Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, annual reconstitution risk, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risk, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, risk of reliance on the Index Calculation Agent, trading difference risk, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X India Select Top 10 ETF’s (the “Fund”) underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Global X K-pop and Culture ETF’s (the “Fund”)The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, equal weighted index risk, risks related to companies with technology themes, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risks, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, trading difference risk, risks associated with ADRs, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks, reliance of the same group risk and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary

Global Thematic ETFs – Apr 2025

Global X India Select Top 10 ETF (3184 HK)

Market Update

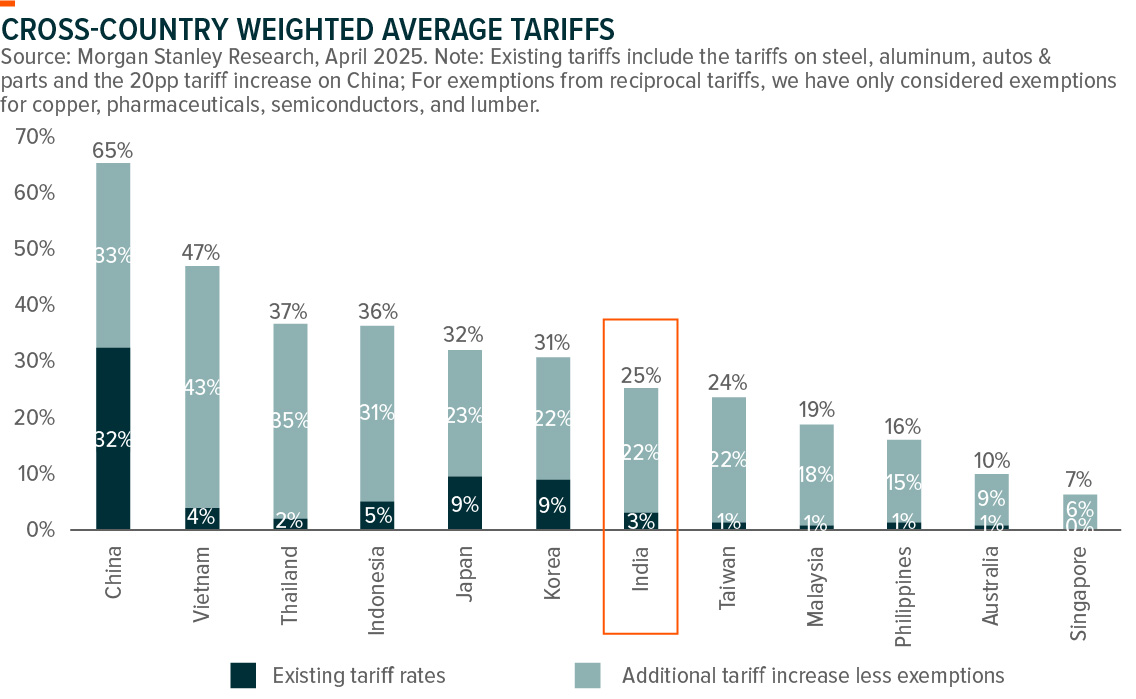

The MSCI India Index was up 9.2% (in USD terms) in March, outperforming the MSCI APxJ/EM Indices of -0.7%/+0.4% respectively, driven by positive signs in high frequency indicators, RBI’s continued easing measures, and INR appreciation. While global macro uncertainty remains due to tariff risks, India’s domestic growth seems to have bottomed out, and a gradual recovery is anticipated in the coming quarters, considering the confluence of a favourable fiscal policy and easing monetary policy across all its levers.

Domestic demand-based high-frequency data for March continued to show a gradual improving trend at an aggregate level. Manufacturing PMI strengthened to an 8-month high of 58.1 in March from 56.3 in February and, while services PMI softened to 58.5 in March from 59.0 in February. GST collections accelerated to INR 1.96tn, showing a robust growth of 9.9%yoy in March ’25. Power demand rose to 6.7%yoy in March as factory orders and production activity grew, and credit growth remained steady, growing 11.1%yoy in March. While vehicle registrations declined in yoy terms, air passenger traffic grew at a healthy rate, reflecting resilient consumer sentiment.

February CPI softened further to 3.6% with faster than anticipated disinflation in food prices. The decline in food prices is broad-based with strong foodgrain production estimated for FY25. March CPI is expected to remain below 4%, which supports the expectation of another 25bps rate cut in April to support growth.

Indian equity flows from foreign institutional investors turned buyers this month and bought USD 1.0 billion in March (vs. net selling of USD 5.4 billion in February), and domestic institutional investors remained their buying trend for the 20th consecutive month by net buying USD 4.3 billion during the same period (vs. USD + 7.4 billion in February).

Stock Comments

- ICICI Bank Limited (ICICIBC IN) the major contributor in March amid improving macro conditions with improved GDP growth and RBI’s easing on liquidity and regulations. ICICI Bank is expected to continue its market share gains, helped by the diversified loan book and strong investments in distribution and technology. While competitive intensity remains strong in deposit, management expects liquidity to improve as RBI’s liquidity measures flows through.

- Infosys Limited (INFO IN) was the major detractor in March mainly driven by concerns on US economy slowdown amid tariff uncertainties which may lead to weaker than expected discretionary spending. IT services sector has high correlation with the US market and economy hence the sector underperformed along with the US market correction.

Preview

While global macro uncertainties remain, we expect India’s domestic growth to recover over the coming quarters, supported by easing monetary policy and improved fiscal spending, moderate inflation, and recovery in consumption. This suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Global X K-pop and Culture ETF (3158 HK)

Market Update

In March, KOSPI increased 2% MoM to 2,481, mainly dragged by Trump’s tariff announcement (25% tariff on Korean products) on Mar 26. Overall, we believe K-pop sector is less vulnerable to US tariffs thanks to unique cultural and fandom characteristics, as well as the potential for price increases to mitigate the effects. For example, entertainment company’s revenue generated from service is less impacted by tariff, while K-pop products like cosmetics brands can conduct price hikes of 7.5%-12.5% to fully offset the tariff impact, implying the absolute price increase of only around US$1-US$3 according to CLSA’s estimates.

Stock Comments

- SM Entertainment (041510 KS): SM recorded 7% return in March. The company is prioritizing its core business while exploring opportunities to divest non-core assets. We believe SM’s outperformance was driven by: 1) rising expectations for significant earnings growth from the consolidation of Dear U starting in 2Q25; 2) the potential for increased monetization in China if the current ban on K-pop is lifted, as indicated by Tencent Music’s recent earnings report highlighting its collaboration with SM Entertainment.

- ORION Corp (271560 KS): ORION recorded 16% return in March. Over the past two years, the company has struggled with weak share performance due to sluggish top-line growth; however, 2025 is expected to mark the start of a long-awaited recovery as the company enhances its competitiveness in both products and distribution channels. In Feb, sales YoY growth was generally robust across markets: Korea +3.5%, China +42.2%, Vietnam +4%, and Russia +18.4%.

- JYP Entertainment (035900 KS): JYP experienced 30% loss in March. The company’s underperformance is mainly due to concerns over potential margin pressures related to three key factors: 1) revised revenue-sharing terms with Stray Kids, stemming from the new contract effective in 2025, 2) an unclear growth outlook for its rookie IPs (e.g., NMIXX, VCHA), which are vital for JYP’s long-term growth, and 3) investments in non-core ventures, such as its platform and INNIT Entertainment.

Preview

We maintain positive on the rise of K-Pop and cultural phenomenon in global market. Recent hit track APT by Rose and Bruno Mars, along with Han Kang’s Nobel Prize win in Literature, have significantly raised global awareness of K-pop culture. We expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. Amid escalating Trump tariff risk, we believe K-pop industry is less vulnerable thanks to its unique cultural and fandom characteristics, as well as the potential for price increases to mitigate the effects.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

TSMC Reportedly Taps Suppliers for 1.4nm Equipment, with Baoshan Paving Way for Trial Production

With its Kaohsiung plant in Southern Taiwan featuring 2nm groundbreaking today (March 31), TSMC’s next-gen 1.4nm seems to be making strides as well. According to the Economic Daily News, the foundry giant has recently informed suppliers to prepare for the necessary manufacturing equipment for the node.

Notably, the report suggests that TSMC’s 1.4nm equipment prep is underway for a trial production line to be set up this year at the Baoshan (Fab 20) P2 plant in Hsinchu. Baoshan’s P3 and P4, originally set for 2nm, will now handle 1.4nm production as well, the report adds.

In addition to Hsinchu’s Baoshan site, TSMC’s Fab 25 in Central Taiwan Science Park will also serve as a hub for 1.4nm production. The report says TSMC plans four 1.4nm fabs at Fab 25, with P1 aiming for risk trial production by 2027 and full-scale production expected in late 2028. (Trendforce)

BYD Unveils Super e-Platform with Megawatt Flash Charging for Electric Vehicles

BYD launched the Super e-Platform, featuring flash-charging batteries, a 30,000 RPM motor, and new silicon carbide (SiC) power chips. The platform upgrades the core electric components, achieving a charging power of 1 megawatt (1000 kW) and a peak charging speed of 2 kilometers per second, making it the fastest for mass-produced vehicles – 5 minutes of charging for 400 kilometers of range. The Super e-Platform also delivers a single-module single-motor power of 580 kW and a top speed over 300km/h. It will first be available on the Han L and Tang L. (BYD)

Global X Japan Global Leaders ETF (3150 HK)

Industry Update

In March 2025, the FactSet Japan Global Leaders Index flat returns in JPY terms1. The YTD underperformance of Japan market brings TOPIX valuation to a low level of 13.9x, even lower than the historical average before Japan’s exit from deflation (post-2010 average). FY2025 Spring wage negotiations (Shunto) in March showed even higher wage increases than last year, reaffirming the reflation trend in Japan. Tariff, JPY appreciation, and US recession concern still brings uncertainty over Japan market performance, however, we are less likely to see the sharp decline in Japan market as we see in August last year, as the risk and pace of JPY appreciation is more manageable this time. USDJPY ended March at 150, from 151 as of end February.2

Stock Comments

- Mitsubishi Heavy Industries (MHI) recorded +28% return in March, a positive contribution to the ETF. The company could be seeing strong sales and profit growth relative to the sector, and management also expressed proactive efforts toward shareholder returns. MHI has also made progress on reducing net interest-bearing debt and improving its financial position.

- Renesas Electronics Corporation recorded -19% return in March, a detractor to the ETF. Stock price slumped at the end of March due to concerns over US tariff uncertainty.

Preview

Japan stock market went through massive volatility over past few months under concern for JPY volatility, US tariff uncertainty, and US economy recession. While short term outlook remains uncertain given slowing global economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging).3

Global X AI & Innovative Technology Active ETF (3006 HK)

Industry Update

DeepSeek V3-0324 tops non-reasoning AI models

DeepSeek V3-0324 has become the highest-scoring non-reasoning model on the Artificial Analysis Intelligence Index in a landmark achievement for open-source AI.The new model advanced seven points in the benchmark to surpass proprietary counterparts such as Google’s Gemini 2.0 Pro, Anthropic’s Claude 3.7 Sonnet, and Meta’s Llama 3.3 70B.

While V3-0324 trails behind reasoning models, including DeepSeek’s own R1 and offerings from OpenAI and Alibaba, the achievement highlights the growing viability of open-source solutions in latency-sensitive applications where immediate responses are critical. (Ainews)

OpenAI rolls out image generation powered by GPT-4o to ChatGPT

OpenAI’s image-generation tool took off instantly after launch, with Altman saying the demand was so high, the company’s GPUs were “melting.” “This model is a step change above previous models,” research lead is Gabriel Goh told The Verge, adding that the team used the GPT-4o “omnimodal” — or a model that can generate any kind of data like text, image, audio, and video — foundation for this feature. (The Verge)

Alibaba Steps Up AI Game With Qwen 3

China’s tech and e-commerce giant Alibaba Group opens new tab is planning to release Qwen 3, an upgraded version of its flagship AI model, as soon as April. The Hangzhou-based company’s new offering may arrive later in April, though the exact timing could still slip. Qwen2.5 is already one of the most competitive models launched in China. (Reuters, Bloomberg)

Stock Comments

- MediaTek -0.68% – The stock is defensive thanks to exposure to android SoC where smartphone demand benefits from China subsidies and cyclical recovery. ASIC project with google is also on track to ramp in 2026.

- Microsoft -5.44% – Microsoft held a special 50th anniversary event. The company also announced upgrades to Copilot. Microsoft’s Copilot AI assistant is getting a massive overhaul that brings with it a host of new features, including the ability for Copilot to “see” what you’re looking at and answer questions about it.

Preview

The Global X AI and Innovative Technology Active ETF Fund is committed to being at the forefront of AI investment, leveraging our expertise to identify and capitalize on opportunities across the AI value chain. By focusing on both established leaders and emerging innovators, we aim to provide our investors exposure to one of the most dynamic and impactful sectors of the global economy. As the AI landscape continues to evolve, we remain dedicated to adapting our strategy to ensure that our investors benefit from the full spectrum of AI-driven growth and innovation.

Global X Electric Vehicle and Battery Active ETF (3139 HK)

Industry Update

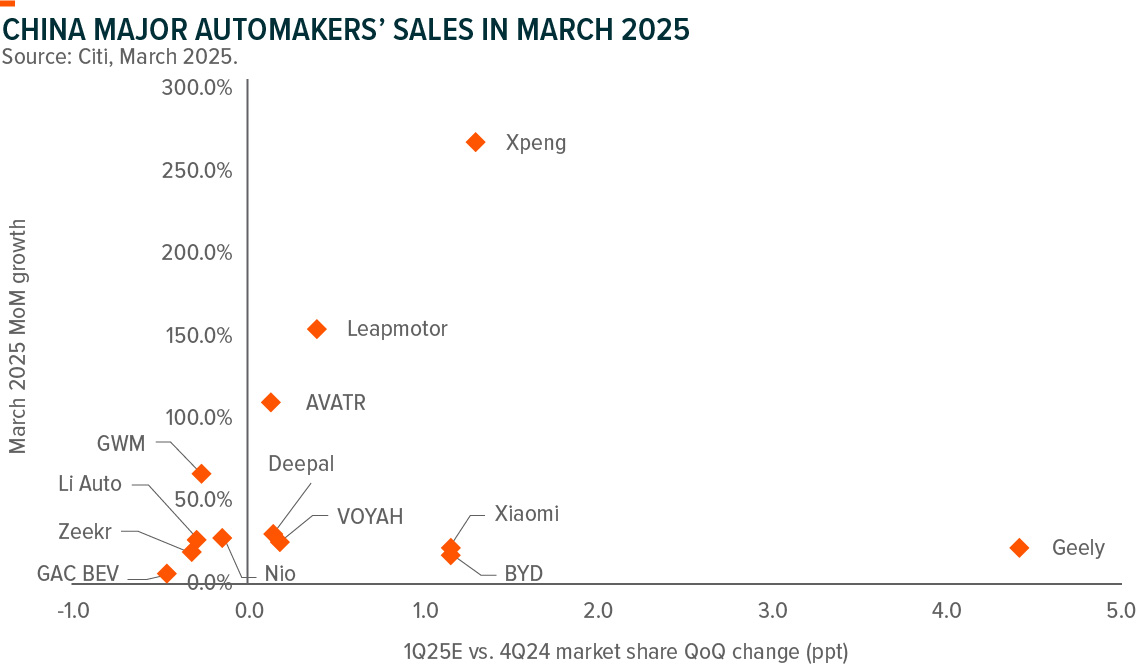

China’s EV sales in March 2025 was estimated at 1.14 million units, +37%yoy and +37%mom, sending 3M25 EV sales to 2.86 million units, +43%yoy. BYD’s wholesale volume in 3M25 ended at 626k units, +60%yoy. Geely including Zeekr and LYNK & CO brands sold 703.8k units in 3M25, +48%yoy. Xpeng delivered 94,008 units in 3M25, +331%yoy. Li Auto booked 92,864 units of sales, +16%yoy. Xiaomi announced Mar-25 deliveries of more than 29k units. They opened 15 new stores nationwide in March and expects to open 33 new stores in April. Geely, Xpeng, BYD and Xiaomi are strongly gaining market share in the first quarter of 2025.

Regarding the impact of US tariff, China passenger vehicles export to the US is very minimal, mainly relating to GM/Volvo, not domestic local brands. Battery makers’ exposure to the US is limited to ESS battery cell, which is also very small portion of their total sales. The reciprocal tariffs impact more on the European EV exports or Korean battery/battery materials exports to the US.

Stock Comments

Zhejiang Shuanghuan Driveline Co., Ltd. Class A: The company is leading in xEV gear in technology and cost. As the key third-party supplier for BYD, the company benefits from BYD’s sales volume growth. It is reportedly that Shuanghuan will also be the vendor for Tesla’s humanoid robot.

NVIDIA Corporation: A low-cost Chinese AI chatbot, DeepSeek sparks AI stock selloff as investors worried it may threaten the dominance of AI leader like NVIDIA.

Preview

We are not bearish on China EV and battery sales in 2025, as China may keep giving EV purchase subsidies to accelerate EV penetration to boost economy in the near term and reduce the dependency on oil imports from the long-term perspectives. We don’t see material impact of US tariff on China EV and battery value chain since the major players have been imposed with high tariff for years. Yet, it may create more uncertainties to European automakers as well as Korean battery supply chain. For example, Korean cathode makers like EcoPro BM and Posco Future have high exposure to the US with no onshore manufacturing. Accordingly, 25% tariff will slow US EV demand growth and hurt Korean battery makers’ margins though they have local facilities.

Global X Asia Semiconductor ETF (3119 HK)

Industry Update

TSMC Reportedly Taps Suppliers for 1.4nm Equipment, with Baoshan Paving Way for Trial Production

With its Kaohsiung plant in Southern Taiwan featuring 2nm groundbreaking today (March 31), TSMC’s next-gen 1.4nm seems to be making strides as well. According to the Economic Daily News, the foundry giant has recently informed suppliers to prepare for the necessary manufacturing equipment for the node.

Notably, the report suggests that TSMC’s 1.4nm equipment prep is underway for a trial production line to be set up this year at the Baoshan (Fab 20) P2 plant in Hsinchu. Baoshan’s P3 and P4, originally set for 2nm, will now handle 1.4nm production as well, the report adds.

In addition to Hsinchu’s Baoshan site, TSMC’s Fab 25 in Central Taiwan Science Park will also serve as a hub for 1.4nm production. The report says TSMC plans four 1.4nm fabs at Fab 25, with P1 aiming for risk trial production by 2027 and full-scale production expected in late 2028. (Trendforce)

Samsung Accelerates HBM3E Redesign, Reportedly Targets NVIDIA Approval by May

Samsung was previously expected to secure NVIDIA’s qualification for its HBM3E between late May and early June. However, the timeline has reportedly been moved up. According to South Korean media outlet EBN, if things go smoothly, Samsung is now targeting a successful qualification of its HBM3E 12-layer product from NVIDIA as early as May.

As noted by the report, sources indicate that Samsung is currently redesigning its HBM3E 12-layer product. The company had previously submitted samples to NVIDIA, but they failed to meet the required performance standards. (EBN)

GlobalFoundries Reportedly Seeks Taiwan’s Approval for UMC Merger

GlobalFoundries and UMC are rumored to be joining forces in mature nodes to counter rising Chinese rivals. UMC had stated that there is currently no merger in progress, but according to Economic Daily News, insiders say GlobalFoundries has already sought approval from Taiwan’s Ministry of Economic Affairs, hoping to get the green light. (Trendforce)

Stock Comments

- Samsung +5.61% – SMIC guides for 6-8% Q/Q revenue growth in 1Q25, beating consensus’ -3%. 1Q gross margin of 19-21% is in-line with consensus of 18.4%. We believe a strong 1Q will be attributable to the product mix, driven by the China consumption subsidy, as well as high wafer prices for advanced node production. On a full-year basis, SMIC expects revenue to grow faster than the peer average.

- Mitsubishi Electric Corp +19.63% – After declining in the wake of 3Q results, the company’s share price has been recovering toward the upper half of its range over the past year, driven by growing interest in defense-related stocks. The company stated an aim for sales of ¥500 billion and a profit margin of about 10% by FY2027 for its defense business. These targets have now been revised up to ¥600 billion or more in sales and an operating margin of 10% or more by FY2030.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2025. (Mirae 2025)