Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Biotech ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Biotech companies invest heavily in research and development which may not necessarily lead to commercially successful products, and the ability for biotech companies to obtain regulatory approval (for example, product approval) may be long and costly.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Further Positive Developments Boost China Biotech Sector Momentum

Global X China Biotech ETF (2820/9820) recorded strong return YTD and is among the best-performing China thematic ETFs. As we outlined in April, we believe biotech sector is showing signs of bottoming out after consecutive years of soft performance, as supported by positive developments including domestic policy support, improving corporate earnings, more favourable macro factors, and ongoing globalization themes. We expect these theses continue to play out throughout the rest of this year, bolstering a more enduring revival of the sector.

| Cumulative Return (%) | 3M | 6M | YTD | Since Listing |

Calendar Year Return (%) | 2024 | 2023 | 2022 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2820/9820 | 11.7 | 19.0 | 22.8 | 5.0 | 2820/9820 | -17.6 | -12.9 | -26.1 | -19.7 | 69.6 |

| Index | 11.8 | 19.4 | 23.1 | 10.3 | Index | -16.9 | -12.3 | -25.5 | -19.2 | 71.9 |

Source: Mirae Asset, 30 May 2025. Past performance information is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of the performance is based on the calendar year end, Net Asset Value to Net Asset Value. These figures show by how much the Fund increased or decreased in value during the calendar year shown. Performance data has been calculated in RMB including ongoing charges and excluding trading costs on SEHK you might have to pay. Where no past performance is shown, there was insufficient data available in that year to provide performance. The Index of the Fund is Solactive China Biotech Index. Fund inception date: 24 July 2019.

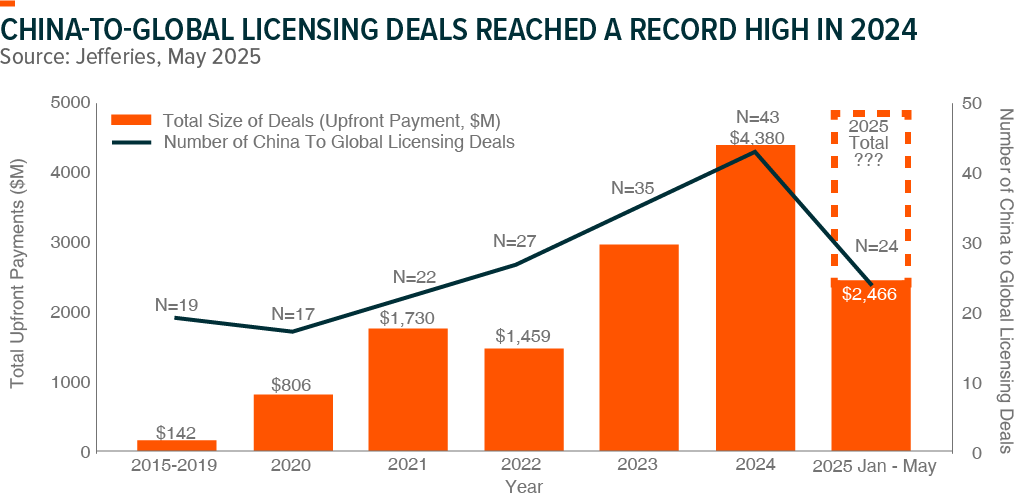

Over the past weeks, we are seeing a number of positive developments further boosting sector momentum. Firstly, HK-listed Chinese biotech company 3SBio announced the US$6bn out-licensing deal (including US$1.25bn upfront and up to US$4.8bn downstream fees if the drug hits all milestones) with US Pharma giant Pitzer on 20 May. This is the largest out-licensing deal by Chinese biotech companies so far, showcasing global recognition of the innovative quality of Chinese companies. We recognize an accelerating trend of increase in out-licensing deals volume and upfront payment over the past 2 years, with novel modalities accounting for an increasing share of out-licensing deals. This suggests that China-originated assets entering US/global market is becoming a new norm in biotech sector. Additionally, we believe such IP licensing is not goods or services export and should be less affected by US tariffs, and the 3SBio-Pitzer deal could further relieve investors’ concerns.

Secondly, a number of Chinese biotech companies are providing drug development updates on the 2025 American Society of Clinical Oncology (ASCO) Annual Conference starting 30 May 2025. There are already over 600 abstracts from Chinese companies, and the clinical data for several of key companies including Innovent and Kelun Biotech has been encouraging, another driver for the sector to continue its positive momentum.

Thirdly, Hengrui’s H Share surged by over 25% on the first day of its Hong Kong dual listing, signalling strong global investor interests and market confidence in the company’s long-term prospects, especially its expanding international pipeline and innovative drug R&D capabilities.

With the accelerating out-licensing momentum, continued breakthrough in innovative drug developments, improving profitability, and recovering investor sentiments, we remain constructive on China biotech sector and expect this positive momentum to continue.