The Case for Re-Shoring Global Supply Chains

The idea itself sounds counterintuitive. After decades of globalization, multinational companies are now turning inward and localizing supply chains. The global pandemic exposed vulnerabilities in supply chains across the globe, intensified by a shortage in labor, transport and logistics—all of which contributed to a bottleneck in supply, particularly for the semiconductor industry.

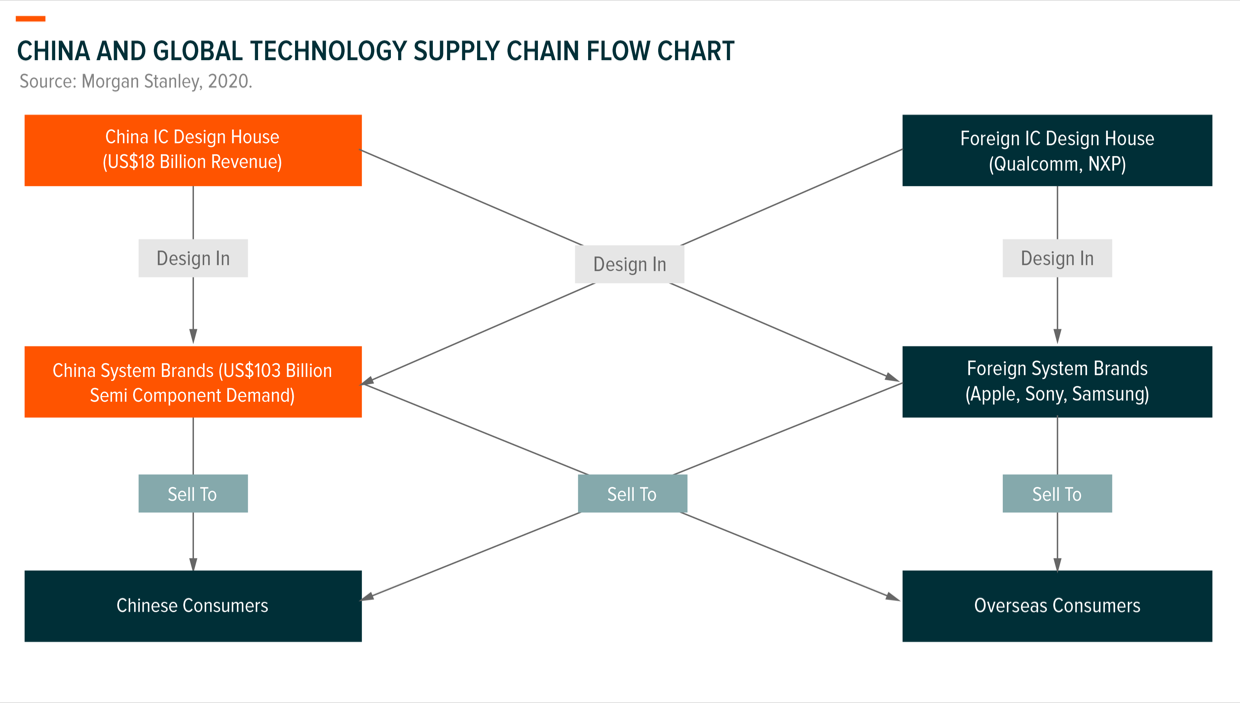

Yet COVID-19 was just the catalyst. A long, drawn-out tech rivalry and trade war between the US and China has brought two things to the surface. First, low-cost labor is no longer considered as crucial to global supply chains as companies prefer knowledge-intensive value chains, encouraging Chinese companies to move up the value chain in manufacturing and technology and boost domestic capabilities. Secondly, China is still largely dependent on foreign companies within the semiconductor supply chain.

The semiconductor industry generally has a higher entry barrier and a long investment cycle. Many companies had been unwilling to invest in the semiconductor industry until very recently. This has resulted in a small upstream presence—only a handful of companies in the world manufacturer leading edge semiconductors—in contrast to downstream global leaders that mass produce devices such as smartphones, PCs and hardware.

Supply Chains Make a Strategic Pivot

The auto semiconductor shortage this year reminds us of how vulnerable the global supply chain can be. Companies had to re-think just-in-time (JIT) processes, where a lean- and low-inventory approach worked well up until the coronavirus pandemic broke out.

In the wake of these events, major economies across the world raced to announce plans to localize semiconductor supply chains. The EU announced a new semiconductor alliance and a financial program to support local production. While the US Congress recently passed the CHIPS (Creating Helpful Incentives to Produce Semiconductors) for America Act, which aims to invest US$52 billion in US semiconductor chip production and research over five years.1 This is part of the wider US$250 billion US Innovation and Competition Act, which includes US$39 billion in production and research and development incentives, in addition to a US$10.5 billion grant for semiconductor manufacturing.2 As US-China competition intensifies, China has also ramped up its efforts to incentivize its domestic semiconductor industry with a RMB650 billion injection into its state-owned National Integrated Circuit Industry Investment Fund, otherwise known as “The Big Fund”.3

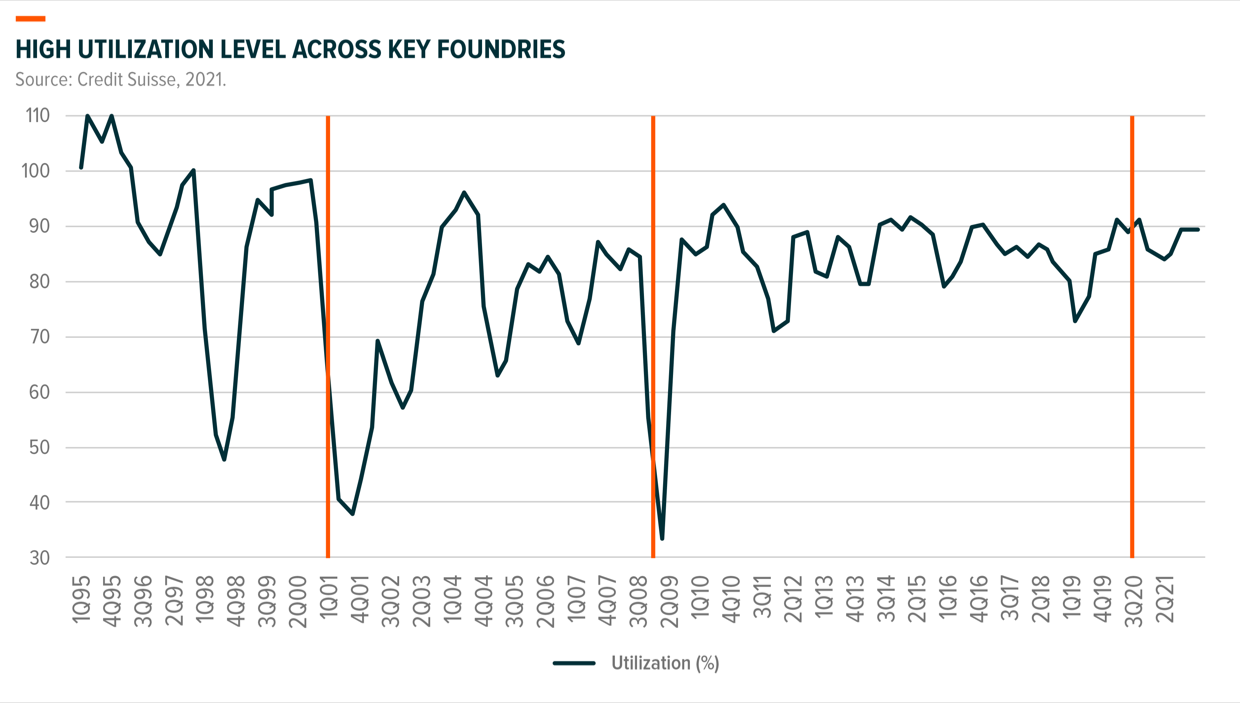

The practicalities of mirroring the same semiconductor capacity at home raises some questions. First, the cost of running a semiconductor fabrication plant varies significantly across the world. Additional capacity in the US and EU may not be as commercially competitive without the support of significant government subsidies. In light of the wide economic impact of COVID-19, most governments have a sizeable debt to service ratio. Secondly, redundant capacity could inevitably result in an oversupply and low utilization of semiconductors, which will likely hurt all players involved in the semiconductor supply chain as prices fall.

Structural and Cyclical Trends Drive Longer and Stronger Upcycle

Three elements contributed to a strong upcycle, as semiconductor supply remained tight across 3Q20.4 This was likely driven by three factors. First, more people worked from home during the initial outbreak of COVID-19, boosting global PC shipments 26.1% year-over-year (YoY) in 4Q20.5 Secondly, increased demand for fifth-generation (5G) smartphones and subsequently creating supply pressure for smartphone chips. Lastly, limited mature node capacity expansion, auto makers underestimating the semiconductors required from foundries and combined with supply chain disruptions, have led to a significant auto chip shortage. As a result, we see a high utilization rate across key foundries, some of which reached over 100% in 2020.6

Electric Vehicles Boost Demand for Power Semiconductors

Power semiconductors are becoming increasingly important, as the rise of electric vehicles (EVs) and automation is expected to create a strong demand for power semiconductors. In this field, Chinese companies are relatively small but gaining market share supported by local EV and electronic companies.

The development of the local EV industry in China is set to drive the local power semiconductor supply chain, similar to how domestic smartphone brands support China’s semiconductor industry. Although domestic power semiconductor players are relatively small compared to global leaders, China has already formed a local supply chain in power semiconductors with a combination of fabless, foundry and integrated device manufacturer companies.

Major economies are already ramping up efforts to ease supply chain tensions by investing in semiconductor development and manufacturing initiatives. As countries continue to turn inward and localize supply chains, it could ease the bottleneck seen in the semiconductor supply chain that has intensified for several quarters. It is those initiatives that could lay the foundation to a country’s up-and-coming domestic semiconductor industry.