Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

US Fed Rate Cut and China Policy Stimulus Package Benefit HK Market

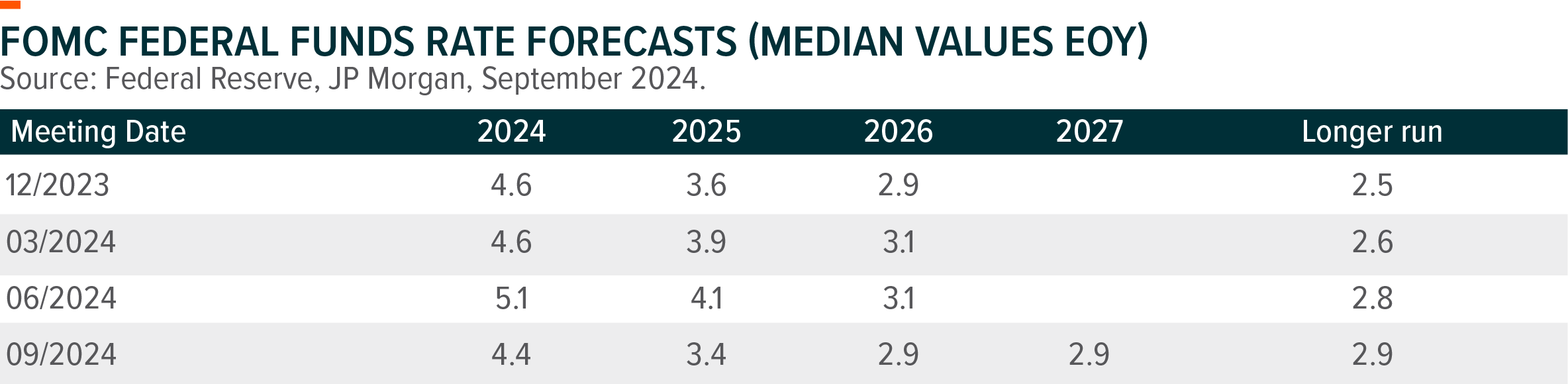

On 18 September after US market close, US Federal Reserve lowered Fed Funds Rate by 50bps to 4.75%-5.00%. This is the first rate cut in 4 years, and the 50bps cut is higher than market consensus of 25bps. The median dot plot showed 50bps more cuts in 2024, 100bps of cuts in 2025, and 50bps of cuts in 2026 to neutral rate of 2.9%. As the tightening monetary cycle comes to an end, we see Hong Kong equity market well positioned to benefit from incremental fund flows, improving liquidity, and further policy stimulus in China.

Hong Kong Market is a Key Beneficiary

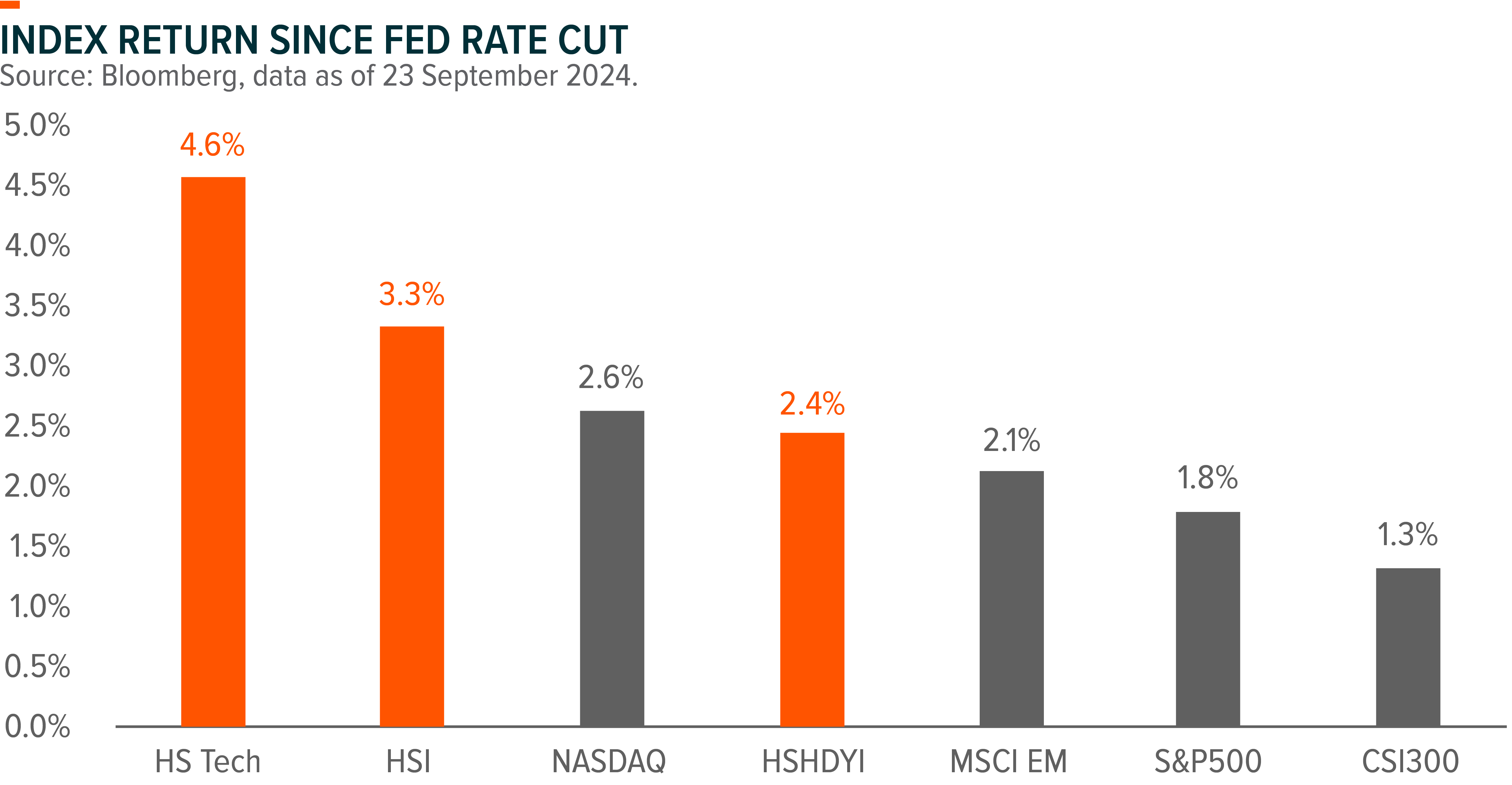

Hong Kong market (Hang Seng Index) saw a 3.3% return after Fed rate cut, outperforming other major markets. With the narrowing policy yield spread and the lingering uncertainty for US economy growth outlook, potential money outflow from the US market could support the liquidity in other markets. Compared to A-Share market, Hong Kong market is a more direct beneficiary of Fed rate cut due to Hong Kong-US dollar peg, with HKMA announcing on 19 September that Base Rate in Hong Kong is lowered by 50bps to 5.25% following Fed rate cut. The rate cut will directly lower the financing costs for Hong Kong enterprises and bring more liquidity to the market, and household consumer confidence could also be boosted as mortgage rate trends lower. Albeit with attractive shareholder returns and quality companies, Hong Kong market is still trading at a discount to peers with low positioning from foreign investors, implying potential to benefit from global asset reallocation.

China – Policy Stimulus Comes into Play

Though macro headwind in China persists, the recent Fed Rate pivot offers more room for China policy makers to adjust monetary policy as FX pressure eases. The weak August economic data also increases the urgency for more effective policy stimulus in order to achieve ‘around 5%’ GDP growth target for the year. Following Fed rate cut, PBOC and other regulators announced a series of measures aiming to stimulate economy growth and stabilize property market. On 23 September, PBOC lowered 14-day reverse repurchase rate by 10bps to 1.85%, and injected more liquidity into the financial system. On 24 September, PBOC announced a series of stimulus, including 1) cut RRR by 50bps, and guidance on another 25-50bps RRR cut by end of 2024; 2) cut 7-day reverse repo rate, China’s key policy rate, by 20bps to 1.5%; 3) down-payments for first and second homes would be unified at 15% (previously 25% for second home) ; 4) lower Interest rates on existing mortgages by 0.5% on average. In addition, PBOC announced new monetary tools to support equity market, setting up Rmb 500bn liquidity provision program for non-bank financial institutions to borrow money directly from the PBOC, and a relending program for banks to support listed companies’ share buybacks. The stimulus package indicates Central Government’s growing concern over domestic economy headwinds, and could signal new rounds of policy easing to support China’s growth.

Global X ETFs in Focus

Global X Hang Seng Tech ETF (2837 HK) comprises 30 renowned Chinese internet platforms, consumer tech companies (Smartphone, PC), and other high-tech companies (EV, Semiconductor) that rank among the top choices for global investors seeking opportunities in the Chinese market. The unique investment value for Hang Seng Tech is also defined by its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV and AI in China.

Global X Hang Seng High Dividend Yield ETF (3110 HK) Amid macro uncertainty and a lower rate environment, high dividend strategy continues to gain traction as stable dividend yields appear more appealing. In addition, there are potential incremental fund flows from household savings currently deposited in the bank to seek higher yield, as savings rates are falling. Among major markets, Hong Kong high dividend stocks deliver the most attractive dividend yield thanks to the lowest valuation among peers. Its healthy free cash flow and relatively conservative payout ratio should support more sustainable dividend payment. Compared to A Share listed peers, Hang Seng High Dividend Yield Index offers exposure to Hong Kong Infrastructure, Utilities, and property (REITs) stocks, which provide stable dividends and limited price downside given low valuation.

Related Global X ETFs’ Product1

| Global X Hang Seng TECH ETF (2837 HK) | Global X Hang Seng High Dividend Yield ETF (3110 HK) | |

|---|---|---|

| Listing Date | 30 Mar 2024 | 17 Jun 2013 |

| Reference Index | Hang Seng TECH Index2 | Hang Seng High Dividend Yield Index3 |

| Primary Exchange | Hong Kong Stock Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.44 p.a. | 0.68% p.a. |

| Product Page | Link | Link |

Global X Hang Seng TECH ETF – The ongoing charges figure is an annualised figure based on the ongoing expenses of the Sub-Fund, expressed as a percentage of the Sub-Fund’s average Net Asset Value of the Listed Class of Units of the Sub-Fund over the same period. The figure may vary from year to year. Please refer to the Product Key Facts Statement and the Prospectus for further details.

Global X Hang Seng High Dividend Yield ETF – adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges figure is an annualized figure based on the ongoing expenses of the Fund, expressed as a percentage of the Fund’s average net asset value over the same period. The figure may vary from year to year. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges of the Fund are fixed at 0.68% of the Fund’s net asset value, which is equal to the current rate of the management fee of the Fund. For the avoidance of doubt, any ongoing expenses of the Fund exceeding the ongoing charges of the Fund (i.e. the management fee) shall be borne by the Manager and shall not be charged to the Fund. Please refer to the Key Facts Statement and the Prospectus for further details.