Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X HSCEI Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng China Enterprises Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X HSI Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Hang Seng TECH Covered Call Active ETF (the “Funds”) is to generate income by primarily investing in constituent equity securities in the Hang Seng TECH Index (the “Reference Index”) and selling (i.e. “writing”) call options on the Reference Indexes respectively to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations.If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the SEHK may suspend the trading of options in volatile markets which may casue the Fund unable to write Reference Index Call Options at times

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the HKFE, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Nasdaq 100 Covered Call Active ETF (the “Fund”) is to generate income by primarily (i) investing in constituent equity securities in the NASDAQ-100 Index (the “Reference Index”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “”premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations. If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the exchange may suspend the trading of options in volatile markets which may cause the Fund unable to write Reference Index Call Options at times.

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- The position of futures or options contracts held by the Manager may not in aggregate exceed the relevant maximum under relevant rules. If the position held or controlled by the Manager reaches the limit or the Fund grow significantly, the Manager will evaluate its position and consider closing out certain positions, which could restrict new share creation and cause the trading price to deviate from NAV.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the CME and/or the Fund’s broker, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking the performance of securities in a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X S&P 500 Covered Call Active ETF (the “Fund”) is to generate income by primarily (i) investing in constituent equity securities in the S&P 500 Index (the “Reference Index”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations. If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the exchange may suspend the trading of options in volatile markets which may cause the Fund unable to write Reference Index Call Options at times.

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking the performance of securities in a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

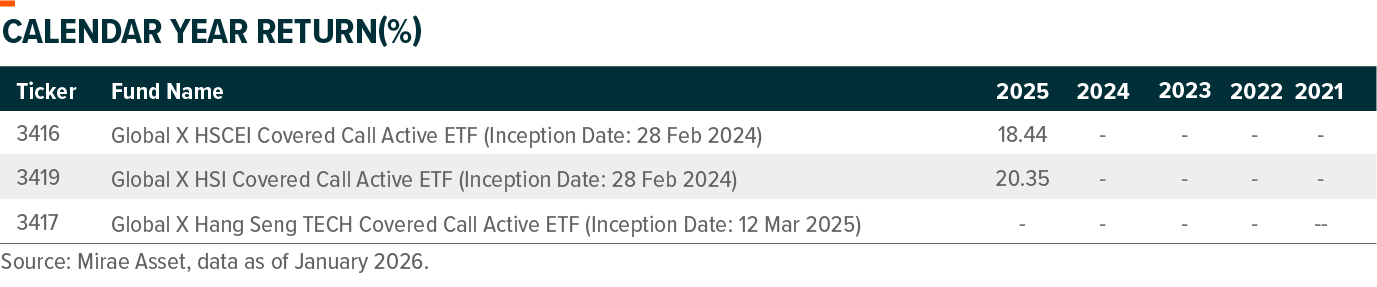

Global X HK Covered Call ETFs 2025 Review

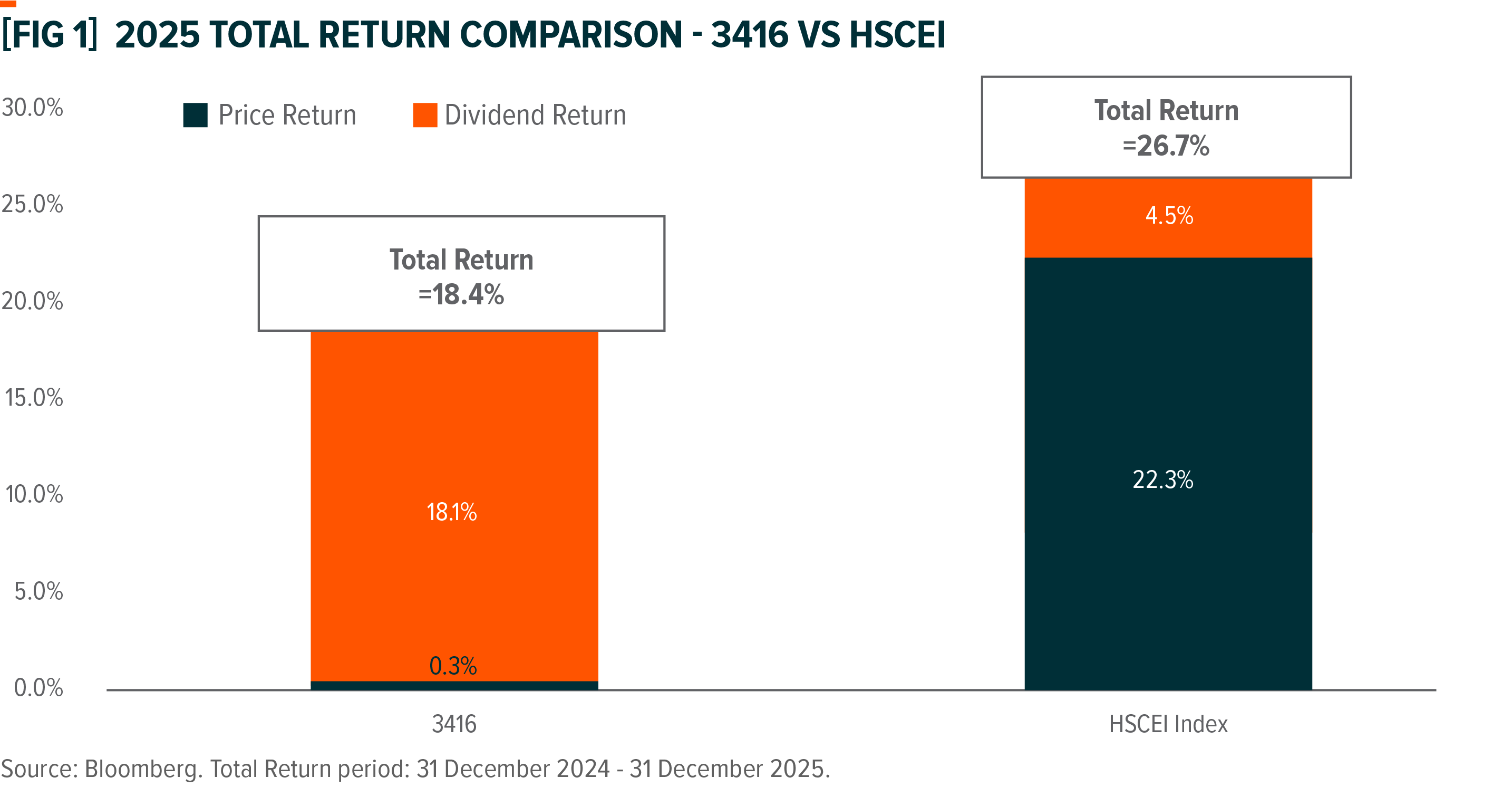

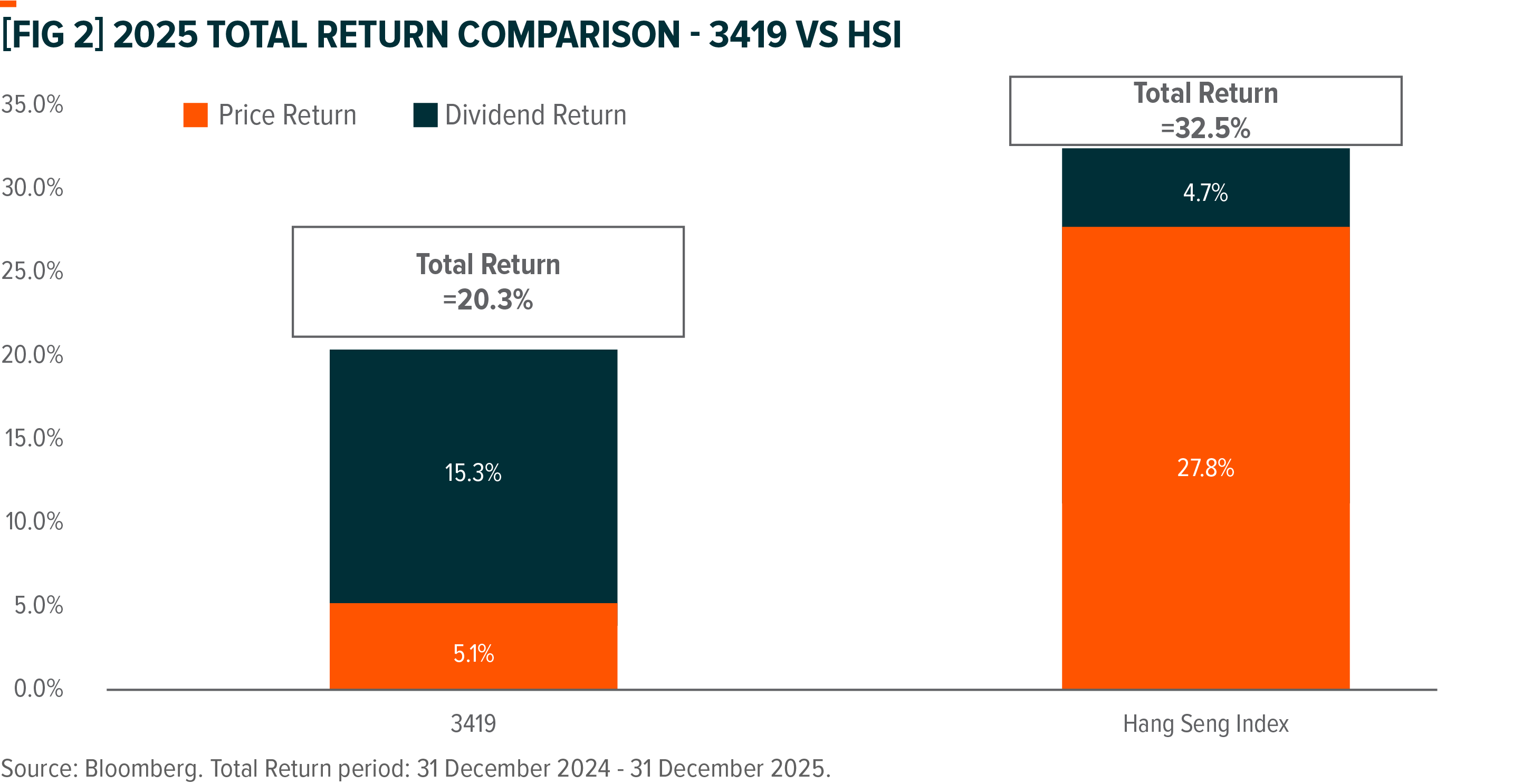

As we analyse the 2025 performance of the 5 Global X Covered Call ETFs listed in the Hong Kong market, we observe patterns that align with our expectations: during market upswings, Covered Call ETFs may lag behind the underlying indices but still deliver decent total returns; conversely, during market corrections, Covered Call ETFs tend to outperform due to the option premiums received. Moreover, these ETFs provide investors with a stable monthly cash flow, reduced volatility, and have proven to offer superior downside protection during market downturns. Given these attributes, integrating Covered Call ETFs into portfolios would enhance risk-adjusted returns for investors.

2025 Performance Review

Global X HSCEI Covered Call Active ETF (3416) recorded 18.4% total return in 2025, with 18.1% dividend return and 0.3% price return. Global X HSI Covered Call Active ETF (3419) recorded 20.4% total return in 2025, with 15.3% dividend return and 5.1% price return. Despite the covered call strategy underperforming their underlying indices in a bullish Hong Kong market (with the HSI up by 33% in total return, marking the best performing year in the past 5 years), Global X Hong Kong Market Covered Call ETFs offer investors a comparatively stable monthly cash flow, and have shown superior downside protection during market drawdowns in both April and October. (Mirae Asset, January 2026)

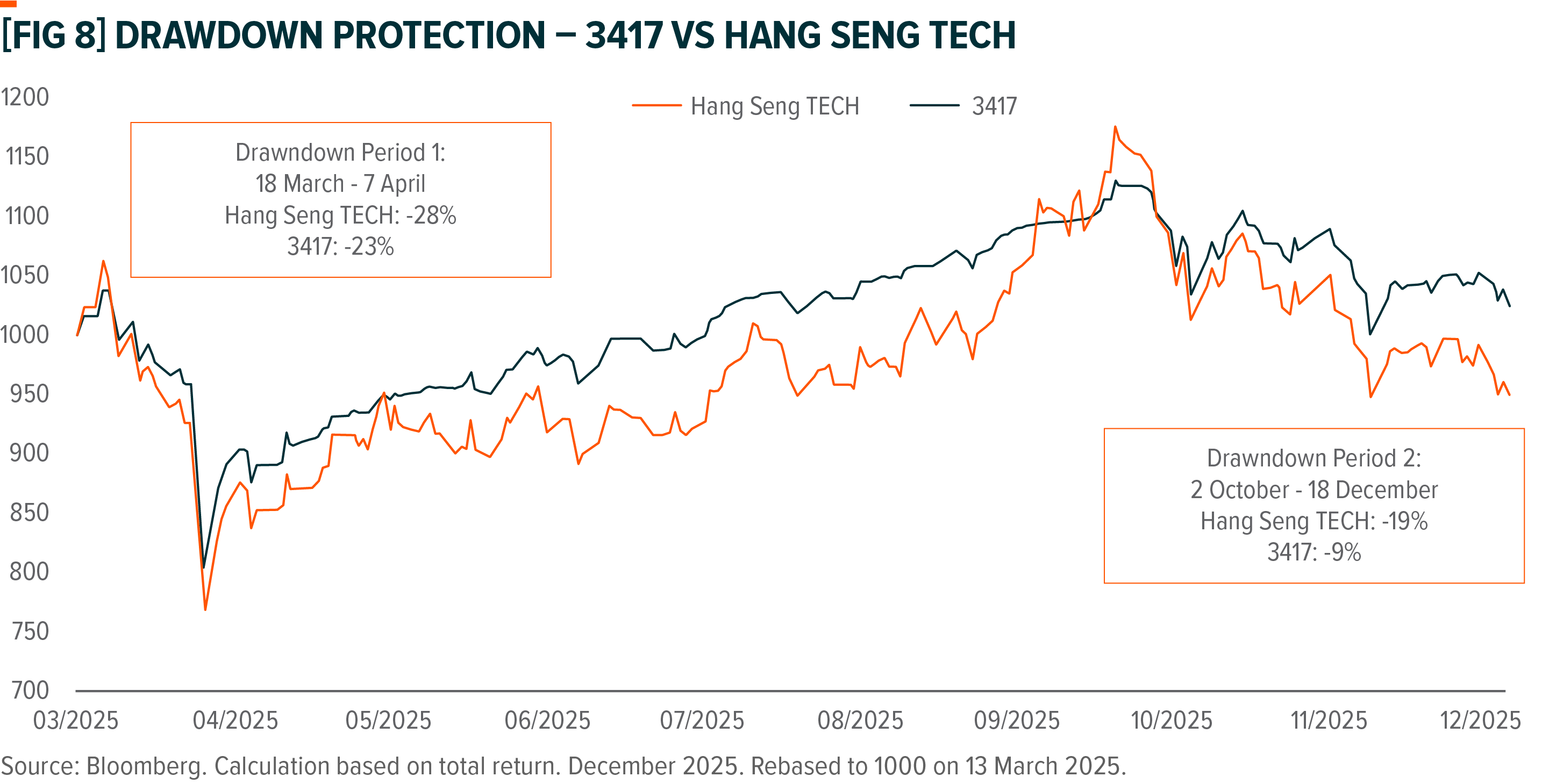

The performance of Global X Hang Seng TECH Covered Call Active ETF (3417) makes a good example. The ETF was launched on 12 March 2025 – a relatively high point in the Hong Kong market, especially for technology stocks, after the ‘DeepSeek Moment’ rally. 3417 HK recorded 5.1% return since launch, with 12.0% from dividend return and -6.9% from price return, outperforming HS TECH Index over the same period. Looking into 2026, expectations for growth in the Chinese tech sector and concerns about sluggish consumption due to the ongoing real estate downturn should lead to extended volatility for the index. We continue to recommend including Covered Call ETFs in investors’ portfolios to potentially reduce volatility while providing a more stable monthly income cash flow. (Mirae Asset, January 2026)

Option Premiums and ETF Dividend Distributions

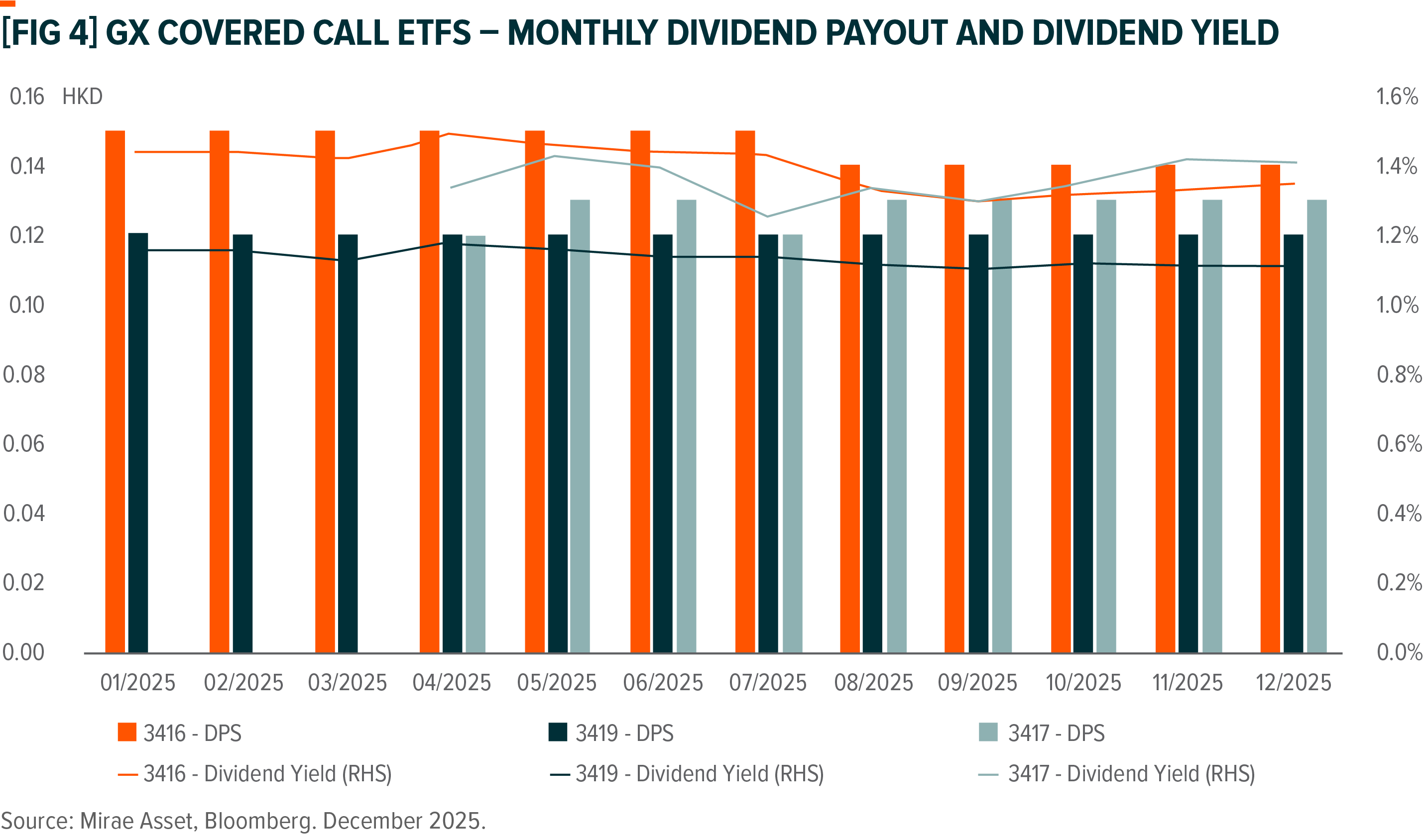

Through selling index call option on a monthly basis, Global X Covered Call ETFs collect monthly option premium and distribute monthly dividends. Below are some key observations on option premiums and dividends for GX Covered Call ETFs in 2025:

- Dividend payout amounts have been relatively stable, bringing stable monthly cash flow for investors. (Fig 4)

- Dividend Yield appears attractive after Hong Kong Market correction in 4Q. As of December 2025, monthly dividend yield is 1.35% for 3416 HK, 1.11% for 3419 HK, and 1.41% for 3417 HK. (Fig 4) (Source: Mirae Asset. Dividend Yield = dividend distributed / NAV at ex-div date)

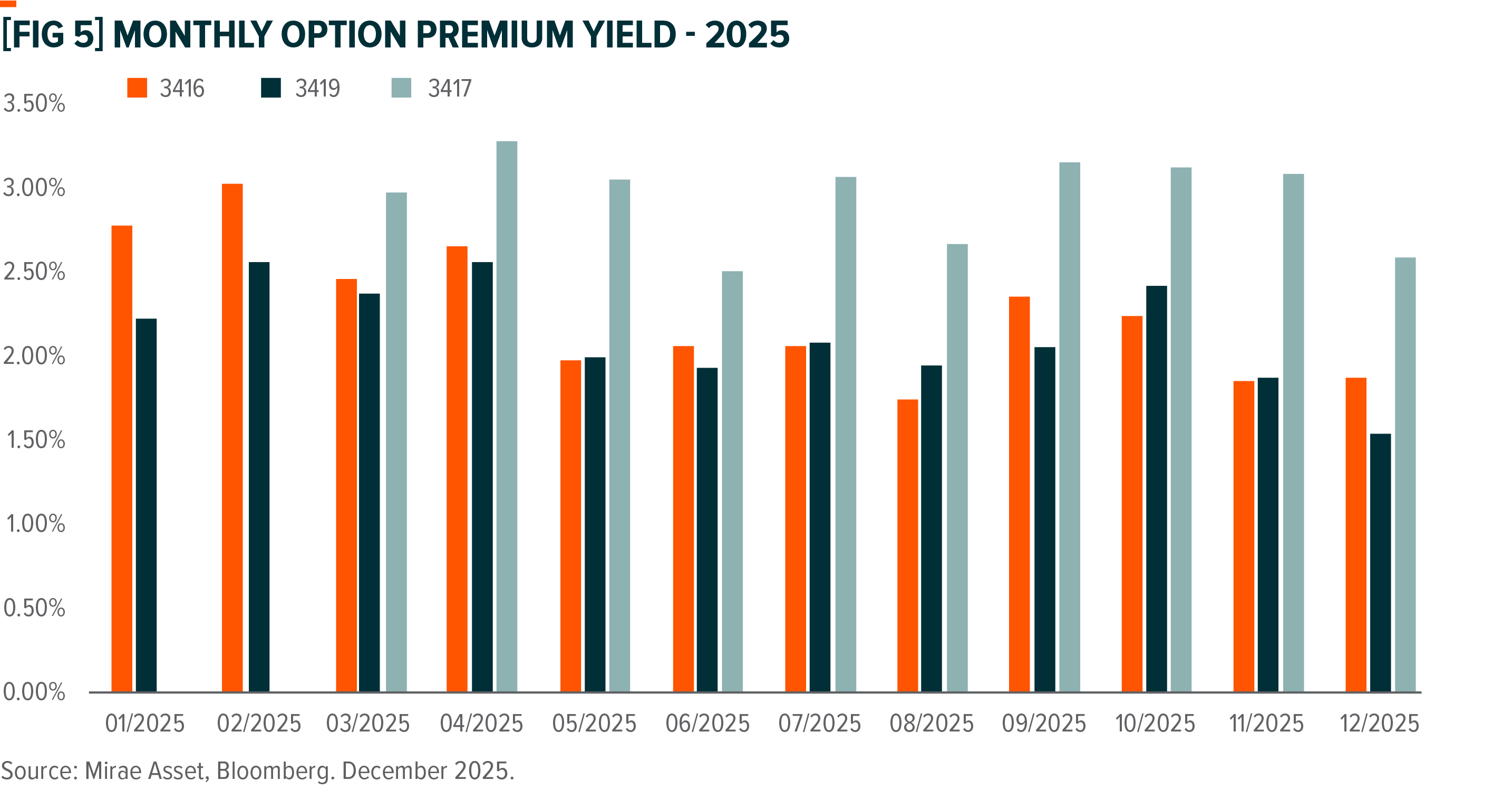

- Option premium is high thanks to the high volatility of Hong Kong market. Average monthly option premium yield is 2.25% for 3416 HK, 2.12% for 3419 HK, and 2.95% for 3417 HK. (Fig 5) (Source: Mirae Asset. Option premium yield = premium collected on the rolling date / AUM at month end)

- Amounts of dividend distribution has been lower than amounts of option premiums received in every single month. Distribution has been relatively conservative, which also helps to smooth out NAV amid market volatility. (Fig 4&5)

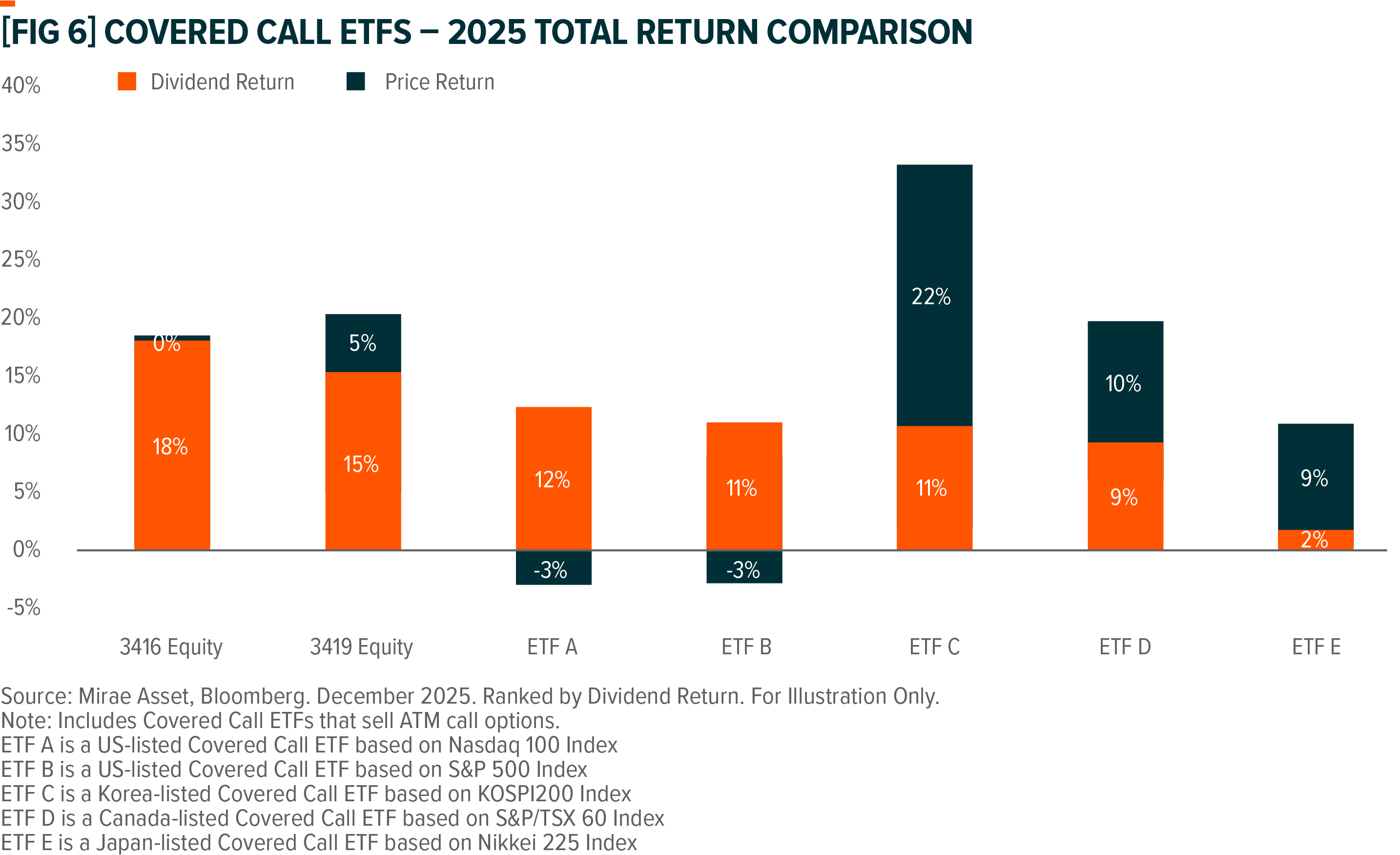

- Compared to peer Covered Call ETFs, 3416 HK & 3419 HK have the highest dividend returns in 2025, while still maintain positive price gains for investors. (Fig 6)

Volatility and Downside Protectio

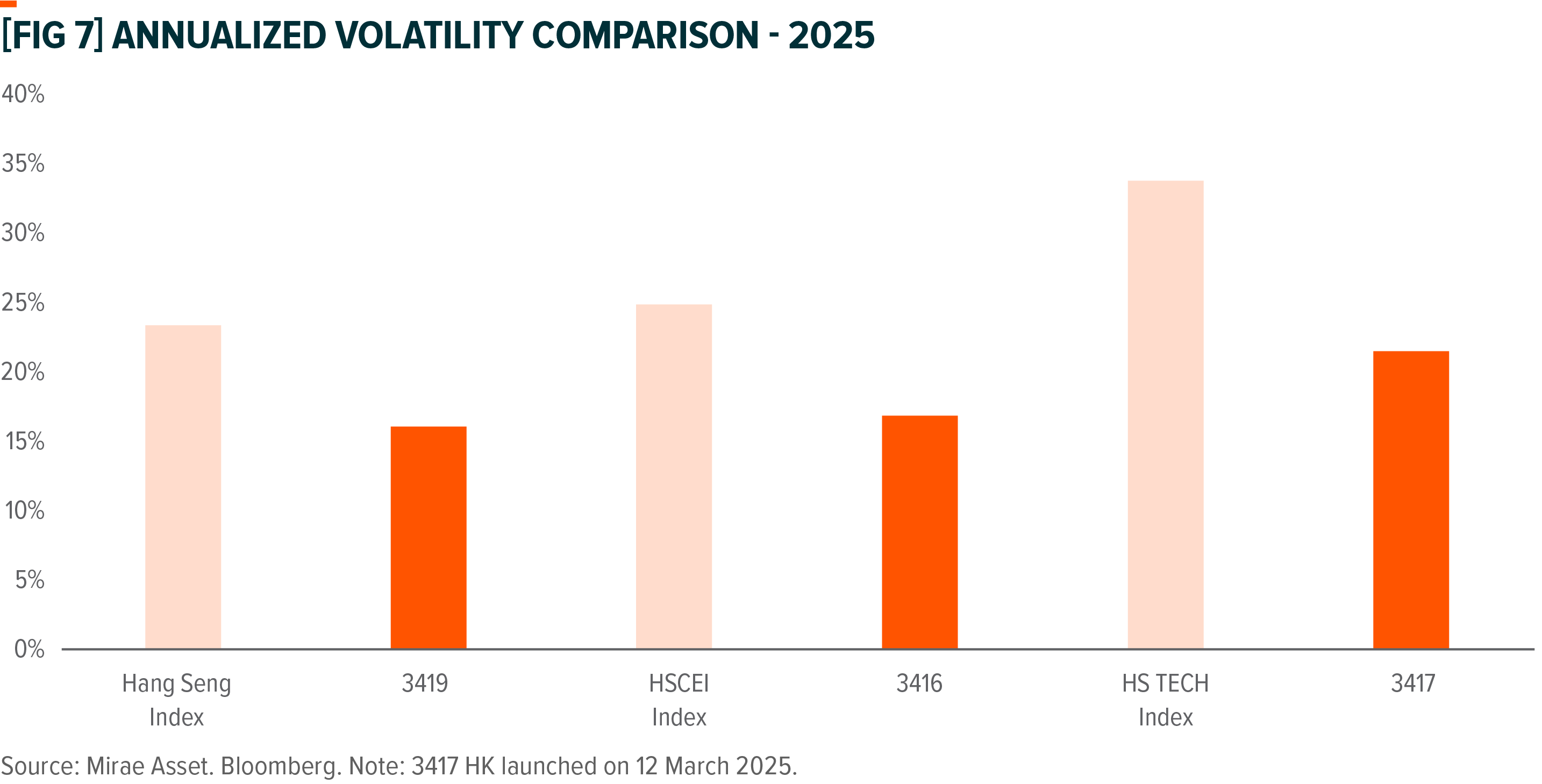

Despite underperforming the underlying indices in the 2025 Hong Kong bull market, the covered call strategy offers investors lower volatility, better drawdown protection, and a consistent source of stable cash flow. In the context of our analysis, we have observed decreased volatility in three GX Hong Kong Covered Call ETFs in comparison to their respective underlying indices (Fig 7). Additionally, the option premiums have provided significant downside protection during the two market corrections in April and October 2025 (Fig 8). While we maintain an optimistic outlook on an extended bull market in 2026, we acknowledge that the high volatility in the Hong Kong market is determined by the investor base and industry structure. The incorporation of covered call ETFs could bolster risk-adjusted returns for investor portfolios.

US Market Covered Call ETFs

In 2H25, Global X Hong Kong also launched 2 Covered Call ETFs based on S&P500 Index and Nasdaq Index. As discussed in our 2026 Global Market Outlook, we do not expect an abrupt ‘AI bubble bust’ in 2026 and expect AI to remain a key investment theme for US and global markets, as we are seeing AI-driven efficiency and probability gain for corporates. However we also acknowledge the historical high valuation and concentration for US Big Techs, implying downside risks. We expect volatility ahead for the US market, and recommend positioning US market through covered call to capitalize on the volatility. Hong Kong listed Global X Nasdaq 100 Covered Call Active ETF (3451) and Global X S&P 500 Covered Call Active ETF (3415 ) also bring tax efficiency for Hong Kong investors.