What to Look for After China’s 20th Party Congress

Listen

The 20th National Congress of the Communist Party of China (CPC) opened in Beijing on 16 October 2022, and the week-long event closed with President Xi Jinping embarking on his third term. Overall, President Xi’s report was consistent with the policy direction we’ve seen from China over the last few years, emphasizing development as a top priority for the Party. In this note, we explore the key messages of Xi’s political report and its potential implications on China’s Covid-19 policy and the outlook for various sectors.

Key Takeaways

- President Xi’s political report to the 20th National Congress laid out the long-term vision and ideologies for the Chinese Communist Party, where development remains a top priority over the long term. We see the willingness to set long-term growth targets as a positive sign that this generation of leaders is continuing to focus on growth.

- While there were no signs of deviations from China’s zero-Covid policy, we have seen some positive signs of easing/fine-tuning to restrictions over the past month as work continues in the background on an effective domestic vaccine.

- Finally, from a sector perspective, we await more concrete policies over the coming quarters but expect most sectors to benefit from China’s increased focus on development, security, and self-sufficiency.

Economic Development Remains a Top Priority for CPC

With the number of global and domestic uncertainties this year, President Xi’s speech delivered at the opening of the CPC was met with much anticipation. But onlookers seeking guidance on China’s future policy direction may have been disappointed. Perhaps the key thing to note is that Xi’s address at the CPC was a ‘political report’, delivered once every five years, which focuses on the ideologies and long-term targets of the Chinese Communist Party. In contrast, many had expected a ‘work report’ that addressed China’s near-term challenges and provided solutions for the way forward.

The distinction is an important one. While work reports do also include political signaling, they are more directed in their response to specific policies and objectives and are more oriented to current challenges. With this context in mind, it makes sense why current events like the property crisis and future Covid policies may not have been directly addressed. Still, the rhetoric points to a broad direction of thinking from which we can infer potential outcomes.

Overall, Xi’s report was consistent with the policy direction we’ve seen from China over the last few years. Development remains a top priority for the Party, promoted under the theme of ‘Chinese-style modernization’. Xi called on the Party to overcome the “unbalanced and inadequate development” across the country to better meet the “people’s needs for a better life”. We see this closely related to China’s focus on ‘common prosperity’ and expect the Party to elaborate more on this idea in future policy meetings.

Closely aligned to development are implicit long-term growth targets, which appear to remain intact. Xi highlighted the importance of more inclusive and high-quality growth, rather than focusing on GDP growth targets. However, he also recognized that a reasonable growth rate is needed, maintaining the long-term target that by 2035, China’s GDP per capita would reach that of a “medium-level developed country”. Initial analysis suggests that to achieve this target, China will need to deliver an average annual growth rate of around 4.7-5% in 2021-2035. However, given the structural headwinds underway, such as the property downtrend, aging population, and geopolitical tensions, policymakers may need to adopt a more pro-growth policy stance in the coming years. Still, we see the willingness to set long-term growth targets as a positive sign that this generation of leaders will continue to have growth among their top priorities.

Elsewhere, security and self-sufficiency have become increasingly important but don’t override development goals. The main focus areas include food, energy, and supply chain security, while other areas, like data, infrastructure, finance, and culture, were also recognized.

Finally, in terms of ideology, investors may express concerns about the concentration of decision-making. With Xi embarking on his third term and promoting four new members to the seven-seat Politburo Standing Committee (PSC), the PSC now has a higher share of Xi’s proteges. This setup raises questions about the checks and balances in place and the potential risks of policy mistakes. Alternatively, it could bring about solidarity at the highest level and allow for more effective policy execution and bolder reforms. We will closely monitor upcoming political sessions with the PSC to determine the committee’s ability to respond to future Covid, property, and economic policies.

Zero-Covid Slogan to Stay, Despite Gradual Easing

Given the series of upcoming political events over the next few months, we believe it is unlikely that the government will deviate from its zero-Covid slogan. Key events include the Central Economic Work Conference in December 2022 and the National People’s Congress in March 2023. As we saw during the CPC, at each of these upcoming events, we expect that the success of China’s zero-Covid approach will be featured as one of President Xi’s achievements. Thus, the message around China’s approach is unlikely to change.

However, we have seen some signs of easing/fine-tuning China’s zero-Covid approach, including:

- a quicker-than-expected reopening of Hong Kong,

- the Chinese government resuming e-visas and group tours for mainland tourists to Macau for the first time in almost three years,

- resumption of the Beijing Marathon on 6 November after being canceled for the last two years, and

- Chinese airline companies announced in mid-October that they will increase international flights over the next two months.

President Xi himself will be joining more overseas trips in the coming months, including the G20 summit in Bali and APAC summit in Thailand in November. As such, we expect to see more gradual relaxation progress over the next two quarters rather than a sudden overnight change, especially as the focus remains on building covid-related healthcare infrastructure and increasing vaccinations.

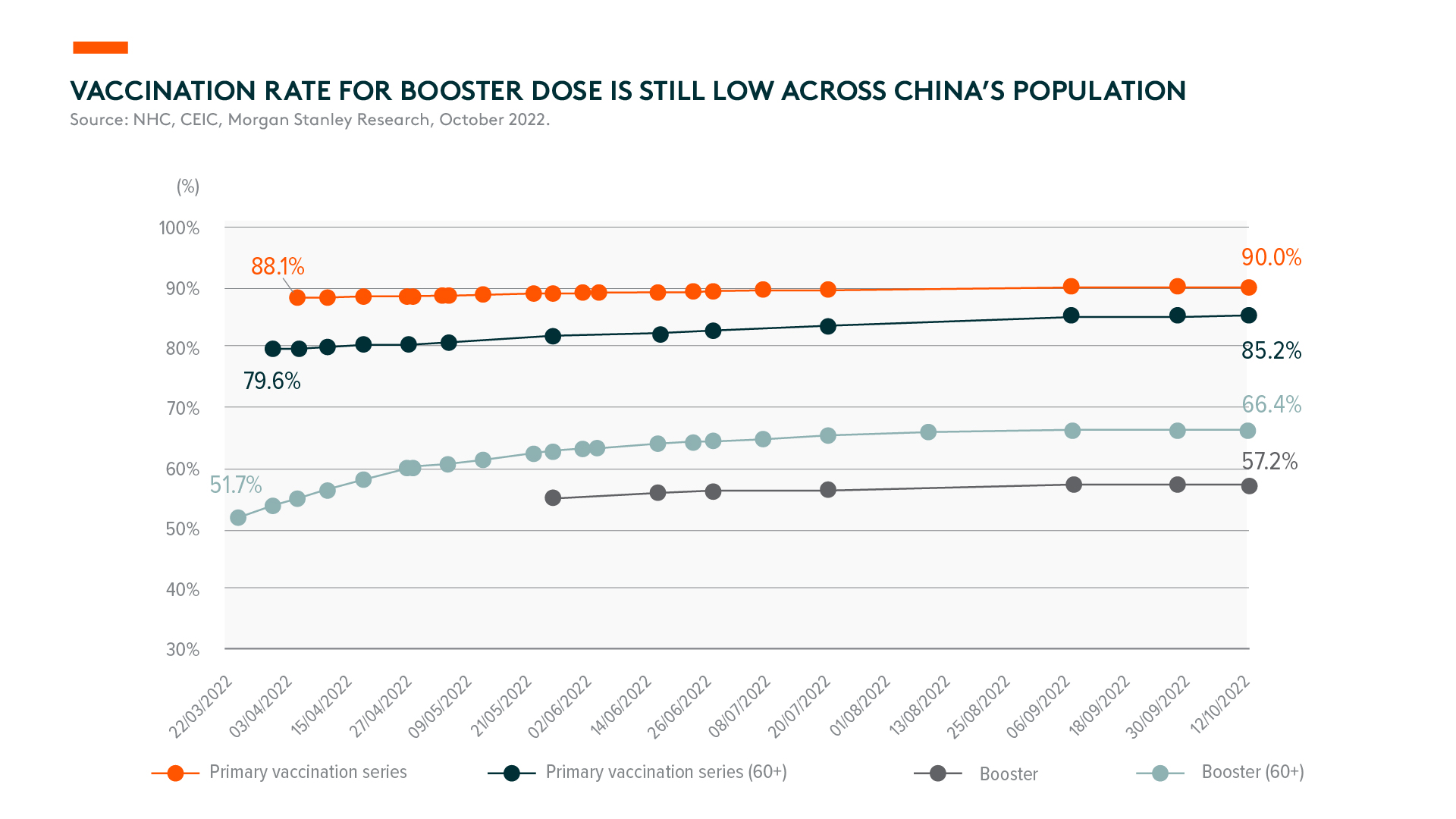

A prerequisite to China’s reopening is a more effective booster vaccination to reach critical mass against the prevailing variant. However, vaccination rates, especially booster doses, remain low across the population. As of 12 October, 90.0% of China’s mainland population has been fully vaccinated, with 57.2% having received boosters. For older people (aged 60+), 85.2% are fully vaccinated, with 66.4% boosted. Waning immunity after several months means a booster shot is necessary for the population to maintain its defense against the pandemic.

However, the pipeline of new vaccinations and Covid-19 treatments does show some promise. To date, four Covid-19 vaccines have been granted market approvals in China as a primary vaccination regimen (three inactivated, one adenoviral vector), while three others have been granted emergency use approvals (two inactivated, one recombinant protein). Seven mRNA vaccine candidates are under clinical trial in China, with CSPC’s mRNA vaccine appearing to be the most promising candidate. In terms of treatment drugs, China’s National Medical Products Administration (NMPA) issued conditional approval for Pfizer’s ‘Paxlovid’ and Henan Genuine Biotech’s ‘Azvudine’ pill for certain adult patients. Brii Biosciences’ Covid-19 neutralizing antibody cocktail was also approved as an antibody therapy.

Outlook and Latest Sector Updates Following the CPC

Software and Internet

President Xi’s political report mentions China’s continuous pursuit of technological self-reliance. We’ve already seen several policy support rounds urging for greater localization across the whole hardware supply chain and software industry. More specifically for software, there’s still a gap (such as technology capability and software performance stability) between domestic and foreign vendors in subsectors like basic software (operating system, middleware, and database), industrial software, high-end enterprise resource planning (ERP), etc. However, domestic software companies have invested heavily in talent over the past decade to enhance their research and development (R&D) capability.

Technology and products are iterating at an unprecedented speed. With a greater emphasis on self-reliance, we expect accelerated substitution of domestic software products, starting from government, to state-owned enterprises, to other enterprises. Looking past the near-term macroeconomic challenges that hamper government and enterprises’ IT budget, we expect a rising proportion of spending on software by the whole nation to continuously digitalize and improve operational efficiency.

Throughout Xi’s speech, national security was emphasized in dedicated and separate parts. With China’s economy undergoing accelerated digital transformation, cyber security will remain one of the most strategically critical software sectors to help safeguard digital assets from attacks. Regulations in great granularity have already been released, such as the MLPS 2.0 (Multi-Level Protection Scheme). The scheme classifies information security risks into five levels ranging from threats to individual interests to threats to national safety, and requires enterprises and local governments to invest in relevant technology/products. As cybersecurity technology is evolving rapidly, leading industry players continue investing in cutting-edge technology development.

There was little mention of internet companies in Xi’s CPC report and we expect most of the heavy sector regulations should be largely behind. The stress of “high-quality growth” for China’s economy should mean fair competition for all internet platforms and potentially increasing focus on profitability instead of growing at all costs.

Battery and Clean Energy

Following the CPC, we don’t expect any industry-wide policy risks to the battery and clean energy sector. Development goals over the next five years mentioned high-quality growth, progress in tech self-sufficiency, and further opening up to secure supply chains in the global market. China has emphasized many times the importance of hi-tech manufacturing, including the electric vehicle (EV) value chain and energy transition via wind and solar on the back of carbon neutrality. Thus, we believe that battery and clean energy will remain beneficiaries of favorable policies in the medium and longer term.

As a matter of fact, China has become the largest market of battery and solar in terms of demand and production, with great dominance in most parts along the supply chain, such as anode, separator, polysilicon, wafer, cell, etc. China has built up competitive advantages in battery and clean energy technologies, cost, and production scale. China-made battery shipment is expected to exceed 400GWh in 2022, thanks to the acceleration of EV penetration with more popular car models and policy tailwinds. Leading battery makers consolidate their competitiveness by breaking into global carmakers’ supply chains and expanding local production overseas. The energy storage business has witnessed rapid growth this year amid clean energy acceleration in Europe following the recent energy crisis. Demand from power and energy storage batteries remains solid, looking into 2023.

Solar and wind demand are also growing fast despite raw materials cost hikes. Domestic solar installation is likely to exceed 70GW by the year-end, while residential and commercial D/G projects are the main sources of demand for better profitability. We expect demand from large-scale solar farm projects to pick up next year when the polysilicon shortage eases.

EV & Manufacturing

Manufacturing continues to be one of the core bread-and-butter segments in China, with the country ranking top globally in terms of manufacturing scale and based on the value of traded goods. In the latest CPC report, the key relevant direction of growth was centered around innovation and supply chain safety. Consistent with the intention for higher-quality national development, China wants to upgrade its manufacturing standards, gradually shifting from scale manufacturing to advanced manufacturing.

Continuous innovation is the key to advanced manufacturing, which has to be done by corporates. The term “Little Giants” was first introduced in 2018 and then further categorized in 2021 into small and medium-sized enterprises (SMEs) that are specialized, refined, differentiated, and innovative. As of August 2022, there are 9,119 companies in the complete “Little Giants” universe. Many of these companies were selected by Chinese authorities and appear strategically important to China in terms of its growth sustainability and national security. These corporates are offered various policy incentives, including tax incentives, fiscal stimulus, financing availability, resource allocation, and talent recruitment. We believe these forms of support are essential for innovation and will continue to sustain over the next few years.

Supply chain and national safety are also key elements mentioned in the CPC report. China has one of the most comprehensive accessibility to manufacturing goods in the world, making it very easy to find the necessary parts, tools, and components in China. However, with the pandemic lockdown and heightened geopolitical tensions, supply chain management has become a lot more important and challenging. It is critical for China to achieve a certain degree of supply chain independence and make sure the core parts and components can be localized. Hence, we see a strong appetite for Chinese products to gradually gain market share from foreign players, even in advanced applications such as robotics, vehicle parts, and industrial software.

Biotech

China’s Healthcare sector, especially the CRO and CDMO (Clinical Research Organization and Clinical Development and Manufacturing Organization) subsectors, saw a sharp correction following the US Government’s Executive Order (EO) on Biotech and Biomanufacturing. On 12 September, the US Government passed an EO with the aim of 1) growing its domestic biomanufacturing capacity and securing supply chains, 2) encouraging R&D to drive medical breakthroughs, and 3) building and protecting the US biotechnology ecosystem, including data collection, data security, data sharing with partners, skilled workforce, etc.

Days later, the US White House released more details on a specific funding budget with over US$2 billion to advance the biotech/biomanufacturing initiative to lower prices, create jobs, and strengthen supply chains. The largest funding was assigned to domestic biomanufacturing expansion with the US Department of Defense and the Department of Agriculture.

In our view, the EO is nowhere near as powerful as the US$52 billion investment in the ‘CHIPS and Science Act’. Besides, the EO has limited impact on China’s biomanufacturing industry at this stage since there aren’t any specific restrictions on China, nor does it mention any specific restrictions on biological products, biotechnologies, supply chains, or key raw materials.

With a high base in 2022 for CRO/CMO companies with Covid revenues, the market is likely to get more optimistic until there is more visibility of 2023 revenue delivery, in our view. Most companies see limited impact from inflation, which they can pass down to downstream clients, and the backlog visibility remains very high. Moreover, capacity expansion remains in progress, driven by robust client demand per management.

For biotech companies, we believe re-prioritizing pipelines to optimize resource allocation and commercialization becomes the next area of focus. We have seen early signs of companies re-prioritizing and have been agile in the evolving competitive landscape for their assets. For more established companies, the sales recovery post-COVID lockdowns will be the focus post-opening up.

Consumer

China’s consumption has been heavily impacted by the zero-Covid policy in 2022, especially when major cities such as Shanghai experienced citywide lockdowns in April and May. Since then, we’ve seen a gradual recovery, but consumer confidence remains low under the zero-Covid policy, which became stricter in October before the CPC meeting.

While the zero-Covid policy may be here to stay, we expect to see gradual relaxation progress to prepare for reopening in the coming quarters. We’ve already seen some progress with the government reducing restrictions in Hong Kong and Macau earlier than expected, while the Beijing Marathon will resume for the first time since the pandemic. These small changes should gradually improve consumer confidence and lead to a recovery in consumption. Discretionary and services industries should benefit the most, especially where the zero-Covid policy impacted demand and, thus, pent-up demand is high.

With the new party members confirmed, we expect the government to refocus on growth, as economic development is key to resolving many social issues. Thus, we expect to see more easing policies to boost domestic consumption over the coming quarters.

As reopening will be a gradual process, overall consumption may stay weak for the next 3-6 months, but a lot of these issues are already reflected in stock prices. Overall, we think this presents a good buying opportunity to invest in high-quality consumer companies in the coming quarters as we get more visibility on the reopening path and government support to boost domestic demand and drive economic growth.

Semiconductor and AI

Semiconductors and artificial intelligence (AI) remain key strategic focus areas in China’s tech development. The broader policy direction we gather from the CPC remains consistent with the previous policies: 1) focus resources on leading-edge technology and develop independence in the core supply chain, and 2) create a competitive ecosystem to encourage innovation and attract talent.

The US Department of Commerce published a new set of export controls on advanced computing and semiconductor to China. In short, the new rules mainly target to limit China’s manufacturing capabilities in advanced logic (16nm or below) and memory chips (128 layers NAND, 18nm DRAM or more advanced), as well as access to high-performance computing semiconductors from the US companies.

We expect the Chinese government to introduce favorable policies to support semiconductors and AI, and more details will emerge as we head into the two sessions in March 2023. For example, the Shenzhen government recently drafted a new set of policies to provide subsidies in key sanctioned semiconductor subsectors. The subsidies range from RMB 5 million for individuals to RMB 15 million for corporate/projects.