Important Information

Global X China Cloud Computing ETF

Global X China Robotics and AI ETF

Global X China Clean Energy ETF

Global X China MedTech ETF

Global X China Biotech ETF

Global X China Semiconductor ETF

Global X China Consumer Brand ETF

Global X China Electric Vehicle and Battery ETF

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China MedTech ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China MedTech Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies in the medical technology industry. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant industry.

- Many of the companies with a high business exposure to a medical technology theme have a relatively short operating history. Rapid changes could render obsolete the products and services offered by these companies and cause severe or complete declines in the prices of the securities of those companies. Additionally, companies with medical technology themes may face dramatic and often unpredictable changes in growth rates and competition for the services of qualified personnel. They may potentially subject to (i) substantial government intervention in the technology industry (including restrictions on investment in internet and technology companies), (ii) complex laws and regulations including privacy, data protection, content regulation, intellectual property, competition, protection of minors, consumer protection and taxation, (iii) heavy and significant capital investment on research and development, (iv) risks of medical failure (including injury or death of patients), negligence or product liability claims, recall or withdrawal of products. These risks may result in adverse impact of the operating results of the companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Shares on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X China Biotech ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Key Themes – Sept 2023

Listen

[2845/9845] Global X China EV & Battery ETF

Battery production to grow in July: According to the China Automotive Battery Innovation Alliance (CABIA), China’s power battery installation reached 32.2GWh in July 2023, down 2% MoM and up 33% YoY. In the same month, China‘s power battery production reached 61GWh, up 1.5% MoM and 28.9% YoY. Battery installation for LFP batteries declined 4.7% MoM to 21.7GWh in July (67% share), while NCM battery installation grew 4.8% MoM to 10.6GWh (33% share). EV battery export volume expanded 12% MoM to 11.2GWh during the month.

Auto sales increase and EV penetration stays solid: Based on the announcements of individual auto companies, the August wholesale volume data stays solid. BYD, Li Auto, Xpeng, and Nio delivered +5%/+2%/+27%/+13% MoM, respectively. According to the China Passenger Car Association (CPCA) data, the August China passenger car vehicle wholesale volume was 2.24mn units (+8.5% MoM/ +6.5% YoY) and production volume was 2.24mn units (+7.1% MoM/ +5.3% YoY). China’s new electric vehicle (NEV) (excl. commercial vehicles) wholesale volume increased to 798k units (+8.2% MoM/ +25.6% YoY). Year-to-August NEV wholesale volume reached 5.08mn units (+38.5% YoY). The NEV penetration in August was 35.7% (flat MoM / +5.5ppts yoy).

Battery material costs have modestly declined: China spot lithium carbonate declined fairly sharply by around RMB60k/t or 10% MoM in August and reached a level around RMB206k/t. In the spot market, near-term demand still fails to outperform. In addition, having experienced the price rollercoaster in the past 2 years, downstream has become increasingly cautious on inventory management. We believe this can become a new norm in the near term, and do not expect to see much stock up more than what is absolutely required for production, especially with the expectation of sufficient supply next year; any restocking will likely come at a lower magnitude than we used to see.

Launch of fast charging LFP battery: On 16 August 2023, CATL launched Shenxing, the world’s first 4C superfast charging LFP battery, capable of delivering 400 km of driving range with a 10-minute charge as well as a range of over 700 km on a single full charge. Shenxing is expected to considerably alleviate fast charging anxiety for EV users, and opens up an era of EV superfast charging. This indicates CATL’s solid battery technology innovation and likely to keep the technology gap, in this case, LFP, with the other battery suppliers.

Positive endorsement of Chinese auto software by Volkswagen: On 26 July, Volkswagen announced that it would invest USD700 million for 4.99% of Xpeng and an observer’s board seat in the Chinese carmaker. The two companies plan to roll out two Volkswagen-branded midsize EVs in 2026 in China. This partnership will allow Volkswagen to expand its position in China, by tapping new customer segments and bringing new intelligent, fully connected electric vehicles to the ICV market more quickly. In China, already over 30% of newly registered vehicles are electrified. It is anticipated that in 2025, that figure will reach 50%. The partnerships also reflect the urgency for Volkswagen, searching for a remedy to increase its presence in the China market, where it has been outcompeted by Chinese start-ups such as Xpeng and Nio. Volkswagen’s EV sales have fallen in the first six months, despite the overall EV market growing 25%.

[2806/9806] Global X China Consumer Brand ETF

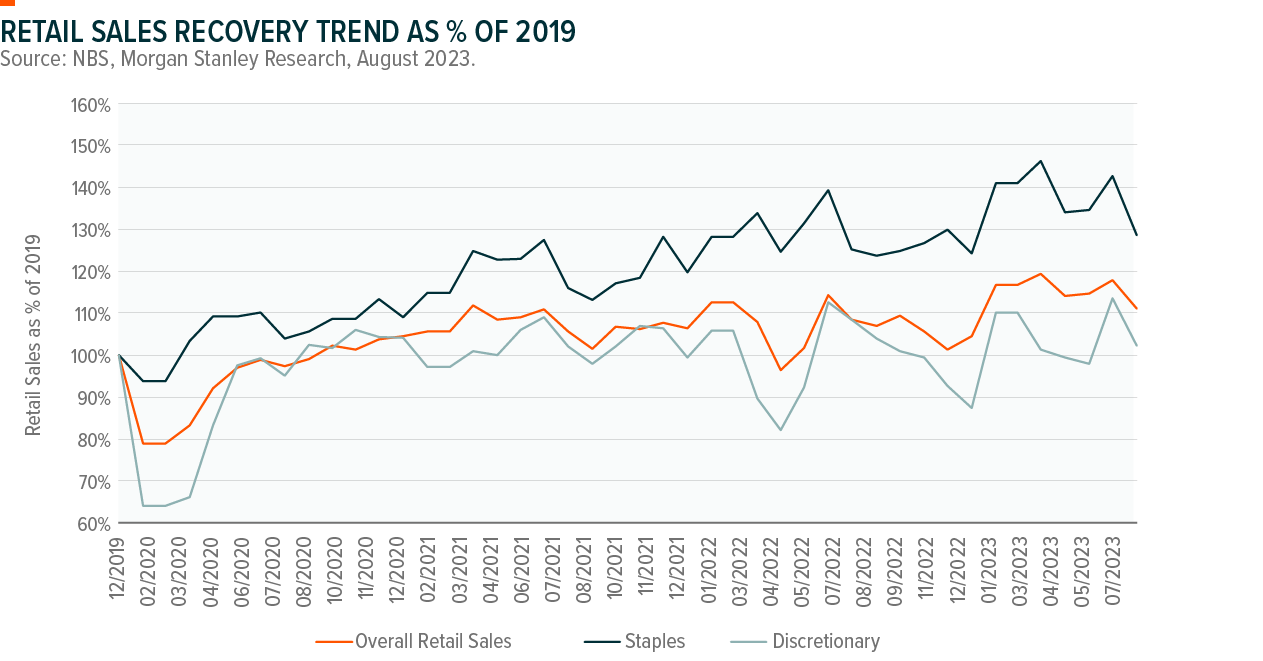

China consumption recovery pace has been softer than expected in recent months. July retail sales growth was +2.5% year-over-year (yoy), missing the street expectation of +4%yoy growth. Sales deceleration was seen across different categories particularly with gold and jewelry, cosmetics, and home appliances which was partly due to front loading of consumption during 618. This chart shows that overall retail sales in orange is at 111% of 2019 level and staples sales are at 129% of 2019 level while 102% of 2019 for discretionary sales amid weak consumer sentiment.

China recovery has shown a divergence trend. A consumer survey by CLSA in July showed that consumers were expecting to increase their spending in the next quarter. It clearly showed travel was an obvious area where people were willing to increase their spending. In fact, a number of traffic for domestic tourism has reached 20% above the 2019 level while spending per tourist remained 16% below the pre-COVID level. Education and medical services were the ones that stayed relatively high throughout the period. While high-value goods such as home appliances, furniture, and other big-ticket items have come down amid an overall weak consumption environment.

Polarization trend so called K consumption has become more obvious in China. Consumer companies that benefit from either premiumization or trade down with strong value proposition reported better than expected 1H23 results. Premium baijiu such as Moutai continued to benefit from resilient high-end spending and delivered top-line and bottom-line growth of +20%yoy and +21%yoy respectively in 2Q23. Meanwhile companies such as Eastroc, Proya, PDD with strong value proposition benefited from consumers trading down and reported better than expected 2Q23 earnings results. Proya management shared that industry sales declined for unit price range of RMB 400 to RMB 1500 while mass (below RMB 400) and luxury (above RMB 1500) demand remained intact. Similarly, beer companies also delivered good results with the premiumization trend. The leading beer company, China Resources Beer, reported strong beer growth with premium beer volume growing +26%yoy and low end also registered a positive growth while mid-range volume was weak.

The government has set a more dovish tone at Politburo meeting in July and since then we have been seeing more policies being announced to support economy as well as property market. We believe the government is currently focusing on economic growth and thus expect more policies may be announced to support growth in coming months. Meanwhile valuation for many consumer companies have come down to more attractive levels thus we are becoming more constructive on China consumption theme.

[3191/9191] Global X China Semiconductor ETF

Huawei Mate 60/Mate 60 Pro launch with Hsilicon chip: Huawei did not disclose any official information about the SoC on this new smartphone. Initial teardown shows the phone carrier an in-house designed Hisilicon SoC. Performance benchmark testing indicates CPU performance comparable to QC SD 888 (launched in December 2020 based on Samsung 5nm). Mobile internet connectivity testing indicates over 500mbps of download speed.

ASML to ship advanced chip tools to China till year-end: The company applied for export licenses to ship our NXT: 2000i plus systems. The Dutch licensing authorities have issued the licenses as of September 1 to be able to continue shipments of the NXT:2000i and subsequent systems this year. Under the new export control rules, ASML is able to ship these systems until the end of the year.

[2820/9820] Global X China Biotech ETF

First domestic PCSK9 launched by Innovent

Innovent has commercially launched its innovative PCSK9 mAb tafolecimab (trade name Sintbilo), with the drug being supplied to hospitals and pharmacies across China.

The drug received China NMPA approval earlier this month as a treatment for adult patients with primary hypercholesterolemia (including heterozygous familial and non-familial hypercholesterolemia) and mixed dyslipidemia.

It became the first domestic PCSK9 inhibitor to be approved in China behind two imported products from Amgen and Sanofi.

Tafolecimab has the longest half-life among the marketed products, with a single dose capable of lowering LDL-C for 3 weeks. The drug also provides flexible drug regimens with three treatment intervals (Q2W, Q4W and Q6W), which can additionally reduce LDL-C rapidly by ~50% (with a maximum reduction of 66%) when used together with moderate doses of statins.

PCSK9 mAbs already on the Chinese market include Amgen’s Repatha (evolocumab) and Sanofi’s Praluent (alirocumab), while Junshi’s ongericimab (JS002), Akeso’s ebronucimab (AK102), and Hengrui’s recaticimab (SHR-1209) are under marketing review.

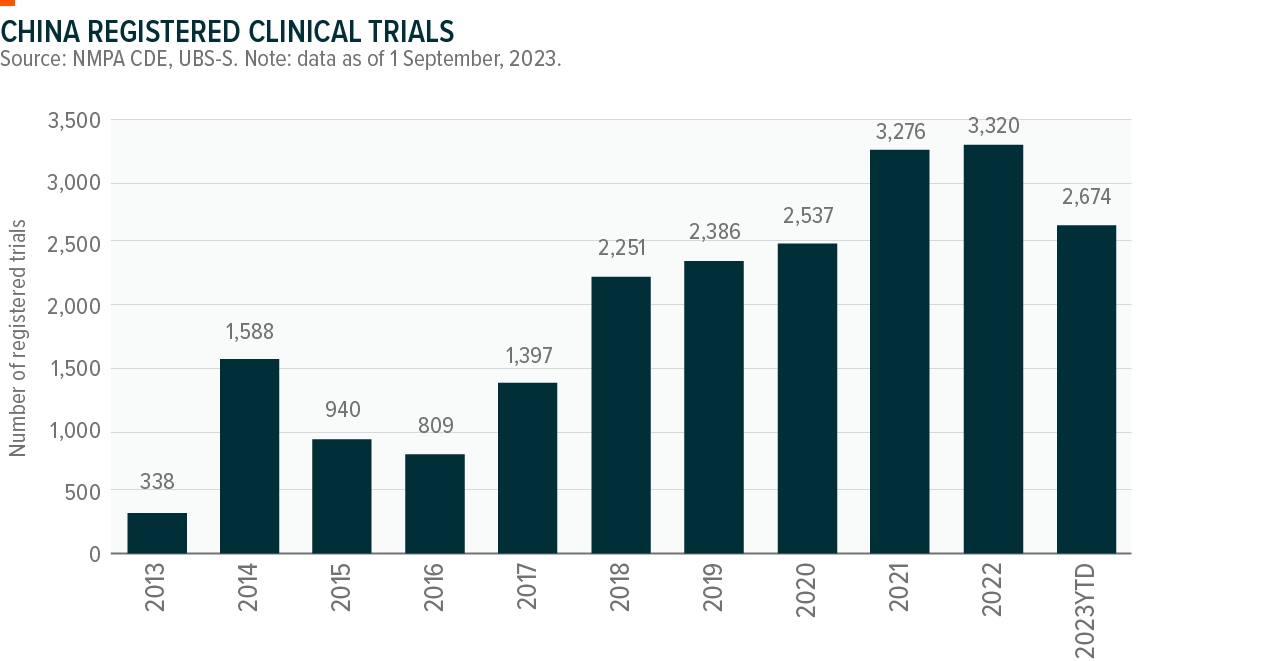

China prepares for 9th VBP round targeting 44 major drug types

China National Allied Procurement Office has released a notification initiating the 9th national VBP tender round.

A total of 44 chemical drugs across 195 different specifications have been selected. Hospitals will be required to provide details of volume usage for molecules involved. The 9th round is notable for targeting CNS drugs (9), followed by cardiovascular drugs (7), GI and metabolic diseases drugs (7), and infectious disease drugs (6).

A total of 7 molecules in this round have appeared in different specifications in previous rounds, namely: esomeprazole (4th and 5th rounds), aripiprazole (5th and 7th), lacosamide (7th), paroxetine (1st), sildenafil (3rd), azithromycin (2nd and 5th), and aciclovir (5th).

[2841] Global X China MedTech ETF

Impact of anti-corruption campaign

Background – as highlighted in our previous commentary for [2820/9820] China Biotech ETF, On 28 July 2023, the Central Commission for Discipline Inspection and the National Supervisory Committee held a meeting to open an investigation into corruption in the healthcare sector.

Mindray Bio-Med, one of the largest device manufacturers in China held a conference call in August 2023 to discuss the impacts of anticorruption efforts. Per management, 20% of its medical equipment sales, including patient monitoring and ultrasound businesses, being sold to public hospitals in China, will likely be delayed from Q323 to Q423 (20% of 25% of total sales). However, this could be offset by potential market share gains in the remaining 80% of ongoing tenders as it may be less risky for hospitals to purchase Mindray’s products, which Mindray says are highly compliant. The company believes the severe impact on tendering will last till end-October 2023 given Shanghai will complete the self-examination and correction work on anti-corruption by then, which serves as a reference point for other parts of China.

Offsetting factors for delay include local governments support for medical infrastructure – In terms of financing for Medtech purchases, China’s local governments are given a clear deadline to issue 100% of the budgeted specialised bonds (RMB380bn) by the end of September and guarantee the capital will be utilised by end-October for new medical infrastructure projects

[2809/9809] Global X China Clean Energy ETF

Solar

Solar materials prices are overall stable in August with polysilicon prices slightly bottoming up to currently RMB80/kg and module prices as low as RMB1.1/w. Polysilicon inventory came down significantly when prices stopped further declining. Downstream resumed production and utilization in wafer, cell and module end are recovering. We are quite positive on demand uptick as close to the year end.

Most of solar companies reported super strong 1H23 earnings results, though it seems not meaningful to stock prices due to concerns on oversupply in the near term. We have seen some new projects delay recently. Sector downside might be limited from here given valuation corrected a lot from peak in 2H21. What is worthy highlight is, Longi’s management confirmed recently that xBC products could be the new mainstream of next-generation solar cell technology, on account of high technology moat, long life cycle and products differentiation. The yield of xBC solar cell production is still not perfect for some leading producers, 93-95% vs PERC 99% and Topcon 97-98%, which largely affect investors’ confidence on the long-term competition landscape. On the bright side, we will see the results soon in the next six to twelve months.

Wind

The latest monthly data points indicate that onshore wind tendering procurement pricing has dropped to RMB1850/kW in August, lower than the average RMB2000/kW in the past 3 months. Wind turbine installations in July were 332MW (+67% yoy). Year-to-July wind installation grew by 76% yoy and reached 26GW, still much below the tendering volume last year of 91GW. The China open market wind tendering volume in August was 4.1GW (-42% yoy). Year-to-July tendering volume was 45GW.

Companies’ results are mostly in line with market expectations: Many Chinese wind companies have reported their 1H23 earnings results. The 2Q wind power installation progress is weak, consistent to the monthly data points for both onshore and offshore projects. However, most of the part suppliers’ gross margin are holding up quite well. Many of the supply chain companies anticipate a recovery in parts demand in the latter part of the year.

[2807/9807] Global X China Robotics & AI ETF

The latest monthly data points released by the National Bureau of Statistics reported on August 15 that China industrial robot production volumes were -13% yoy in Jul (+4% mom vs. Jun and past five years’ seasonality of +2% mom); China machine tool production volumes were -2% yoy in Jul (-17% mom vs. Jun and past five years’ seasonality of -11% mom). Manufacturing fixed asset investment (FAI) was +4% yoy in July (moderated vs. +6% in Jun). High-tech manufacturing FAI stayed at +12% yoy in July. Railway FAI continued the recovery trend with +25% yoy in July (vs. +21% yoy in June).

Order momentum bottoming in Japan/Europe/US: Based on the final machine tool order data released by the Japan Machine Tool Builders’ Association (JMTBA) on 24 August, global machine tool orders in July 2023 totaled JPY114.3bn (-20% yoy/-6% mom). This includes a decline in domestic Japan orders below the JPY40bn mark (-24% yoy/-4% mom). The yoy decline is lower than last few months but still remained at a low level. Overseas orders (ex-Japan) continued to decline on a yoy basis, and came in at JPY75.0bn (-17% yoy/-8% mom). Orders momentum is steadily approaching a bottom yoy in Japan, Europe, and the US.

China automation data are showing weakness: China July orders totaled JPY17.8bn (-36% yoy/-7% mom). Monthly order volume was the lowest since August 2020 (JPY17.0bn). As in June, orders were weak in areas such as EVs, batteries, and semiconductors, which had seen brisk orders through 2022. According to the JMTBA, capex appetite has been stagnating in all fields except solar panels, and this has resulted in a significant decline in machine tool demand.

Positive commentary from the supply chain leads to improving outlook: One of the key players in the robotic supply chain guided positively on their outlook to humanoid robot production during their analyst results presentation. The company guides that their production schedule is based upon the client production plan of 100 bots per week in 1Q24, 3,000 per week in 2Q24 and 10,000 per week in 3Q24. This progress, if true, is much faster than market expectation and hence lead to an improving sentiment and outlook to the robotic sector.

[2826/9826] Global X China Cloud Computing ETF

July revenue growth for China software industry: China Software industry July revenues were +9% YoY, slowing down compared to June (+18% YoY), leading 7M23 revenues to increase by 13.5% YoY, lower than 6M23 growth of 14.3% YoY. IT services growth outpaced the industry at 15% YoY in 7M23, driven by cloud computing and big data analysis services, while EDA software growth slowed at 3% YoY, and e-commerce IT services growth was at 8% YoY, followed by embedded system software at +11% YoY, software products at +11% YoY, driven by industrial software at +13% YoY, and cybersecurity at +10% YoY. Net margin was up to 12.8% in July (vs. 10.5% in June). Source: MIIT, August 2023.

July revenue growth for China telecom industry: July telco rev grew 6.2% YoY, a strong recovery from 3.5% in June. Mobile revenue recovered from -10% in June to +2.5% in July, while fixed line revenue growth of 6.9% remained healthy. Telcos 1H23 reported cloud growth vastly exceeds the MIIT figures, indicating potentially a different reporting basis. Source: MIIT, August 2023

AI License granted to LLM developers: Eight generative AI applications have registered with China’s cyberspace authority, including Baidu’s Ernie Bot, ByteDance’s Doubao, Sogou founder’s Baichuan and chatbots built on the lab work of top research institutions like Tsinghua University and Chinese Academy of Sciences.