Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

High Dividend Strategy Thrives in Volatile Market

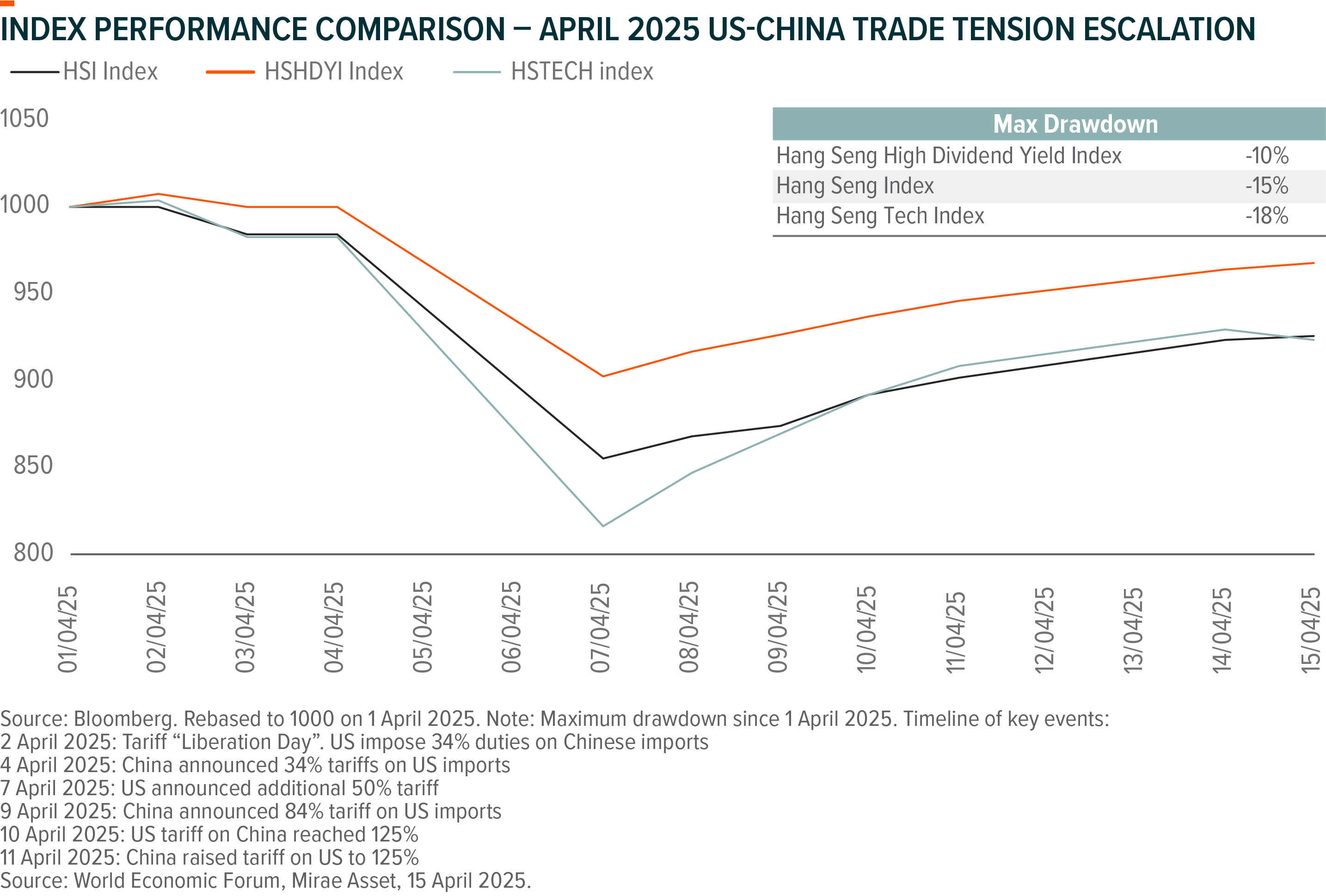

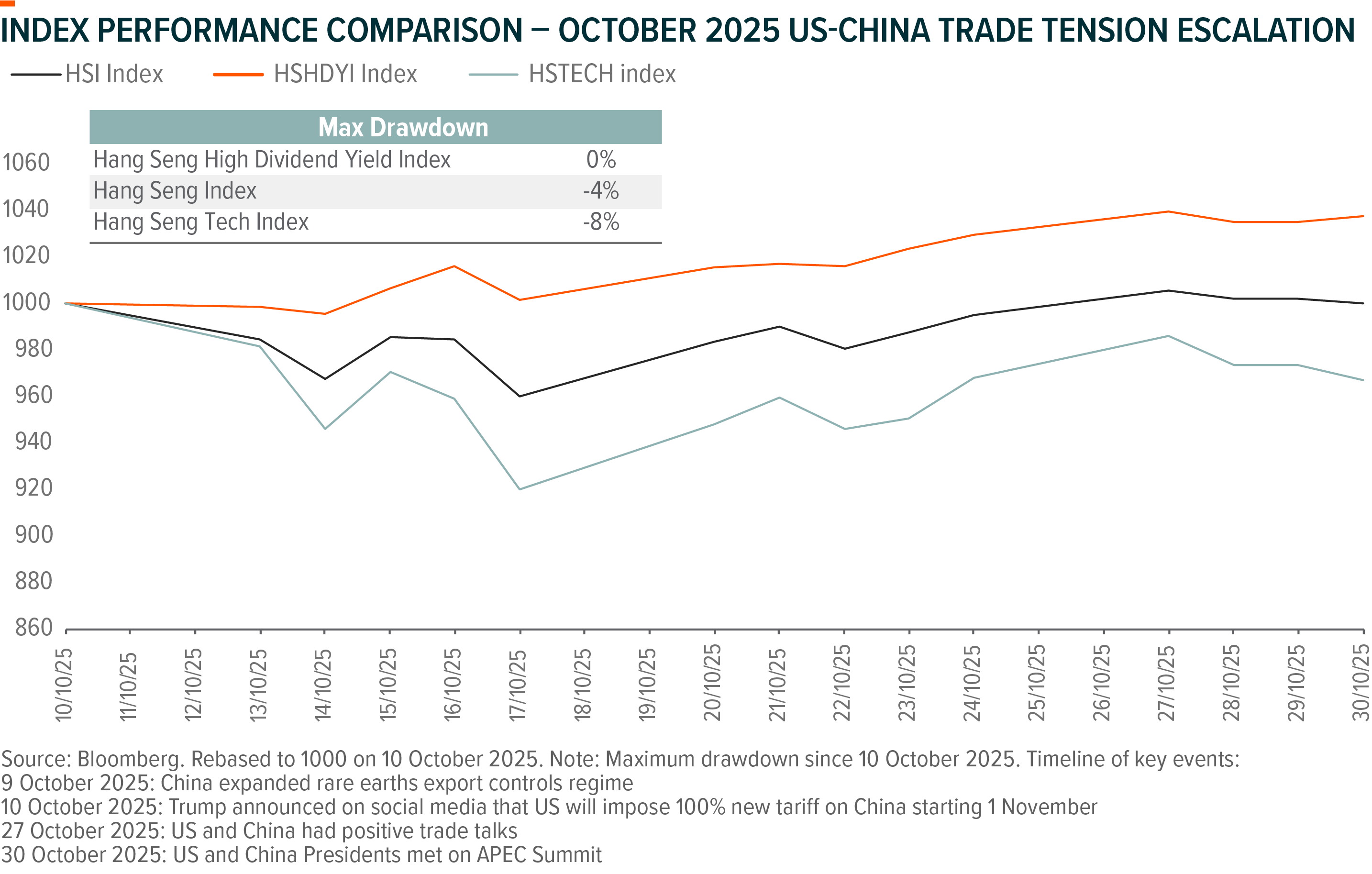

High dividend strategy has been outperforming the broader market since October 2025, with Hang Seng High Dividend Yield Index (HSHDYI) returning +5.4%, as compared to -3.3% for Hang Seng Index and -10.0% for Hang Seng TECH Index (Source: Mirae Asset, Hang Seng Index, 30 Sep – 4 Nov, based on total return). Following a tech-driven rally earlier this year, the Hong Kong/China market is now entering into a consolidation phase amidst a confluence of factors, such as the re-escalation of US-China trade tensions, investor profit-taking, central government meeting, and the onset of the 3Q25 reporting season. More investors are rotating from growth/tech to value/dividend amid market volatility. Although US-China trade talk at end-October yielded positive results that lowered trade policy uncertainty, the prolonged shutdown of US government is draining market liquidity and leads to sell down of global risk assets at the start of November. Defensive strategies such as high-dividend stocks offer a more robust position for investors to navigate the current market volatility.

Alongside the shifting investor preferences recently, we identify compelling investment cases for the high-dividend strategy within the Hong Kong/China market over the long term. Fundamentally, Chinese listed companies have the ability to enhance shareholder returns, bolstered by high cash positions, robust free cash flow, and a presently low payout ratio. This theme is further bolstered by policy support delineated in the Nine Measures of April 2024 and the PBOC’s initiative in September 2024 to encourage corporate buybacks. In terms of fund flow dynamics, the high yield and low volatility characteristics of the high dividend strategy align well with insurers’ investment requirements. This strategy is poised to draw increased interest from insurers over the long term, particularly given the persistently low deposit rates and bond yields in China. Likewise, this dynamic applies to China’s household savings pools, which may increasingly channel into the equity market as individuals pursue higher returns amid a low-interest-rate environment.

Global X Hang Seng High Dividend Yield ETF (3110) invests in 50 high dividend Hong Kong listed stocks selected and weighted based on dividend yield. The ETF offers an attractive dividend yield (6.3% as of August 2025) and tracks Hang Seng High Dividend Yield Index. This Index is likely to outperform broader market in current volatile environment thanks to its low valuation and domestic demand-focused sector distribution.

1. Source: Mirae Asset. Dividend rate is not guaranteed, distributions may be made out of capital or income at the Manager’s discretion and please refer to important information. The Manager may at its absolute discretion declare distributions semi-annually to unitholders in each financial year and details of the distribution declaration dates, distribution amounts and ex-dividend payment dates will be published on the Manager’s website https://www.globalxetfs.com.hk/. Distributions may be made out of capital or income at the Manager’s discretion. There can be no assurance that a distribution will be paid and dividend rate is not guaranteed. Please refer to the prospectus of the fund to understand the distribution policy and other details. The annualized yield is calculated as follows: (dividends per share distributed in Mar 2025 and Sep 2025) / net asset value per unit of the fund on 29 Aug 2025. Investors should note that yield figures are estimated and for reference only and do not represent the performance of the Fund, and that there is no guarantee as to the actual frequency and/or amount of dividend payments. Please note that a positive distribution yield does not imply a positive return on the total investment. Investors should not base investment decisions on the above information alone. Please refer to the Prospectus(including Product Key Facts Statement) for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance.