Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, annual reconstitution risk, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risk, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, risk of reliance on the Index Calculation Agent, trading difference risk, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X India Select Top 10 ETF’s (the “Fund”) underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Global X K-pop and Culture ETF’s (the “Fund”)The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, equal weighted index risk, risks related to companies with technology themes, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risks, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, trading difference risk, risks associated with ADRs, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks, reliance of the same group risk and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary

Global Thematic ETFs – May 2025

Global X India Select Top 10 ETF (3184 HK)

Market Update

The MSCI India Index was up 4.7% (in USD terms) in April outperforming the MSCI APxJ/EM Indices by 1.4%/1.0% respectively, driven by Trump’s tariff pause, a second interest-rate cut, and ongoing cash injections by RBI, a weaker USD, falling oil prices and increasing optimism among foreigner investors about India’s domestic demand and faster economic growth despite the global trade war. However, the markets were affected by heightened uncertainty due to India-Pakistan tensions weighed over the last one week.

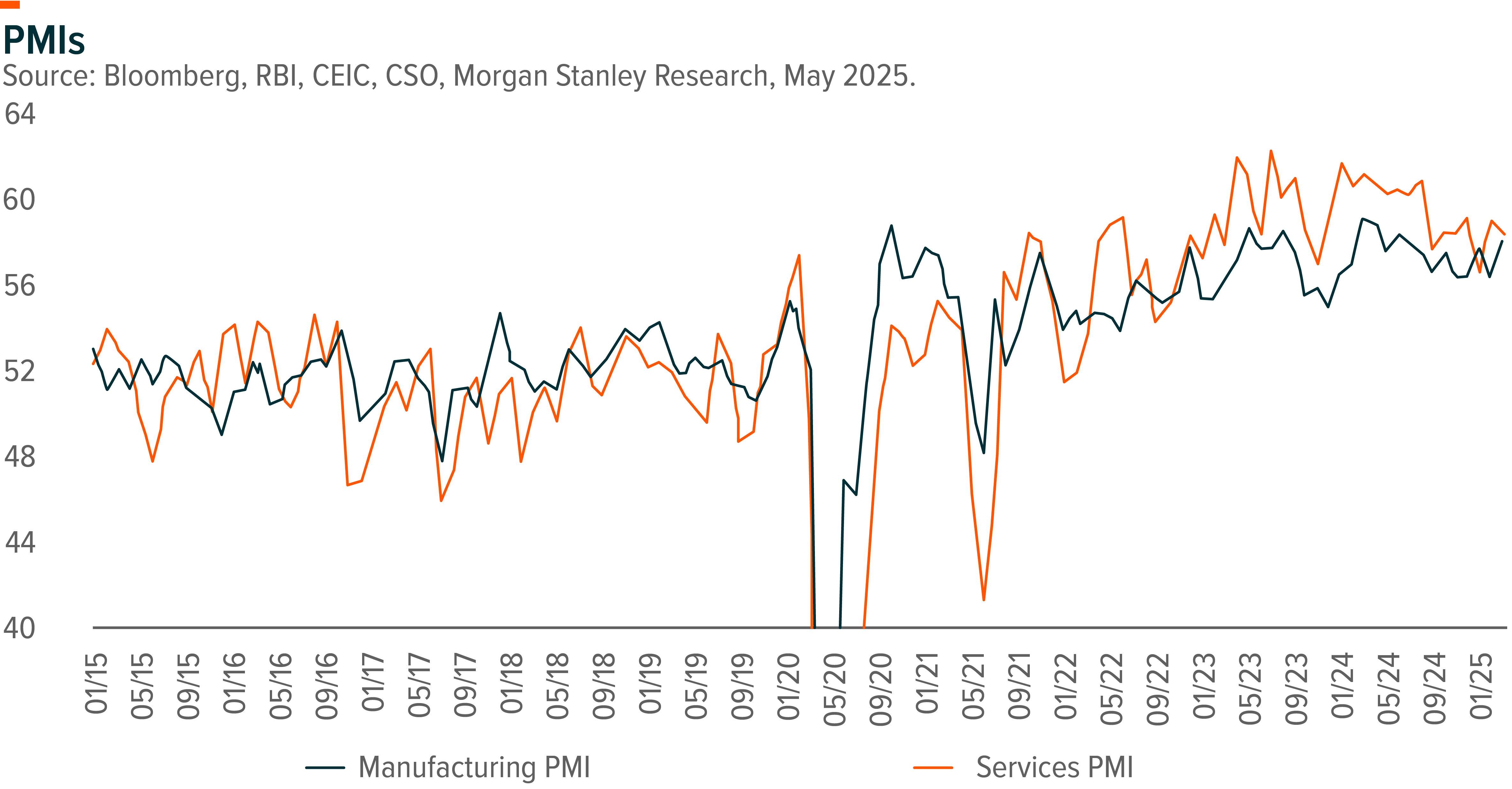

Domestic demand-based high-frequency data for April presented a mixed picture but showed a gradual improvement overall. The Manufacturing PMI reached a 9-month high of 58.2 in April, driven by an increase in international orders. The services PMI also rose to 58.7 in April from 58.5 in March. GST collections hit a record high of INR 2.4 trillion, reflecting a stronger year-on-year growth of 12.6%. However, power demand weakened to 2.2% in April, from 6.7%yoy in March, and credit growth moderated to 10.3%yoy in April. On a positive note, vehicle registrations improved for both two-wheelers and passenger vehicles in year-on-year, and air passenger traffic continued to grow at a healthy rate, indicating resilient consumer sentiment.

March CPI printed at a 6-year low of 3.3% down from 3.6%yoy in February. A large part of the recent softness in CPI inflation was driven by an easing in food prices. April CPI could see a further sequential drop, which supports RBI’s easing monetary policy.

Indian equity flows from foreign institutional investors continued buying this month and bought USD 1.3 billion in April (vs. USD +0.2bn in March), and domestic institutional investors remained their buying trend by net buying USD 3.3 billion during the same period (vs. USD + 4.3 billion in March).

Stock Comments

- Bharti Airtel (BHARTI IN) the major contributor in April as the company provides both growth as well as defensiveness as a leading telecommunication company in India. The sector’s active subscriber base increased by ~3.3mn to 1,068mn in February post a ~5mn increase in January ’25. Within the industry, Jio and Bharti both gained subscribers while VIL lost its shares.

- Infosys Limited (INFO IN) was the major detractor in April mainly driven by concerns on US economy slowdown amid tariff uncertainties which may lead to weaker than expected discretionary spending. IT services sector has high correlation with the US market and economy hence the sector underperformed along with the US market correction.

Preview

While global macro uncertainties remain, we expect India’s domestic growth to recover over the coming quarters, supported by easing monetary policy and improved fiscal spending, moderate inflation, and recovery in consumption. This suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Global X K-pop and Culture ETF (3158 HK)

Market Update

In April, KOSPI increased 3% MoM to 2,557, first slumped following the Liberation Day tariff announcements, then recovered on the tariff pause and widening exemptions. Amid recent tariff turmoil, K-pop industry remains defensive and relatively insulated from direct tariff risks. Furthermore, the sector stands to gain from improving Korea-China relations, as the potential reopen of China market could unlock significant growth opportunities. Despite this, the fundamentals of K-pop industry are poised to improve in 2025, fueled by top artists’ comeback, rising momentum from new artists, China rebound and a low base.

Stock Comments

- SM Entertainment (041510 KS): SM recorded 15% return in April. SM’s 1Q25 revenue and OP missed consensus if excluding c.W20bn one-off item in the streaming segment. Looking forward, we expect a recovery starting from 2Q25, supported by upcoming releases from key artists such as Aespa, NCT WISH, and RIIZE. Album sales in April (1.6m+) from the return of NCT WISH and NCT’s Mark has surpassed the total sales in 1Q25 (971k), while the momentum is expected to sustain from upcoming releases by Aespa and RIIZE in May and June.

- JYP Entertainment (035900 KS): JYP recorded 17% return in April. 1Q25 earnings are expected to be relatively weak due to seasonality and limited activity from key artists such as TWICE and Stray Kids. However, the strong earnings growth from 2Q25 has high visibility driven by Stray Kids’ tour – 23 shows with a total audience of c1.2m based on the maximum capacity of each venue during the quarter. Additionally, TWICE is scheduled to launch next world tour in 2H25, further supporting full-year earnings improvement.

- Kakao Corp (035720 KS): Kakao experienced 2% loss in April. 1Q revenue slightly missed at -6% YoY, mainly dragged by negative growth of Content revenue. Consolidated OP was in line with consensus and decreased by 12% YoY on disciplined labor/marketing cost. Moving forward, AI execution is viewed as the main swing factor.

Preview

We maintain positive on the rise of K-Pop and cultural phenomenon in global market. Recent hit track APT by Rose and Bruno Mars, along with Han Kang’s Nobel Prize win in Literature, have significantly raised global awareness of K-pop culture. We expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. Amid escalating Trump tariff risk, we believe K-pop industry is less vulnerable thanks to its unique cultural and fandom characteristics, as well as the potential for price increases to mitigate the effects.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

TSMC delivered strong result and guidance

1Q slight beat: Revenue down 5.1% QoQ in USD terms, led by smartphone seasonality, partly offset by continued AI growth. GPM 58.8%, down 0.2ppt, due to Overseas dilution (Kumamoto Fab) and earthquake impact (60bps impact), partly offset by cost reduction efforts. EPS at 13.94 -4% QoQ/+60% YoY was 5% ahead of the street.

2Q strong guide: 28.4-29.2bn (+13% QoQ at mid point) Gross profit margin to be between 57% and 59%. (Margin dilution impact from US fab) Operating profit margin to be between 47% and 49%. 2Q tax rate 20%, full year 16-17%.

TSMC maintained 2025 revenue to grow at mid-20% in USD, despite the strong 2Q25 revenue guide, indicating a slower than expected HoH growth in 2H25 (implied HoH growth at 6-7% vs 12-27% range in the past 5 years). (Mirae Asset)

OpenAI negotiates with Microsoft to unlock new funding and future IPO

OpenAI and Microsoft are rewriting the terms of their multibillion-dollar partnership in a high-stakes negotiation designed to allow the ChatGPT maker to launch a future initial public offering, while protecting the software giant’s access to cutting-edge artificial intelligence models.

According to multiple people with knowledge of the negotiations, the pair are also revising the terms of a wider contract, drafted when Microsoft first invested $1bn into OpenAI in 2019. The contract currently runs to 2030 and covers what access Microsoft has to OpenAI’s intellectual property such as models and products, as well as a revenue share from product sales. (FT)

Global X Japan Global Leaders ETF (3150 HK)

Industry Update

In April 2025, the FactSet Japan Global Leaders Index recorded 2.5% returns in JPY terms (FactSet, January 2025). Japan market fell sharply in early April on US tariff announcements, and subsequently recovered the majority of its losses as the market saw several positive developments including ongoing progress of US-Japan trade talk, easing of JPY appreciation pressure, and the ongoing efforts by corporates to enhance quality through raising shareholder returns. Under US tariff uncertainty, BOJ tone turned more dovish on 1 May, which could take a pause to JPY appreciation trend. USDJPY ended April at 143, from 150 as of end March. (Bloomberg, March 2025)

Stock Comments

- Nintendo recorded 17% return in the month, a key contributor to the ETF. Nintendo announced details of Switch 2 on April 2 event. Switch 2 will be launch in major global markets (excl. China) on 5 June, along with several new major title launches from software makers. The company announced that it had received ~2.2mn applications in Japan for Switch 2 lottery sales, indicating strong initial demand.

- Toyota Industries recorded 32% return in the month, a key contributor to the ETF. Nikkei on 26 April reported that Toyota Industries was considering to become private. Toyota Industries on the same day issued a press release stating that “While the Company is considering all possibilities to enhance its enterprise value in a situation where it has received various proposals such as improving its capital efficiency or its going-private through a special purpose company, there are currently no matters that have been determined.” Share price goes up by 20% after the announcement

Preview

Japan stock market went through massive volatility over past few months under concern for JPY volatility, US tariff uncertainty, and US economy recession. While short term outlook remains uncertain given slowing global economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging). (JP Morgan, August 2024)

Global X AI & Innovative Technology Active ETF (3006 HK)

Google release Gemini 2.5 Pro Preview (I/O edition)

Releasing early access to Gemini 2.5 Pro Preview (I/O edition), an updated version of 2.5 Pro that has significantly improved capabilities for coding, especially building compelling interactive web apps. Gemini 2.5 Pro Preview (I/O edition) is available via the Gemini API and Google’s Vertex AI and AI Studio platforms, and is priced the same as the Gemini 2.5 Pro model it effectively replaces. It’s also in Google’s Gemini chatbot app for the web and for mobile devices. (Google)

OpenAI reasoning with image

OpenAI o3 and o4-mini represent a significant breakthrough in visual perception by reasoning with images in their chain of thought. OpenAI o3 and o4-mini are the latest visual reasoning models in our o-series. For the first time, our models can think with images in their chain-of-thought—not just see them.

Similar to our earlier OpenAI o1 model, o3 and o4-mini are trained to think for longer before answering—and use a long internal chain of thought before responding to the user. o3 and o4-mini further extend this capability by thinking with images in their chain-of-thought, which is achieved by transforming user uploaded images with tools (OpenAI)

Alibaba unveils Qwen3, a family of ‘hybrid’ AI reasoning models

Chinese tech company Alibaba on Monday released Qwen3, a family of AI models that the company claims can match and, in some cases, outperform the best models available from Google and OpenAI. Most of the models are available for download under an “open” license on AI dev platform Hugging Face and GitHub. They range in size from 0.6 billion parameters to 235 billion parameters. (Techcrunch)

Stock Comments

Microsoft +5.29%

OpenAI and Microsoft are rewriting the terms of their multibillion-dollar partnership in a high-stakes negotiation designed to allow the ChatGPT maker to launch a future initial public offering, while protecting the software giant’s access to cutting-edge artificial intelligence models.

Netease +4.13%

Once Human Mobile was launched globally on April 24. The game will be dual platform and integrated – mutual access to game and content on both PC (previously launched) and mobile. The PC version has ranked in the #6 position on Steam’s best-selling games chart, indicating a major recovery in activities in the overseas PC channel.

Preview

The Global X AI and Innovative Technology Active ETF Fund is committed to being at the forefront of AI investment, leveraging our expertise to identify and capitalize on opportunities across the AI value chain. By focusing on both established leaders and emerging innovators, we aim to provide our investors exposure to one of the most dynamic and impactful sectors of the global economy. As the AI landscape continues to evolve, we remain dedicated to adapting our strategy to ensure that our investors benefit from the full spectrum of AI-driven growth and innovation.

Global X Electric Vehicle and Battery Active ETF (3139 HK)

Industry Update

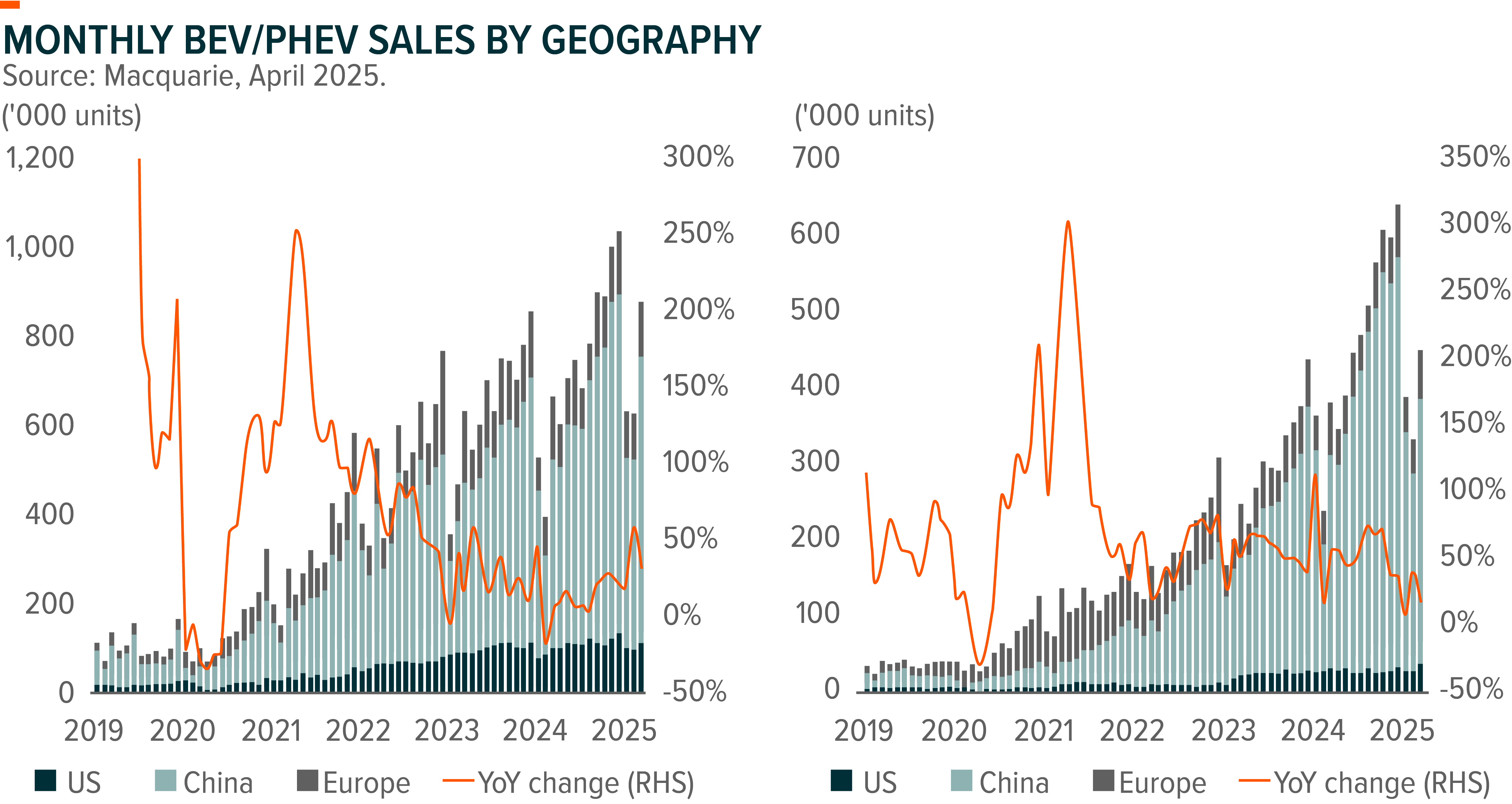

China and Europe are enjoying strong xEV sales growth YTD, while growth in the US lags. EU March BEV/PHEV sales ended at 170k/83k units, +25%/+22% YoY, +62%/+93% MoM, respectively. BEV sales rose across major countries except France due to generally the low base, an influx of affordable models and front-loading purchase before tax increase in some specific markets. EU’s proposed move to ease compliance should weaken BEV sales. However, the tariff negotiations between Europe and China may pose upside. China’s xEV sales in March was both YoY and MoM growing, while for April, the newest data shows major domestic xEV players remain YoY growth but some registered MoM declines in volumes. BYD delivered 380k units in April, +22% YoY and +1% MoM. Xpeng delivered 35k units, +273% YoY and +6% MoM. Li auto announced April sales of 33,939 units, +32% YoY but -7% MoM. US March BEV/PHEV sales ended at 112k/38k units, +12%/+31% YoY and +15%/+37% MoM. GM and Hyundai were the biggest gainers, while Tesla was the detractor on the back of Model Y refresh and Elon Musk’s political involvement.

Stock Comments

Zhejiang Shuanghuan Driveline Co., Ltd. Class A: The company is leading in xEV gear in technology and cost. As the key third-party supplier for BYD, the company benefits from BYD’s sales volume growth. It is reportedly that Shuanghuan will also be the vendor for Tesla’s humanoid robot.

NVIDIA Corporation: A low-cost Chinese AI chatbot, DeepSeek sparks AI stock selloff as investors worried it may threaten the dominance of AI leader like Nvidia.

Preview

We remain constructive on China EV and battery sales in 2025, as China may keep giving EV purchase subsidies to accelerate EV penetration to boost economy in the near term and reduce the dependency on oil imports from the long-term perspectives. We don’t see material impact of US tariff on China EV and battery value chain since the major players have been imposed with high tariff for years.

Global X Asia Semiconductor ETF (3119 HK)

Industry Update

SK Hynix reported solid 1Q25 result

1Q beat: SK Hynix reported 1Q25 OP of W7.4tr, ahead of street at W6.7tr. Revenue was KRW18trn (-11% QoQ, +42% YoY). 1Q DRAM B/G growth turned out to be -HSD% QoQ, beating the guidance of low-teens% QoQ decline, driven by expanded sales of HBM3E/DDR5 and better-than-expected DRAM shipment for PC and smartphone applications. ASP flat QoQ. NAND B/G -high teens QoQ, ASP -20% QoQ.

2Q guide: Hynix forecasts its 2Q25E DRAM B/G to increase +low-teens% QoQ on a likely crossover of HBM3E 12Hi in 2Q. Hynix projects 2Q NAND B/G to increase >20% QoQ.

HBM: Hynix remains confident on global HBM demand, expecting it to register +50% cagr from 2024 to 2028E. While maintaining its 2x YoY HBM revenue guidance, Hynix expects a crossover of HBM3E 12Hi in 2Q25E and projects HBM4 12Hi to be ready for mass production within 2025. (Mirae Asset)

TSMC delivered strong result and guidance

1Q slight beat: Revenue down 5.1% QoQ in USD terms, led by smartphone seasonality, partly offset by continued AI growth. GPM 58.8%, down 0.2ppt, due to Overseas dilution (Kumamoto Fab) and earthquake impact (60bps impact), partly offset by cost reduction efforts. EPS at 13.94 -4% QoQ/+60% YoY was 5% ahead of the street.

2Q strong guide: 28.4-29.2bn (+13% QoQ at mid point) Gross profit margin to be between 57% and 59%. (Margin dilution impact from US fab) Operating profit margin to be between 47% and 49%. 2Q tax rate 20%, full year 16-17%.

TSMC maintained 2025 revenue to grow at mid-20% in USD, despite the strong 2Q25 revenue guide, indicating a slower than expected HoH growth in 2H25 (implied HoH growth at 6-7% vs 12-27% range in the past 5 years). (Mirae Asset)

Stock Comments

- Naura +8.4%Naura reported Q125 revenue was Rmb8.2bn (+38% YoY), a slight 0.6% beat of the mid point of the pre-results; NP attributable to parent was Rmb1.58bn (+39% YoY), at the mid point of the pre-results and in line with expectations. (Company data)

- Tokyo Electron +10.76%The company provided positive guidance for the next fiscal quarter. F3/25 results beat TEL’s plan. F3/26 guidance is for YoY sales/profit growth. Positive impression from rise in etcher market share in 2024; competitiveness of other products also improved. (Company data)

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2025. (Mirae 2025)