Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

Global X AI and Innovative Technology Active ETF (3006) Outlook 2025

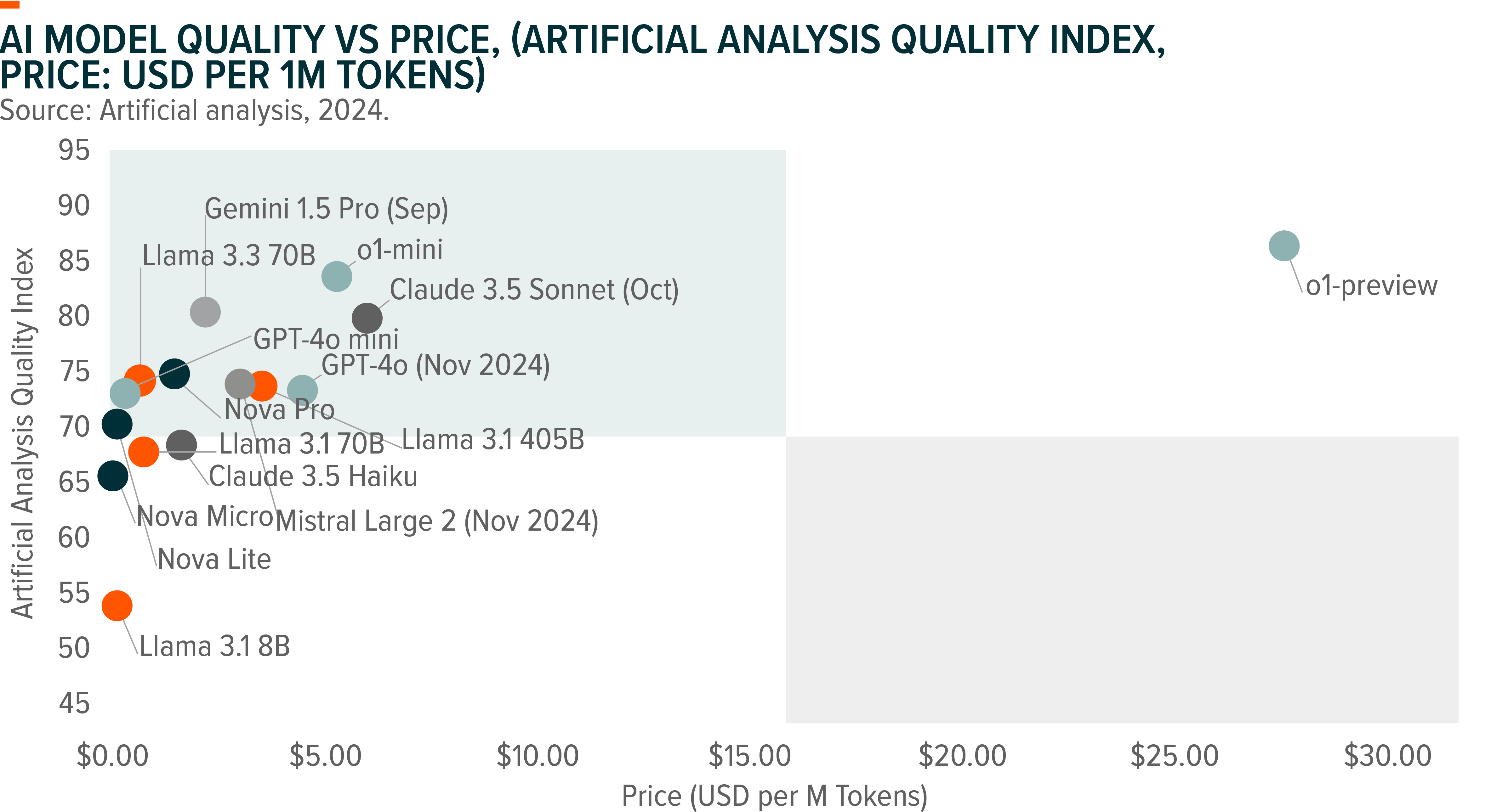

It has been two years since the release of GPT3.5 to the public in November 2022. Since then, the launch triggered an arms race to build the most advanced LLMs (large language models). The competitive landscape intensified quickly. Tech giants like Google, Microsoft, and Meta unveiled their own advanced models—PaLM, Gemini, and LLaMA—while startups such as Anthropic and Mistral AI gained traction with specialized, safety-focused systems. Investment poured into both training and inference capabilities, reflecting the astronomical costs of building and deploying LLMs. Model performance continues to increase with dropping costs. This democratization of AI sparked a wave of adoption across sectors such as customer support, content creation, and software development. The AI LLM sector has become a hub for investment, innovation, and competition. As companies push the boundaries of what these models can achieve, the broader implications—on jobs, governance, and global power dynamics—continue to unfold, marking this as one of the most transformative periods in technology history. Looking into 2025, the key focus of the sector centers around two points. First, the constraint of scaling in front-tier models and its implications for AI infrastructure spending. Second, adoption and monetisation of LLMs.

Scaling of Large Language Model and its Implications to AI Infrastructure

Research indicates that larger models typically exhibit improved performance, as evidenced by the “scaling laws” identified by Kaplan et al. (2020), which suggest that increasing model size often leads to better accuracy and functionality in diverse applications.

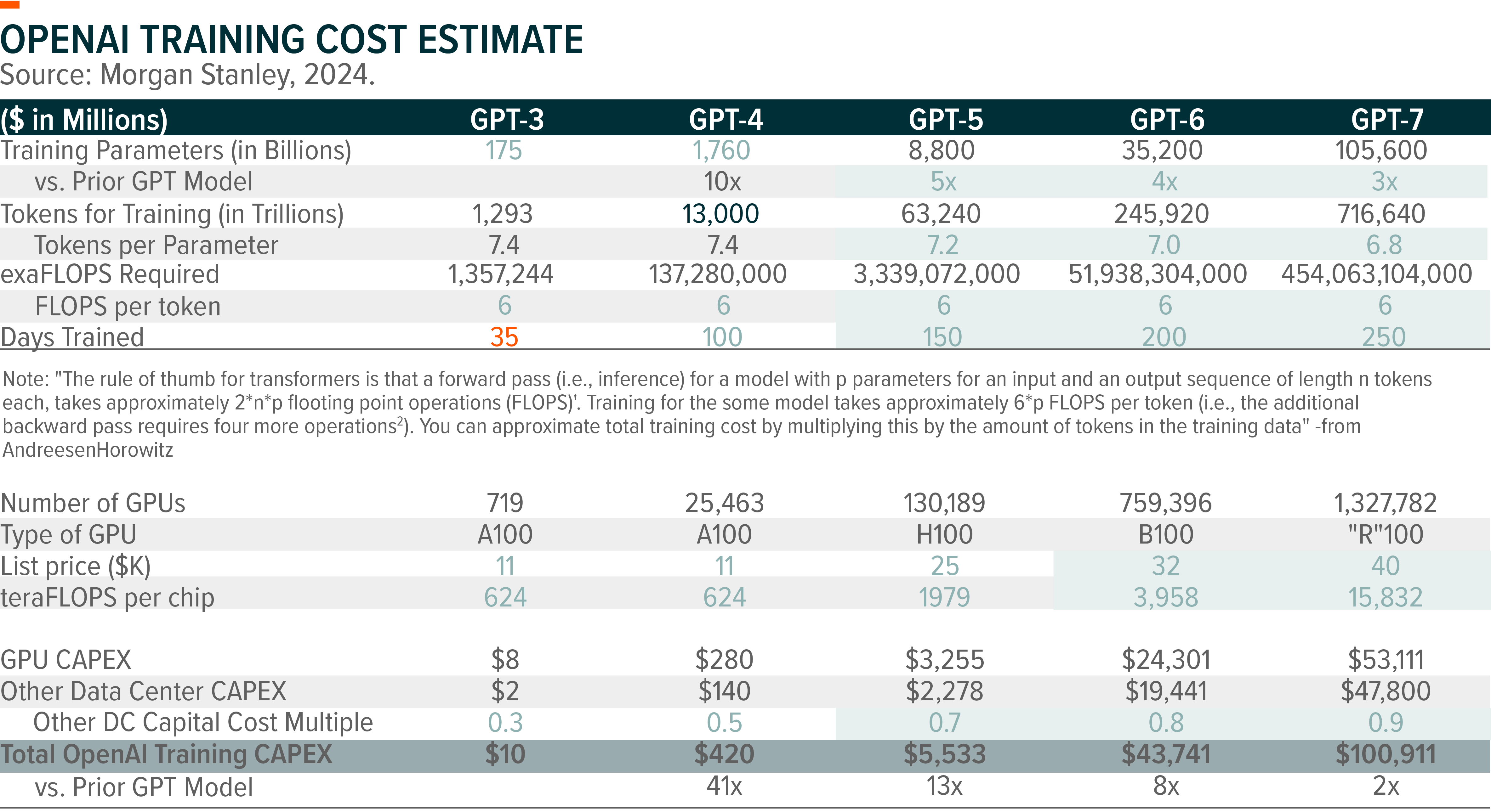

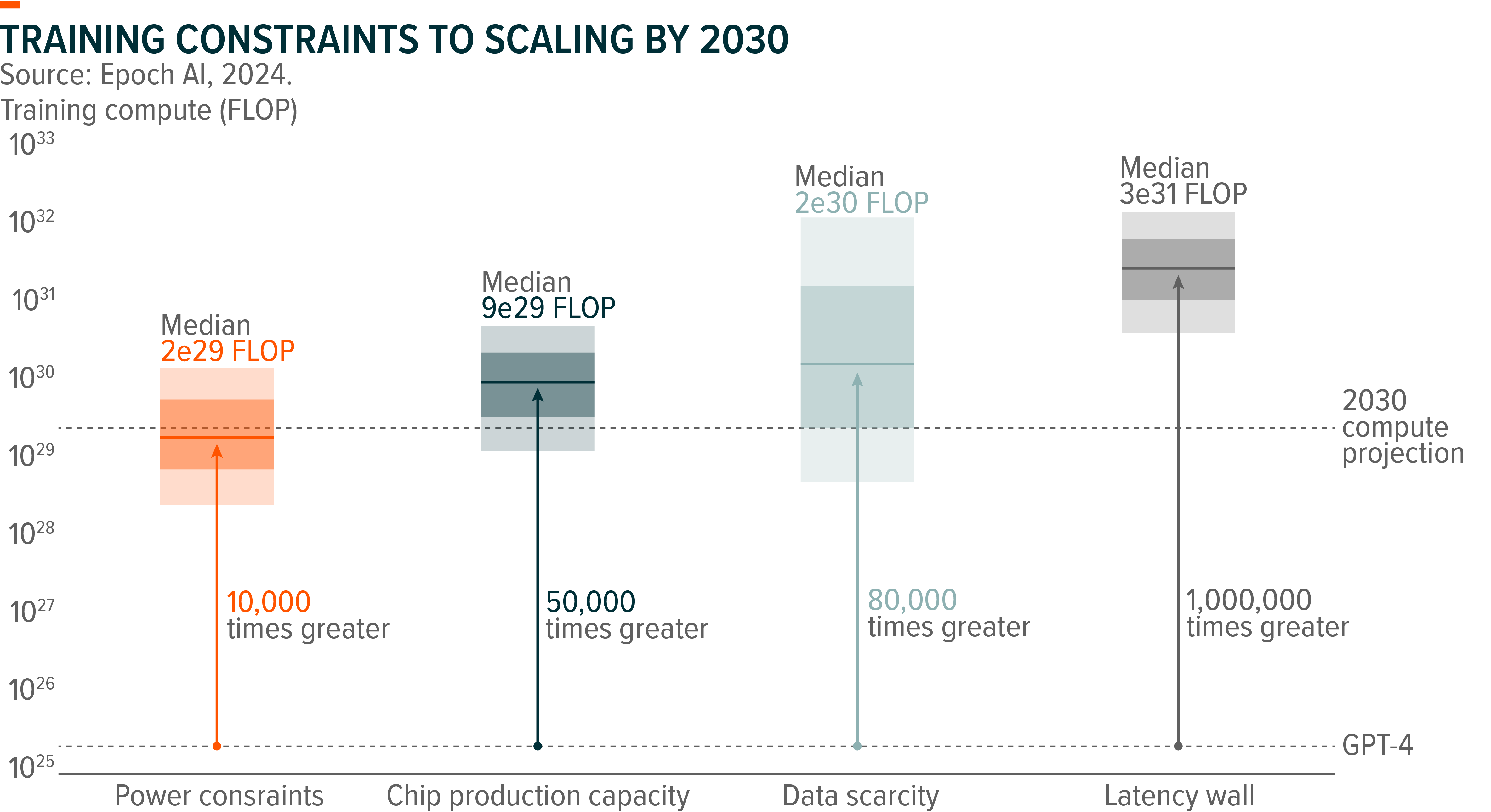

Scaling LLMs involves not just increasing the number of parameters, but also optimizing training processes and leveraging advanced hardware architectures. This necessitates robust AI infrastructure encompassing high-performance computing resources, efficient energy consumption, and scalable storage solutions. Scaling laws suggest that next-generation front-tier models (ChatGPT 5 equivalent) require $3B in GPU investment. The generations afterwards ( ChatGPT 6/7) could cost 10x-20x, or $25B+-$50B+ each. (MS 2024) The demand for AI training and inference semiconductors from companies like Nvidia and other ASIC providers like Broadcom and Marvell will therefore continue to increase if the industry scales the models under the current trajectory.

Data availability is arguably the most important constraint in the scaling of LLMs as we only have one internet. Training large AI models requires correspondingly large datasets. The indexed web contains about 500 trillion words of unique text and is projected to increase by 50% by 2030. (Epoch AI 2024) Multimodal learning from image, video and audio data will likely moderately contribute to scaling, plausibly tripling the data available for training. Synthetic data generation from AI models could increase data availability substantially.

Adoption of LLMs – Impact to the Software Industry

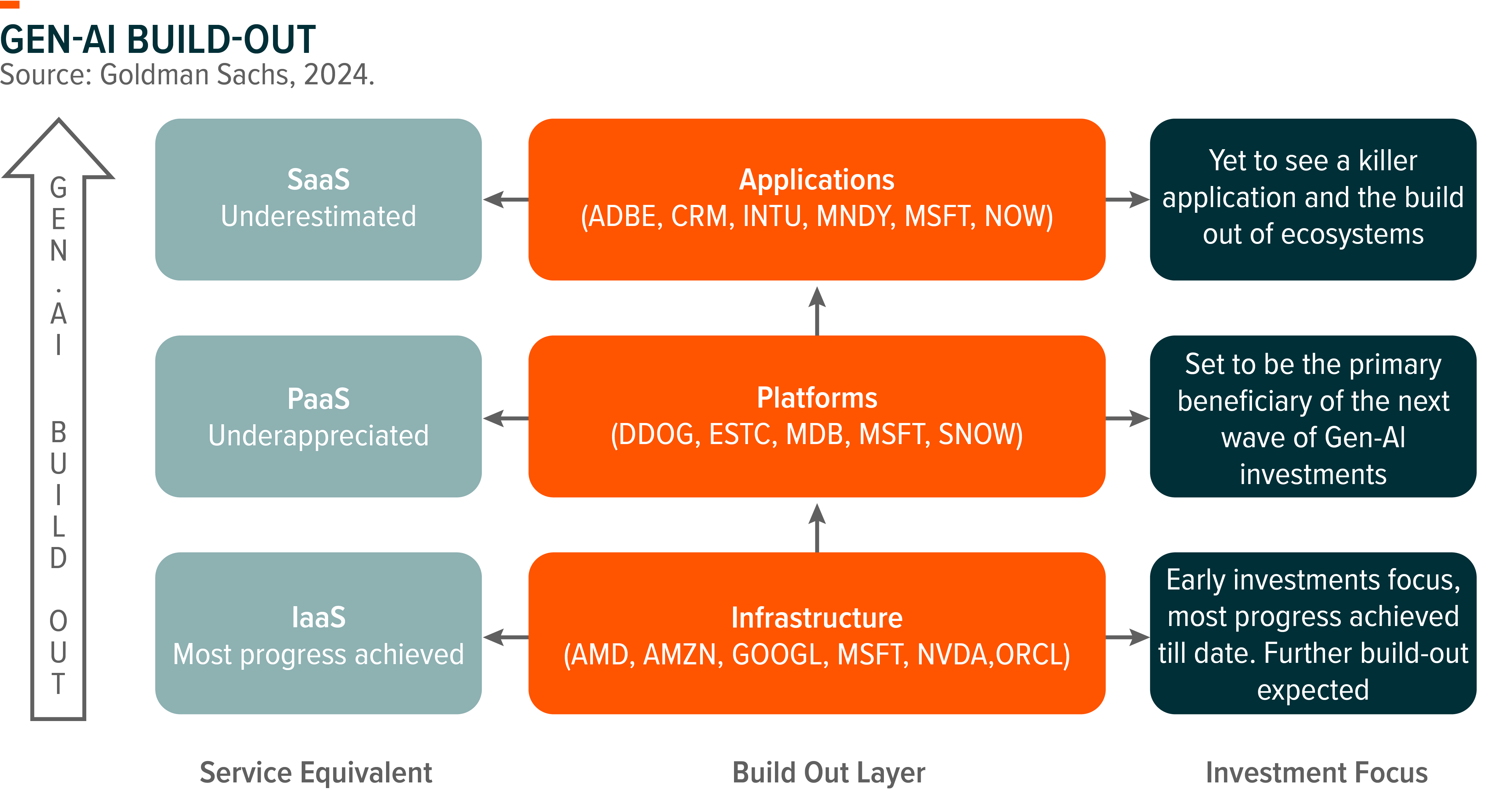

The integration of Generative AI (Gen AI) into the software landscape is reshaping how technology companies deliver value across various layers. By examining the Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) layers, we can better understand the evolving strategies that companies, especially giants like Microsoft and Amazon, are deploying to capitalize on Gen AI. Each layer presents distinct opportunities and challenges, influencing how organizations can generate revenue and drive innovation.

IaaS serves as the foundational layer where cloud computing resources—such as computing power, storage, and networking—are made available to users. At this stage, IaaS has been the focus of AI investment so far, where the industry has invested sizable hardware to support LLM training and inference workload.

Platform-as-a-Service (PaaS) is poised to capture increasing value as the focus shifts to the platform layer, which will serve as the foundation for enabling practical, scalable generative AI use cases at the application layer. The growing complexity of IT environments within enterprises is expected to remain a significant bottleneck in the adoption of AI-native applications. This creates a compelling opportunity for both established players and emerging vendors to deliver solutions that simplify and streamline the deployment and integration of generative AI technologies.

SaaS represents the final layer where end-users directly interact with AI-enhanced applications. The potential for Gen AI to transform SaaS offerings is considerable, as applications can become more responsive, personalized, and capable of automating complex tasks. For instance, companies like Salesforce and Adobe are already embedding Gen AI into their applications, enabling features such as predictive analytics and automated content generation.

Global X AI and Innovative Technology Active ETF (3006) Strategy

The Global X AI and Innovative Technology Active ETF Fund is strategically positioned to capture the full value chain of AI development, from foundational infrastructure to transformative applications. Our investment approach is rooted in identifying opportunities across the core verticals globally: from AI Infrastructure to application layers. By maintaining a diversified yet focused portfolio, we aim to deliver long-term capital growth while managing risks associated with this rapidly evolving sector.

Our fund’s core holdings currently center around AI infrastructure providers or supply chains like Microsoft, Alphabet, Meta, TSMC, and Nvidia. These companies represent the backbone of AI development, providing essential hardware, software, and services that enable AI research and deployment. The competitive landscape in this area is more predictable at this stage given the significant CAPEX required and technology barriers in semiconductors. These barriers create a high moat for existing leaders, allowing them to capitalize on their technological advancements and scale.

In addition to AI infrastructure, the fund also gains exposure to AI robotics through Tesla. We view Tesla as a global leader in AI robotics with deep expertise in full-stack autonomous driving and humanoid robotic system development. The company’s ongoing innovations in AI and robotics align with our strategy to invest in transformative technologies that have the potential to disrupt traditional industries and create new market opportunities.

Over time, we look to increase our exposure to the platform and application layers as the industry builds out the ecosystem and we gain more visibility on the Total Addressable Market (TAM) and competitive dynamics in AI downstream sectors.

The Global X AI and Innovative Technology Active ETF Fund is committed to being at the forefront of AI investment, leveraging our expertise to identify and capitalize on opportunities across the AI value chain. By focusing on both established leaders and emerging innovators, we aim to provide our investors exposure to one of the most dynamic and impactful sectors of the global economy. As the AI landscape continues to evolve, we remain dedicated to adapting our strategy to ensure that our investors benefit from the full spectrum of AI-driven growth and innovation.