Implications of the US IRA on China’s Battery Supply Chain

The US has just passed the Inflation Reduction Act (IRA) in August 2022, with a large part of the spending going into building the domestic battery supply chain. We think the market is overly concerned about the US IRA’s impact on Chinese battery companies. However, we believe the total amount which the US government is set to spend, US$4 billion per annum over the next ten years1, falls short of the amount required to establish its own supply chain. In comparison, the Chinese government is expected to spend around US$16 billion on electric vehicle (EV) subsidies alone in 2022.2

The IRA includes a US$369 billion investment in energy security and climate change.3 The most prominent support to the EV and battery industries are the consumer tax credit per vehicle sales and the advanced manufacturing credit for battery cell and module production.

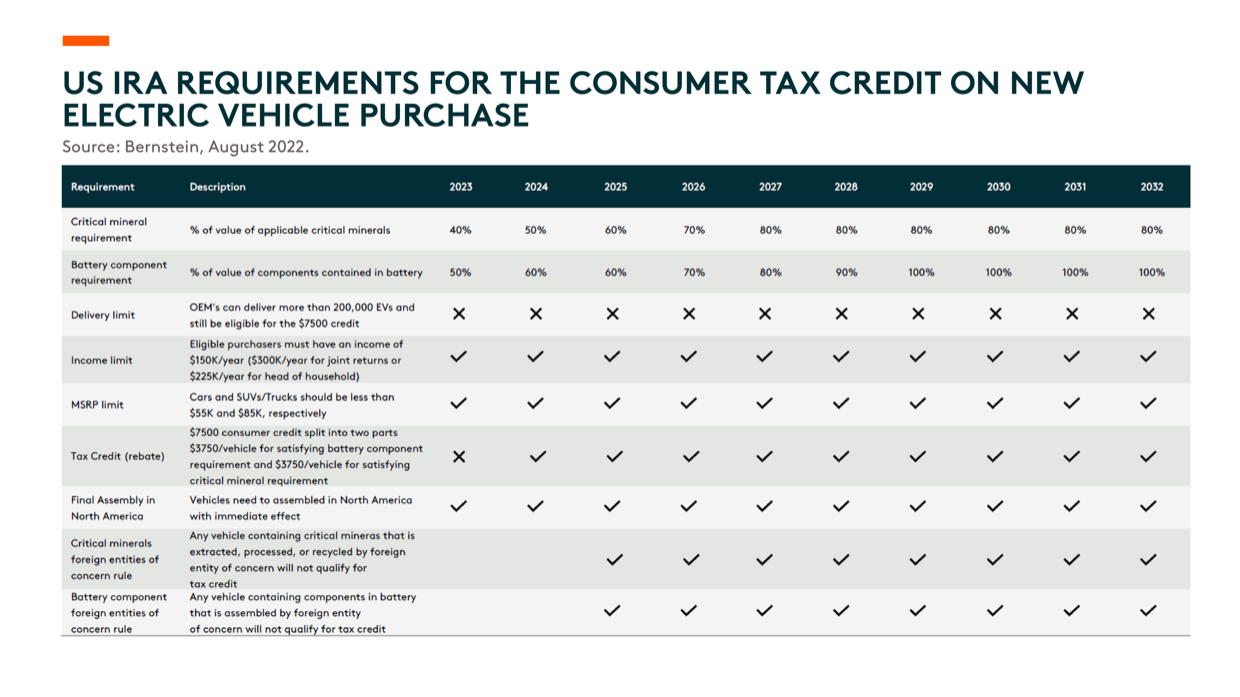

Firstly, on the consumer tax credit, a US$7,500 tax credit is offered for new electric vehicle sales. However, the IRA has specified that the vehicle’s final assembly location must be in the US, and eligibility is limited to specific price caps on the vehicle and income caps on households/individuals. The credit is split into two parts and is subject to meeting 1) a battery components requirement (US$3,750 per vehicle) and 2) a critical minerals requirement (US$3,750 per vehicle). The IRA also allows consumers to receive a tax credit of US$4,000 or 30% of the auto’s price – whichever is less – on the purchase of any used EV where the model is at least two years old. Again, specific price caps and income caps apply. Finally, additional clauses exclude EVs exposed to “foreign entities of concern”. Foreign entities currently include China, Indonesia, India, Russia, and Venezuela, among others, though the entity list can also change over time.

There are multiple layers of restrictions under the consumer tax credit policy that could lower the incentive’s effectiveness, including the North America final assembly requirement, the EV/hybrid purchase price cap, and the maximum household/individual income limits. On the additional clauses, we looked further into the two stricter requirements around critical mineral and battery components and the exclusion of “foreign entities of concern”.

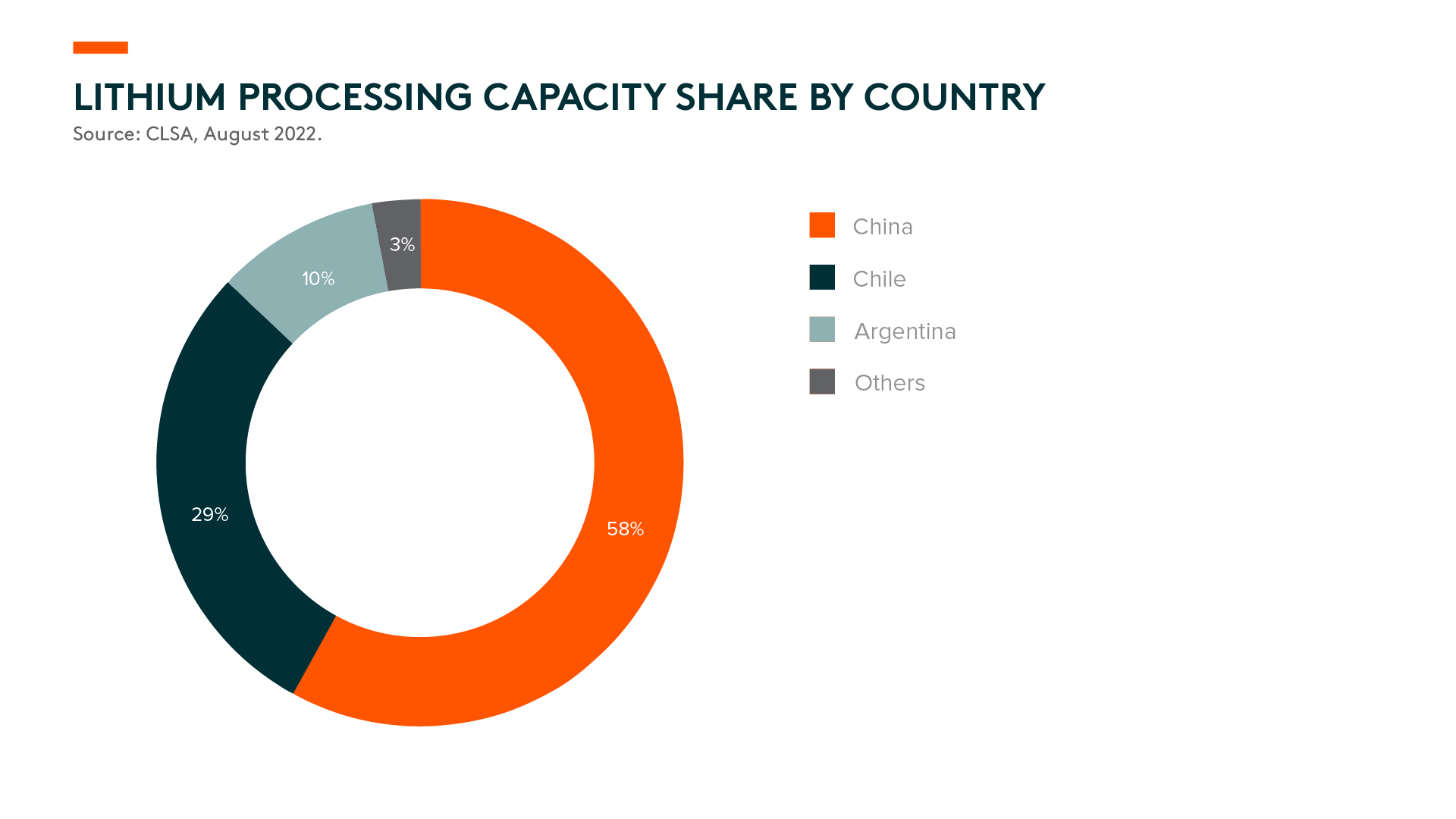

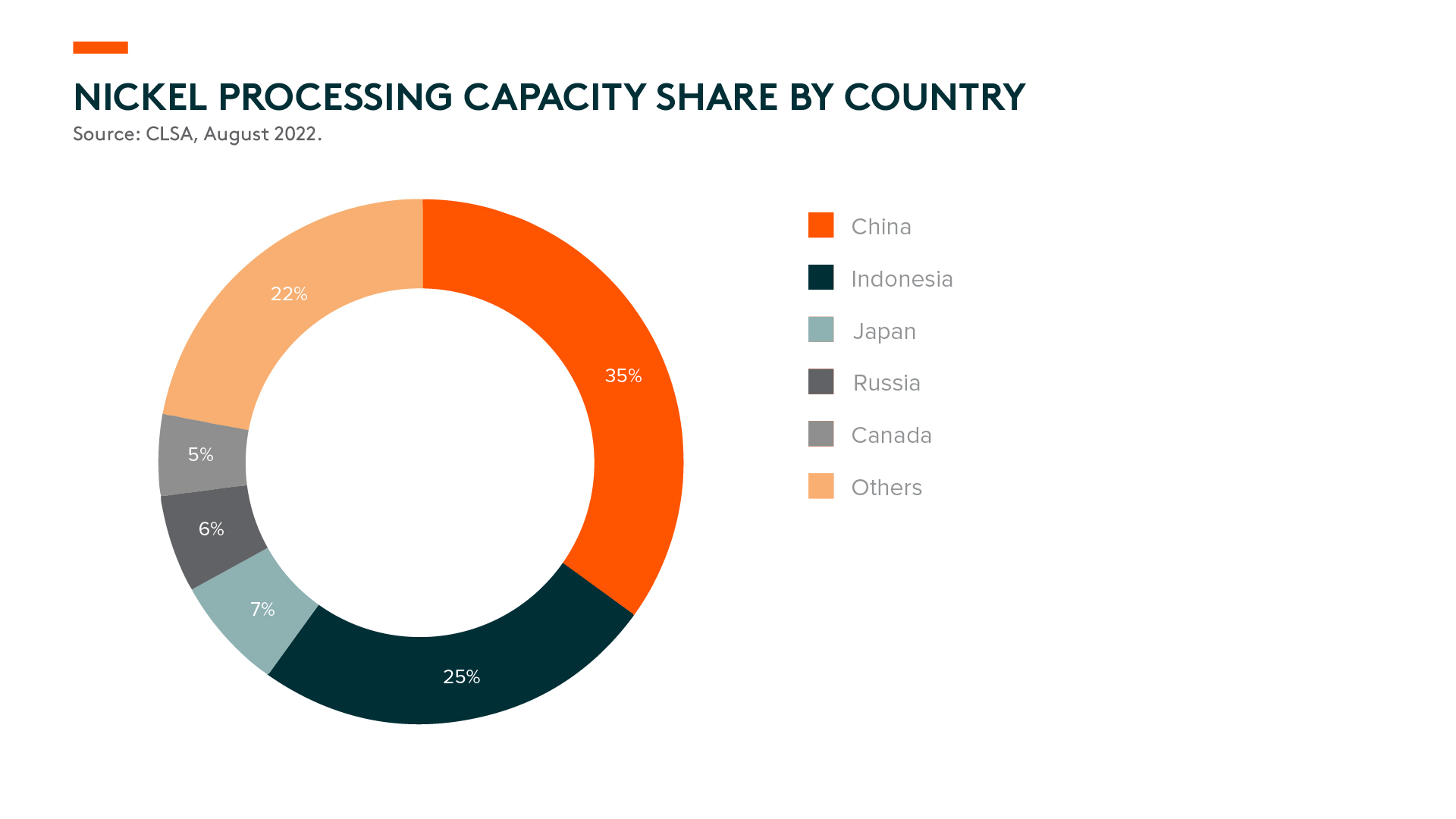

China dominates the mid-stream battery component manufacturing process, which produced over 80% of global anodes, electrolytes, and LFP precursors in 2021.4 Among all battery materials, anode and LFP cathode are the most challenging materials to meet the content requirements. For critical minerals such as lithium and nickel, the core processing capacities are located in China and Indonesia, both of which are considered foreign entities of concern. Many of these capacities could take years to rebuild in other countries.

Even if all the criteria can be met, we need to further assess the magnitude of the consumer tax credit. The overall budget of US$7.5 billion for the US$7,500 consumer tax credit can cover 1-2 million units of new EV/hybrid vehicles.5 The budget coverage looks small compared to the total sales forecast of 43 million EV and hybrid vehicles in the US between 2022 to 2030, or the global total sales forecast of 263 million units over the same period.6 Moreover, the US budget amount looks negligible when we compare it against China’s market. Car purchase tax exemptions in China have already reached US$6 billion (RMB40 billion) in the first seven months of 2022, covering 3.2 million EVs.7 In August, the Chinese government announced that the car purchase tax exemption would be extended to the end of 2023, costing an additional US$14.5 billion (RMB100 billion).8 Thus, we view the incremental impact of the US’s consumer tax credit on new electric vehicles to be mild.

Regarding the advanced manufacturing credit, the bill includes a US$10/kWh credit for battery modules and a US$35/kWh credit for battery cells manufactured in the US, or US$45/kWh for the entire battery. 100% of the credit will be available through 2029, after which it will reduce to 75% in 2030, 50% in 2031, and 25% in 2032. Assuming an average-sized battery pack of 75kWh, this is equivalent to a US$3,375 subsidy per vehicle. At this level, the subsidy looks meaningful compared to the current estimated battery system cost of US$127/kWh.9

Soon after the IRA was announced, several leading EV and battery corporates began plans to increase their investment in the US. For instance, LG Energy Solution and Honda may form a joint venture to invest in 30-40 GWh of battery cell capacity with construction starting next year.10 Toyota announced an investment of ¥730 billion in battery electric vehicle (BEV) batteries in Japan and the US.11 Around ¥350 billion will be invested in Toyota Battery Manufacturing in North Carolina to increase automotive battery production. We believe the IRA could bring forward many corporates’ investment plans, but we don’t expect it to have a material influence on long-term battery capacity investment decisions. If one were to invest in a US battery plant now, the plant might be completed in 2025/26 at the earliest and reach stabilized operations with positive profitability in another 1-2 years. The window for capturing the full manufacturing credit is fairly narrow. Moreover, there are no conditions around Chinese supply chain exclusions. Thus, Chinese upstream and mid-stream companies are likely to join the US supply chain to enjoy the benefit.

Similar to the consumer tax credit policy, we assessed the magnitude of the manufacturing credit. The total production tax credits budget is estimated to be US$30 billion throughout the whole period (including the manufacturing of batteries, solar panels, and wind turbines).12 Even if the entire budget was dedicated to battery manufacturing, though unlikely, the manufacturing credit might support 9 million units of EV sold in the US over the next 10 years, which still looks small compared to the expected total US and global EV and hybrid sales. Comparing the numbers in another way, assuming the US reaches 400GWh of battery capacity by 2025, that would equate to annual tax credits of almost US$20 billion per year, assuming all battery makers are qualified for the full credits.

We expect a mild impact from the consumer tax credit on the US market and the global battery supply chain dynamics. But it’s also the part within the IRA that’s drawn the most public attention and raised market concerns toward Chinese battery players due to the focus on domestic content requirements and the foreign entities of concern. Some might even draw a comparison with the US-China semiconductor trade and ADR listing issue. We think all these concerns are overly pessimistic, and some are irrelevant. Regarding the advanced manufacturing credit, we believe this is a useful tool to direct earlier EV and battery investments in the US. However, the magnitude is small, while Chinese battery players can also enjoy the credit if they decide to invest in the US.

Finally, we would like to highlight that just looking at China’s domestic EV market alone, we already see 7-8 times battery volume growth potential driven by EV sales growth from 3 million units in 2021 to 20 million units in 2030.13 This makes China one of the largest markets globally (40% of global sales14) and is a large enough market for the Chinese EV and battery companies to pursue. As auto is a critical economic contributor, we believe there will be more and more EV and battery industry supporting policies from various countries, aiming to grow and support their own supply chains. However, we see a low chance, and also no signals, of China’s global-leading competitiveness in the battery supply chain being challenged.

To conclude, we believe the US IRA won’t have a meaningful impact on China’s battery supply chain. The magnitude of the credits is insufficient to drive a meaningful shift in the competitive dynamics of the global battery supply chain. Chinese battery companies have ample room for growth ahead, not only in the domestic market, but they’re also well-positioned to capture the global battery demand growth.