Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which

- may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary

China Thematic ETFs – Dec 2024

Global X China Electric Vehicle and Battery ETF (2845 HK)

Industry Update

- Strong November EV Sales: According to CPCA estimates, November NEV wholesale volume reached 1.46mn, +51% YoY1, as driven by supportive trade-in policies. Major EV Brands delivered solid November sales. BYD reported record-high monthly NEV PV sales of 504k units, +67% YoY, with PHEV continuing to record strong growth. YTD sales reached 3.74mn units, on track to reach 4mn annual sales target. Xpeng (+48% YoY) also recorded solid sales momentum in November. Li Auto delivered 49k units in November, +19% YoY. Xiaomi SU7 delivery exceeded 20k units for the second consecutive month in November, and is on track to achieve 130k annual delivery target in 2024. (for reference only, above mentioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration declined slightly MoM to 48% in the last week of November.2

- Over 2mn applications for Auto trade-in program: The trade-in stimulus has been doubled to Rmb20k (from Rmb10k) per NEV, and Rmb15k (from Rmb7k) per eligible ICEV,3 following central government’s indication that long-term government bonds could be used to fund consumer goods trade-in.4 As of 18 November, the Ministry of Commerce trade-in information platform has received 2mn applications for the auto trade-in subsidy program. The trade-in program till the end of Dec is likely to support an accelerated auto sales growth in December, and the key to watch is whether the trade-in policy will be extended into 2025.

- EU Tariff: Media reported at end-Nov that EU and China are nearing a solution over tariffs on Chinese electric vehicle (EV) imports, but this was later denied by EU officials.5Though uncertainty still prevails, the EU tariff deals present potential upside for China EV market if materializes, as EU is the second largest EV market globally.

- Battery material costs stabilized after substantial decline: China’s Battery grade lithium carbonate price was Rmb78.7k/ton as of end-November, -0.9% wow, -46%/-23%/-27%/-3% vs. average of 4Q23/1Q24/2Q24/3Q24.6. Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- Ningbo Tuopu Group recorded +20% gain in November, a positive contributor to the ETF. The solid performance is bolstered by 1) strong China EV sales momentum; 2) popularity of the humanoid robot theme throughout the month. Tuopu Group is a leading Chinese chassis supplier with a well diversified customer base including Tesla, Seres AITO, and Xiaomi. The company reported solid 3Q24 results at end-October with Rmb7.1bn in revenue (+43% YoY), and Rmb778mn in net profit (+55% YoY).

- Shenzhen Inovance recorded +9% gain in November, a positive contributor to the ETF. The company disclosed industrial automation segment orders were up 10% YoY in Nov, driven by growth in electric construction machinery, wind power, process industries, and air conditioners, among others. Inovance continues to outperform peers thanks to technological strength. Overseas expansion presents further opportunities for the company.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program, together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X Hang Seng TECH ETF (2837 HK)

Industry Update

Global X Hang Seng Tech ETF (2837 HK) recorded -3% return in November. Major internet companies reported 3Q results, mostly with in-line revenue and better-than-expected profits. With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiments that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

- NetEase recorded +9% gain in November, a key contributor to the ETF. The company reported better-than-feared 3Q24 results in November as driven by strength in PC gaming revenue helped by the return of Blizzard games. With YTD return of -5% (vs +16% for HS Tech), NetEase’s share price could have priced in mobile game softness and several unsatisfactory new games performance YTD. With a solid pipeline ahead, NetEase’s fundamental could have bottomed in 3Q24.

- Kuaishou recorded +5% gain in November. A key contributor to the ETF. The company reported in-line 3Q24 results in November, with revenue up +11% YoY and adj. net profit up +24% YoY. Kuaishou recorded continued external ads strength driven by mini-drama demands, adtech and user conversion enhancement. User engagement remained robust with over 400mn DAUs, and GMV growth remains at mid-teens YoY. AI applications bring upside potentials for the company.

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China.

Global X China Clean Energy ETF (2809 HK)

Industry Update

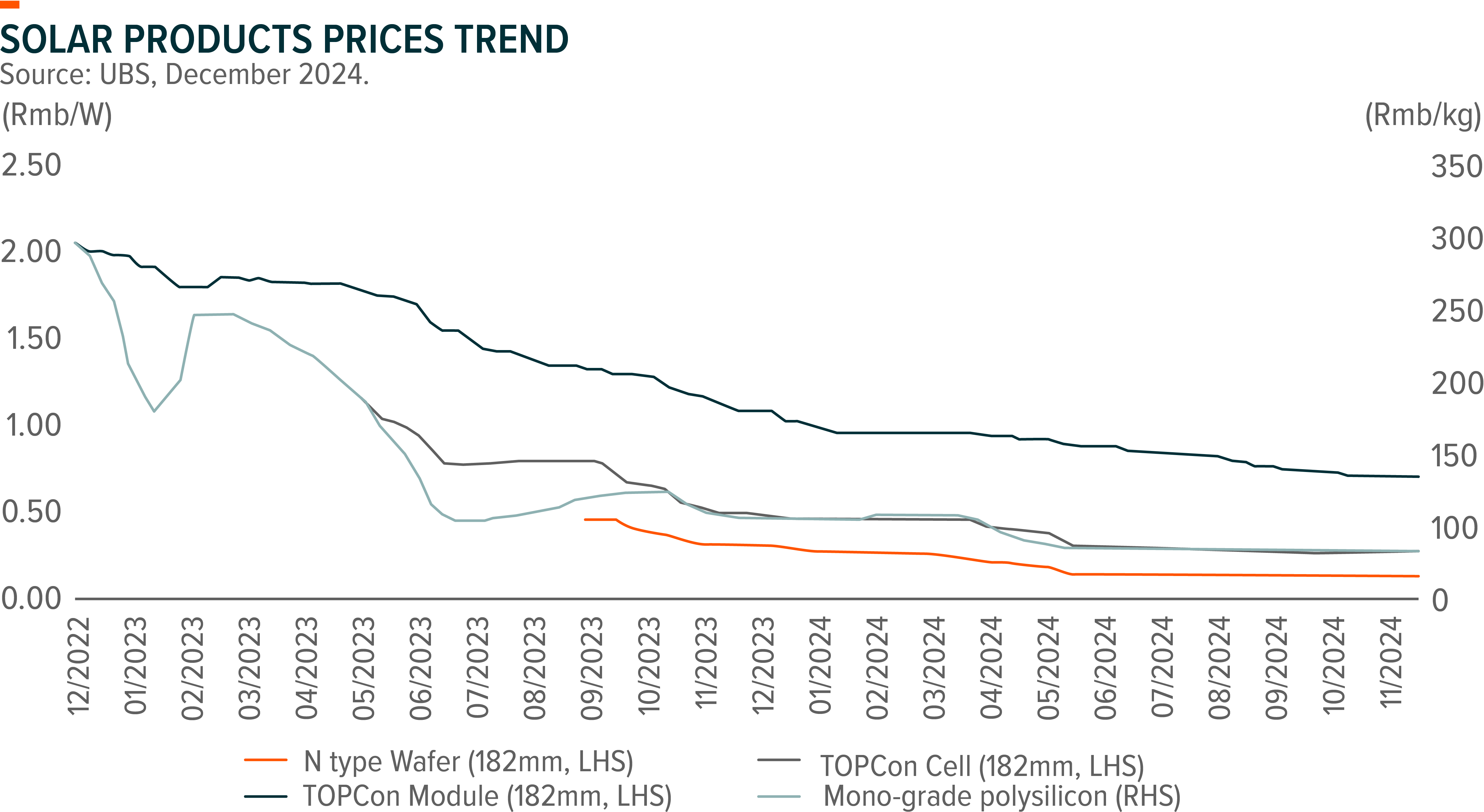

China solar installation remained on track in October, adding another 20GW vs 20.9GW in September, sending 10M24 the total solar installation to 181GW, +27%yoy. Global solar demand outlook in 2025 remains resilient from channel feedback. New policies have been drafted by China Ministry of Industry and Information Technology to force the inefficient electricity-consumption capacities exit and push the consolidation/production cut from a top-down perspective. The latest quarterly results of the major solar companies also showed the loss narrowed down or even slightly positive earnings, which implies the worst time is behind although the oversupply and excessive competition issues would last for a while. Should global demand increase by extra 20~30%, we may see substantial fundamental changes in solar value chain.

China wind installation is also accelerating in October by adding 6.8GW vs 5.5GW in September, sending 10M24 accumulated wind installation to 45.8GW, +22.8%yoy. China’s grid infrastructure investment as of 10M24 ended at Rmb450bn, +20.7%yoy. Power grid capex is strong as expected to better utilize the renewables generation in the near future.

Stock Comments

- NAURA Technology: Company is the key beneficiary from high-end equipment import substitution. Naura is increasing their exposure in solar cell business.

- Ming Yang Smart Energy Group: We have seen wind exports and China offshore wind installation are accelerating recently. It is reportedly there could be production cut in wind industry, similar as other sectors.

- Sungrow Power Supply: The company has relatively larger ESS exposure to the US market which is beneath the overhang of Trump tariff on China imported products. In fact, company delivered solid 3Q24 earning results.

Preview

We remain constructive on the global clean energy growth and the trend of energy transition, just worried about the near-term broad mismatch between supply and demand. The current policies on production cut may only help setting a floor price of ~Rmb68cents/w for solar modules, which allows most of the major players not bleeding in terms of average cash cost. It is not sufficient for substantial profitability improvement, despite the worst time behind. We believe, it still needs time to get out of the woods.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

October 2024 total retail sales growth was 4.8% YoY (vs +3.2% YoY in Sep 2024), beating BBG/Wind consensus of 3.8%/3.9% YoY. Growth of cosmetics outgrew other categories, with 40.1% YoY on earlier start of Double-11. Within staples, food/beverage/liquor & tobacco retail sales grew by 10.1%/-0.9%/flat YoY. Within discretionary, home appliances continued to deliver a strong growth of +39.2% YoY, improving from +20.5%/+3.4% YoY in September/August. 2024 Double-11 total GMV (ex-live streaming) was up 20% YoY, driven mainly by: 1) longer promotion period (29 days this year, vs 19 days last year); 2) deeper discount level (supported by subsidy from government, brands and platforms).

Stock Comments

- Pop Mart (9992 HK): Pop Mart achieved a 30% return in November. Pop Mart’s global expansion is extending the duration of rapid growth. Overseas store productivity is rising despite the rapid pace of openings and severe product shortages – a sign the growth ceiling is far off. Pop Mart is likely the first homegrown Chinese consumer brand to achieve significant global success by attracting consumers via IP, design and products, rather than pricing. Having a global market will make the popularity of its IP and products last much longer than if it operated only in China. Thus, this should mitigate investor concerns that many consumption trends in China tend to be short-lived.

- Yum China (YUMC US): Yum China recorded 8% return in November. Yum China 3Q24 results surprised on margins. Company’s key initiatives, “Project Fresh Eye”, “Project Red Eye” and automation systems effectively drove the margin beat in 3Q24, and as management cited, these cost benefits are sustainable long term. Near-term SSSG could remain volatile, but should turn positive in 4Q24 before a more consistent uptick in YoY tends in 2025. Shareholder return plan for 2024-2026 increased from US$3bn to US$4.5bn.

- H World (HTHT US): H World experienced 11% loss in November. Adjusted EBITDA was Rmb2,113mn (-9% YoY), roughly in line with consensus. Blended RevPAR from China declined 8%, slightly better than the industry’s -9% and Atour’s -10.5%. Hotel openings were a significant beat, with a record 774 gross openings in 3Q24. 4Q24 revenue growth guidance of +3% YoY for China implies full-year 2024 revenue growth of 7-8% YoY, lower than the 8-12% growth guidance back in August.

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer. Looking into 2025, we expect that the government will gradually announce more consumer-related stimulus policies with potential surprises from: 1) an extension of trade-in program with a simplified application procedure and an expanded range of categories; 2) an acceleration of government-related spending due to the issuance of specialty bonds to relieve local government debt pressures; 3) a more favourable regulatory environment for the service industry given its importance in job creation, which is critical to elevate consumers’ income expectations and boost consumer confidence; 4) cash coupons for general consumer goods & services. However, the path of policy roll-out remains unclear. Therefore, we expect that more time will be needed before fundamentals improve under the current policy setup. Key events to watch include the Politburo meeting and Central Economic Work Conference in Dec 24, as well as the Two Sessions in March 25.

Global X China Robotics and AI ETF (2807 HK)

Industry Update

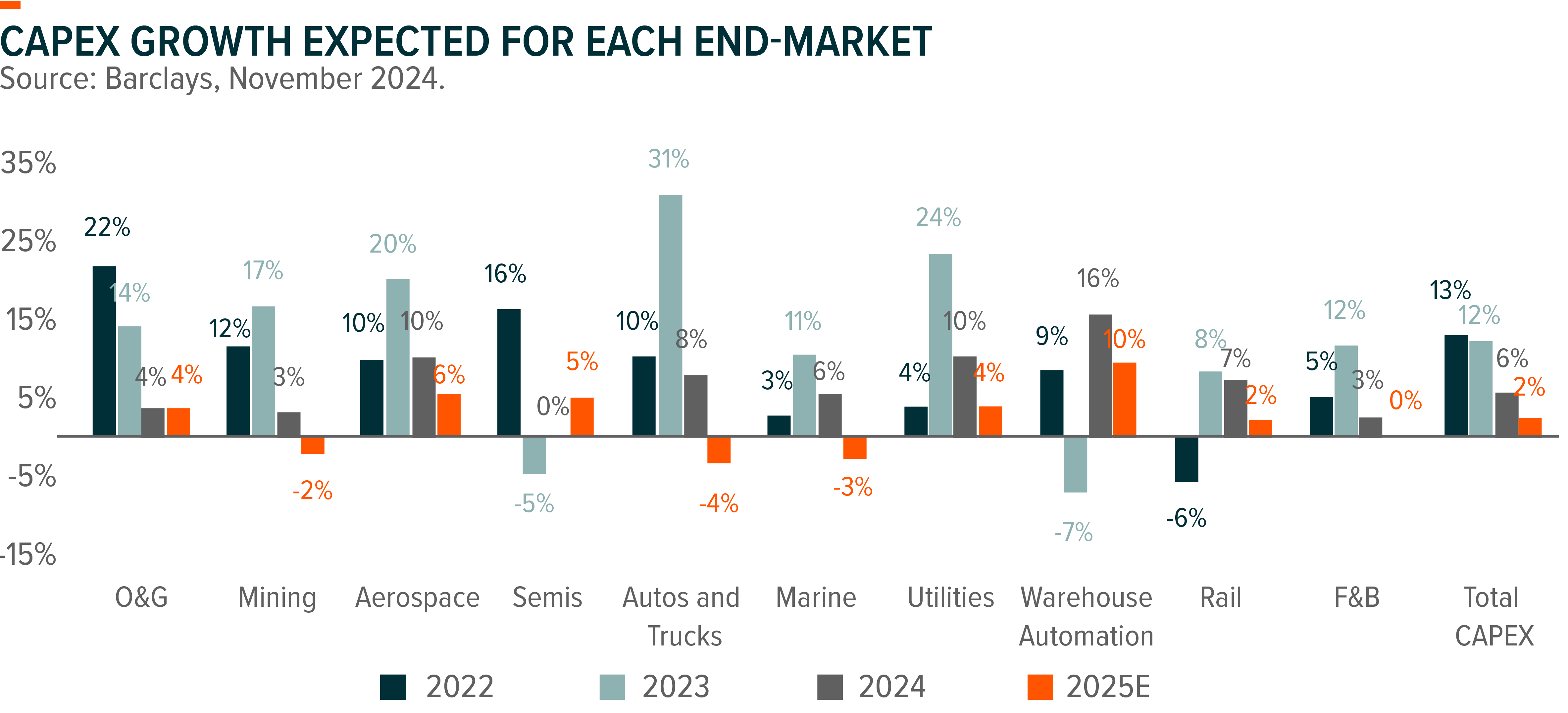

China industrial automation is one of the few sectors in which Chinese companies still have great room to grow and generally, market share remains low. The sector benefits from import substitution and downstream industry dynamics changes from a long-term perspective. As a matter of fact, Japan accounted for 6.28% of China’s total imports in 2022, in which machinery and automation related products contributed to 10+%. Both numbers for Germany are roughly 5%. The foreign brands also have a large share of local production in China. When we look at the downstream demand breakdown, competition landscape of global automation market continues changing, as with other industries dynamics changes, e.g. autos, renewables, construction machinery, shipbuilding, etc., where Chinese companies are playing an increasingly important role. It is easier for Chinese automation producers to make a breakthrough into new business segment. Additionally, China government has been accelerating the policy guidelines in increasing automation, robotics and cutting-edge machinery production to mitigate the negative impact of aging labor issues. The sector also benefits from the ongoing large-scale equipment replacement cycle in 2025.

Stock Comments

- SIASUN Robot & Automation: Company benefits the recent supportive policies on humanoid robots, coupled with Tesla’s positive tone on their Optimus humanoid robots recently.

- Beijing Kingsoft Office Software: Stock went up due as market expect accelerated office software localization pace into 2025, as Chinese government policy pivot since late Sep seems to tackle local gov debt issues which should lead to potential improvement in local gov financials and increasing IT spending.

- Zhongji Innolight: Company’s order inflows remained on track, and stock rallied a lot during China rally. Investors may just take profits recently.

Preview

The Chinese government’s stimulus measures launched in late September, along with the “large-sized replacement program”, are starting to translate into improved enterprise confidence and the initiation of new projects. We have seen some early signs of stabilizing pricing trend and demand bottom-out. We remain positive on the long-term trend of China industrial automation market growth. Domestic manufacturers continue gaining market share on the back of customized products across emerging industries, fast delivery and advanced post-sale services, while foreign brands keep losing market share in China.

Global X China Semiconductor ETF (3191 HK)

Stock Comments

- SMIC +3.65%: Domestic foundry utilization continues to recover on restocking orders. Market turn more positive on China semiconductor demand after the government announced stimulus package. SMIC has projected a 13-15% Q/Q revenue growth for 3Q24. 3Q gross margin guidance of 18-20% exceeds expectations, due to rising ASP, given a higher 12-inch wafer shipment mix.

- AMEC +15.37%: 3Q result was a miss but management provided positive outlook for 2025. 3Q24 revenue reached Rmb2,059mn, up 12% Q/Q and up 36% Y/Y. Backlog in 2024 will be Rmb11-13bn. 2025 backlog is expected to grow further as the management team expects 2025 foundry capex to enjoy 10%+ growth, along with market share gain in China.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024. (Mirae 2024)

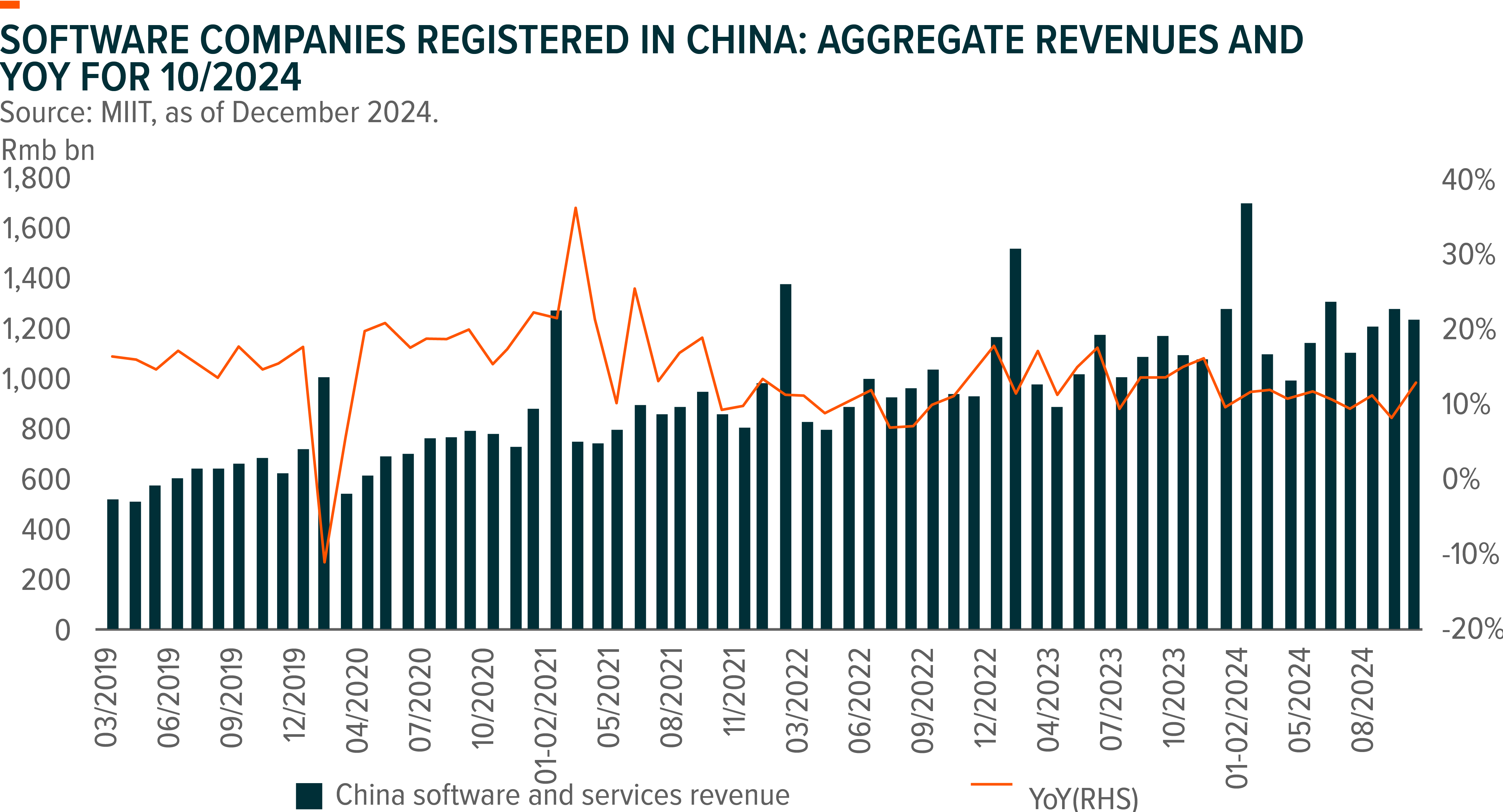

Global X China Cloud Computing ETF (2826 HK)

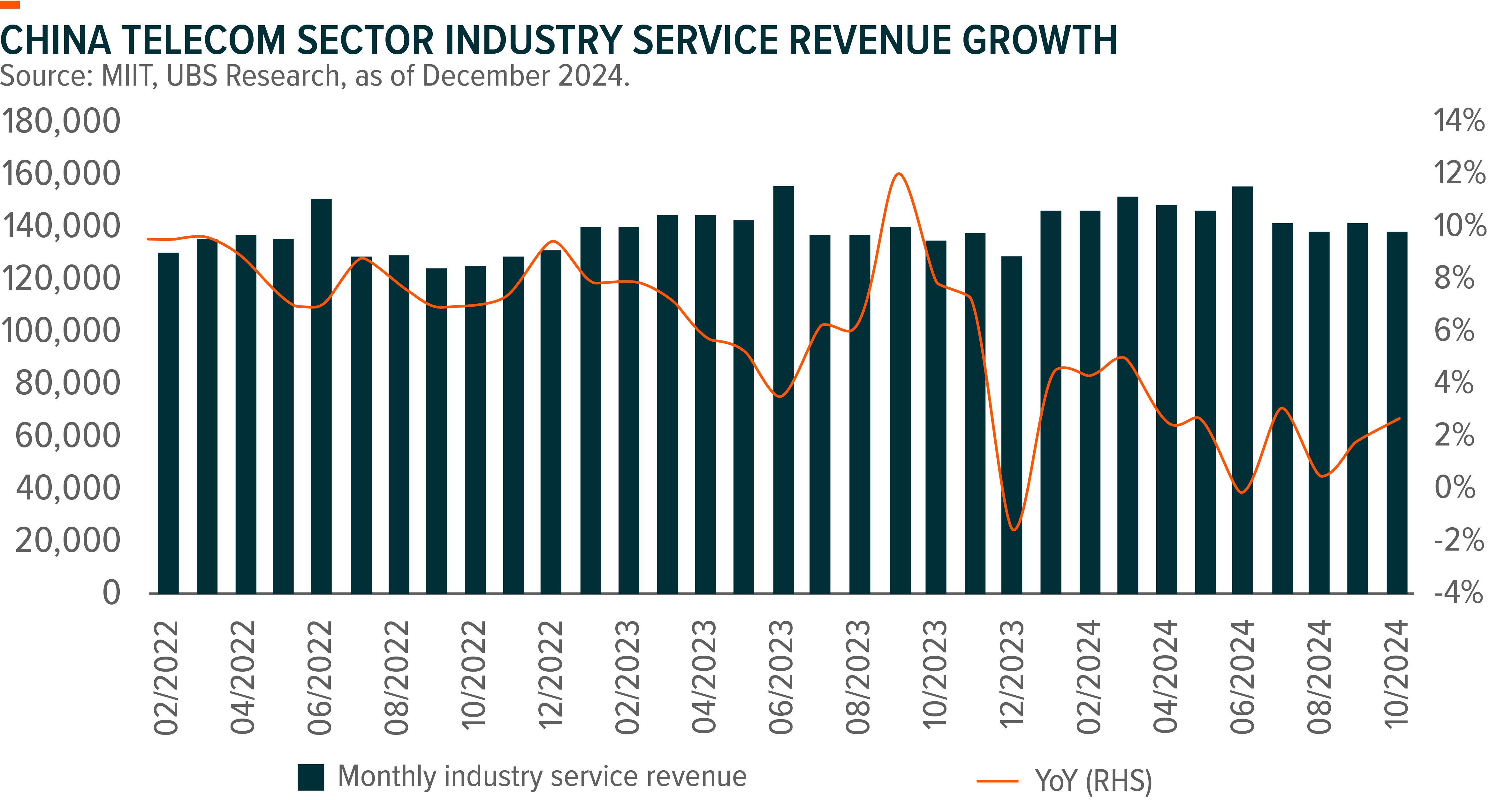

- China software industry growth in October recovered to 12.7% YoY (vs. September at +8.2% YoY), up from last month, leading aggregate 10M24 revenues +11.0% YoY (vs. 10M23 at 13.7% YoY and 9M24 at 10.8% YoY). In October, aggregate net income of software companies registered in China was Rmb174bn (US$25bn), net margin was 14.1% (vs. 10.9% in September), resulting in 10M24 net margin of 12.1%, higher than 9M24 net margin of 11.8%, per MIIT.

- In October 2024, telecom industry service revenue increased by 2.6% YoY, slightly recovered from +1.8% YoY in Q324 / +1.6% in Q224, but remained soft amid macro headwinds. Mobile data revenue and fixed data revenue were up 1.7% and 5.2% YoY respectively, vs. +2.0% / +1.1% YoY in Sept. Traditional telecom service revenue increased by 2.1% YoY in Oct, vs. +0.8% in Q324 / -1.1% Q224. Value-added service revenue grew 4.2%, further decelerating vs. +5.0% in Q324 / +10.6% in Q224.

Stock Comments

- Hithink RoyalFlush Information Network: A key beneficiary of substantial increase in A-share market turnover in recent month. The company has a sound user base, covering over 90% of securities houses in China. As of 1H24, it had 19.21mn weekly active users (WAU).

- Beijing Kingsoft Office Software: Stock went up due as market expects accelerated office software localization into 2025, as Chinese gov’s policy pivot since late Sep seems to tackle local gov debt issues which should lead to potential improvement in local gov’s financials and increasing IT spending.

- Alibaba: 2QFY25 results slightly missed consensus expectation due to slower CMR growth and widened gap between core commerce topline and EBITA growth. The company commented on continuous investments in user experience and merchant support which should weight on margins.

- Tsinghua Tongfang: Profit taking post a strong share price rally in late-Sep 2024.

Preview

We expect the industry growth takes time to return to 2023 level (avg. at 13%) given the demand stabilization and lower receivables days are yet to prove. November SMB PMI recovered to 49.1 (vs. 47.5 on avg. in Aug to Oct, 2024), while expect specific segments to benefit first (1) client IT spending priorities (ERP, EDA, AI), and (2) segments exposed to supportive policies, ahead of recovery of broader IT spending.

Global X China Little Giant ETF (2815 HK)

Industry Update

Following a sharp rally in September and resilient performance in October, Global X China Little Giant ETF recorded -1% return in November. In the current volatile market environment, small- and medium-sized enterprises (SMEs) have shown strong stock performance, particularly those benefiting from government support. Post US election, to mitigate the impact of rising US tariffs on China economy, Beijing would be likely to scale-up fiscal stimulus. The resurgence of trade tensions might reinforce the top leadership’s commitment to enhancing supply chain upgrades and achieving self-sufficiency. President Xi’s earlier remarks in October also underscored importance of science and technology in advancing China’s modernization. Therefore, these specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development. Moreover, as a high-quality, small-cap fund, Global X China Little Giant ETF is likely to benefit more than large-cap funds if the economy turns to strong recovery in 2025.

Stock Comments

TFC declined in Nov likely due to 3Q24 result’s 2% q-q revenue growth. The q-q slowdown in revenue growth was likely due to the optical chip shortage, which has been a key issue for the optical transceiver sector. Potential rise of Ethernet/Non-Nvdia market share is another concern of the market

We think this is a near term concern, TFC will continue to benefit from strong demand in the 1.6T transceiver product cycle, as a key supplier for NVIDIA (Mellanox). And in the future,it will be one of the key beneficiary from co-packaged optics (CPO), which have higher entry barriers.

Rrising penetration of SiPh (silicon photonics) and CPO may be a medium- to long-term concern, as these technologies may reduce the demand for certain optical components, such as ceramic sleeves. Meanwhile, the company’s core products such as FAU (fiber array units) may still enjoy solid demand and high entry barriers in the CPO value chain. We see strong growth for the FAU segment next two years, Meanwhile, if there are any acceleration in CPO commercialization timeline, we think there will be more earnings upside for this product line.

Preview

Main outperformers come from smaller stocks (Chengdu CORPRO Technology, Fujian Torch Electron, Harbin Boshi Automation, Sichuan Injet Electric, etc.). We see mid cap tech related stocks outperformed market as policy focus on technology upgrade and self-reliant themes. This moment could continue if market sentiment and liquidity remain accommodative.