Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, annual reconstitution risk, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risk, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, risk of reliance on the Index Calculation Agent, trading difference risk, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X India Select Top 10 ETF’s (the “Fund”) underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Global X K-pop and Culture ETF’s (the “Fund”)The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, equal weighted index risk, risks related to companies with technology themes, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risks, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, trading difference risk, risks associated with ADRs, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks, reliance of the same group risk and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

Monthly Commentary

Global Thematic ETFs – March 2025

Global X India Select Top 10 ETF (3184 HK)

Market Update

- The MSCI India Index was down 8.0% (in USD terms) in February, underperforming the MSCI APxJ/EM Indices due to concerns on uncertainty around tariffs under Trump 2.0 and domestic growth challenges. RBI announced a rate cut of 25bps, bringing down the policy rate to 6.25%, along with other monetary easing measures to revive growth. India’s 3QFY25 GDP growth came in at 6.2%, and the government forecasts GDP growth for FY25 to be 6.5%.

- Domestic demand-based high-frequency data for February continued to show a gradual improving trend. While manufacturing PMI softened to 56.3 in February from 57.7 in January, the services PMI strengthened to 59.0 in February from 56.5 in January. GST collection showed a robust growth of 13%yoy, reaching Rs 1.8tn in February. Central government capex spending rose by 51.4%yoy in January to Rs 720bn, which came in lower than Rs 1.7tn in December but higher than the average of Rs 640bn between April and November ’24. Power demand also improved with 6.7%yoy increase in February, alongside steady credit growth of 11.3%yoy during the month. While vehicle registrations declined for both two-wheelers and passenger vehicles compared to the same period last year, air passenger traffic showed robust growth, and consumer sentiment remained resilient.

- January CPI softened further to 4.3% from 5.2% in December, driven by faster-than-anticipated disinflation in food prices, which came in at 6.0% in January. We expect the headline CPI in February to have further softened, based on the trend in high-frequency food prices for February, which may give RBI room to continue easing monetary policy to support growth.

- Indian equity flows from foreign institutional investors ended with a persistent net selling of USD 4.0 billion in February (vs. net selling of USD 8.4 billion in January), while domestic institutional investors maintained their buying trend for the 19th consecutive month by net buying USD 7.4 billion during the same period (vs. USD + 10.0 billion in January).

Stock Comments

- HDFC Bank (HDFCB IN) was the major contributor in February amid improving macro conditions with improved GDP growth and RBI’s easing on liquidity and regulations. HDFC faced restrictions due to high LDR post its merger with HDFC limited; thus, the recent monetary easing policy by RBI has raised loan growth expectation for HDFC in the coming year.

- Tata Consultancy Services (TCS IN) and Infosys (INFO IN) were the major detractors in February mainly due to concerns on US economy slowdown amid tariff uncertainties, which may lead to weaker than expected discretionary spending. IT services sector had outperformed the market in the last couple of months amid weakening INR, but this also led to profit taking in this month.

Preview

We expect India’s GDP growth to remain robust, supported by easing monetary policy, improved fiscal spending, moderate inflation, and a recovery in consumption. This suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on the India market.

Global X K-pop and Culture ETF (3158 HK)

Market Update

In February, KOSPI increased 0.6% MoM to 2,533. For K-pop sectors, the entertainment industry (our product’s top holding sector) outperformed KOSPI and rallied on growing hope of China’s reopen. Starting around 2016-2017, China had “Hallyu” ban on K-pop due to political tensions over THAAD, affecting K-pop concerts, TV shows, and other cultural exports. However, after 8 years, the situation is likely to end as Korea Economic Daily reported on 20 Feb that China may lift its ban on K-pop culture as early as May. K-pop stocks rallied on the growing hope of the reopen of China market. In the short term, China’s reopening will directly boost profit through offline concerts, while the long-term upside is substantial driven by further penetration into this large population market.

Stock Comments

- SM Entertainment (041510 KS): SM recorded 20% return in February. Despite the sector rally, SM is currently engaged in some M&A activities: 1) SM announced to raise its stake in DearU (376300 KS) from 33.7% to 45.1% on 21 Feb., with the transaction expected to be completed by 24 March 24. This acquisition will allow SM to consolidate DearU’s earnings; 2) According to a report by Maekyung on 14 Feb, SM intends to sell its entire 33.71% stake in the non-core subsidiary KeyEast (054780 KS) for W37bn, with estimated sale price at 33.6% premium over KeyEast’s closing price on 14 Feb. We view both transactions positively: the enhancement of earnings and the strategic focus on core music operations, along with DearU’s partnership with Tencent Music Entertainment, are likely to bolster SM’s earnings outlook.

- HYBE (352820 KS): HYBE recorded 16% return in February. Despite the sector rally, HYBE 4Q24 revenue beat consensus while OP missed. Topline grew by 19% YoY to W725bn, 9% above consensus, thanks to strong concert and merchandise sales from Seventeen, Enhypen, and TXT. OP was below consensus by 23% at W65 billion, due to higher sales contribution from younger artists, along with rising SG&A expenses related to new business ventures (e.g. Weverse, HYBE IM, and Supertone). Company also reported a net loss of W29bn, primarily due to a goodwill impairment associated with Ithaca Holdings. We remain positive on company’s outlook, supported by expected BTS return in 2H25 and enhanced monetization on Weverse through new membership options and advertising revenue.

- Amorepacific (090430 KS): Amorepacific experienced 7% loss in February. 4Q24 sales came largely in line at 18% YoY, while OP of W78bn was 10% below consensus. This is mainly dragged by a 31% rise in personnel costs, declining sales for Cosrx—which saw a DD% drop attributed to weak performance in the U.S. market, excessive inventory levels, and intensified competition, particularly on Amazon—and a lower OPM in the low 20% range, compared to the guidance of mid to high 20%. Management also toned down the outlook for both China and COSRX.

Preview

Although facing short term fluctuations such as political uncertainties (which we believe are easing and well-reflected in share prices), we maintain positive on the rise of K-Pop and cultural phenomenon in global market. Recent hit track APT by Rose and Bruno Mars, along with Han Kang’s Nobel Prize win in Literature, have significantly raised global awareness of K-pop culture. We expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. We also believe that price competitiveness and compelling value propositions stand out as key factors driving the strong export of Korean consumer goods in the global market, especially under current economic uncertainties and consumer downtrading trend.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

NVIDIA announced January Quarter results

January revenue of $39.3bn (up 12.1% q/q and 77.9% y/y) beat Street expectations of $38.101bn. By segment, Data Center revenue of $35.580bn was up 15.6% q/q and 93.3% y/y, Gaming was down 22.4% q/q and 11.2% y/y to $2.543bn, Professional Visualization was up5.1% q/q and up 10.4% y/y to $511mn, Automotive was up 26.9% q/q and 102.8% y/y to $570mn, and OEM & Other was up 29.9% q/q and up 40.0% y/y to $126mn. Gross margin of 73.5% was in line with the Street. (Mirae Asset)

Apple announced Dec quarter result

Dec Q solid, weak China sales: Sales were $124.3bln (+4% y/y) largely in-line with street; EPS was $2.4 slightly ahead of street due to better GPM at 46.9%, reflecting Services gross margin of 75.0% (potentially impacted by FX) and Product gross margin of 39.3%. iPhone revenue were down 1% YoY, Macs + 16% YoY, iPad + 15% YoY, wearables -2% YoY; greater china sales down 11% YoY.

Guide better than feared: ‘’March quarter total company revenue to grow LSD to MSD % yoy. (vs. street MSD %) We expect services revenue to grow low DD % yoy. (vs. street low-teen %) When you remove the negative impact of the foreign exchange headwinds I described earlier, the yoy growth rate would be comparable to that of the December quarter. We expect gross margin to be between 46.5% and 47.5%. (vs. street 47%)’’

BYD introduce ADAS across majority of its vehicle lineup

BYD has made significant strides in advancing its autonomous driving technology, launching the “God’s Eye” advanced driver-assistance system (ADAS) across its entire vehicle lineup, including budget models like the $10,000 Seagull. he basic system is called God’s Eye C and relies on 12 cameras (three front-view, five panoramic, four surround-view) and 17 different radar sensors. God’s Eye B is more advanced and includes a Lidar sensor. This mid-level system will find its way into some high-end BYD vehicles but is mostly intended for Denza and Fang Cheng Bao cars. (BYD).

Global X Japan Global Leaders 10 ETF (3150 HK)

Industry Update

In February 2025, the FactSet Japan Global Leaders Index recorded -1% returns in JPY terms1. Japan market’s underperformance against global market is due to increase in uncertainty over Trump’s tariff policies and concerns over accelerate in BOJ rate hike due to inflation. After market volatility, TOPIX 12m fwd PE decreased to 14x, lower than past 10 year average in a deflationary economy, suggesting attractive valuation. USDJPY ended January at 151, from 155 as of end January.2

Stock Comments

- Sony recorded 11% return in February, a key contributor to the index. Sony reported better-than-expected Dec-Q results. Games segments continued strong profit momentum, as supported by strong PS5 sales and 3p software sales. The strong momentum could continue into the coming quarters as supported by strong game pipeline ahead.

- Seven & I recorded 11% loss in February, a detractor to the index. On 26 February, Nikkei reported that Itochu has decided not to participate in a proposal by the company’s founding Ito family aimed at taking it private, share price dropped over 10% on the news. This indicates a lower possibility of the buyout proposal by the founding family materialising.

Preview

Japan stock market went through massive volatility over past few months under concern for JPY volatility and US economy recession. While short term outlook remains uncertain given slowing global economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging).3

Global X AI & Innovative Technology Active ETF (3006 HK)

Industry Update

xAI releases Grok 3

Grok, xAI’s answer to models like OpenAI’s GPT-4o and Google’s Gemini, can analyze images and respond to questions, and powers a number of features on Musk’s social network, X. Grok 3. xAI has been using an enormous data center in Memphis containing around 200,000 GPUs to train Grok 3. In a post on X, Musk claimed Grok 3 was developed with “10x” (or so) more computing power than its predecessor, Grok 2, using an expanded training set.

xAI claims Grok 3 beats GPT-4o on benchmarks including AIME (which evaluates a model’s performance on a sampling of math questions) and GPQA (which assesses models using PhD-level physics, biology, and chemistry problems). (xAI, TechCrunch)

OpenAI release GPT4.5

GPT-4.5, OpenAI’s latest model, focuses on enhancing conversational abilities, factual accuracy, and emotional intelligence. Despite some of its limitations, GPT-4.5 hallucinates a lot less than GPT-4o, according to OpenAI, and slightly less than its o1 model. “We aligned GPT-4.5 to be a better collaborator, making conversations feel warmer, more intuitive, and emotionally nuanced,” Raphael Gontijo Lopes, a researcher at OpenAI, said during the company’s livestream. “To measure this, we asked human testers to evaluate it against GPT-4o, and GPT-4.5 outperformed on basically every category.” (OpenAI )

Tencent’s messaging app Weixin launches beta testing with DeepSeek

Tencent said on Sunday its Weixin messaging app, China’s largest, is allowing some users to search via DeepSeek’s artificial intelligence model as firms race to link up with the AI startup. In a beta test, Weixin is testing access to DeepSeek for searches, Tencent said in a statement to Reuters. The move by the Chinese tech giant is notable as integrating DeepSeek brings in an external AI platform, while tech firms compete fiercely in developing the most advanced AI. (Reuters, The economic times)

Stock Comments

- Tencent + 19.54% – China tech sector rallied after the launch of Deepseek along the signals of positive policy support. Tencent launched Yuanbao, an app which host its own AI model and Deepseek quickly gained traction.

- Apple +1.61% – An in-line Dec Q and better-than-feared Mar Q create a cleaner catalyst path into the April iOS 18.4 launch & June’s WWDC. Dec Q revs of $124B were in line with expectations though gross margin of ~47% was better than expected thanks to all-time high Services GM. March Q guide implies ~$94B of revs at midpoint and EPS of $1.50-1.68, better than feared.

Preview

The Global X AI and Innovative Technology Active ETF Fund is committed to being at the forefront of AI investment, leveraging our expertise to identify and capitalize on opportunities across the AI value chain. By focusing on both established leaders and emerging innovators, we aim to provide our investors exposure to one of the most dynamic and impactful sectors of the global economy. As the AI landscape continues to evolve, we remain dedicated to adapting our strategy to ensure that our investors benefit from the full spectrum of AI-driven growth and innovation.

Global X Electric Vehicle and Battery Active ETF (3139 HK)

Industry Update

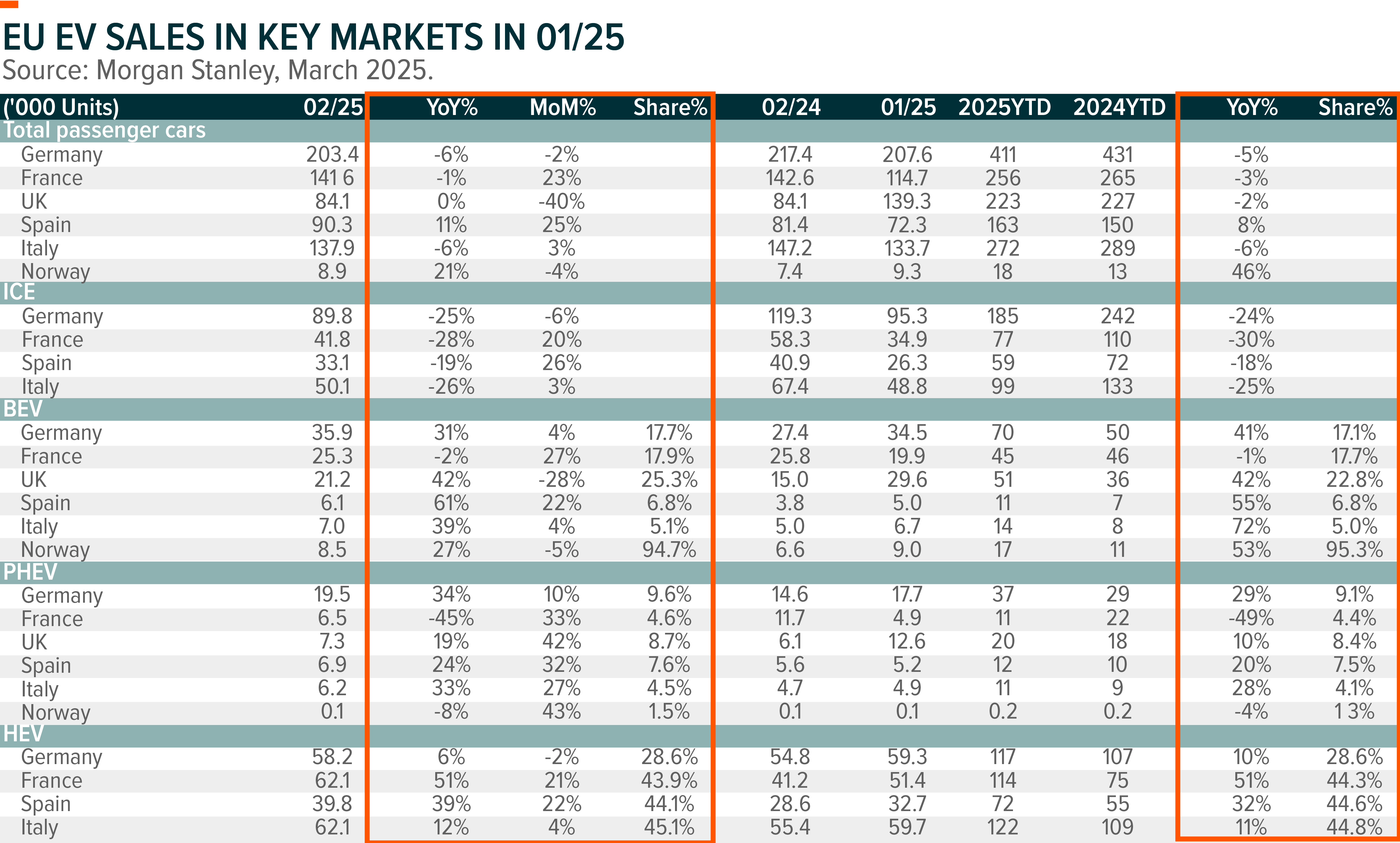

China EV sales remained on track in February despite the impact of Chinese Lunar New Year holidays, while EU EV sales also showed robust sales growth in key markets, much better than feared on the back of unclear EU CO2 emission policies before March. For example, Germany BEV sales grew by 31%YoY in January 2025, UK 42%YoY, Spain 61%YoY, Italy 39%YoY and Norway 27%YoY.

The European Commission released its Action Plan for the automotive industry on March 5th, responding to demands from automakers and suppliers for relief from emission requirements and measures to boost competitiveness against rivals from China and the US. Car manufacturers will be enabled to meet their compliance targets by averaging their performance over a three-year period(2025-2027), allowing them to offset any shortfalls in one or two years with excess achievements in the other year(s), while keeping the overall ambition on the 2025 targets. The EU’s CO2 emission targets related to new EVs sales in 2035 stay the same. The amendment provides some relief to investors concerning the gap between EU’s EV sales targets and the legacy automakers’ short supply of competitive EV models in 2025.

Stock Comments

- BYD Co., Ltd. Class H: The company hosted a press conference on Feb 10th, posting the announcement that they will equip all their cars with different levels of autonomous driving features for free.

- NVIDIA Corporation: A low-cost Chinese AI chatbot, DeepSeek sparks AI stock selloff as investors worried it may threaten the dominance of AI leader like Nvidia.

Preview

We believe, China domestic EV sales and exporting to the emerging markets and Europe would remain the key driver for global EV and battery growth in 2025. We maintain our whole year estimation of global EV sales unchanged, that is, China xEV sales around 15mn units, +40%yoy, Europe +5%yoy to 4.56mn units, US flat yoy at 1.57mn units and other markets of 0.74mn units. We turn more positive on China EV, battery and battery materials supply chain going forward, considering the competitiveness of Chinese EV products and sequentially utilization improvement from channel feedback