Trends in Key Components of Electric Vehicles

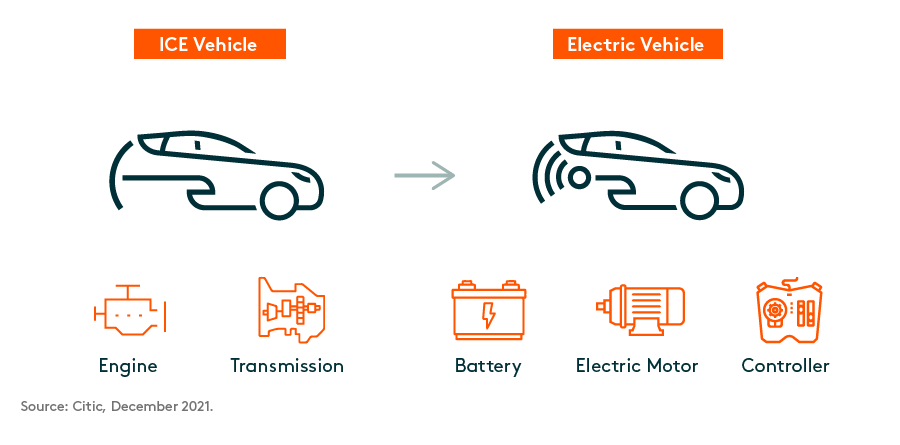

As the global automotive market shifts from internal combustion engine (ICE) vehicles to electric vehicles (EVs), vehicle designs have been restructured with multiple new components and applications being added to bring better performance and user experience. This electrification process is creating a great content opportunity and hence new addressable markets for auto parts and components suppliers.

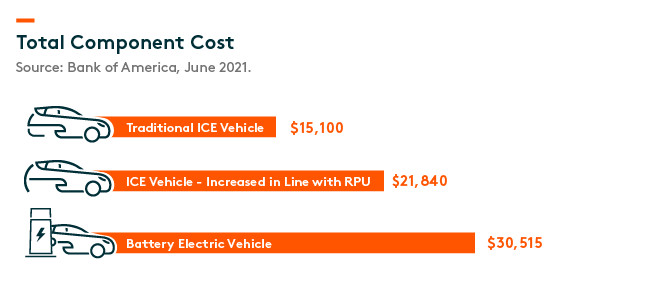

Batteries are key to EVs and account for about 30% of total component costs.1 On top of that, there are electrical architecture, power train system and power electronics which take up about 15% of the costs.2 These new components have replaced the traditional fuel system, engine, and exhaust in an ICE car model. Content per value is expected to increase meaningfully from US$22,000 for an ICE vehicle to US$31,000 for an EV.3

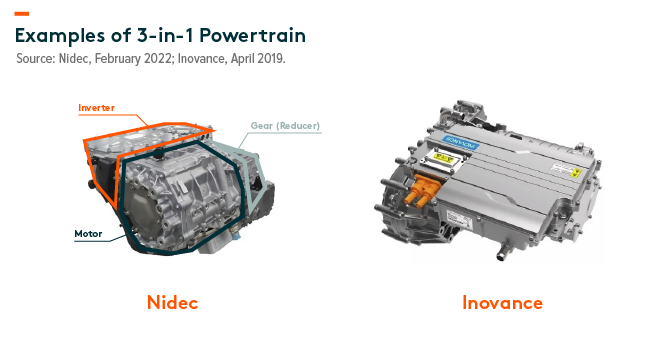

We expect a dynamic competitive landscape in EV auto parts supply chain in response to these new addressable markets. We have summarized the following industry trends auto parts suppliers are facing: 1) Many EV makers are new to the auto industry with relatively stretched balance sheets. They do not have sticky supply chain relationships and hence are more willing to outsource components; 2) Technology disruption potential is high for new electric components. We see more and more integrated solutions such as 3-in-1 power train or 7-in-1 power train. These new solutions have created room for new entrants to win their presence; 3) The total addressable market is large and the industry is fast growing. This is an attractive market for both new entrants and existing auto parts companies; 4) Though EV penetration is still at an early stage, customers and car makers are expecting higher standards and better performance, such as higher ranges, faster charging, autonomous driving capability, etc., which means auto parts suppliers have to consistently invest and improve product performance.

To cater to the electrification trend, many global major auto parts companies are shifting their focus to electric components and are preparing new product lines such as electrified powertrain. Many of them are optimistic about their increased addressable content value. For instance, Magna estimates its addressable content per vehicle (CPV) to grow from $900 to $1,100; BorgWarner forecasts its CPV to grow from $907 to $2,640; Valeo estimates 6X CPV by 2025. 4 We see some of them leveraging on their existing strong relationships with car makers and entering into strategic alliances on EV product designs. New entrants or lower-tier auto parts suppliers, such as Nidec, Inovance and Shuanghuan, are also trying to gain a bigger market share in the EV supply chain.

In addition to the new power train system, EV makers are making innovations regarding smart cockpit designs and autonomous driving capability. They are transforming cabins into those with always-connected digital cockpits, which will enable a better multimedia experience, smartphone-like operating system and smart navigation.