Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

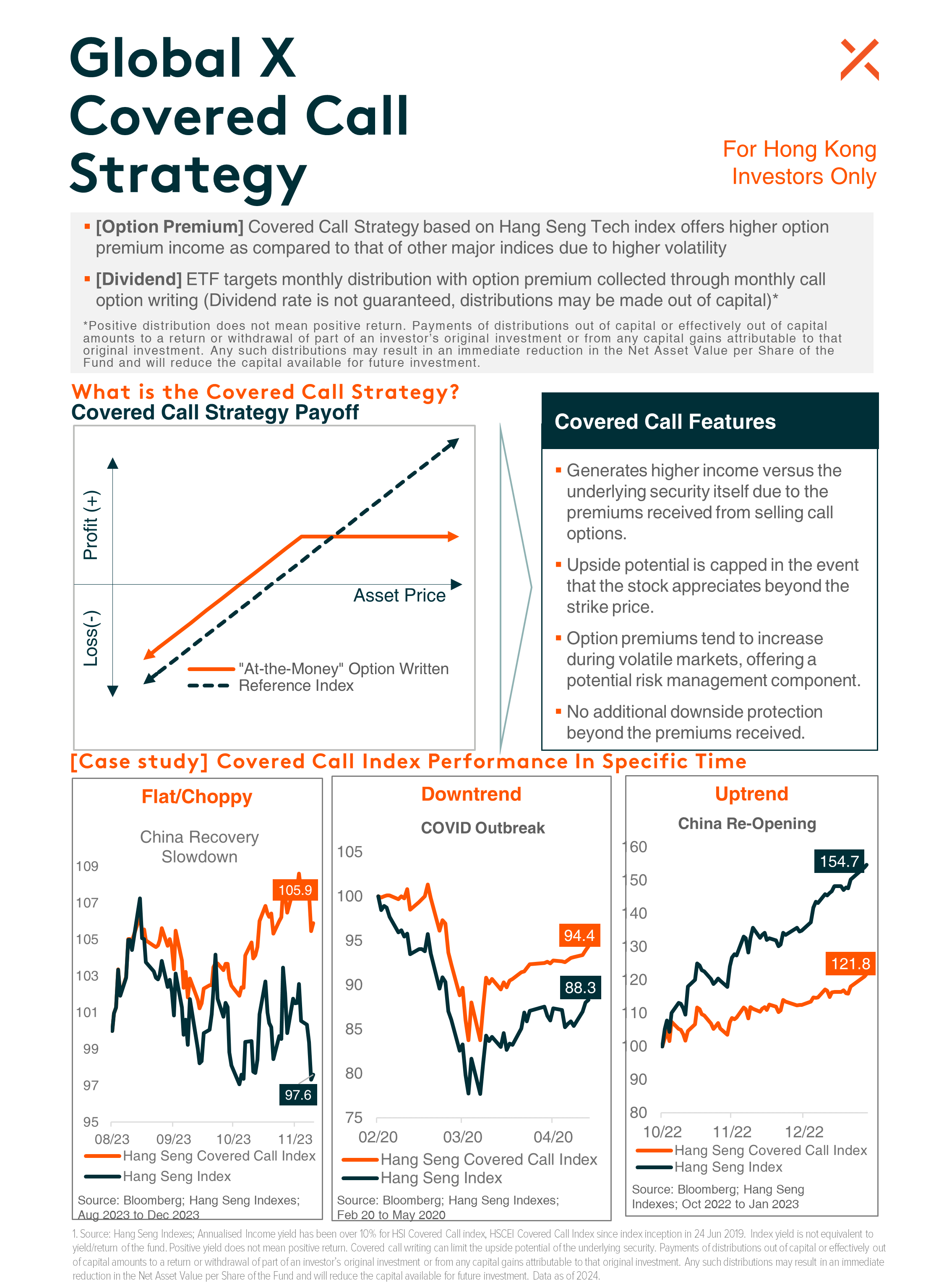

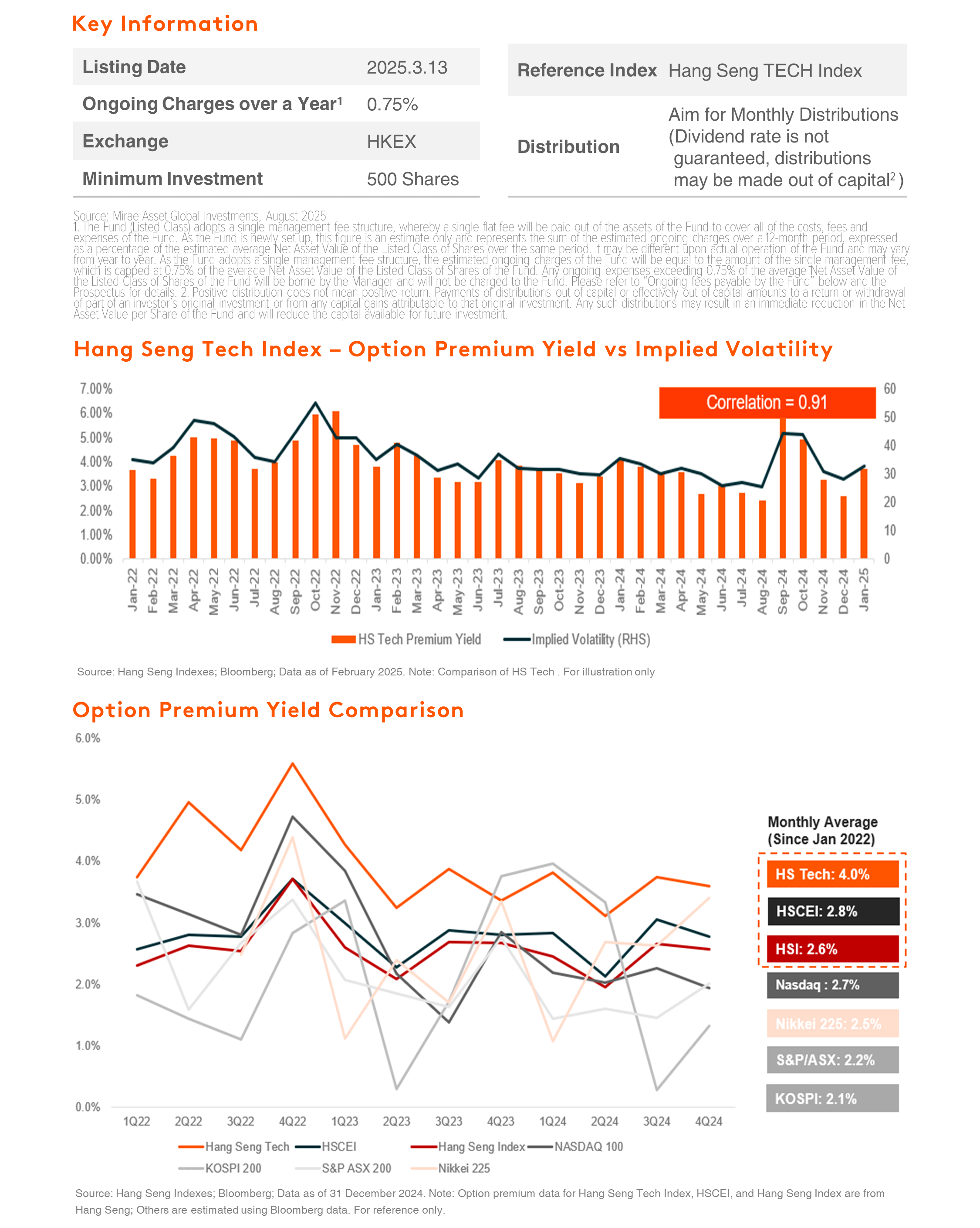

- The investment objective of Global X Hang Seng TECH Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng TECH Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

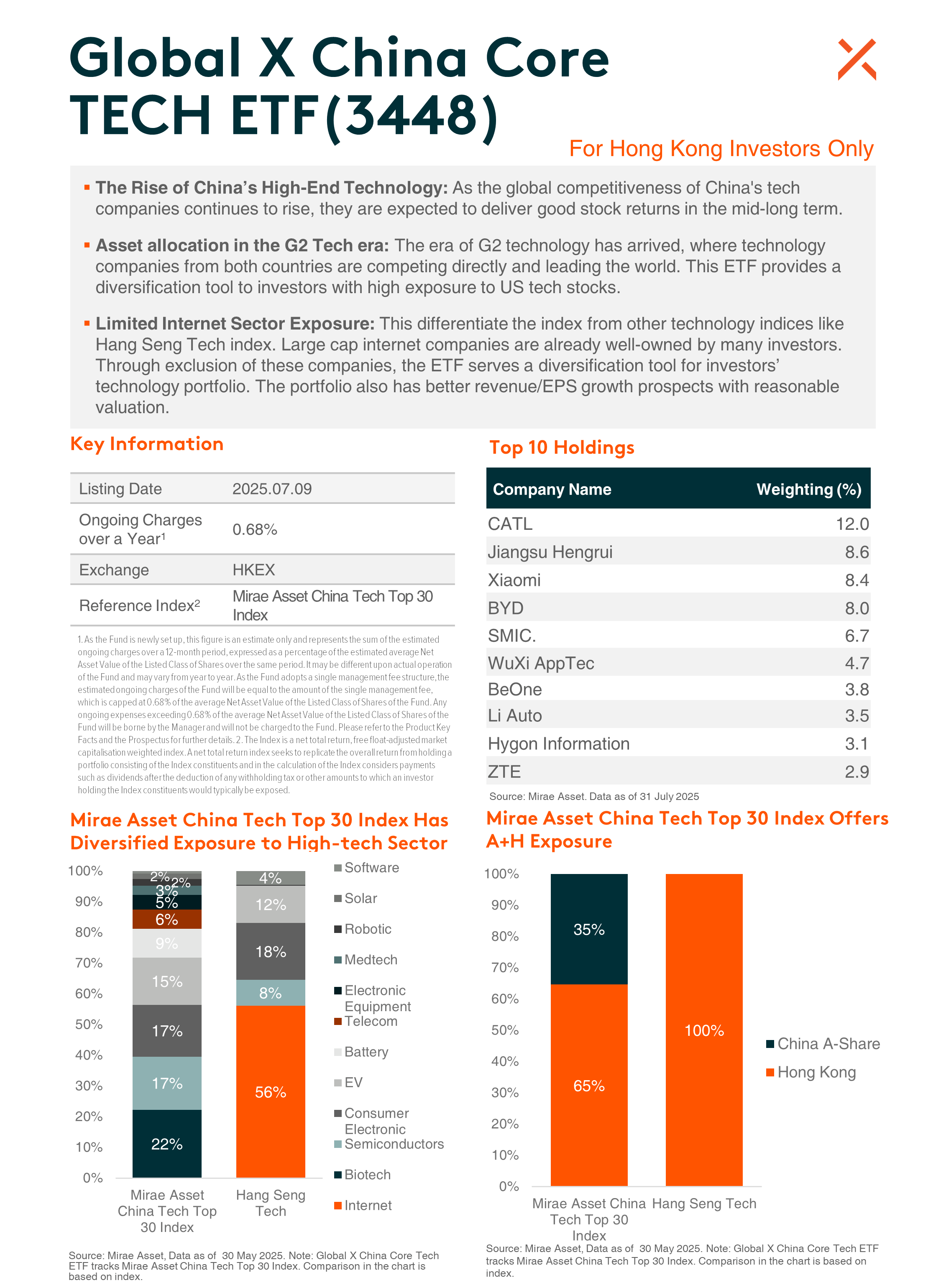

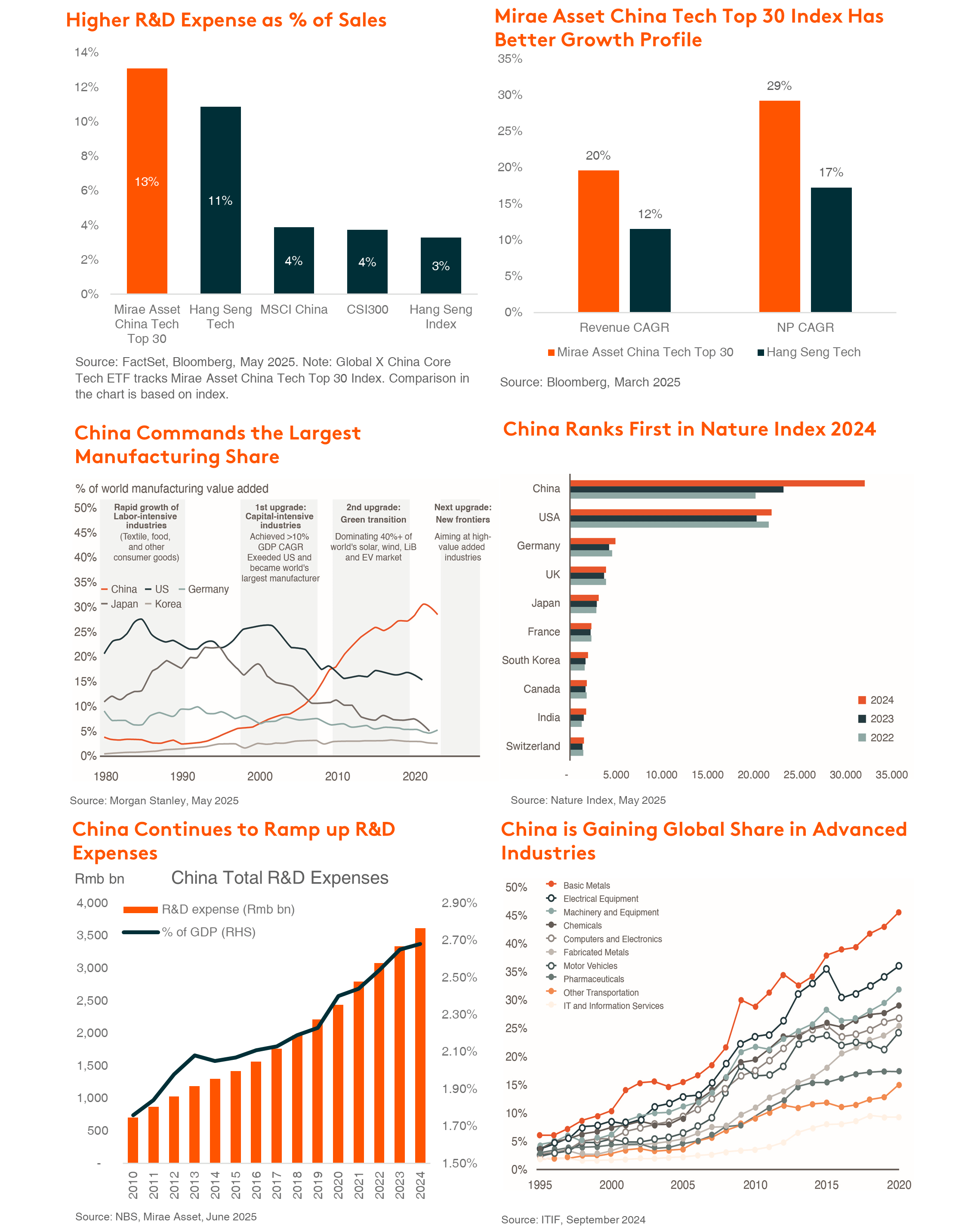

- The investment objective of Global X China Core TECH ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset China Tech Top 30 Index.

- The Fund is exposed to concentration risk by tracking a single region or country. It is potentially more volatile than a broad-based fund due to adverse conditions in the region.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit (the “Unit”) on the SEHK is driven by secondary market trading factors. The Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

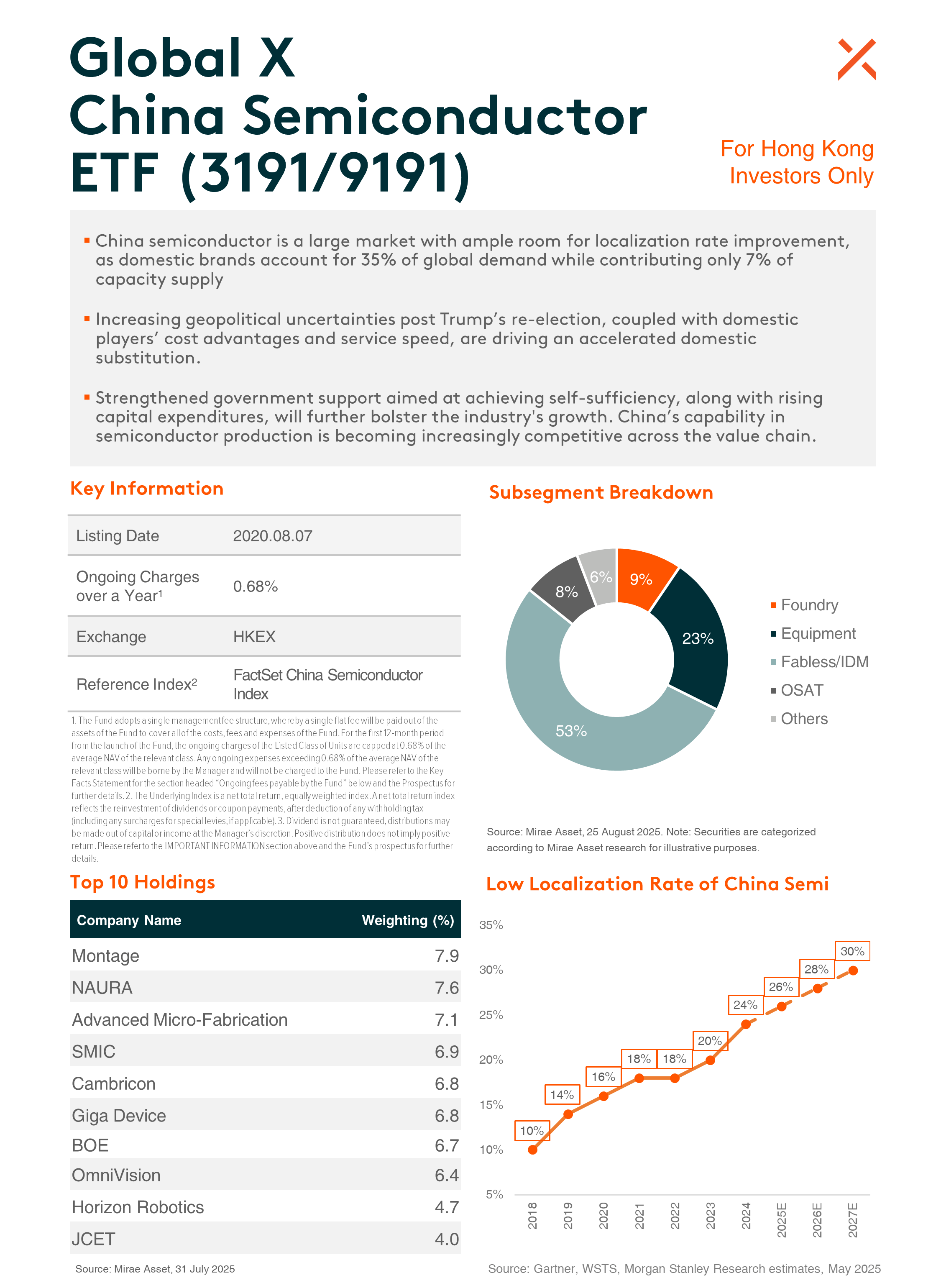

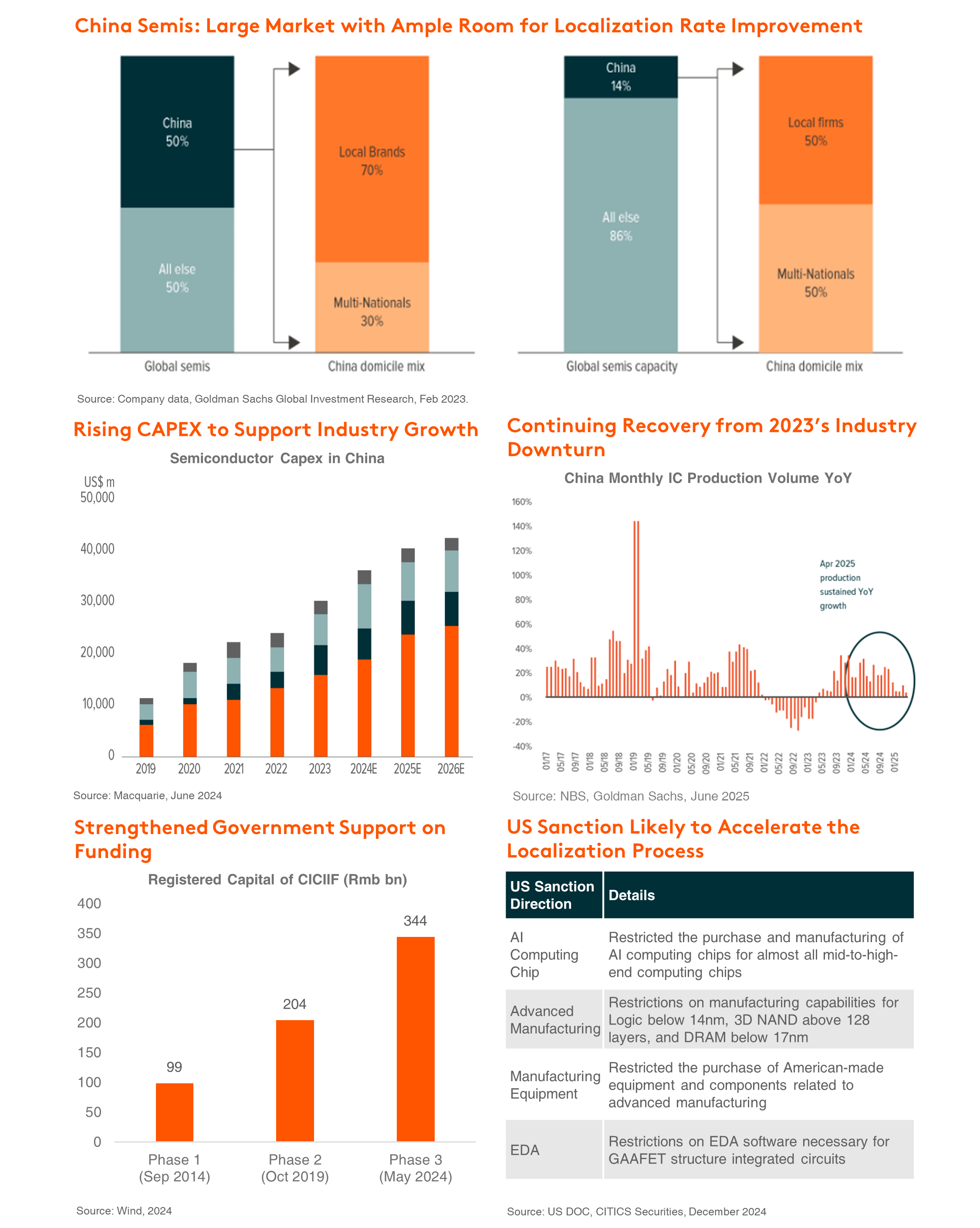

- The investment objective of Global X China Semiconductor ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Semiconductor Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

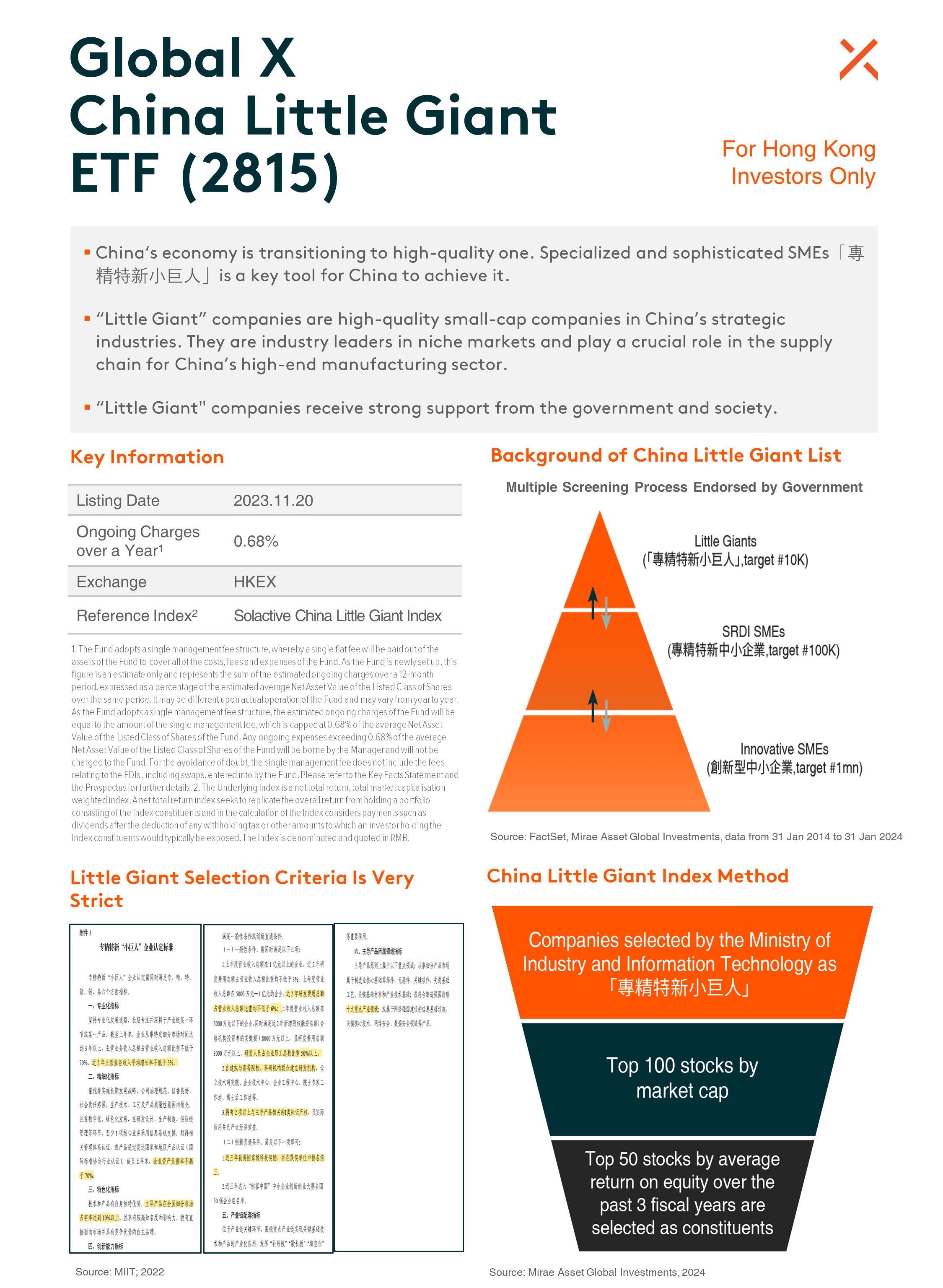

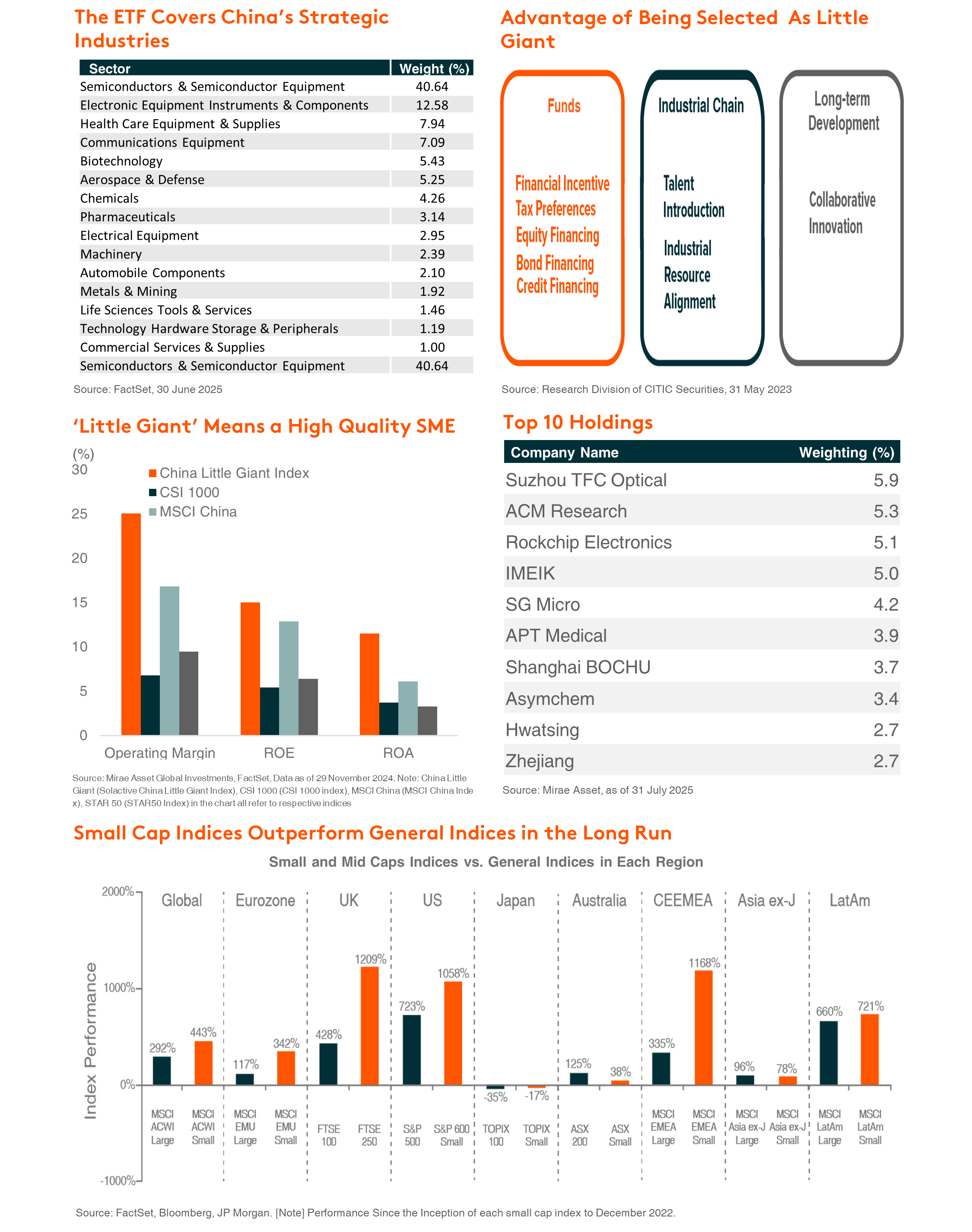

- The investment objective of Global X China Little Giant ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index.

- The Fund is exposed to concentration risk by tracking a single regions or countries.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

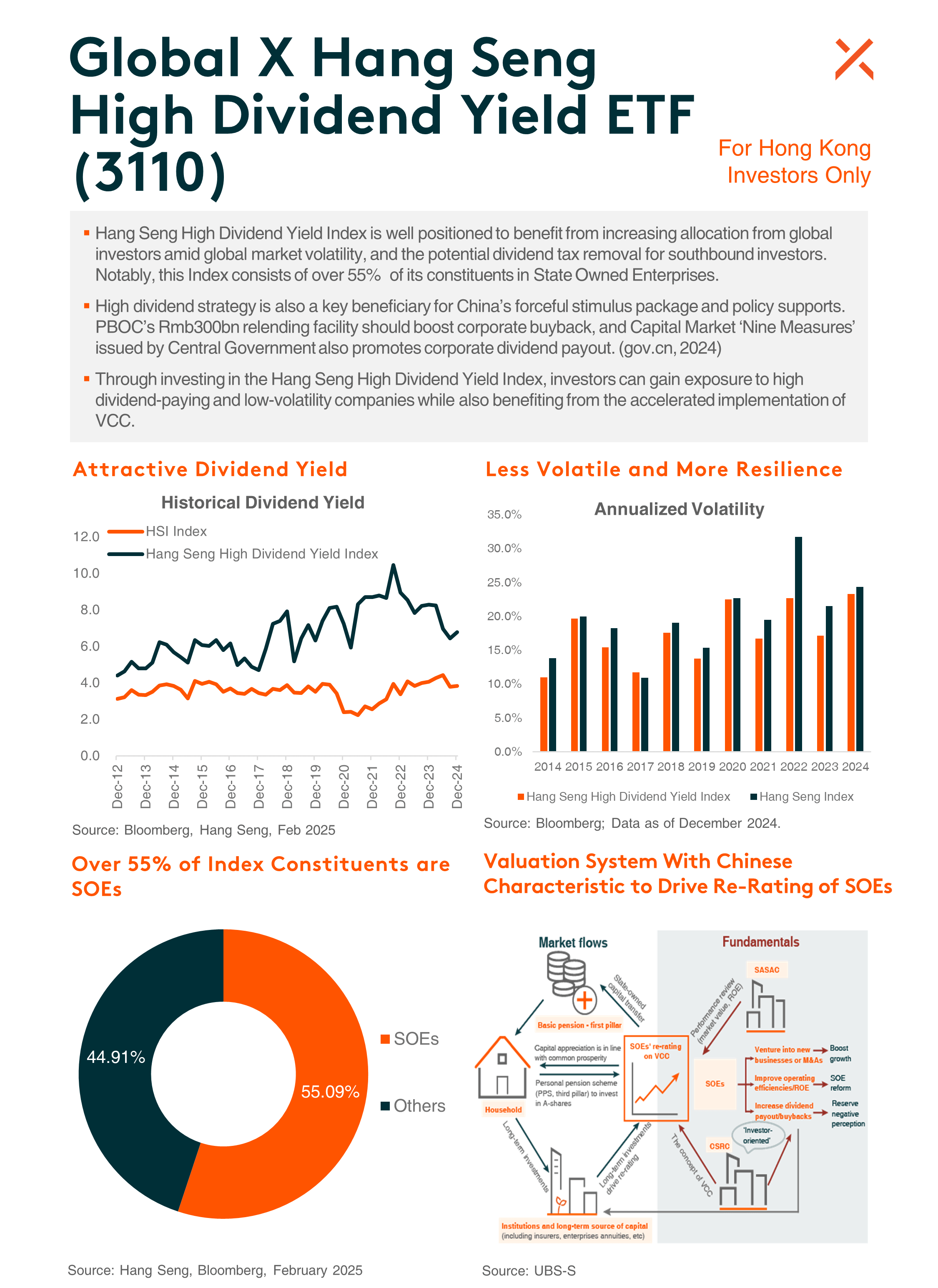

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

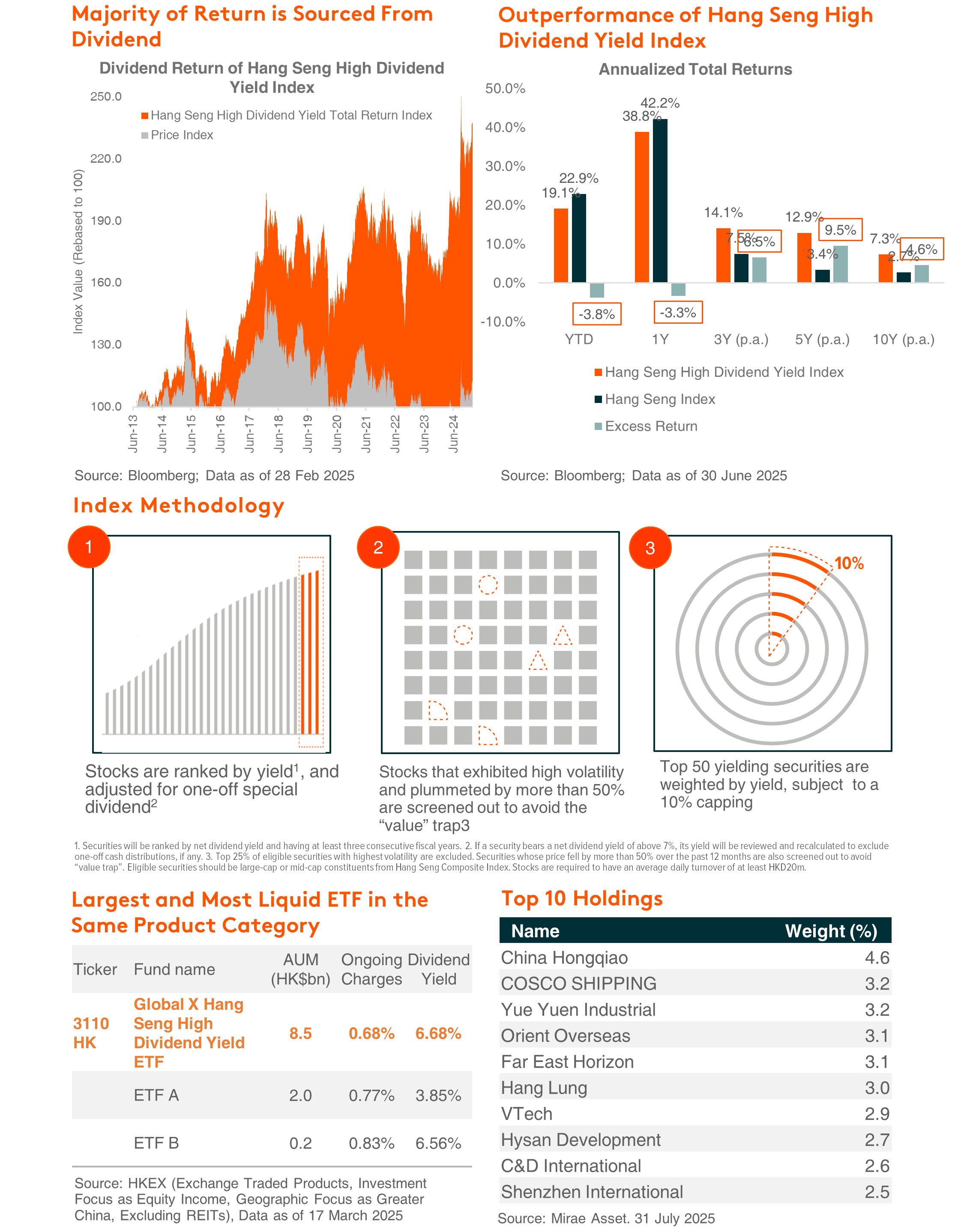

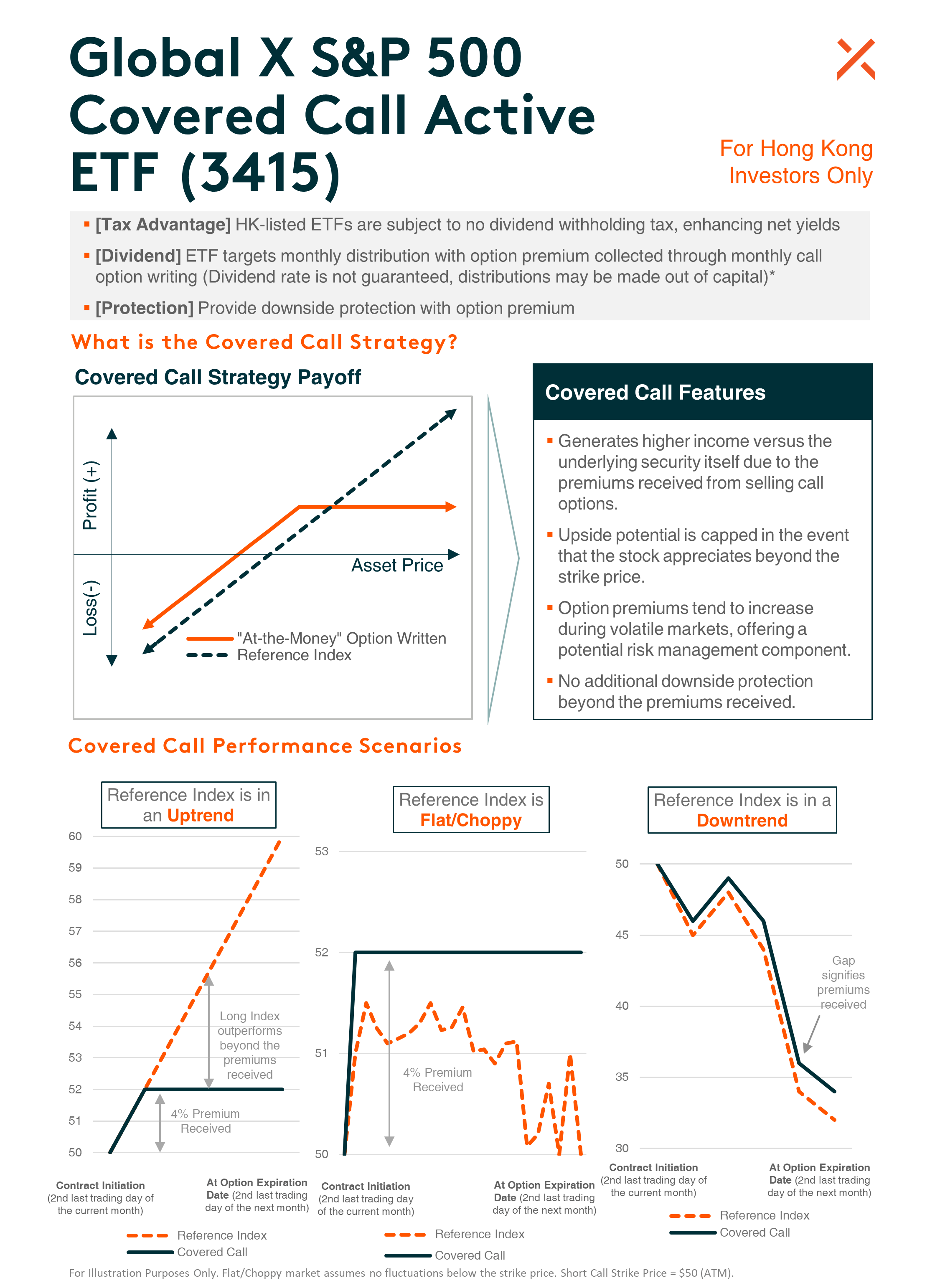

- The investment objective of Global X S&P 500 Covered Call Active ETF (the “Fund”) is to generate income by primarily (i) investing in constituent equity securities in the S&P 500 Index (the “Reference Index”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations. If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the exchange may suspend the trading of options in volatile markets which may cause the Fund unable to write Reference Index Call Options at times.

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking the performance of securities in a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

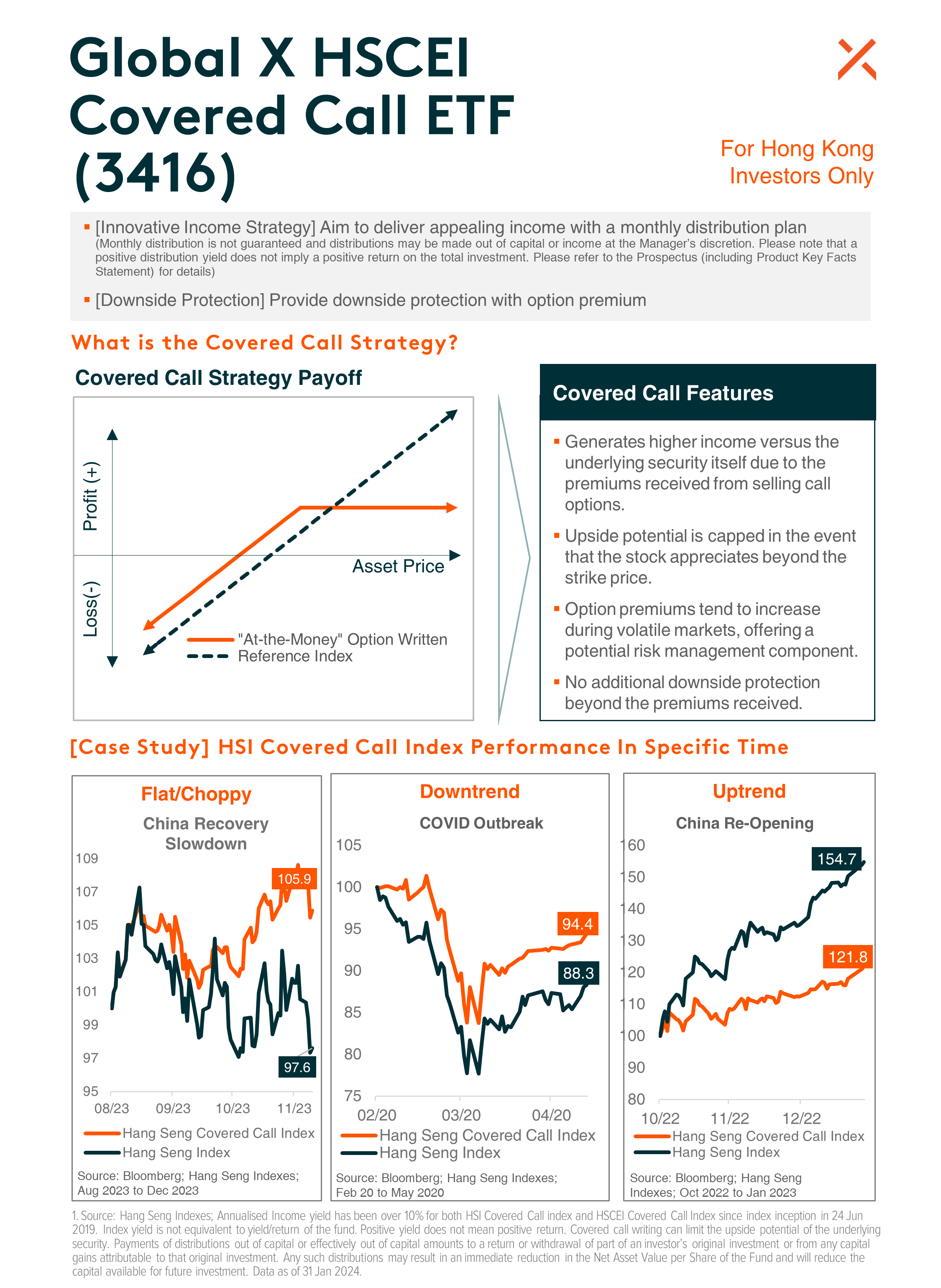

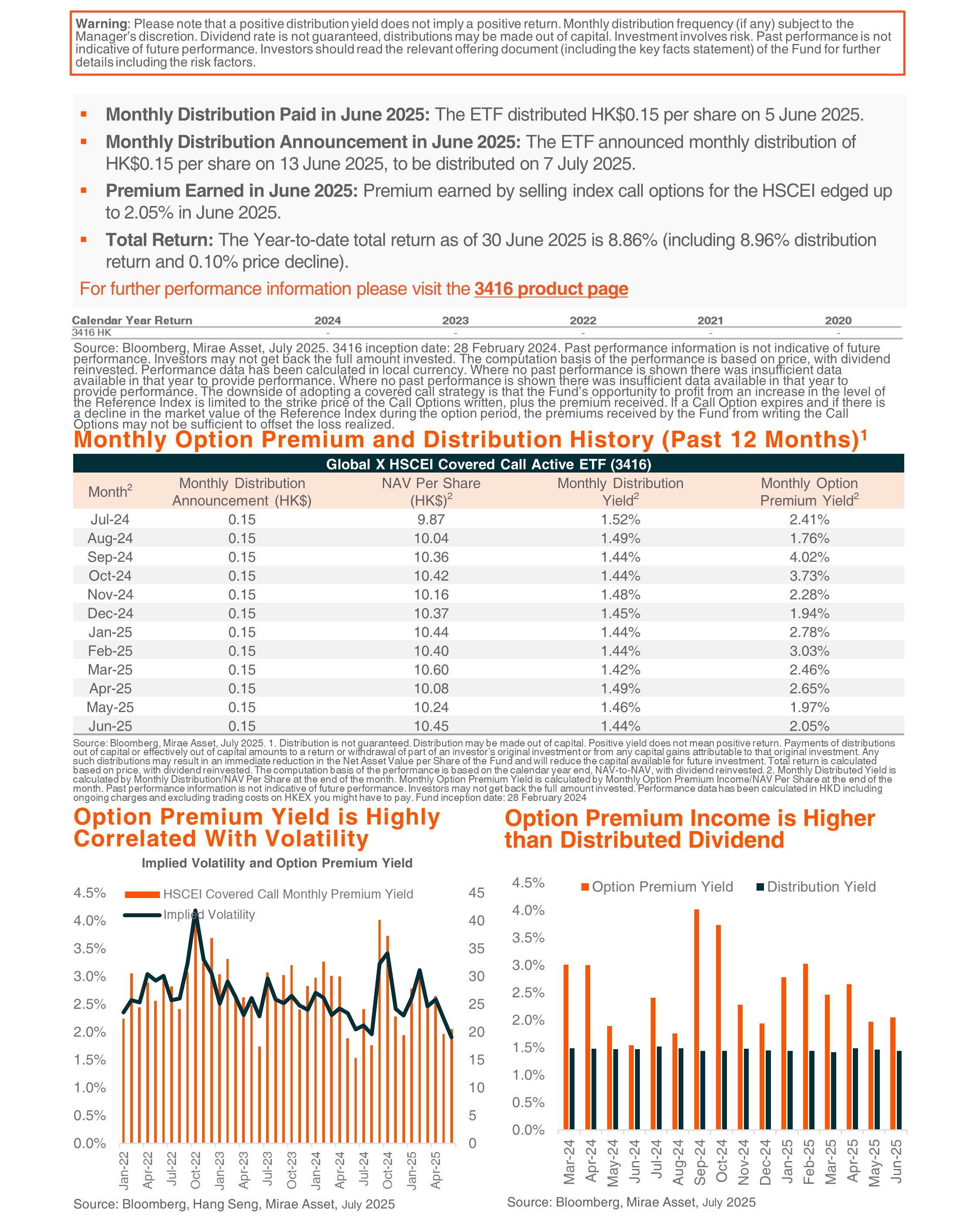

- The investment objective of Global X HSCEI Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

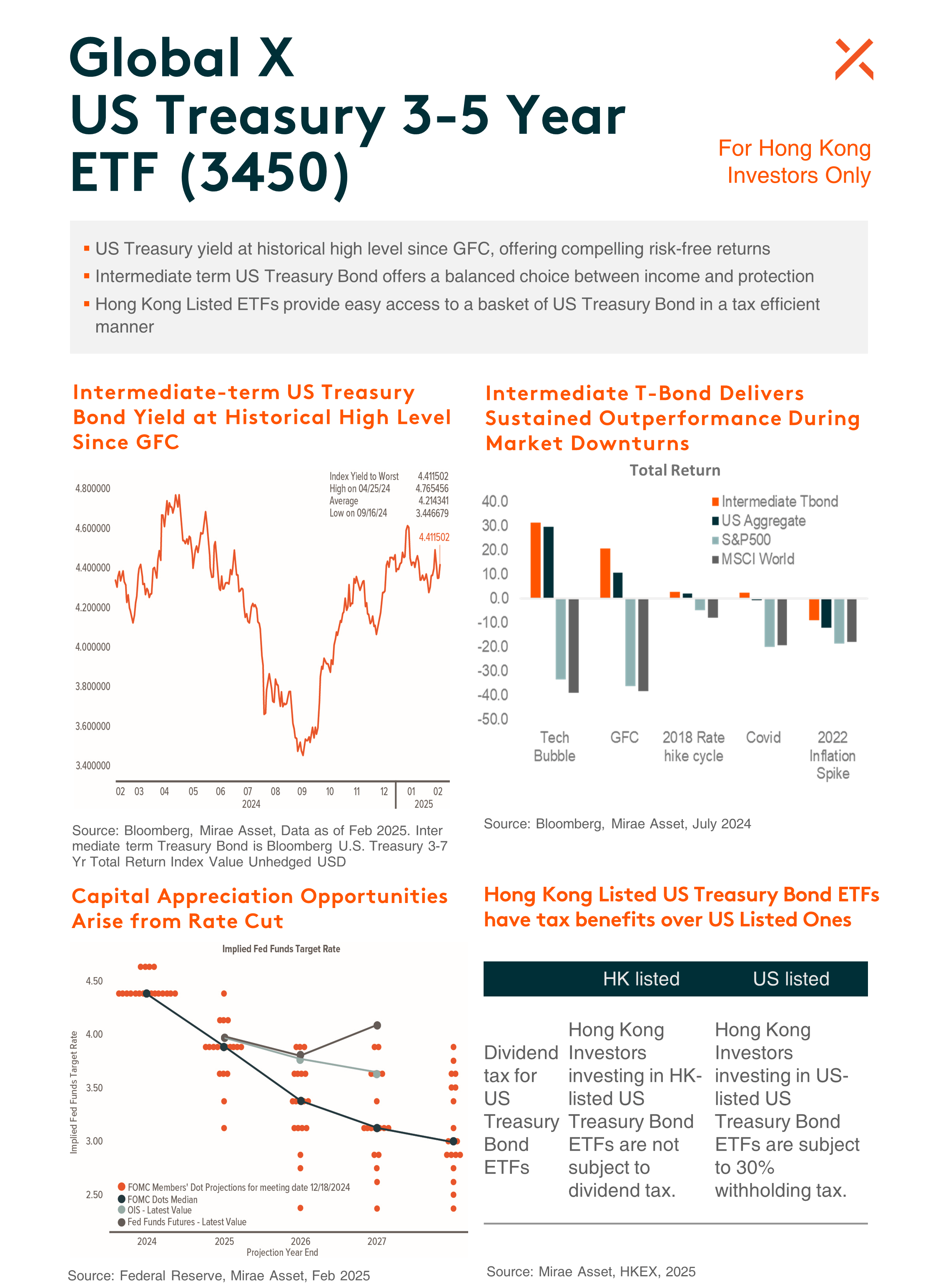

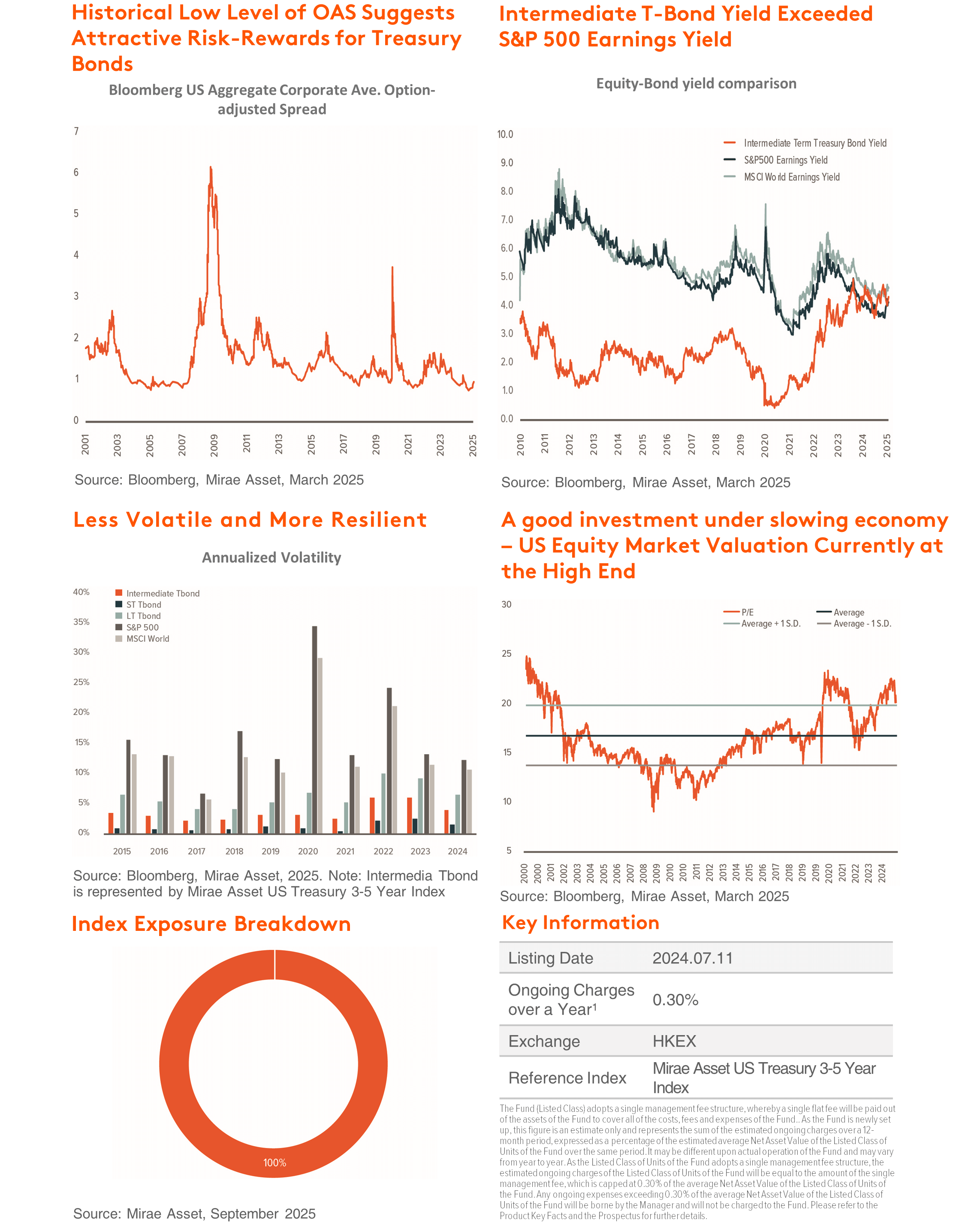

- The investment objective of Global X US Treasury 3-5 Year ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset US Treasury 3-5 Year Index (the “Underlying Index”).

- The Fund is exposed to the Credit/Default risk of issuers of the debt securities that the Fund may invest in; the Credit Rating risk that the credit ratings assigned by rating agencies are subject to limitations and do not guarantee the creditworthiness of the security and/or issuer at all times; the Downgrading risk that the Manager may or may not be able to dispose of the debt securities that are being downgraded; the Interest rate risk that the prices of debt securities rise when interest rates fall, whilst their prices fall when interest rates rise; the Policy risk that the changes in macro-economic policies in the US may have an influence over the US’ capital markets and affect the pricing of the bonds in the Fund’s portfolio, which may in turn adversely affect the return of the Fund; the Sovereign debt risk that the Fund’s investment in US Treasury securities may be exposed to political, social and economic risks that the Fund may suffer significant losses when there is a default of the US Treasury; the valuation risk that the valuation of the Fund’s instruments may involve uncertainties and judgmental determinations. If such valuation turns out to be incorrect, this may affect the Net Asset Value calculation of the Fund.

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Underlying Index is subject to concentration risk as a result of tracking the performance of a single geographical region, namely the US, and is concentrated in debt securities of a single issuer, namely the US Treasury. The Fund’s value may be more volatile than that of a fund having a more diverse portfolio and may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the US market.

- The base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the collateral, adverse market movements in the collateral value or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of distributions out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

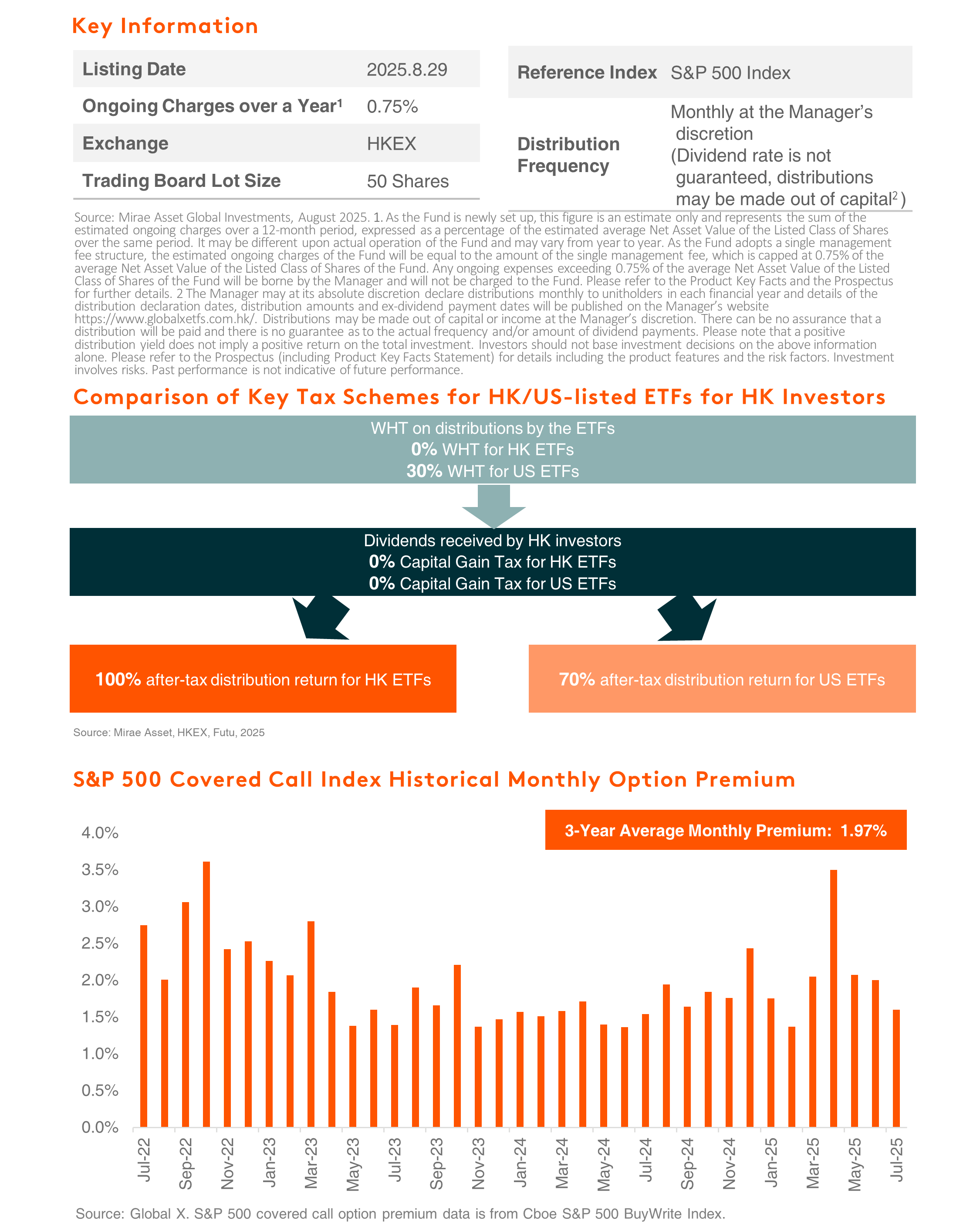

Global X Select ETFs

September 2025

| Product Name | Investment Points | Top 10 Holding (%) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hang Seng TECH Covered Call ETF (3417) | Covered call strategy based on Hang Seng TECH Index may has the higher option premium yield due to higher volatility of the index. Hang Seng TECH Index is likely to remain volatile. The index is benefiting from the continued development and breakthrough by leading Chinese companies in technology sectors such as AI and Semiconductor, but is also impacted by intense competition in sectors such as food delivery and EV. Covered call strategy is well-suited for positioning within this market. (Aims at Monthly Distribution. Dividend rate is not guaranteed, distributions may be made out of capital 1 ).

1. Positive distribution does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. |

|

||||||||||||||||||||

| China Core TECH ETF (3448) | As the global competitiveness of China’s tech companies continues to rise, they are expected to deliver good stock returns in the mid-long term. This ETF provides a hedging tool to investors with high exposure to US tech stocks. In addition, this ETF has limited exposure to internet stocks, this differentiates from other technology indices like Hang Seng Tech index. Large cap internet companies are already well-owned by many investors. Through exclusion of these companies, the ETF serves a diversification tool for investors’ technology portfolio. The portfolio also has better revenue/EPS growth prospects with reasonable valuation. |

|

||||||||||||||||||||

| Global X China Semiconductor ETF (3191) |

China semi sector rallied sharply on the import substitution narrative. Sentiment was initially boosted by reports that Nvidia had asked its suppliers to halt H20-related production and further amplified by the government‘s push for domestic chip adoption, as well as the launch of DeepSeek’s New V3.1. The new model launch reignited interest in semiconductor localization as it is optimized for the FP8 low-precision format, enabling efficient operation on domestic AI chips. 3191 has 92% exposure to A shares, riding the recent A-share momentum. |

|

||||||||||||||||||||

| China Little Giant ETF (2815) | China’s manufacturing excellence is built on its highly sophisticated supply chain that has been established over the past decades. “Little Giant” are picked by governments, featuring high-quality small-mid cap companies in China’s strategic important technology industries. They are industry leaders in niche markets and play a crucial role in the supply chain for China’s high-end manufacturing sector. Specialized and sophisticated SMEs「專精特新小巨人」is a key tool for China to achieve China‘s economic transition towards high-quality growth. Based on “Little Giant” lists provided by the government, 2815 invests in 50 listed “Little Giant” companies ranked by average ROE and weighted by total market cap. |

|

||||||||||||||||||||

| Global X Hang Seng High Dividend Yield ETF (3110) | Amid ongoing global trade uncertainty and the decreasing policy rates set by major central banks, the High Dividend Strategy continues to stand out for its combination of elevated dividend yields and reduced volatility. High dividend strategy is also a key beneficiary for China’s forceful stimulus package and policy supports. PBOC’s Relending facility should boost corporate buyback, and Capital Market ‘Nine Measures’ issued by Central Government also promotes corporate dividend payout. |

|

||||||||||||||||||||

| Global X S&P 500 Covered Call Active ETF (3415) |

3415 implements covered call strategy on S&P 500 index. For Hong Kong investors, HK-listed ETFs offer a tax advantage on dividends compared to their US-listed counterparts. At the ETF level, dividends paid from US ETFs to HK investors are subject to a 30% withholding tax. While it may be possible to reclaim this tax through specific procedures, the process is often complex. (Aims at Monthly Distribution. Dividend rate is not guaranteed, distributions may be made out of capital 1 ).

1. Positive distribution does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. |

|

||||||||||||||||||||

| HSCEI Covered Call ETF (3416) | Market uncertainty persists due to the interplay of conflicting factors, including the ongoing US-China trade negotiations and the potential scale up of China’s stimulus policy, creating favourable environment for covered call ETFs outperformance. Covered Call ETF remains an effective vehicle for investors to capitalize on market volatility through increased option premiums and stable monthly dividend payout (Aims at Monthly Distribution. Dividend rate is not guaranteed, distributions may be made out of capital 1 ).

1. Positive distribution does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. |

|

||||||||||||||||||||

| UST 3-5 Years ETF (3450) | Federal Reserve Chair Powell struck a more dovish tone at Jackson Hole, hinting that a rate cut could be on the horizon. The market is now expecting a 25bps Fed rate cut in September. 3-5 Years US Treasury is well positioned to benefit from accelerated policy rate cut. Furthermore, Hong Kong Investors investing in HK-listed US Treasury Bond ETFs are not subject to dividend tax. |

Characteristics

Maturity Breakdown

|

Source: Mirae Asset, 29 August 2025, unless otherwise stated. Top 10 Holding data as ofr 31 July 2025.