Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X HSI Components Covered Call Active ETF/Global X HSCEI Components Covered Call Active ETF (the “Funds”) aims to generate income by primarily investing in constituent equity securities in the Hang Seng Index/Hang Seng China Enterprises Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- The objective of adopting a covered call strategy is to generate income and reduce potential loss against the downward market. Each time the Fund writes a Reference Index Call Option, the Fund receives a premium. If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The Fund is an ETF which adopts a covered call strategy by (i) investing in constituent equity securities in the Reference Index and the Reference Index ETF and long positions of Reference Index Futures, and (ii) writing call options on the Reference Index. The Fund is one of the first covered call ETFs in Hong Kong. Such novelty makes the Fund riskier than traditional ETFs investing in equity securities.

- The Fund employs an actively managed investment strategy. In addition to seeking to obtain exposure to the constituent equity securities in the Reference Index in substantially the same weightings as these securities have in the Reference Index through investing directly in constituent equity securities of the Reference Index and Reference Index ETF and long positions of Reference Index Futures, the Fund also writes call options on the Reference Index. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The market value of an Reference Index Call Option may be affected by an array of factors including but not limited to supply and demand, interest rates, the current market price of the Reference Index in relation to the strike price of the Reference Index Call Options, the actual or perceived volatility of the Reference Index and the time remaining until the expiration date. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations, which cannot be assured and are subject to market behaviour or unexpected events.

- If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Fund may write Reference Index Call Options over an exchange or in the OTC market. The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. There may be a limited number of counterparties which are willing to enter into Reference Index Call Options as purchasers or the Fund may find the terms of such counterparties to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets. If trading is suspended, the Fund may not be able to write Reference Index Call Options at times that may be desirable or advantageous to do so.

- The use of futures contracts involves risks that are potentially greater than the risks of investing directly in securities and other more traditional assets. The risks include but not limited to market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. Additional funds may need to be posted as margin to meet margin calls based upon daily marking to market of the Reference Index Futures and the Reference Index Call Options. Increases in the amount of margin or similar payments may result in the need for the Fund to liquidate its investments at unfavourable prices in order to meet margin calls. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- Reference Index Futures and Reference Index Call Options are registered, cleared and guaranteed by the HKFE Clearing Corporation. In the event of the bankruptcy of the clearing house, the Fund could be exposed to a risk of loss with respect to its assets that are posted as margin.

- To the extent that the constituent securities of the Hang Seng Index are concentrated in Hong Kong listed securities of a particular sector or market, the investments of the Fund may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- Global X HSCEI Components Covered Call Active ETF is subject to concentration risk as a result of tracking the performance of a single geographical region or country (Mainland China). Global X HSCEI Components Covered Call Active ETF may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations resulting from adverse conditions in Mainland China. In addition, to the extent that the constituent securities of Hang Seng China Enterprises Index are concentrated in Hong Kong listed Mainland securities of a particular sector or market, the investments of Global X HSCEI Components Covered Call Active ETF may be similarly concentrated. For Global X HSI Components Covered Call Active ETF, to the extent that the constituent securities of Hang Seng Index are concentrated in Hong Kong listed securities of a particular sector or market, the investments of Global X HSI Components Covered Call Active ETF may be similarly concentrated. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments. The value of the Fund may be more susceptible to adverse conditions in such particular market/sector.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The base currency of the Fund is HKD but the class currencies of the Shares are in HKD, RMB and USD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

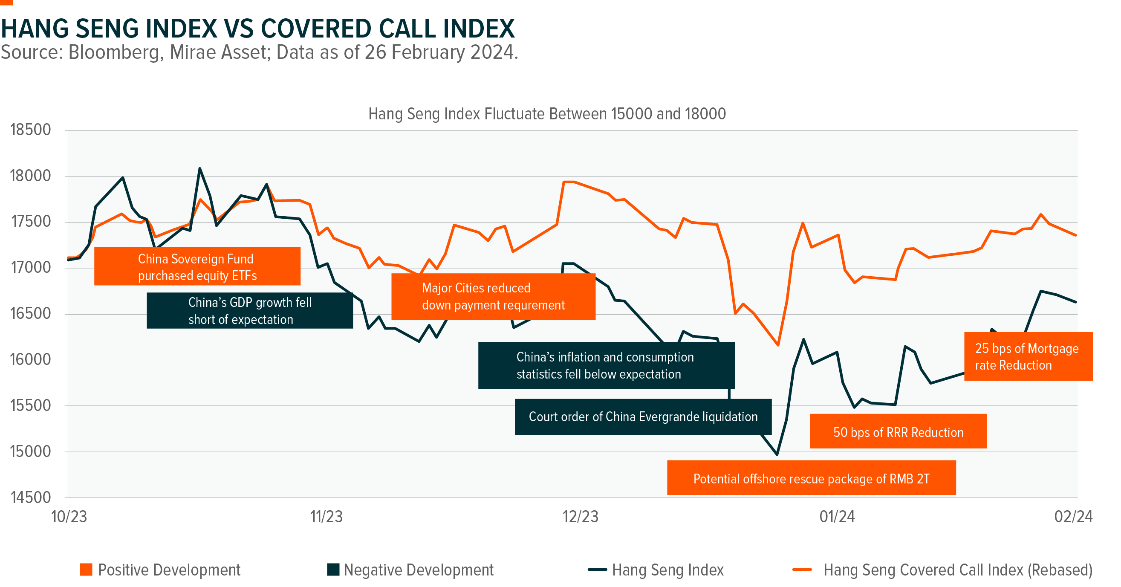

Hang Seng Index Fluctuated within Established Trading Range

Over the past three months, the Hang Seng Index has displayed a consistent pattern of fluctuating between the levels of 15,000 and 18,000. This volatility can be primarily attributed to the vulnerabilities observed in specific sectors of the Chinese economy, offset by the counter-cyclical measures released by policymakers to restore confidence to the market.

One significant factor influencing the market’s performance is some of the Chinese economic data which has fallen short of investors’ expectations. This includes indicators related to consumption, inflation, and economic growth. When these figures indicate a softer-than-expected economic outlook, it puts pressure on Chinese equities to be sold.

However, Chinese policymakers have been proactive in implementing counter-cyclical policies aimed at supporting the market. These policies, which involve fiscal stimulus and monetary easing, have been instrumental in mitigating the negative effects of soft economic data. For instance, in October 23, China’s sovereign fund made significant equity purchases in an effort to stabilize the market.1 Additionally, the People’s Bank of China has reduced policy rates, such as Reserve Requirement Ratio and Mortgage Rate, to enhance overall liquidity in the economy and support the real estate sector.

Despite the gradual recovery taking place in China, the path to full economic stability remains uncertain, resulting in a bumpy road for investors. Consequently, it is likely that the Hong Kong equity market will continue to be volatile and remain range-bound, moving within the established trading range.

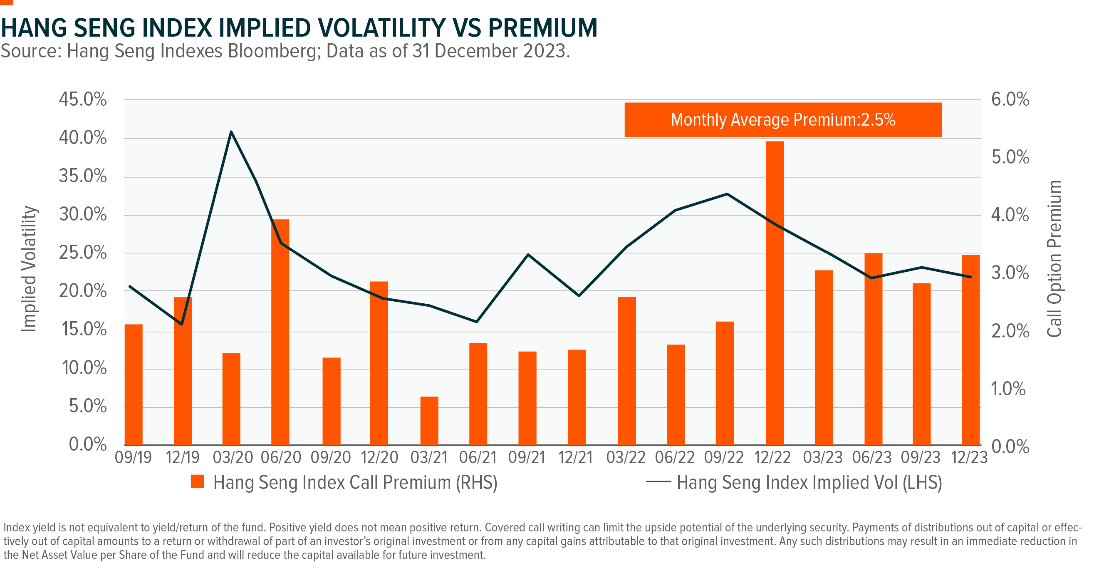

Harness Volatility to Generate Compelling Income2 in Range Bound Scenarios

In such range-bounding scenarios, covered call strategies tend to be perform well. Covered call strategies involve writing call options on a portion of the securities that are already owned, potentially generating additional income2 for investors from the option premiums in addition to the dividends accrued from the stocks. While the upside potential is limited, covered call strategies can provide compelling income yields. For example, the Hang Seng Covered Call Index has delivered an average monthly yield of 2.5%3,5 since index inception in Jun 2019. In general, higher market volatility tends to result in increased option premiums. In range-bound scenarios, investors can earn the income yield without exposing themselves to excessive downside risk.

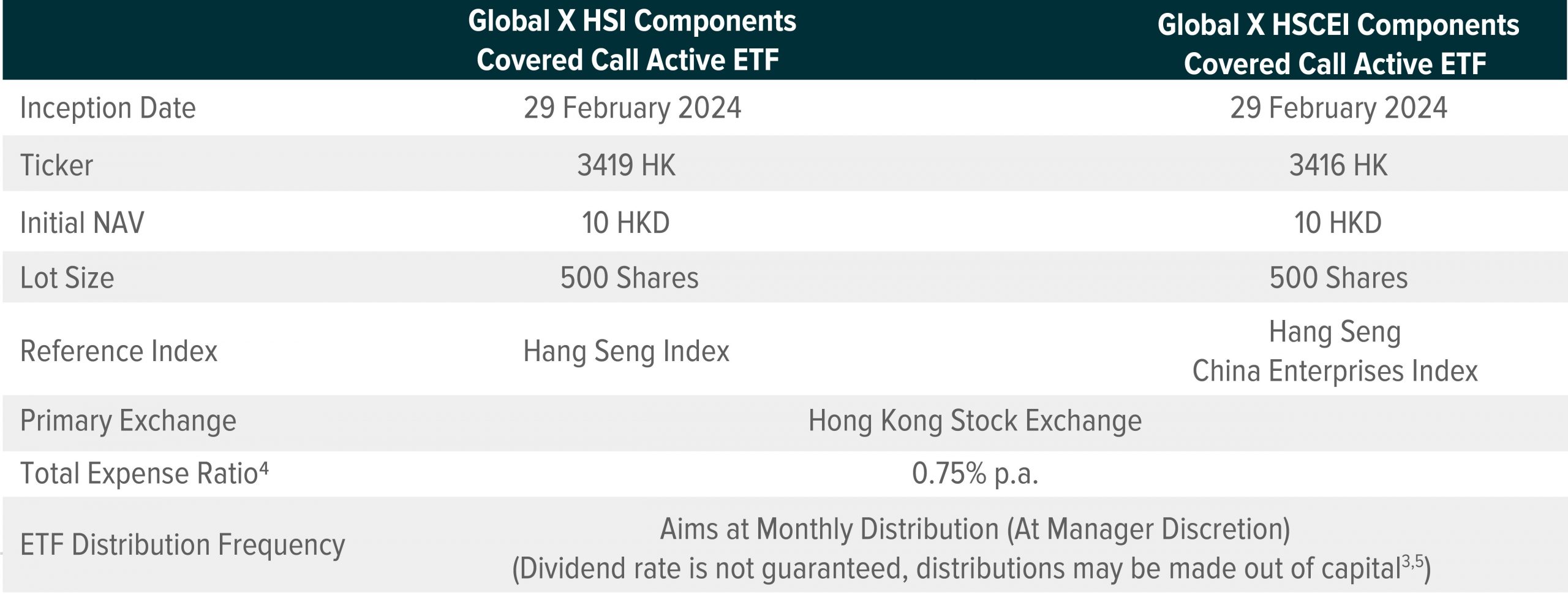

Global X has launched the world’s first two ETFs referencing to the Hang Seng Index and Hang Seng China Enterprises Index, offering attractive exposures under the current market conditions. These ETFs provide investors with opportunities to harness the volatility of the Hong Kong equity market in an effort to generate compelling return.