Global Electric Vehicle & Battery: Q3 2022 Review

Listen

Global electric vehicle (EV) sales have maintained resilient growth in recent months, with US and China leading the development. The macro environment remained volatile in the third quarter, with ongoing energy crises and inflation issues in key economies. The gloomy economic outlook has led to concerns about global automobile sales. On a positive note, many traditional OEMs (original equipment manufacturers) are accelerating their EV transition. We believe EV penetration still has a lot of room to grow, which will support the whole EV and battery supply chain. The strong global auto semiconductor demand driven by electrification and more autonomous functionality is also worth noting. In this article, we address the key topics in the Global EV and battery sector.

- Global EV penetration increase is still on the rise, but concern on auto sales is growing due to the economic slowdown in key economies. Battery investment is still very active globally with supportive stimulus and strong investment appetite.

- Tesla is one of the key beneficiaries of the US Inflation Reduction Act (IRA). Their production volume has reached a record high level but still falls short of market expectations.

- Auto semiconductors are growing their addressable market during the electrification process. Infineon has provided a clear roadmap to maintain its global leadership in the auto semi market.

Global EV Penetration Still Rising; Active Battery Investments Globally

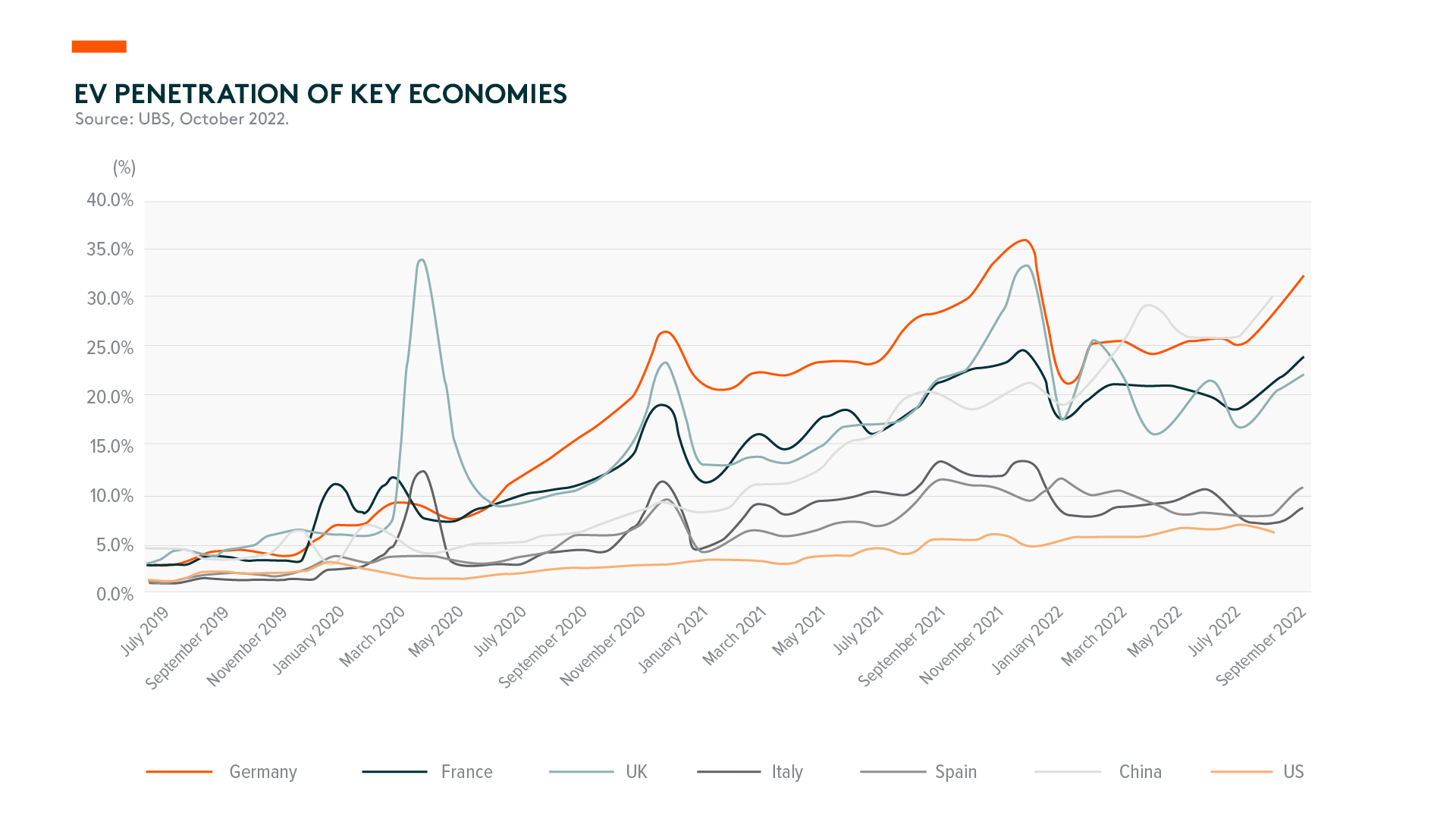

Over the past couple of months, we saw a strong increase in EV sales in the US and China. We view the supportive government policy and the high energy prices as good tailwinds to support EV demand. Both factors positively impact the total cost of EV ownership compared to internal combustion engine (ICE) vehicles. On the supply side, we see supply chain constraints from H1 2022, such as chip shortages and production disruption, have eased further in recent months. Additionally, newer and more competitive EV car models are being launched, which supports the rise in EV penetration.

While we are positive about the global vehicle electrification transition in the foreseeable future, we also acknowledge the growing concern on economic weakness and inflation risks in key economies. In China, we have ongoing concerns about the weak property market and pandemic disruptions. In Europe, the energy crisis is lowering the disposable income of households. In the US, we’re facing growing concerns of an economic recession. All of the above factors are weakening consumer confidence and, thus, lowering spending on consumer discretionary purchases. While it doesn’t mean the EV penetration ratio will reverse, the whole auto market could go into a deep downcycle.

With a strong pipeline of competitive EV models and rising EV penetration, we expect the battery industry will be the key beneficiary. It might not be an ideal environment for EV startups as competition intensifies and global interest rates are also on the rise. But it’s good news for battery makers because they don’t need to rely on one single car model to be popular to achieve good corporate returns.

Leading battery makers can build a broad range of customer penetration and be equipped in multiple car models, lowering their operational risk. In the past few months, there have been various new battery investment plans globally and new partnerships and co-investments between battery makers and auto OEMs. For instance, Gotion, backed by Volkswagen, is planning to build a battery facility in Michigan.1 Our Next Energy, a US EV battery startup backed by BMW, is also set to invest in a battery facility in Michigan.2 Leading battery makers are able to expand faster, backed by a strong order backlog and good access to funding, which, consequently, helps them invest more in R&D and enjoy economies of scale.

Tesla a Key US IRA Beneficiary as Production Volume Reaches Record High

While we think the recent US Inflation Reduction Act (IRA) has limited impact on China’s battery supply chain, we believe Tesla is one of the key beneficiaries. Prior to the bill, all EVs sold in the US were eligible for a US$7,500 consumer credit, but the credit expired once the OEM’s sales volume hit 200,000 units of EV sales. Both Tesla and General Motors have reached the limit. The US IRA now scraps the 200,000 unit limit but imposes additional restrictions. Tesla will likely be able to enjoy the tax credit once again starting in 2023 when the cap requirement is lifted. In addition to the consumer tax credit, Tesla is well positioned to earn the production tax credit for its battery facility investment in the US. That is also partly why Tesla might prioritize their US battery investment instead of their European battery facility.3

In addition to the policy incentive, Tesla delivered solid cost leadership and production resiliency. They dominated the premium EV segment in China. The deliveries in September hit an all-time high on the back of expanded production capacity at its Shanghai Gigafactory.4 The waiting time for Model Y in China has been reduced to just one week from as long as 24 weeks in June.5 However, this strong delivery is still below market consensus, where the company cited supply constraints as the key bottleneck. On the contrary, the minimum customer waiting time of top-selling new energy vehicle (NEV) models in China maintained a stable range between 1 to 24 weeks (on average 9.3 weeks, versus 8.6 weeks in early August, versus 6.7 weeks in mid-June).6 We are yet to see a clear downcycle in the EV demand trend.

Auto Semiconductor Demand on the Uptrend

EV-related auto semiconductor demand is solid, reflecting a structural trend in the growing need for data collection, computing power and higher semiconductor content per car. According to Infineon, the world’s number 1 automotive semi player, in their recent automobile division call, it stated that its automotive order book remains very solid and is exceeding its capacity.7 MCUs (micro controlling units) continue to be significantly overbooked with strong demand and no push-outs. Throughout 2H22 and into 1H23, Infineon expects auto semis demand to stay strong in all regions, given the large amount of pent-up demand that needs to be recovered.8

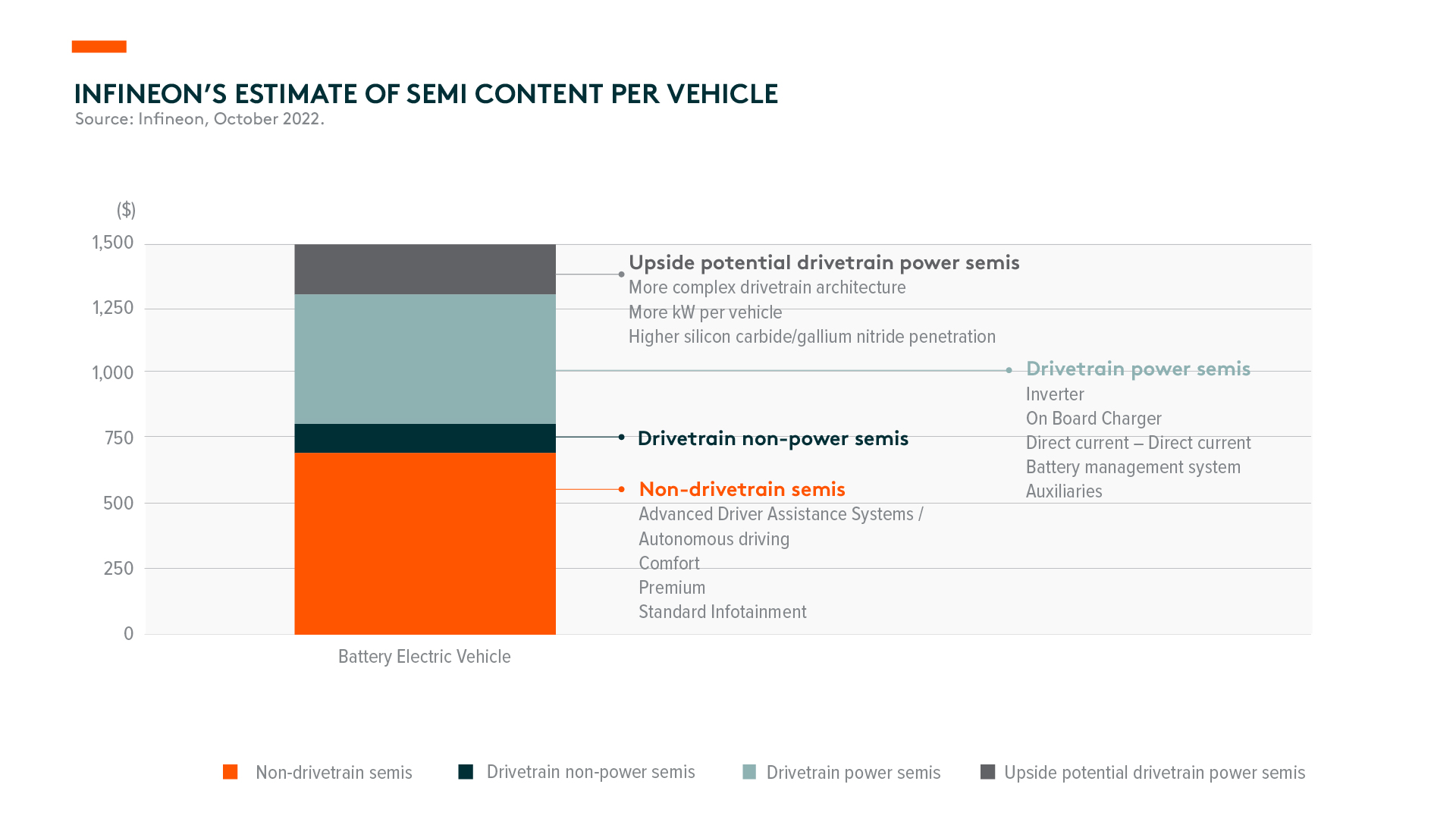

Infineon also provided further context to their expectation on per-car semi content increase and silicon carbide (SiC) development. As we go through the electrification process, Infineon expects the EV semi content to grow from per car value of US$500 for ICE to US$1,000 for EV. They forecast the per-car value to grow further to around US$1,500 by 2027, citing upside from more complex drivetrain architecture, higher voltage per vehicle, and higher SiC penetration.9 On SiC, Infineon announced two new SiC contract wins with US and Japanese OEMs in 4Q22. Following the previously-announced SiC capacity expansion plans at Villach and Kulim, Infineon expects to increase its SiC capacity tenfold by 2027 compared to today.10 This reflects the ample room to grow that applies to all auto semi companies.