Important Information

Global X China Cloud Computing ETF

Global X China Clean Energy ETF

Global X China Consumer Brand ETF

Global X China Electric Vehicle and Battery ETF

Global X China Semiconductor ETF

Global X China Robotics and AI ETF

Global X China Biotech ETF

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Biotech ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Key Themes – Aug 2023

Listen

[2845/9845] Global X China EV & Battery ETF

According to the China Passenger Car Association (CPCA) data, the July China passenger car vehicle wholesale volume was 2.10mn units (-4.3% MoM/ -2.6% YoY) and production volume was 2.07mn units (-7.6% MoM/ -3.2% YoY). China’s new electric vehicle (NEV) (excl. commercial vehicles) wholesale volume increased to 737k units (30.7% YoY/ -3.1% MoM). Year-to-July NEV wholesale volume reached 4.28mn units (+41.2% yoy). The penetration in June was 35.7% (+9ppts yoy).

Auto sales increases and EV penetration stays solid: Based on the announcements of individual auto companies, the July wholesale volume data stays solid. BYD, Li Auto, Xpeng, and Nio delivered +4%/+5%/+28%/+91% MoM, respectively.

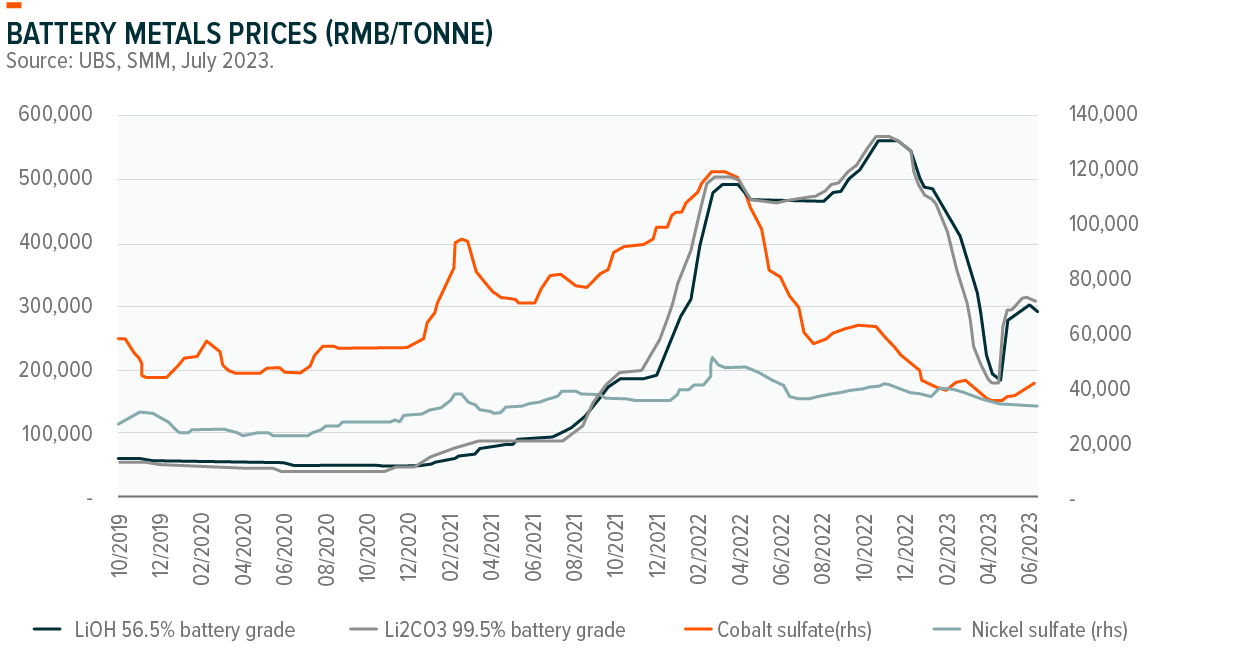

Battery material costs have modestly declined: China spot lithium carbonate declined by around RMB30k/t or 10% MoM in July and reached level around Rmb264k/t. As the market expects sufficient lithium supply next year, the futures at Guangzhou Futures Exchange are all trading below the launching price of RMB246k/t despite some rebounds, which affects the overall sentiment. In the spot market, near-term demand still fails to outperform. In addition, having experienced the price rollercoaster in the past 2 years, downstream becomes increasingly cautious on inventory management. We believe this can become a new norm in the near term, and do not expect to see much stock up more than what is absolutely required for production, especially with expectation of sufficient supply next year; any restocking will likely come at a lower magnitude than we used to see.

Supportive China government policy on EV consumption continues: On July 31, 2023, the National Development and Reform Commission (NDRC) and other departments have come up with new policies to promote automobile purchases. The policies include expanding consumption of new energy vehicles, building a high-quality charging infrastructure system, supporting new energy vehicles going to the countryside, and extending and optimizing the vehicle purchase tax exemption for new energy vehicles. Measures are also designed to optimize the management of automobile purchase and use. Regions are not allowed to add new automobile purchase restriction measures, and regions that have already implemented purchase restrictions are to optimize automobile purchase restriction measures according to local conditions. This is consistent to the supportive stance delivered during the July Politburo Meeting.

Positive progress in overseas expansion of Chinese automakers: According to Reuters on July 4, 2023, BYD said it will invest USD3 billion reais (USD620.17 million) in a new industrial complex in northeastern Brazil, as it aims to boost local production to offer more competitive prices. Operation at the plants is expected to start in mid-2024. One of the plants will be dedicated to production of chassis for buses and electric trucks, BYD said in a statement. The second plant will be focused on hybrid and electric cars with an initial production estimated at 150,000 cars per year, while the third will process lithium and iron phosphate for the foreign market. According to another Reuters article on July 10, Chinese electric vehicle manufacturers are pouring into Thailand, having committed to invest USD1.44 billion in production facilities there. This new wave of investment has been backed by Thailand’s government, which has rolled out incentives and courted Chinese firms, with a target to convert about 30% of the country’s annual vehicle production into EVs by 2030.

[2809/9809] Global X China Clean Energy ETF

Solar

Polysilicon prices is stable at RMB60~70/kg for a few weeks. Module prices declined to currently Rmb1.1~1.2/w. Key talks after SNEC are about oversupply in 2024 and N-type cells transition (penetration, technology roadmap and premium pricing versus P-type in the worst case in 2024). Channel checks show utilization is improving along solar value chain in July and August month by month, on the back of strong orders from China solar farm and overseas market. China demand this year has been revised up as much as 200GW. Heading to 2024, supply and demand balance remains invisible. Leading Chinese wafer/cell/module makers are quite close in production cost now. Capacities for key solar materials in 2024 are all above 500GW. Consequently, there is chance that pricing along solar value further decline to a level of extremely low profitability for a short while. We may see the result by as early as the first quarter of next year. We don’t anticipate great upside before that, though sector performs well fundamentally.

Wind

The latest monthly data points indicate that onshore wind tendering procurement pricing has stabilized at around RMB 2000/kW in July, similar to the past 3 months. Wind turbine installations accelerated sequentially in June to 660MW much higher than the levels in March to May and is up 213% YoY. Year-to-June wind installations grew by 78% and reached 23GW, falling below the tendering volume last year of 91GW. The China open market wind tendering volume in July is 4.3GW (-45% YoY). Year-to-July tendering volume reached 39GW.

Overseas expansion potential: According to the Recharge News on July 26, 2023, Goldwind targets to win projects in the Spanish wind sector. After the scandal from Siemens Gamesa, Chinese wind turbine player Goldwind is actively seeking to buy renewable energy projects in as it is making offers to the main promoters with wind farms under development, with a particular interest in already-permitted ready-to-build projects.

Improve the grid capability: According to Reuters on July 26, 2023, the China National Development and Reform Commission (NDRC) announced plans to increase the flexibility to power grids and build storage capacity to avoid outages. China is introducing more flexible power transmission arrangements into its national grid system, helping to avoid a repeat of the outages that plagued parts of the country last year, according to central government officials. In response to decreased output from hydropower plants, authorities have “rationally optimised” power transmission between provinces to send more power to the country’s drought-stricken southwest, according to Guan Peng of the NDRC during a press conference.

[2807/9807] Global X China Robotics & AI ETF

The latest monthly data points released by the National Bureau of Statistics reported on July 17, 2023 that China industrial robot production volumes were -12% yoy in Jun (-1% mom vs May production volumes, vs. past five years’ seasonality of -4% mom); China machine tool production volumes were +0% yoy in June (+20% mom vs May average production volumes, vs. past five years’ seasonality of +16% mom). Manufacturing fixed asset investment (FAI) was +6% yoy in Jun (slightly improved vs. +5% in May). High-tech manufacturing FAI was +12% yoy in Jun, moderated from May’s +13% yoy. Railway FAI continued the recovery trend with +21% yoy in Jun (vs. +16% yoy in May).

Order momumtum bottoming in Japan/Europe/US: Global machine tool orders in June 2023 totalled JPY122.0 bn (-21% yoy/+2% mom), including a rebound in domestic orders to the JPY40 bn range (-30% yoy/+8% mom), although the margin of decline widened from May on a yoy basis. Overseas orders were largely flat mom, at ¥81.1 bn (-15% yoy/-1% mom), and continued to decline on a yoy basis. Orders momentum is steadily approaching a bottom yoy in Japan, Europe, and the US.

China automation data are showing weakness: China June orders totaled JPY19.1 bn (-45% yoy/-19% mom), falling below the JPY20 bn mark for the first time in 33 months (since August 2020). EV and battery-related investment remains on a downward trend, and JMTBA said that members’ views on the outlook appeared less optimistic.

Improving robot intelligence and vision: On July 27, 2023 Google DeepMind released a paper about its Robotic Transformer 2 (RT-2) model, a web-scale-data training model that can significantly enhance a robot’s ability to recognise objects, interpret working situations, reason, and make corresponding robotic operations accordingly. It demonstrates the intelligence level a robot can achieve with an upgradable algorithm by collecting more data points. Tasks the robot can perform include “pick up the bag about to fall off the table” or “move banana to the sum of two plus one”. The paper also shows a robot’s ability to understand working situations and to make operations correctly by asking the right questions (eg, which type of drink is for a tired person? Take the energy drink). The combination of robot intelligence and robotic vision is making steps to become increasingly possible, with more practical applications.

[2806/9806] Global X China Consumer Brand ETF

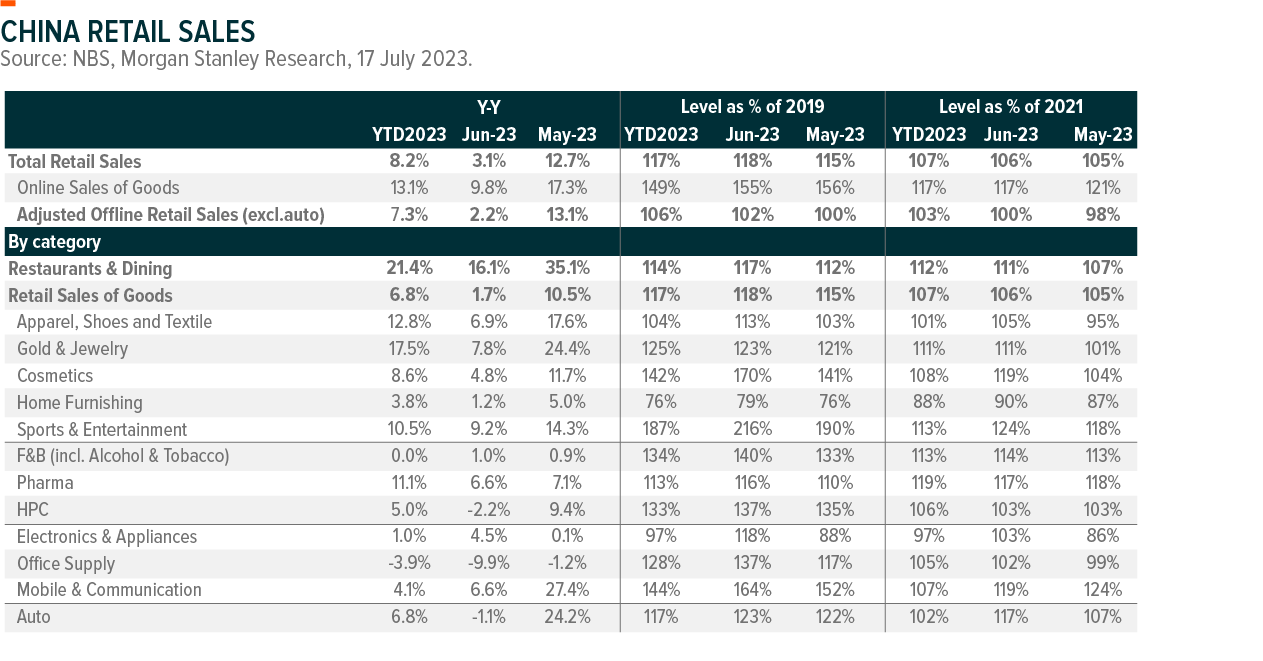

China’s consumption recovery pace remains sluggish amid reopening impact fading out. June retail sales growth came in at +3.1%yoy decelerating further from May’s +12.7%yoy growth partly due to a high base. This implies June retail sales reached 118% of 2019 level and total retail sales grew +8.2%yoy in H1 23. A weak property market and a high youth unemployment rate continued to weigh down on consumer confidence which went down back to 87.1 in April from 94.9 in March 2023. July retail sales trend is expected to have remained weak according to our channel checks.

The government held politburo meeting earlier than expected and set more dovish tone reaffirming its focus on economic growth. We expect more easing policies to be announced post this politburo meeting on July 24, 2023. In fact, the NDRC issued 20 guidelines to boost consumption recovery on July 31, 2023. The guidelines cover overall consumption aspects including support on purchases of big ticket items like auto and home appliances, consumer services such as restaurants and cultural tourism, as well as rural consumption and relevant infrastructure. We expect more detailed policies to be announced in coming months. In addition, the government is expected to further ease monetary policy, continue its efforts to stabilize property market as well as improve business confidence. This may then improve consumer confidence which will lead to gradual consumption recovery in H2 23.

While overall consumer sentiment remains weak, K consumption trend has continued in China. Most European luxury companies have reported their Q2 23 earnings and surprisingly, China has shown robust growth during the quarter for luxury brands. According to BofML estimates, Chinese luxury demand on average was up +80%yoy in Q2 23 on a weighted basis for those who provided commentary on China, and this implies +34% growth compared to Q2 21 level. In general, overall Chinese luxury demand has been stronger than the market expectation albeit weak overall consumption in the country. Similarly, Anta announced its Q2 23 update and shared that Anta core brand grew high single digit % yoy whereas its higher end brands like Fila’s retail sales grew high teens % yoy, Descente and Kolon’s retail sales grew 70-75%yoy during the quarter. We assume consumers traded down from Anta brand to lower priced other local brands amid weak consumption, while demand for higher end brands stayed more resilient. While Anta’s management has not changed their full year targets, they shared that they have not yet witnessed meaningful pick up in sales in July.

We expect more gradual consumption recovery this year as we need consumer sentiment to improve for high household savings to translate into consumption in a more meaningful way. We expect to see more policies to be announced to support economic and consumption recovery post July politburo meeting. The government will continue focus on economic growth and put more efforts to stabilize property market, improve business confidence as well as job market, which then will improve consumer confidence that can lead to a consumption growth in coming quarters.

[3191/9191] Global X China Semiconductor ETF

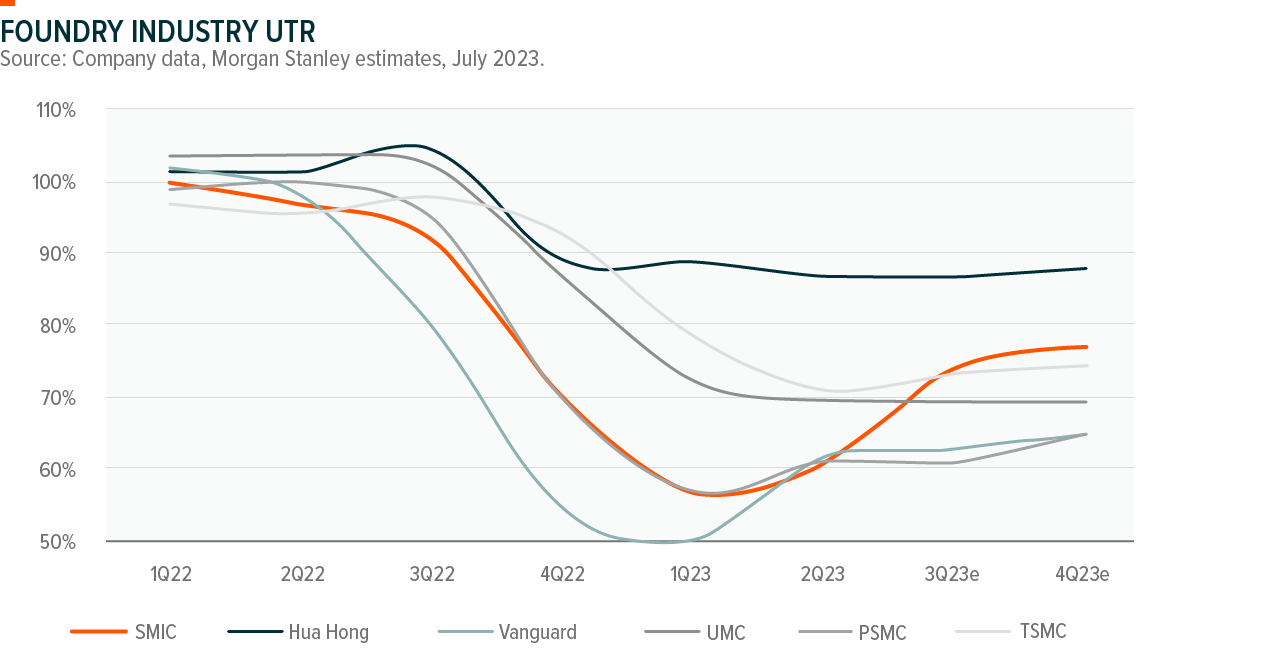

Mature foundry utilization bottoming out

We expect to see a sequential drop in inventory days for China fabless companies going into 2H23 supported by healthy channel inventory level in smartphone and discipline order placing at foundries. By subsegment display driver IC already reach a healthy inventory level, while SoC, CIS, and MCU inventory days are coming off relatively high levels in Q2 23. Utilization for mature foundries to bottom out in Q2/Q3 23. The pace of recovery remains relatively slow, China foundries are gaining some market share with a more aggressive pricing strategy in H2 23, prioritizing utilization over margin. The decline in foundry pricing helps lower the cost structure for fabless companies which is positive for fabless companies ‘margin going forward.

China smartphone shipment saw sequential improvement in Q2 23

According to IDC data, China smartphone shipment was up 1.5% Quarter on Quarter(QoQ) in Q2 23 to 65.7m units. A healthy inventory level in the smartphone supply chain combined with stabilize demand set the condition for recovery in smartphone semiconductor suppliers.

[3006] Global X Metaverse Theme Active ETF

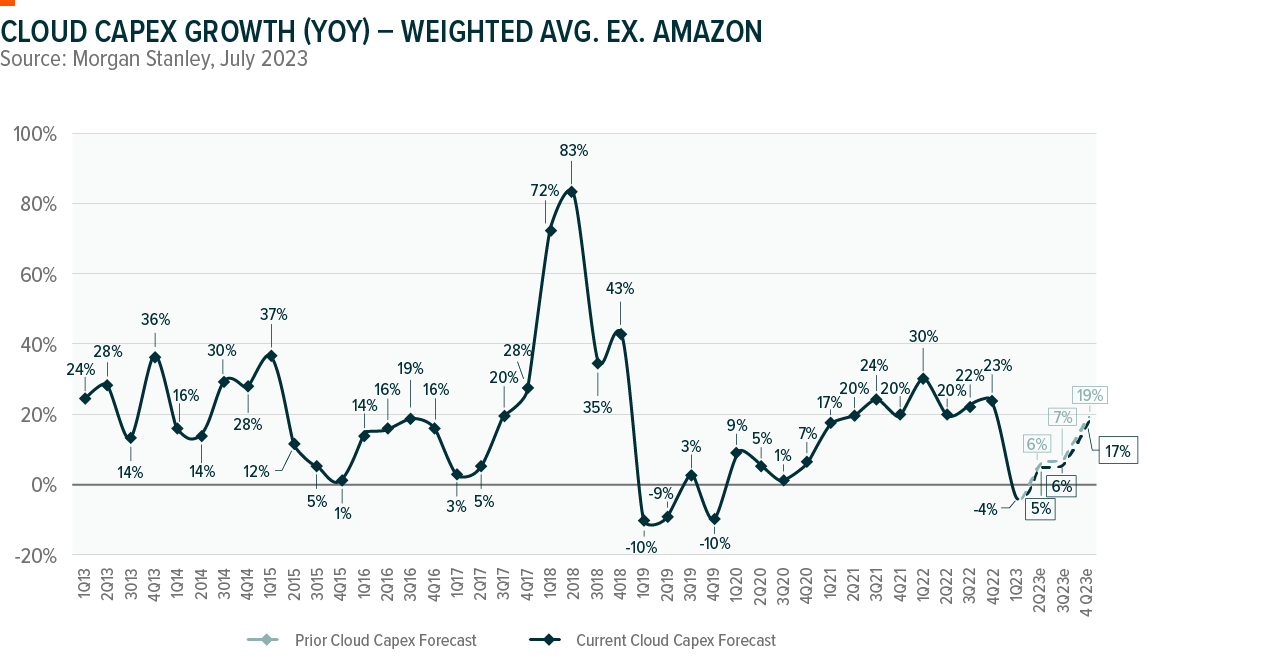

US Hyperscalers prioritize AI spending in data center capex

Microsoft guided CAPEX to increase sequentially over the next few quarters to support AI workload and overall commercial cloud demand. Google expect elevated levels of investment in our technical infrastructure increasing through the back half of 2023 and continuing to grow in 2024, driven by investment to support the opportunities in AI. Meta lowered 2023 CAPEX guide to USD27-30billion(bn) (from USD30-33bn) The reduced forecast is due to both cost-savings, particularly on non-AI servers as well as shifts in CAPEX into 2024 from delays in projects and equipment deliveries.

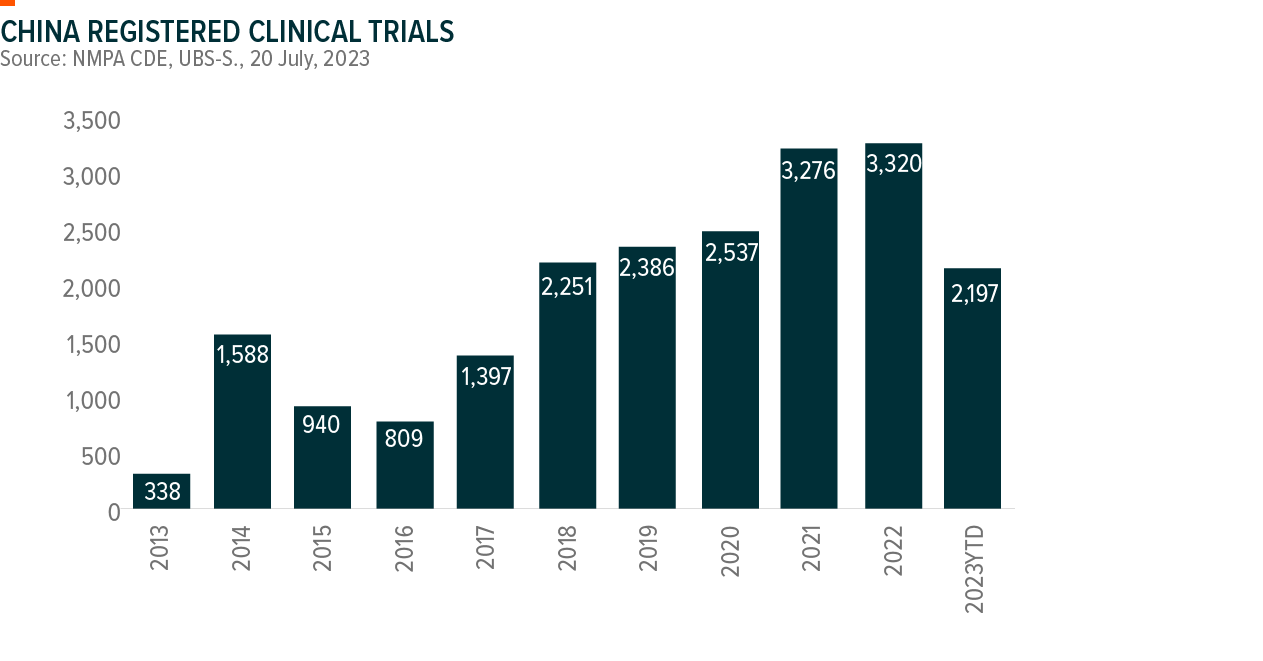

[2820/9820] Global X China Biotech ETF

Major updates / issues on the themes

2023 NRDL Negotiation Kicked off in July 2023

We saw marginal improvement on price cuts from the new rule. On July 4, 2023, the 2023 National Reimbursement Drug List (NRDL) renewal policy draft was published by China National Healthcare Security Administration (NHSA), soliciting public comments. Compared with the rules from last year, the draft includes more favorable terms for NRDL drugs seeking contract renewal. The maximum price cut without renegotiation remains to be capped at 50%, per UBS July 2023. In addition to contract renewal rules, the proposed rules of “bidding for non-exclusive drugs” remain largely the same as last year. Overall, the draft policy could lead to a milder price cut for contract renewal and facilitate the inclusion of new indications. More importantly, the increasing transparency on NRDL renewal to benefit the biotech sectors in China over the long run.

China Government Outlines Key Tasks for Healthcare System Reform in 2H23

China government released the “Key Tasks for Deepening the Reform of the Medical and Health System in H2 23”. The document sets out 6 aspects with 20 specific tasks, including promoting the expansion of high-quality medical resources and balanced regional layout; deepening the reform of public hospitals guided by public welfare; promoting the orderly linkage of multi-level medical security and others.

Anti-Corruption campaign in ongoing

On 28 July 2023, the Central Commission for Discipline Inspection and the National Supervisory Committee held a meeting to enhance corruption investigation in the healthcare sector.

In our view, the major targets of the probe are likely to be (1) doctors, who will be required to provide more visibility about the source of their income; and (2) hospital management, which will have to provide more clarity about how decisions involving medical equipment and drug procurement are made.

It would be a short term pain but in the long run, encourage healthcare businesses to focus on R&D and product quality.

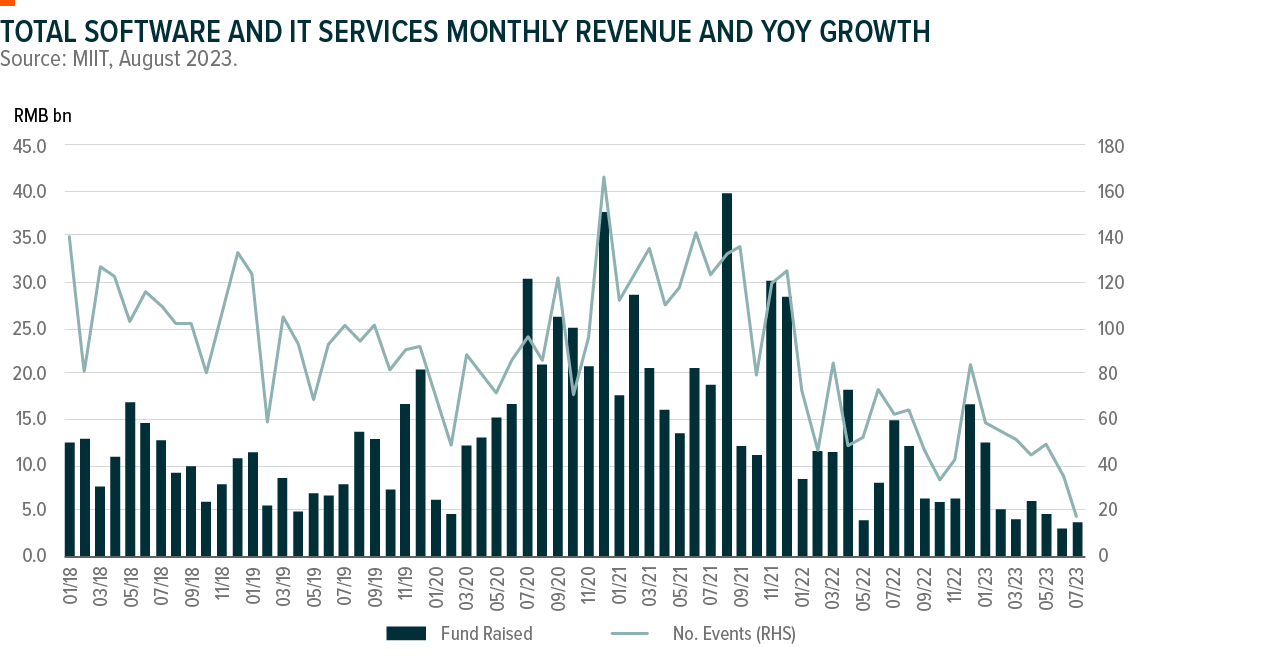

[2826/9826] Global X China Cloud Computing ETF

Major updates / issues on the themes

June revenue growth for China software industry: China software industry’s June revenue growth was 18% Year-on-year (YoY), accelerating from May (+15% YoY), leading H1 23 to increase by 14% YoY. IT services growth outpaced the industry at 15% YoY in 6M23, driven by cloud computing and big data analysis services. Software products at +12% YoY, driven by industrial software at +13% YoY, and cybersecurity at +12% YoY. Net margin was up to 10.5% in June (vs. 12.4% in May).

June revenue growth for China telecom industry: June telco revenue grew only 3.5% YoY, the lowest since 2021, but 9.6% MoM. Mobile revenue fell 10.0% YoY due to a very high base and grew 1.3% MoM. New business industrial internet revenue grew by 15.4% YoY (40% up MoM), meaningfully up from 11.6% in May. However, cloud growth further slowed to <30% YoY.

Latest software localization trend in China: According to Qianzhan, the penetration of domestic operating systems, middleware, application software and database in 2021 was 1%, 35%, 45% and 48%, respectively, which signifies great potential for localization. Into July 2023, software localization accelerated. Software localization order momentum is picking up compared with relatively muted progress in H1 23. In July, domestic operating system (OS) player Kylinsoft received c120,000 OS license orders from China Communications Construction and China Post, signaling an acceleration in the progress of localization. We expect overall software localization order volume to pick up in H2 23.