Webinar Replay: The Case for ESG ETFs

Listen

Transcript

I am going to talk about the Global X Hang Seng ESG ETF. The ticker is 3029.

Globally, ETFs have reached a key milestone last year, accumulated $10 trillion in assets.1 It is proven that ETF is a very effective instrument for many types of investors. It’s a very cost-efficient type of vehicle, and it’s easy to trade.

One characteristic that’s driving the growth of ESG ETF is its transparency. A lot of investors are criticizing greenwashing within the ESG space. Greenwashing refers to some mislabeling practices, essentially mislabeling some of the non-ESG products as green products. In comparison, ETF is transparent. It discloses the index methodologies transparently. At the same time, it also discloses the holdings, with most ETFs disclose holdings on a daily basis. And because of its transparency, ETF is an effective instrument to avoid greenwashing. In terms of AUM growth in the last decade, it has grown exponentially with a CAGR of 32.6%.2

We launched the Global X Hang Seng ESG ETF. It is an expansion of our ESG offering. In fact, we launched the first SFC-authorized3 ESG ETF, named as Global X China Clean Energy ETF, and we are pleased to expand our product offering in the ESG spectrum today.

Regarding the index methodologies, the initial universe is the Hang Seng Index. Hang Seng Index has about 65 securities, and some ESG techniques have been applied to enhance the Index, so that it is more ESG-tilted.

There are 2 types of techniques. The first type of technique is exclusionary screening, and the second is ESG tilting.

For exclusionary screening, it is implemented in a three-step approach.

- The first step is excluding the company that is in breach of the United Nations Global Compact, such as businesses that breach the human rights, labor rights or involving in corruptions.

- The second step is excluding companies that are involved in controversial sectors, such as tobacco, and weapon manufacturing. The index also excludes companies that are relying heavily on thermal coal to generate energy.

- The third step is excluding some companies that are very vulnerable to ESG risk. For example, some companies are vulnerable as we transit to a net-zero economy. These companies are exposed to more physical and transition risks. The ESG risk that we are measuring is defined by a company called Sustainalytics. It is an ESG data company that is owned by the Morningstar. They involve in our index methodology to objectively assess the sustainability profile of the underlying companies.

After these three steps of exclusionary screening, the index applies ESG tilting for the remaining constituents. The index is overweighting companies that have better ESG profiles and underweighting the opposite. As a result, the weighting of these constituents is adjusted to have a stronger ESG tilt.

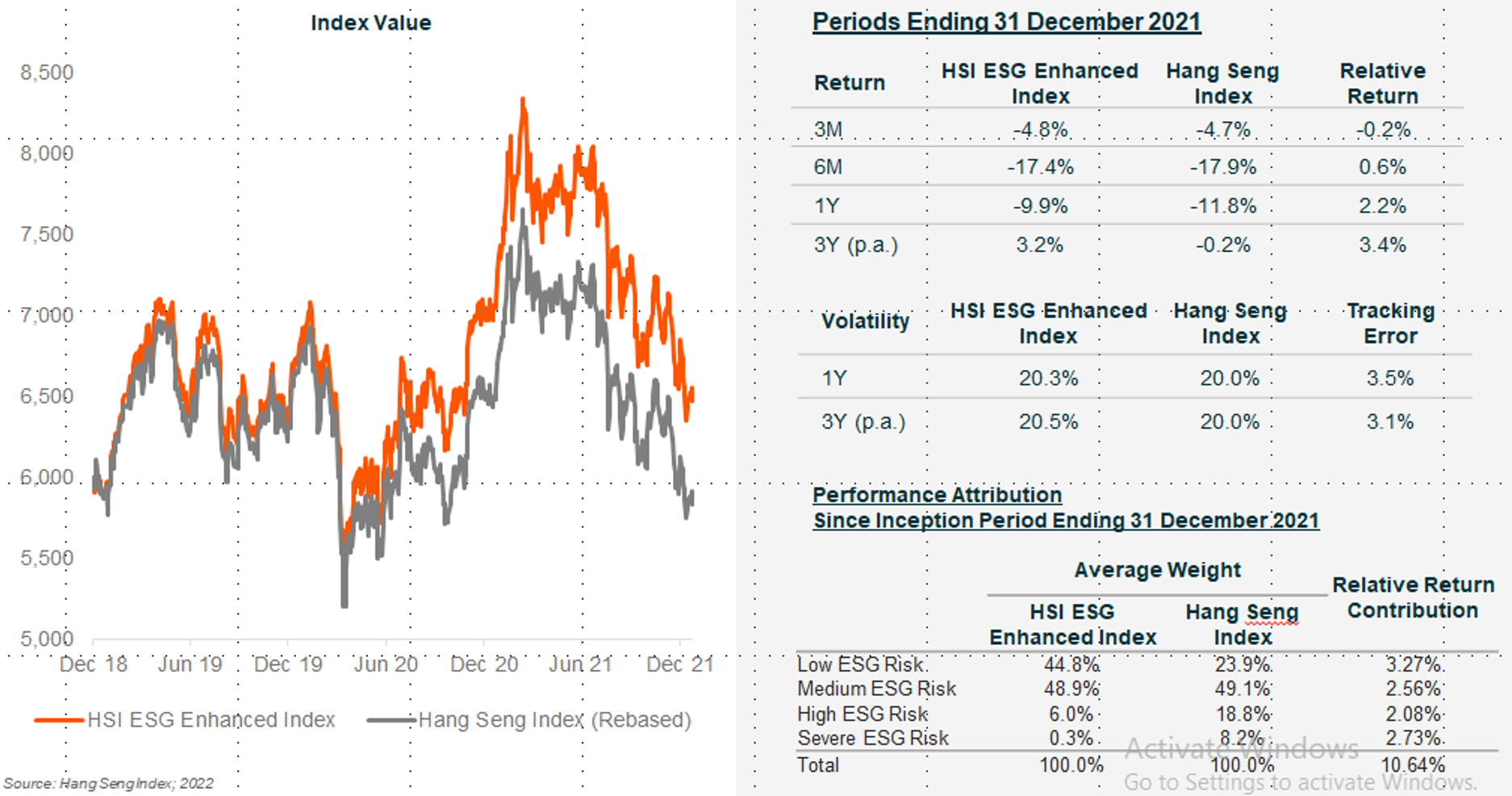

Regarding the historical performance, we compare the index that we track, HSI ESG Enhanced Index to the Hang Seng Index as a broad market. I think the performance of the figures is self-explanatory. It shows that over longer term like three years period, the HSI ESG Enhanced Index outperforms the broad based index. And at the same time, the volatility level is about the same, which is roughly 20%.4

I talked about the ESG tilting methodology that we adopt in the index methodology previously, and this is a performance attribution that shows the ESG tilting technique adopted actually works. Over the past three years, it shows that the HSI ESG Enhanced Index is overweighting low-risk companies, and the overweight allocation generated alpha. Same for the high-risk company as well – the underweight allocation of high ESG risk companies also generated alpha. So this is a piece of solid evidence that shows the ESG tilting methodology is actually enhancing the return. Obviously, this is only a past performance, I’m not saying that it will necessarily repeat itself, but this is a solid track record to reference to.

The Global X Hang Seng ESG ETF charges a very competitive fee of 29 basis points.5 We invest in a wide range of sectors and industries ranging from financials, IT, and utilities. In terms of industry breakdown, it’s very diversified and we only invest in companies that are listed in Hong Kong. This is meant to be an ESG index, the Hang Seng Index that’s enhanced from an ESG lens.

Learn more about the Global X Hang Seng ESG ETF.