Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Monthly Commentary on Key Themes – Jan 2024

Global X Hang Seng TECH ETF (2837 HKD)

Industry Update

- The key underperforming sector was communication services as China announced new regulations on the gaming industry, which prompted a broad tech selloff towards the end of December.1 Meanwhile, year-end position adjustments, supportive government policies, and the Fed’s pausing of rate hikes have limited its loss, resulting in a 1.74% loss in December for the Hang Seng Tech Index.2

- Communication Services sector slumped after the new online gaming curbs but bounced back with share buybacks and favorable macro environment: The communication services sector contributed -2.48% to the fund return in December.3 When the new online gaming curb was announced on December 22, Tencent (700.HK) slid by 12.35%, NetEase (9999.HK) by 24.60%, and Bilibili (9626.HK) by 9.67%, which led as much as US$80 billion drop in market value.4 However, soon after the announcement, some companies like Tencent boosted their share buybacks to about US$1.3 billion of shares in December to express their confidence. The government also softened its stance on the new gaming curb, resulting in some gains. The month ended with Tencent (-7.96%), NetEase (-20.02%), and Bilibili (+7.22%).5

- Information Technology sector contributed a modest return to the index, mainly driven by Lenovo and Xiaomi, similar to the previous month: The information technology sector, accounting for 25.31% of the fund, contributed +0.47% return.6 Lenovo Group (992.HK) has gained over 30% from a mid-October low, showing the strongest annual performance since 20097. Lenovo’s significant increase in growth contributed to a wider upward trend observed in its industry, indicating potential recovery from the economic downturn caused by the pandemic. This resurgence can be attributed to the cyclical need for PC replacements and upgrades, which suggests a positive outlook for the post-pandemic market. The stock price of Xiaomi (1810.HK) also jumped amid expectations of their EV manufacturing and incorporation of auto and consumer electronics in its vehicles.8

Preview

Historically, higher US Treasury yields tended to prompt fund outflows from equity markets, especially emerging markets. Thus, the expectation of rate cuts in 2024 will likely support inflows to lower valuation assets globally, such as the Hong Kong/China stock market.9 In addition, government policy stimulus will help to attract back the investor’s inflows. The People’s Bank of China agreed to ramp up the existing monetary policy and stimulate consumer prices to expand domestic demand, improve confidence, and promote a better economic cycle in 2024.10

Global X Hang Seng High Dividend Yield ETF (3110 HKD)

Industry Update

- Hang Seng High Dividend Yield Index recorded a +3.55% gain in December, mainly driven by the Utilities and Financials sectors.11

- Utilities sector benefited from the Fed’s rate cut and expected lowering of financial costs: The utilities sector, accounting for 10.58% of the fund, recorded a 10.40% gain in December, contributing +1.08% to the fund.12 All utility sector stocks rose, with Beijing Enterprises Water Group (371.HK) rising by 10.13%, CK Infrastructure (1038.HK) by 14.74%, CLP holdings (2.HK) by 9.93%, Guangdong Investment (270.HK) by 6.57%, and Power Assets Holdings (6.HK) by 11.87%.13

CK Infrastructure’s interim net profit fell 3.9% year-on-year (YoY) due to the weakening performance of foreign currencies against the Hong Kong dollar and rising financial costs.14 However, the company has been increasing dividends since its listing, which makes it very attractive in such a volatile market. The practice of constantly increasing dividends bolsters the value of its shares. The depreciation of the US dollar and the appreciation of other currencies towards the end of the interest rate hike period could potentially be advantageous for stocks within the utilities sector. It would allow these companies to reduce their financial expenses and payout ratio, consequently allowing them to increase dividend payments. - Financials sector is well-positioned to gain in 2024: Most of the financials sector stocks gained in December: Far East Horizon (3360.HK) by 10.03%, Hang Seng Bank (11.HK) by 6.24%, Agricultural Bank of China (1288.HK) by 5.99%, and Bank of Communications (3328.HK) by 5.64%.15 Far East Horizon rose amid the company’s special dividends distribution to shareholders in early December to increase the dividend yield. Based on the closing price on December 7, the special dividend rate was about 2.37%, making the company’s total dividend rate for the first half of 2023 10.62%.16

Preview

Hong Kong banks are expected to improve their margin as a higher prime rate could help them offset the rising funding costs from Hong Kong’s property woes, which could result in strong earnings and, thus, higher dividends.17 Also, mortgage growth might improve as buyers respond to the falling property prices, and corporate lending could recover if more mainland Chinese firms turn to the city for offshore financing.18

Global X China Electric Vehicle and Battery ETF (2845 HKD)

Industry Update

- Strong sequential auto sales growth and EV penetration stay solid in December: Based on the announcements of individual auto brands, many of them registered double-digit month-over-month (MoM) growth in December. BYD reported December new energy vehicle (NEV) sales of 341.0k units, +45% YoY/+13% MoM.19 2023 NEV sales improved by +62% YoY to 3.02mn units.20 Li Auto delivered 50,353 units of vehicles in December (+137% YoY/+23% MoM), successfully achieving its monthly delivery target of 50,000 vehicles.21 Nio December deliveries logged 18,012 units, +14% YoY/+13% MoM.22 Xpeng December deliveries logged 20,115 units, +78% YoY/+0% MoM.23

- Battery production to grow in November: According to the China Automotive Battery Innovation Alliance (CABIA), China’s power battery installation reached 45GWh in November, up 15% MoM.24 Energy storage battery sales in November were 16GWh, up 15% MoM; battery production reached 88GWh, +13% MoM; LFP batteries accounted for 65% of total battery installation.25 CATL’s market share in domestic installation rose 1ppt MoM in November, to 44%, while BYD’s share was down 3ppts MoM, to 23%.26

- Battery material costs declined further in December: China’s spot lithium carbonate price was around RMB 99k/t at the end of December, down by around RMB 34k/t or 26% MoM.27 Inventory-wise, total inventory of lithium carbonate came in at 66,584 tons (vs. 61,852 tons last month).28

- Strong momentum from Huawei AITO: The AITO brand deliveries reached 24,468 units in December (+30% MoM), with new AITO M7 deliveries at 20,611 units (last month was 15,242).29 Total deliveries in 2023 reached 94,380 units. Non-refundable orders of M9 have exceeded 30k units in 7 days after product launch, and accumulated orders of new M7 have exceeded 120k units.30

Stock Comments

- BYD (002594.CH): BYD’s share price was up 2.1% in December, a positive contributor to the ETF.31 BYD has been showing decent monthly sales figures and met their aggressive full-year sales figures. We believe that can translate to strong margins thanks to economies of scale.

- CATL (300750.CH): CATL’s share price was down 2.2% in December, a negative contributor to the ETF.32 The share price continues to underperform the sector in recent months. We believe the market remains concerned about the company’s ability to maintain its global market share as the US and Europe are raising their bar on battery imports.

- Ganfeng (002460.CH): Ganfeng’s share price was up 9.7% in December, a positive contributor to the ETF.33 This is a sharp rally after seven consecutive months of underperformance along with lithium carbonate prices. The stock price rallied as the lithium carbonate prices hit the emotional price floor of RMB 90k/t. There are limited signs of inventory rebuild by the battery supply chain players. Many of the players stayed cautious about the lithium pricing outlook into 2024.

Preview

We are confident about China’s NEV penetration into 2024 as auto suppliers have solid and competitive car model pipelines. The market share competition will remain very intense, with traditional auto suppliers and overseas brands taking a major hit. New entrants such as Huawei AITO and Xiaomi are raising consumer attention in smart driving. While we think lithium prices have some further downside, the marginal impact on the supply chain and battery cost is much lower than before. The supply chain is in a much better position to restock into 2024, which is positive for the battery makers.

Global X China Clean Energy ETF (2809 HKD)

Industry Update

- Solar – Polysilicon prices stabilized but are still on the declining path: Solar polysilicon prices stayed at RMB 65/kg by the end of December, the same as the level a month ago.34 Module prices are now at RMB 0.95/0.98/W for M10/G12, lower than the RMB 1.01/1.0/W a month ago.35 According to SCI99, solar glass prices stayed at RMB 17.25/26.25/sqm for 2.0mm/3.2mm. Inventory levels increased to 24.25 days from 22.26 days. Soda ash prices stayed at RMB 3,000/t.36.

Inverter exports were up 1% MoM in November 2023.37 Total exports stood at US$560 million in November (+1% MoM; -47% YoY).38 The positive MoM growth drove some market optimism around the potential for the industry to bottom out. - Grid and power installation – Strong solar installation; grid capex back to decent growth: China’s November 2023 wind installations were 4.1GW (+7% MoM; +196% YoY), with 11M23 installations of 41.4GW (+84% YoY) vs. market expectation for 60-70GW for 2023.39 China’s November 2023 solar installations were 21.3 GW (+57% MoM; +185% YoY), with 11M23 installations of 163.9GW (+149% YoY), likely meeting the already high market expectations of 180-200GW.40 In November, the electricity grid spending in China reached RMB 73 billion (+4% YoY), with 11M2023 grid spending up +5.9% YoY.41 The grid spending in China is second-half loaded. December, in particular, is the strongest month, constituting 15% of annual spending on average.42

Preview

We are optimistic about the structural growth profile in renewable development, with China taking the leading position globally, particularly in the solar supply chain. However, it is worth noting that the solar supply chain entered a consolidation phase starting in 2023, as it has taken time for the industry to digest excess capacity in the past few years. We believe the profitability for the value chain will stay constrained, and players who can keep a good balance sheet and maintain technology leadership will be the long-term winners. Meanwhile, we are bullish on the electrical equipment players who benefit from increased grid and system investment in China and globally.

Global X Asia Semiconductor ETF (3119 HKD)

Global X China Semiconductor ETF (3191 HKD)

Industry Update

- SMIC soon to ramp new 12-inch fab in Shanghai: Chinese pure-play foundry, Semiconductor Manufacturing International (SMIC), is expected to open its largest-ever 12-inch (300mm) wafer manufacturing base in Lingang, Shanghai, as early as the first quarter of 2024.43

- Huawei Nova 12 launches with new Kirin 8000 SOC: There are three models in the nova 12 series, namely nova 12, nova 12 Pro, and nova 12 Ultra. Nova 12 is only equipped with Snapdragon 778G 4G processor, while nova 12 Pro and nova 12 Ultra are equipped with the Kirin 8000 processor. This marks further progress in Huawei’s in-house chip and return to the mid-end smartphone segment.

Stock Comments

- Naura : Naura is a long-term beneficiary of China’s semiconductor equipment localization trend. Cyclical downturn impacted customer equipment pull-in pace in 2023. Looking forward to 2024, domestic customers, especially in memory, are likely to increase CAPEX.

- BOE : BOE is positioned to capture the expansion of OLED applications in mid-size IT products like tablets and laptops. The company announced the investment in a new factory targeting these applications. LCD panel cycle remains weak but stabilizing.

Preview

Increasing AI adoption in data centers and increasing penetration of AI at the edge and on-device will be the key enabler of the next upcycle semiconductor, as AI-enabled devices have much higher semi content. We are still in the process of cycle recovery as both stocks and earnings are below the previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

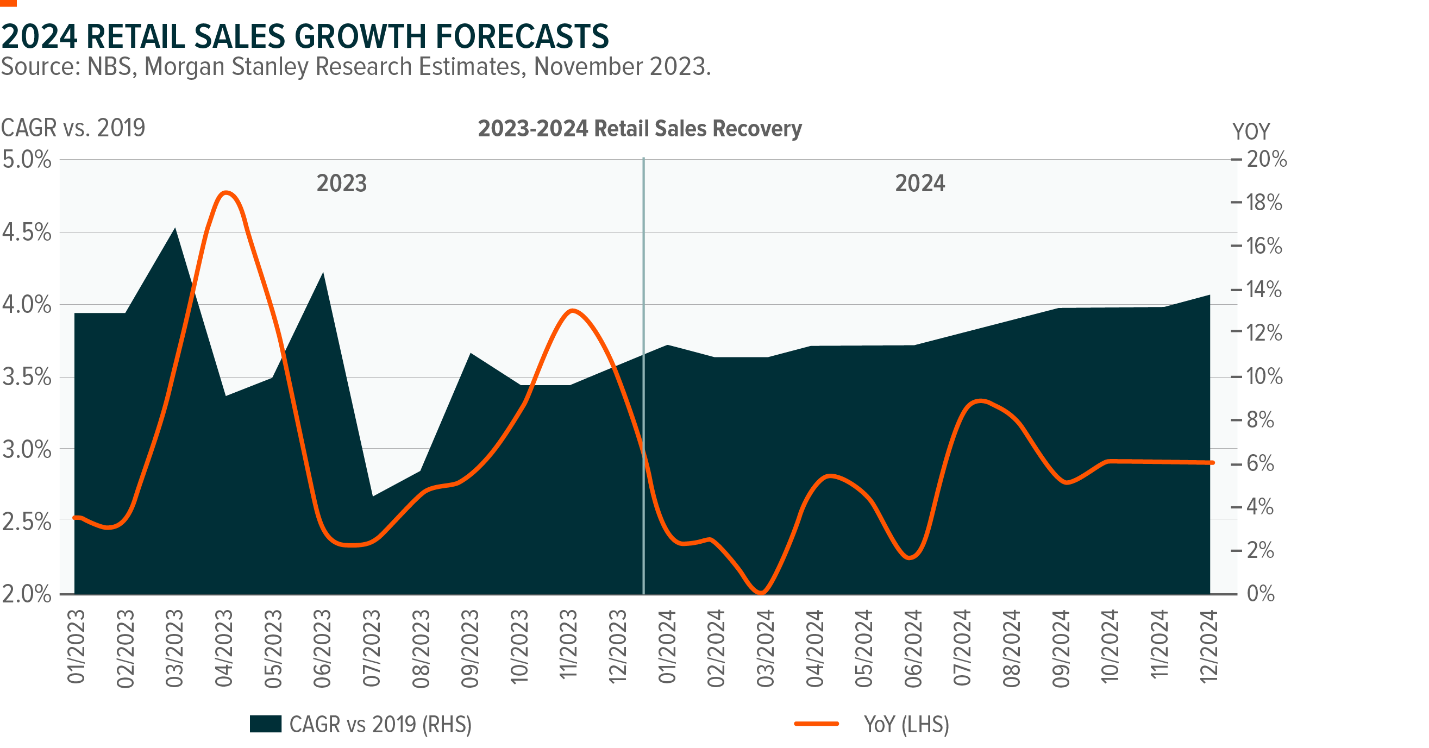

- China consumption remains soft amid weak consumer confidence but continues to stabilize, with total retail sales growing +10.1% YoY in November, improving from +7.6% YoY in October and +5.5% in September.44 Morgan Stanley forecasts China retail sales to grow +4.8% YoY in 2024.45

- The Central Economic Work Conference (CEWC) did not deliver any major surprises, with a policy focus on industrial transformation and higher productivity via innovation. While initial support does not seem sufficient, more stimulus may come throughout the year as the government focuses on growth.

- Headline consumer price index (CPI) deflation intensified in November, falling a deeper-than-expected 0.5% YoY, compared to -0.2% YoY in October.46

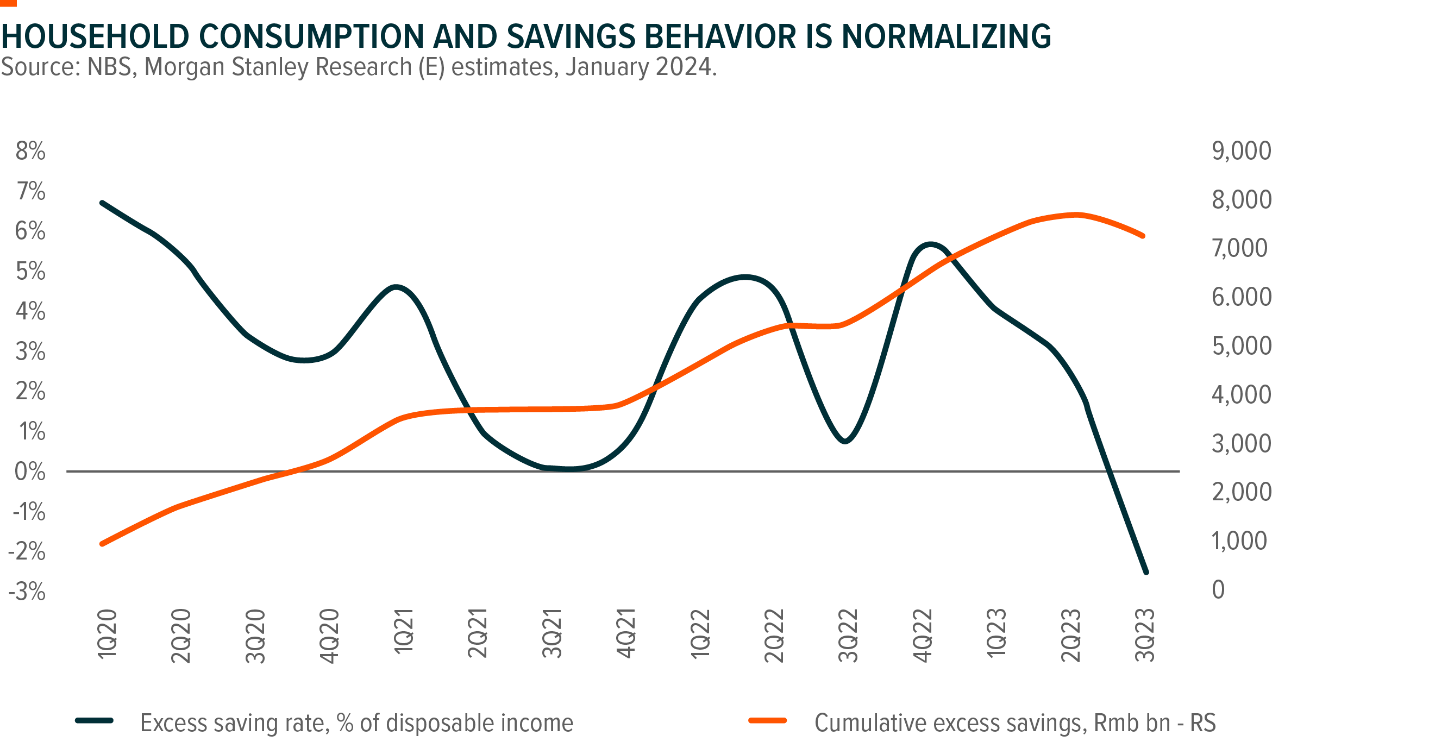

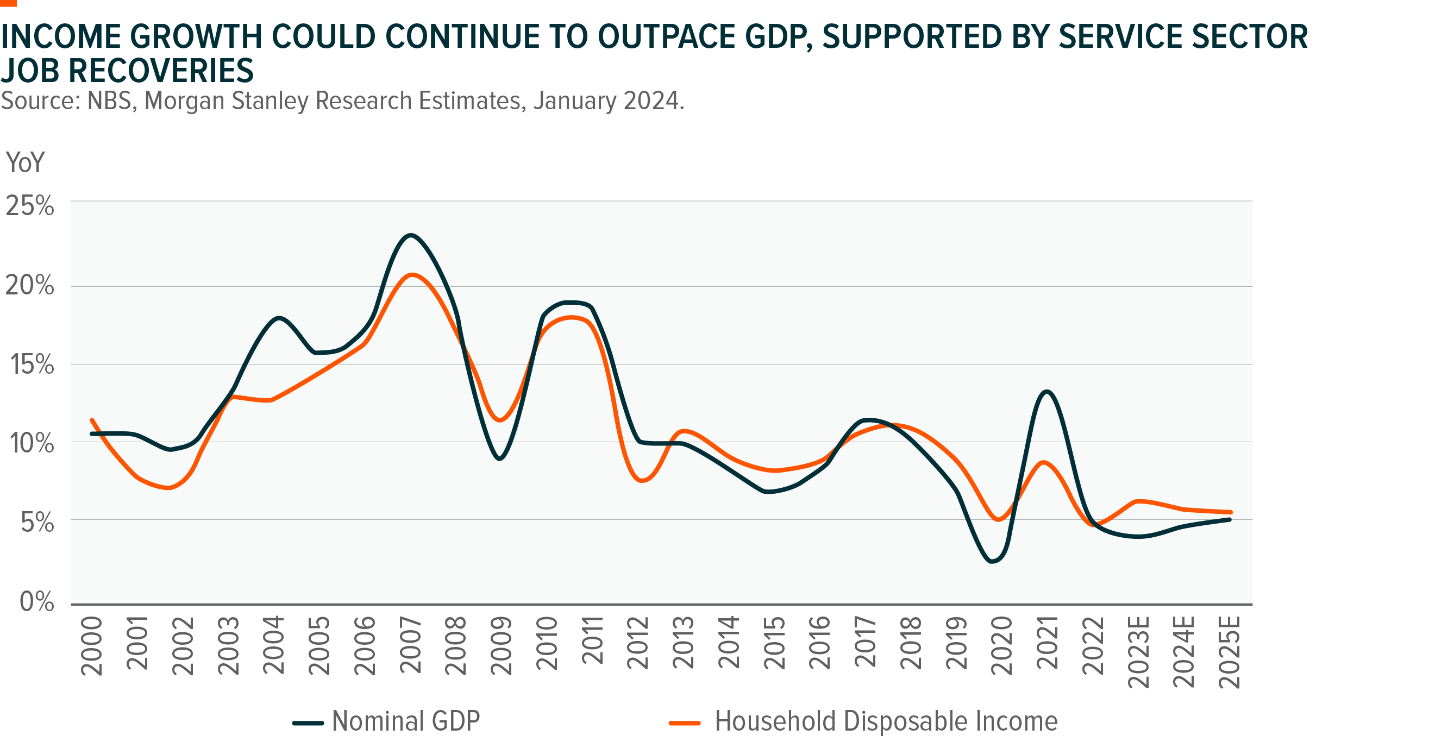

- Household consumption and savings behavior has started to show some normalization since 2H23, and income growth could continue to outpace GDP growth supported by job market recovery, which may support gradual consumption recovery in 2024.

Stock Comments

- Techtronic (669 HK) was the biggest contributor of the month thanks to the Fed for the first time providing a road map of rate downcycle from 2024. The market expects more construction activities backed by lower borrowing costs to benefit Milwaukee and an improving US housing market outlook and home improvement under rate cut to improve DIY tools demand, which led to a re-rating of the stock.

- Luzhou Laojiao (000568 CH) was the major detractor in December due to concerns on weak Baijiu demand. According to distributors, Guojiao sales company communicated with some distributors regarding the new channel strategy of Guojiao 1573, and the company proposed front-loading 2024 sales rebates to distributors for the pre-Lunar New Year prepayment and increase the rebate by RMB 30-50 per bottle, according to Goldman Sachs.47 This increased market participants’ concerns about the demand outlook for premium Baijiu and rising competition amid a soft demand environment.

Preview

We have started to see sell-side revising down earnings estimates for 2024 and 2025 amid a soft consumption environment. This may continue throughout 1Q24 along with companies’ FY23 full-year results announcement. Also, consumption growth is likely to be the lowest in 1Q24, considering the high base from the first two months of last year, and recover gradually throughout the year.

Global X China Cloud Computing ETF (2826 HKD)

Industry Update

- China Software industry November revenues were +16% YoY, accelerating from September/October (+14%/+15% YoY), leading 11M23 revenues to increase by 13.9% YoY (vs. 10M23 at 13.7% YoY).48 IT services growth outpaced the industry at 15% YoY in 11M23, driven by cloud computing and big data analysis services, while EDA software growth slowed at 7% YoY, with e-commerce IT services growth at 9% YoY, followed by embedded system software at +13% YoY, software products at +11% YoY, driven by industrial software at +12% YoY, and cybersecurity at +12% YoY.49 Net margin was 13.1% in November (vs. 12.6% in October).50

Stock Comments

Key Contributors:

- Shanghai Baosight Software Co., Ltd. Class A: Fundamentals remain strong for Baosight, given more resilient than expected data center demands from manufacturing clients.

- Alibaba: Stock price over-corrected post 3Q23 earnings results, as slower than expected turnaround on CMR and cloud revenue growth, cloud spin-off withdrawal, which brings uncertainty to the value-unlocking from reorganization and lack of capital management catalyst without cloud distribution, all negatively impacted stock price in the past three months. The market has already looked beyond these negative factors, and the stock price edged up into December 2023.51

Key Detractors:

- NetEase Inc Sponsored ADR / Tencent: China’s NPPA released a consultation draft document named “Online Games Management Practices”, proposing a number of measures, including (1) a one-year limit for approved games to launch; (2) restrictions against bonuses for daily logins, the first payment, continuous payment; (3) limits to user payment amounts (though notably there was no mention of where such limits might lie); (4) restrictions on closed betas (no more than 20k users, plus no retention of usage data during the beta); and (5) a requirement that virtual items sold via gacha must also be purchasable for specific amounts. Tencent and NetEase shares closed the day down 12% and 25%, respectively.52

Preview

For China’s software sector, 2023 was very tough as the macroeconomic slowdown negatively impacted customer spending. State-owned enterprises (SOEs) and large-scale enterprises represent a key opportunity, given their better visibility and as they are less vulnerable than SMEs (small and medium-sized enterprises). Into 2024, companies with higher SOE exposure will position better unless there’s a meaningful turnaround in macro conditions. In addition, companies with higher recurring revenues or higher contract liability to revenues ratio will outperform, given their relatively higher growth visibility.

For China’s internet sector, companies will continue to focus on improving efficiency to drive profit growth. For the topline, increasing focus will be 1) overseas expansion and 2) new growth drivers like AI.

Global X China Little Giant ETF (2815 HKD)

Industry Update

- China’s market remained weak in December, with MSCI China retreating 2.6% during the month, likely due to weaker-than-expected macro data.53

- The Central Economic Work Conference (CEWC) did not deliver any major surprises, with a policy focus on industrial transformation and higher productivity via innovation, which is in line with the focus of the Little Giant ETF.

- Other key market events included the unexpected draft regulation on online gaming announced on December 22, which initially rattled investor confidence before a subsequent approval of 105 domestic games by Beijing authorities helped to partially stabilise sentiment.

- We also observed a style rotation/risk off likely due to A share mutual funds position adjustment as well as rotation back to value, which could be one of the reasons behind the weakness in healthcare and biotech names.

Stock Comments

- iRay was among the main contributors this month. In December, iRay launched a new product – residual gas analyzers, a type of mass spectrometer. The company is also actively developing RF power suppliers, largely used in pan-semiconductor equipment, enjoying a US$3-5 billion market globally at present. Also, iRay is establishing its CMOS workshop in Hefei, China, which is likely to have some potential cooperation with SeeYA in terms of front-end wafer processing.