The Investment Case for Green Bonds in Asia

The Rise of Green Bonds

In order to achieve the United Nations Sustainable Development Goals (UN SDGs) by 2030, Asia is projected to need investments of up to US$ 1.5 trillion every year1. UN SDG 7 (Affordable and Clean Energy) and UN SDG 13 (Climate Action) are areas that require the most investments, to support the decarbonization of energy systems to meet carbon neutrality goals set by Asian countries like South Korea, China, and India for 2050, 2060, and 2070 respectively.

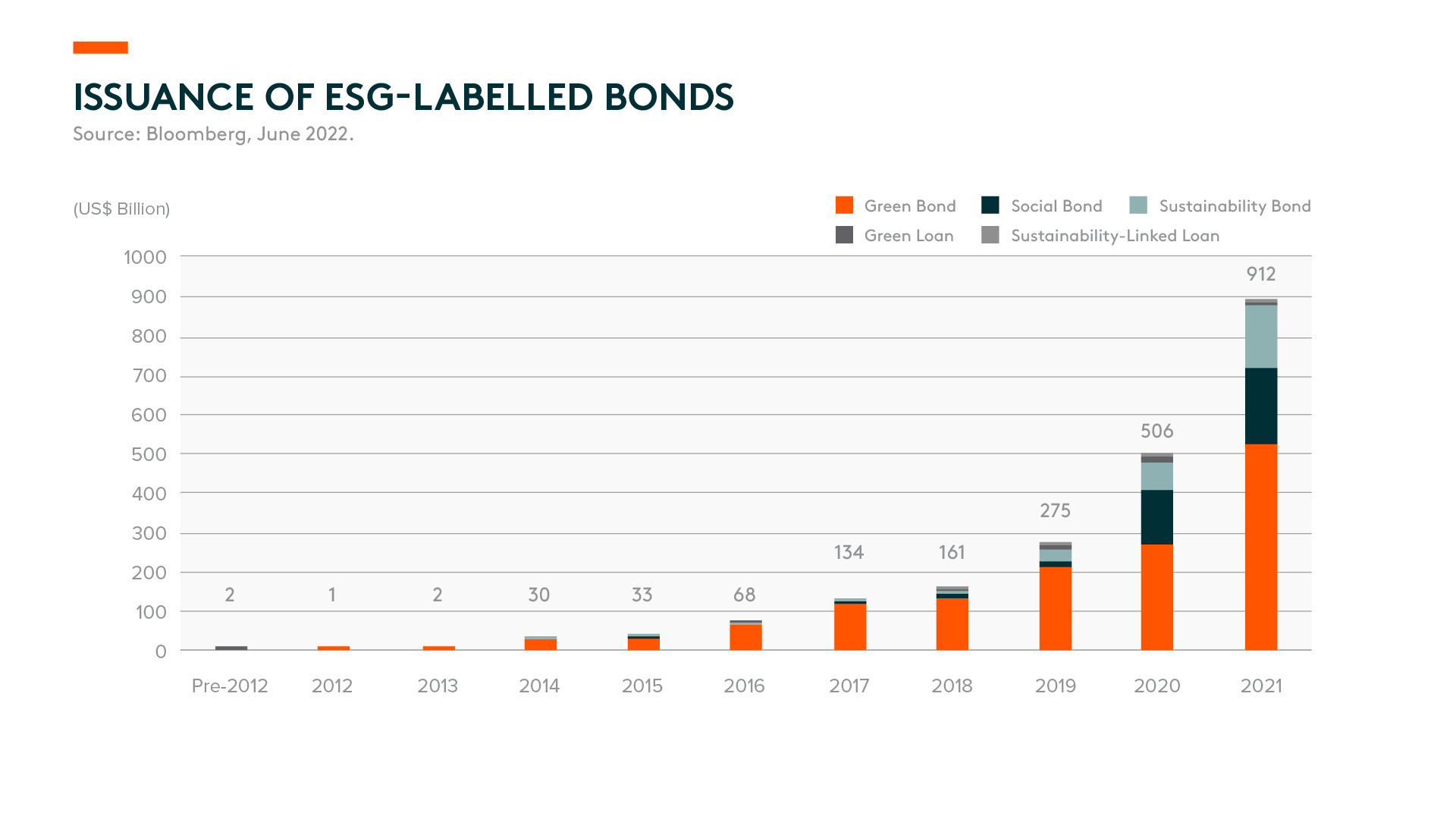

ESG-labelled bonds were introduced to corporate financing in the late 2000s, whereby debt instruments encourage investments based on the issuer’s ability to meet high environmental, social, and governance standards2. Among the different types of ESG-labelled bonds, green bonds particularly grew exponentially throughout the past decade, driven by the prominent need to finance the path to a low-carbon economy.

What are Green Bonds?

The first green bond was issued by European Investment Bank in 2007 when it raised a €600 million Climate Awareness Bond of which proceeds were used for renewable energy and efficient energy projects3. Today the global green bond market stands at US$ 1.4 trillion and green bonds have been issued by different kinds of issuers across different regions4.

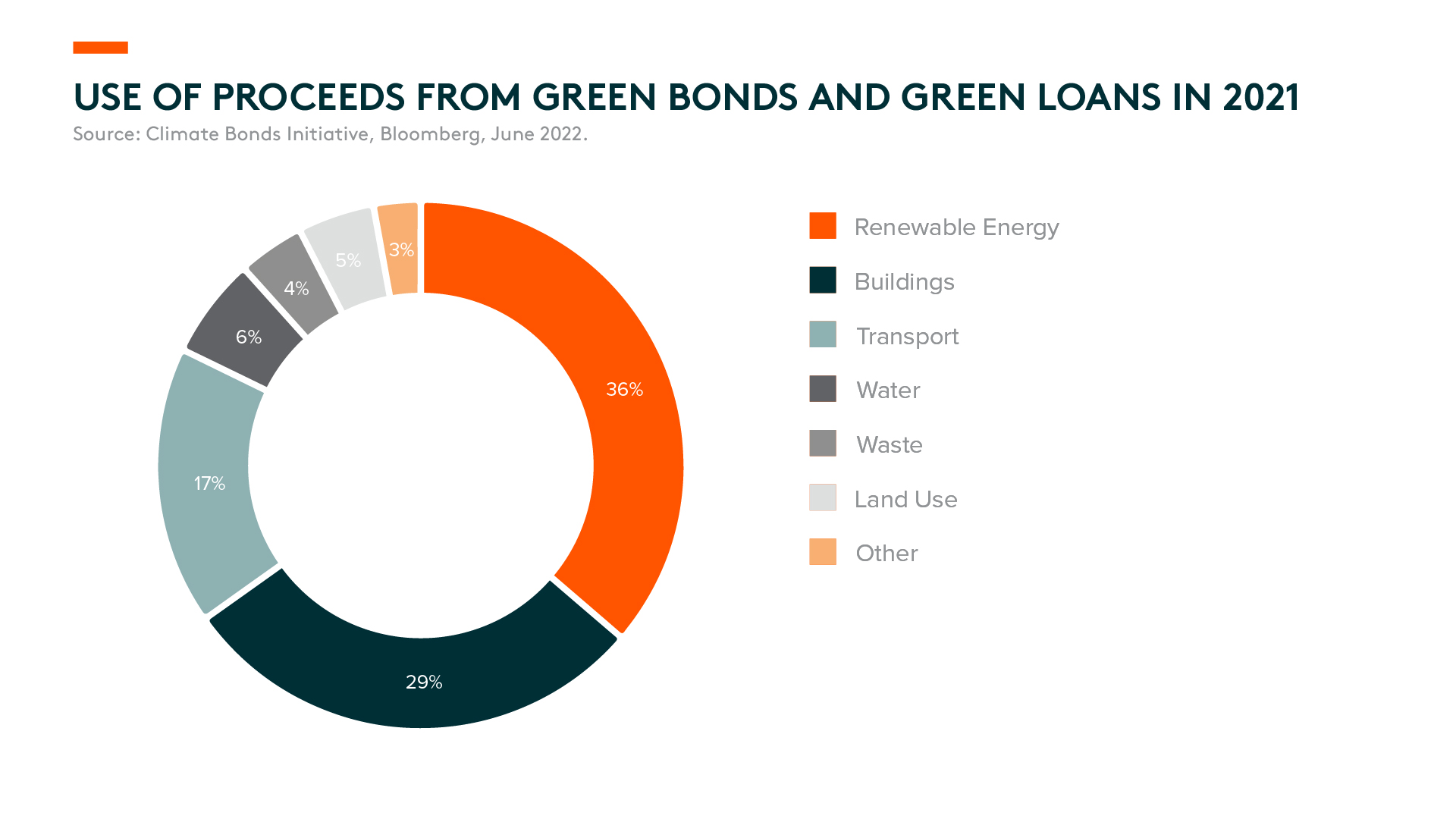

Green bonds are “use of proceeds” bonds where the proceeds raised by issuing a green bond are earmarked for specific environmental projects. Green bonds are governed by the International Capital Market Association (ICMA)’s Green Bond Principles which list the eligible environmental project types, such as renewable energy, energy efficiency, or clean transportation. Renewable energy and green building are popular use of proceeds from green bonds and loans.

Green bonds need to be verified by a third party to certify that the bond will fund projects with direct environmental benefits in order to qualify for a green bond status. Different jurisdictions also have different rules for green bonds. For example, China published its China Green Bond Principles in July 2022, unifying China’s domestic green bond standards with international standards. Issuers of China’s onshore green bonds are now required to allocate 100% use of proceeds to eligible green projects, and for foreign issuers, the scope of eligible green projects can be based on the EU Taxonomy or the EU-China Common Ground Taxonomy5.

The Advantages of Investing in Green Bonds

The premium on green bonds also referred to as “greenium”, is the spread of a green bond to a conventional (“non-green”) bond from the same issuer of the same seniority. Green bonds and conventional bonds are typically structured similarly to be senior unsecured, thus greenium should be zero. However, greenium has been observed to be on average structurally negative, over time and across different markets. This is because green bonds are in higher demand; regular investors can buy both conventional and green bonds, whereas green bond investors can only buy green bonds. This helps reduce the cost of funding for projects with direct environmental benefits6.

In addition, issuers who issue green or other ESG-labelled bonds for the first time tend to have a “halo effect” – at the time of the issuance of the first green bond, all other bonds from the issuer seem to also outperform the market7. Given that ESG-focused investors are not all restricted to ESG-labelled bonds only, the issuer’s green bond issuance may attract ESG-focused investors to invest in the issuer’s non-ESG-labelled bonds as well.

Moreover, green bonds often come with monetary incentives such as tax exemption and subsidies, either to the issuer or the investor, thanks to national green bond policies. For example, to support the issuance of green and sustainable debt instruments in Hong Kong, the HKMA issued a Green and Sustainable Finance Grant Scheme (GSF Grant Scheme) in 2021. The GSF Grant Scheme provides subsidies for eligible bond issuers and loan borrowers to cover their bond issuance and external review expenses8. Furthermore, in some countries, bond investors do not have to pay income tax on interest from the green bonds they hold; such types of tax incentives are typically applied to municipal green bonds in US markets9.

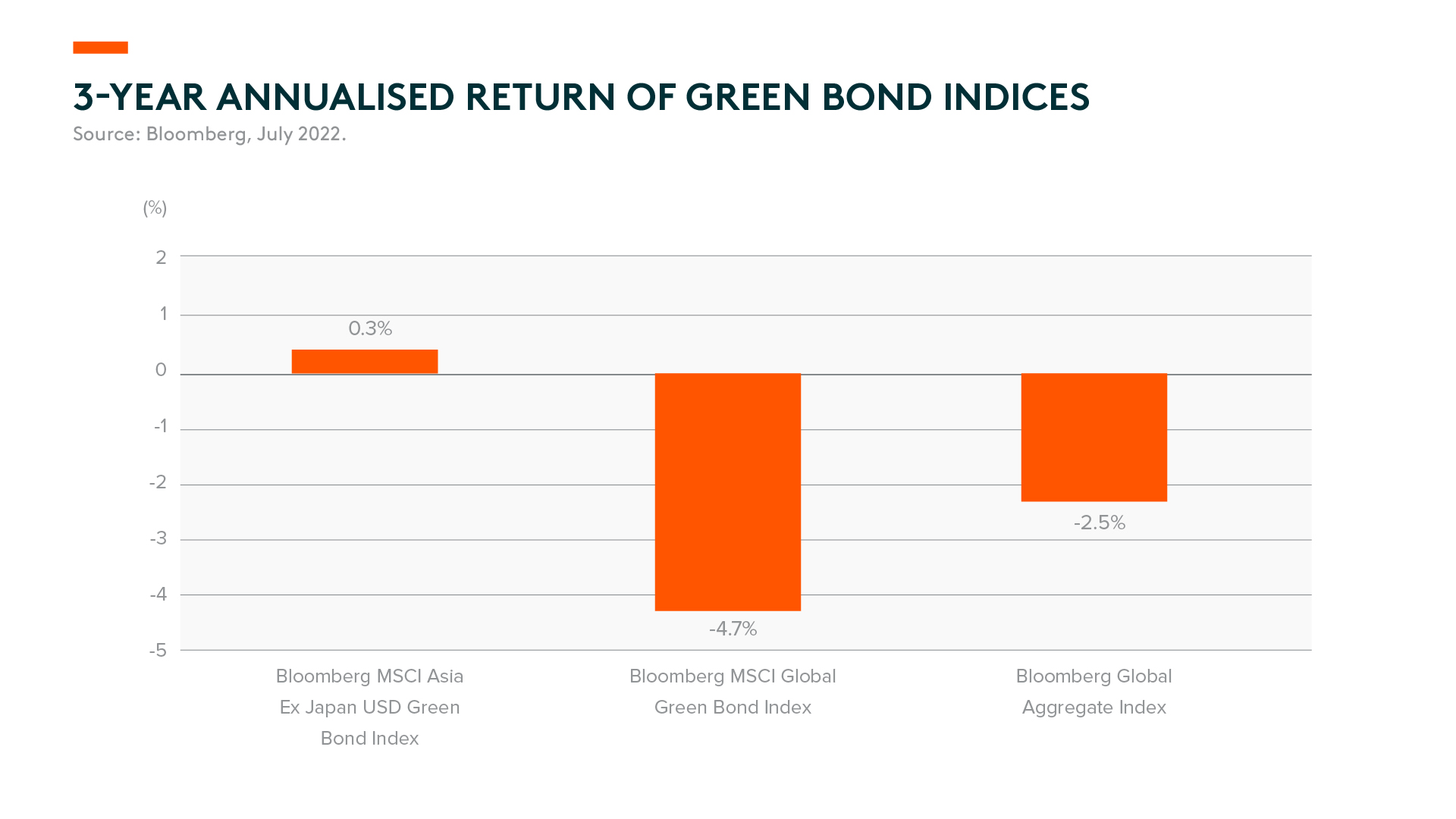

In Asia, green bonds have demonstrated the potential to outperform global counterparts and other major fixed income asset classes10. During times of market turbulence, such as the COVID-19 pandemic and quantitative tightening in early 2022, Asia green bonds have also demonstrated stronger market resilience with lower levels of volatility.

Introduction to the Global X Bloomberg MSCI Asia ex Japan Green Bond ETF

The Global X Bloomberg MSCI Asia ex Japan Green Bond ETF invests in a diversified portfolio of high-quality green bonds issued by governments, supranational organizations and corporates in the Asia region. The fund applies a rigorous screening process to ensure constituents meet ICMA Green Bond Principles and thus capital is allocated to fund projects with direct environmental benefits.

An example of a bond issuer within the portfolio is the MTR Corporation (MTR). MTR is considered a pioneer in green finance in Hong Kong, has set up a Green Bond Framework in 2016 that aligned with the ICMA Green Bond Principles. MTR’s sustainable finance transactions are primarily targeted toward the development of sustainable urban infrastructure through improving the energy efficiency of train lines and infrastructure, building sustainable train stations, etc. The use of proceeds for MTR’s 9 projects in 2020, which were allocated green financing, contributed to the avoidance of more than 15,000 tonnes of carbon emissions in total11.