Important Information

Global X Asia Semiconductor ETF (3119)

Global X Metaverse Theme Active ETF (3006)

Global X China Cloud Computing ETF (2826)

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Metaverse Theme Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which engage in activities relating to or provide products, services or technologies that enable the development and operation of the Metaverse.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the Metaverse Business, which may experience relatively higher volatility in price performance when compared to other economic sectors.

- The Metaverse is a new theme. The values of the companies involved in the Metaverse Business may not be a direct reflection of their connection to the Metaverse, and may be based on other business operations. The Metaverse may not exist on a scale that provides identifiable economic benefit to many or all of the companies involved in the Metaverse Business.

- The performance of the Fund may be exposed to risks associated with different sectors and themes, including industrial, consumer discretionary, financial, information technology, robotics and artificial intelligence, semiconductor, video games and e-sports, communication services, entertainment as well as technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Implications and Opportunities of AI

Listen

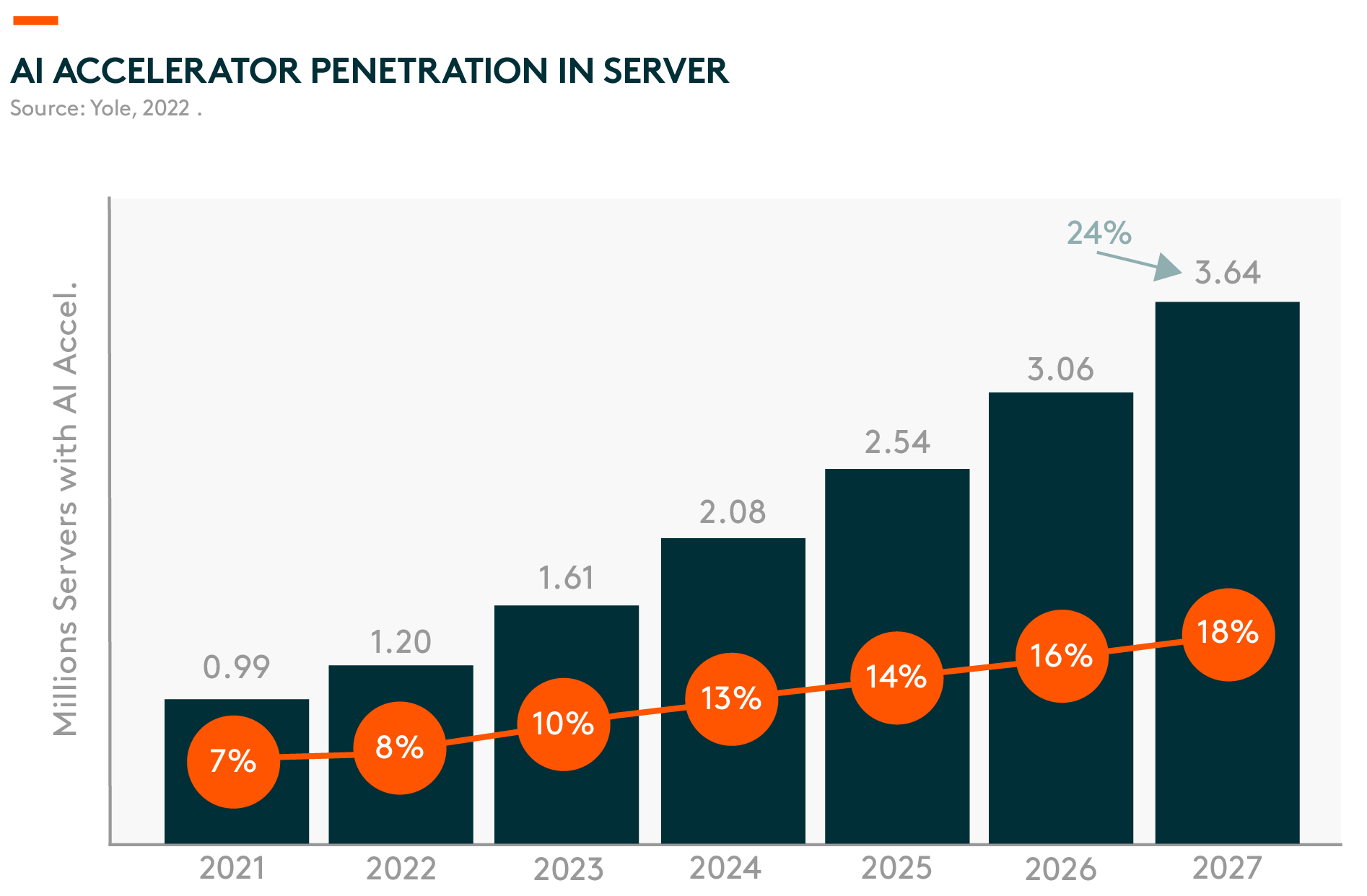

The success story of ChatGPT’s commercialization led to great expectations that artificial intelligence (AI) technology will create lucrative new business models and nurture lots of new tech companies. Meanwhile, its development will need lots of semiconductors. For reference, AI accelerator penetration is expected to grow at a compound annual growth rate (CAGR) of 24% between 2021 and 2027 1. This will benefit Asia and China’s high-performance computing-related semiconductor supply chains.

The Global X Asia Semiconductor ETF (3119) and Global X Metaverse Theme Active ETF (3006) hold several relevant hardware, services, and semiconductor names that will thrive on the development of generative AI technology. Additionally, the Global X China Cloud Computing ETF (2826) holds software and platform companies which are relevant to and will thrive on the development of generative AI technology.

Q: What is Generative AI?

Generative AI describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, videos, etc. ChatGPT is the latest natural language model launched by OpenAI and trained on Microsoft Azure’s supercomputing infrastructure. The model is trained using Reinforcement Learning from Human Feedback (RLHF). ChatGPT is tuned from a model in the GPT-3.5 series, which finished training in early 2022.

Q: What Potential Business Models Could Spawn from Generative AI?

1. Support other products built on an application programming interface (API): Companies which own large AI models can provide API services for other companies to build software/applications on top of its model and cloud services. Currently, services are priced per word/image. For example, a high-resolution image output of 1024×1024 pixels generated by DALL.E (Open AI’s image model) costs $0.02/image 2.

Hyperscale cloud service providers all offer different versions of AI capabilities. For example, Google Cloud and Amazon’s cloud both provide AI capabilities as API services. Differentiating factors will be in the type of tasks and capabilities of the model itself. As a result, there are ample opportunities for companies to innovate with access to large AI models via API.

It’s likely that GPT models can be leveraged by metaverse builders to help generate content and write code. More specifically, GPT can produce interactive features and representations of virtual settings within metaverse worlds and provide more immersive experiences to users if specifically trained for virtual settings.

2. Search: Google works by crawling billions of web pages, indexing that content, and then ranking it in order of the most relevant answers. It then spits out a list of links for the user to click through. ChatGPT offers a single answer based on its own search and synthesis of that information. OpenAI is working on a system called WebGPT, which it hopes will lead to a more accurate answer to search queries and also include source citations.

Q: How Advanced Are China’s AI Capabilities Compared to Developed Markets Like the US?

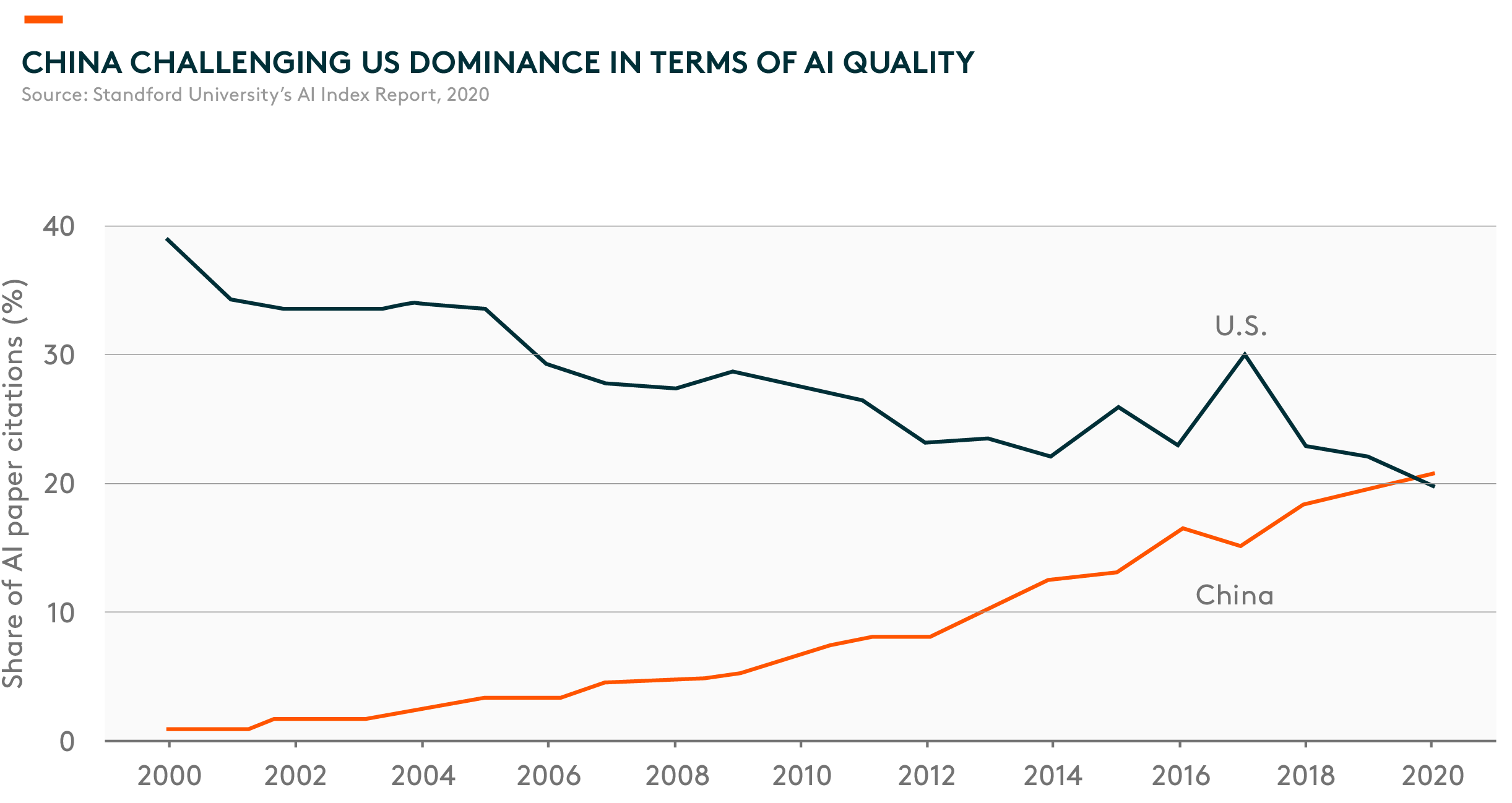

In the past decade, China has built a solid foundation to support its AI economy and made significant contributions to AI globally. China ranks number one in terms of the total number of AI-related research papers. AI research often leads to real-world applications, which we’ve seen rapid growth in China. According to Nikkei Asia, China produced 43,000 AI papers in 2021, roughly twice as many as the US, and contributed to one-third of AI journal papers worldwide 3. According to Stanford University’s AI Index Report (2020), China has also surpassed the US regarding the share of AI paper citations 4.

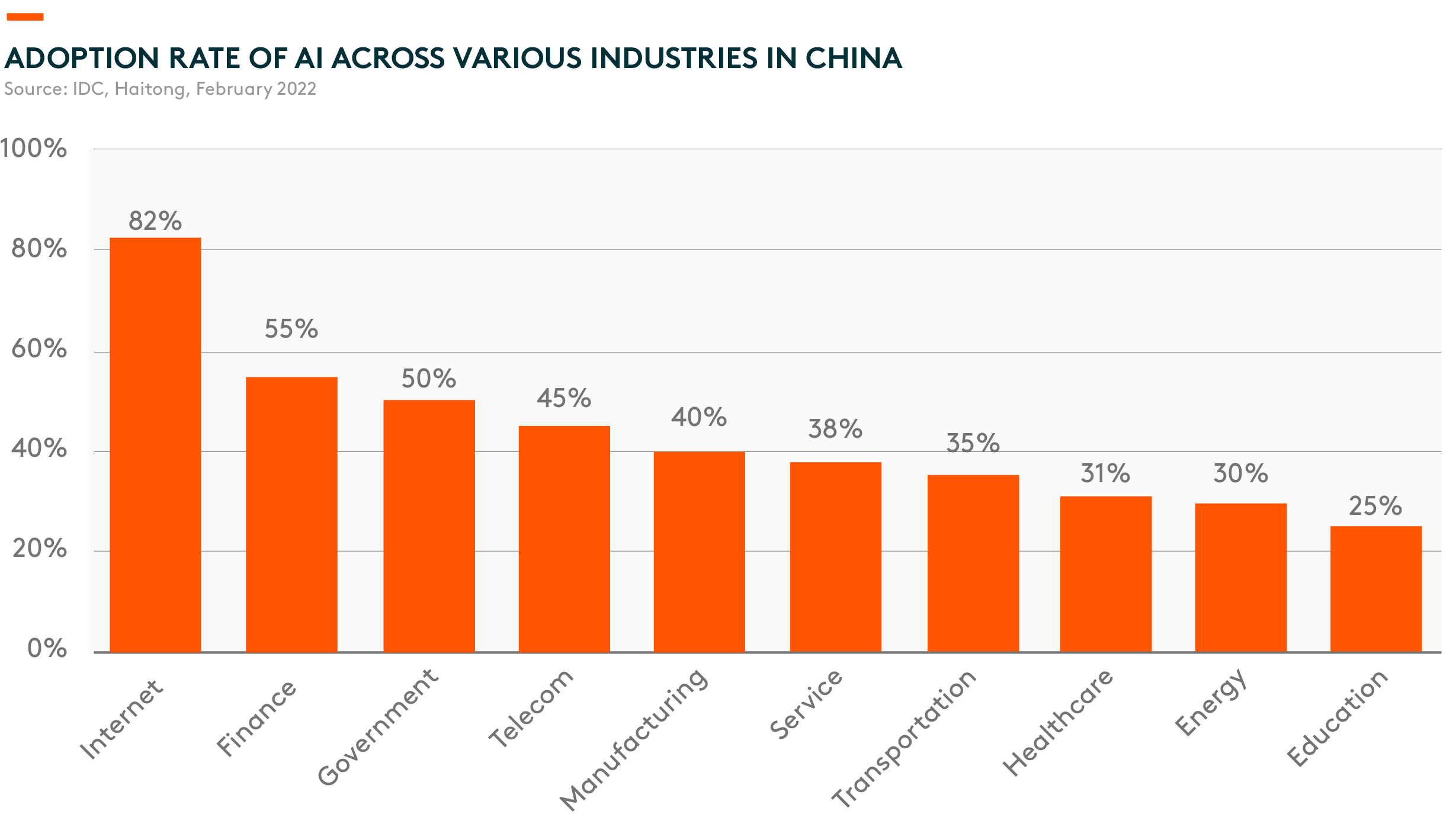

Today, AI adoption has started to prevail in many industries including finance, retail, and high-tech. The Chinese government has already released supportive policy guidelines to foster investments in AI-related fields.

Q: Are There Any Generative AI Engines Developed by Chinese Companies?

Baidu is positioned to be one of the leaders in generative AI in China. Baidu has had an early start on AI technology, particularly on natural language processing (NLP), given the close synergy to its core search business. According to the company, Baidu’s own generative AI product, ERNIE Bot, is expected to complete beta testing and be open to the public in March 2023 5. The underlying model of ERNIE 3.0 fuses an auto-regressive network and an auto-encoding network. Hence, the trained model can be easily tailored for both natural language understanding and generation tasks with zero-shot learning, few-shot learning, or fine-tuning.

Besides Baidu, companies like ByteDance, Alibaba, and Tencent also have the potential and have shown ambition to develop generative AI, given the sheer amount of data these companies have on hand. ByteDance has always utilized algorithms to analyze user preferences. Therefore, content generation using AI technology, whether for text, image, or video format, could blend in naturally with its existing businesses. Additionally, the development of generative AI could help improve the overall monetization/pricing opportunities for Baidu, Alibaba, and Tencent’s cloud services.

Given the amount of computing power required and the significant cost associated with each time a model is trained and updated, large companies with a deep bench of cash on hand, in our view, will be better positioned to tap into this field.

Q: Does China Have Any Unique Competitive Advantages in this Space?

First of all, most of the AI applications that have been widely adopted in China to date have been in consumer-facing industries like internet, propelled by the world’s largest internet user base. Internet platforms have seen phenomenal growth over the past decade, underpinning a strong investment cycle for cloud computing-related infrastructure. This has set a good foundation in terms of computing power, data, and training models required for AI development.

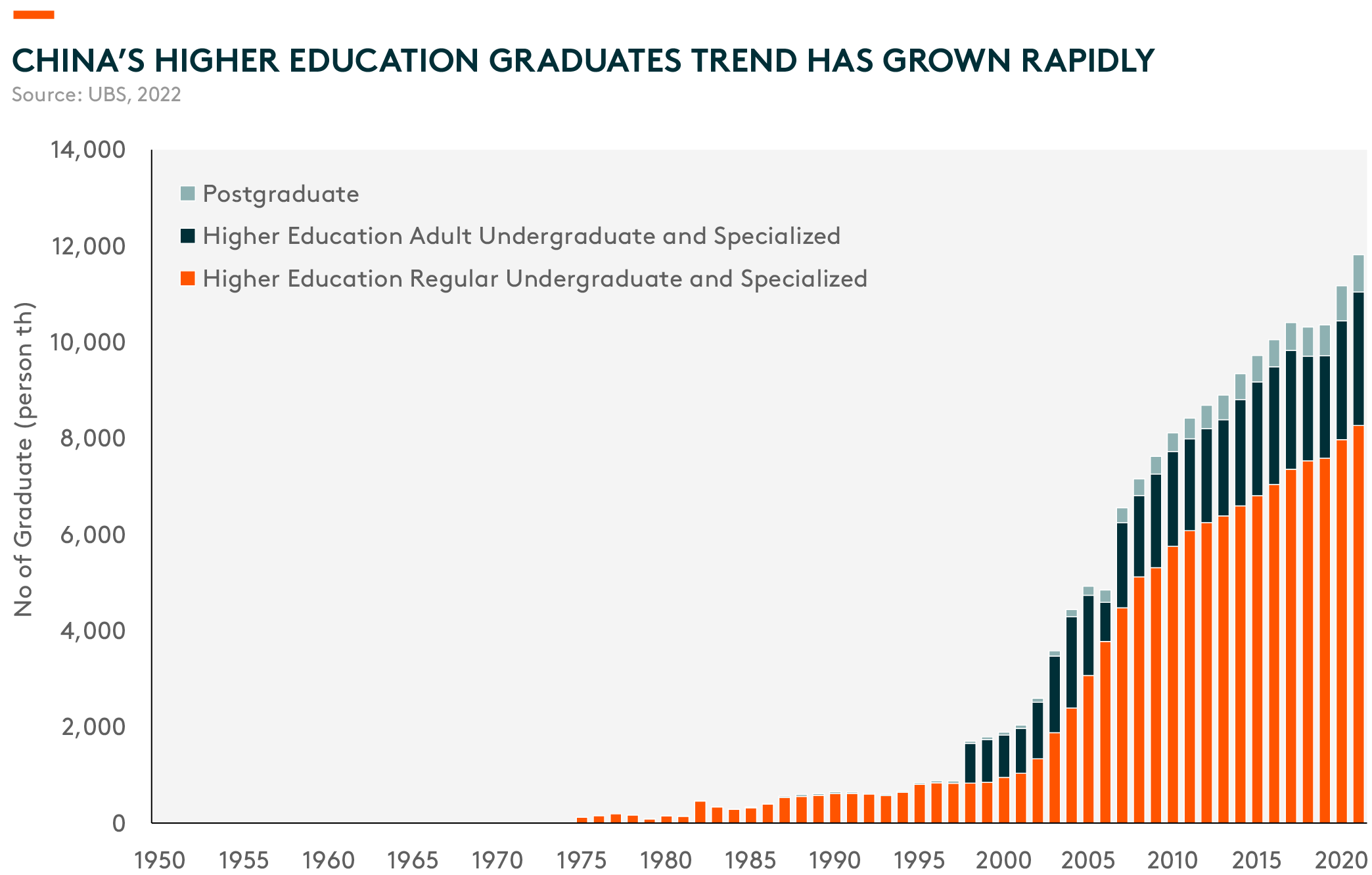

Secondly, China’s comparative advantage lies in its huge engineering talent pool. Tertiary attainment ratio among 18–22 years-old rose from 10% in 2000 to 49% in 2019. The large pool of engineers, especially software engineers, will continue to support strong growth in AI development.

Q: Which Sectors Across Asia Will Benefit the Most from Generative AI?

Asia and China’s semiconductor industries should benefit from the infrastructure investment required for generative AI. The development of advanced AI models and the ensuing blossom of new products will require significant investment in computing power to support its operations. Yole projects AI accelerator penetration to increase from 8% in 2022 to 18% in 2027, representing a CAGR of 24% from 2021 to 2027 6. This will benefit Asia and China’s high-performance computing-related semiconductor supply chains, including:

- Asia foundries. An increase in demand for AI accelerators (i.e. GPU, ASIC 7) will benefit the foundry industry, as most AI accelerators are produced by fabless, which relies on foundries to produce their chips. Asian foundries have over 90% market share globally 8.

- Design service and integrated circuit (IC) design companies. There are a number of companies in Asia that provide design services for ASIC chips in AI accelerators. MediaTek, for example, has an ASIC division focusing on high-performance computing.

- AI and machine learning (ML) applications will demand better memory performance and more bits.

- Equipment makers will also benefit from the strength in semiconductor demand driven by AI-related workloads.

Q: Which ETFs will benefit from the AI trend?

The Global X Asia Semiconductor ETF and Global X Metaverse Theme Active ETF hold several relevant hardware, services, and semiconductor names that will thrive on the development of generative AI technology. Additionally, the Global X China Cloud Computing ETF holds software and platform companies which are relevant to and will thrive on the development of generative AI technology.