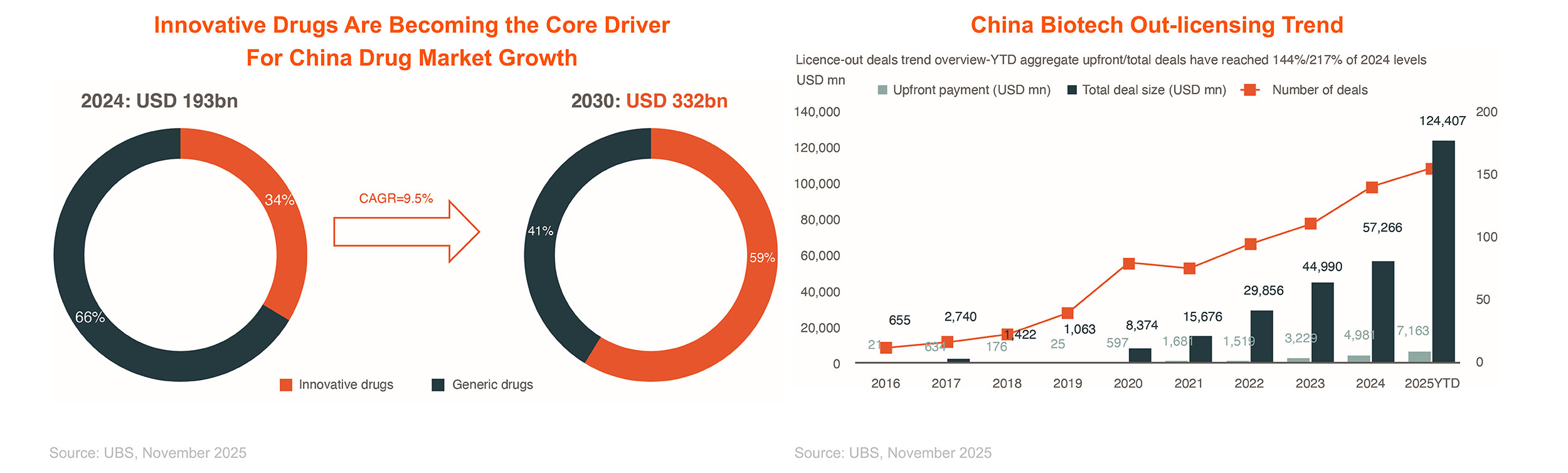

- Biotech is also mentioned in China’s 15th FYP as core technology industry. Chinese biotech companies are demonstrating improving innovation capabilities supported by talents and policy supports, driving the rapid growth of China’s innovative drug.

- The increasing out-licensing deals and the improving commercialization are driving the share price and the fundamental improvements for the sector. In addition, China’s aging population is driving the long term healthcare demand.

Global X China Core TECH ETF (3448 HKD)

Global X China Semiconductor ETF (3191 HKD / 9191 USD)

Global X China Biotech ETF (2820 HKD / 9820 USD)

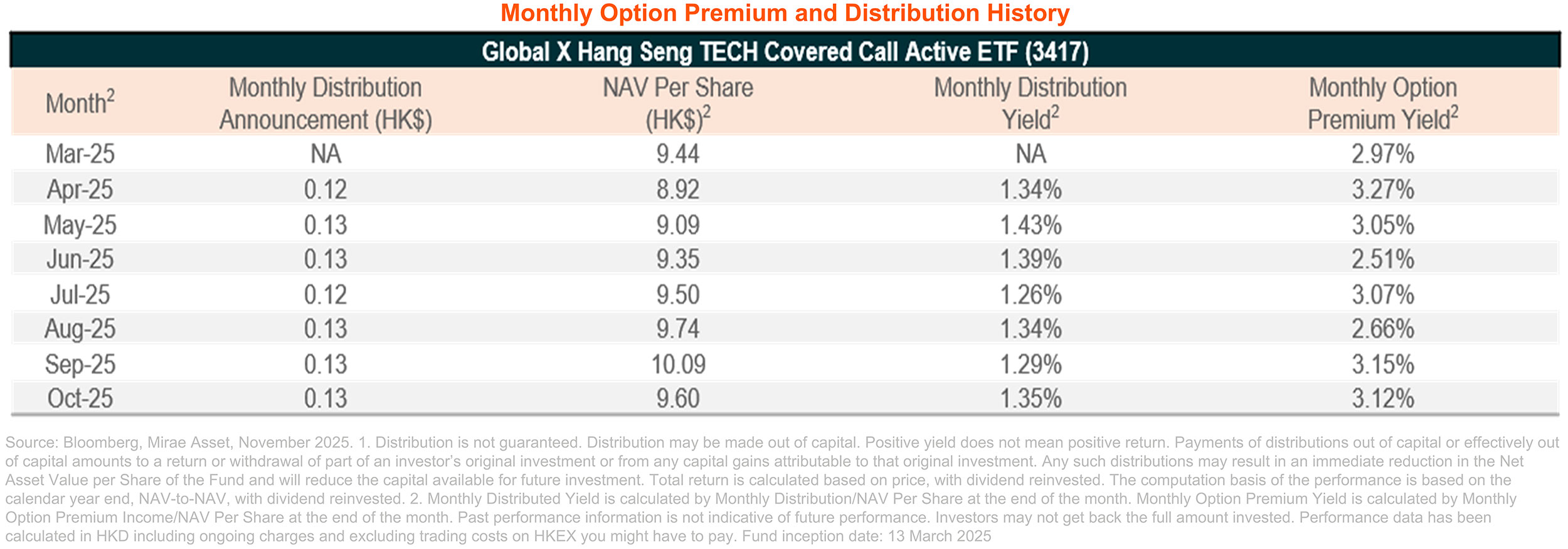

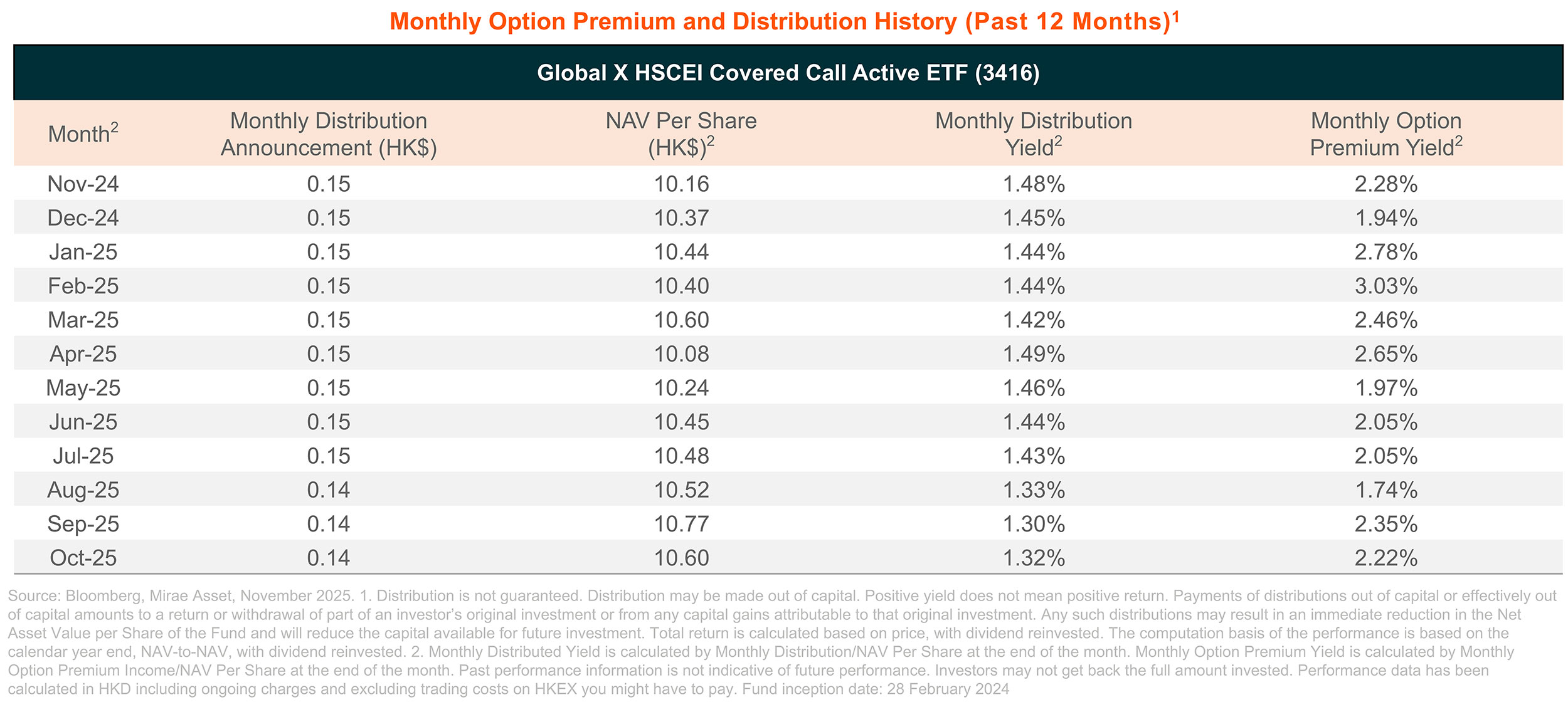

We Need A Barbell Strategy With Strong Income Support ① – Covered Call

- Global X Covered Call ETFs roll ATM call option on a monthly basis, and target to distribute monthly dividend to investors. Typically in a more volatile market, covered call strategy can generate higher option premium

- These ETFs can also be convenient building blocks for portfolios with substantial growth prospects while securing a dependable stream of stable income

We Need A Barbell Strategy With Strong Income Support ② – High Dividend

- High dividend strategy is characterized by low historical volatility and low valuations, strengthening the downside protection of a portfolio

- The shareholder return theme in the Chinese market is growing, driven by strong regulatory policy initiatives

- The yield spread between the HS High Dividend Yield Index and China’s 10-year government bond yields has widened

- The HS High Dividend Yield Index has smartly outperformed the Hang Seng Index over the past decade

Global X Hang Seng High Dividend Yield ETF (3110 HKD)

Global X Hang Seng TECH Covered Call Active ETF (3417 HKD)

Global X HSCEI Covered Call Active ETF (3416 HKD)

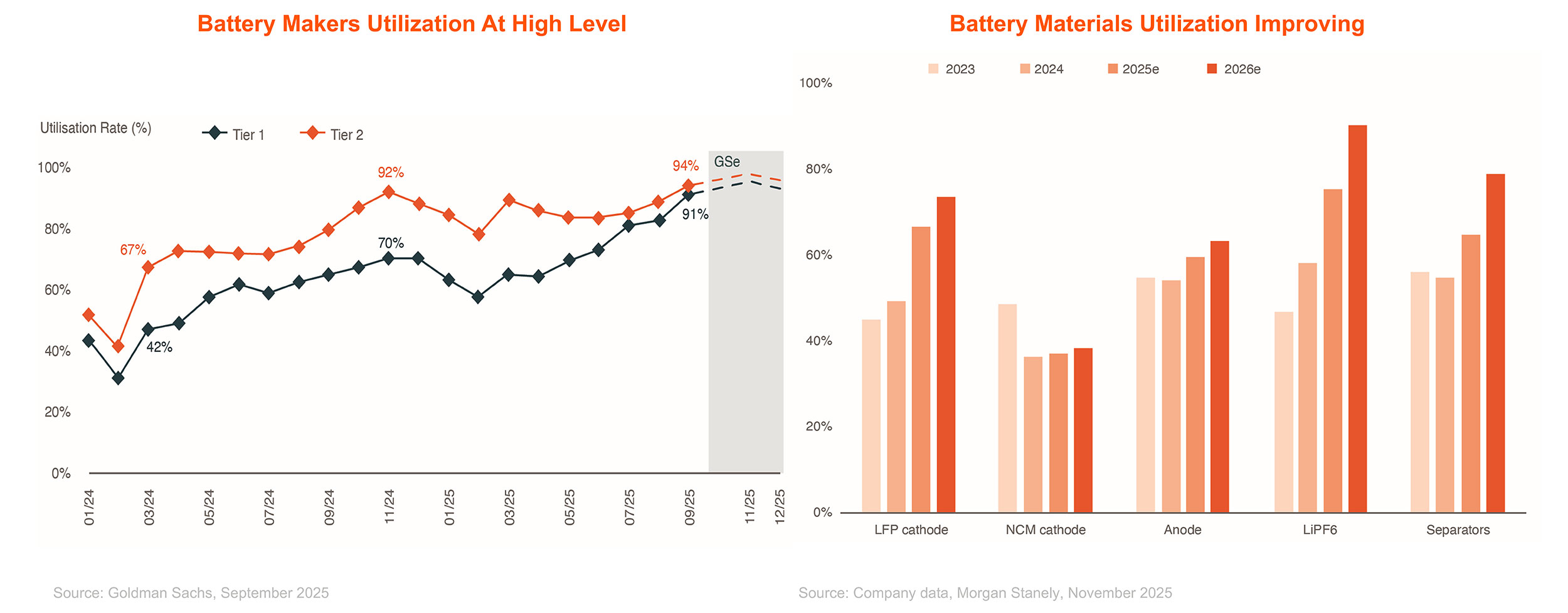

We Found A Very Favorable Supply And Demand Cycle – Battery

- Both China and overseas ESS battery demand is stronger than expectation, with 9M25 global ESS battery shipments recorded >100% growth YoY. Bloomberg NEF forecasts a 45% YoY growth in 2026 for global ESS installation

- On supply side, CAPEX rationalized in past quarters with incremental mainly from leading players. Anti-involution push should also improve industry landscape. Improving S-D dynamics should drive utilization improvement

- Improving supply and demand dynamics should drive utilization improvement

Global X China Electric Vehicle and Battery ETF (2845 HKD / 9845 USD)

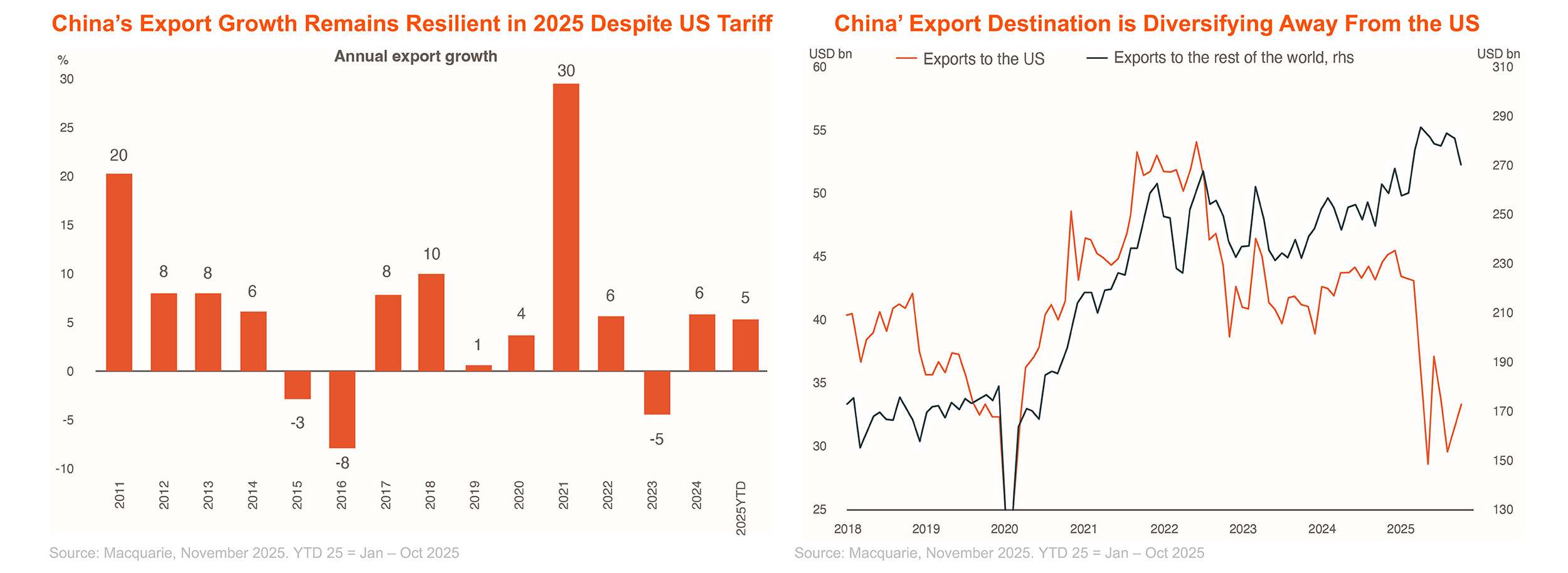

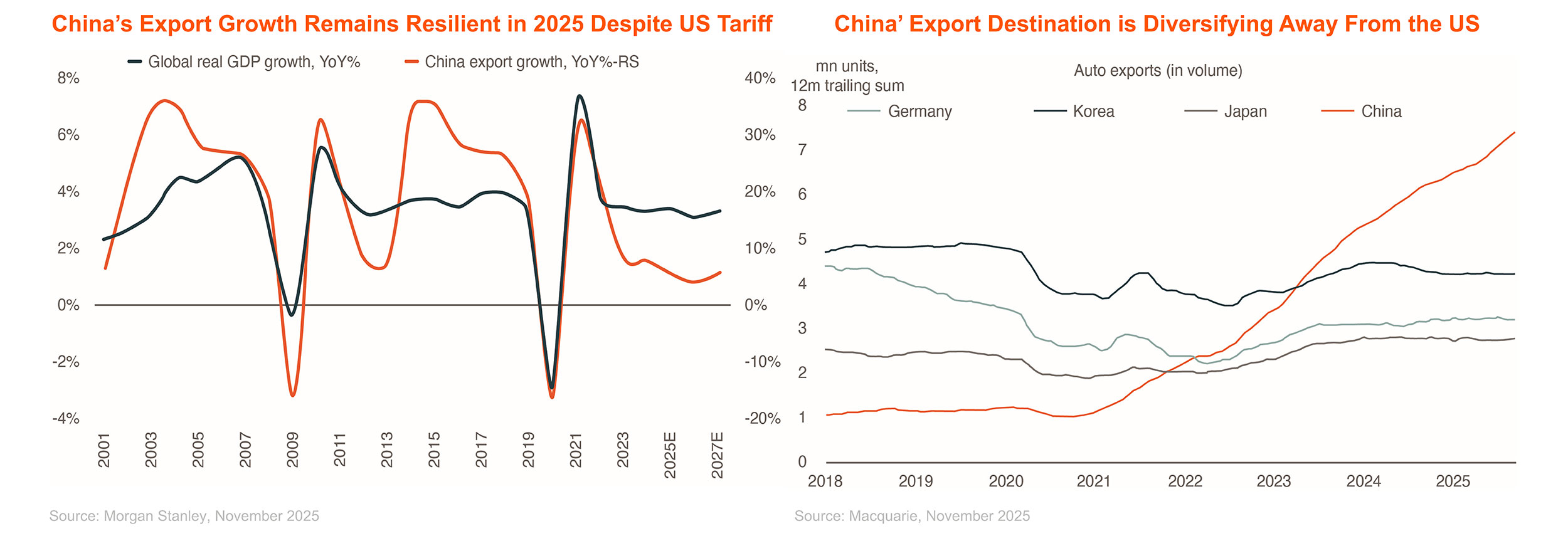

Despite Long-standing Skepticism, Chinese Companies Continue To Grow In Overseas Markets

- Despite US tariff, China’s export holds up steady in 2025, growing 5% YoY in 10M25

- Driven by successful export diversification, China’s manufacturing competitiveness, and a modestly weak CNY

- China’s export could remain resilient in 2026. This will be supported by a steady global demand growth, and decreased tail risk of full-blown trade/tech war, the cost advantage and productivity gains for China

- China is moving up the value chain, with more global market share in auto, batteries, and semiconductor