Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary

China Thematic ETFs – Feb 2025

Global X China Electric Vehicle and Battery ETF (2845 HK)

Industry Update

- January 25 EV sales declined sequentially on seasonality: According to CPCA estimates, January NEV retail sales volume was 720k, -45% MoM due to seasonality, while YoY growth was solid at +8% YoY from a low base. By individual brands, BYD reported January NEV PV sales of 297k units, +47% YoY while -42% MoM. Overseas sales was the bright spot with record high 66.3units, Latin America and ASEAN should be major contributors. Xpeng emerged as the best-selling start-ups with 30.4k units in January, while sales for Li Auto weakened. Xiaomi saw continued demand for its best-selling SU7 model selling >20k units in January. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF).

- Trade-in policy extended: On 8 January, NDRC announced that the auto trade-in policy will be extended, with amounts of subsidies remain unchanged at Rmb20k for NEV purchases and Rmb15k for ICEV. Separately, the NDRC also announced that local governments will offer trade-in subsidies of up to Rmb15k for NEV purchases and Rmb13k for ICEVs (more details to be disclosed at later stage). This should help to sustain the strong purchase demand.

- ADAS gaining traction: The strong performance and low costs for DeepSeek AI model ignites hopes for AI application acceleration, and autonomous driving could be among the key AI use cases. BYD announced on 6 February that it will hold a conference on 10 February, focusing on its advanced smart driving system. This could signal increasing NOA adoption, esp. for mass market models.

- Battery material costs remained low: China’s Battery grade lithium carbonate price Battery grade lithium carbonate price was Rmb77.9k/ton, +1.8% wow, -24%/-27%/-4%/+2% vs. average of 1Q24/2Q24/3Q24/4Q24. 1 Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- BYD recorded 3% loss in January, a detractor to the ETF. BYD’s monthly sales declined sequentially in January due to seasonality, yet its outlook remains solid on the back of extended trade-in program and solid model pipeline. BYD announced on February 6 that it will host a ‘vehicle intelligence strategy’ conference on February 10, focusing on its advanced smart driving system. BYD’s share price soared for more than 10% on the announcement as this signals that BYD is catching up on autopilot and bringing autonomous driving functions to mass market models. This could also accelerate NOA adoption in China.

- Sanhua Intelligence recorded 30% gain in January, a key contributor to the ETF. Tesla’s plan for Optimus Robots to enter mass production in 2025 boosts sentiments for Sanhua Intelligence, as the company is a supplier for Tesla. Sanhua also applied for HKEX listing in January, a potential catalyst for the company as it could expand investor base and offer better access to international capital for Sanhua.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program (which has been extended in 2025), together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X Hang Seng TECH ETF (2837 HK)

Industry Update

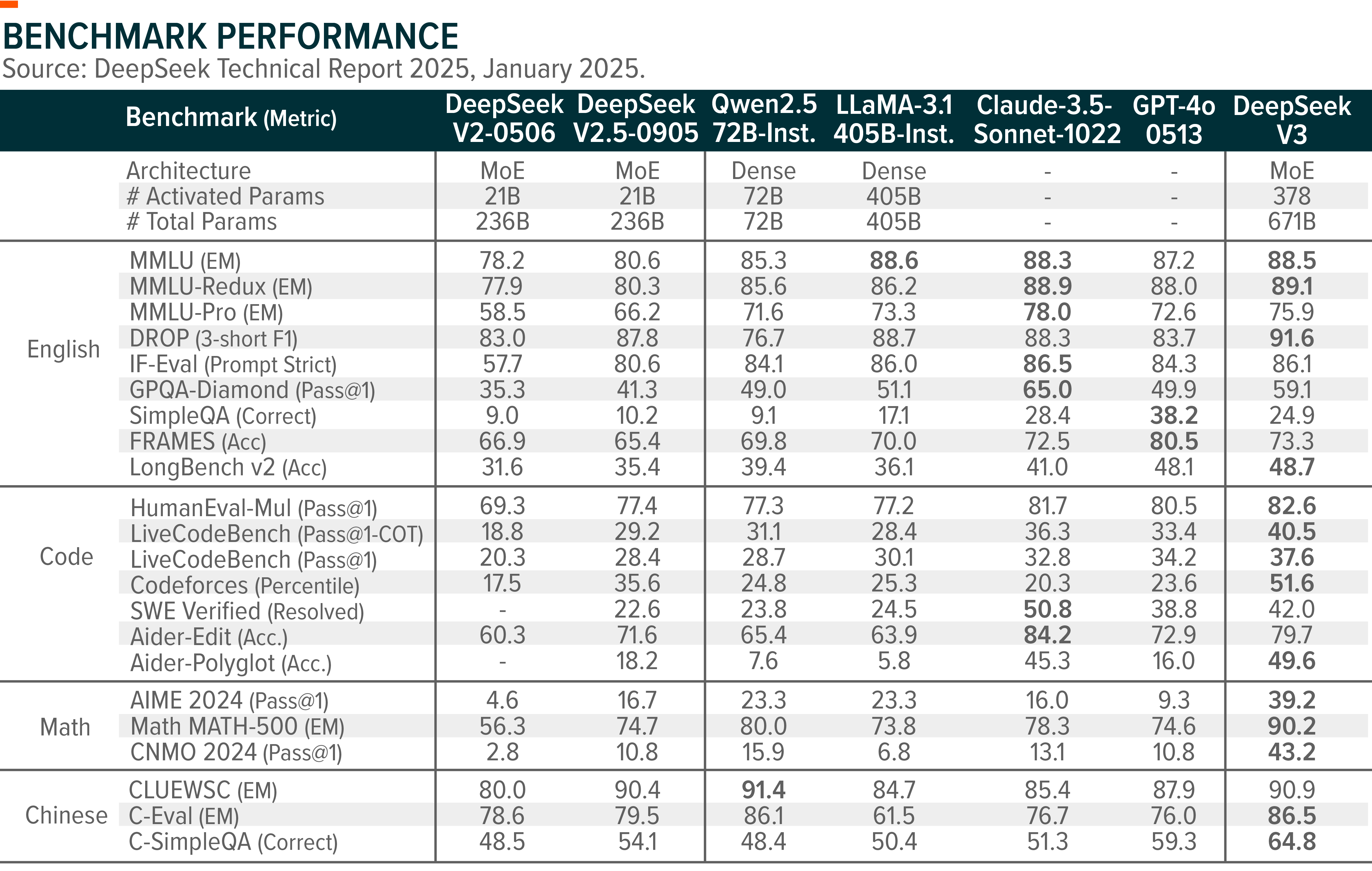

Global X Hang Seng Tech ETF (2837 HK) recorded positive return in January. The successful launch of DeepSeek V3/R1 models ignite hopes for China AI development as it achieved top performance at a substantially lower training/inference costs and computing power requirements. Major Cloud providers (BAT) have announced deployments of DeepSeek models in their platforms and are poised benefit from the rising usage. Enhanced cost efficiency will also accelerate Generative AI adoption, benefiting software and internet companies. Concerns over escalating US-China geopolitical tensions under Trump presidency and policy supports for domestic chip development continue to drive the elevated sentiments on China semiconductor sector, leading to outperformance of leading domestic players like SMIC. With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiments that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

- Kingdee recorded +21% gains in January, a contributor to the ETF. Kingdee is one of the largest domestic ERP software providers in China, and is benefiting from the positive sentiment around generative AI. The low costs and good performance of DeepSeek models should accelerate AI adoption, this will bring enhanced user experience and potential new monetization opportunities (through subscription for example) for the company. Kingdee has been integrating AI agents across finance/HR/supply chain modules and supply to key clients.

- Alibaba recorded +7% gains in January, a contributor to the ETF. Alibaba launched its Qwen2.5-Max, a large-scale MoE model with leading performance results as compared to global peers. Alibaba Cloud is the major provider for its Qwen LLM as it is currently not fully open-sourced, and Alibaba’s stock price has recorded substantial outperformance vs peers since the launch of Qwen2.5-Max.

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China.

Global X China Clean Energy ETF (2809 HK)

Industry Update

2024 China solar installation delivered a strong beat of 277.5GW capacity addition, +28%yoy, with utility-scaled of 159.39GW and distributed of 118.17GW. China wind installation was 79.34GW in 2024, +4.5%yoy, with onshore 75.31GW and offshore 4.03GW. Offshore wind installation was missing the initial expectation of 7-8GW due to project construction delay. In December, solar installation was accelerating to 70.9GW, while wind added 27.6GW capacity, down by 20%yoy. Investment in power generation capacity/power grid was Rmb1,168.7bn/Rmb608.3bn in 2024, +20.8%yoy/+15.3%yoy, respectively. Power grid investment in December 2024 was Rmb79.3bn, down 2.9%yoy, vs. Rmb78.8bn in November, +8.4%yoy.

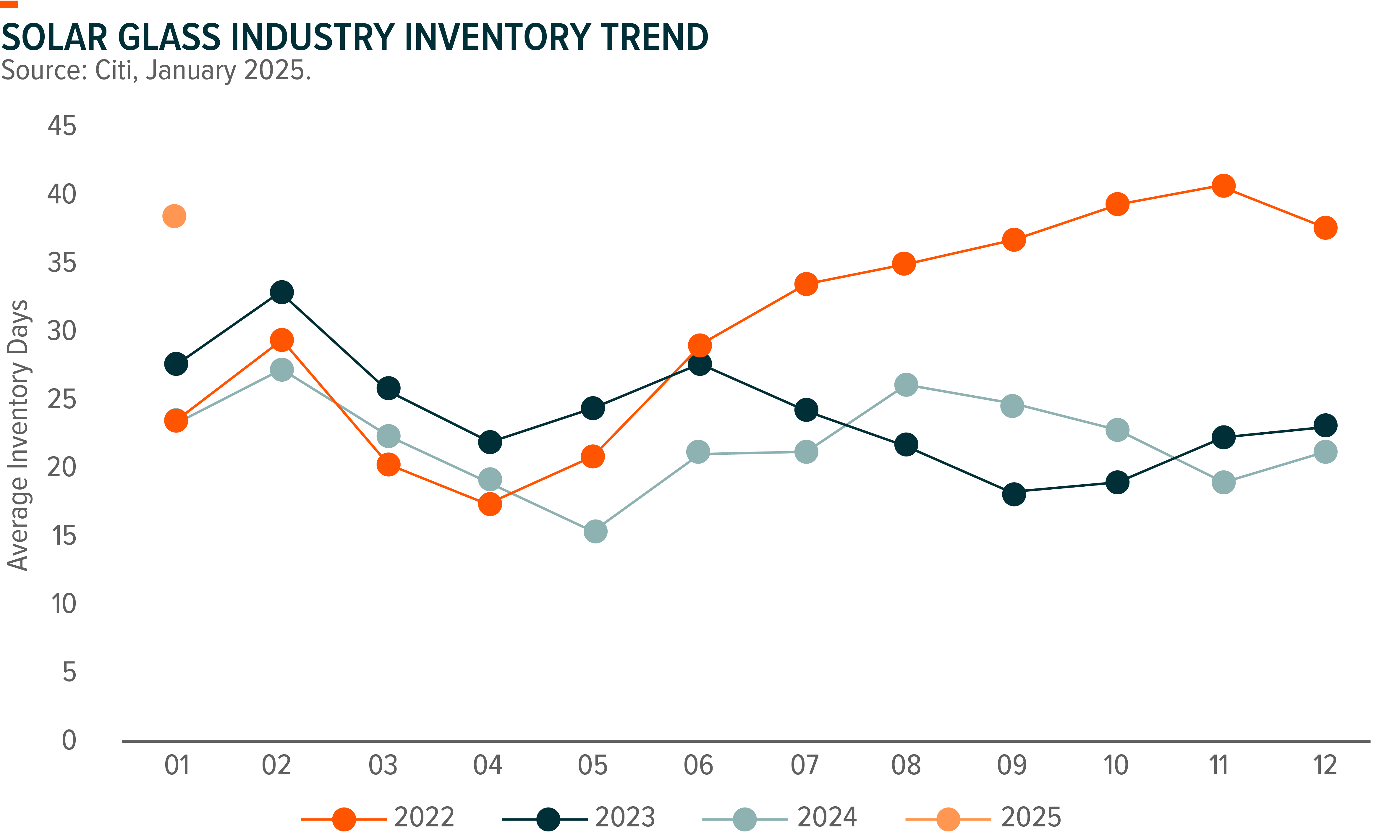

The first two months of the year are generally low season due to Chinese Lunar New Year holidays. Utilization is relatively low, while inventory is accumulating along the supply chain. We need more time to see the impact from the supply-side policies to help the industry get out of the woods.

Stock Comments

- Sieyuan Electric Co., Ltd. Class A: The company is the key beneficiary from power equipment exporting in 2024. Sales outside China would remain solid heading into 2025.

- GCL Technology Holdings Limited: Polysilicon was destocking in January before CNY holidays. Polysilicon prices are bottom.

- NARI Technology Co., Ltd. Class A: China UHV lines construction were slowing down in the second half of 2024, missing market expectation. We remain bullish on UHV capex in 2025.

Preview

We expect a modest growth rate for the European solar power market, mainly because the residential solar demand slowed down for the decreasing ROI as electricity prices normalized and the impacts of the energy crisis faded. China’s supply-side policies on solar may take more time to play out, despite the worst time behind. We are constructive on China’s wind equipment exporting for better profitability from exporting. We remain constructive on the global clean energy growth and the trend of energy transition, just staying cautious about the near-term broad mismatch between supply and demand.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

The 2025 CNY holiday period (January 28 – February 4) showcased mild yet steady growth in China’s retail and consumer sectors, reflecting a balance between cautious spending and targeted policy support. While demand stabilized compared to previous festive seasons, the market’s focus now shifts to sustainability beyond the seasonal peak and the potential for further stimulus to bolster growth in the first quarter. According to the Ministry of Commerce (MOC), sales of key retail and restaurant enterprises grew by 4.1%, aligning with subdued market expectations.

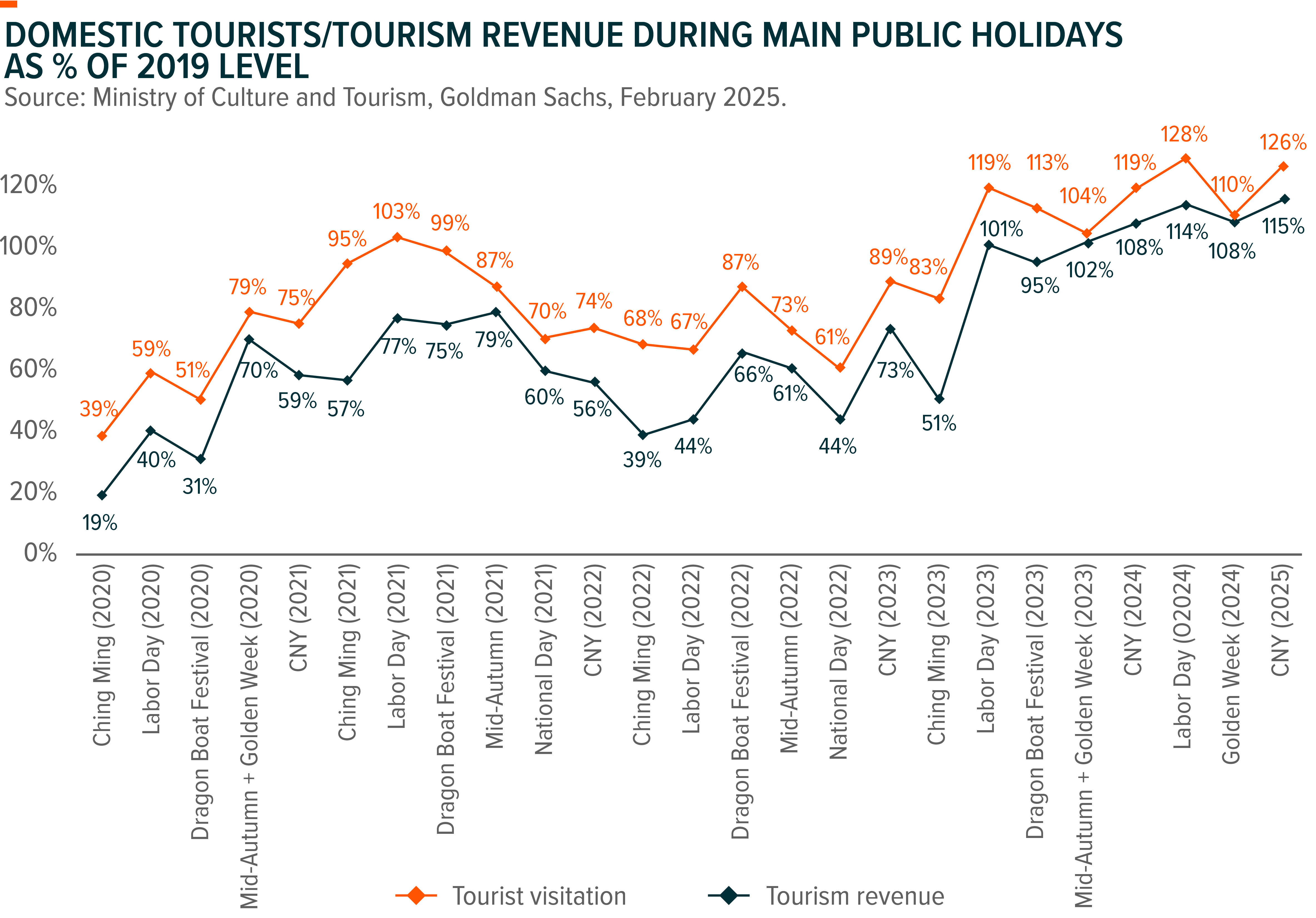

Domestic tourism recorded robust rebound, with structural shifts toward experiential spending. According to the Ministry of Culture and Tourism, domestic tourist number/tourism revenue recorded 501m person times/Rmb677bn, up 5.9%/7.0% YoY and 25.8%/15.2% above 2019’s level. Per capita spending rose by 1.2% YoY to Rmb1,351 but still 8% below pre-Covid level, reflecting still rational spending. The recovery in Chinese outbound travel lagged, +5.2% YoY.

Spirits market has saw a soft start under shipment control. Overall demand may decline 10-15% YoY due to high 2024 comps. However, stabilization was evident compared to sharper declines during the Mid-Autumn Festival. Premium brands hold steady as Moutai and Wuliangye saw MSD declines to slight growth, supported by disciplined inventory management (e.g. Wuliangye’s < 1 month stock levels in most regions) and rising wholesale prices for core super premium products. Fen Wine and King’s Luck gained traction in the upper mid-tier segment, benefiting from targeted promotions and improved channel dynamic.

Stock Comments

- ANTA Sports (2020 HK): Anta achieved 5% return in January. Amid a challenging retail environment, Anta reported robust operational results for 4Q24, reinforcing investor confidence in its ability to meet full-year targets. Both ANTA and FILA brands achieved HSD retail sales YoY growth in 4Q24. While ANTA’s performance aligned with expectations, FILA’s growth notably exceeded market projections. Descente and Kolon Sport accelerated growth, with retail sales surging 50–55% YoY in 4Q24. Management also highlighted stable inventory levels and disciplined discounting (e.g., ANTA’s online discounts improved 1ppt YoY). Sales trends remained strong ahead of the CNY, particularly for winter and outdoor apparel.

- Giant Biogene (2367 HK): Giant Biogene recorded 15% return in January. Giant Biogene’s new aesthetic product for neck wrinkles has received a fast-track review designation (FTD) from the Center for Medical Device Evaluation (CMDE), as it is classified as “a medical device under the national key R&D program.” This highlights Biogene’s leadership in recombinant collagen technology, as it is the only aesthetic/beauty company among the 21 medical devices granted FTD in 2024 so far. Additionally, the company’s product targeting forehead lines and crow’s feet is expected to gain approval in the first quarter of 2025, according to management. These developments should help ease market concerns about potential delays in launching new aesthetic products.

- New Oriental (CH): New Oriental experienced 27% loss in January mainly due to weak management guidance. For 3QFY25, management guided core revenue to grow 18-21% YoY (in USD terms). The slowdown is mainly dragged by weaker-than-expected growth in overseas test prep, new businesses (mainly 2B and books), and cultural tourism. Core OPM is expected to decline by 1.5ppts YoY due to pressures from overseas test prep and cultural tourism, partially offset by improving margins in the K12 segment. Additionally, management revised down its full-year FY25 revenue and OPM guidance. Core revenue growth for FY25 was adjusted from +30% YoY (in USD terms) to +25% YoY (in RMB terms), and the previous core OPM guidance of a +1ppt YoY improvement was withdrawn.

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. We expect that macroeconomic recovery, supported by supportive policies, presents the largest upside risk for China’s consumer sector in 2025, especially given that demand was under pressure across nearly all subsectors in 2024. However, the path of policy rollout remains unclear. Therefore, we expect consumption recovery to unfold gradually, with a more noticeable improvement likely in 2H25. More time will be needed before fundamentals improve under the current policy setup. Key events to watch include the Two Sessions in March 25. By subsector, we like sectors that are direct focus of stimulus policies, such as home appliance under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu.

Global X China Robotics and AI ETF (2807 HK)

Industry Update

A Chinese technology start-up, DeepSeek, has taken the tech world by storm in the beginning of 2025, with the release of two large language models (LLMs) that rival the performance of the dominant tools developed by US tech giants but built with a fraction of the cost and computing power. DeepSeek’s breakthrough in LLM technologies include 1) it proves that LLM capabilities can be enhanced by surpassing SFT (supervised fine-tuning) and depending almost purely on RL (re-enforcement learning) so that cost and time-consuming data labeling procedure can be significantly reduced, 2) it advances in MoE load balancing and multi-token prediction, and 3) the first to successfully adopts FP8 training framework on a large scale model. We have witnessed a great step forward in robotics and AI in China in the last two years that improved the features significantly and could be applied to some simplified production scenario. The success of DeepSeek will definitely accelerate the AI development in China.

Stock Comments

- Leader Harmonious Drive Systems Co., Ltd. Class A: The company is leading in harmonious drive in China, which will benefit from humanoid robot penetration accelerating from here.

- Beijing Kingsoft Office Software. Inc. Class A: The company was seen as one of the key beneficiaries from AI adoption in China if DeepSeek is widely used in software development.

- NARI Technology Co., Ltd. Class A: China UHV lines construction were slowing down in the second half of 2024, missing market expectation. We remain bullish on UHV capex in 2025.

Preview

China’s FAI in advanced manufacturing and technology have been strong despite the overall economy slowdown. Robotics, AI and automation are one of the key beneficiaries from both the government’s stimulus measures in the near term and the economy transition goal in the long run. The success of DeepSeek will definitely boost AI development in China, encouraging more R&Ds in the downstream applications with much cheaper cost than before. We have also seen the acceleration of humanoid robotics penetration in China in the beginning of 2025. We expect the key component producers will be one of the key beneficiaries from here.

Global X China Semiconductor ETF (3191 HK)

Industry Update

TSMC reported strong 4Q result and 1Q guidance

4Q came in at the high end of guidance: revenue up 14.3% qoq in NTD, led by N3 and N5, GPM up 1.2ppt qoq to 59.0%, due to higher UTR and productivity gains, partially offset by dilution from the continued ramp-up of 3nm.

China’s Huawei, SMIC ‘to Ramp Production’ of Newest AI Chip

Chinese technology giant Huawei and chipmaker Semiconductor Manufacturing International Corp (SMIC) are aiming to begin mass-production of China’s most advanced homegrown artificial intelligence chip, starting next year, according to Reuters. As part of that effort, Huawei plans to start mass producing the Ascend 910C, its newest AI chip offering in China, in the first quarter of 2025. (Reuters)

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2025. (Mirae 2025)

Global X China Cloud Computing ETF (2826 HK)

Industry Update

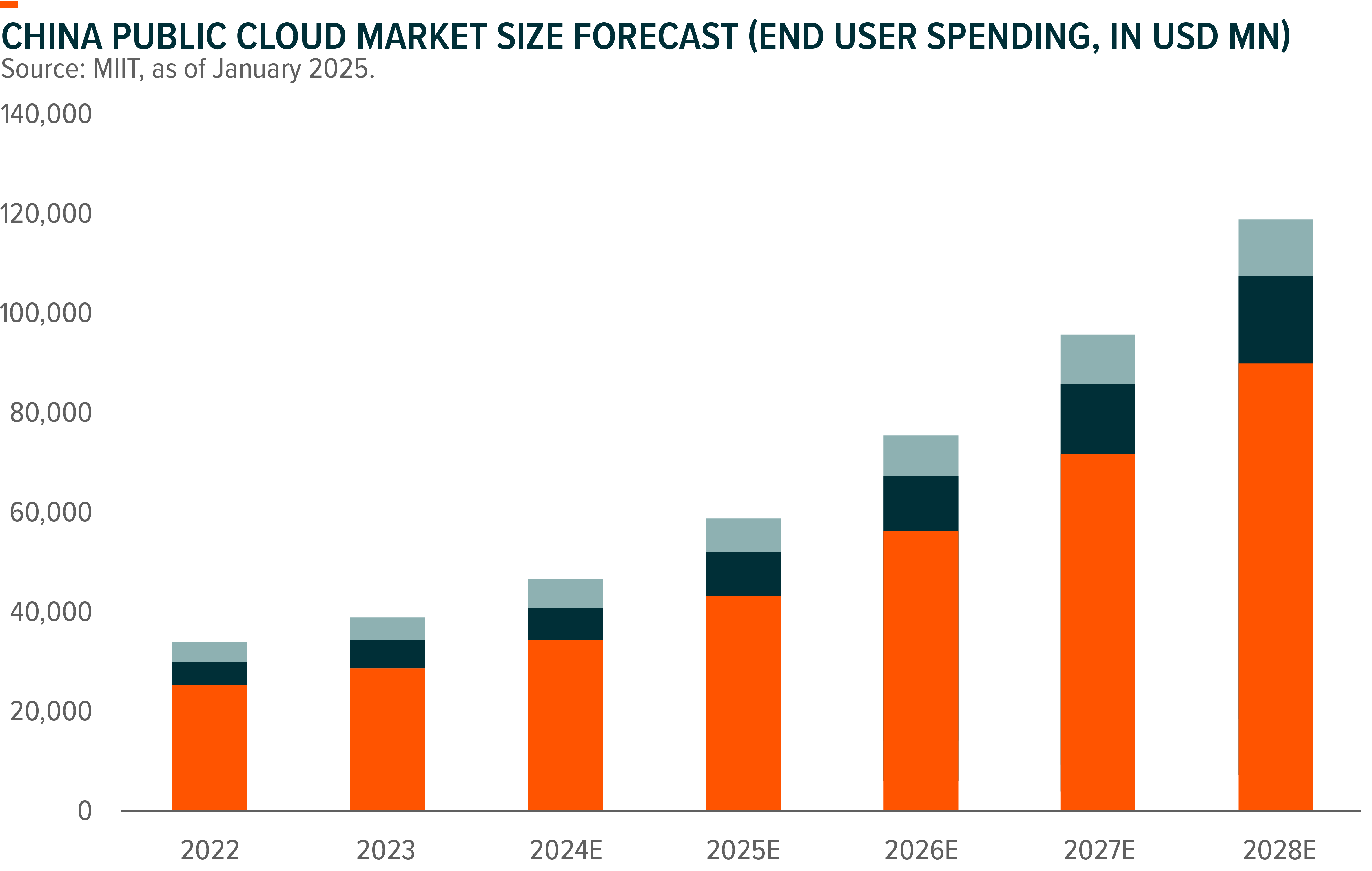

- China software industry growth in 2024 full year was +10% YoY, reaching Rmb137.3trn. For the full year, aggregate net income of software companies registered in China was Rmb1,695.3bn, net margin was 12.3%.

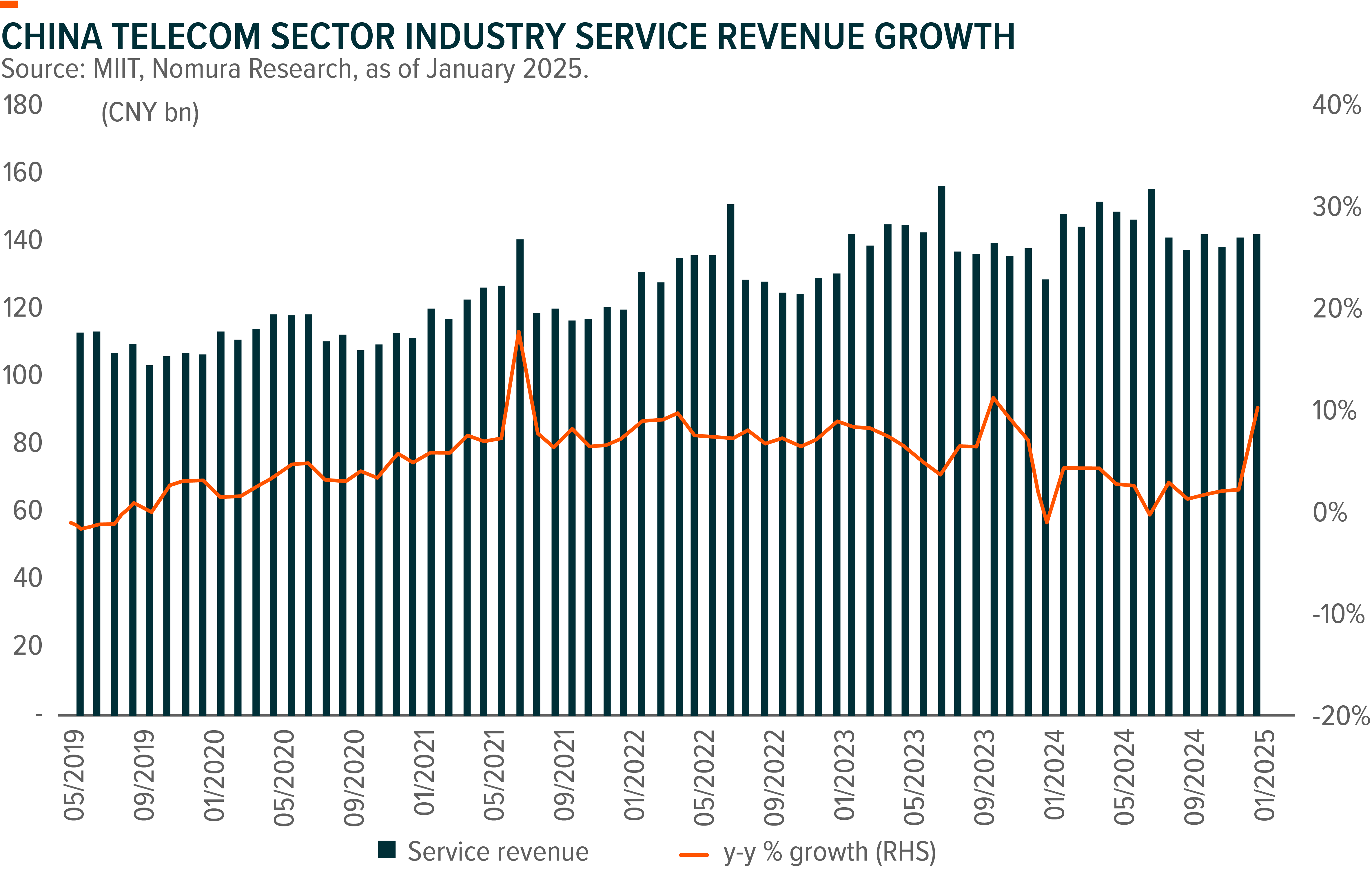

- In December, China telecom industry revenue was up 10.3%YoY with 4Q24 revenue growth of 6.4%YoY. Fixed service revenue was up 7.4%YoY in the month and 6.7%YoY in 4Q24, while mobile service revenue was up 3.7%YoY in Dec and flat in 4Q24. New business revenue was up 47.4%YoY, likely due to year-end revenue recognition, while 4Q24 growth was 14.3%YoY.

Stock Comments

- Baidu, Inc. Sponsored ADR Class A: Stock price went up attributable to as market become incrementally positive on Chinese internet companies’ LLM capability. In addition, Baidu’s cloud revenue growth is expected to further accelerate in 2025E aided by solid public cloud revenue as well as continuous ramp-up of GPU cloud demand.

- NetEase Inc Sponsored ADR: NetEase’s new game Marvel Rivals was released in early Dec. and surpassed expectation with ~650k concurrent players on Steam. In addition, Where Winds Meet was also released during the same time, which will contribute to 2025 PC/Mobile game rev. Market now expects a reacceleration in gaming revenue into 2025E.

- Hundsun Technologies Inc. Class A: Share price was weak due to concerns on 2024 revenue and earnings revisions. In the face of a constantly changing external environment and challenges, the company has maintained strategic focus, increased tactical elasticity, and actively responded to the challenges of cyclical fluctuations to build up momentum for future growth.

- Hithink RoyalFlush Information Network Co., Ltd. Class A: Share price corrected in tandem with broader market correction.